All-Natural & Sustainable:

What Canadian Parents Want for their Baby

Published on December 22, 2020

After our parenthood post , Caddle wondered what factors influence Canadian parents on their baby product purchases.

On November 30, here’s what we found:

1.

What labels are important when deciding what baby products to buy? (e.g. all natural, organic)

Over half of respondents ranked All-Natural and Sensitive as important labels when purchasing baby products

2.

Where do you get your information on what baby products to buy?

Over half the respondents get their information on baby products from friends/family as well as self-discovery (personal research)

3.

What would most influence you to purchase a new baby product based on environmental sustainability?

78% of consumers believe that environment sustainability is important, and the top 2 most influential factors of a new baby product being reusable packaging and paper-based packaging

Key Takeaways

All-natural and sensitive

are ranked as the most important labels to consider when purchasing baby products

Parents rely on word-of-mouth and personal search

to discover what baby products to purchase

Reusable packaging & paper-based packaging

are the most influential factors when purchasing a new baby product based on environmental sustainability

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle Insights?

Sign up to our email list!

Canadians' Parenthood Plans Continue While American Parents Dwindle

COVID-19 hasn’t stopped Canadians from planning for parenthood, but it has amplified the concerns of those wanting to have a child in the next five years.

Published on December 16, 2020

You’ve likely heard stories for years now about how Canada’s population is shrinking. Yet the latest population data indicates otherwise: Canada experienced a 1.4% YOY increase in the number of people living in the country in 2019—the highest growth rate since 1989–90.

Though this increase was driven mostly by immigration, it’s still noteworthy for several reasons: First, Canada’s growth rate is the highest among G7 counties and more than 2x that of the U.S. Second, these statistics were gathered months before the COVID-19 pandemic hit global markets. With this in mind, we wondered:

- Would all of the uncertainty around the pandemic colour Canadians’ perspectives around parenthood?

- If, pre-pandemic, people were planning on having children, would they still want to after experiencing the effects of the lockdown and other restrictions?

- And, what factors come into play in Canadian consumers’ parenthood planning?

Let’s dig into the results to learn more.

HOW MANY PEOPLE HAVE KIDS AND HOW MANY PEOPLE WANT THEM?

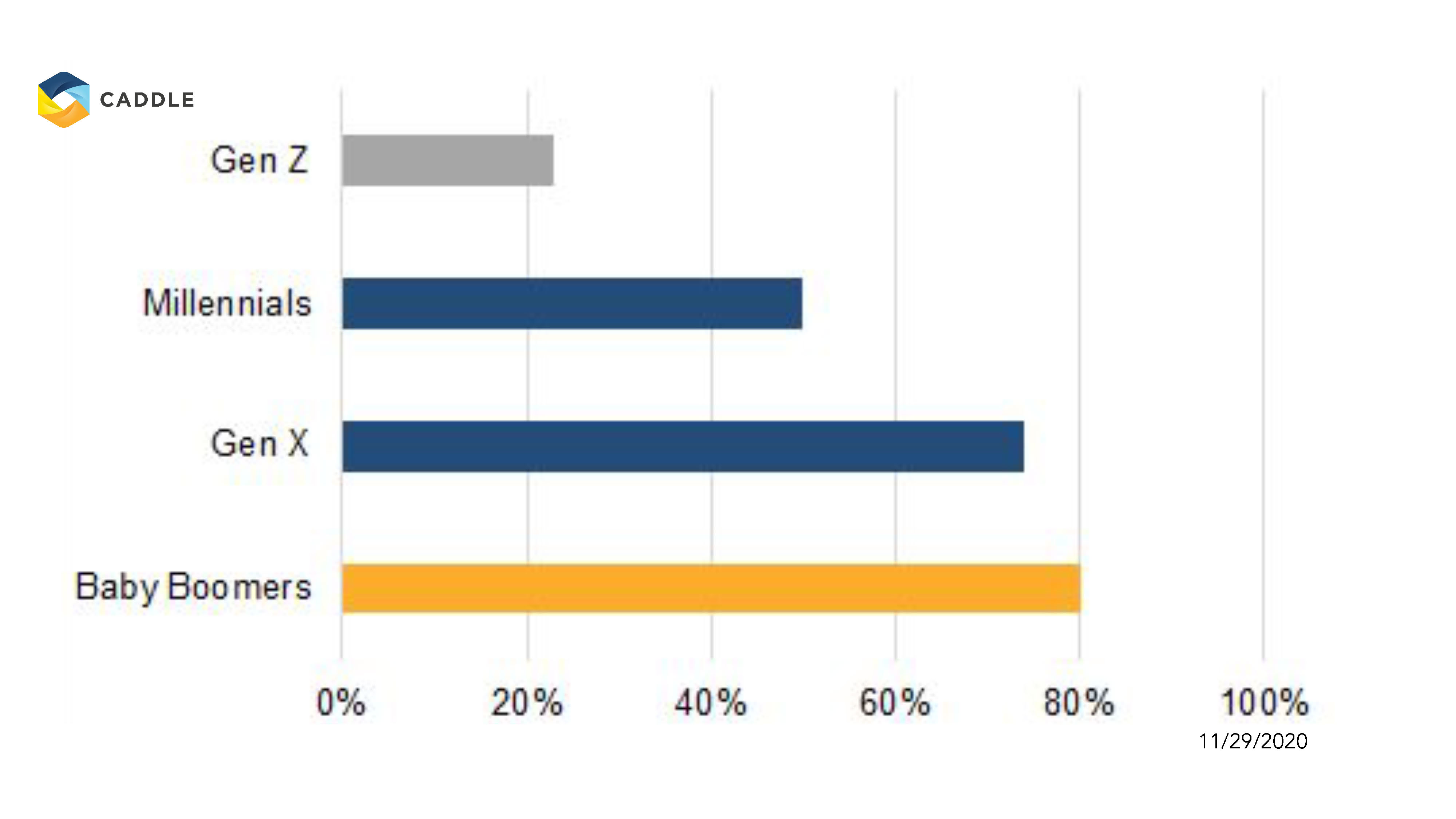

More than 60% of our 10,000-strong Daily Survey panel are currently parents—including 80% of Baby Boomer, 74% of Gen X, 50% of Millennial and 23% Gen Z respondents.

Among these current parents, nearly 1 in 5 people had been planning, pre-pandemic, to have children within the next five years. Only a small portion of this population (~8%) had changed their parenthood plans because of the pandemic.

In contrast, about a quarter of non-parent respondents had been planning, pre-pandemic, to have children within the next five years and an even smaller proportion of those (6.6%) had changed their minds due to COVID-19.

