COVID-19 Insights: Customer Experience and Ratings and Reviews Top Influencers for eCommerce in Canada

Upwards of 88% of respondents say ratings and reviews are important when buying something new

Back in the good ol’ days of 2019—pre-pandemic, pre-lockdown, pre-widespread COVID isolation blues—Canadian ecommerce rates were already chugging along: Canada Post research indicated that eight out of ten Canadians had shopped online the year before, and all indications suggested that online shopping rates would continue to grow as markets matured.

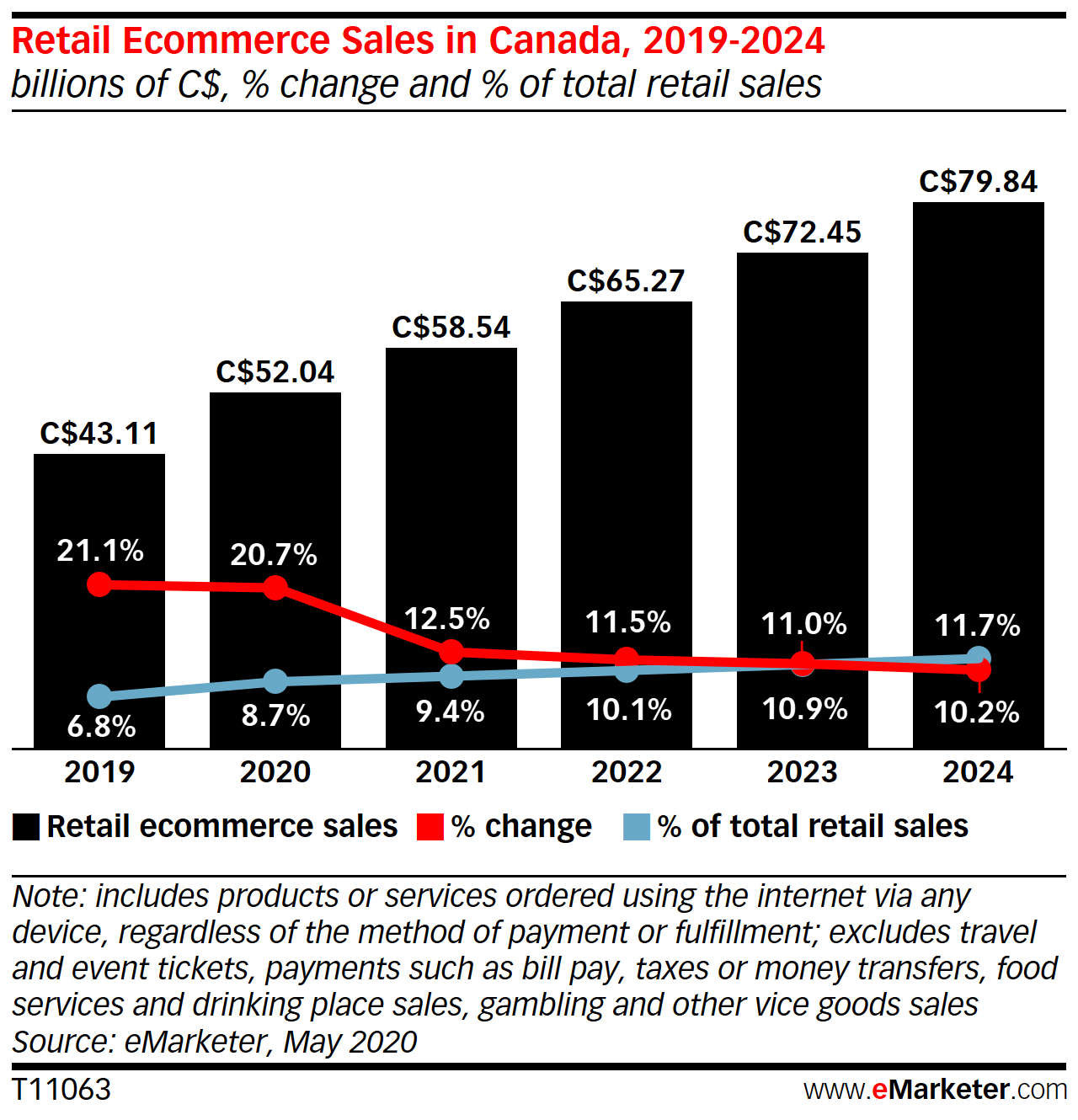

Now, eight months into 2020 and five months into COVID life, consumers have shifted more of their retail spending toward eCommerce than expected even a year ago: eMarketer estimates suggest a YOY increase of 20.7% (8.7% of all Canadian retail sales) in 2020, one-third of which will be driven by mobile. (Note that these values are still lower than other countries, such as the U.S., where eCommerce grew 27% in May 2020 from the previous 12 months, according to one CIBC Equity Research report.)

