COVID-19 Insights: Canadian COVID Concerns Rise as Stores Re-Open

52% express negativity about stores re-opening

With findings from mid-May indicating that COVID-19 has had a decidedly negative effect on Canadians mental health, we would expect to see shoppers eager to get back to their pre-pandemic ways of life—including heading back to brick-and-mortar stores to get their retail fix.

However, data from our 10,000 daily survey respondents suggests that Canadian consumers are still wary of stores re-opening if there’s any lingering concern over a COVID-19 resurgence.

And that hesitation continues to have an influence on Canadian consumers’ shopping habits, with a third of respondents expecting to use curb-side pick-up services even after stores have re-opened.

Let’s dig into this week’s data in greater detail:

If you’re not already on the mailing list, sign up here for our free weekly summaries.

IS IT TOO SOON FOR STORES TO BE RE-OPENING?

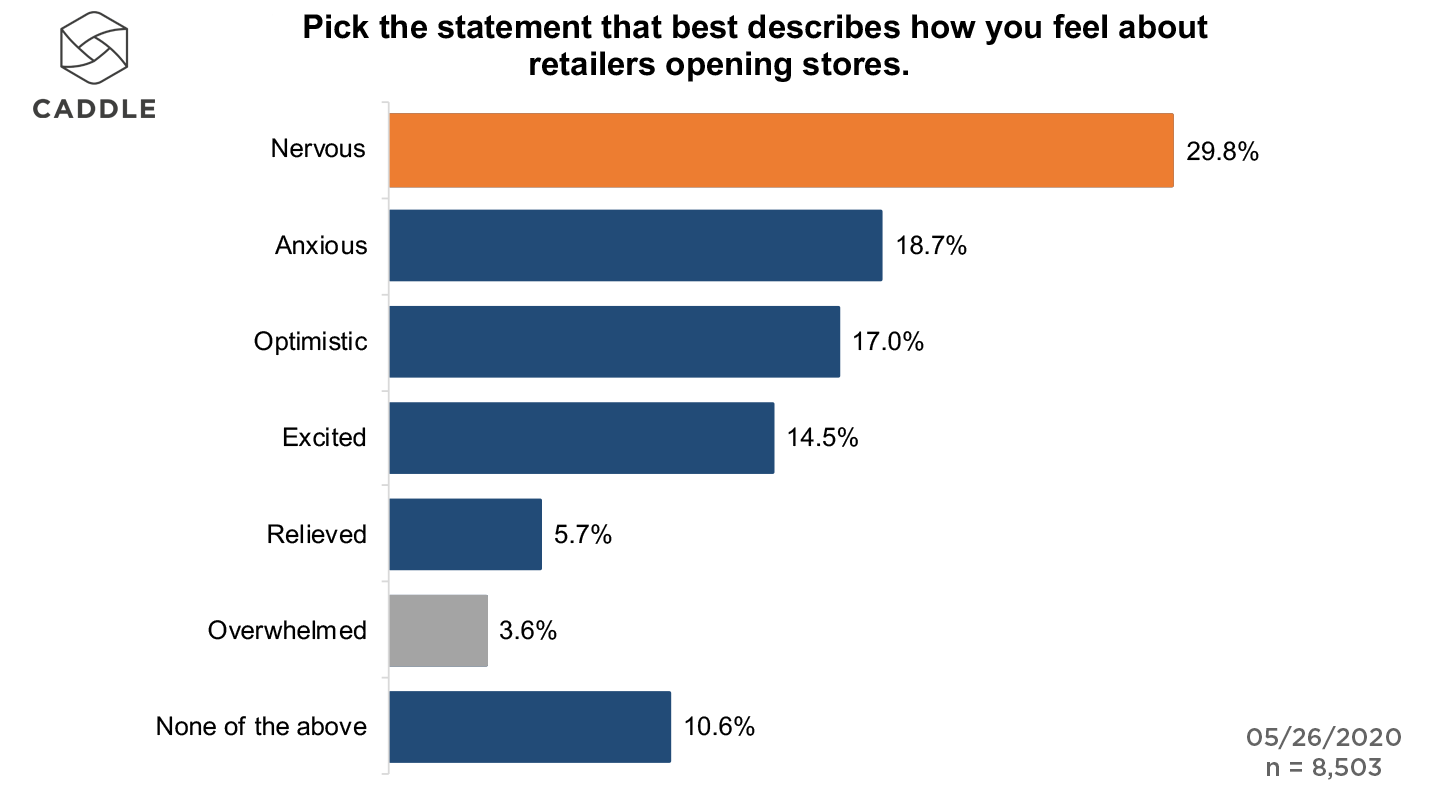

Based on our research, more than half of Canadian consumers have negative sentiments about the loosening of store restrictions: Almost 50% of respondents overall indicated they are “nervous” or “anxious,” while a further 3.6% are “overwhelmed” by the thought of retailers re-opening their stores while there’s still a threat of a COVID-19 resurgence.