Compare this to stats gleaned on our neighbours to the south: 58% of Americans who, pre-pandemic, were planning to have children in the next five years say that COVID-19 have made them less likely to want to have children.

What might be driving this trend? Well, a whopping 93% of U.S. households with school-aged children reported having to accommodate distance learning at home during the pandemic. Could this major stressor, added on top of ongoing financial and health concerns, be the reason for Americans’ burst baby bubble? Or is it just another indication of the widespread decline in global fertility rates?

(Side note: The U.S. in particular has been reporting a steady decline in fertility rates for decades, with 2019 seeing the lowest number of births in 35 years.)

WHAT’S MAKING CANADIANS PUSH OUT THEIR PARENTHOOD PLANS?

A handful of concerns are weighing heavily on Canadian consumers’ minds when it comes to having children. No surprises here, as they’re life factors we’ve seen and talked about before in relation to the pandemic.

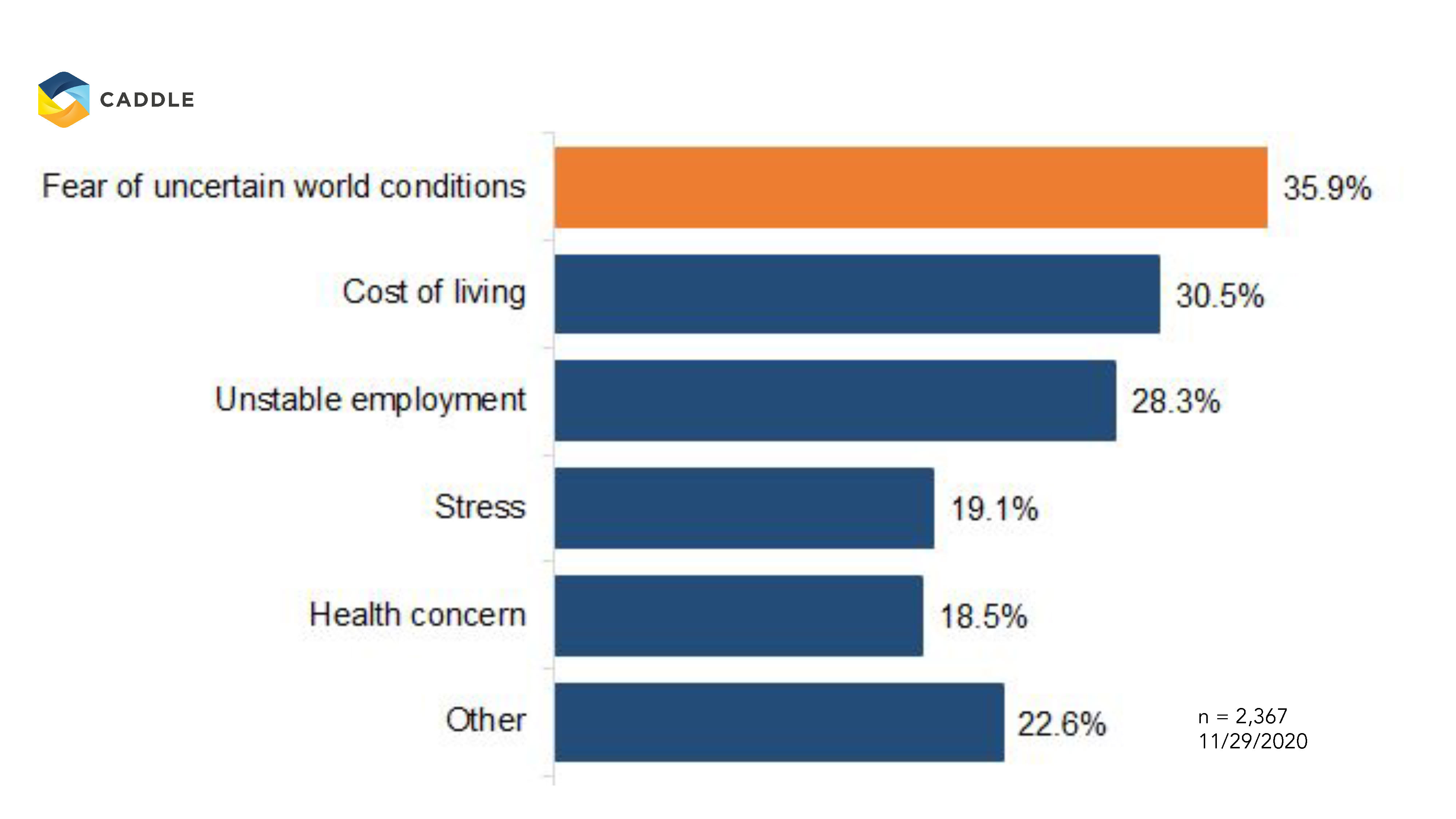

Whether it’s due to “fear of uncertain world conditions” (36%), the “cost of living” (30.5%), “unstable employment” (28%) or more generally, stress and health concerns (both about 19% each), it’s clear that the practical effects of the pandemic are leading some Canadians to postpone child-bearing to more than five years out.

Of note:

Though the top three concerns are consistent for both parents and non-parents, current parents over-index in their “fear of uncertain world conditions” (at 37.6%), while non-parents rank the “cost of living” as their biggest consideration (at 35%). This suggests that the factor of already having children in the household could have an amplifying effect on parents’ empathy responses. In contrast, non-parents seem to be thinking more practically about their financial futures and the implications of adding another family member to the household.

