Webinar: Profile of the Canadian Costco Shopper

Who's A Member? Costco Edition

Published on June 14, 2021

With Mick Higgins, Head of Growth and Sonia Sharma, Research Consultant

Topics Covered:

???? Why Costco was the winner of the pandemic and how they maintained the highest NPS throughout the pandemic

???? The profile of Costco members: A demographic breakdown and insights on their shopping behaviour

???? Costco’s shift to online grocery shopping and their partnership with Instacart

???? What the future of Costco looks like as competitors pick up on trends

Livestream on June 10th, 2021

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want to attend future Caddle events? Sign up to our email list!

Meditation Surges Into Canadian Mainstream

Driven by Work From Home (WFH) and Easier Access Through Tech

Published on June 9, 2021

COVID-19 has been- and still is- making an impact on the mental health of Canadians, specifically with increased anxiety and stress. With this in mind, while Canadians continue to work on their mental well-being, what can employers do to assist their employees and ensure they are doing their part?

Meditation comes to mind.

When we asked Caddle’s largest daily active panel in the Canadian market, we received over 8,500 respondents! What did we discover? 69% believe that regularly meditating would improve their work-life balance, especially the younger generations. Millennials and Gen Zers have a profound interest in meditation as well as a keen interest in integrating meditation into their work lives, particularly during the pandemic, where isolation and anxiety are rampant.

In partnership with Victoria-based meditatehere.com, a leading producer of meditation products and services for individuals and businesses, Caddle’s Daily Survey Panel had some interesting insights on meditation.

What is Meditation?

Many Canadians have somewhat of an understanding as to what meditation really is. It comes as no surprise that a majority of those very familiar with the practice are from Gen Z. In comparison, approximately 17% of Gen Z know meditation well, whereas only about 5% of Baby Boomers do.

How familiar are you with meditation (practice using mindfulness to achieve a mentally clear and emotionally calm state)?

The younger generations (Millennials, Gen Z) also demonstrate more interest towards meditation as they are more likely to practice meditation and have a stronger desire to learn about meditation than older generations (Baby Boomers, Gen X). About 16% of Gen Z and 12% of Millennials agree that they have developed a desire to learn more about meditation while working from home. In comparison, only about 6% of Gen X and 4% of Baby Boomers do.

Meditation in the Workplace

While 63% of Canadians agree that employers should provide services to improve their mental health, 69% believe that regularly meditating would improve their work-life balance. With the constant practice of meditation potentially leading to higher productivity levels and more stable mental health, is this the secret ingredient to success?

“This is the largest survey ever done about Canadians and meditation,” said Eric J. Gerritsen, co-founder of meditatehere.com. “We did not know what to expect, but we discovered a huge interest among Millennials and Gen Zers to not only learn and practice meditation, but to see meditation offered by their companies as part of an overall progressive and modern approach to mental health and well being,” added Gerritsen.

Generation Zen

Meditation practices appear to be favoured by the younger generations, specifically Gen Z. In fact, Gen Z is 21.7% more likely to strongly agree that employers should provide mental wellness services to employees working from home when compared to Baby Boomers. While a majority of Canadians believe that meditating regularly can improve work-life experience, only 7% of those who strongly agreed were Baby Boomers, compared to over 22% of Gen Z.

How do you feel about this statement: “Regular meditation practice will improve my work-life experience”?

Siri, Start My Meditation Practice

According to Caddle’s panel data, we discovered that a majority of Canadians prefer to meditate at home by themselves (35.3%). The second most favoured option is meditating through an app. Over 27% of Gen Z agreed that they prefer to meditate while using an app and approximately 16% use meditating apps to assist them with combating anxiety.

How would you prefer to learn how to meditate?

Mindfulness at Work

So, what happens if employers decide to offer meditation sessions as a company benefit? Our panel results show that over 30% of Canadians are likely to participate in Zoom meditation sessions if provided by their employer. About 24% of those who indicate a strong interest are Gen Z, and 23% are Millennials.

If your employer offered live Zoom meditation sessions (20 min or less) with highly qualified teachers, how likely are you to attend?

For businesses, these are interesting trends to pay attention to. As the Baby Boomer generation is retiring from the workforce, the younger generations will be taking their places. To ensure productivity increases and mental health levels remain stable, should employers accommodate the present desire that Generation Z and Millenials are presenting? Our statistics indicate that the younger generations are looking to satisfy their “zen” and manage their mental health while at work, which leads us to believe that meditation could be the answer.

Key Stats

- 73% believe regular meditation practice will improve work/life balance

- 22% of Canadians meditate once per week

- 49% had an increased desire to learn to meditate as a result of WFH

- 56% use meditation for stress relief

- 41% use meditation for health benefits

- Gen Zs are 15% more likely to agree that regular meditation practice will improve their work experience, compared to Baby Boomers

- 58% are likely to attend Zoom meditation sessions offered by their employers

Main Takeaways

No.1 |

Younger generations demonstrate a higher level of understanding and desire toward meditation compared to the older generations.

