First-of-its-Kind eCommerce Canadian Grocery Retail Report

Insight on consumer preference across all of the major online Canadian grocery retailers

Published on December 4, 2020

Caddle launched a

first-of-its-kind

eCommerce Canadian Grocery Retail Tracker,

looking at consumer preference across all of the major online Canadian grocery retailers.

What’s in the data?

The data is weighted by region, gender, and age, based on the most recent Canadian census figures to ensure that the sample reflects Canada’s population.

This report summarizes the results for 5 weeks of data collection, which includes 7,209 completed surveys

What's Inside

Online Grocery Shopping Experience Across 12 Factors

1. Easy to pick up order

2. User-friendly app/site

3. Availability of items

4. Fresh food quality

5. Payment options

6. Keeping you updated

7. Order availability/quick delivery

8. Cleanliness & hygiene

9. Order accuracy

10. Return policy

11. Price online vs. in-person

12. Secure transaction

Get the Report!

NPS Score by eCommerce Banner

Measuring willingness of customers to recommend a company’s products or services to others based on their experience

Key Driver Analysis

to identify attributes with the most impact on NPS

3 Key Takeaways

1. Out of 11 eCommerce grocery retailers,

the winner was no surprise…

Amazon takes 1st place

in 7 of 12 measured attributes, and top 3 in 11 of 12 attributes.

2. 50% of consumers access home delivery and click & collect equally

when it comes to online grocery shopping. Both avenues

must be optimized and are critical to winning

in eCommerce.

3. 1 in 2 consumers

are likely to use a different retailer next time they shop for groceries online.

Loyalty is low

and consumers are trying different providers.

Interested to see our In-store Grocery CX Report? See blogpost here.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Sustainability: Canadians are All Talk with a Slow Walk

90% of Canadians say they care about sustainability, but COVID-19 has affected whether we act on these values.

Published on December 2, 2020

At its broadest, sustainability is “development which meets the needs of the present without compromising the ability of future generations to meet their own needs”.

Canadians have by and large been held up as sustainability conscious consumers.

Back in 2017, a report from the Business Development Bank of Canada showed that more Canadians were integrating environmentally responsible practices into their lifestyles—

and they expected companies to do the same.

Whether it’s recyclability, biodegradability, less waste going into landfills… Caddle wanted to test the assumptions that Canadians are environmentally driven. We were also curious as to whether Canadians would keep to their values in the face of pandemic restrictions that make it harder to lead an environmentally conscious lifestyle.

Did you know?

Caddle® is the largest daily and monthly active panel in the Canadian market.

Receive Our Free Weekly Insights Newsletter!And so,

Caddle dug into consumer sentiments and behaviour on sustainable practices and products. Let’s start with

whether Canadians really do consider sustainability in their daily lives.

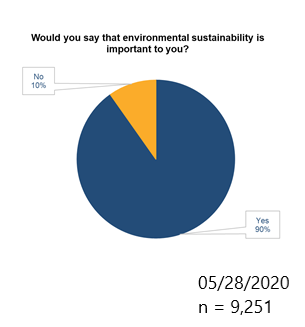

Sustainability is important to the vast majority of Canadians.

Do Canadians Actually Care?

Back in May 2020, the answer was a resounding ‘yes’—across all demographic groups and regions.

Does Consumer Sentiment on Sustainability Actually Influence Behaviour?

While many Canadians raise clear concerns about sustainability practices, their actions don’t always match —especially during COVID-19. Let’s look at how sustainability figures in Canadian consumers’ daily lives.

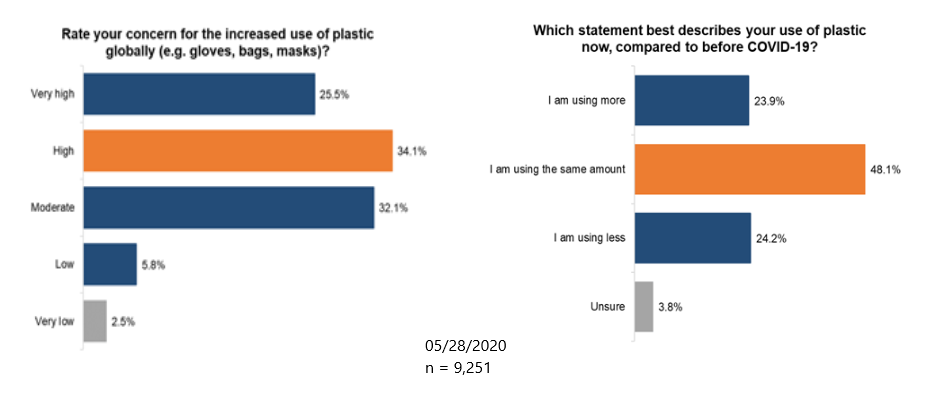

Use of Plastics

While 60% of consumers were concerned about the increased use of plastic during COVID-19 (especially Gen Zers and Millennials),

50% of respondents are using the same amount of plastic compared to pre-pandemic,

and almost

1 in 4 consumers are using more!

(Gen Zers and Millennials over-index at 26.5% and 25.7% respectively).

Curiously,

consumers in British Columbia—the stereotypically eco-conscious—seem to be the least aligned with sustainability efforts. Though B.C. consumers expressed the greatest concern with the global increase in plastic use, they also reported the

highest % of single-use plastic usage since the pandemic began!

In contrast, Maritimers—who draw tourism dollars for its scenic landscapes like the West Coast—walk the sustainability talk a bit more, over-indexing on lower plastic use in general.

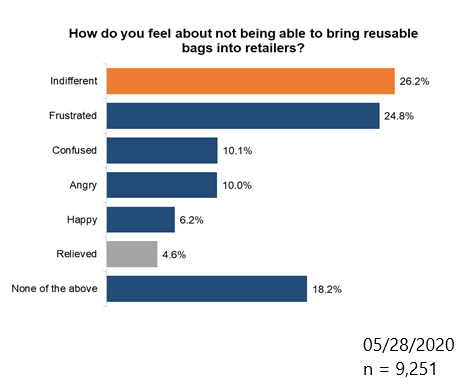

Use of Plastics in Shopping

Most consumers are either “frustrated” or “indifferent”

about not being able to make use of reusable shopping bags in-store.

Who’s Most Frustrated of All?

Millennials (26%), though they’re also among the most indifferent consumers, tied with Gen Zers (at 28.2% and 28.5% respectively) and outflanking older generations for “indifference” by at least 3 points.

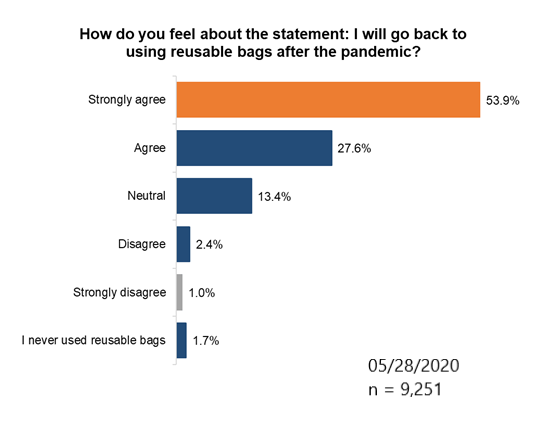

Meanwhile,

more than 50% of all consumers "strongly agree”

they’ll go back to shopping with reusable bags after the pandemic.

Who is least likely to go back to reusable bag use?

Gen Z! If you guessed the youngest generation, you’re right.

Sustainable Packaging

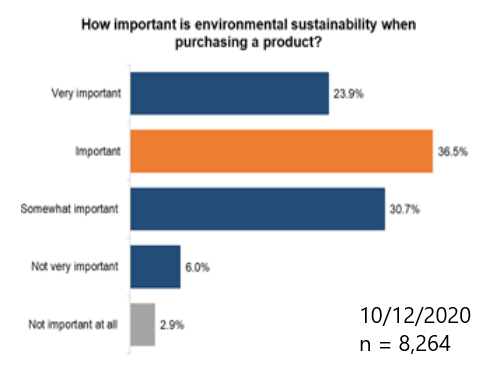

About 1 in 4 of all consumers find environmental sustainability “very important” when purchasing a product; this holds true across all demographic and geographic groups.

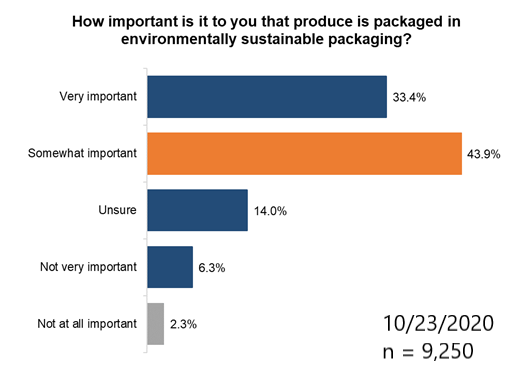

Consumers are especially interested in environmentally sustainable packaging for produce purchases. 80% of consumers suggest it’s “somewhat important”/“very important.”

In fact,

more than 40% of consumers are willing to pay up to 5% more for produce that is packaged sustainably,

though more so among older generations. Consistent with earlier findings, this suggests older consumers either have more dollars to spend on sustainable products OR have greater intent to do so.

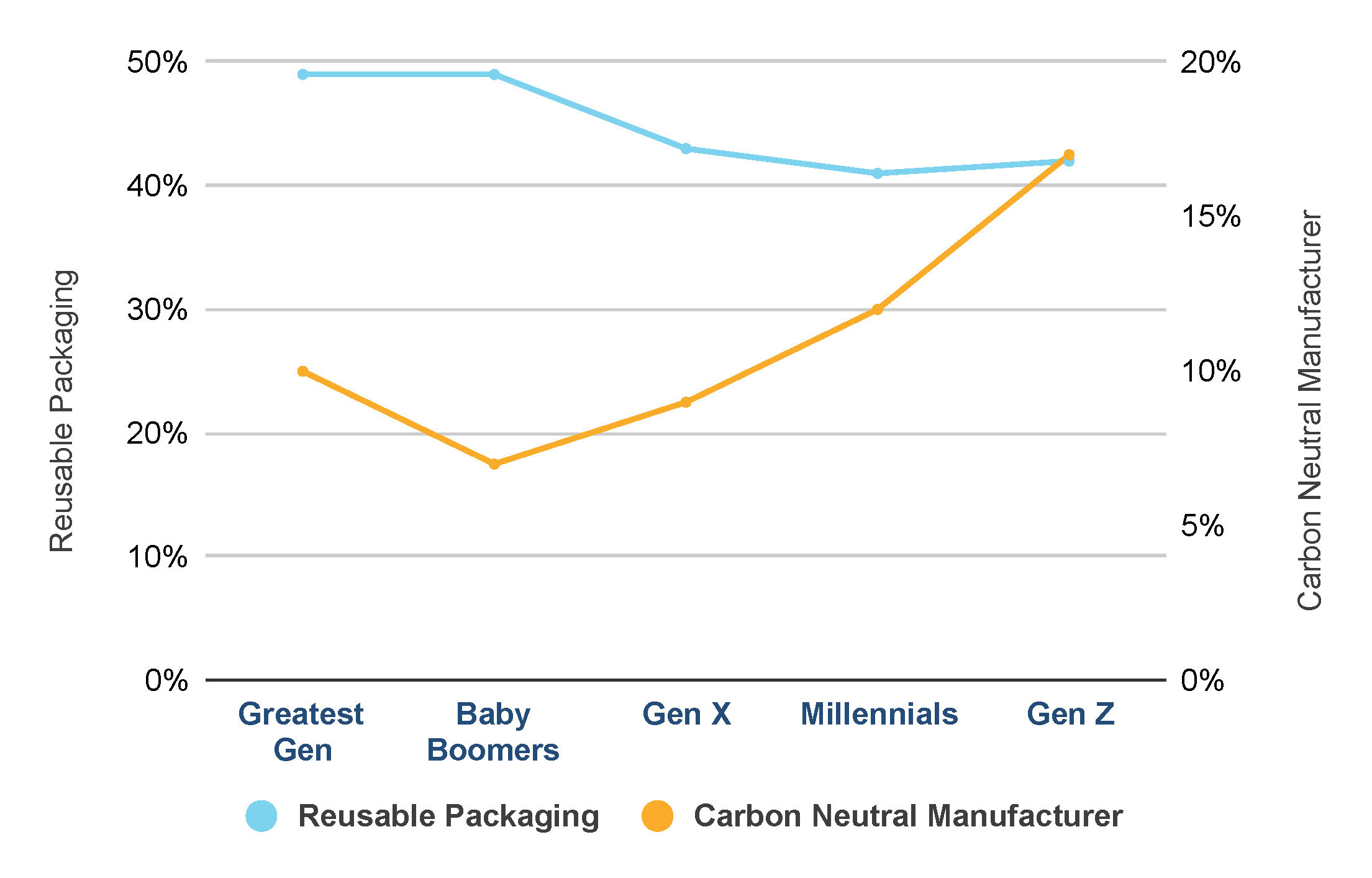

Reusable packaging is the strongest influence in purchasing a new product—

though the younger the consumer, the less they seemed to value reusable packaging.

Is this further indication that Canada’s youngest generations place more emphasis on other elements of sustainable consumption?

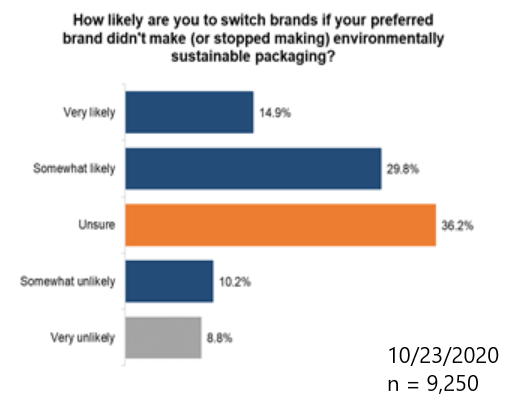

Finally, 40%

of Canadian consumers are likely to switch brands

if their preferred company didn’t make environmentally sustainable packaging. Note* packaging is a relevant concern for eco-conscious consumers.

KEY TAKEAWAYS

1. Canadian Consumers Care About the Type of Packaging that Manufacturers Use.

Canadian consumers don’t just think sustainable packaging is more important; many consumers (particularly older generations) would pay more

for sustainably packaged products and they’d ditch their preferred brands if they aren’t offered in environmentally sustainable materials.

The opportunity is ripe for retailers to increase share of wallet

by expanding their assortment of products that are packaged using sustainable and/or reusable materials.

And for retailers with white-label assortment: adapting packaging now to more sustainable options isn’t just a good environmental choice;

it may help you to better compete with global brands, too.

2. Younger Consumers Think About Sustainability Differently.

We’ve heard talk for years (and have copious evidence to back it up!) about how

Gen Zers and Millennials are leading the charge on environmental issues. Yet,

our results indicate that many of the measures we typically associate with “capital-S Sustainability” just don’t seem to mean as much to Canada’s younger consumers.

The fact of the matter is,

if you’re truly going to understand the thinking and behaviour of any demographic—whether Gen Z or the Greatest Generation or anyone in between

—you need plenty of good, reliable data.

And so, it’s incumbent on retailers and manufacturers to continue to work with partners like Caddle to gather as much broad-spectrum data as possible, if they’re going to really

get into the heads, hearts and wallets of these up-and-coming change-makers.

3. COVID-19 is Affecting Canadians in Surprising Ways

Perhaps it’s just the malaise we’re all feeling from the seemingly never-ending restrictions and changes to life as we know it. And you’d think with lockdowns and restricted comings-and-goings, people would be using less plastic—especially if they eschewed single-use plastics pre-pandemic.

But,

up to 25% of Canadian respondents report using more single-use plastics now than before the pandemic struck.

This signals to us that

the pandemic will continue to throw some surprising curveballs at retailers and product manufacturers

in the coming months. To manage, retailers should maintain a holistic assortment of products and services. That way, regardless of inconsistencies that may occur between sentiment and behaviour, they’re still catering to as wide a population as possible at any given time.

Looking to know more about consumers and their views, intentions and habits towards plastics and sustainability? Contact us today.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Contact Us

Gen Z Joins Shopping Mall-Walking Trend as Exercise This Winter!

Published on November 20, 2020

With pandemic closures expected to continue into the holiday season and possible COVID-19 spikes, are shopping malls the fitness solution we’re all in need of?

So, are consumers using shopping malls for mall-walking to stay fit?

We asked over 8500 Canadians

last week and almost half of all respondents are worried about sticking to their fitness routines this winter. For Canadians who visit malls,

47% are interested in visiting a shopping mall for exercise during the winter. Surprisingly, Gen Z are the most interested

in visiting a shopping mall to exercise during the winter.

Are Gen Z the new generation of “mall-walkers”?

Are walk/run lanes at shopping malls a hot thing this winter?

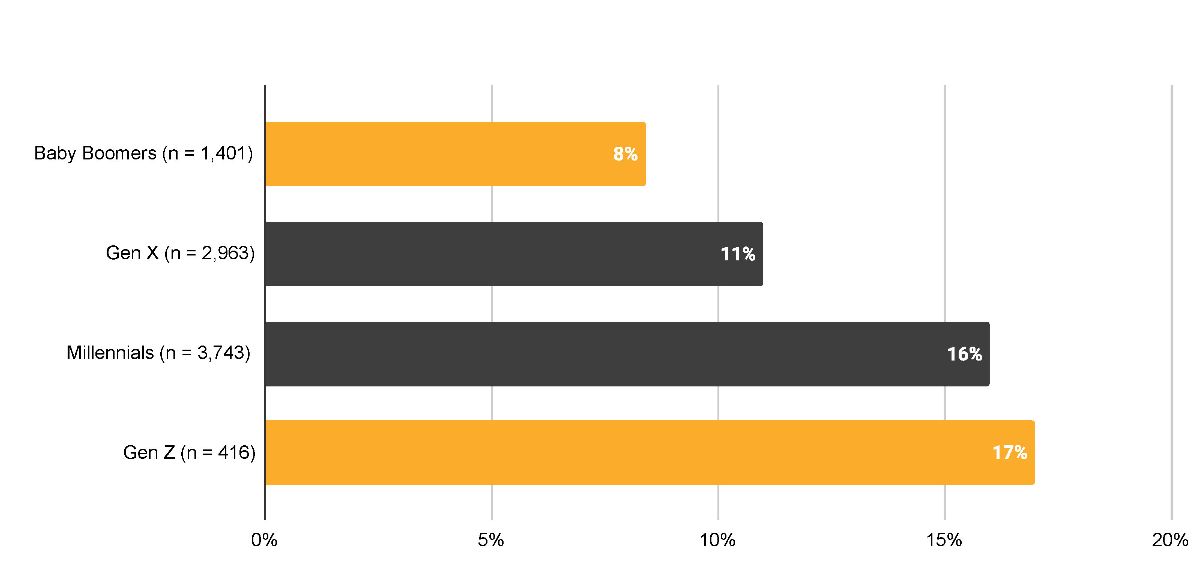

Gen Z are Twice as Worried About Exercise

n = 8,577 | November 15, 2020

Gen Z over-index more than 2X when compared to Baby Boomers and say they are

“extremely worried”.

As a result,

many are looking to shopping malls as their physical activity of choice in order to get their daily steps in.

Again, of the consumers that visit malls often or sometimes,

Gen Z are 2X as interested in a run/walk lane at their local shopping mall when compared to Baby Boomers!

Caddle is the largest mobile provider of Canadians insights with 10,000+ daily active panel members. Our data is used by research firms including Nielsen, Environics, & major CPG/retailers like P&G, Coca Cola, Nestle, Walmart, Canopy and many more.