In contrast, about 37% feel positive sentiments about retailers’ re-opening efforts.

These findings could be further indication of the negative impact that COVID has had on Canadians’ mental health. Yet, when we look deeper into this week’s results, it’s clear that other factors are at play as well.

WHAT’S HOLDING CONSUMERS BACK IN THE RETURN TO BRICK-AND-MORTAR RETAIL?

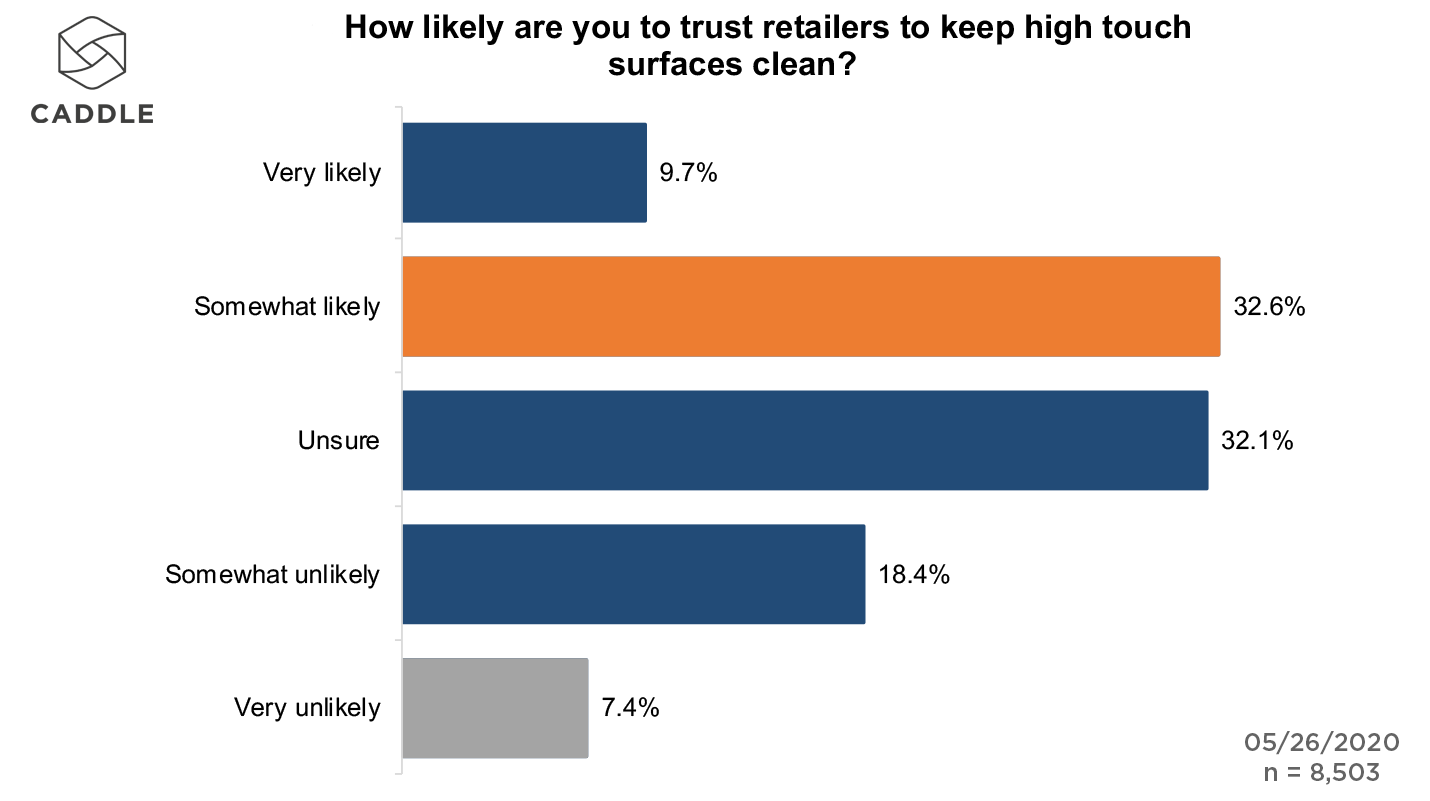

Cleanliness is one factor. In general, more than a quarter of respondents don’t trust retailers to keep high-touch surfaces clean.