Time will tell how the COVID-driven disruption of the retail market will shake out in the balance of the year. Yet, right now, there’s no question that the lockdown and ongoing health and safety concerns have changed Canadian consumers’ shopping activities.

And so, we wanted to get first-hand insights into Canadians’ retail behaviour. Specifically, since the beginning of the pandemic, have consumers shifted more of their buying to online channels? And, in general, are they spending more or less now than pre-pandemic? Finally, what factors are most influential in their purchase decision-making?

Let’s dive into the stats to learn what we discovered when we polled our 10,000-strong Caddle user panel.

ARE CANADIANS DOING MORE OF THEIR SHOPPING ONLINE?

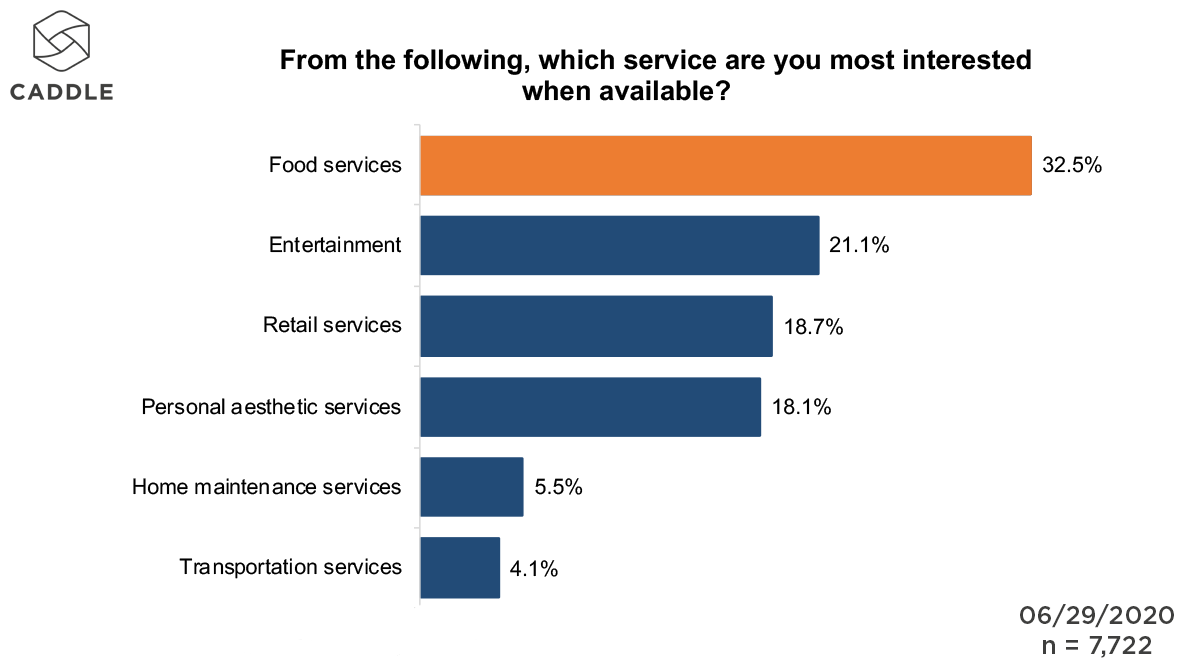

Back in June, we asked Canadian consumers which services they were most interested in taking advantage of, once available. Their top responses: Food Services (32.5%), Entertainment (21.1%), and tied for third, Retail (18.7%) and Personal Aesthetic Services (18.1%).

Among our general population, Baby Boomers, Gen Xers, and respondents in British Columbia, Manitoba, Saskatchewan, New Brunswick, Newfoundland and Labrador seemed most excited about the return of Retail Services—in many cases, eclipsing Entertainment, though never beating out Food Services for top spot.