No.2 |

Generation Z had the highest response rate in favour of meditation and believe employers should be providing services to support the mental health of their employees.

No.3 |

A majority of Canadians agree that they prefer to meditate at home by themselves, however, Gen Z favours meditation through an app.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle insights? Sign up to our mailing list below!

Canadian Grocer News Feature | Out with Sustainability?

Factors driving grocery revenues now and post-pandemic

Published on May 18, 2021

Caddle is thrilled to announce our partnership with Canadian Grocer by sharing our first contributed column to their magazine subscribers this month.

Caddle CEO Ransom Hawley discusses factors driving grocery revenues now and post pandemic. According to Caddle supported data, value, convenience and selection trump eco-consciousness for COVID-stressed Canadians.

Subscribe to Canadian Grocer here to view the full magazine

Death of the Third-Party Cookie, Rise of FLoC

Use Caddle to Better Understand Your Audience

Published on March 31, 2021

It’s been in the works for some time, but recent major headlines speak to what the end of Google’s third party cookies mean for marketers and their companies. If you’re not up to speed, Google’s announcement of ending its third-party cookies potentially sets a new industry standard, limiting companies’ abilities to retarget consumers on the web.

“Users are demanding greater privacy–including transparency, choice, and control over how their data is used–and it’s clear the web ecosystem needs to evolve to meet these increasing demands,” says Google.

According to The Drum, Google is gearing up to replace third-party cookies with something called the Federated Learning of Cohorts (FLoC) – a privacy-focused solution intent on delivering relevant ads “by clustering large groups of people with similar interests”. Accounts are anonymized, grouped into interests, and more importantly, user information is processed on-device rather than broadcast across the web. Google will make FLoC-based cohorts available for the public this month. By Q2, advertisers can start testing FLoC-based cohorts in Google Ads.

While many marketers have been preparing for this day for a while, we wanted to find out from Canadians what consumers think about the use of their data for marketing purposes.

Turns out, most consumers are in the know about what data privacy means.

About 4 in 5 of respondents have at least “a little” familiarity with data & privacy laws/regulations.

How familiar are you with data and privacy laws/regulations?

About 74% of respondents believe that Facebook and Google use their data for personalized ads.

Which of the following companies do you believe uses your data for personalized ads? (select all)

Do consumers care about third-party cookies?

While data privacy seems to be on consumers’ minds, there may be an opportunity to educate on the different types of data collection, and what they’re used for. From the Caddle panel, we discovered that while 4 in 5 respondents don’t think that personal data should be used for commercial purposes, approximately 50% of respondents still prefer to see ads online that are relevant to them. This conflicting response suggests that personal data is something consumers are willing to provide if it means seeing more ads relevant to them (personal marketing).

Unsurprisingly, younger generations (Millennials and Generation Z) are less likely than older generations (Baby Boomers) to be against the commercial usage of personal data. Again, this supports the notion that consumers are not opposed to data collection, but merely require better knowledge on the collection process to understand its purpose. And perhaps, companies should start thinking about ways to compensate users for their personal data.

Caddle found out that consumers want to be compensated for their data if companies are collecting it. Only 4.4% of respondents do not seek compensation of any kind for personal data collection from companies.

How would you want to be compensated for sharing your personal data? (select all)

Now at the end of the third-party cookie, the importance of first-party data has never been more pertinent to a company’s success. Caddle’s first-party data has the wealth of insights waiting to be discovered by you and your brand. With Google’s plans to replace third-party data with FLoC, Jed Schneiderman– marketing, media, and tech executive- says that Caddle can help you navigate this new, uncharted territory of FLoC:

“Use Caddle to better understand your audience and then you can make better use of the new cohort way of targeting.”

Key Takeaways

No.1 |

50% of Canadians still prefer to see ads online which are relevant to them, therefore the end of third-party cookies should not equate to the end of personalized marketing for brands.

No.2 |

Consumers are not against personal data collection, but do require better knowledge on the collection process to understand its purpose, and how it brings value to them.

No.3 |

User compensation for personal data collection is looking like a viable strategy for advertisers, with 1 in 3 consumers in favour of sharing data for improved advertising. As we see further proliferation of platform as a service (PaaS) business models, the market for first-party consumer panels will be at the forefront of many industry conversations in the coming years.

No.4 |

Caddle grants access to a first-party audience for marketers to test a multitude of important company-wide considerations including ad creatives, messaging, and consumer profiles. Caddle even offers first party acquisition with rewards!

Interested to learn more about Caddle Capabilities?

Reach out to learn about a free demo!

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle Insights? Sign up to our email list!

COVID-19: One Year Later Report 2021

New report suggests the pandemic has had little or no impact on how satisfied Canadians are with the food industry.

Published on March 11, 2021

One year later: New report suggests the pandemic has had little or no impact on how satisfied Canadians are with food industry.

The Agri-Food Analytics Lab at Dalhousie University, in partnership with Caddle, released a new report about consumer confidence on our food industry, one year after the pandemic began. At the end of February 2021, a total of 10,005 Canadians were surveyed on confidence and satisfaction of the food industry. Results, overall, were quite positive for the food industry.