Sign-Up for Caddle’s Weekly Insights Report and never miss a beat on the newest Canadian consumer insights!

2020 U.S. Election Would Have Different Results in Canada

see how the 2020 U.S. election would have panned out if Canada was voting

Published on November 16, 2020

How closely did you follow the 2020 U.S. election? This is a question we wanted to know at Caddle… and we found the answers!

As Canadians, our close ties with the U.S. cannot be disregarded. As such, here at Caddle, we want to know not only how many Canadians were following the election, but WHY.

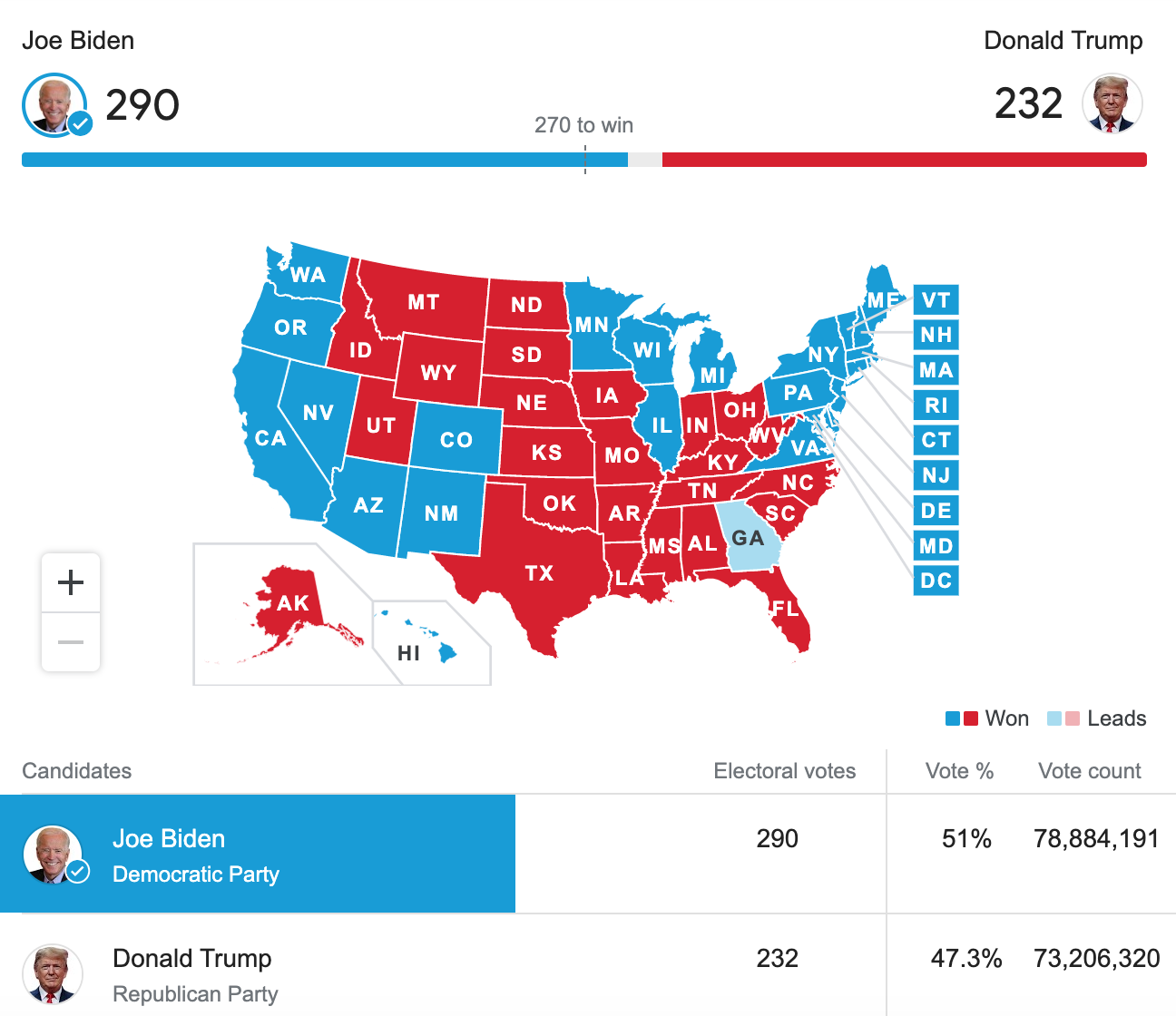

2020 U.S. Election Results

After the announcement of Joe Biden winning the 2020 U.S. presidential election, Caddle put together a Rapid Response survey to our 10,000+ daily member panel to find out what Canadians think about the 2020 U.S. election.

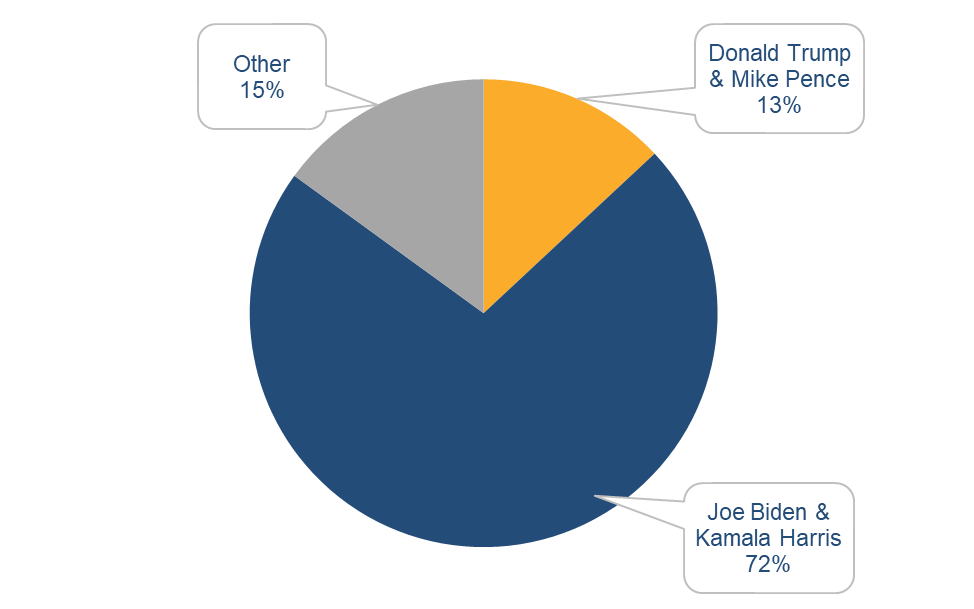

Over 70% of Canadians Would Vote Joe Biden & Kamala Harris

Which U.S. presidential candidate would you have voted for?

Baby Boomers are the most in favour for Joe Biden when you look across generation cohorts, while Generation Z is most in favour of Donald Trump when compared to other generation groups.

Are you surprised by these results?

With the presidential elect decided, we also want to know consumers’ opinions on Canada & U.S. relations.

How dependent do you believe Canada should be on the U.S.?

What is your top concern in regards to Canada-U.S. relations over the next 4 years?

Get in touch below and we will send you Caddle’s full report on how Canadians really feel about the 2020 U.S. election.

Canadian Millennials vs. Boomers & COVID-19 Habits

The Great Divide | One Country, Multiple Cohorts

Published on November 9, 2020

At Caddle, we’ve been collecting consumer insights on Canadian grocery retailers since the pandemic began. Why? To help brands and agencies understand COVID-19 & the Canadian Consumer. As a result, we’ve turned those insights into a short report as we head into the busiest retail season of the year!

Ransom Hawley

CEO at Caddle

Get the Report!“Now, as we stare down a second wave of COVID-19, and with learnings gathered from living through more than half a year of pandemic-driven ups and downs, we at Caddle know that consumer insights have never been more important.”

COVID-19: 5 Tips for Canadian Grocery Retailers in Q4 & the New Year

1. Don’t rely on old data

2. Don’t assume non-Canadian data is a “good enough” indicator of Canadian shopping preferences

3. Do talk to your audience throughout the purchase cycle

4. Do measure how you stack up against your competitors

5. Do invest in improving your omnichannel customer experience

So, the ongoing effects of COVID-19 on the Canadian retail sector is in for more tumultuous times – in December and most likely into 2021. As a result, brands need relevant and recent consumer data from a reputable source—and plan your holiday ramp-up accordingly.

So, What’s Inside?

- COVID-19 | The pandemic has brought Canadians together but has also driven them apart

- Retail is Failing | What consumers want vs. what they’re getting

- Millennials vs. Baby Boomers | How generations differ in grocery shopping habits & what that means for brands and retailers

- and more!

Sneak Peek

Grocery Retailers: Who is Winning & Who is Falling Behind?

Do any of these rankings surprise you? Want to know how Caddle can accelerate time to insight for you and your brand? Get in touch!

Full Insights Here: The Great Divide

Seasonal Shopping at a Crossroads—Plenty of Revenue Opportunities But There’s No Time to Waste

Don’t count out consumer interest in the holidays; Canadians plan to shop for seasonal items this year, even with pandemic restrictions.

In 2019, consumers spent a record $7.4 billion online on Black Friday and a further $9.4 billion on Cyber Monday. And while various media outlets ponder the potential demise of seasonal spending—due, in part, to financial concerns and tighter budgets related to the pandemic—some online retailers are hedging their bets that consumers will still want to shop.

Take Amazon Prime Day: Usually a mid-July event, it’s shifted to October 13–14 this year and reports suggest that Amazon plans to de-emphasize the typical summer and back-to-school sales push and instead, make an early lead-in to the holiday season. The sales that Amazon’s expected to generate from this two-day event: $9.91 billion, up 43% from last year’s Prime Day.

In contrast, heavily brick-and-mortar–based Home Depot announced in early September that they would be “reinventing” Black Friday by offering discounts for two months, beginning in early November and running through December. The stated reason: Promote the safety and sanity of their customers, who normally rush to stores to grab the best deals.

What’s leading major retailers to make such big bets on consumers’ seasonal shopping intent? Well, if numbers from the U.S. are any indication, the pandemic has actually driven higher sales around key holidays than a year before. To wit, Adobe reports that Memorial Day 2020 sales reached $3.5 billion, a 63% growth over decidedly lacklustre 2019 spending.

What’s more, Google research (reported here) indicates that 73% of U.S. holiday shoppers say they plan to do more shopping online this year than they have in previous years, and 77% will browse for gift ideas online rather than in store—an indication of the ease that omnichannel shopping brings to concerned populations who are reticent to get back to brick-and-mortar retail.

Though we march to the beat of our own drum in Canada on a number of measures, we were curious to understand how Canadians will be shopping this holiday season. Specifically: Will Canadians complete more or less of their shopping online, and will they be spending more or less than in previous years? What purchases will they invest in and what others will they let go of? And what will these patterns mean for retailers as they look ahead to what’s usually the busiest retail season of the year.

Let’s dig into the data to find out.

HOW FAR AHEAD ARE CANADIAN SHOPPERS PLANNING AHEAD AND WHAT DO THEY PLAN ON PURCHASING?

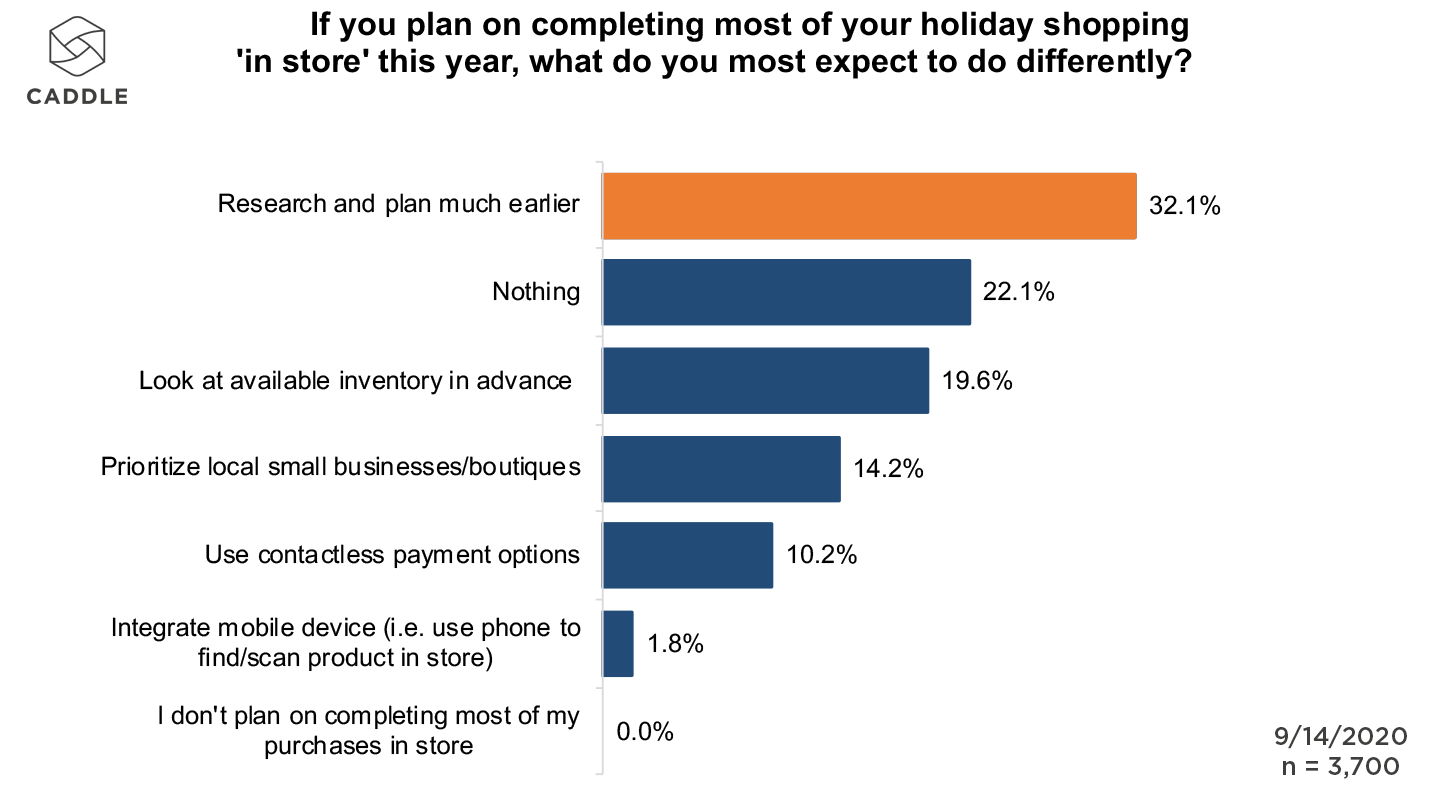

Consumers are beginning their holiday shopping earlier each year, and 2020 is no exception. If anything, consumers are planning even further ahead this year, potentially as a means to avoid the same availability or delivery issues experienced earlier in the pandemic.

Among our Canada-wide Caddle users who anticipated making holiday purchases, nearly 28% had already started to create a shopping list by mid-September (especially people living in the Maritimes, who significantly over-indexed on this measure, with values ranging from 41% in New Brunswick to 46% in Newfoundland). Meanwhile, an equal proportion of our general population planned to start in November. And, among those respondents who planned to complete most of their holiday shopping in-store, nearly one-third argued that they’d research and plan much earlier than they had in previous years.

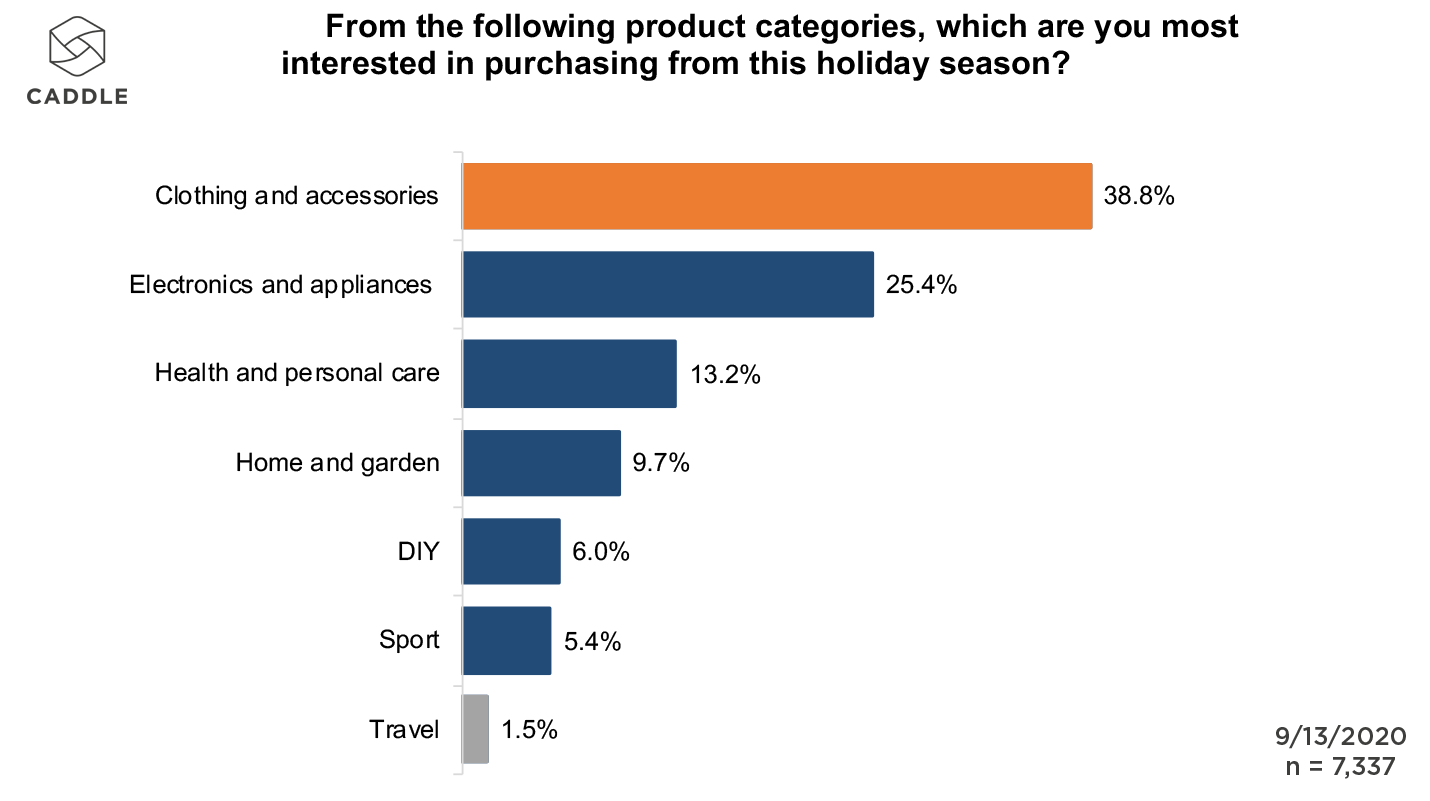

Canadians seem most interested in purchasing items that can deliver immediate gratification: Clothing and Accessories (39%), Electronics and Appliances (26%), and Health and Personal Care (13%) top the list of product categories they’re most interested in shopping for this coming holiday season, while understandably, given continued lockdown in cities across the country, Travel comes in last for all respondents, at 1.5%. (Likewise, in a separate Caddle Panel from later in September, nearly a third of respondents indicated that they planned to decrease spending in the fall/winter on Travel.)

WHICH CHANNELS DO CANADIANS FAVOUR FOR THEIR SEASONAL SHOPPING IN 2020?