WHAT MIGHT BE HOLDING CONSUMERS BACK FROM SHOPPING ONLINE?

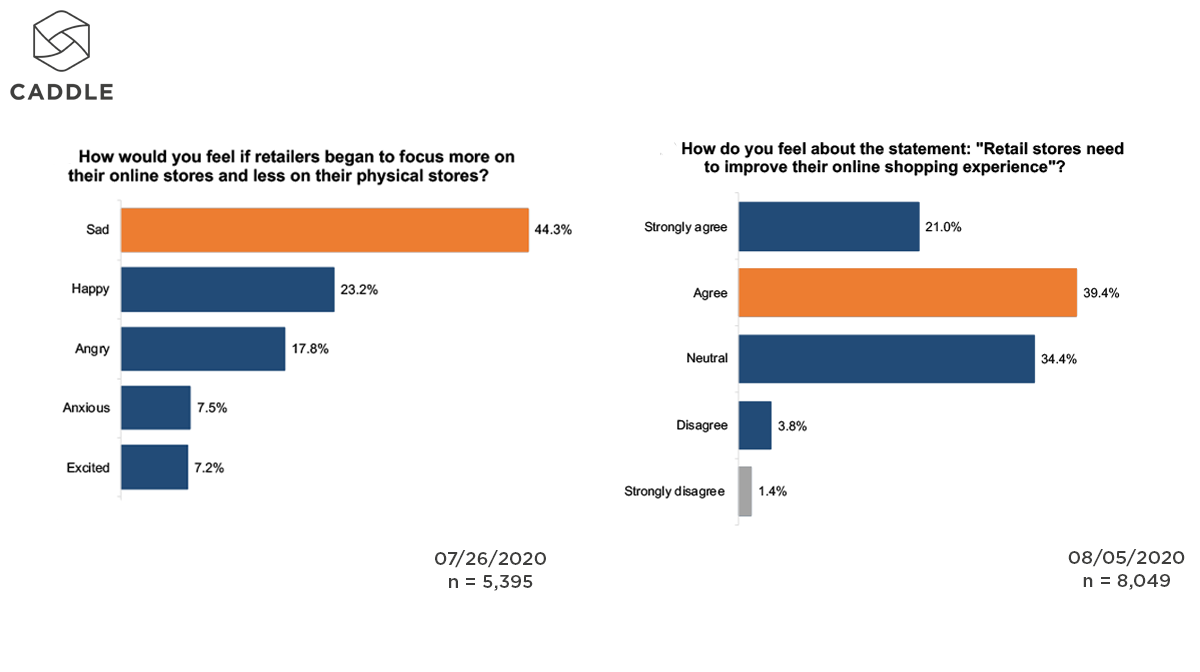

While our research identified an uptick in online ordering (especially for groceries) in the early stages of the pandemic, more recent responses indicate that retail stores need to up their online game—though not necessarily to the extent that it jeopardizes their brick-and-mortar shopping experience. Specifically, though more than 44% of respondents indicated they’d be “sad” if retailers focused more on their online stores than their brick and mortar locations (and only 23% said they’d be “happy”), in another study, a little over 60% of people “agreed”/”strongly agreed” that retail stores need to improve their online shopping experience.

Predictably, digital natives are especially critical of the online shopping experience—especially Millennials (65.4%)—as well as male-identifying respondents (63%).

IN CONTRAST, WHAT MIGHT BE DRIVING CONSUMERS TO DIGITAL SHOPPING CHANNELS?