Among these respondents, Millennials are least likely to trust retailers’ cleaning practices (28.5%), followed closely behind by Gen Zers (27%). Meanwhile, while Gen Xers (23%) and Baby Boomers (22%) are slightly more trusting overall.

With some consumers still leery of getting back to shopping in brick-and-mortar stores, it leads us to consider whether consumers will continue to favour online shopping—and in particular, curb-side pick-up options—even after legislation allows for progressive store re-opening.

WILL CONSUMERS STILL USE CURB-SIDE PICK-UP AFTER STORES RE-OPEN?

Based on our research, a significant portion of shoppers are satisfied with their curb-side pick-up experience, with 35% of Caddle respondents indicating that their most recent experience was “excellent” or “above average.” (Interestingly, New Brunswickers, Newfoundlanders and Labradorians skew even higher in their interest in curb-side pick-up, at almost 42% each.)

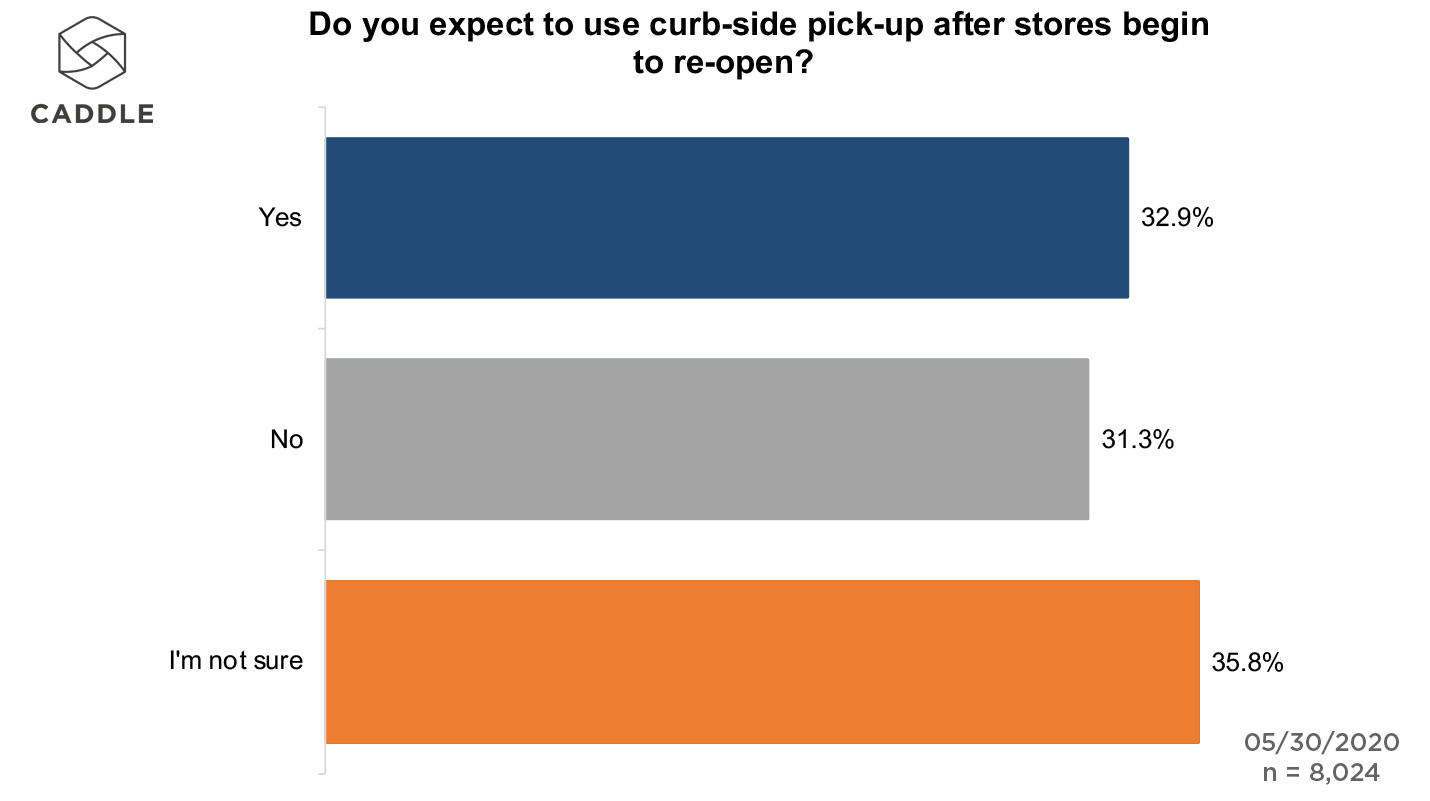

Yet, even so, consumers seem divided on whether they expect to use curb-side pick-up services after stores ease restrictions: About a third of respondents overall agreed that they would, while a slightly larger segment (36%) admitted that they were uncertain.

Among these respondents, Millennials are most likely to continue to use curb-side pick-up (38%), while Gen Zers and the Greatest Gen (born between 1900–45) are least likely (at 41% and 39%, respectively).

WHAT WOULD LEAD SHOPPERS TO ADOPT CURB-SIDE PICK-UP OVER THE LONG TERM?