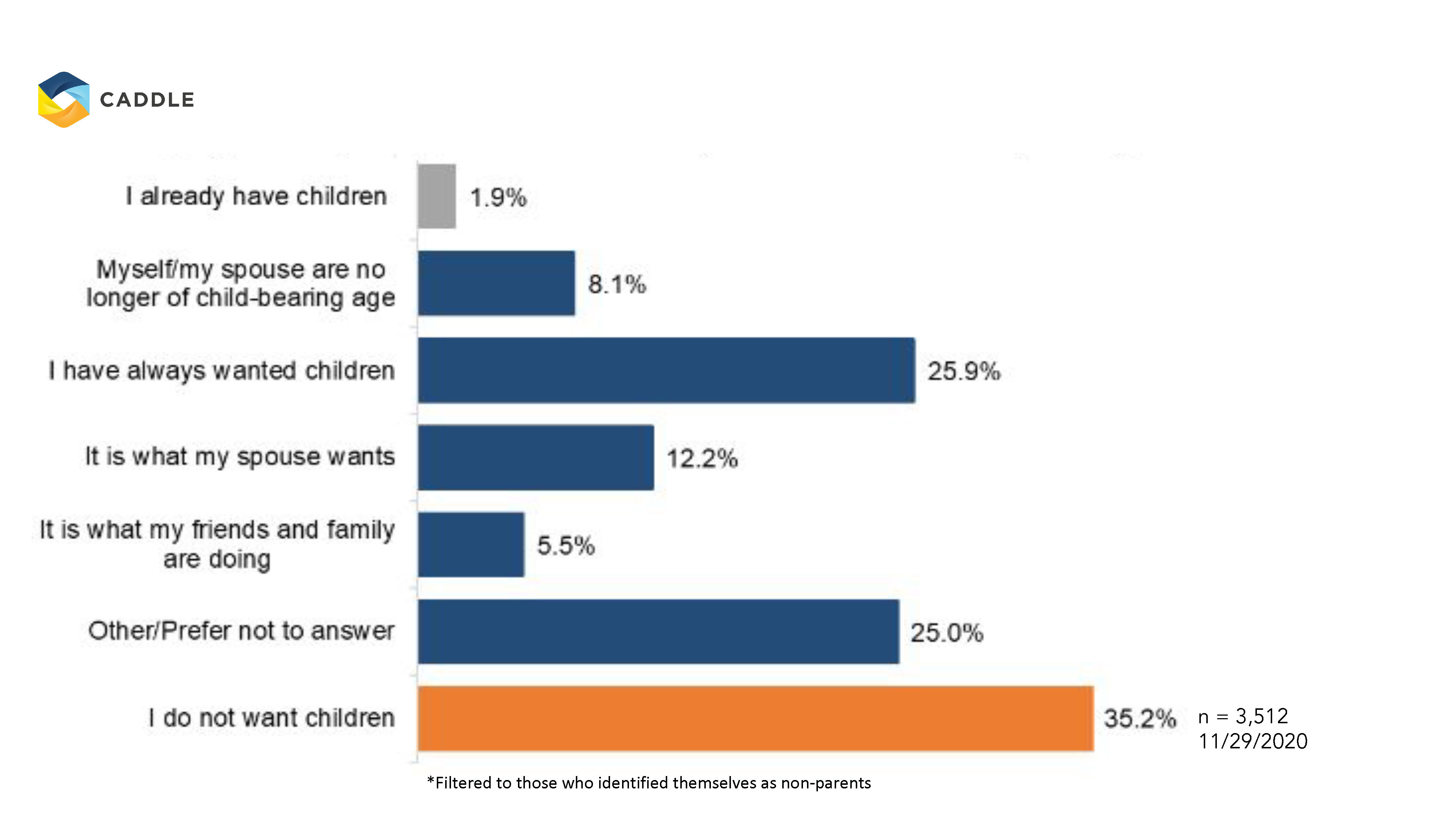

WHAT FACTORS INFLUENCE CANADIANS’ DECISION-MAKING AROUND WHETHER TO HAVE CHILDREN OR NOT?

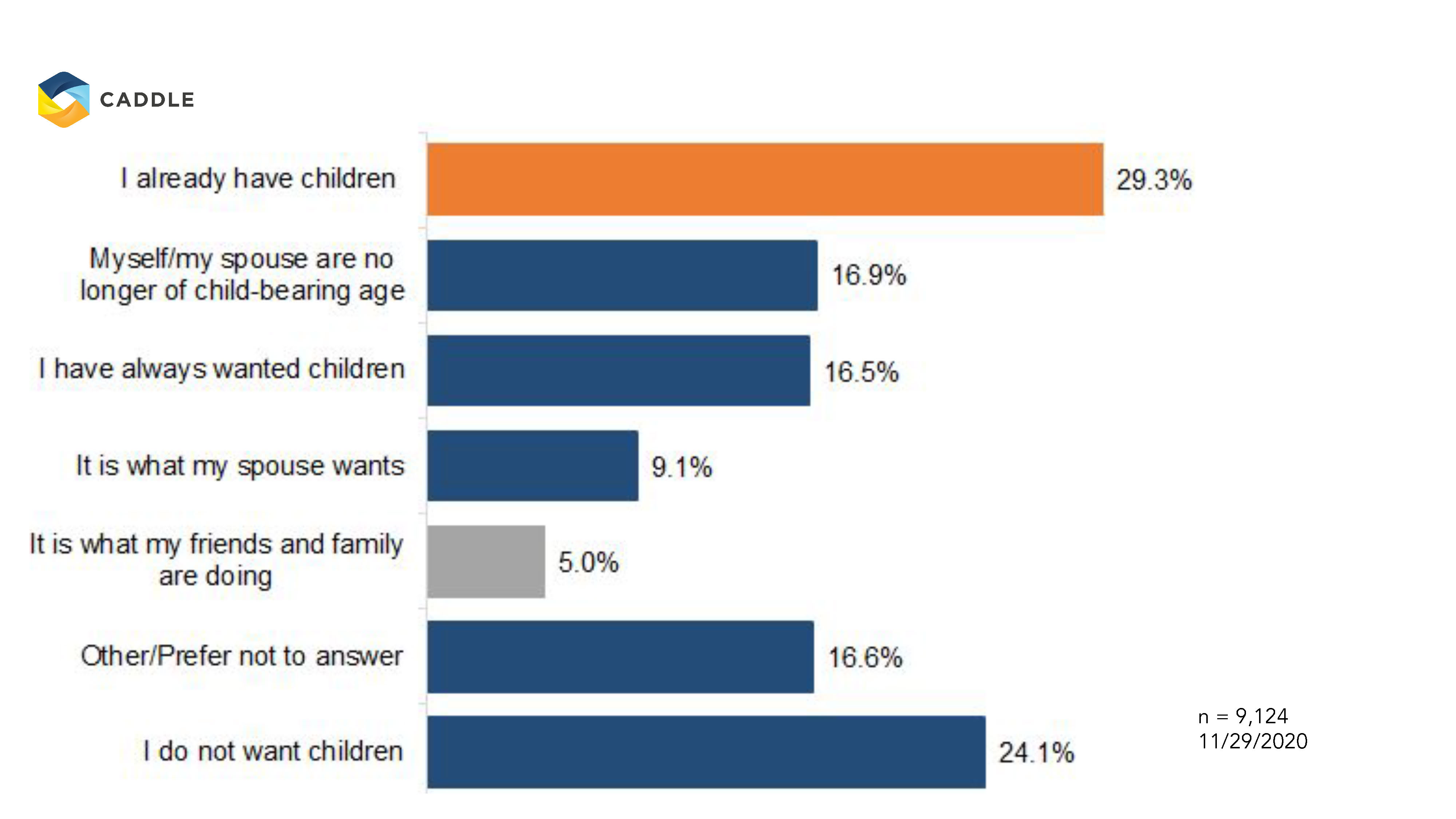

Not surprisingly, the factors that influence respondents’ mindsets around parenthood reflect a combination of both personal and societal norms: Interestingly, only about a third of respondents identified “already having children” as the reason to have more children in the future.