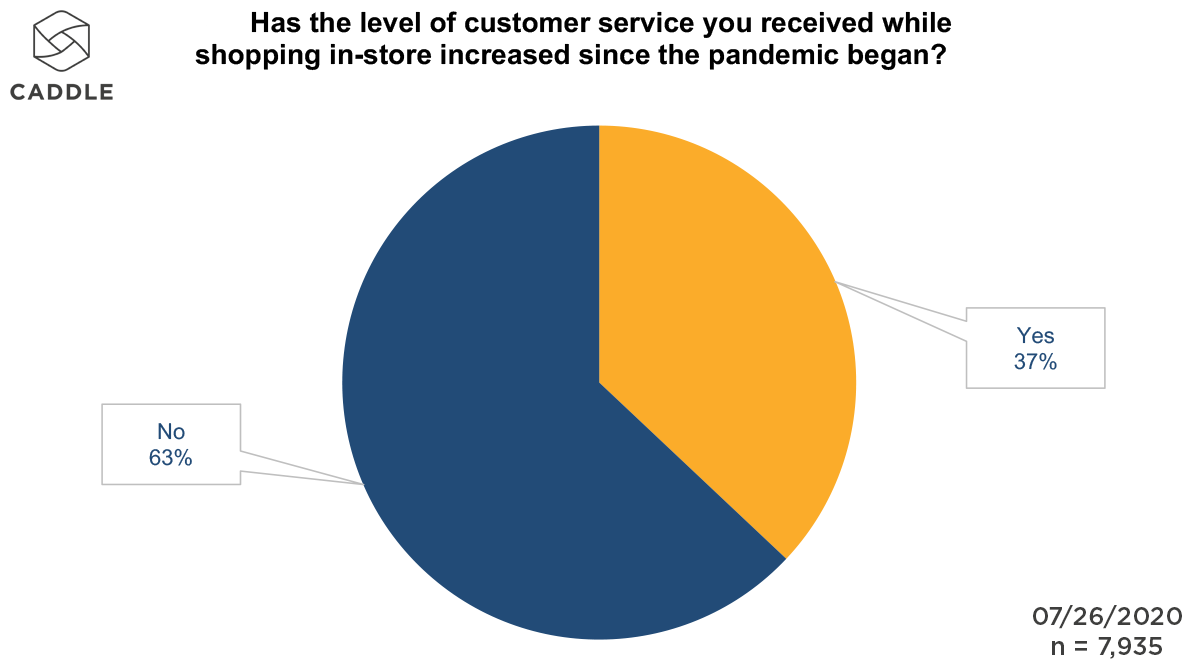

Nearly two-thirds of respondents indicated that in-store service has lagged since the pandemic began. Thus, it’s no surprise that, aside from the convenience and health and safety protocols, more Canadians are flocking to online sites for their retail purchases than before the pandemic.

