Growth of Lawn & Garden Activities Indicates More Canadians Are Embracing Stay-at-Home

Growing vegetables, flowers and houseplants top the list of gardening projects pursued by most Canadians

While some may argue that the COVID-19 pandemic has brought out the worst in people (e.g., only three in five Canadians are reportedly wearing masks when out in public—one of the lowest rates worldwide), we at Caddle prefer to take a “glass half full” perspective.

Yes, indeed, we’re witnessing some odd behaviour—perhaps driven by anxiety and isolation blues. But when it comes to how Canadians are spending their time during the progressive stages of lockdown, we’ve been buoyed to find that they’re sticking closer to home and working with what they’ve got locally to stay healthy, happy and as motivated as possible while under restricted movement.

We were interested to understand the types of activities that are keeping Canadians busy whilst they work from home, care for family members and in general, go about their daily lives during the pandemic. And, while reports suggest that record numbers of people are redirecting travel budgets into cottage purchases, responses from our Daily Survey Panels reveal that just as many (if not more) are turning to gardening for a healthy, cost- and family-conscious break from the woes of COVID.

If you’re not already receiving our free Weekly Insights newsletter, what are you waiting for?! Sign up here.

The question remains whether these new habits will persist once we’re past this emotionally difficult time.

Let’s dig in to find out:

HOW ARE CANADIANS KEEPING BUSY DURING THE PANDEMIC?

Aside from the work of staying healthy and safe, working from home, taking care of family members and other requisite tasks, we wanted to know how Canadian consumers were keeping busy. The answer: Hobbies!

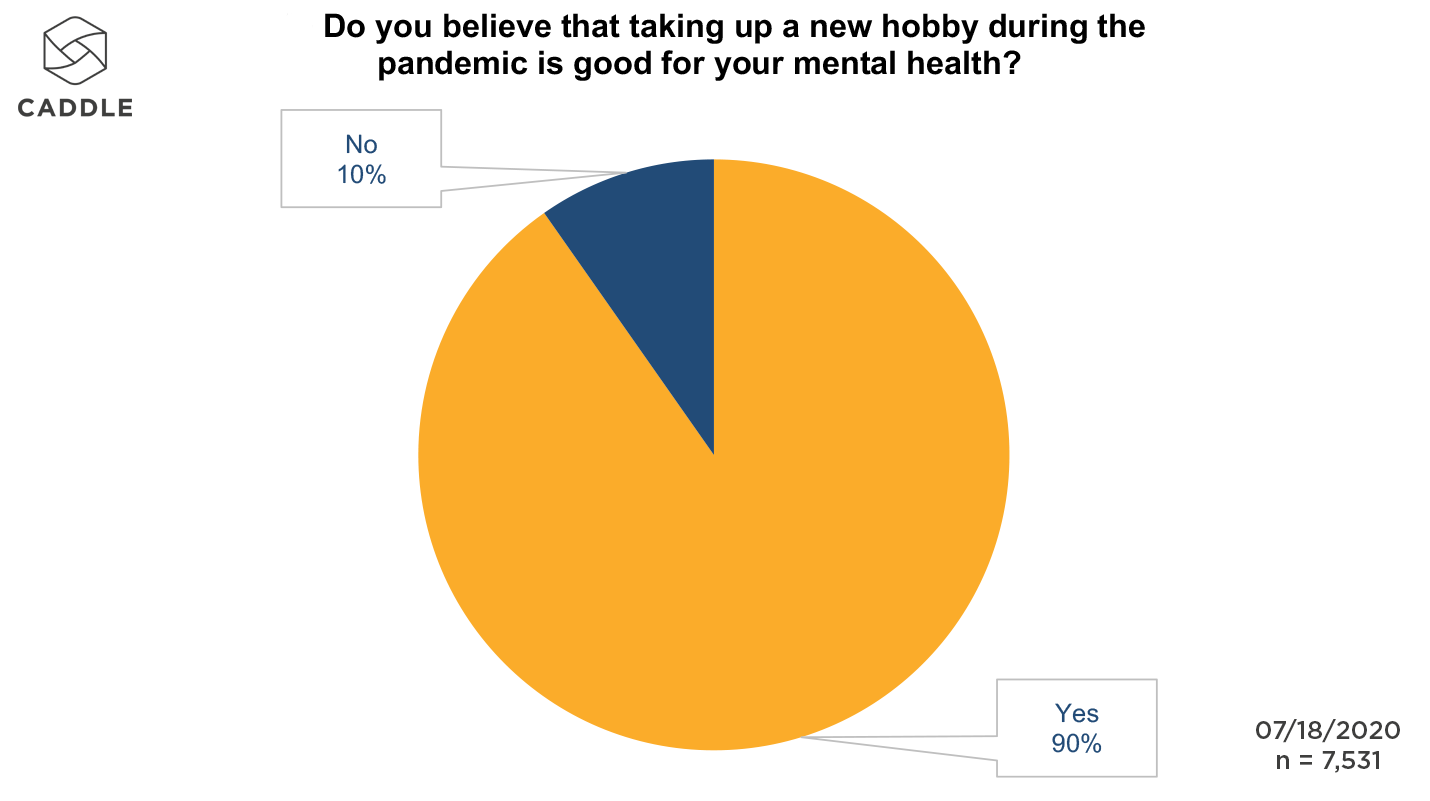

The vast majority of respondents (90%) believe that taking up a new hobby during the pandemic is good for their mental health.