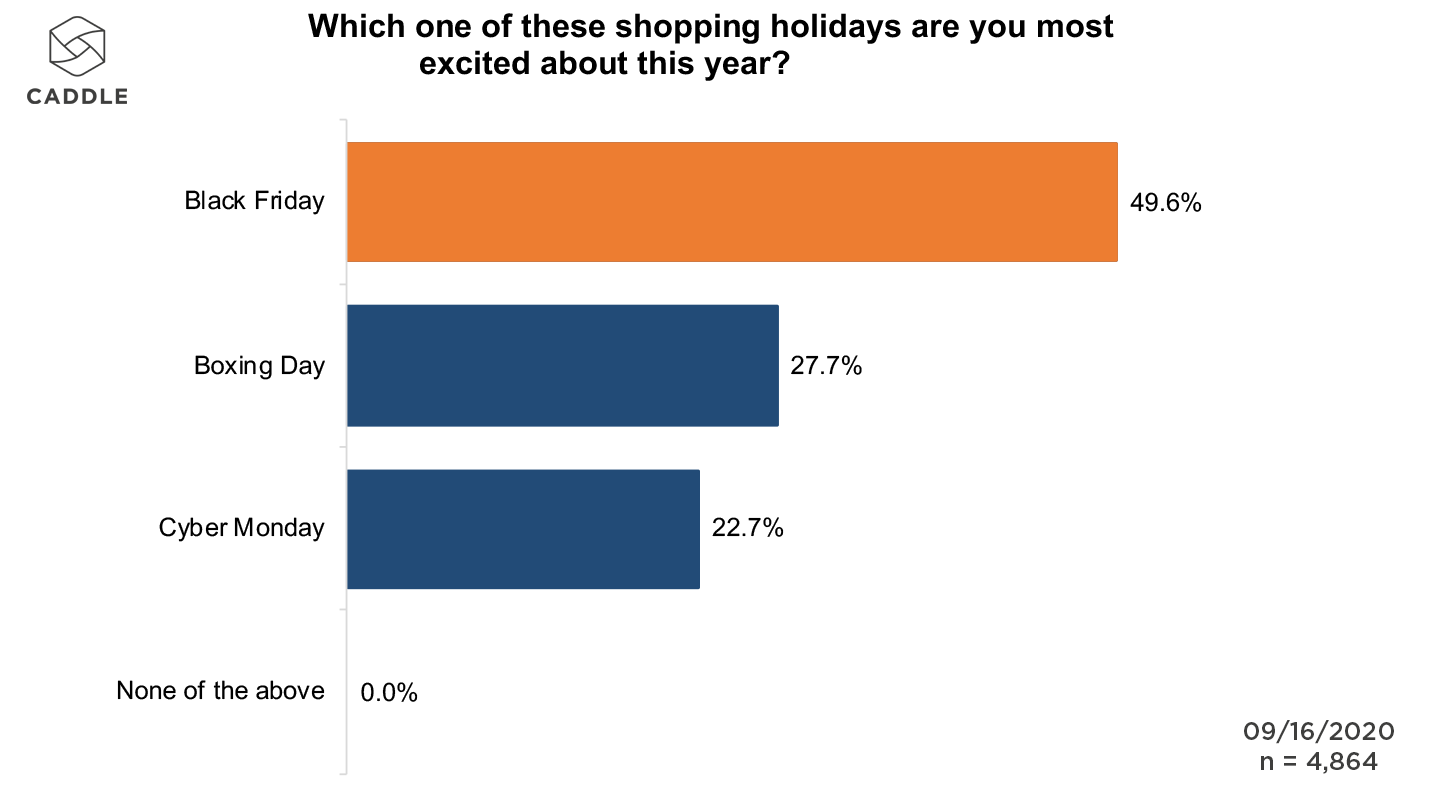

Canadian consumers are almost 2x more excited about Black Friday shopping than Boxing Day and Cyber Monday, and this seems to correlate with their preferred shopping locations.

Based on our research, many consumers seem undeterred from visiting brick-and-mortar locations. On the one hand, among our Caddle users who were most excited about Black Friday and Boxing Day shopping opportunities, at least 40% are likely to shop at a brick-and-mortar location at least once over the holiday season. (Prince Edward Islanders are far and away the most likely, at 72%, while Quebeckers are least likely, at 38%.)

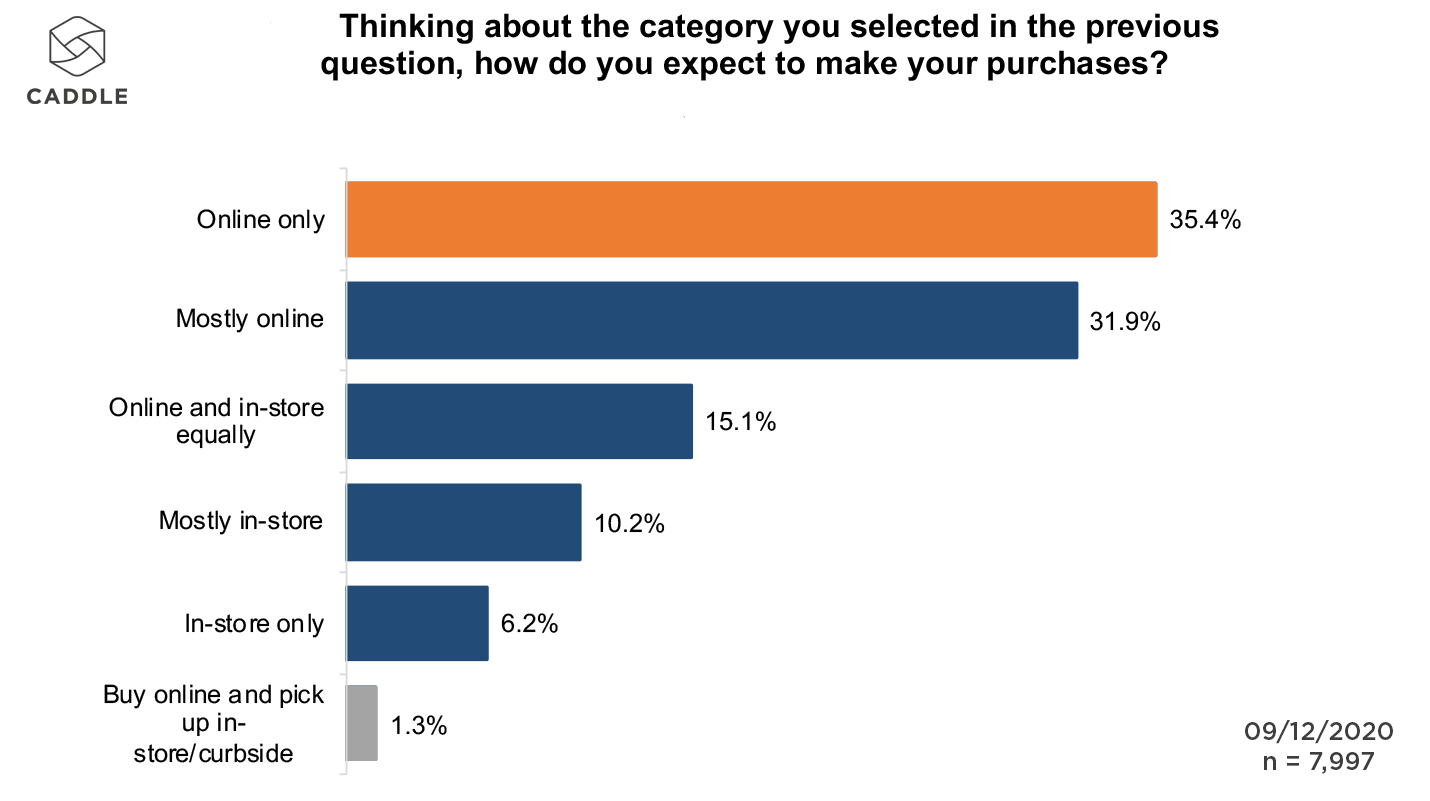

On the other hand, when it comes to the top categories of products they’d purchase (as outlined above), responses were mixed, and included “Mostly online with some in-store shopping” (34%), “Online and in-store equally” (22%), and “Mostly in-store with some online” (20%). In the meantime, “Online only” and “In-store only” ranked relatively lower and fairly equally matched, at 13% and 11% respectively.

Interestingly, buy online, pickup in-store (BOPIS)/curbside hardly registers for these respondents. This could relate to the fact that winter weather can be unpredictable at best and downright nasty at worst—making a trip to pick up already purchased items a slog.

However, it’s a curious finding when we consider that among consumers who had completed most of their holiday purchases in-store in 2019, 56% were interested in shifting to BOPIS/curbside. This is particularly the case among Gen Zers from Newfoundland and Alberta (87.5% and 68%, respectively), as well as Prince Edward Islanders (60.8%), British Columbians (60.5%) and Newfoundlanders (59%) of all ages.

DO CANADIANS PLAN TO SPEND MORE OR LESS ON HOLIDAY SHOPPING THAN IN PREVIOUS YEARS?

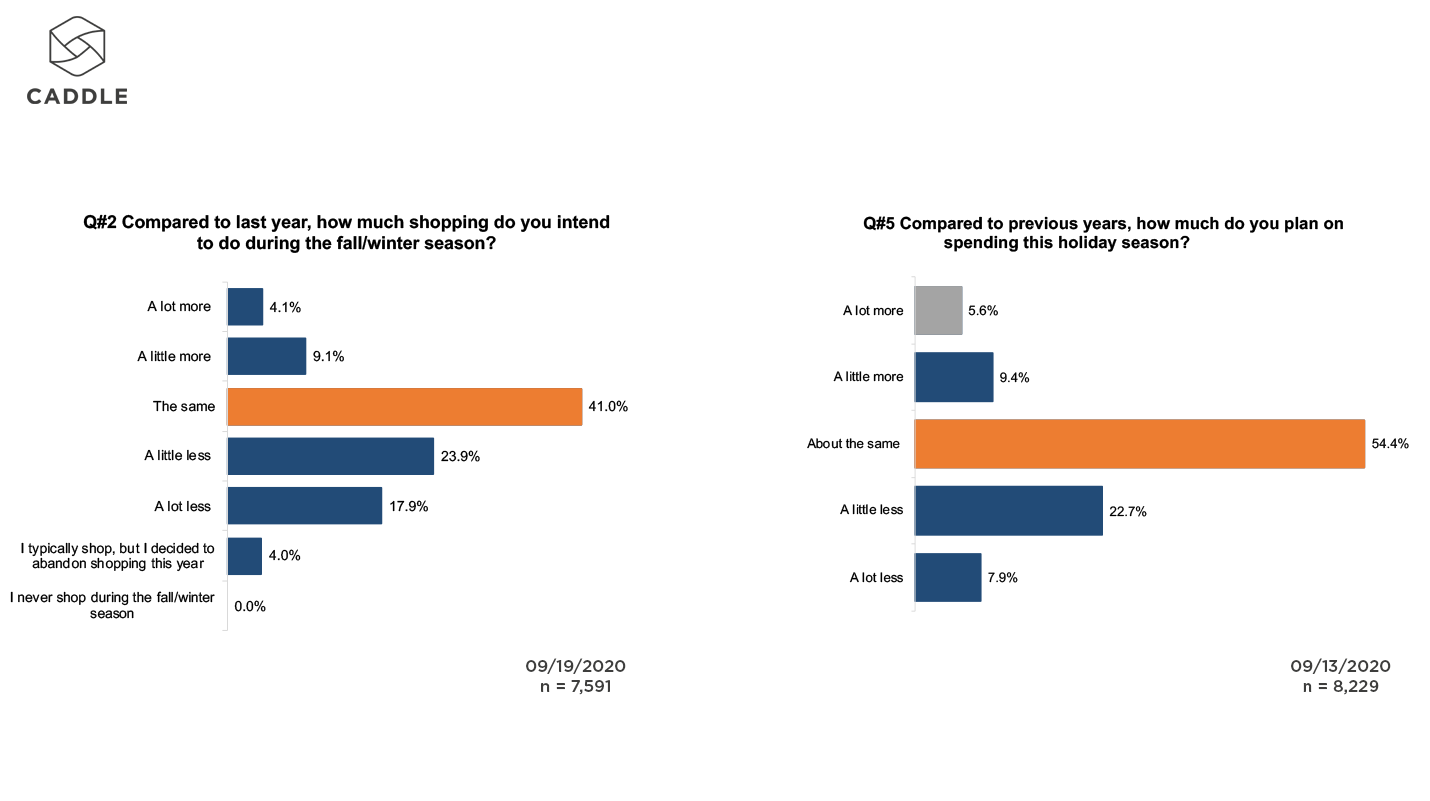

Most Canadians plan to shop and spend “about the same” amount in the latter months of the year when compared to previous years.

This comes as a bit of a surprise, as we learned elsewhere that nine in ten Canadians had tightened their budgets as a result of financial concerns driven by the pandemic. And it raises some important questions: Are more Canadians seeing the light at the end of the COVID tunnel? Or perhaps they feel like they’ve held back long enough and want to return to “normal,” at least for the holidays.

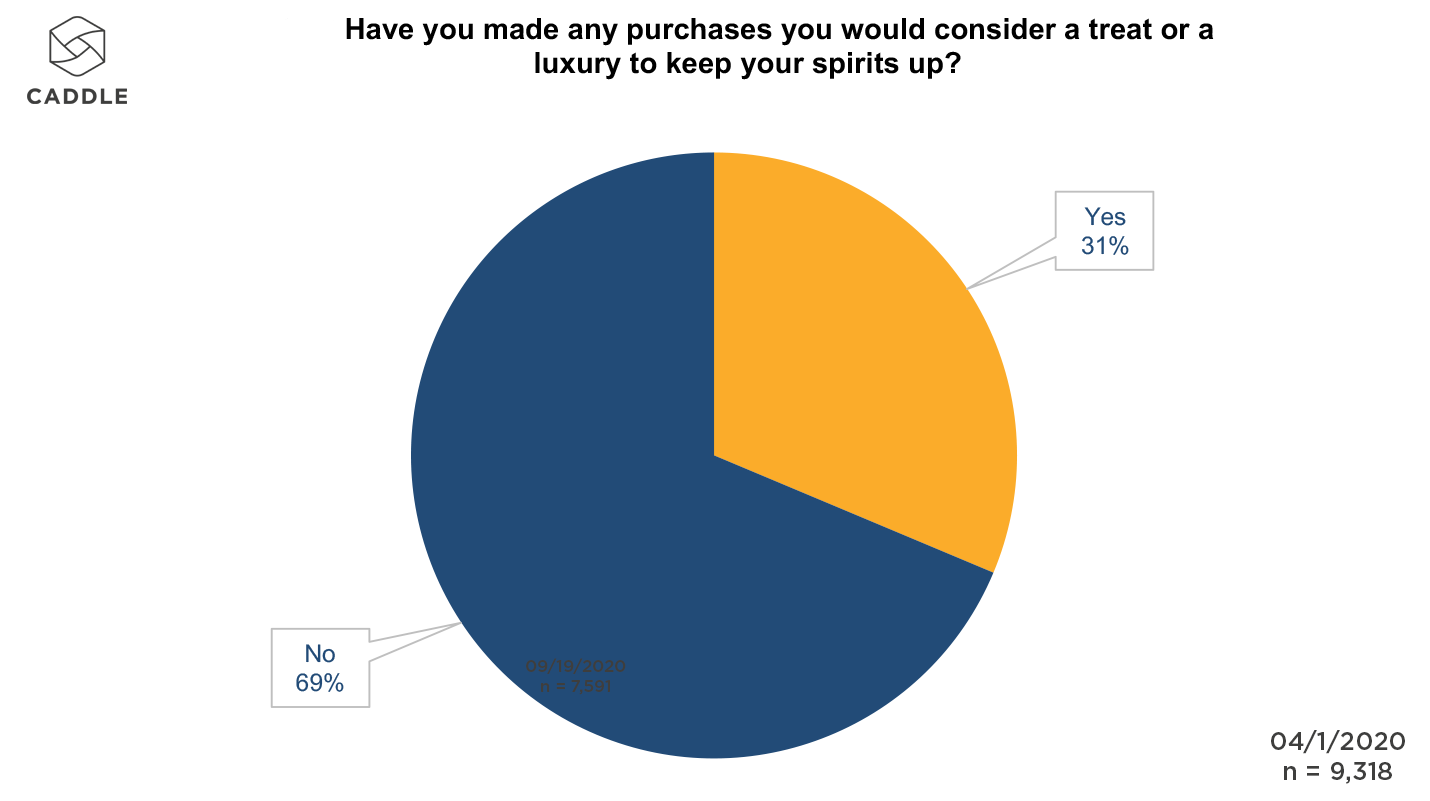

We may also find some insights in our panel’s thinking around “treating themselves”: A third of respondents said they had purchased a treat or a luxury item to keep their spirits up during the pandemic.

This finding dates back to the early days of the pandemic, and perhaps hints at the growing need for consumers to continue to “treat” themselves as a second wave of COVID cases is on our doorsteps.

At the same time, the majority of our Caddle users (70%) indicated they’d be more mindful about how much they’d spend this coming fall/winter—especially respondents from Ontario, Manitoba and New Brunswick (72% each), and Alberta (74%).

KEY TAKEAWAYS

PEOPLE ARE PLANNING AND SHOPPING FOR THE HOLIDAYS EVEN EARLIER THAN EXPECTED.

According to a recent Shopify webinar, Google data from 2019 indicated that shoppers had entered Black Friday/Cyber Monday week with more than a third of their shopping already completed. And by late August 2020, 1 in 4 shoppers had already started their holiday shopping.

With seasonal spending beginning earlier each year—and consumers primed for big deals because of Amazon and other online mega-retailer events—Canada’s retail sector needs to get ahead of the curve (and fast!) if they’re going to be able to take advantage of consumer interest in seasonal spending.

CANADIANS ARE OPEN TO DIFFERENT WAYS OF GETTING THEIR SEASONAL SHOPPING FIX.

The pandemic has caused significant changes to the way people get things done—and that’s fantastic news for retailers. Why? Because even those die-hard brick-and-mortar shoppers from holidays-past are now more willing than ever to consider online shopping or a hybrid (i.e., BOPIS).

Smart retailers will take advantage of this opportunity, and if they haven’t already gotten their omnichannel shopping and fulfillment plans squared away, will definitely want to do so well before winter hits and “in-store only” shopping becomes less desirable for many consumers.

SHOPPERS MAY BE NOSTALGIC FOR “BETTER TIMES” AND WILL KEEP UP THEIR SPENDING HABITS IN THE COMING HOLIDAY SEASON.

Though consumers continue to be conscious of the effects of COVID on their finances, they’re also still planning on shopping this coming holiday season—especially for particular categories, like clothing and accessories, electronics and appliances, and health and personal care items.

That’s great news for retailers who already stock these types of products. But it’s also a ripe opportunity for alternative banners to get ahead of the holiday spending season; consider integrating these coveted categories into your assortment to take advantage of Canadian consumer intent in the coming months.

Growth of Lawn & Garden Activities Indicates More Canadians Are Embracing Stay-at-Home

Growing vegetables, flowers and houseplants top the list of gardening projects pursued by most Canadians

While some may argue that the COVID-19 pandemic has brought out the worst in people (e.g., only three in five Canadians are reportedly wearing masks when out in public—one of the lowest rates worldwide), we at Caddle prefer to take a “glass half full” perspective.