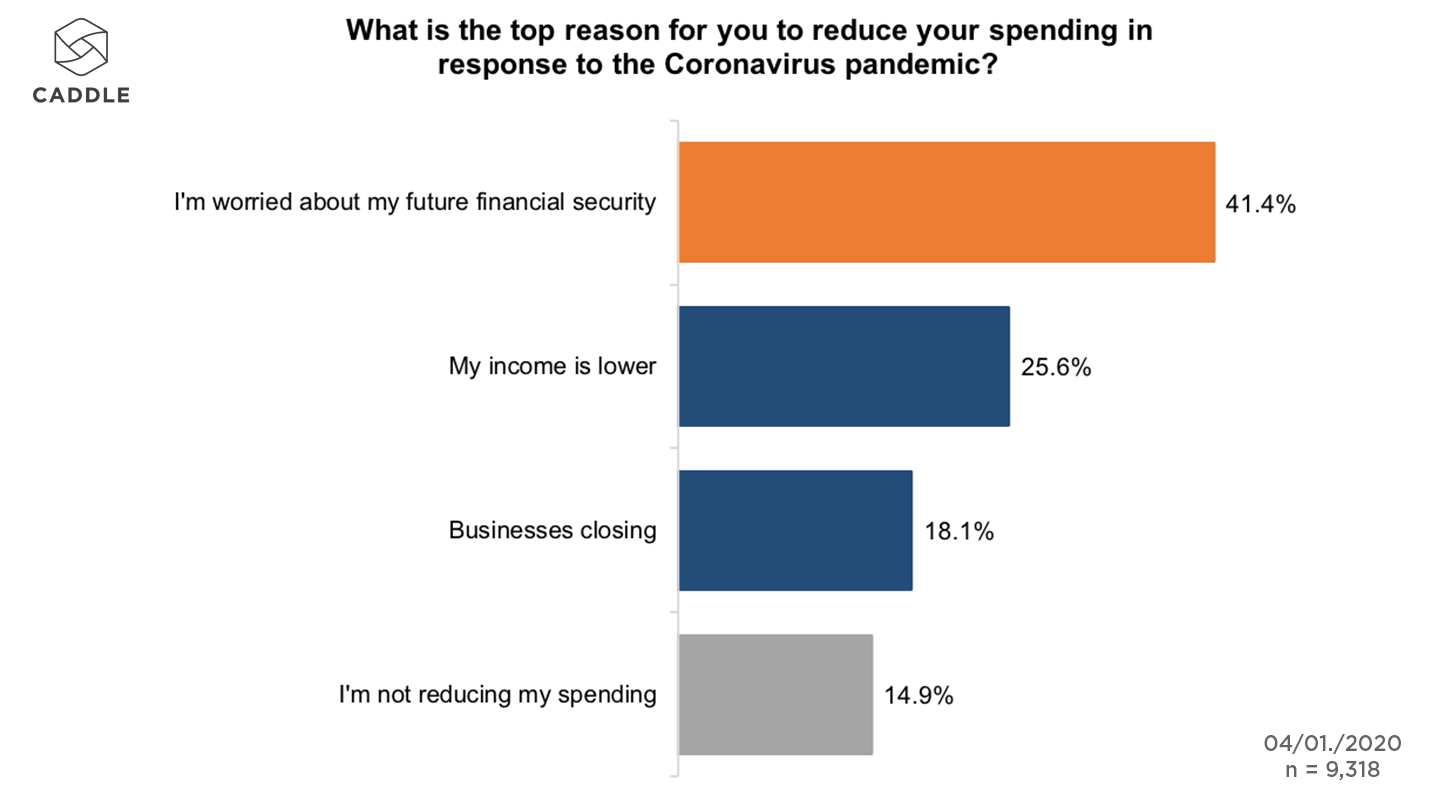

Cost may come into play too: We had already learned that almost nine in ten Canadians have cut back on spending during the pandemic, whether due to a drop in income (25%), businesses closing (18%) or simply, worry about financial security (41.4%).

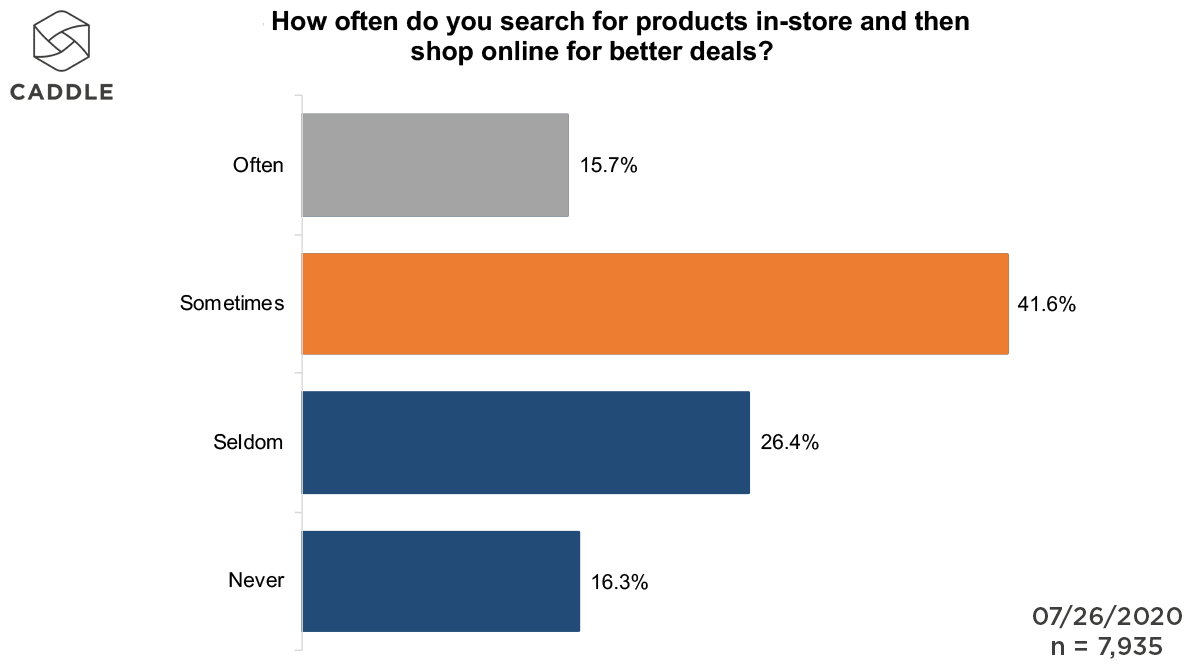

In a follow-up panel from July, we determined that nearly 60% of respondents “sometimes” or “often” search for products in-store but purchase online for better deals.