Following very closely behind are respondents who “do not want children at all” (24%) and, tied for third, is the fact that they “have always wanted children” and that their spouses or themselves are “beyond child-bearing age” (16.9% and 16.5 % respectively).

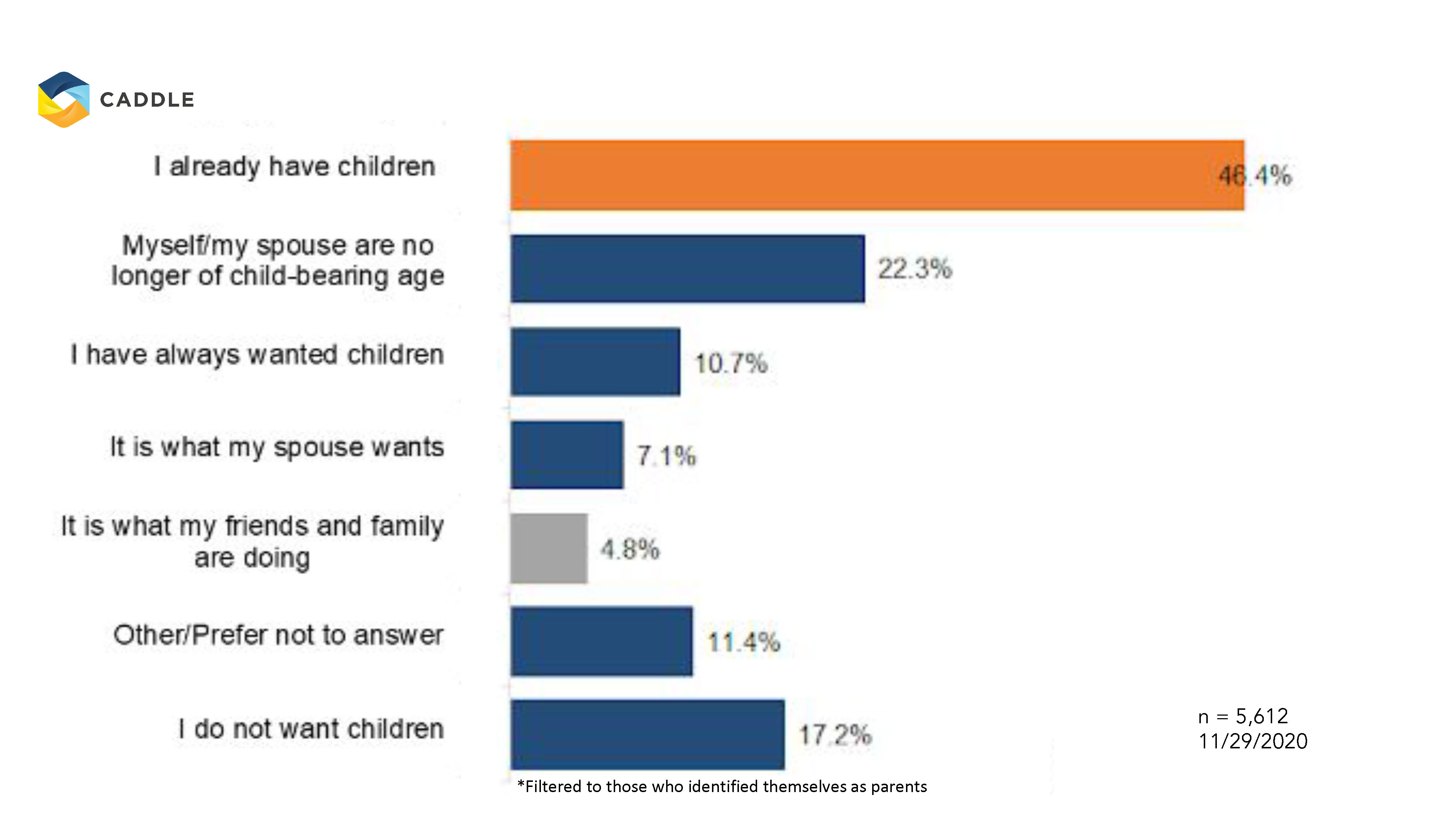

Does the factor of whether they’re already parents make a difference?

Yes, indeed!

Respondents who are currently parents over-index significantly in already having children, and at the same time, weigh their and/or their spouses’ ability to have children more highly than the general population. In contrast, non-parents differed significantly, with more than a third indicating they don’t want children and another 26% suggesting they always wanted children.

Important side note: Millennials make up 58% of the non-parent segment in this sample, which goes a long way to explaining the relatively small proportion of responses that indicate age as an influence on child-bearing. In contrast, Gen Xers and Millennials are more evenly represented in the “current parents” segment (at 41% and 37% respectively), which edges them somewhat closer to the point in life where bearing children becomes a more complicated prospect, though not completely out of the question.

KEY TAKEAWAYS

Canadians are still planning on having babies—especially younger folks

Caddle Daily Panel survey results suggest that a decent proportion of the Canadian population are still intent on bearing and rearing children. And while Baby Boomers are getting too old to have kids (they now account for the majority of seniors in Canada) and Gen Xers feel that they’ve had enough kids already, Millennials want children and aren’t letting the pandemic stand in their way. Meanwhile, Gen Zers have always wanted kids and still do.

This poses an opportunity for forward-looking retailers to think about the varying demographics of parents, and further tailor their baby assortment to the tastes of different parental age groups. For instance, we know that younger generations tend to be more tech savvy and sustainability conscious. So, consider bringing more innovation and technology to traditional baby categories with game-changing products like smart diapers that notify parents when they need changing or pacifiers made from sustainably sourced latex rubber.

COVID-19 will continue to give would-be parents pause for thought

The pandemic has and continues to play mind games with many Canadians: On the one hand, we know that COVID has had a negative effect on Canadians’ mental health, and the potential for postpartum depression could only make this worse. Yet, we also know that many Canadians (and especially younger segments) are looking for any silver lining they can find from 2020—and what better silver lining is there than welcoming a new baby into the family in the New Year?

As such, retailers should expect steady business from baby- and child-care categories through 2021 and beyond, though some non-essential purchases may come in fits and starts as COVID-driven concerns dovetail with pregnancy side effects for new parents.

Financial and health concerns are unlikely to go away anytime soon

Our Daily Panel surveys have uncovered a consistent pattern of financial and health concerns among the majority of Canadians. Such concerns are obviously weighing heavily on people’s minds and though it hasn’t completely deterred people from starting or expanding their families, it’s definitely made them question their priorities.