Yes, indeed, we’re witnessing some odd behaviour—perhaps driven by anxiety and isolation blues. But when it comes to how Canadians are spending their time during the progressive stages of lockdown, we’ve been buoyed to find that they’re sticking closer to home and working with what they’ve got locally to stay healthy, happy and as motivated as possible while under restricted movement.

We were interested to understand the types of activities that are keeping Canadians busy whilst they work from home, care for family members and in general, go about their daily lives during the pandemic. And, while reports suggest that record numbers of people are redirecting travel budgets into cottage purchases, responses from our Daily Survey Panels reveal that just as many (if not more) are turning to gardening for a healthy, cost- and family-conscious break from the woes of COVID.

If you’re not already receiving our free Weekly Insights newsletter, what are you waiting for?! Sign up here.

The question remains whether these new habits will persist once we’re past this emotionally difficult time.

Let’s dig in to find out:

HOW ARE CANADIANS KEEPING BUSY DURING THE PANDEMIC?

Aside from the work of staying healthy and safe, working from home, taking care of family members and other requisite tasks, we wanted to know how Canadian consumers were keeping busy. The answer: Hobbies!

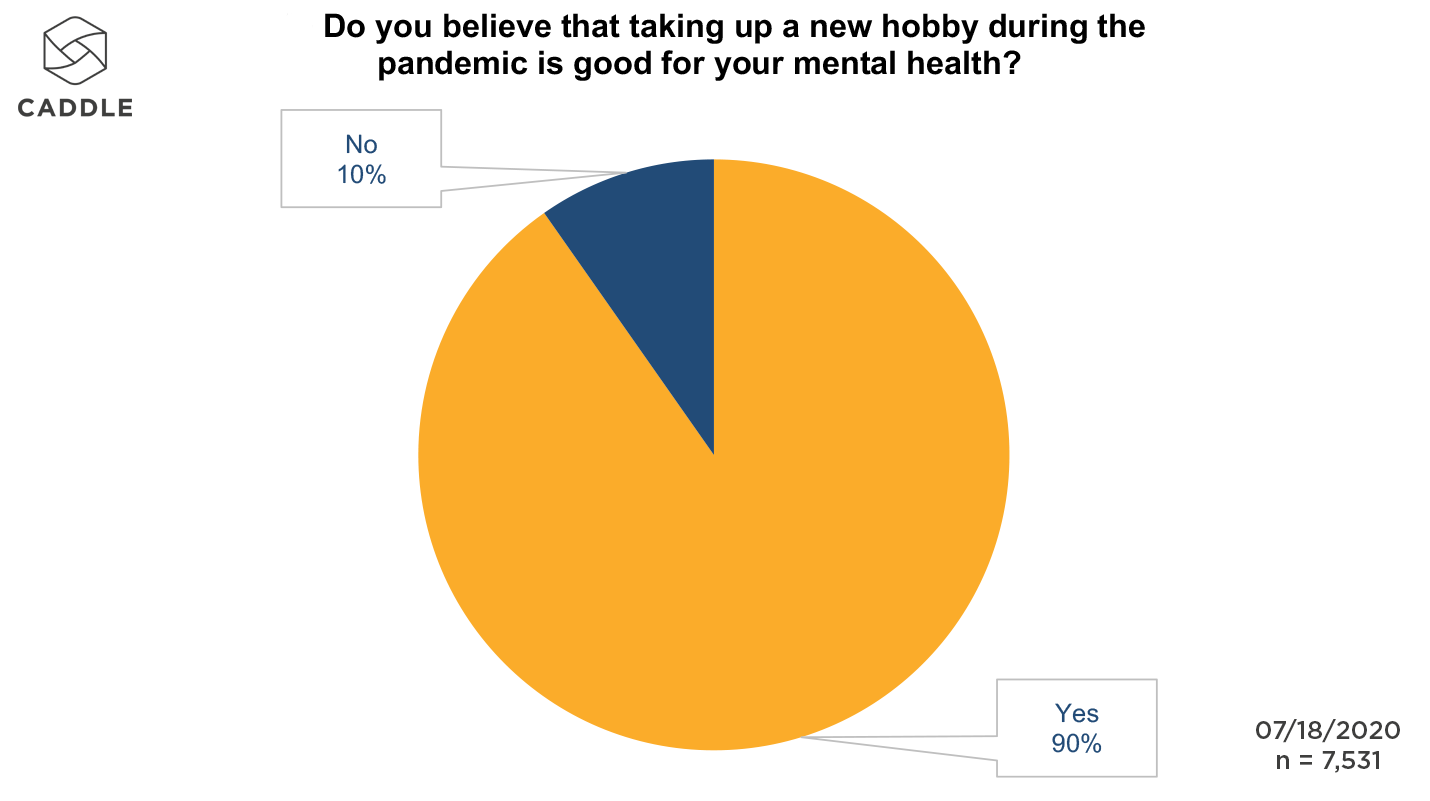

The vast majority of respondents (90%) believe that taking up a new hobby during the pandemic is good for their mental health.

Meanwhile, nearly equal proportions of respondents believe that taking up a new hobby during the pandemic is good for “self improvement,” “to learn something new,” and “to avoid boredom/pass the time” (25%, 23% and 19%, respectively).

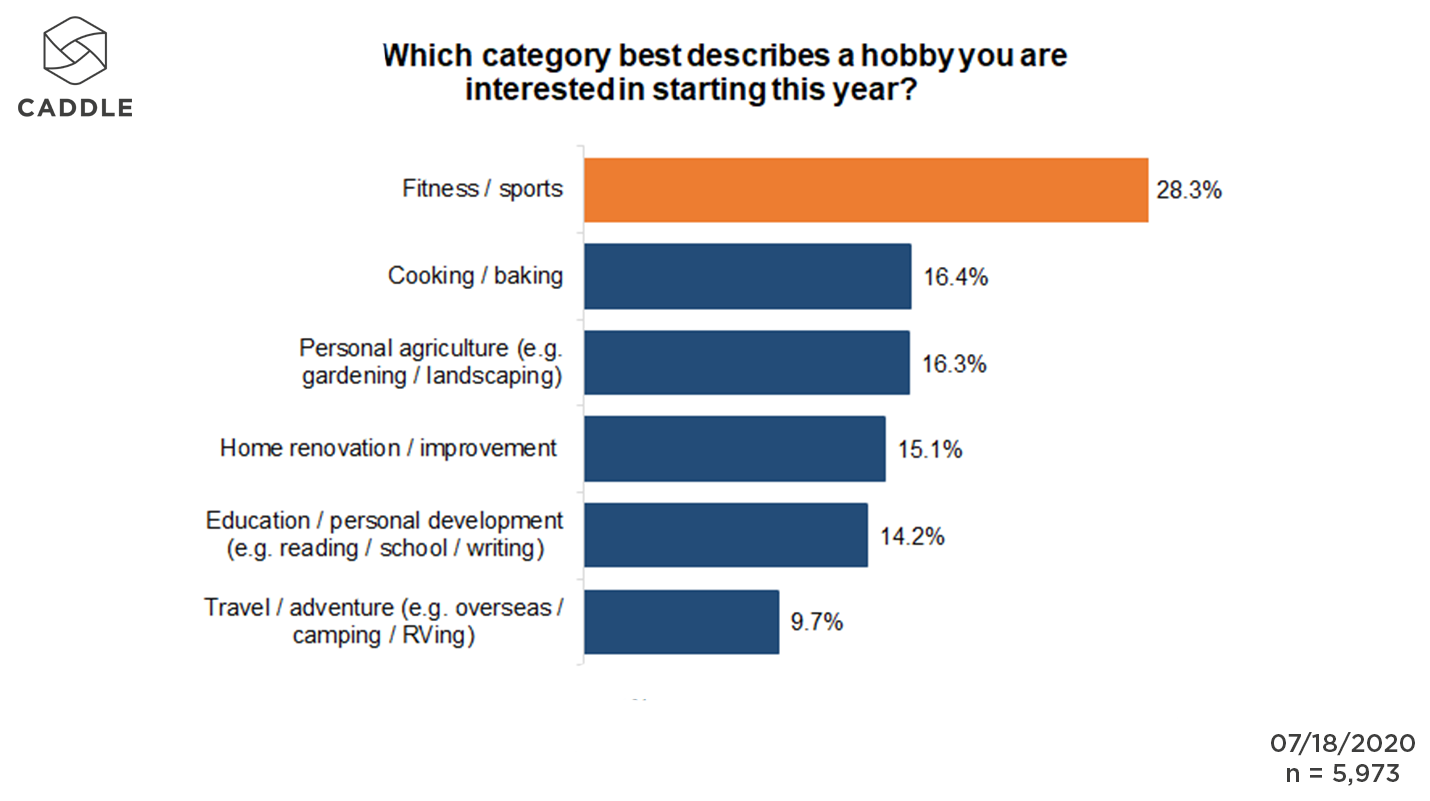

What are Canadians’ new hobbies of choice? Tied for second are “gardening/landscaping” and “cooking/baking” (both at 16%), followed very closely by “home renovations/improvements” (at 15%)—indicating that the majority of Canadian respondents are not just embracing but making the most of stay-at-home protocols during the pandemic and into the latter half of 2020.

Baby Boomers and people from Newfoundland and Labrador, Nova Scotia, Quebec and P.E.I. seem most interested in gardening as a hobby in 2020 (at almost 19% each), while Gen Zers and people from New Brunswick and Saskatchewan under-indexed on this response (at about 13% each). This is perhaps indicative of the younger generation’s lack of access to green space of their own, though doesn’t necessarily hold true for every province.

WHICH CANADIANS HAVE THE GREENEST THUMBS?

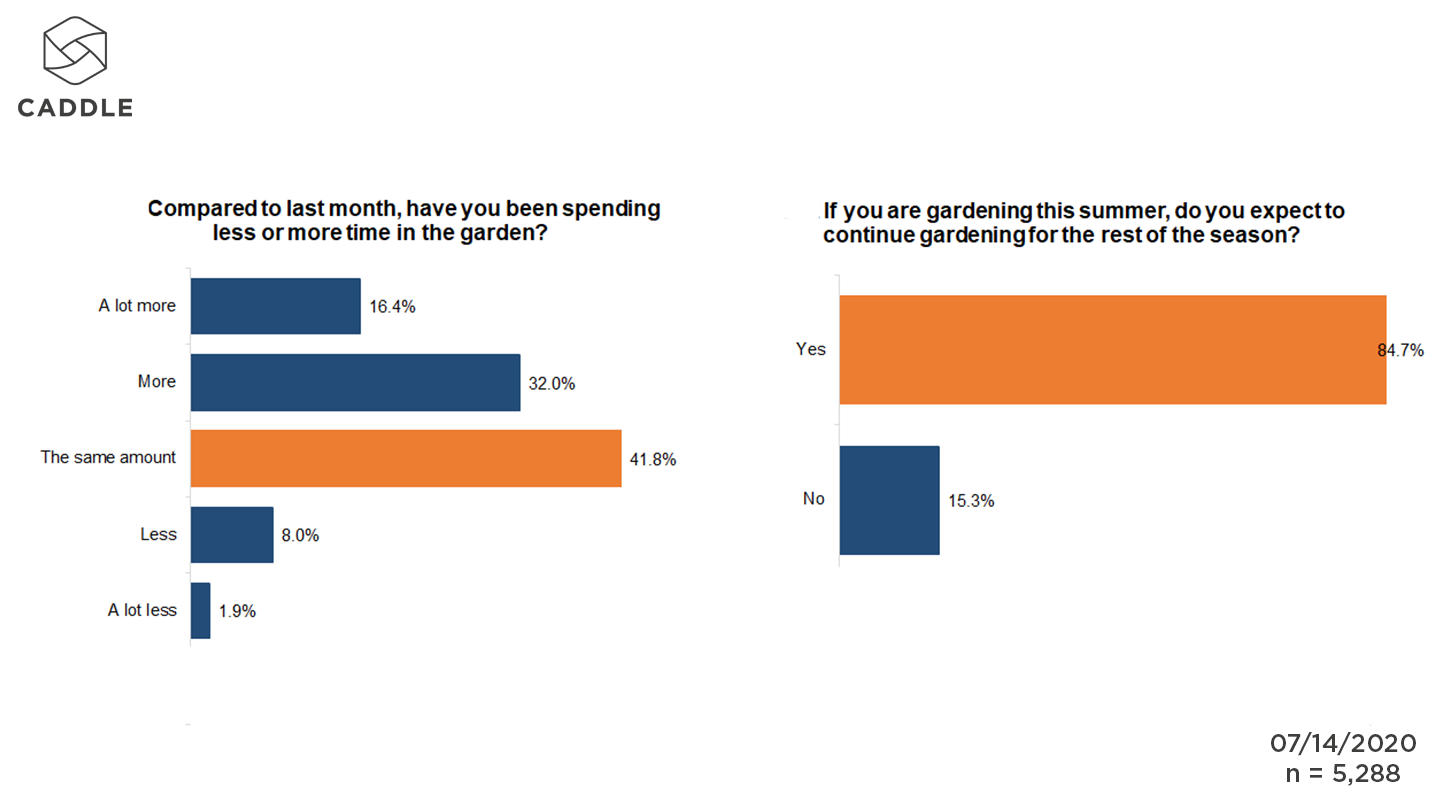

Among the respondents who garden, 48% were spending more time in the garden than the month previous, and 85% expected to continue gardening for the rest of the summer season.

Out of our panel, female-identifying Canadians have been spending more time in the garden, while Saskatchewanians, New Brunswickers and Prince Edward Islanders (93%), Manitobans (92%) and Nova Scotians (86%) expect to continue gardening into the next season.

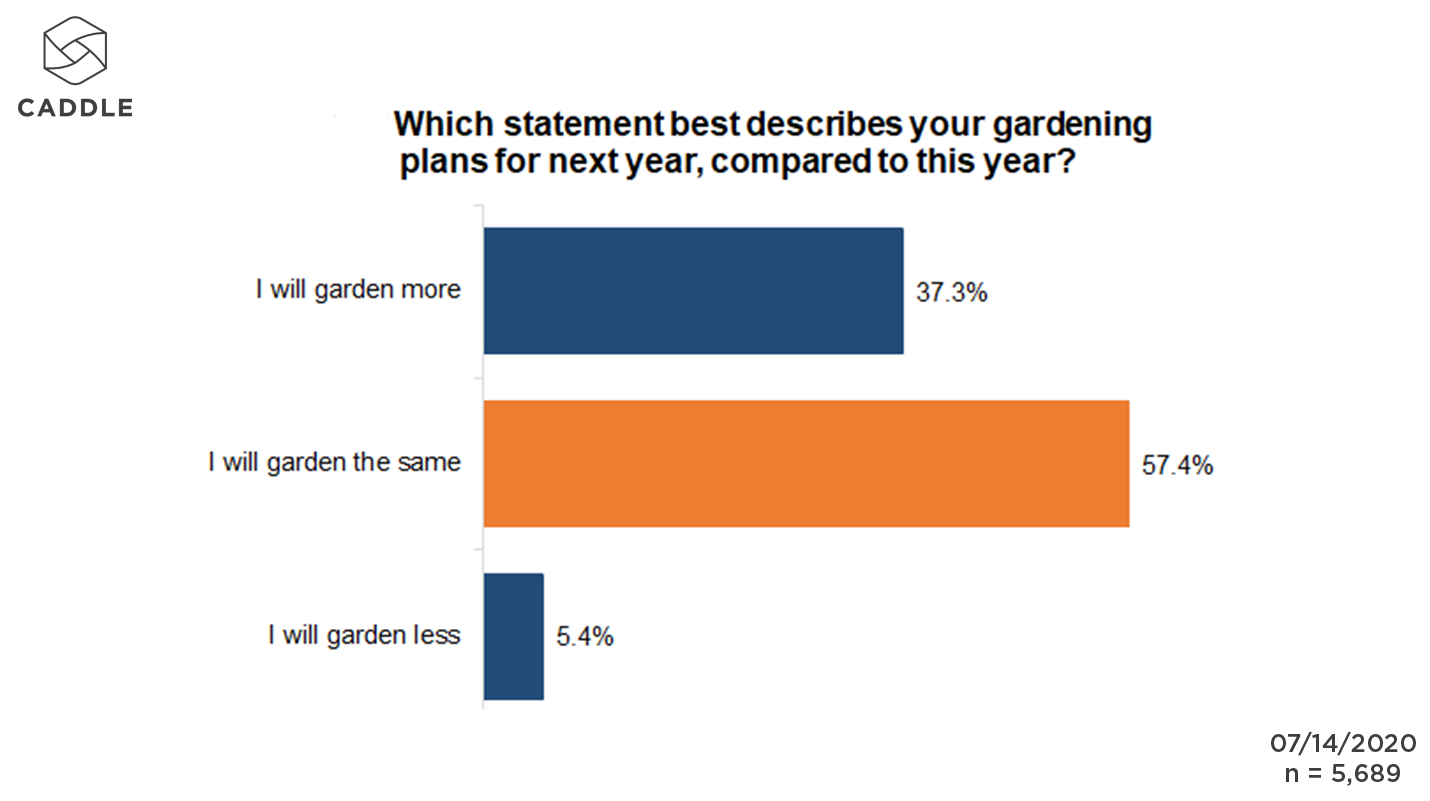

And into the future? We expect to see over a third of our general population gardening more in the year to come than in 2020. (Overall, just over 5% of respondents said they’d be gardening less in 2021.)

Millennials and New Brunswickers seem especially keen to get their hands dirty in the garden in 2021 (over-indexing at 42% and 44%, respectively).

WHAT ARE CANADIANS GROWING?

Because this subject has bearing on a slew of different factors in people’s lives—from their hobbies and interests to their eating and spending habits, and more—we’ve looked at the contents of Canadian gardens in several different surveys.

From mid-July 2020, we learned that four of five respondents (more than 82%) are interested in growing their own fruits and vegetables—especially Prince Edward Islanders, who over-index the most (at almost 91%), Saskatchewanians (at 89%), Manitobans, (at 87.5%), Nova Scotians and New Brunswickers (at 85% each), and British Columbians and Quebeckers (at 83% each).