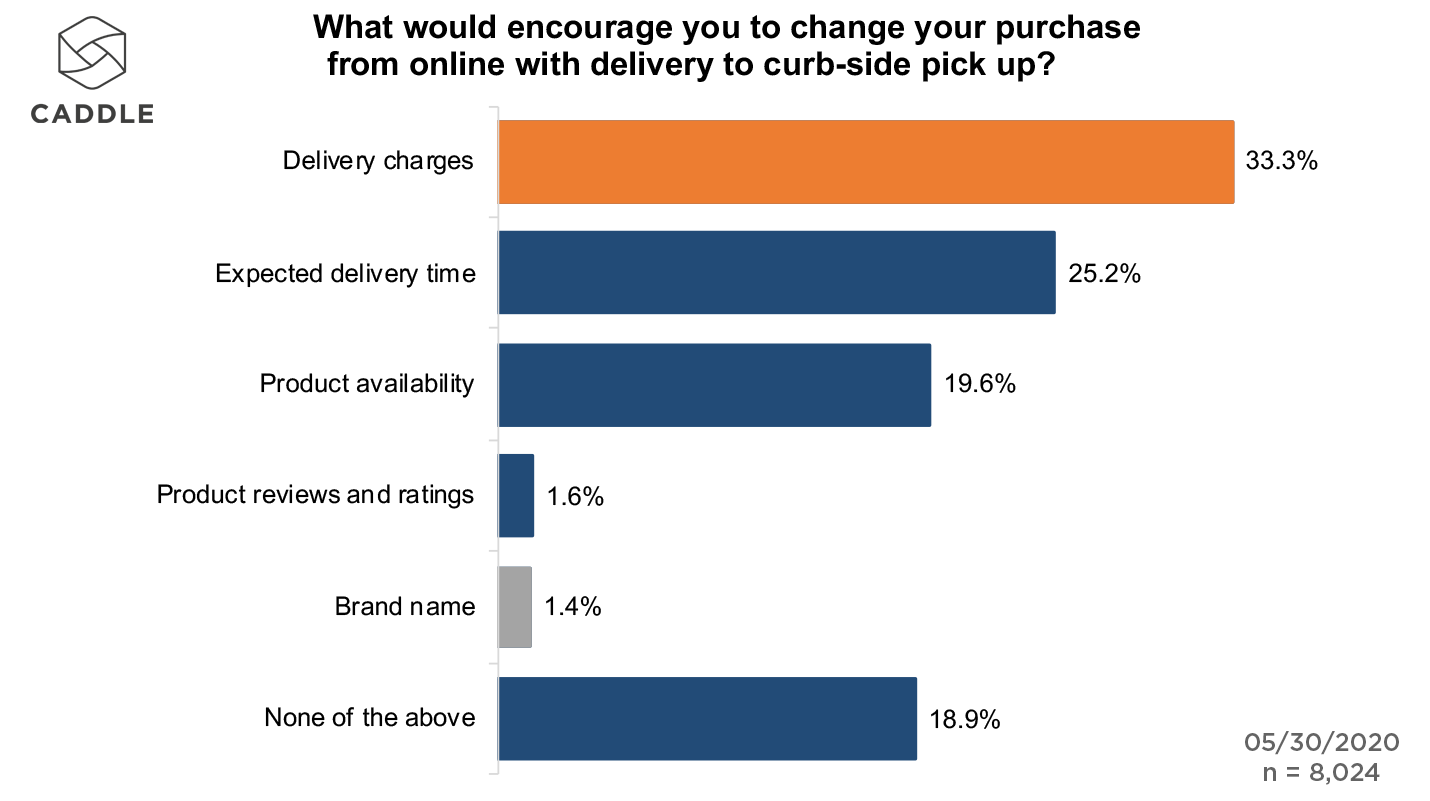

Faced with obstacles when using curb-side pick-up—including long wait times, lack of order accuracy, and length of time between placing and picking up orders—Caddle users identified several factors that come into influence their decision-making around using curb-side pick-up instead of online purchasing with delivery.

From delivery charges tacked on to digital orders (33%) and expected delivery time (25%) to inconsistent products being made available via the different services (almost 20%), it’s clear that retailers have an opportunity here to give consumers more of what they want from their shopping journey, whether that involves delivery to their homes, curb-side pick-up, or buy-online-pick-up-instore (BOPIS) as restrictions ease on brick-and-mortar visits.

If that’s the case, then, we’d expect to see increased consumer willingness to support retailers who are working harder to provide a better customer experience. Indeed, this extends to other pain points that consumers experience from click-and-collect and curb-side pick-up.

Take, for example, the product assortment available to shoppers during the COVID-19 lockdown: A quarter of respondents indicated that they’re unwilling to forgive brands who are producing more single-use plastic due to the pandemic’s safety precautions. (Quebecers are the least forgiving, at 35%, while respondents in the Maritime provinces and Canada’s northern territories are most forgiving.)