Forward-thinking retailers will want to keep such concerns in mind and consider ways to make child-rearing a less financially taxing endeavour. Some ideas: Extend rewards programs to cover the many costs associated with newborns, perhaps considering cash-back as an option to cover childcare. Or, deploy lifecycle marketing campaigns that track and reward parents for their children’s milestones.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle Insights?

Sign up to our email list!

COVID-19 Did Not Steal Canadians' Holiday Spirit

Canadians plan for holiday celebrations at home

Published on December 10,2020

This holiday season: how are Canadians celebrating?

Canadians are planning to keep up holiday spirits by cooking & baking at home this year.

Caddle found out that everyone is reducing gatherings over the holiday season.

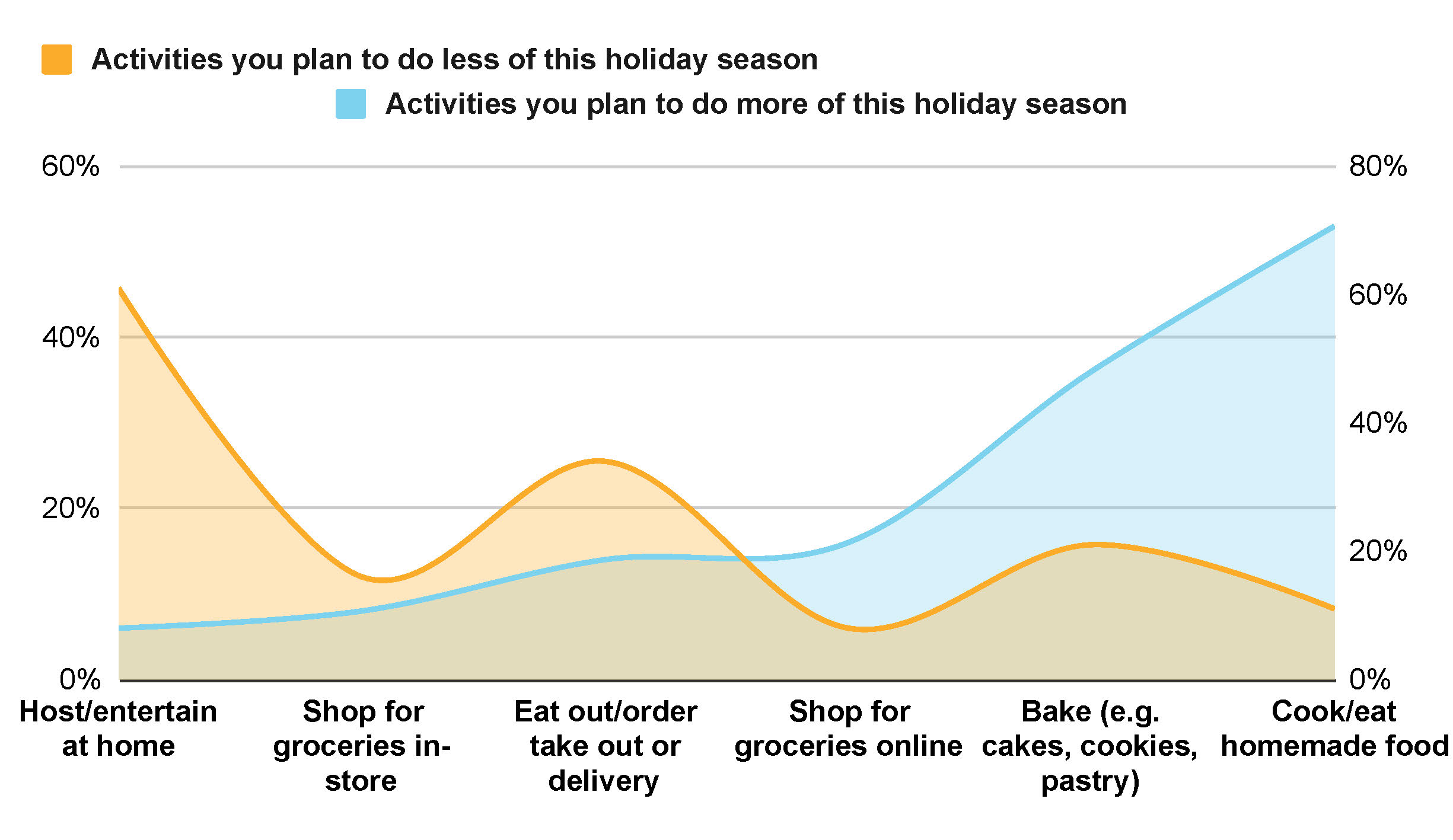

What are Canadians planning to do more/less of this holiday season?

Let’s find out.

Canadians plan to…

entertain less,

host less gatherings, &

shop for groceries less in-store due to the pandemic.

Instead, consumers are

cooking more,

baking more, &

shopping for groceries online.

In fact,

Over 87% of Canadians plan to cook or bake at home this year.

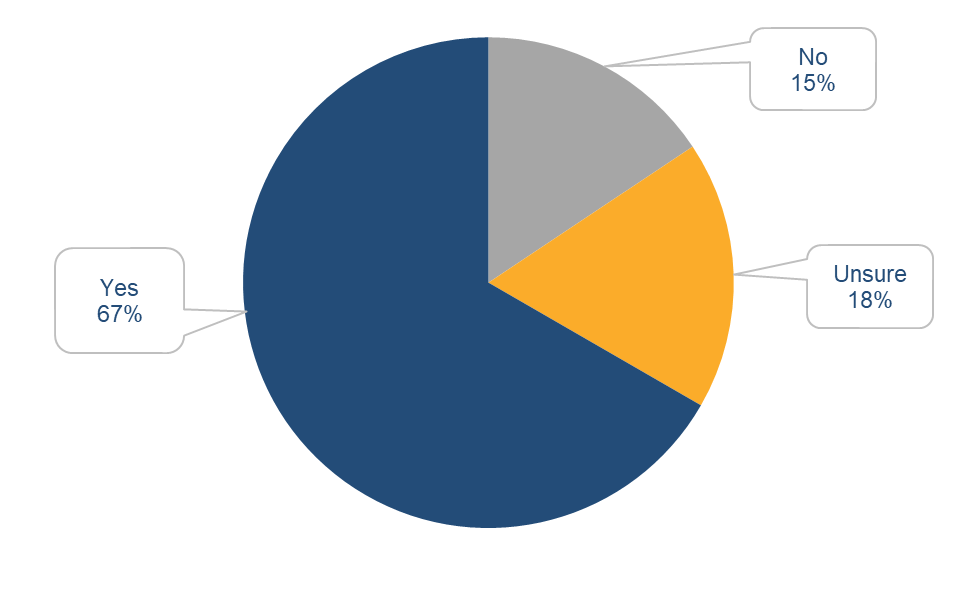

Tis' the Season of Baking: 67% of Canadians

are planning on doing some form of baking over the holidays.