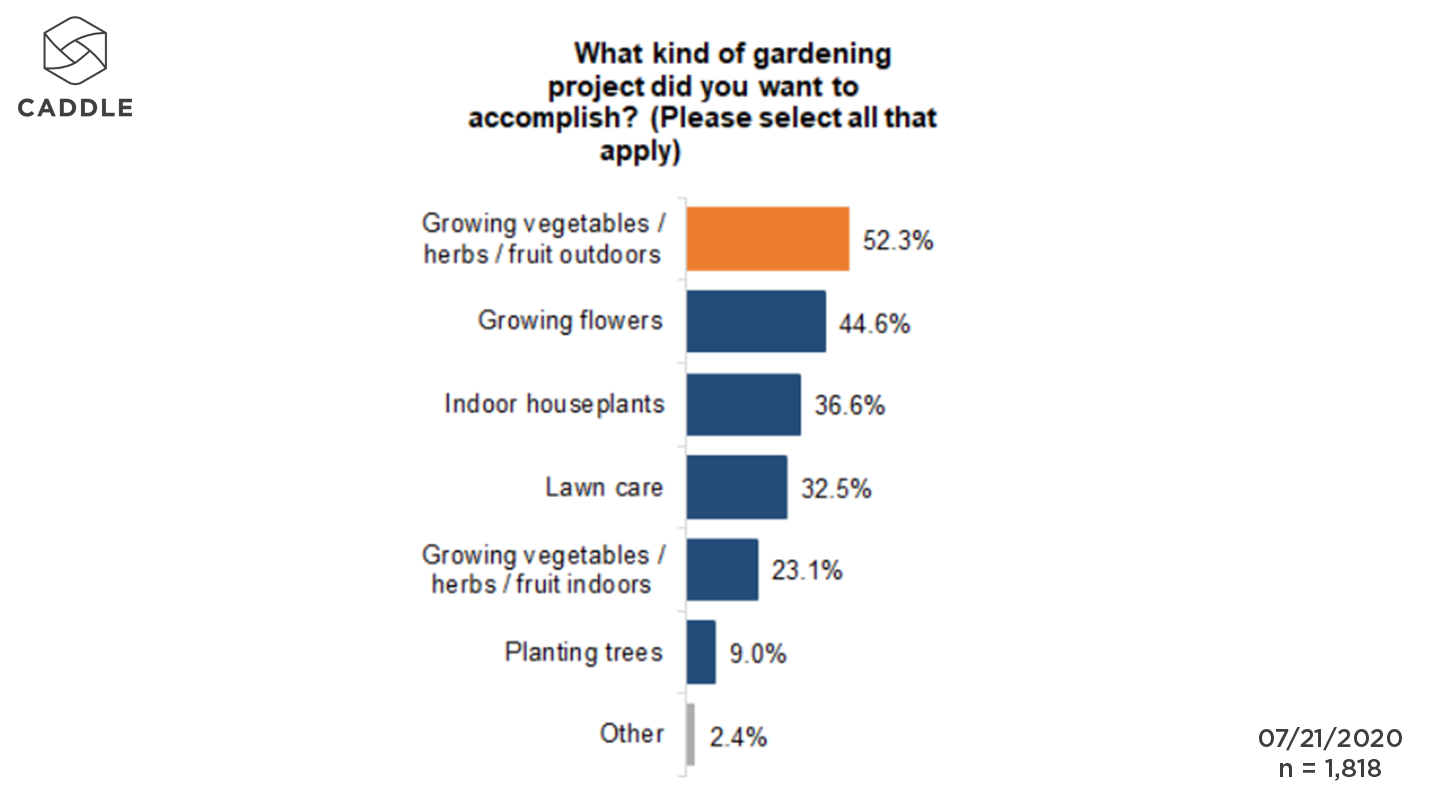

In a follow-up survey from later in July, we explored Canadians’ intentions for future gardening projects, and once again, fruits and vegetables came out on top: More than half of respondents indicated they’d like to accomplish an outdoor vegetable/herb/fruit growing project. When we add in the number of Caddle users who wish to grow vegetables/herbs/fruit indoors (bringing the total number up to 75%), it’s clear that more Canadians are prioritizing the growth of healthier food ingredients among their off-time activities.

It’s important to note, too, that respondents listed growing flowers and houseplants as the next-most important to them—underlining the fact that Canadians are likely trying to make the best of “work from home” and “isolating in place” protocols by beautifying their homes the natural way.

WHERE DO CANADIANS GET THEIR GARDENING SUPPLIES & WHAT FACTORS INFLUENCE THEIR PURCHASING DECISIONS?

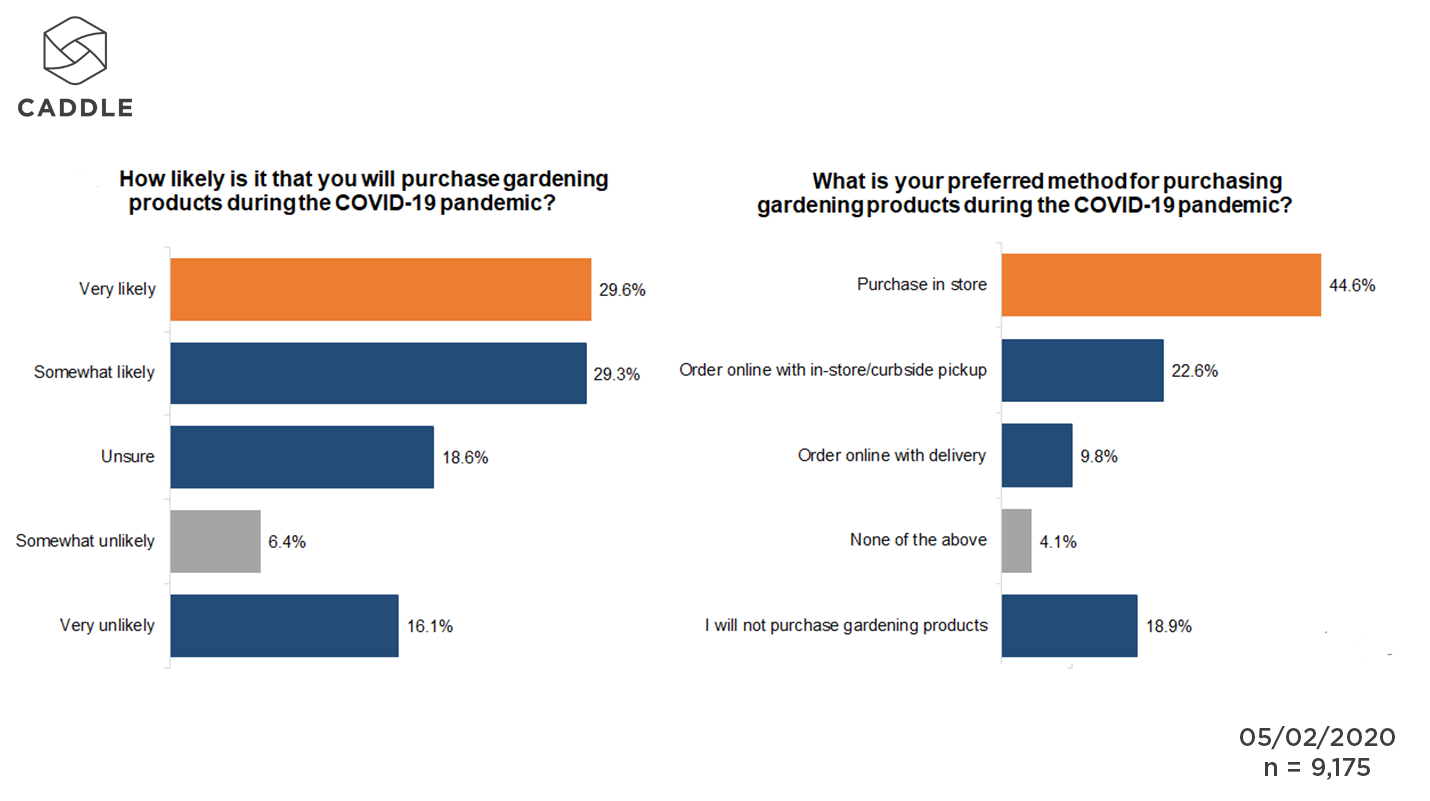

Back in early May, as provinces began relaxing certain lockdown restrictions, it seems that many Canadians were chomping at the bit to get their green thumbs working the earth again: While almost 60% agreed that it was “somewhat likely”/”very likely” that they’d purchase gardening products during the pandemic, just under 45% indicated that they’d most prefer to shop for those same products in brick-and-mortar stores (a further 32% preferred order online with in-store/curbside pick-up or delivery).

Unsurprisingly, the gardening products that Canadians were most likely to buy online were the most easily shippable—seeds and plants (nearly 36%). Soil and fertilizer ranked second, but with less than half the number as those who identified seeds and plants, we have to wonder if shipping fees for heavier items, as well as the availability of products in early May, might have been a deterrent for eCommerce consumers.

Note: We learned at the end of May that delivery charges influence shopper decision-making around online purchasing; it’s conceivable, then, that the higher delivery cost of heavy, bagged items like soil would lead more customers to buy online and pick-up in-store (BOPIS) or at the curb-side.

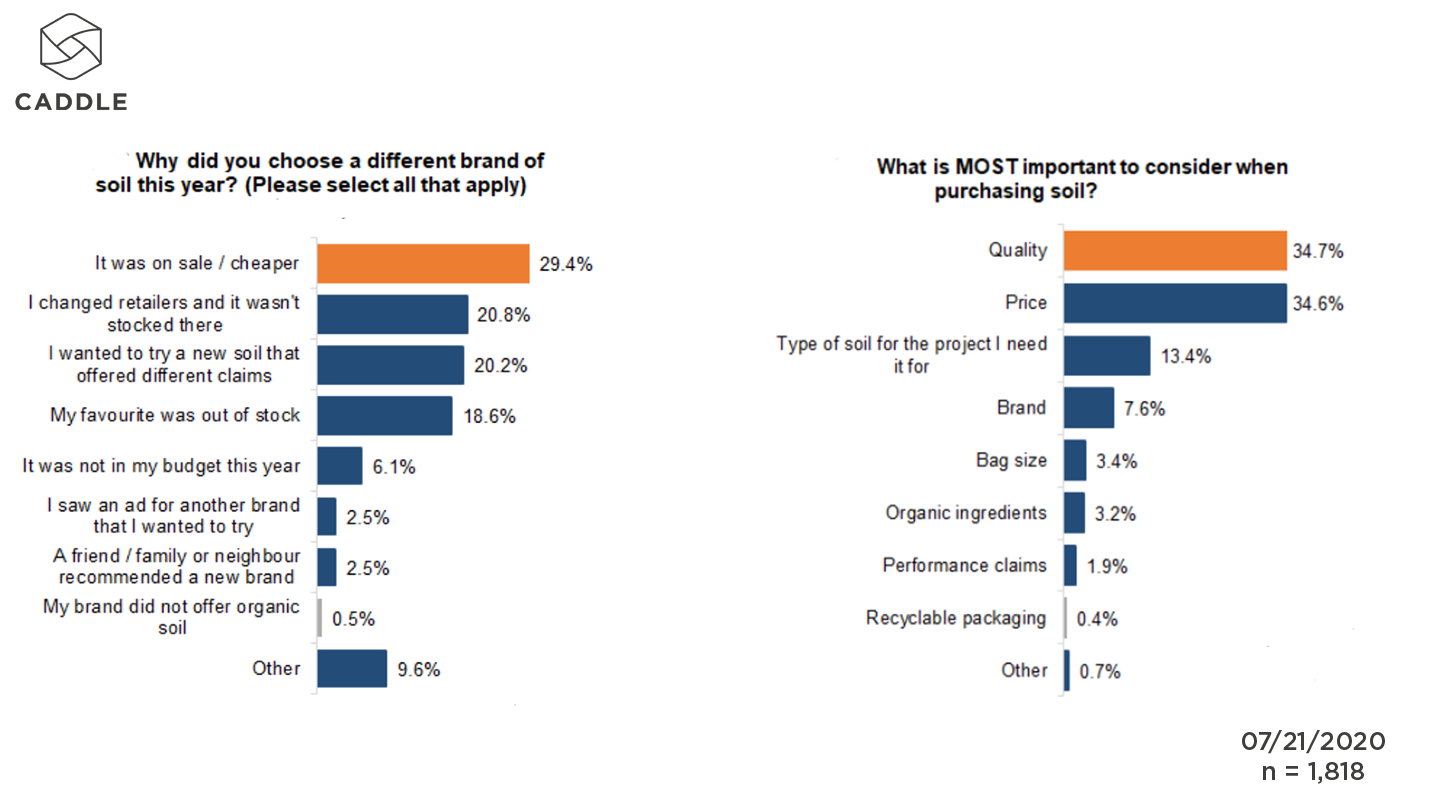

This led us to wonder about the determining factors for Canadians when purchasing soil products. And, true to our typically thrifty ways (also likely exacerbated by tightened budgets brought on by the pandemic), quality and price were equally important factors for the majority of consumers who were considering purchasing soil.

So, where about 35% of our general population identified price as the most important consideration (along with quality of the product), nearly the same percentage of respondents (30%) changed brands because of the price. (Note that this differs from insights gained in April, where brand loyalty still outweighed price, at least in the purchase of luxury goods.)

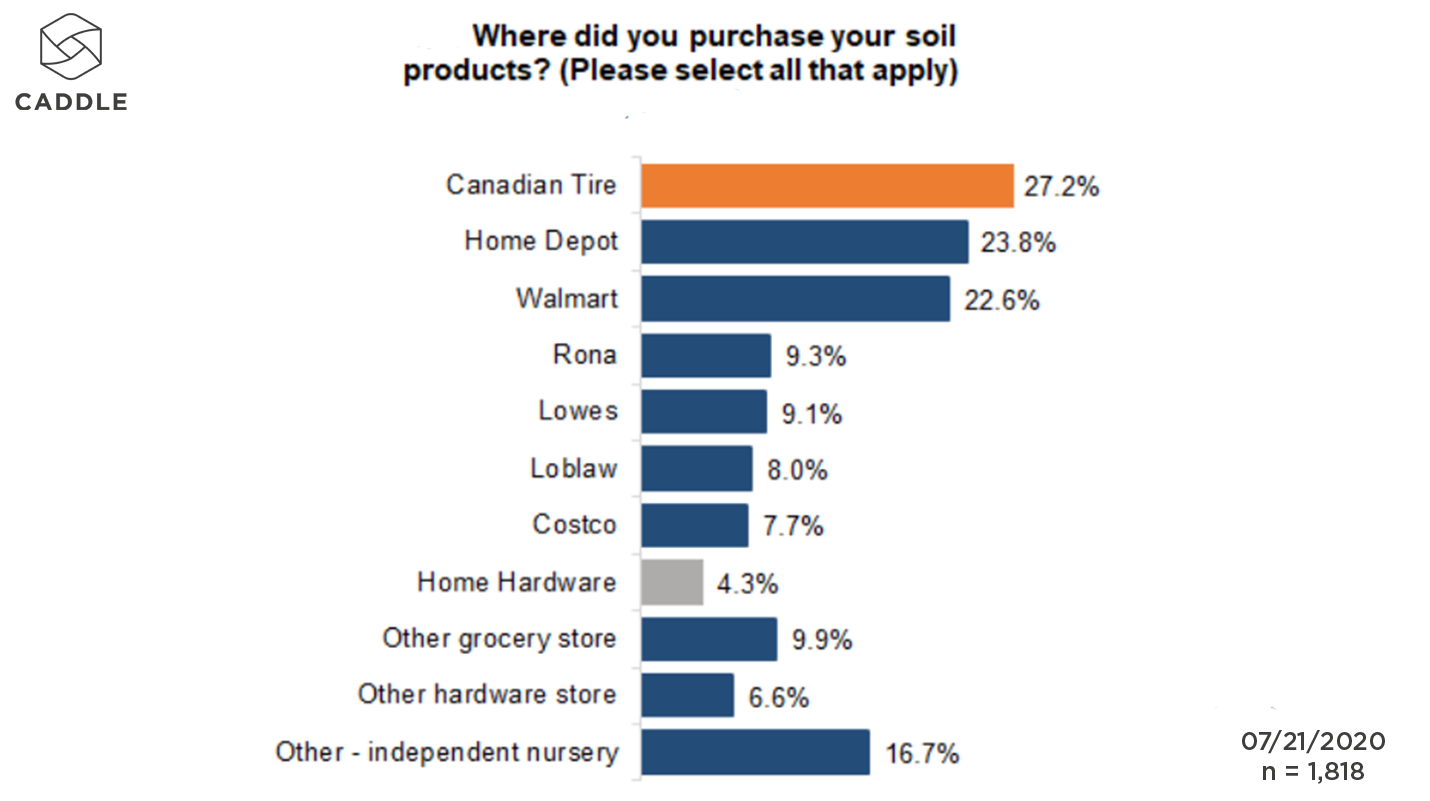

Unsurprisingly, major hardware and general merchandise retail banners (including Canadian Tire, Home Depot and Walmart) took the lion’s share of soil product purchases—perhaps indicative of their ability to offer a lower price-point to meet consumers’ needs, while also being able to offer the quantities and assortment that smaller and/or more regional retail banners can’t support.

Interestingly, Canadians also similarly valued the soil selection at independent nurseries, possibly in a nod to the tendency for many Canadians to “shop local,” especially during the pandemic.

NOW IS THE TIME TO PUT EFFORT INTO ATTRACTING CUSTOMERS WITH VALUE-ADDED INFO & SERVICES

As pandemic worries wage on—and with the “second wave” expected to hit in the coming months—the gardening boom is unlikely to bust anytime soon, as people continue to try to distract and/or keep themselves busy, and also, work to update their homes and lives while they shelter in place.

Smart retailers will take the opportunity now to prepare people who are new to the gardening lifestyle as well as returning customers for what’s to come in the months ahead. One idea: Provide project “how-tos” in-store and online to help newbies get started. Alternatively, consider the entirety of lawn and garden seasonality, offering tips and ideas for outdoor gardening enthusiasts to keep their hobbies going inside during winter months.

COMPLIMENTARY CATEGORIES BUILD BASKET SIZE & DRIVE MARGINS

There’s a reason that peanut butter is stocked in the same aisle as jams and jellies, along with a freestanding display of loaves of bread: Merchandising complimentary categories in close proximity to each other works to build basket size, particularly for new entrants into a category, who don’t necessarily know what products to buy to accomplish their project.

Consumers will be more loyal to retailers that help them to complete a project from start to finish in one trip with less time in-store (and thus, less potential coronavirus exposure).

With lawn and garden products, consider merchandising all the products that consumers will need to complete a project, including garden fertilizer, gloves and tools, near the skids of soil, grass seed and mulch.

DON’T COUNT ECOMMERCE OUT FOR THE LAWN & GARDEN CATEGORY

We’ve said it before and we’ll say it again: Canadian retailers need to up their online game if they’re ever to match the eCommerce numbers posted in other countries.

While consumers may not have completely bought-in to online shopping for lawn and garden, the interest in eCommerce options is definitely there—particularly if a second wave of the pandemic causes renewed restrictions on people’s coming and goings.