Canadians have faith in the food industry

In this report we cover:

- Food safety

- Sustainability

- Food access

- Food affordability

- Consumer confidence in the food industry

“A lot of people are struggling right now, whether it’s physical or mental,” says Sylvain Charlebois. “(It’s) important for the industry to think about being a partner for Canadians in their journey to a better self.”

Director of the Agri-Food Analytics Lab at Dalhousie University, Sylvain Charlebois, breaks down the findings on National Post.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle Insights? Sign up to our email list!

Whole Health Trends in 2021

Plant-Based Foods, Immune Health, & More!

Published on February 10, 2021

Caddle in Grocery Business Magazine

January/February 2021 Issue

Caddle insights include:

- p.39 Immune health still top of mind for consumers

- p.41 A healthy outlook: supplements & functional products

- p.44 Plant-based foods

- and much more!

Flip to the whole health section to see what Caddle discovered about the health & wellness market, immune health, the supplements market, and the future of plant-based foods.

Get the Free Magazine

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle Insights? Sign up to our email list!

First-of-its-Kind eCommerce Canadian Grocery Retail Report

Insight on consumer preference across all of the major online Canadian grocery retailers

Published on December 4, 2020

Caddle launched a

first-of-its-kind

eCommerce Canadian Grocery Retail Tracker,

looking at consumer preference across all of the major online Canadian grocery retailers.

What’s in the data?

The data is weighted by region, gender, and age, based on the most recent Canadian census figures to ensure that the sample reflects Canada’s population.

This report summarizes the results for 5 weeks of data collection, which includes 7,209 completed surveys

What's Inside

Online Grocery Shopping Experience Across 12 Factors

1. Easy to pick up order

2. User-friendly app/site

3. Availability of items

4. Fresh food quality

5. Payment options

6. Keeping you updated

7. Order availability/quick delivery

8. Cleanliness & hygiene

9. Order accuracy

10. Return policy

11. Price online vs. in-person

12. Secure transaction

Get the Report!

NPS Score by eCommerce Banner

Measuring willingness of customers to recommend a company’s products or services to others based on their experience

Key Driver Analysis

to identify attributes with the most impact on NPS

3 Key Takeaways

1. Out of 11 eCommerce grocery retailers,

the winner was no surprise…

Amazon takes 1st place

in 7 of 12 measured attributes, and top 3 in 11 of 12 attributes.

2. 50% of consumers access home delivery and click & collect equally

when it comes to online grocery shopping. Both avenues

must be optimized and are critical to winning

in eCommerce.

3. 1 in 2 consumers

are likely to use a different retailer next time they shop for groceries online.

Loyalty is low

and consumers are trying different providers.

Interested to see our In-store Grocery CX Report? See blogpost here.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Canadian Millennials vs. Boomers & COVID-19 Habits

The Great Divide | One Country, Multiple Cohorts

Published on November 9, 2020

At Caddle, we’ve been collecting consumer insights on Canadian grocery retailers since the pandemic began. Why? To help brands and agencies understand COVID-19 & the Canadian Consumer. As a result, we’ve turned those insights into a short report as we head into the busiest retail season of the year!

Ransom Hawley

CEO at Caddle

Get the Report!“Now, as we stare down a second wave of COVID-19, and with learnings gathered from living through more than half a year of pandemic-driven ups and downs, we at Caddle know that consumer insights have never been more important.”

COVID-19: 5 Tips for Canadian Grocery Retailers in Q4 & the New Year

1. Don’t rely on old data

2. Don’t assume non-Canadian data is a “good enough” indicator of Canadian shopping preferences

3. Do talk to your audience throughout the purchase cycle

4. Do measure how you stack up against your competitors

5. Do invest in improving your omnichannel customer experience

So, the ongoing effects of COVID-19 on the Canadian retail sector is in for more tumultuous times – in December and most likely into 2021. As a result, brands need relevant and recent consumer data from a reputable source—and plan your holiday ramp-up accordingly.

So, What’s Inside?

- COVID-19 | The pandemic has brought Canadians together but has also driven them apart

- Retail is Failing | What consumers want vs. what they’re getting

- Millennials vs. Baby Boomers | How generations differ in grocery shopping habits & what that means for brands and retailers

- and more!

Sneak Peek

Grocery Retailers: Who is Winning & Who is Falling Behind?

Do any of these rankings surprise you? Want to know how Caddle can accelerate time to insight for you and your brand? Get in touch!

Full Insights Here: The Great Divide

Growing DIY culture suggests big opportunity for beauty trends

The act of making time for yourself using varied techniques to take care of your mental and physical wellbeing has become a major opportunity for brands. And a rather expensive one to say the least.

From skin care products to yoga memberships, these self-care healthy lifestyles quickly add up over time. But are these beauty and wellbeing trends worth it?

Due to the expensive nature of self-care, DIY culture has been on the rise. DIY culture is defined as the process of doing things yourself for a fraction of the cost, and has begun disrupting the industry.