Meanwhile, nearly equal proportions of respondents believe that taking up a new hobby during the pandemic is good for “self improvement,” “to learn something new,” and “to avoid boredom/pass the time” (25%, 23% and 19%, respectively).

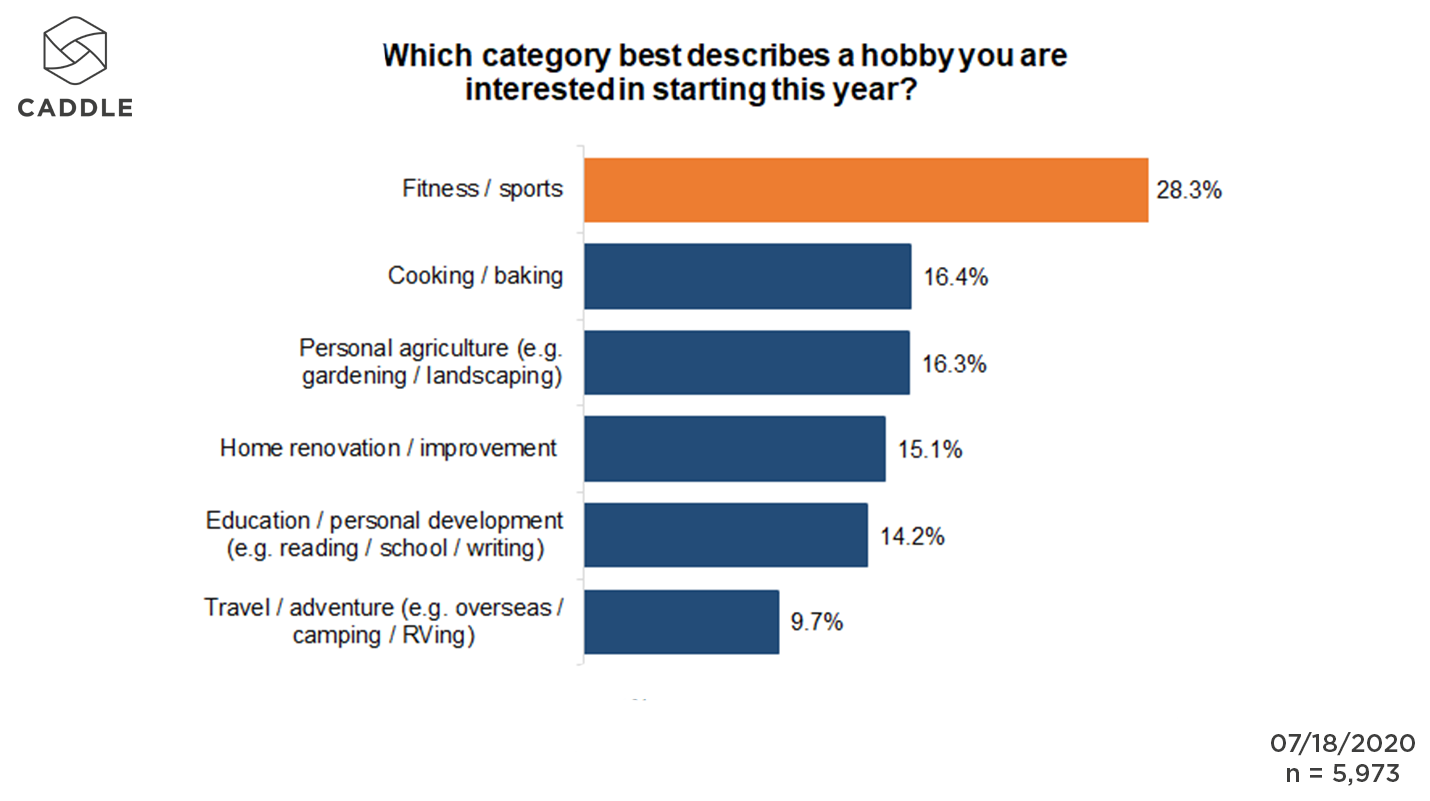

What are Canadians’ new hobbies of choice? Tied for second are “gardening/landscaping” and “cooking/baking” (both at 16%), followed very closely by “home renovations/improvements” (at 15%)—indicating that the majority of Canadian respondents are not just embracing but making the most of stay-at-home protocols during the pandemic and into the latter half of 2020.