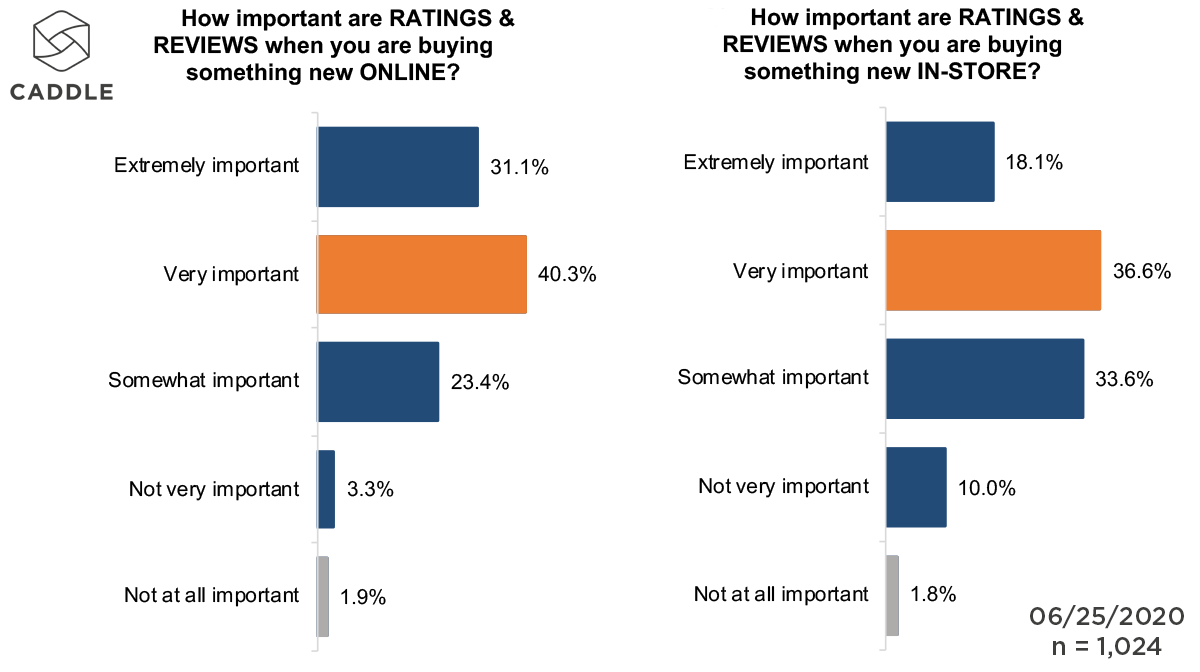

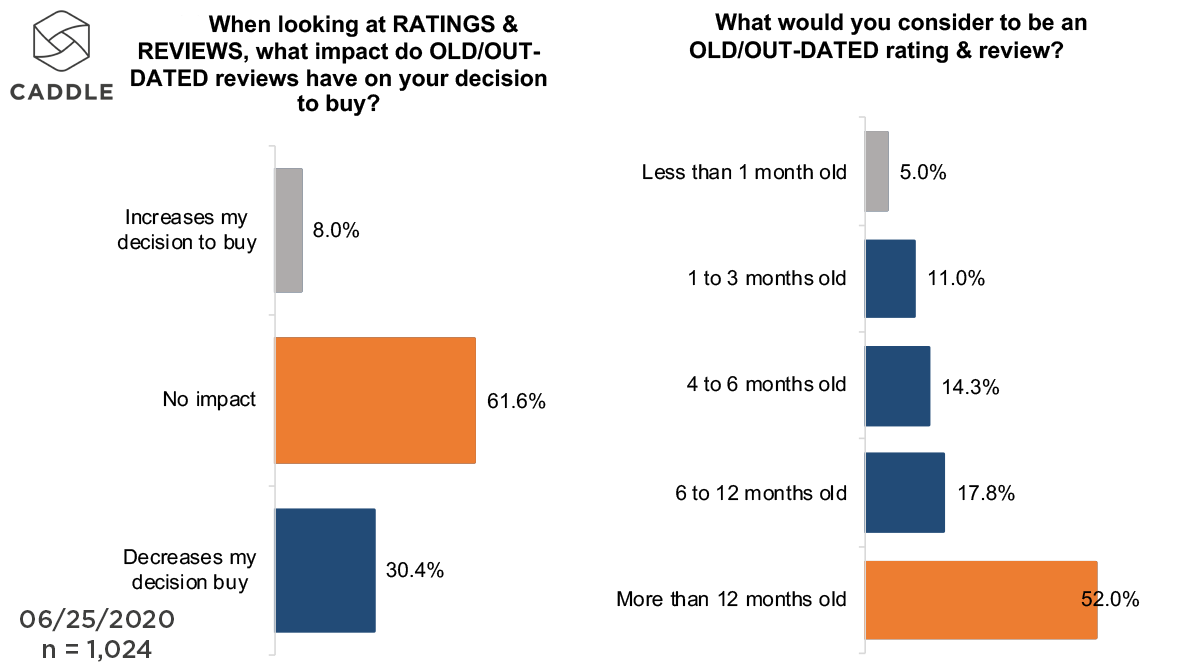

At the same time, we know that ratings and reviews make a significant difference in consumers’ decision-making process, especially if the ratings and reviews were posted no more than six months before. Now, it’s up to retailers to encourage adoption of omni-channel shopping. Some ideas: Offer incentives that get customers to BOPIS or at the curb-side. Or alternatively, cultivate new entrants into the category through emphasis on peer ratings and reviews—especially Millennials, who are keen to continue growing their own fruit and vegetables in the coming months and find ratings and reviews to be notably influential in their purchase journeys.

COVID-19 Insights: Customer Experience and Ratings and Reviews Top Influencers for eCommerce in Canada

Upwards of 88% of respondents say ratings and reviews are important when buying something new

Back in the good ol’ days of 2019—pre-pandemic, pre-lockdown, pre-widespread COVID isolation blues—Canadian ecommerce rates were already chugging along: Canada Post research indicated that eight out of ten Canadians had shopped online the year before, and all indications suggested that online shopping rates would continue to grow as markets matured.

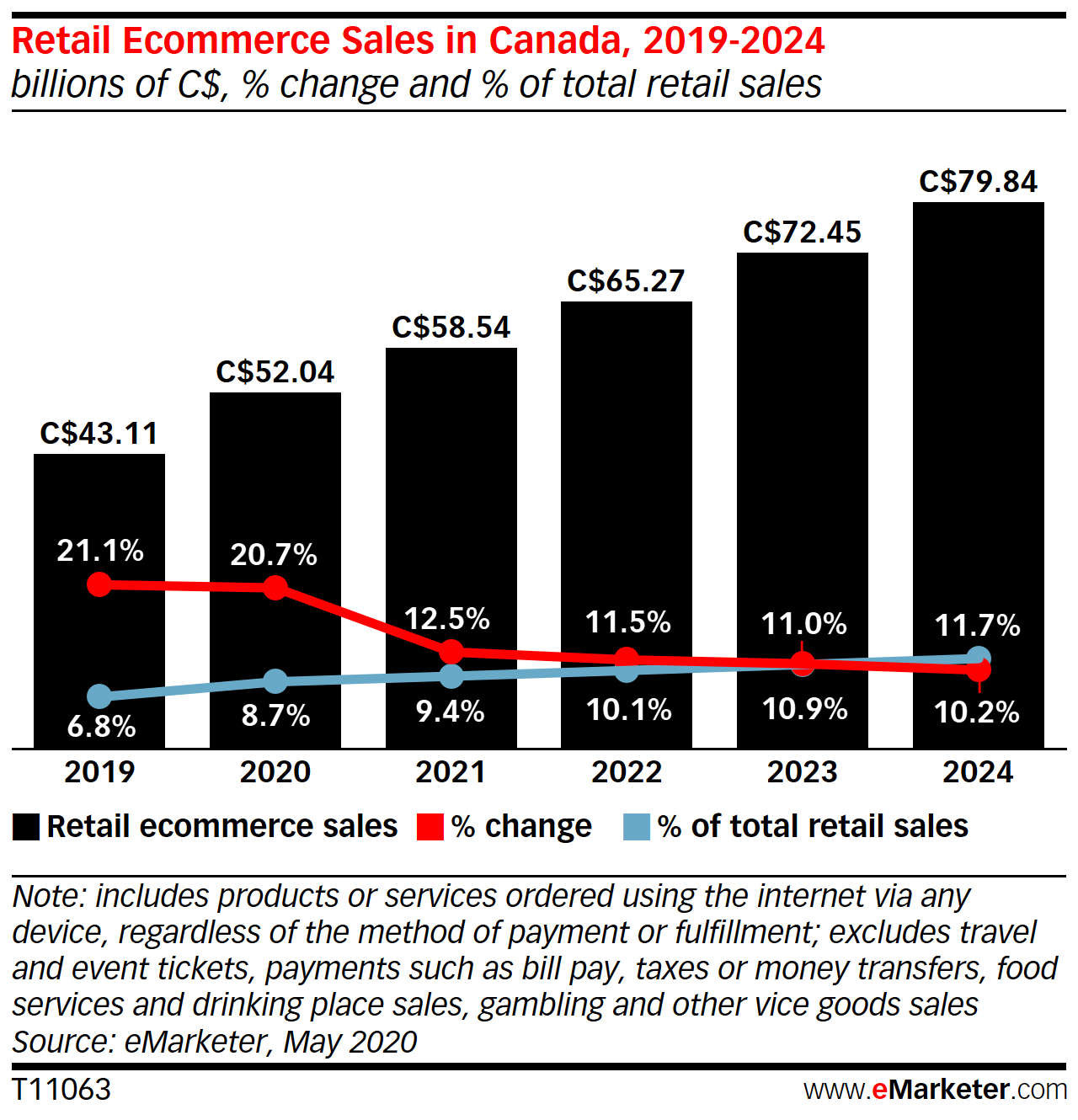

Now, eight months into 2020 and five months into COVID life, consumers have shifted more of their retail spending toward eCommerce than expected even a year ago: eMarketer estimates suggest a YOY increase of 20.7% (8.7% of all Canadian retail sales) in 2020, one-third of which will be driven by mobile. (Note that these values are still lower than other countries, such as the U.S., where eCommerce grew 27% in May 2020 from the previous 12 months, according to one CIBC Equity Research report.)

Time will tell how the COVID-driven disruption of the retail market will shake out in the balance of the year. Yet, right now, there’s no question that the lockdown and ongoing health and safety concerns have changed Canadian consumers’ shopping activities.

And so, we wanted to get first-hand insights into Canadians’ retail behaviour. Specifically, since the beginning of the pandemic, have consumers shifted more of their buying to online channels? And, in general, are they spending more or less now than pre-pandemic? Finally, what factors are most influential in their purchase decision-making?

Let’s dive into the stats to learn what we discovered when we polled our 10,000-strong Caddle user panel.

ARE CANADIANS DOING MORE OF THEIR SHOPPING ONLINE?

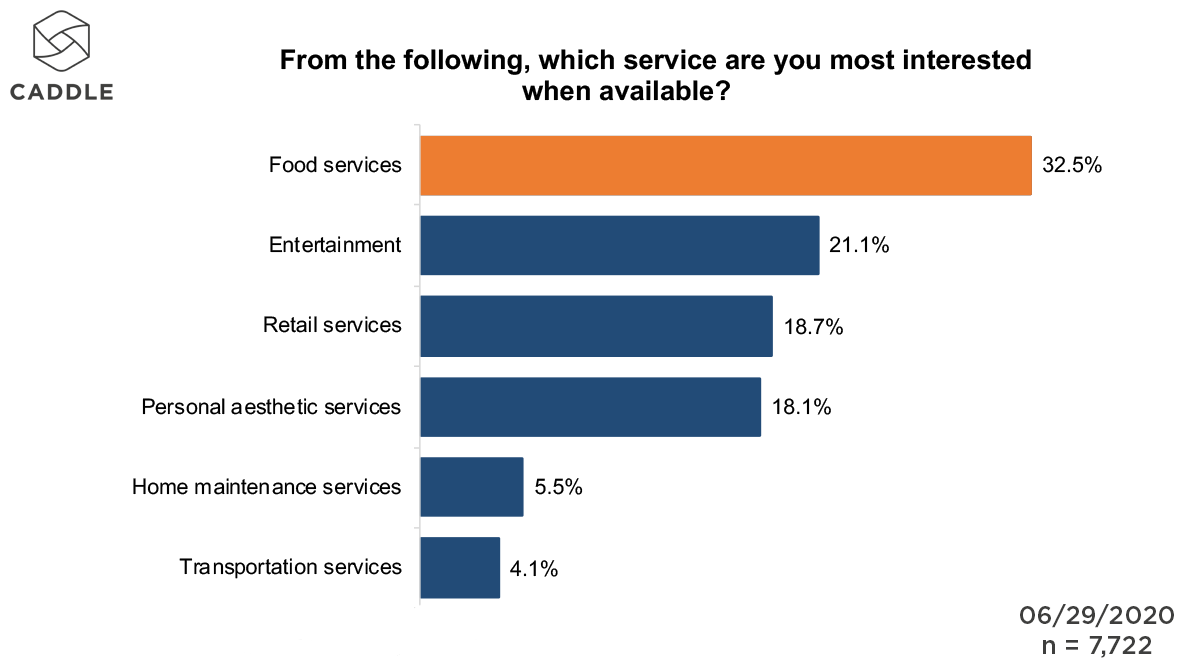

Back in June, we asked Canadian consumers which services they were most interested in taking advantage of, once available. Their top responses: Food Services (32.5%), Entertainment (21.1%), and tied for third, Retail (18.7%) and Personal Aesthetic Services (18.1%).

Among our general population, Baby Boomers, Gen Xers, and respondents in British Columbia, Manitoba, Saskatchewan, New Brunswick, Newfoundland and Labrador seemed most excited about the return of Retail Services—in many cases, eclipsing Entertainment, though never beating out Food Services for top spot.

WHAT MIGHT BE HOLDING CONSUMERS BACK FROM SHOPPING ONLINE?

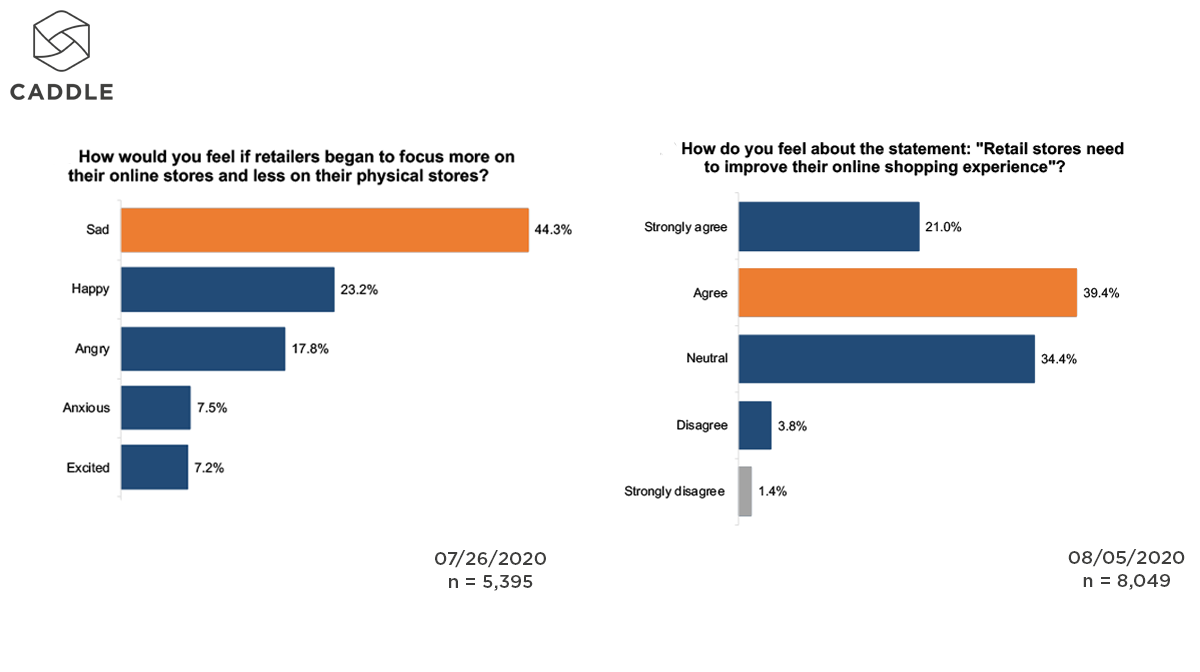

While our research identified an uptick in online ordering (especially for groceries) in the early stages of the pandemic, more recent responses indicate that retail stores need to up their online game—though not necessarily to the extent that it jeopardizes their brick-and-mortar shopping experience. Specifically, though more than 44% of respondents indicated they’d be “sad” if retailers focused more on their online stores than their brick and mortar locations (and only 23% said they’d be “happy”), in another study, a little over 60% of people “agreed”/”strongly agreed” that retail stores need to improve their online shopping experience.

Predictably, digital natives are especially critical of the online shopping experience—especially Millennials (65.4%)—as well as male-identifying respondents (63%).

IN CONTRAST, WHAT MIGHT BE DRIVING CONSUMERS TO DIGITAL SHOPPING CHANNELS?

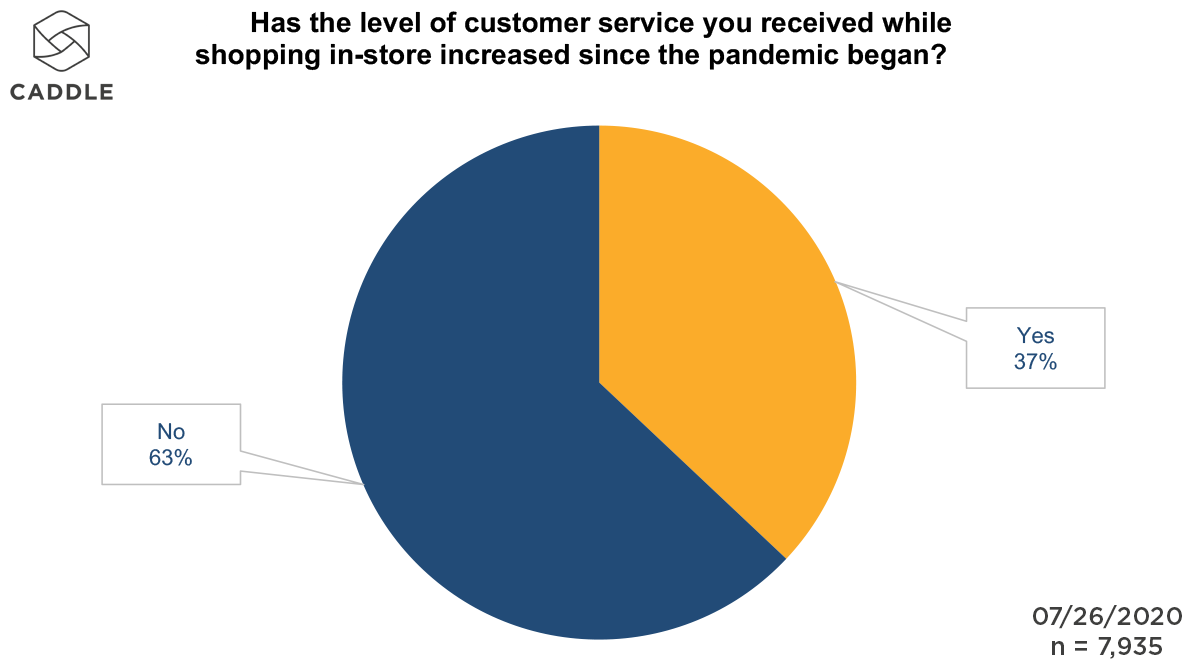

Nearly two-thirds of respondents indicated that in-store service has lagged since the pandemic began. Thus, it’s no surprise that, aside from the convenience and health and safety protocols, more Canadians are flocking to online sites for their retail purchases than before the pandemic.