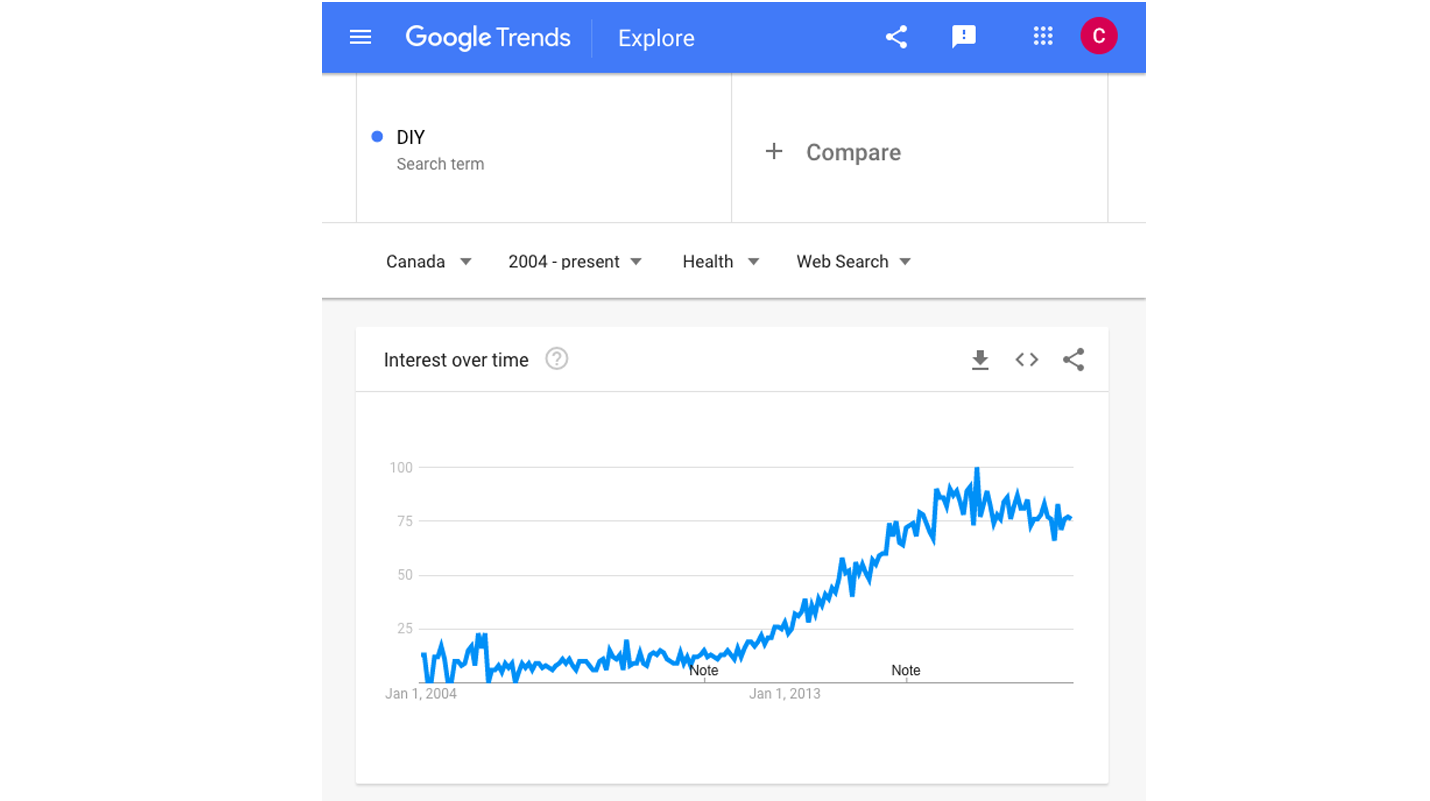

When comparing DIY searches under the health category, the Google Trend results speak for themselves.