Baby Boomers and people from Newfoundland and Labrador, Nova Scotia, Quebec and P.E.I. seem most interested in gardening as a hobby in 2020 (at almost 19% each), while Gen Zers and people from New Brunswick and Saskatchewan under-indexed on this response (at about 13% each). This is perhaps indicative of the younger generation’s lack of access to green space of their own, though doesn’t necessarily hold true for every province.

WHICH CANADIANS HAVE THE GREENEST THUMBS?

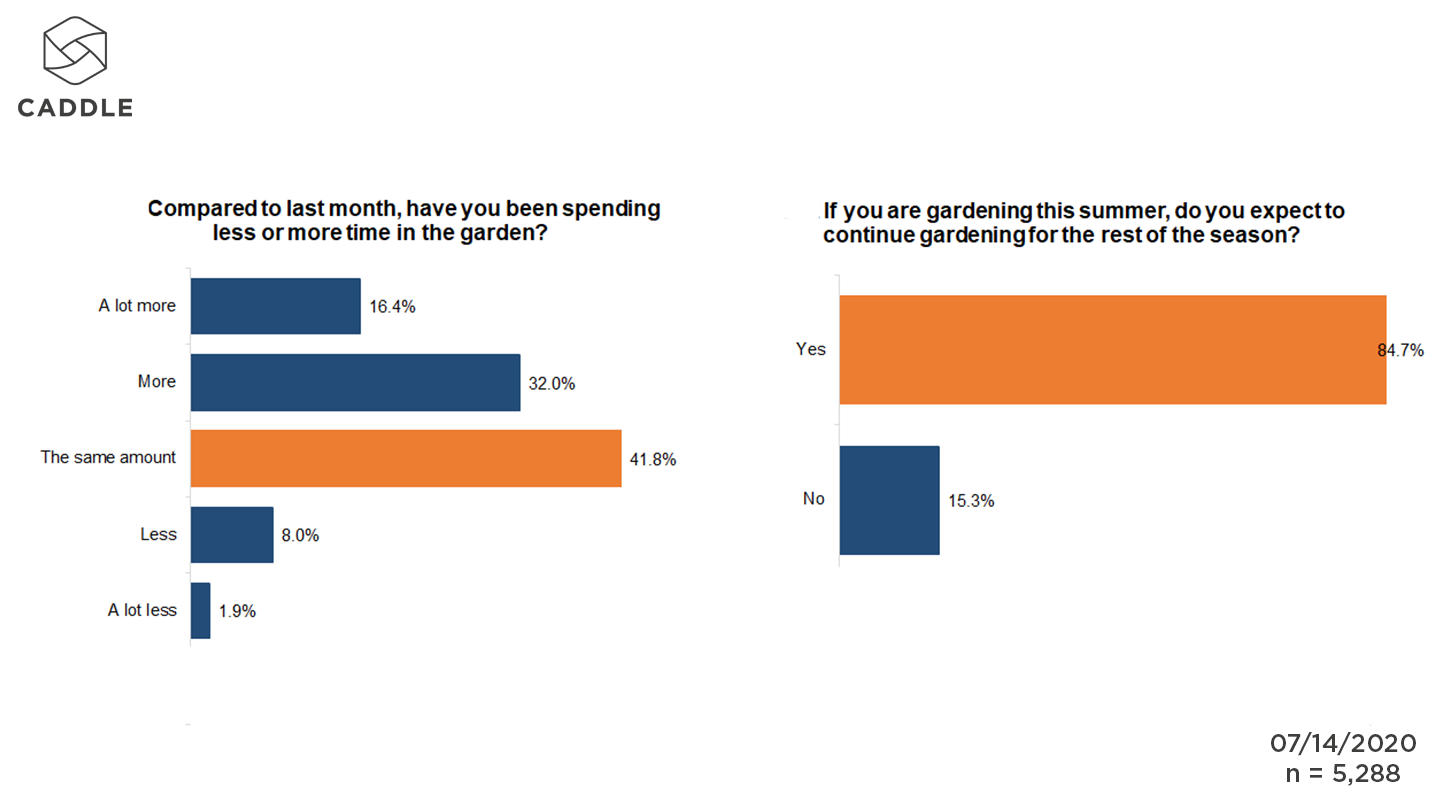

Among the respondents who garden, 48% were spending more time in the garden than the month previous, and 85% expected to continue gardening for the rest of the summer season.

Out of our panel, female-identifying Canadians have been spending more time in the garden, while Saskatchewanians, New Brunswickers and Prince Edward Islanders (93%), Manitobans (92%) and Nova Scotians (86%) expect to continue gardening into the next season.