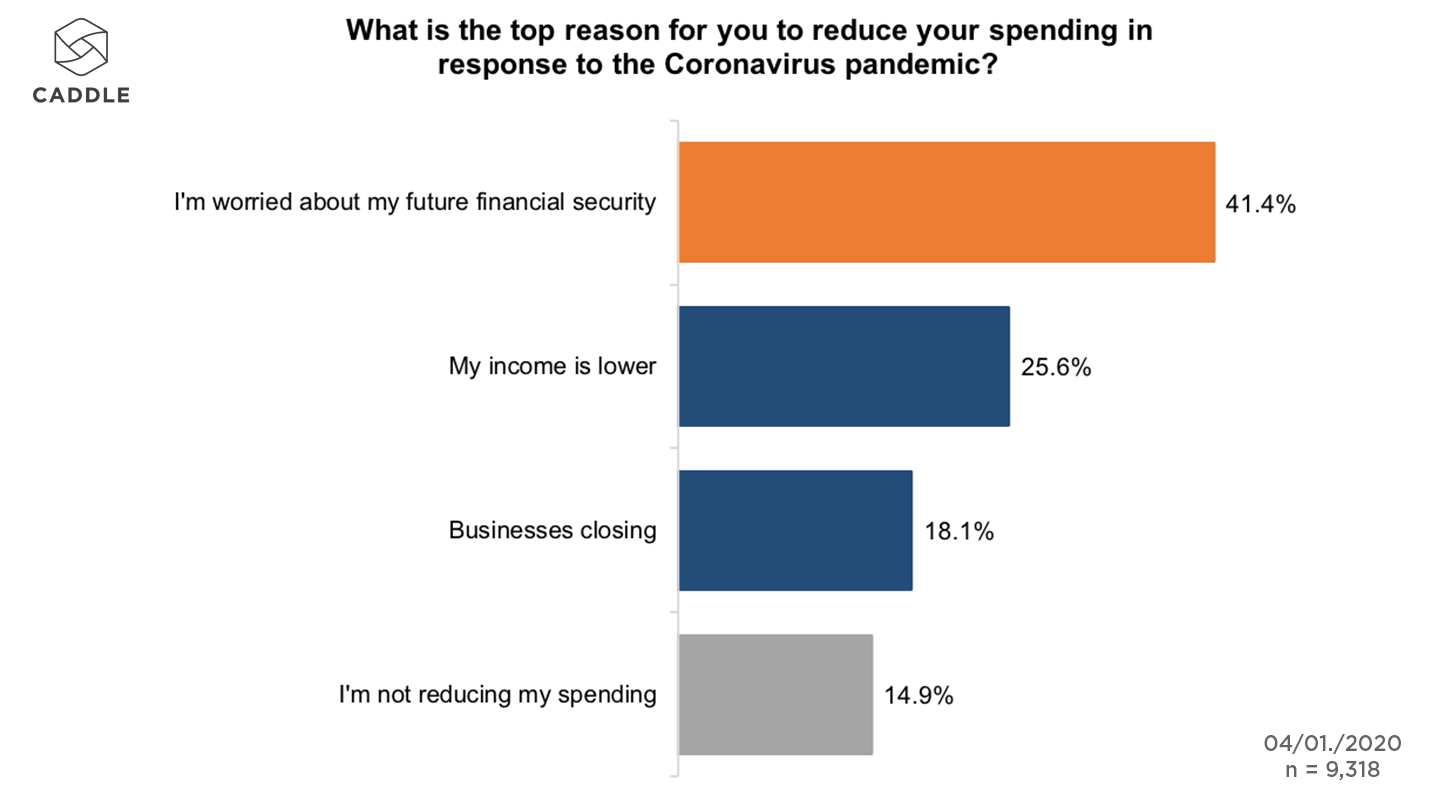

Cost may come into play too: We had already learned that almost nine in ten Canadians have cut back on spending during the pandemic, whether due to a drop in income (25%), businesses closing (18%) or simply, worry about financial security (41.4%).

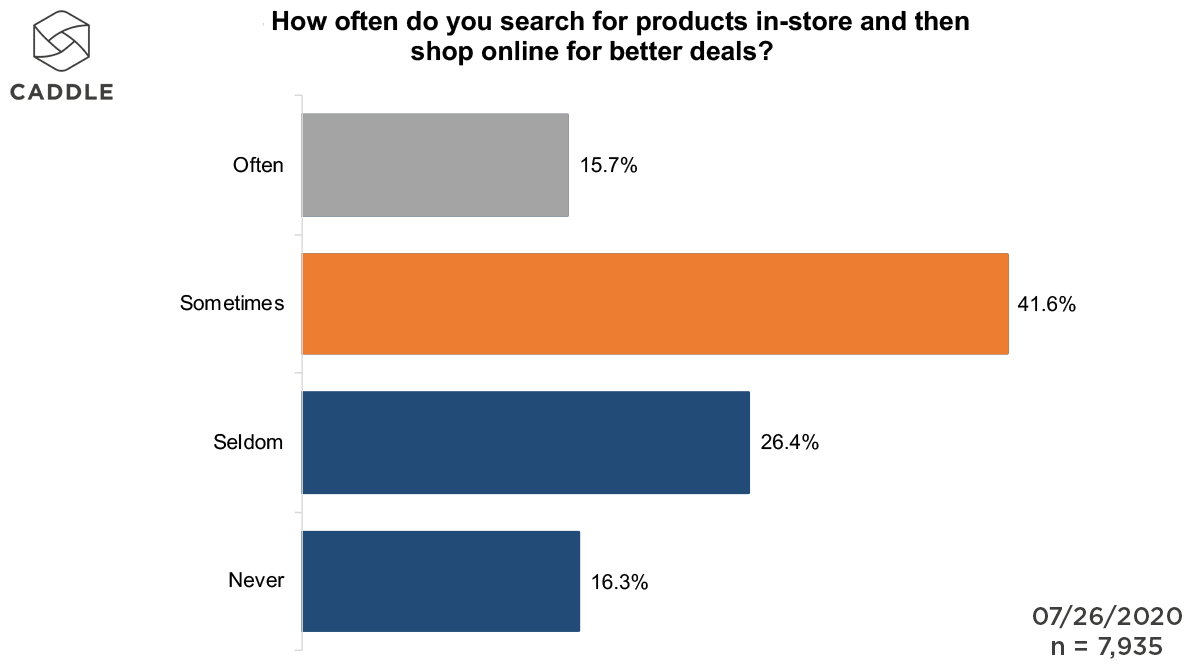

In a follow-up panel from July, we determined that nearly 60% of respondents “sometimes” or “often” search for products in-store but purchase online for better deals.

These results suggest that Canadian consumers remain cost-conscious amidst the ongoing uncertainty surrounding COVID and its impact on our nation’s economic and social well-being.

Yet, along with cost, perhaps the most influential factor involved in consumers’ decision-making is the availability of ratings and reviews: Whether in-store or online, the vast majority of Caddle users indicate that ratings and reviews are important when buying something new (88% for in-store and 91% for online).

And, once again, we found digital-native Gen Zers and Millennials to be especially fond of checking ratings and reviews, over-indexing against the general population for both online and in-store, while elder respondents (including Baby Boomers and the Greatest Generation) seem to put less value in other people’s opinions when buying something new in any retail setting.

Yet, ratings and reviews are not all equally influential in consumers’ eyes. Upwards of 63% of Caddle users argued that ratings and reviews from six or more months ago are “old”/”outdated,” and an equal number suggested that such old/outdated ratings and reviews would have “no impact” on their buying decisions.

Meanwhile, 41% of consumers would switch to another retailer if ratings and reviews weren’t available on their site.

Without a doubt, these statistics should cause a pause for thought among retailers who are lagging behind on keeping their digital sites up to date.

KEY TAKEAWAYS

ECOMMERCE STILL HAS PLENTY OF ROOM TO GROW IN CANADA

Though some categories are further ahead than others—such as grocery, likely due to the necessity of staying out of harm’s way during the pandemic—the majority of retailers in Canada have a long way to go to match the eCommerce numbers posted in other countries, including our neighbours to the south.

Retailers’ best opportunities may exist in winning the hearts, minds and shopping dollars of those Canadians who are most excited about the return of Retail Services. If they can prove to Baby Boomers, Gen Xers, and people in British Columbia, Manitoba, Saskatchewan, New Brunswick, and Newfoundland and Labrador that their eCommerce experience is as good (if not better) than the brick-and-mortar experience—or perhaps connect their services to categories with highest anticipation upon re-opening (i.e., Food Services and Entertainment)—there’s a higher likelihood that they’ll win share of basket away from competitors with more solid eCommerce experiences.

RETAILERS NEED TO CONTINUE TO BUILD ON THEIR ONLINE CUSTOMER EXPERIENCE

We’ve known this for some time in relation to brick-and-mortar retail, but with the anticipated growth in eCommerce—and plenty of room for online retail development in Canada (see Takeaway #1, above)—no retailer, in any category, can afford to rest on their laurels when it comes to digital customer experience.

In the words of Bruce Winder, author of RETAIL Before, During & After COVID-19, “eCommerce… is here to stay and it’s going to grow, especially with certain demographics. I would invest in technology, both for omnichannel and eCommerce, as well as adding technology to the stores too… With Amazon coming in and roaring, I’d be getting my ‘A Game’ on now [in order to compete with global contenders].”

THE MOST IMPORTANT DRIVER OF ONLINE CONVERSION IS RATINGS AND REVIEWS

Take them or leave them, ratings and reviews are proving to be a crucial factor in consumers’ retail decision-making process.

As such, brands need to do whatever they can to establish a solid source of customer comments—and keep them coming, as recency is also important—if they’re going to continue to grow their share of eCommerce dollars in the months ahead.

COVID-19 Insights: The Future of Live Events is Uncertain as Canadians Still Wary of Mass Gatherings

“Take me out to the ballgame” has new meaning with only a third of respondents interested in attending live sports as soon as they become available

Sports and live event sponsorships are a huge business: This past January, Marketing Dive predicted the strongest increase in global sports sponsorships spend (+5%), to a total of $48.4 billion by the end of 2020. But, that was pre-pandemic. More recently, it was estimated that the NFL could lose a reported $5.5 billion in stadium revenues (the sum of tickets, concessions, sponsors, parking and team stores) from playing to empty stadiums. And that’s just one professional sports league among the many worldwide…

From the NFL to NHL, NBA to MLB, MLSE and CFL, not to mention other billion-dollar leagues, venues, musical events and so much more—the pandemic has hit live entertainment hard over the last four months, and event life isn’t expected to get back to “normal” for some time.

Meanwhile, plenty of stories have emerged about how brands are attempting to “stay the course” amid ongoing attendance uncertainties:

- Sports teams are playing to empty or half-empty stadiums; some are even subbing in cut-outs, dolls or digital representations of fans in the stands to make it seem more “normal” for viewers at home.

- Property management company Cadillac Fairview has piloted drive-in theatres to bring traffic back to mall parking lots.

- Musical artists are taking to digital performance app Side Door to perform, build communities around their art, and recoup lost revenues due to cancelled concerts, appearances and album launches.

We here at Caddle are no less fanatic about our sports and entertainment than other Canadians. And so, we were curious to understand what the future of sponsorships will look like moving forward, under ongoing pandemic restrictions and after.

Specifically, we wanted to know how fans feel about the lack of live sports and entertainment in their lives. Would they return to live sporting and entertainment events? And if so, when? What terms would make attending live events acceptable? And, are Canadian consumers open to other forms of events, such as drive-in concerts.

Read on to learn what we discovered when we asked industry experts like Chris Shewfelt of Maple Leaf Sports & Entertainment (MLSE), as well as our 10,000+ daily user panel, about the outlook for sports and entertainment in the coming months.

HOW DO CANADIANS FEEL ABOUT PROFESSIONAL SPORTS RESUMING IN SUMMER 2020?

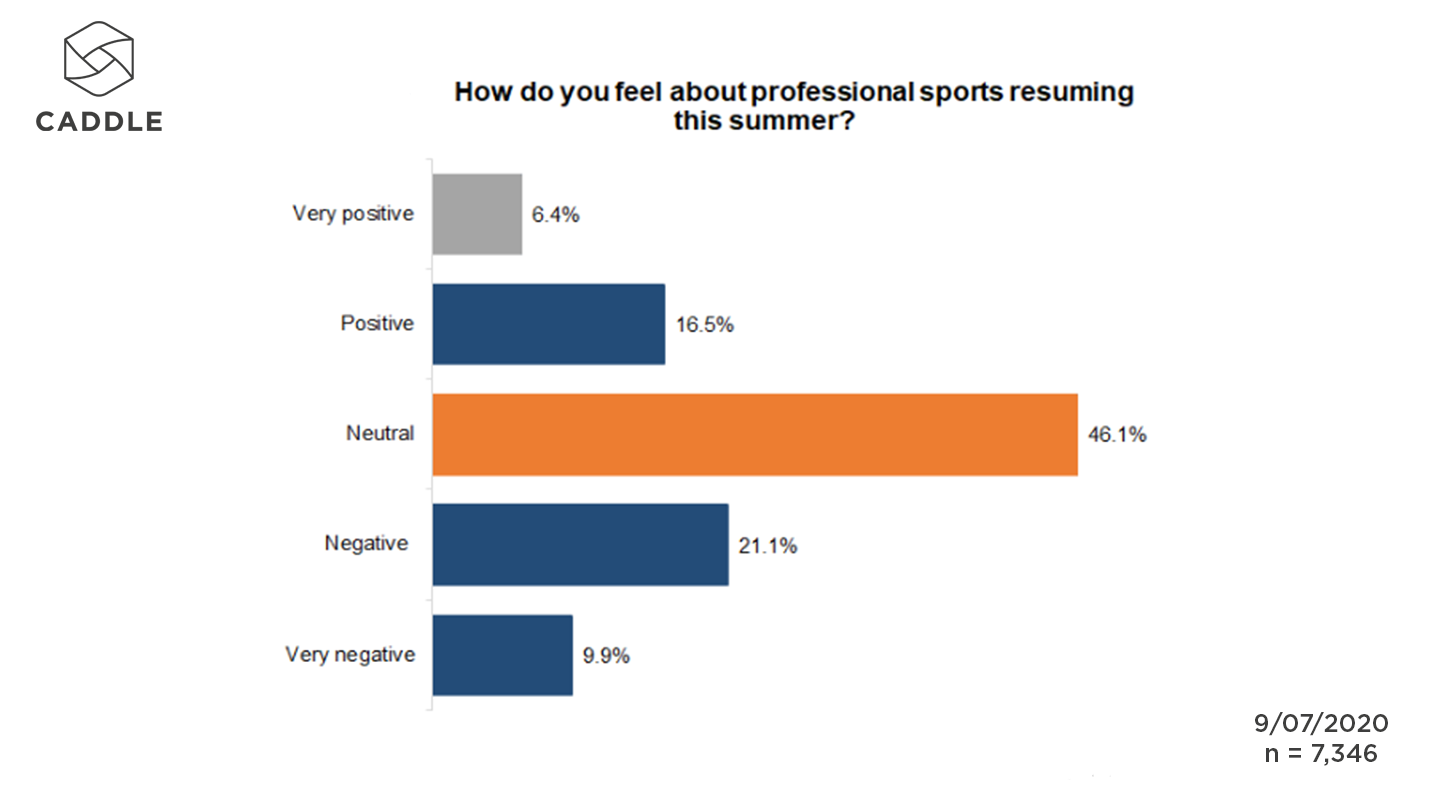

Almost half of respondents on our Canadian panel are neutral on the subject of the return of professional sports this summer, while in general, more respondents are negative about the resumption of sports than positive (31% vs. 23%, respectively).

Who seems most excited about the return of professional sports? Saskatchewanians over-index on positivity (at 30%), along with Manitobans (28%), Prince Edward Islanders (27%), Albertans (26%) and Quebeckers (25%).

IS IT TOO SOON FOR PROFESSIONAL SPORTS TO RETURN?

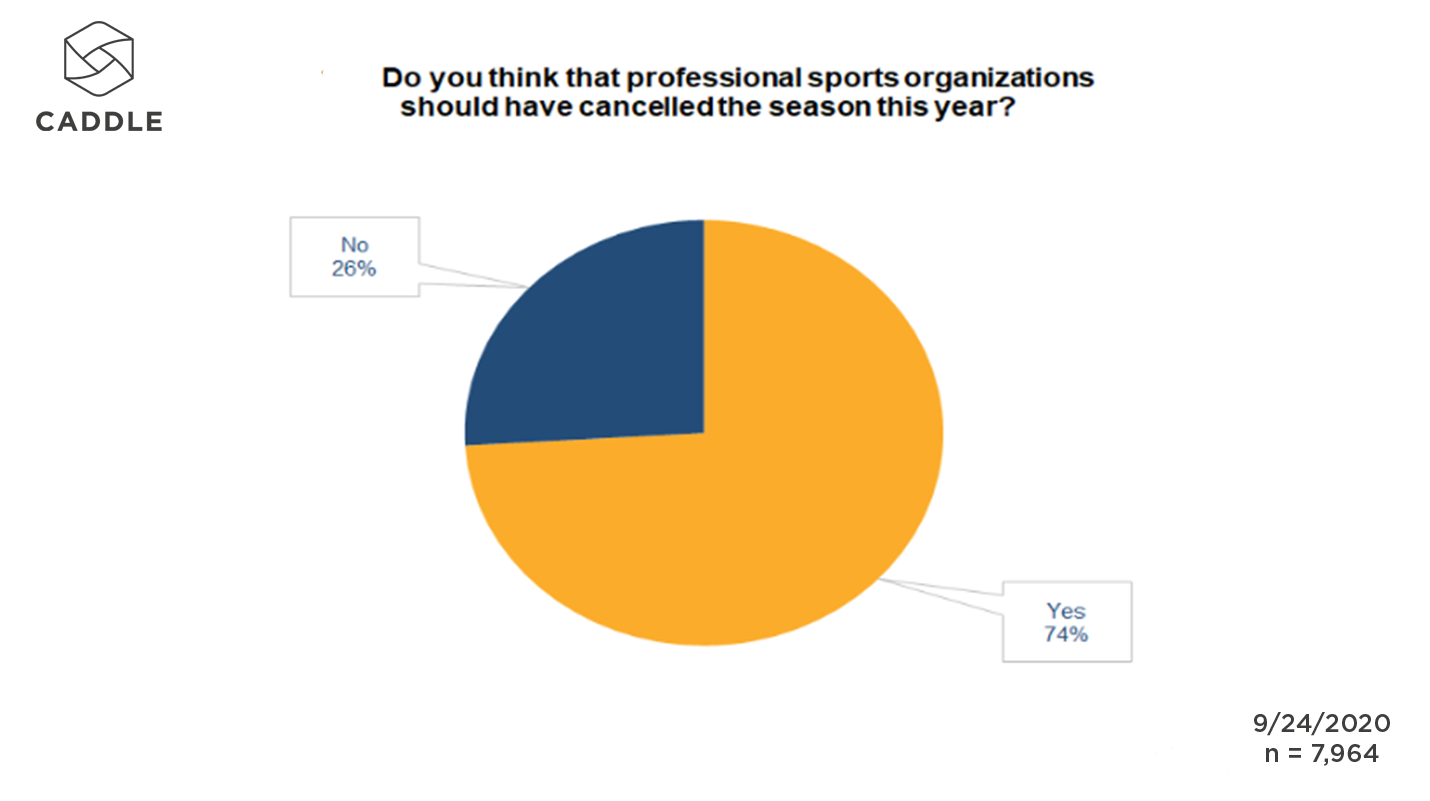

Following on the above question, we asked whether professional sports organizations should have cancelled their 2020 seasons. In response, 74% of the general population said “yes.” [Female-identifying respondents and those living in the Yukon, the Maritimes, British Columbia and Saskatchewan seem especially adamant (over-indexing up to 80%).]