Q: Are you, or someone in your household, planning to bake during the holidays?

Sign up for Caddle Insights

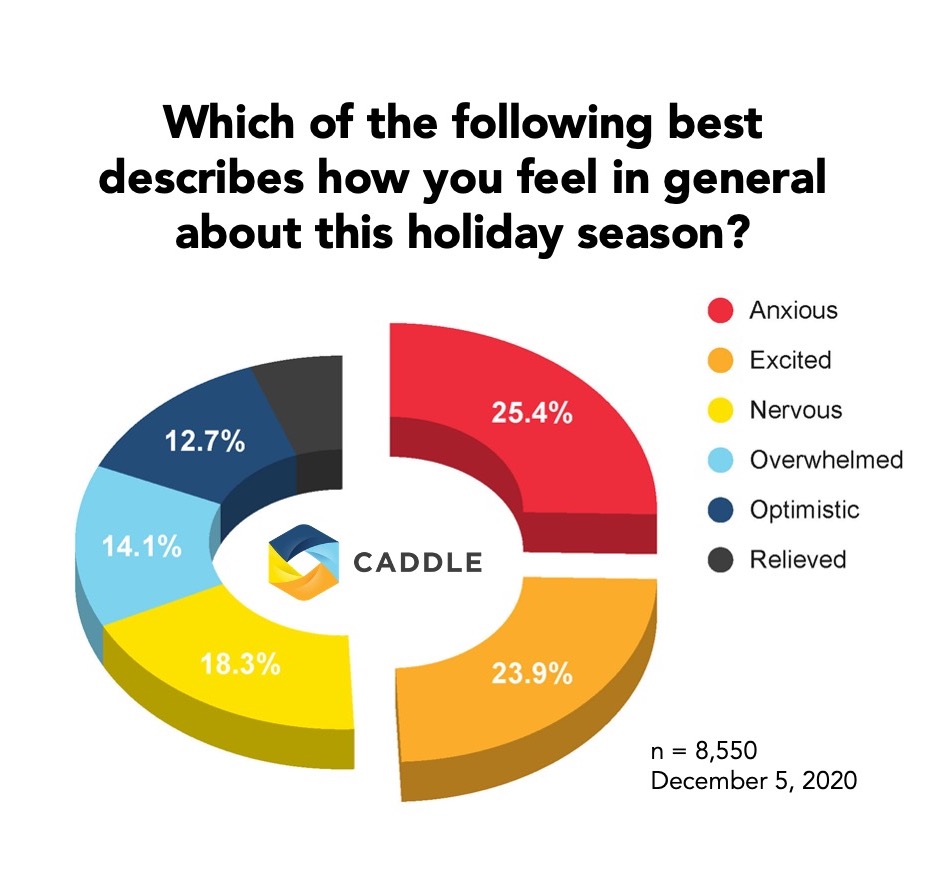

But how are Canadians feeling about the holiday season? Anxious? Excited? Nervous?

Finally,

Holiday cheer is strongest among the youngsters as

Gen Z are 15% more excited for the holidays compared to Baby Boomers,

with 24% vs. 9% respectively.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle insights? Sign up to our mailing list below!

First-of-its-Kind eCommerce Canadian Grocery Retail Report

Insight on consumer preference across all of the major online Canadian grocery retailers

Published on December 4, 2020

Caddle launched a

first-of-its-kind

eCommerce Canadian Grocery Retail Tracker,

looking at consumer preference across all of the major online Canadian grocery retailers.

What’s in the data?

The data is weighted by region, gender, and age, based on the most recent Canadian census figures to ensure that the sample reflects Canada’s population.

This report summarizes the results for 5 weeks of data collection, which includes 7,209 completed surveys

What's Inside

Online Grocery Shopping Experience Across 12 Factors

1. Easy to pick up order

2. User-friendly app/site

3. Availability of items

4. Fresh food quality

5. Payment options

6. Keeping you updated

7. Order availability/quick delivery

8. Cleanliness & hygiene

9. Order accuracy

10. Return policy

11. Price online vs. in-person

12. Secure transaction

Get the Report!

NPS Score by eCommerce Banner

Measuring willingness of customers to recommend a company’s products or services to others based on their experience

Key Driver Analysis

to identify attributes with the most impact on NPS

3 Key Takeaways

1. Out of 11 eCommerce grocery retailers,

the winner was no surprise…

Amazon takes 1st place

in 7 of 12 measured attributes, and top 3 in 11 of 12 attributes.

2. 50% of consumers access home delivery and click & collect equally

when it comes to online grocery shopping. Both avenues

must be optimized and are critical to winning

in eCommerce.

3. 1 in 2 consumers

are likely to use a different retailer next time they shop for groceries online.

Loyalty is low

and consumers are trying different providers.

Interested to see our In-store Grocery CX Report? See blogpost here.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Sustainability: Canadians are All Talk with a Slow Walk

90% of Canadians say they care about sustainability, but COVID-19 has affected whether we act on these values.

Published on December 2, 2020

At its broadest, sustainability is “development which meets the needs of the present without compromising the ability of future generations to meet their own needs”.

Canadians have by and large been held up as sustainability conscious consumers.

Back in 2017, a report from the Business Development Bank of Canada showed that more Canadians were integrating environmentally responsible practices into their lifestyles—

and they expected companies to do the same.

Whether it’s recyclability, biodegradability, less waste going into landfills… Caddle wanted to test the assumptions that Canadians are environmentally driven. We were also curious as to whether Canadians would keep to their values in the face of pandemic restrictions that make it harder to lead an environmentally conscious lifestyle.

Did you know?

Caddle® is the largest daily and monthly active panel in the Canadian market.

Receive Our Free Weekly Insights Newsletter!And so,

Caddle dug into consumer sentiments and behaviour on sustainable practices and products. Let’s start with

whether Canadians really do consider sustainability in their daily lives.

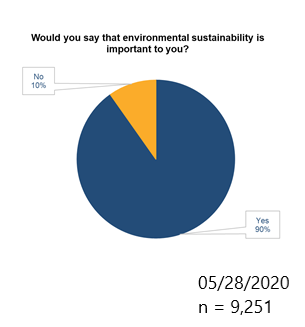

Sustainability is important to the vast majority of Canadians.

Do Canadians Actually Care?

Back in May 2020, the answer was a resounding ‘yes’—across all demographic groups and regions.