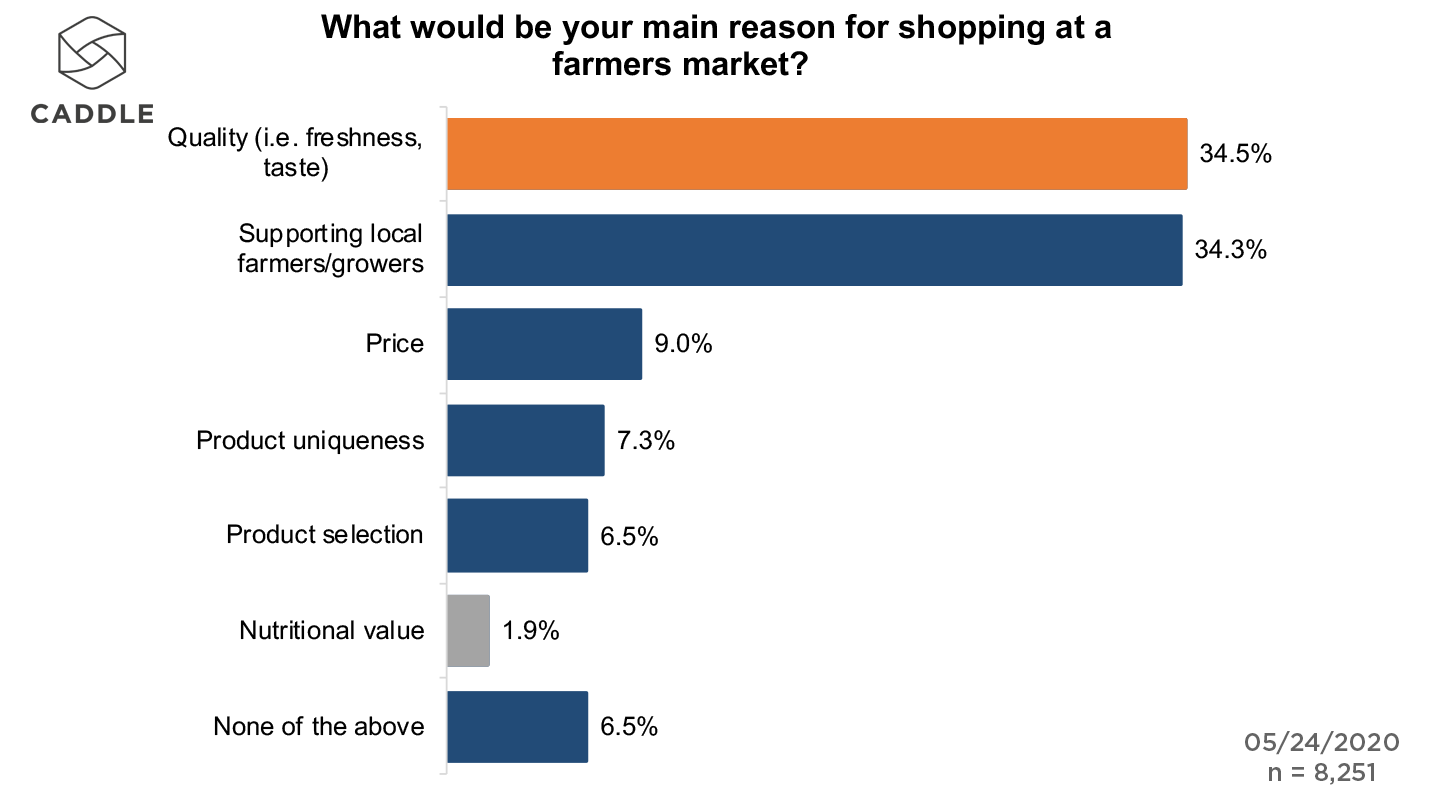

Further, product and service quality can be hit and miss with curb-side pick-up, which might explain why such factors as quality and the “shop local” trend each influence about 35% of Caddle respondents to shop at farmers markets, where “farm-to-table” freshness and seasonality are prioritized.

The question then is: What are the implications of ongoing COVID-19 restrictions on non-essential purchases?

HOW HAS THE PANDEMIC AFFECTED NON-ESSENTIAL PRODUCT PURCHASES?

According to our research, 50% of respondents have been forced to abandon a non-essential purchase due to COVID-19, and only 34% of those respondents who abandoned a non-essential purchase put that money in savings, while almost 25% plan to save the money until the purchase becomes available in the future.

With almost 72% of non-essential purchases coming in at an average of $0–300, we can conclude that retailers should expect a reasonable windfall of discretionary purchases to take place once consumers feel confident that the pandemic is firmly under control and stores begin to open up more broadly across the marketplace. (This is further supported by our findings from May 8, 2020, wherein 31% of respondents across our 9,273-strong sample indicated that they were planning an online shopping spree over the next month.)

KEY TAKEAWAYS

CANADIAN CONSUMERS ARE DIVIDED ON THEIR PREFERRED SHOPPING EXPERIENCE AS COVID-19 RESTRICTIONS EASE