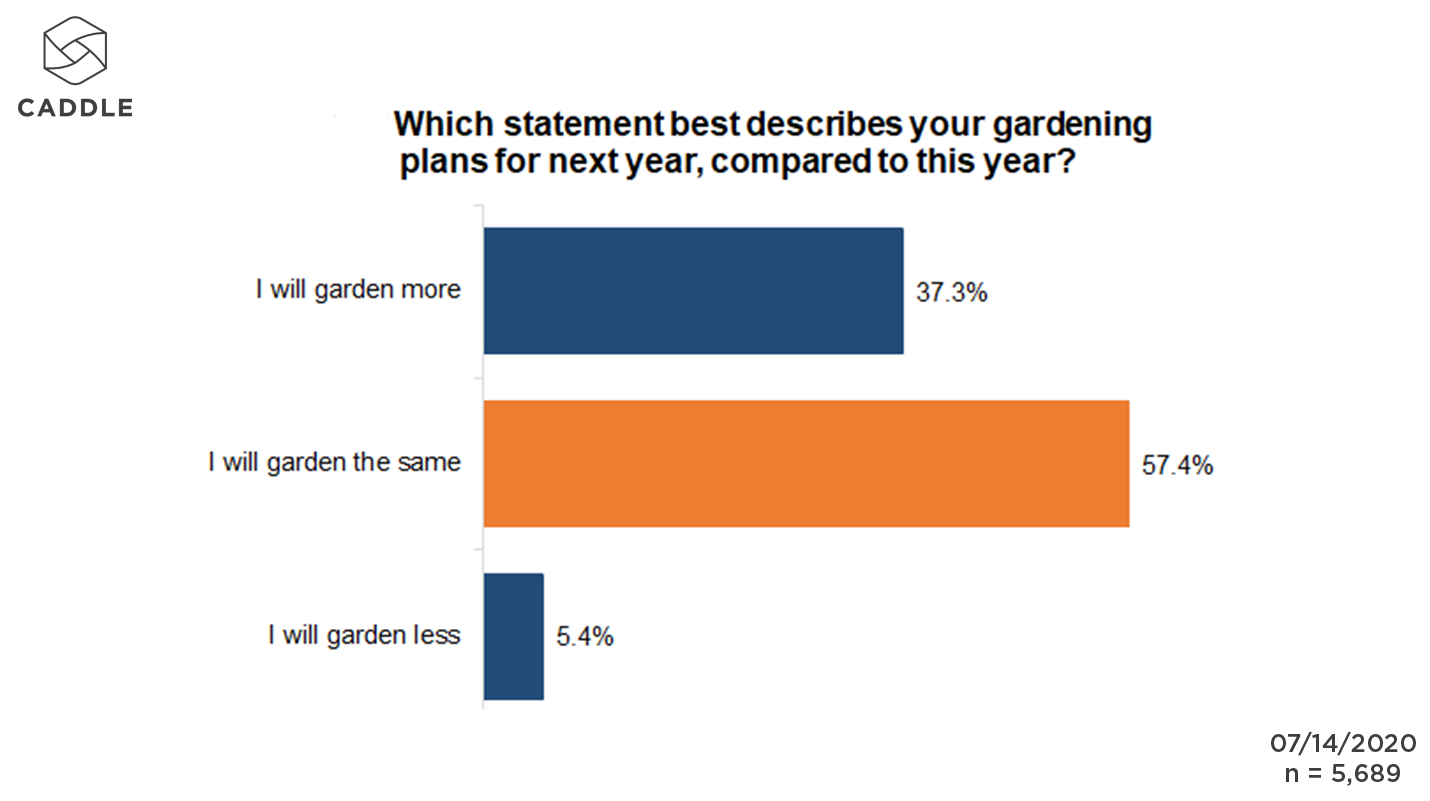

And into the future? We expect to see over a third of our general population gardening more in the year to come than in 2020. (Overall, just over 5% of respondents said they’d be gardening less in 2021.)

Millennials and New Brunswickers seem especially keen to get their hands dirty in the garden in 2021 (over-indexing at 42% and 44%, respectively).

WHAT ARE CANADIANS GROWING?

Because this subject has bearing on a slew of different factors in people’s lives—from their hobbies and interests to their eating and spending habits, and more—we’ve looked at the contents of Canadian gardens in several different surveys.

From mid-July 2020, we learned that four of five respondents (more than 82%) are interested in growing their own fruits and vegetables—especially Prince Edward Islanders, who over-index the most (at almost 91%), Saskatchewanians (at 89%), Manitobans, (at 87.5%), Nova Scotians and New Brunswickers (at 85% each), and British Columbians and Quebeckers (at 83% each).