Does Consumer Sentiment on Sustainability Actually Influence Behaviour?

While many Canadians raise clear concerns about sustainability practices, their actions don’t always match —especially during COVID-19. Let’s look at how sustainability figures in Canadian consumers’ daily lives.

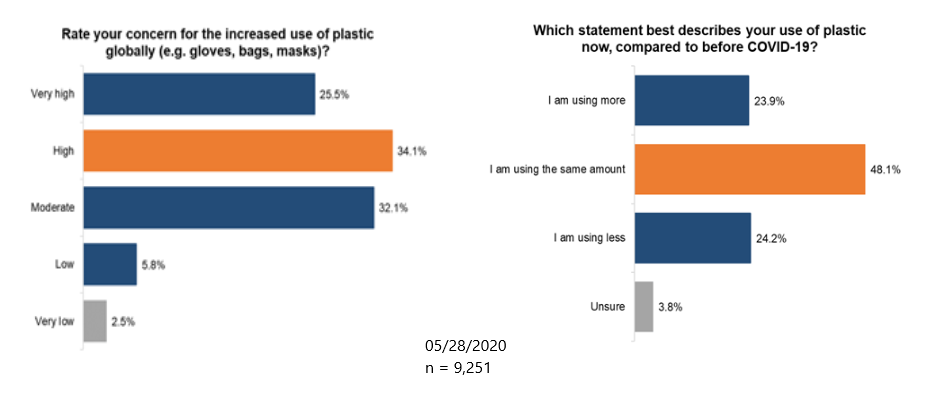

Use of Plastics

While 60% of consumers were concerned about the increased use of plastic during COVID-19 (especially Gen Zers and Millennials),

50% of respondents are using the same amount of plastic compared to pre-pandemic,

and almost

1 in 4 consumers are using more!

(Gen Zers and Millennials over-index at 26.5% and 25.7% respectively).

Curiously,

consumers in British Columbia—the stereotypically eco-conscious—seem to be the least aligned with sustainability efforts. Though B.C. consumers expressed the greatest concern with the global increase in plastic use, they also reported the

highest % of single-use plastic usage since the pandemic began!

In contrast, Maritimers—who draw tourism dollars for its scenic landscapes like the West Coast—walk the sustainability talk a bit more, over-indexing on lower plastic use in general.

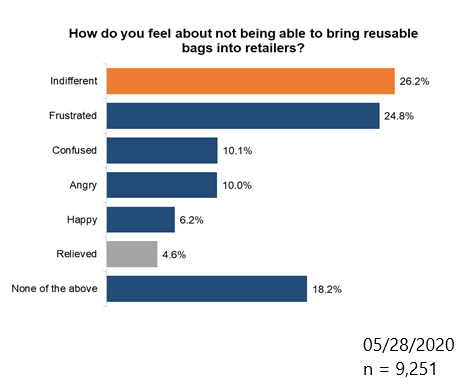

Use of Plastics in Shopping

Most consumers are either “frustrated” or “indifferent”

about not being able to make use of reusable shopping bags in-store.

Who’s Most Frustrated of All?

Millennials (26%), though they’re also among the most indifferent consumers, tied with Gen Zers (at 28.2% and 28.5% respectively) and outflanking older generations for “indifference” by at least 3 points.

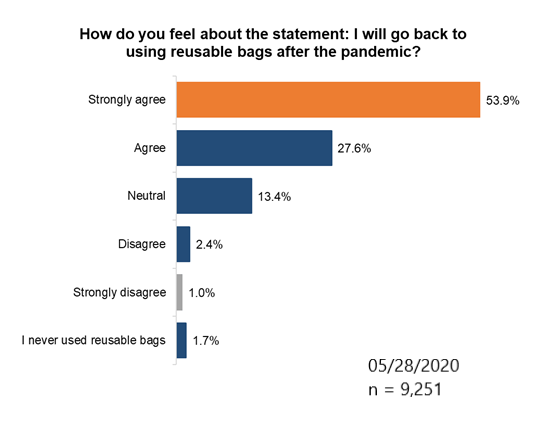

Meanwhile,

more than 50% of all consumers "strongly agree”

they’ll go back to shopping with reusable bags after the pandemic.

Who is least likely to go back to reusable bag use?

Gen Z! If you guessed the youngest generation, you’re right.

Sustainable Packaging

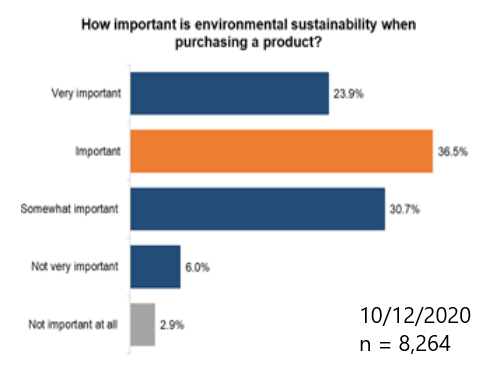

About 1 in 4 of all consumers find environmental sustainability “very important” when purchasing a product; this holds true across all demographic and geographic groups.

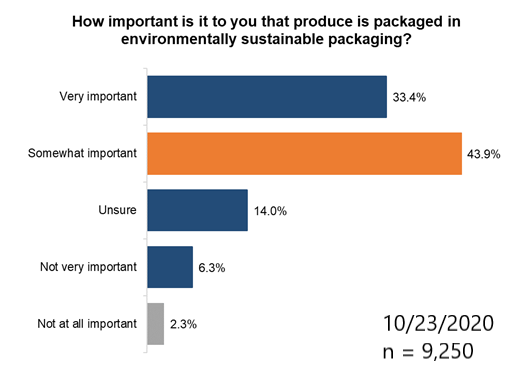

Consumers are especially interested in environmentally sustainable packaging for produce purchases. 80% of consumers suggest it’s “somewhat important”/“very important.”

In fact,

more than 40% of consumers are willing to pay up to 5% more for produce that is packaged sustainably,

though more so among older generations. Consistent with earlier findings, this suggests older consumers either have more dollars to spend on sustainable products OR have greater intent to do so.