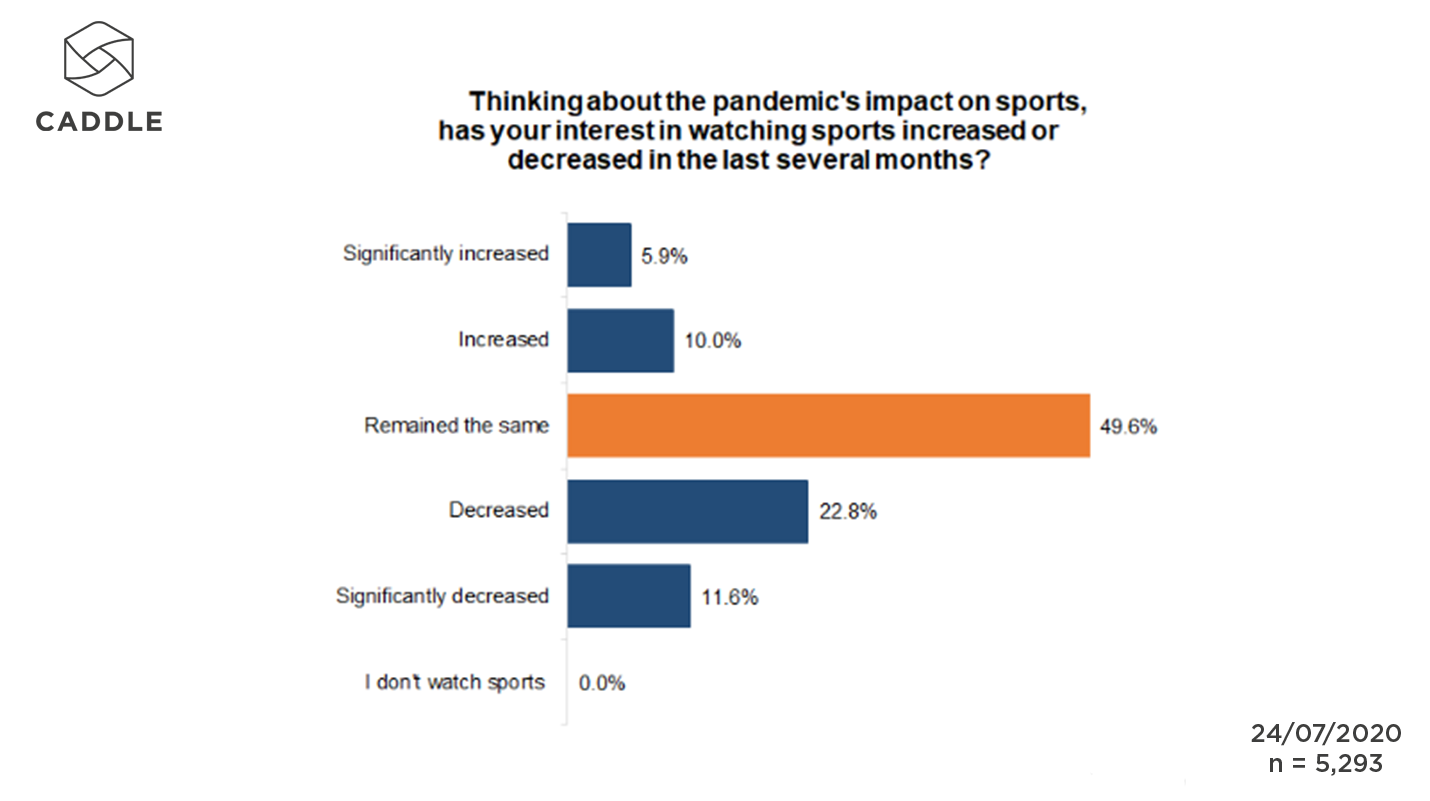

Perhaps this is because the level of interest in viewing sports has been affected by the pandemic blues: About 35% of the general panel of respondents indicated that their interest in watching sports has “decreased”/”significantly decreased,” while only 16% thought their interest had “increased”/”significantly increased.”

With the seeming effects of the pandemic on consumer interest in live sports, we wondered whether attendance would suffer once live venues re-open for widespread public turnout. And once again, our panel results show a clear uncertainty among Canadian consumers.

WILL CANADIANS ATTEND LIVE SPORTING EVENTS IN THE FUTURE?

Some Canadian sports fans are ready to head back to sporting venues once they’re made available to the public, though results are mixed. In a recent webinar, we learned from Chris Shewfelt, VP Business Operations with MLSE, that among their bread-and-butter attendees (i.e., season seat holders and members), a high percentage want to come back to MLSE venues.

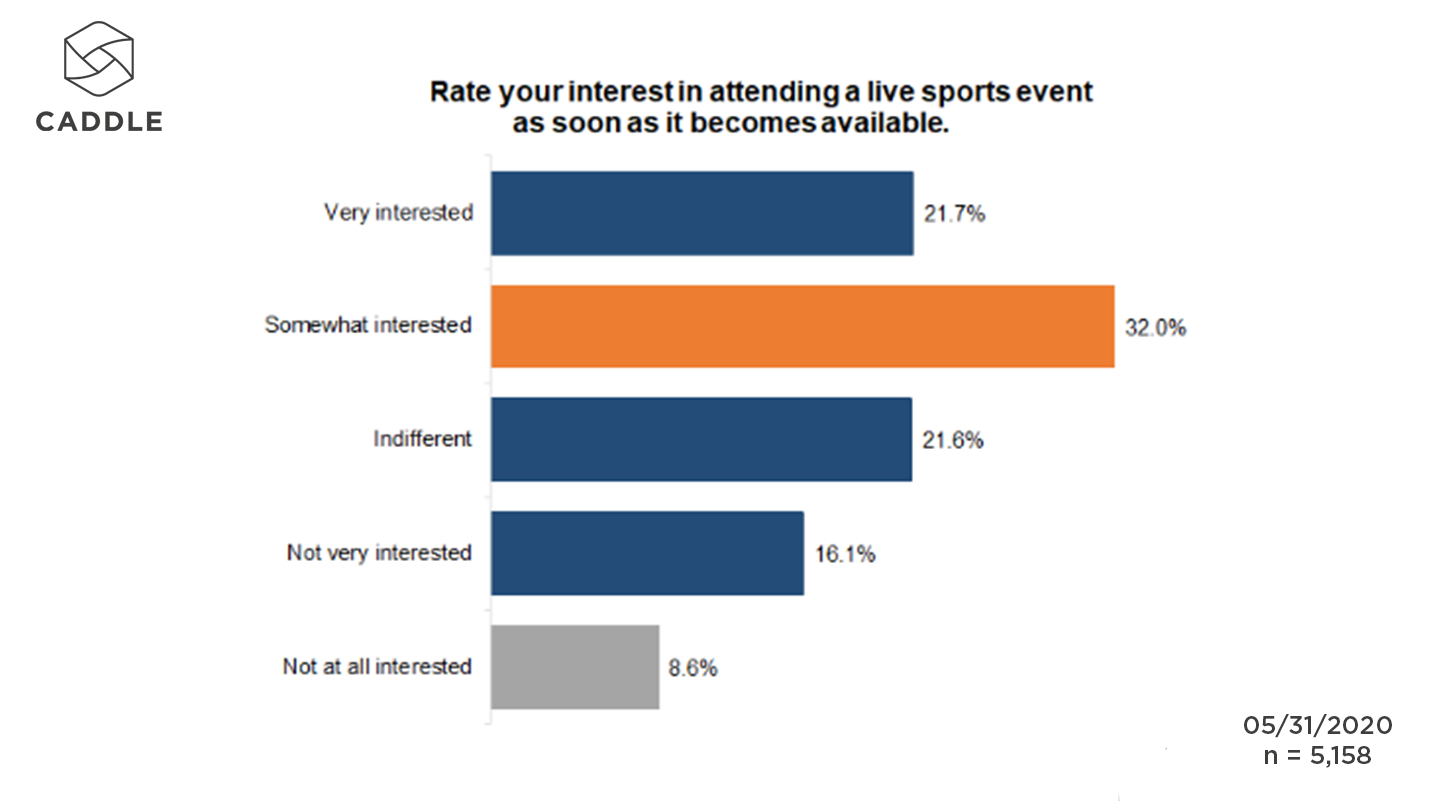

This is supported by survey responses from our Caddle panel, where 54% indicated their interest in attending a live sports event as soon as it becomes available—especially Gen Zers (43%), Millennials (39%), Saskatchewanians (40%) and New Brunswickers (37.5%).

WHAT MIGHT BE HOLDING PEOPLE BACK FROM ATTENDING LIVE EVENTS?

Results indicate that social distancing isn’t a deciding factor for the majority of respondents: Almost 56% indicated that enforced social distancing would make them neither more nor less likely to visit a sports arena. This pattern holds across generational and geographic divides, though Gen Zers are slightly more likely to attend amid enforced social distancing and Gen Xers, the Greatest Generation, and respondents in the Maritimes and Quebec are less likely.

This could be reflective of the COVID-19 statistics, more so than interest in sports or other live events, as the Maritimes have had reasonably fewer cases than other provinces, and perhaps are eager to take precautions to stay that way. At the same time, older populations and folks in Quebec have been hit hard by the illness, and for that reason, might want to stay away from situations where they could be newly exposed.

Also: These statistics were collected in May, at a time when Alberta, British Columbia and other harder-hit provinces hadn’t yet experienced spikes in COVID cases that they would later in the summer months. In a follow-up panel from June 3, 50% of respondents said they would attend live entertainment events at the same rate as they did pre-pandemic.

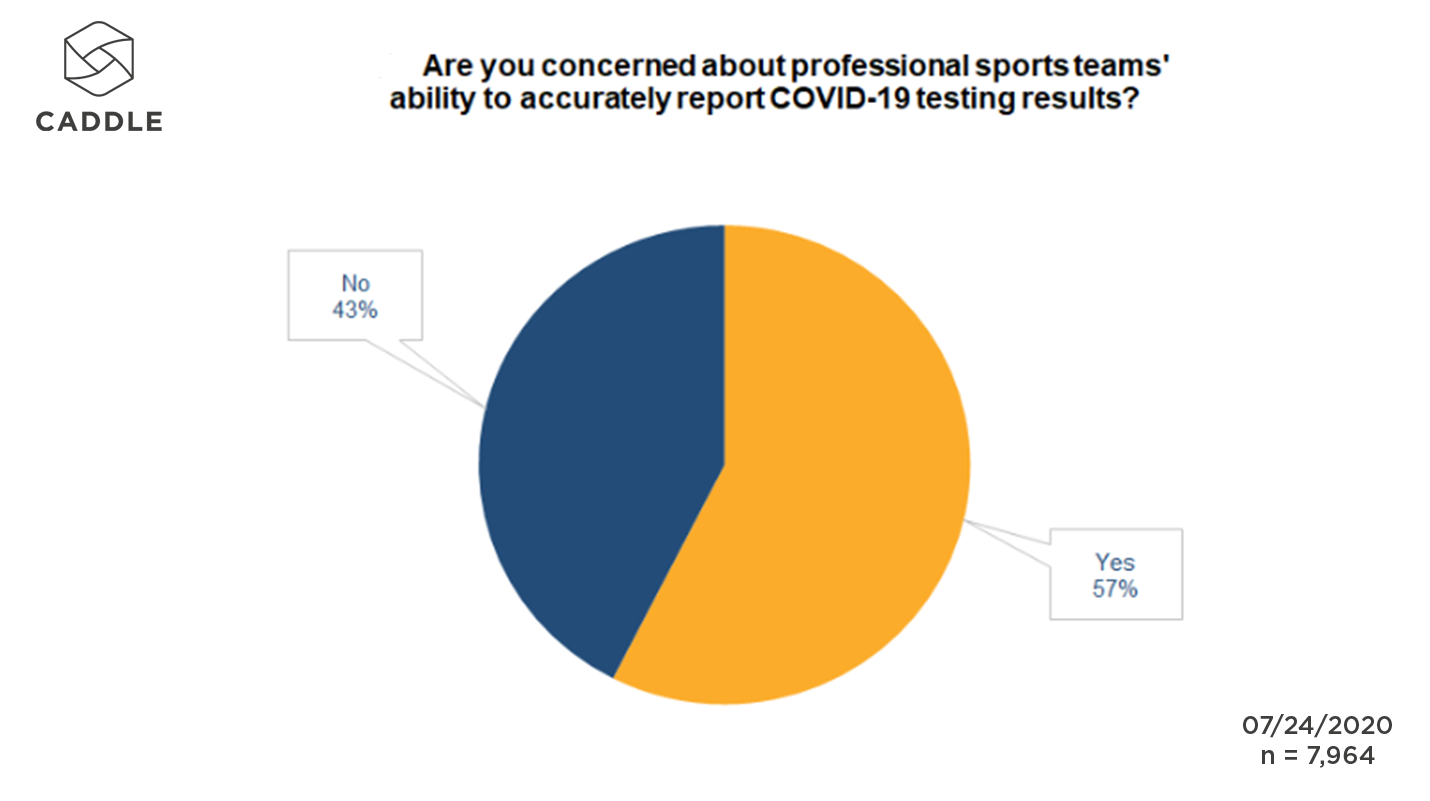

Meanwhile, about the same percentage of the general population (57%) also indicated their concern over professional sports teams’ ability to accurately report COVID-19 testing results. This indicates that the pandemic remains of concern for Canadians, but it won’t necessarily stop them from attending live events moving forward.

WHAT MIGHT INCENTIVIZE CONSUMERS TO COME BACK TO LIVE EVENT VENUES?

At least for Canadian sports viewers, alcohol consumption has proven to be a significant part of the experience, with nearly 15% agreeing that it improves their viewing. This is especially the case for Gen Zers and Millennials, and less so for Baby Boomers, Gen Xers and the Greatest Generation.

The message here, then, is that the experience in-venue has got to be as close to its earlier, pre-pandemic incarnation; this includes the necessity for concessions to sell alcohol to amplify the sports-watching experience.

Additionally, we know that COVID-19 has affected financial stability for many Canadians, and financial concerns seem to cast a shadow over their interest in attending live events. Specifically, over 50% of Canadians are not interested in live events if circumstances surrounding the pandemic cause an increase in ticket prices.

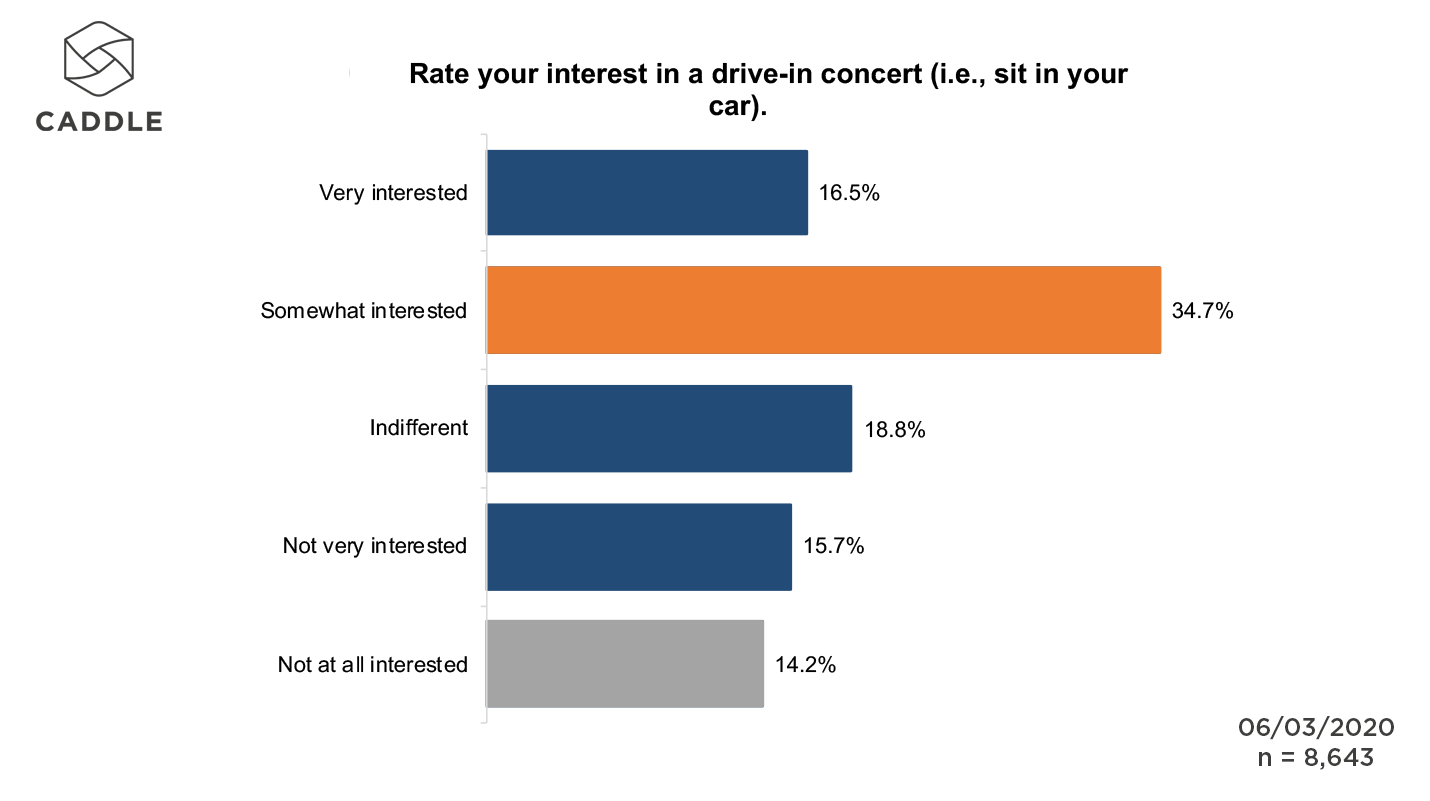

And finally, creative approaches to social distancing while also providing entertainment seem to be amenable for a significant number of Canadians. For instance, about 50% of Caddle users are “very interested”/”somewhat interested” in drive-in concerts.

This suggests that, even more so now than during pre-COVID times, brands who get creative with looking after consumers’ wants and needs will win back their attendance, and by extension, their share of entertainment revenues.

KEY TAKEAWAYS

EVENT PRIORITIES ARE GOING TO NEED TO CONTINUE TO PROVIDE FANS

In a recent webinar, retail industry insider Bruce Winder spoke of how retailers would need to work overtime to make sure that consumers feel comfortable in-store. This extends to live event venues, too: “[They] need to ensure that cleanliness and social distancing are in place… you’re really telling people that it’s safe to come back again.”

Chris Shewfelt of MLSE concurred: “The live sporting event has changed. When live events come back, there are certain aspects that the consumer is going to demand of those properties.”

Whether it’s taking measures to emphasize their cleanliness protocols, revising floor plans to allow for streamlined entrance and exit, or offering incentives like reasonable ticket prices even while social distancing, brands are going to need to continue to provide fans with reassurance that they’re taking precautions to make live event venues as safe and yet, still enjoyable, as possible.

BRANDS WILL NEED TO INNOVATE THEIR SPONSORSHIP PROGRAMS TO BE MORE COMPETITIVE IN “THE NEW NORMAL”

Brands are facing a new marketplace where some of their most effective promotional opportunities are simply no longer available, including in-venue advertising and promotions, broadcast plays, major event sponsorships like the Summer Olympics, plus countless other traditionally high-ticket placements.

In their stead, Shewfelt suggests that the brands must be prepared to innovate. “Maybe they weren’t thinking about virtual ads in the past… we need that evolution to happen in real time in order for sports teams to pay their expenses.”

New promotional placements, including virtual ad insertions and high-impact fan engagement in real time, are likely to revolutionize the future of live events, and Shewfelt believes that the winners in this brave new marketplace will be those who recognize the opportunities and are first to take advantage of them.

TECHNOLOGY IS A REVENUE-ENABLER FOR LIVE EVENT VENUES

In addition to the safety and health-related upgrades and initiatives suggested above, consumer demands will continue to emphasize convenience and (relatively instant) gratification. And though this isn’t new among the considerations for most modern sports and entertainment venues, technological innovations have a role to play in continuing to advance consumers’ interests in attending live events, instead of just catching them at home or online.

For instance, Shewfelt explains, “The new normal doesn’t necessarily mean lining up at a concession.” MLSE had already gone mobile with all of their venues from a retail and food perspective. But he acknowledges that venues need to make the path to purchase quicker. Cashless transactions will likely be a key component in this process, as “conversion in venues to a more tech-driven environment is going to be very important with the sports and entertainment world in the months to come.”