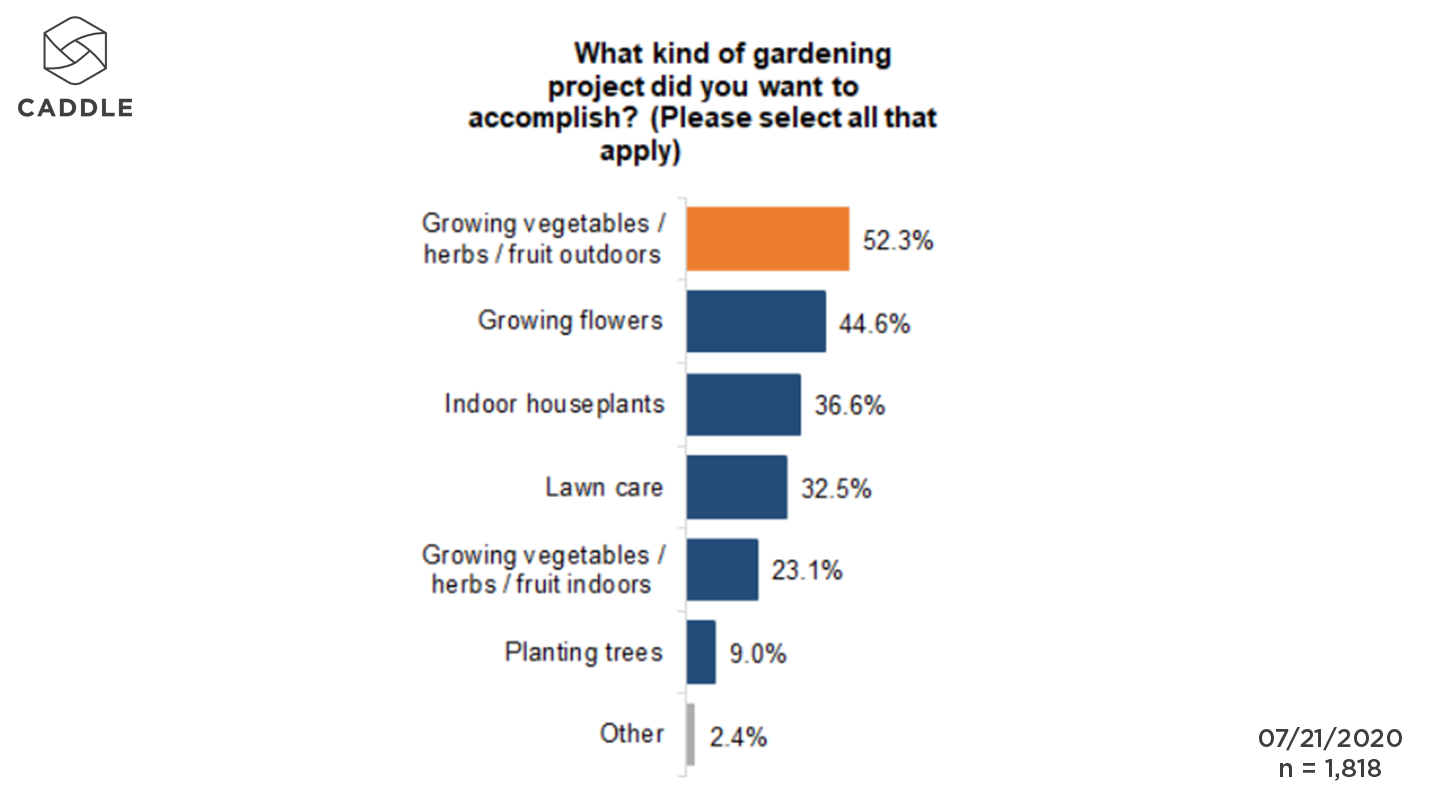

In a follow-up survey from later in July, we explored Canadians’ intentions for future gardening projects, and once again, fruits and vegetables came out on top: More than half of respondents indicated they’d like to accomplish an outdoor vegetable/herb/fruit growing project. When we add in the number of Caddle users who wish to grow vegetables/herbs/fruit indoors (bringing the total number up to 75%), it’s clear that more Canadians are prioritizing the growth of healthier food ingredients among their off-time activities.

It’s important to note, too, that respondents listed growing flowers and houseplants as the next-most important to them—underlining the fact that Canadians are likely trying to make the best of “work from home” and “isolating in place” protocols by beautifying their homes the natural way.

WHERE DO CANADIANS GET THEIR GARDENING SUPPLIES & WHAT FACTORS INFLUENCE THEIR PURCHASING DECISIONS?