DIY for better wellbeing

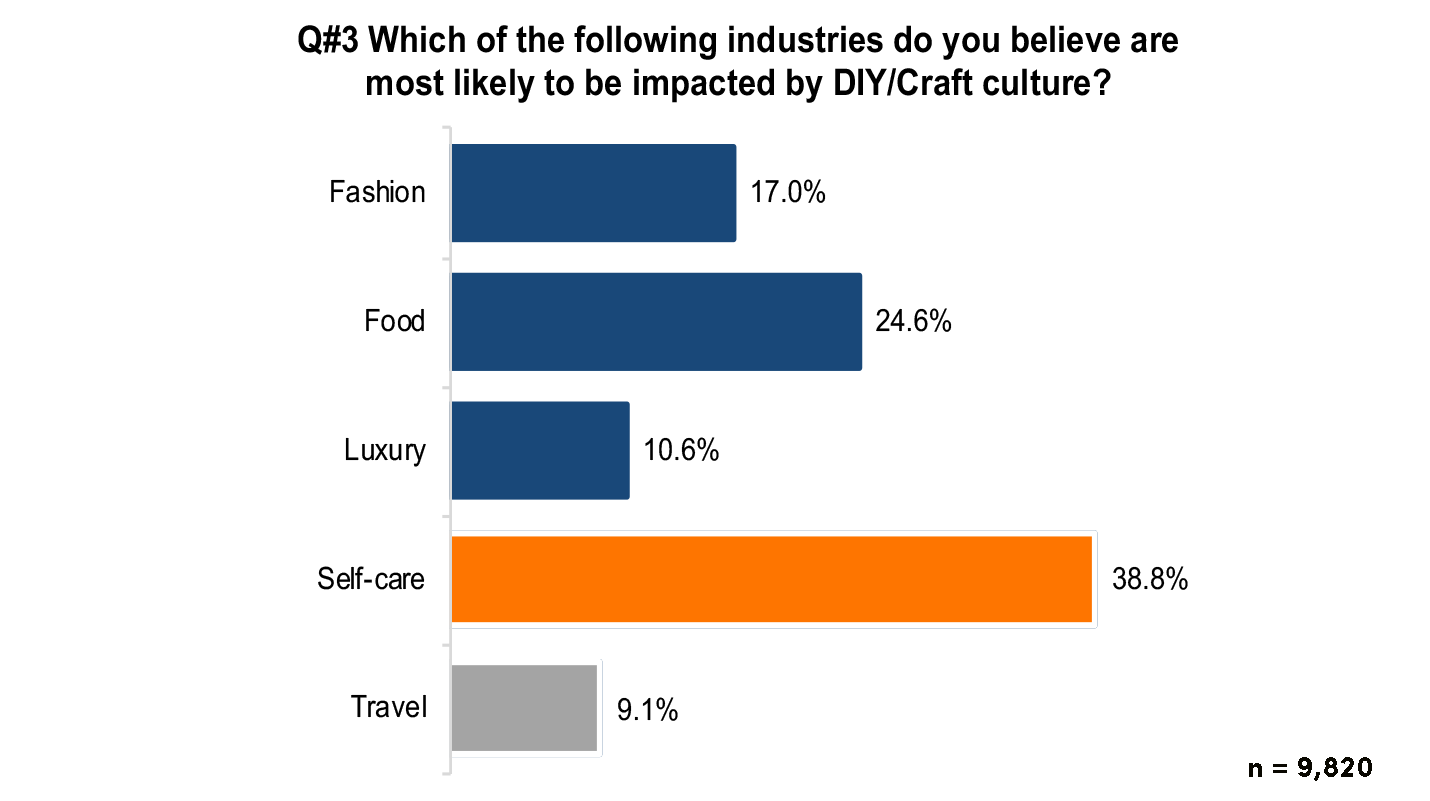

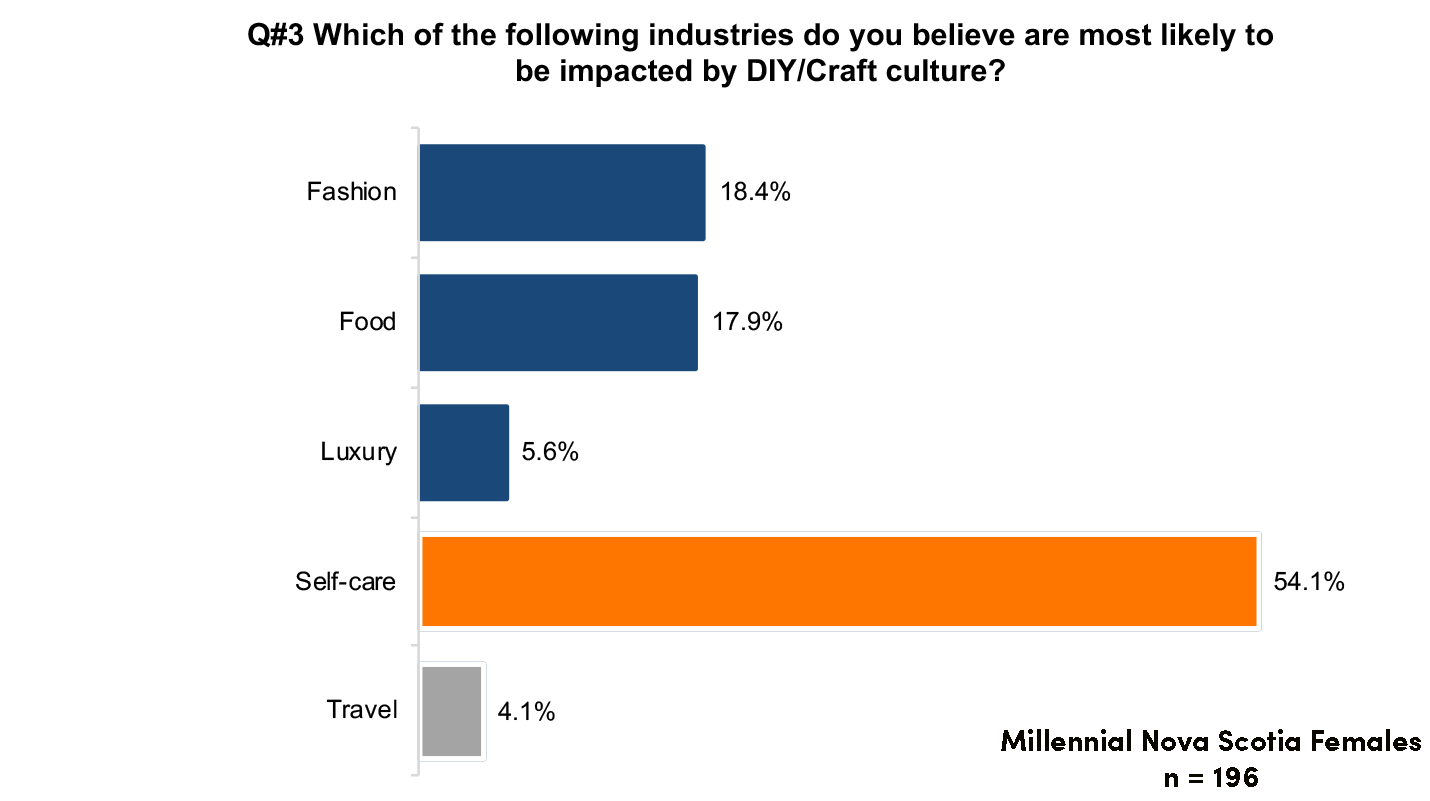

In search of further insights, our team of data scientists tested this hypothesis to see if the self-care industry was ripe for disruption. In a survey with just over 9,800 responses, 39% of survey respondents agreed that they feel the self-care industry will be impacted by DIY culture.