These results suggest that Canadian consumers remain cost-conscious amidst the ongoing uncertainty surrounding COVID and its impact on our nation’s economic and social well-being.

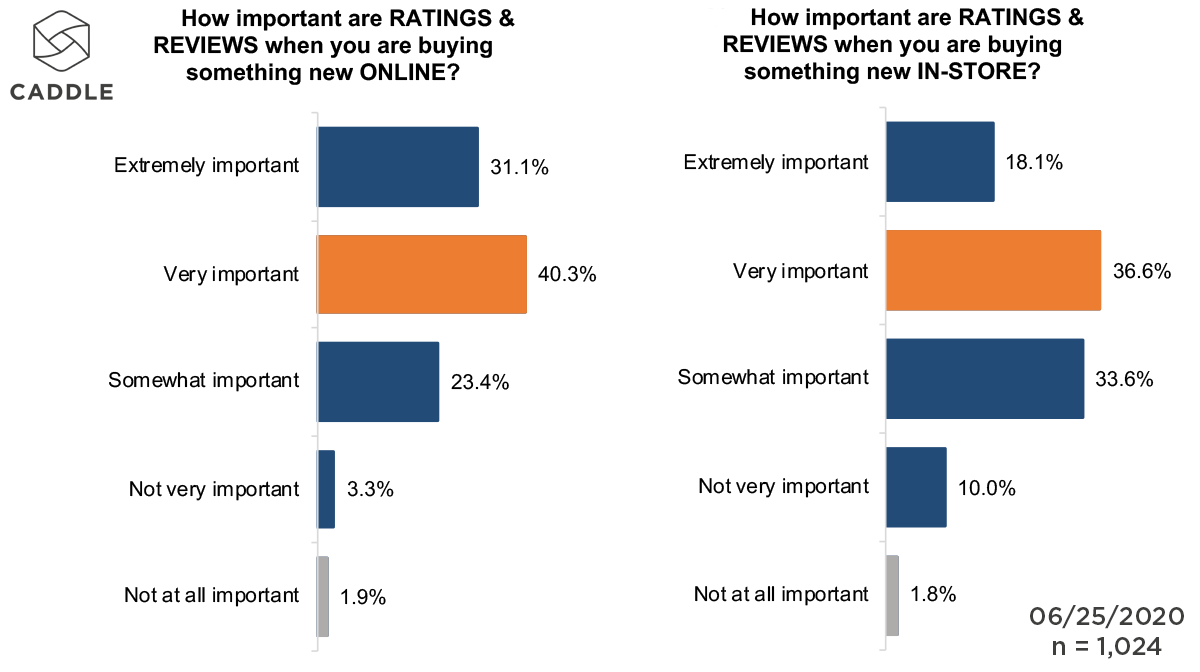

Yet, along with cost, perhaps the most influential factor involved in consumers’ decision-making is the availability of ratings and reviews: Whether in-store or online, the vast majority of Caddle users indicate that ratings and reviews are important when buying something new (88% for in-store and 91% for online).

And, once again, we found digital-native Gen Zers and Millennials to be especially fond of checking ratings and reviews, over-indexing against the general population for both online and in-store, while elder respondents (including Baby Boomers and the Greatest Generation) seem to put less value in other people’s opinions when buying something new in any retail setting.