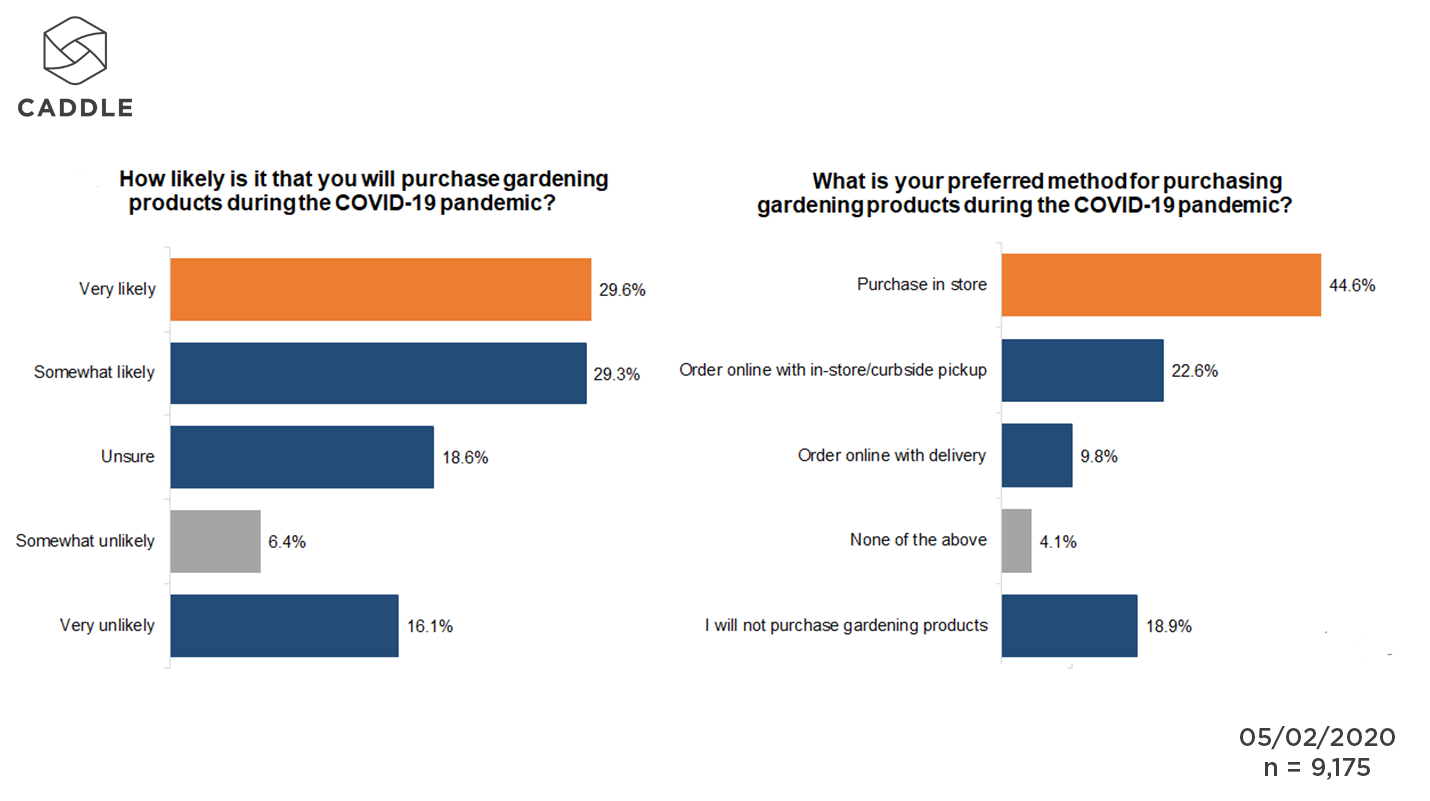

Back in early May, as provinces began relaxing certain lockdown restrictions, it seems that many Canadians were chomping at the bit to get their green thumbs working the earth again: While almost 60% agreed that it was “somewhat likely”/”very likely” that they’d purchase gardening products during the pandemic, just under 45% indicated that they’d most prefer to shop for those same products in brick-and-mortar stores (a further 32% preferred order online with in-store/curbside pick-up or delivery).

Unsurprisingly, the gardening products that Canadians were most likely to buy online were the most easily shippable—seeds and plants (nearly 36%). Soil and fertilizer ranked second, but with less than half the number as those who identified seeds and plants, we have to wonder if shipping fees for heavier items, as well as the availability of products in early May, might have been a deterrent for eCommerce consumers.

Note: We learned at the end of May that delivery charges influence shopper decision-making around online purchasing; it’s conceivable, then, that the higher delivery cost of heavy, bagged items like soil would lead more customers to buy online and pick-up in-store (BOPIS) or at the curb-side.