Younger generations most likely to disrupt the industry

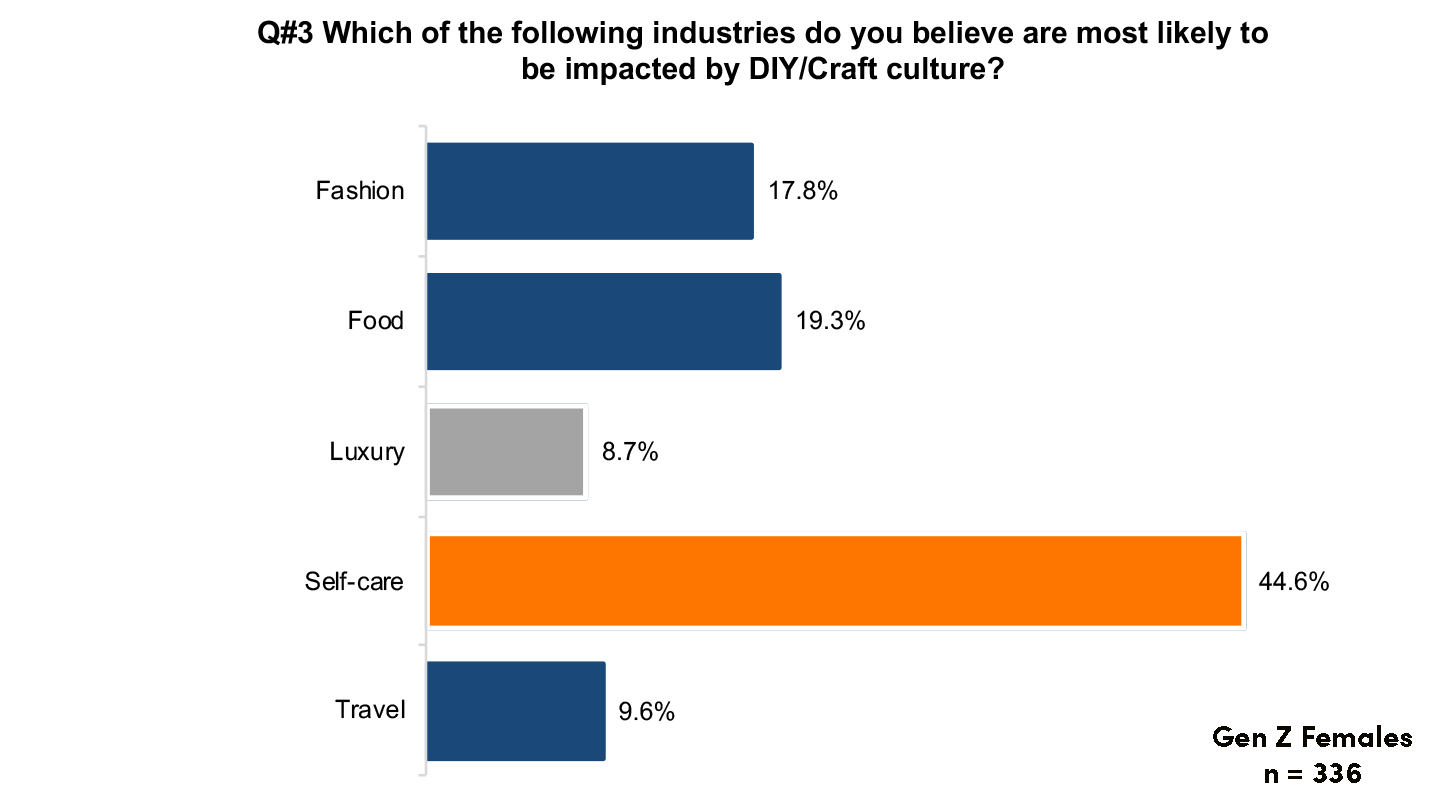

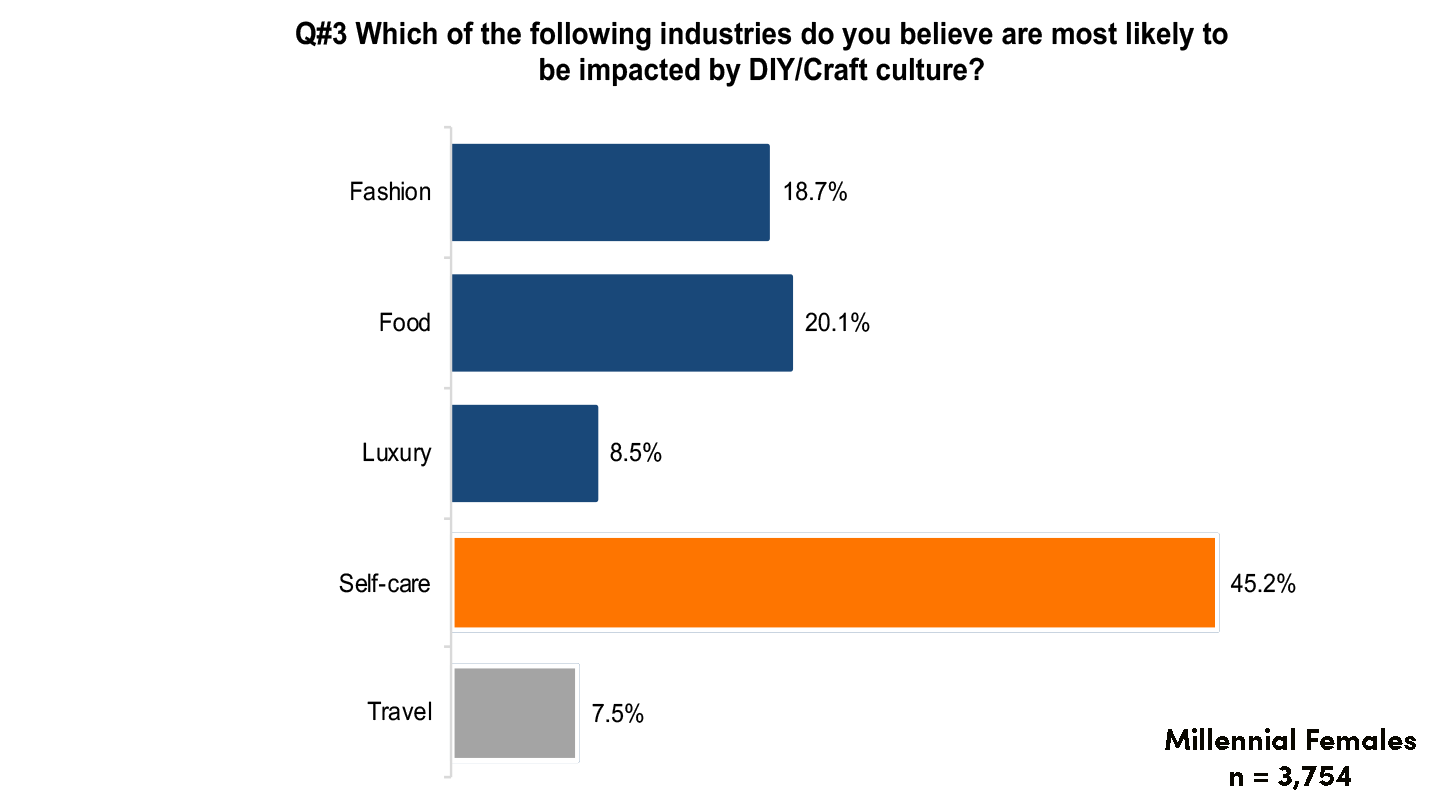

Millennial and Gen Z females aren’t too keen on spending money when it comes to their self-care. These generations over-indexed in agreeing that DIY culture will impact the self-care industry.

East is the best test market for your new self-care DIY product

Out of all survey results, Millennial females living in Nova Scotia seem to pose the biggest opportunity to the self-care industry.

There may be no better place to develop some self-care DIY products than Nova Scotia. Hardened by brutal winters, peaceful surroundings, and often stormy waters, the millennial females of Nova Scotia seem to be always on the lookout for new ways to treat themselves to some self-care. Perhaps this DIY culture in itself is self-care.

How can you jump on this opportunity?