Not all consumers are ready to head back to brick-and-mortar stores—especially those who have concerns about retailers’ abilities to keep surfaces clean during a potential resurgence of the pandemic.

A sizeable swath of Canadian consumers have taken up curb-side pick-up in place of in-store shopping, and a third of those shoppers expect to use curb-side pick-up even after stores begin to re-open—suggesting that retailers will need to be hypervigilant about delivering as many positive customer experiences as possible to keep consumers shopping in their stores, whether online or, as restrictions ease, in-store.

TRADITIONAL BRICK-AND-MORTAR RETAILERS CAN LEARN FROM LOCAL SELLERS

Shoppers who prioritize product quality, freshness and “shop local” sourcing are supporting farmers markets with greater frequency.

Traditional brick-and-mortar retailers can take a page from farmers markets’ playbooks, by prioritizing the quality and availability of their products and services, while also working to keep prices down (including delivery charges) and using less single-use plastics while doing so.

SOME NON-ESSENTIAL PURCHASES ARE BEING DEFERRED, BUT THEY’RE NOT NECESSARILY BEING CANCELLED FOREVER

Though a significant number of consumers have had to abandon non-essential purchases because of the pandemic, the dollars they would have spent aren’t necessarily going away for good. Instead, Canadian consumers have deferred those purchases—which means that retailers may see a return of non-essential purchases, as stores open up and greater product assortment hits shelves in the months to come.