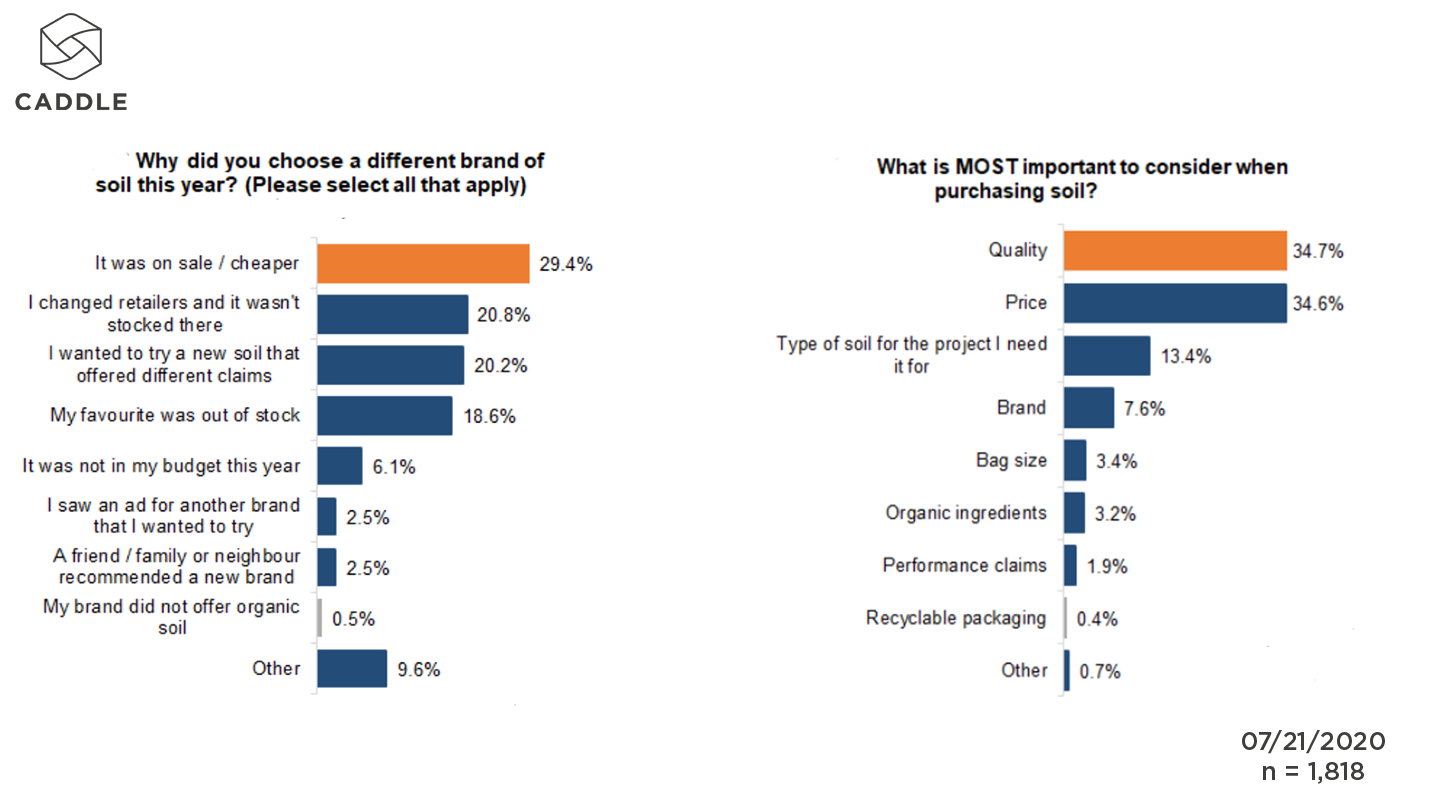

This led us to wonder about the determining factors for Canadians when purchasing soil products. And, true to our typically thrifty ways (also likely exacerbated by tightened budgets brought on by the pandemic), quality and price were equally important factors for the majority of consumers who were considering purchasing soil.

So, where about 35% of our general population identified price as the most important consideration (along with quality of the product), nearly the same percentage of respondents (30%) changed brands because of the price. (Note that this differs from insights gained in April, where brand loyalty still outweighed price, at least in the purchase of luxury goods.)