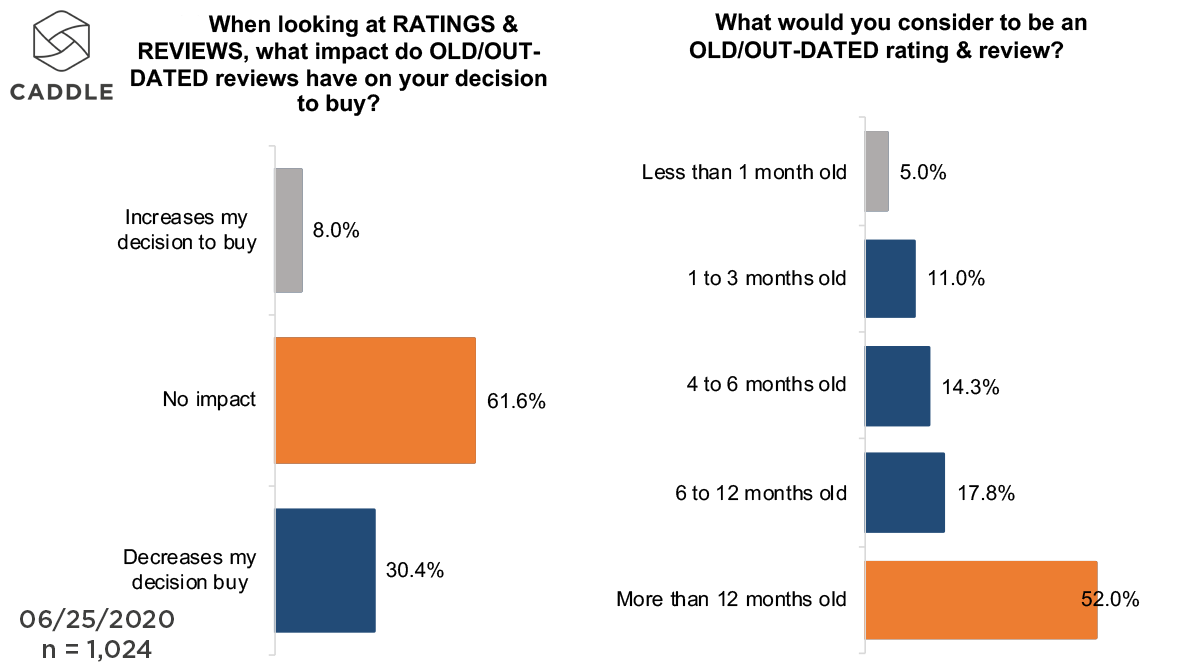

Yet, ratings and reviews are not all equally influential in consumers’ eyes. Upwards of 63% of Caddle users argued that ratings and reviews from six or more months ago are “old”/”outdated,” and an equal number suggested that such old/outdated ratings and reviews would have “no impact” on their buying decisions.

Meanwhile, 41% of consumers would switch to another retailer if ratings and reviews weren’t available on their site.

Without a doubt, these statistics should cause a pause for thought among retailers who are lagging behind on keeping their digital sites up to date.

KEY TAKEAWAYS

ECOMMERCE STILL HAS PLENTY OF ROOM TO GROW IN CANADA

Though some categories are further ahead than others—such as grocery, likely due to the necessity of staying out of harm’s way during the pandemic—the majority of retailers in Canada have a long way to go to match the eCommerce numbers posted in other countries, including our neighbours to the south.

Retailers’ best opportunities may exist in winning the hearts, minds and shopping dollars of those Canadians who are most excited about the return of Retail Services. If they can prove to Baby Boomers, Gen Xers, and people in British Columbia, Manitoba, Saskatchewan, New Brunswick, and Newfoundland and Labrador that their eCommerce experience is as good (if not better) than the brick-and-mortar experience—or perhaps connect their services to categories with highest anticipation upon re-opening (i.e., Food Services and Entertainment)—there’s a higher likelihood that they’ll win share of basket away from competitors with more solid eCommerce experiences.

RETAILERS NEED TO CONTINUE TO BUILD ON THEIR ONLINE CUSTOMER EXPERIENCE

We’ve known this for some time in relation to brick-and-mortar retail, but with the anticipated growth in eCommerce—and plenty of room for online retail development in Canada (see Takeaway #1, above)—no retailer, in any category, can afford to rest on their laurels when it comes to digital customer experience.

In the words of Bruce Winder, author of RETAIL Before, During & After COVID-19, “eCommerce… is here to stay and it’s going to grow, especially with certain demographics. I would invest in technology, both for omnichannel and eCommerce, as well as adding technology to the stores too… With Amazon coming in and roaring, I’d be getting my ‘A Game’ on now [in order to compete with global contenders].”

THE MOST IMPORTANT DRIVER OF ONLINE CONVERSION IS RATINGS AND REVIEWS

Take them or leave them, ratings and reviews are proving to be a crucial factor in consumers’ retail decision-making process.

As such, brands need to do whatever they can to establish a solid source of customer comments—and keep them coming, as recency is also important—if they’re going to continue to grow their share of eCommerce dollars in the months ahead.