While self-care encompasses both the physical and mental wellbeing, a quick search on the interwebs seems to indicate that the skin-care segment is most at risk due to the pricey nature of these products. Both Google, YouTube and Pinterest highlight frugal ways to make DIY skin-care products for a fraction of the cost.

In a positive light, these ‘risks’ can actually be seen as opportunities. Further insights we collect from our rapid research through crowdsourced surveys, we can help pinpoint exact consumer pain points which industry leaders can target.

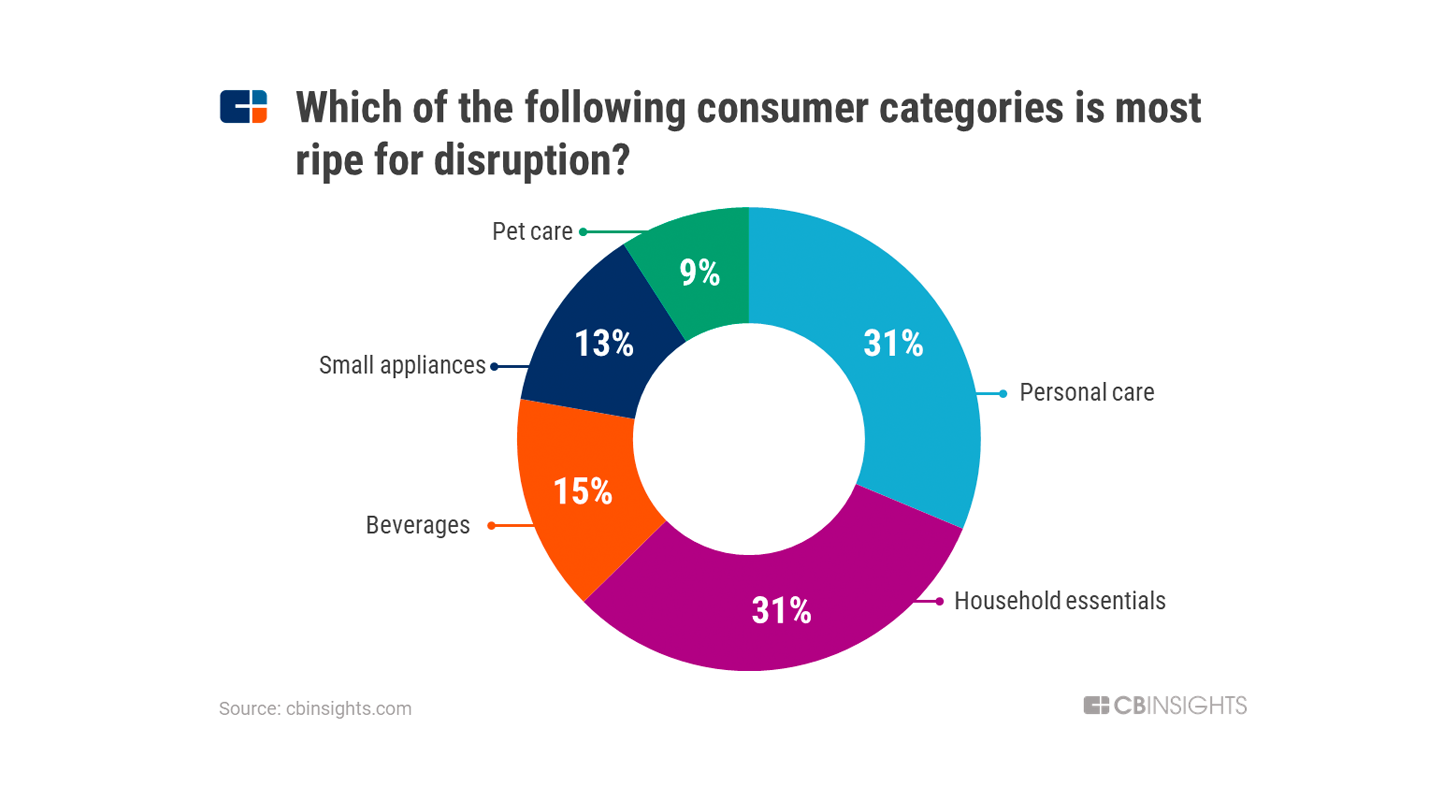

Opportunities most ideal for beauty brands

Frankly there just isn’t enough insight to suggest where disruption is most likely to target in the self-care industry. But it might be beneficial to create a product line that tends to the frugal shopper for starters.

A recent report by CB Insights found that traditional self-care brands might want to invest in indie brands and innovative technology.

What’s in store for 2020

Despite what the factors may be, 2020 has the opportunity to disrupt many industries and create a whole new area of opportunity. Some trends you might expect to see throughout the year could be:

- More incubator projects from Fortune 500 companies like P&G, J&J and L’Oréal,

- More packaged DIY projects,

- Increased alignment with social responsibility and environmentally friendly customer experiences

Got questions? We’ve got answers

- All these insights making you thirst for data? Request the full report here

- Got a question for our DIY panel? Submit your question and you might be featured in our next blog

- Looking to learn more about Caddle’s capabilities? Click here