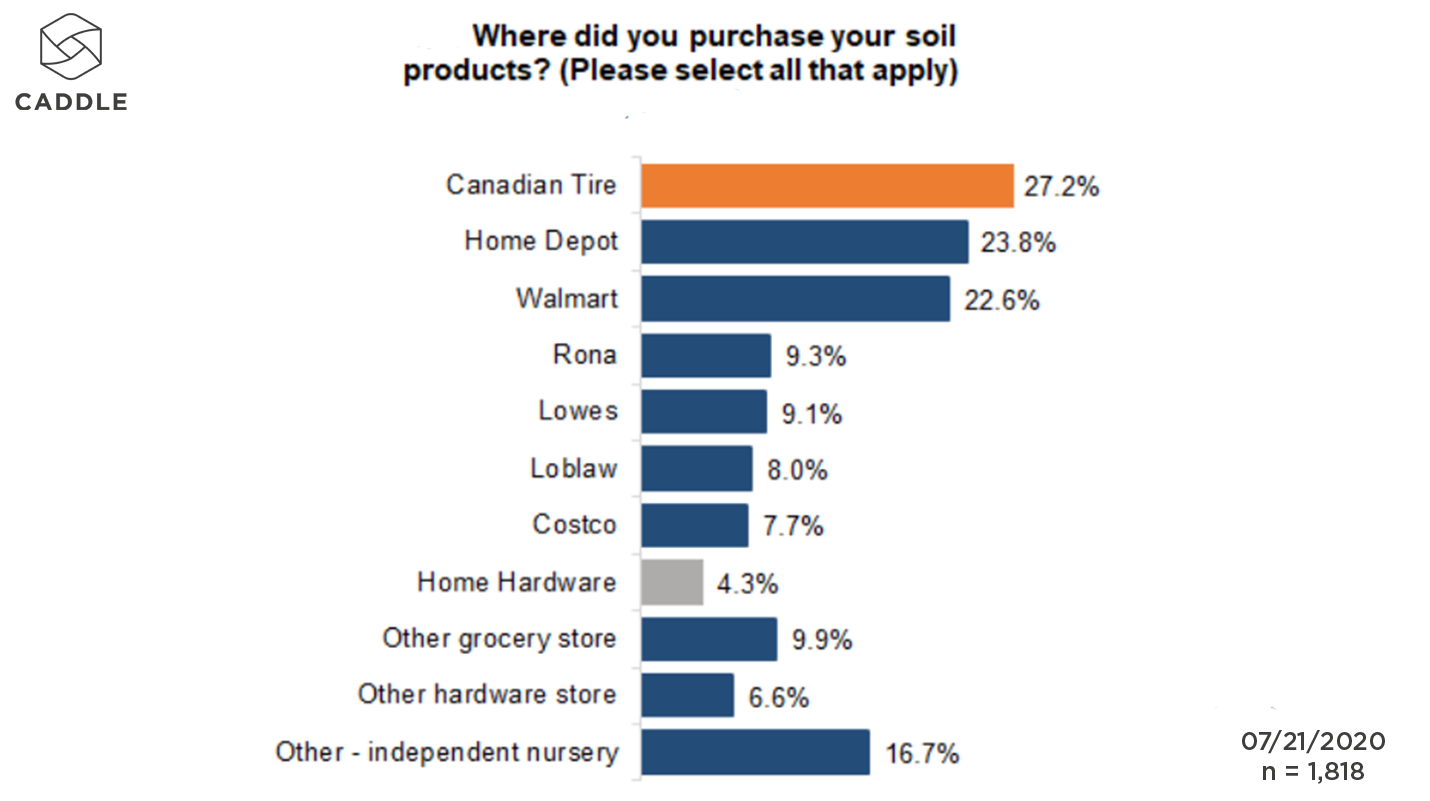

Unsurprisingly, major hardware and general merchandise retail banners (including Canadian Tire, Home Depot and Walmart) took the lion’s share of soil product purchases—perhaps indicative of their ability to offer a lower price-point to meet consumers’ needs, while also being able to offer the quantities and assortment that smaller and/or more regional retail banners can’t support.

Interestingly, Canadians also similarly valued the soil selection at independent nurseries, possibly in a nod to the tendency for many Canadians to “shop local,” especially during the pandemic.

NOW IS THE TIME TO PUT EFFORT INTO ATTRACTING CUSTOMERS WITH VALUE-ADDED INFO & SERVICES

As pandemic worries wage on—and with the “second wave” expected to hit in the coming months—the gardening boom is unlikely to bust anytime soon, as people continue to try to distract and/or keep themselves busy, and also, work to update their homes and lives while they shelter in place.

Smart retailers will take the opportunity now to prepare people who are new to the gardening lifestyle as well as returning customers for what’s to come in the months ahead. One idea: Provide project “how-tos” in-store and online to help newbies get started. Alternatively, consider the entirety of lawn and garden seasonality, offering tips and ideas for outdoor gardening enthusiasts to keep their hobbies going inside during winter months.

COMPLIMENTARY CATEGORIES BUILD BASKET SIZE & DRIVE MARGINS

There’s a reason that peanut butter is stocked in the same aisle as jams and jellies, along with a freestanding display of loaves of bread: Merchandising complimentary categories in close proximity to each other works to build basket size, particularly for new entrants into a category, who don’t necessarily know what products to buy to accomplish their project.

Consumers will be more loyal to retailers that help them to complete a project from start to finish in one trip with less time in-store (and thus, less potential coronavirus exposure).

With lawn and garden products, consider merchandising all the products that consumers will need to complete a project, including garden fertilizer, gloves and tools, near the skids of soil, grass seed and mulch.

DON’T COUNT ECOMMERCE OUT FOR THE LAWN & GARDEN CATEGORY

We’ve said it before and we’ll say it again: Canadian retailers need to up their online game if they’re ever to match the eCommerce numbers posted in other countries.

While consumers may not have completely bought-in to online shopping for lawn and garden, the interest in eCommerce options is definitely there—particularly if a second wave of the pandemic causes renewed restrictions on people’s coming and goings.

At the same time, we know that ratings and reviews make a significant difference in consumers’ decision-making process, especially if the ratings and reviews were posted no more than six months before. Now, it’s up to retailers to encourage adoption of omni-channel shopping. Some ideas: Offer incentives that get customers to BOPIS or at the curb-side. Or alternatively, cultivate new entrants into the category through emphasis on peer ratings and reviews—especially Millennials, who are keen to continue growing their own fruit and vegetables in the coming months and find ratings and reviews to be notably influential in their purchase journeys.