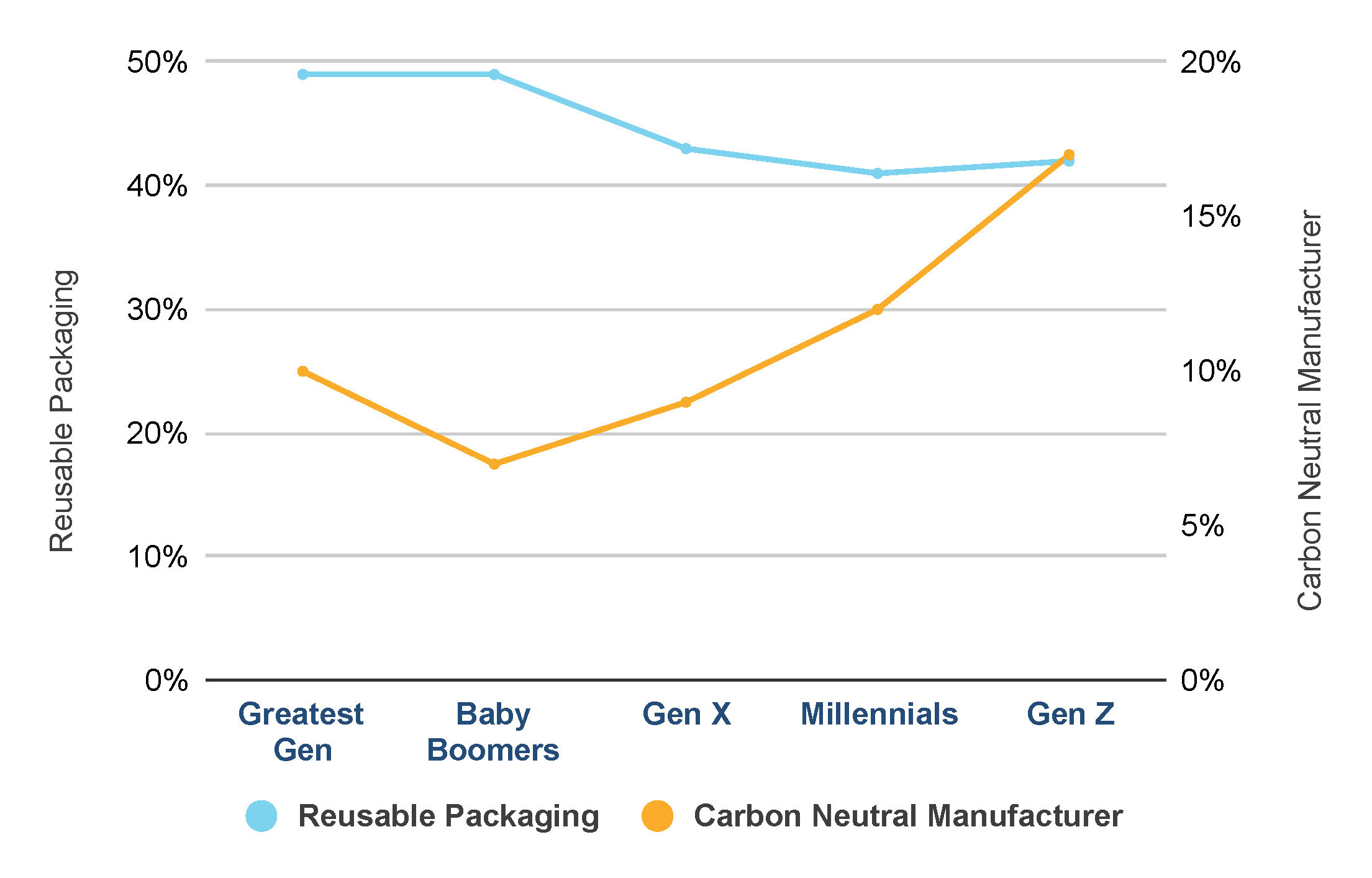

Reusable packaging is the strongest influence in purchasing a new product—

though the younger the consumer, the less they seemed to value reusable packaging.

Is this further indication that Canada’s youngest generations place more emphasis on other elements of sustainable consumption?

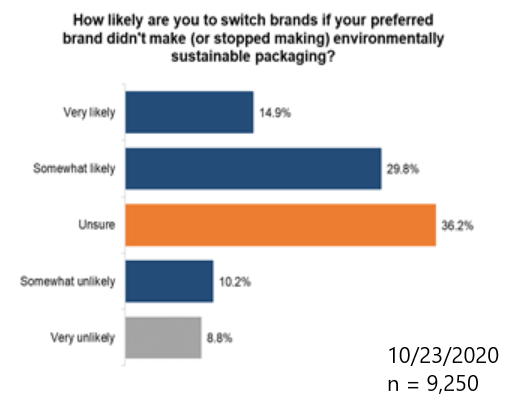

Finally, 40%

of Canadian consumers are likely to switch brands

if their preferred company didn’t make environmentally sustainable packaging. Note* packaging is a relevant concern for eco-conscious consumers.

KEY TAKEAWAYS

1. Canadian Consumers Care About the Type of Packaging that Manufacturers Use.

Canadian consumers don’t just think sustainable packaging is more important; many consumers (particularly older generations) would pay more

for sustainably packaged products and they’d ditch their preferred brands if they aren’t offered in environmentally sustainable materials.

The opportunity is ripe for retailers to increase share of wallet

by expanding their assortment of products that are packaged using sustainable and/or reusable materials.

And for retailers with white-label assortment: adapting packaging now to more sustainable options isn’t just a good environmental choice;

it may help you to better compete with global brands, too.

2. Younger Consumers Think About Sustainability Differently.

We’ve heard talk for years (and have copious evidence to back it up!) about how

Gen Zers and Millennials are leading the charge on environmental issues. Yet,

our results indicate that many of the measures we typically associate with “capital-S Sustainability” just don’t seem to mean as much to Canada’s younger consumers.

The fact of the matter is,

if you’re truly going to understand the thinking and behaviour of any demographic—whether Gen Z or the Greatest Generation or anyone in between

—you need plenty of good, reliable data.

And so, it’s incumbent on retailers and manufacturers to continue to work with partners like Caddle to gather as much broad-spectrum data as possible, if they’re going to really

get into the heads, hearts and wallets of these up-and-coming change-makers.

3. COVID-19 is Affecting Canadians in Surprising Ways

Perhaps it’s just the malaise we’re all feeling from the seemingly never-ending restrictions and changes to life as we know it. And you’d think with lockdowns and restricted comings-and-goings, people would be using less plastic—especially if they eschewed single-use plastics pre-pandemic.

But,

up to 25% of Canadian respondents report using more single-use plastics now than before the pandemic struck.

This signals to us that

the pandemic will continue to throw some surprising curveballs at retailers and product manufacturers

in the coming months. To manage, retailers should maintain a holistic assortment of products and services. That way, regardless of inconsistencies that may occur between sentiment and behaviour, they’re still catering to as wide a population as possible at any given time.

Looking to know more about consumers and their views, intentions and habits towards plastics and sustainability? Contact us today.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Contact Us

Gen Z Joins Shopping Mall-Walking Trend as Exercise This Winter!

Published on November 20, 2020

With pandemic closures expected to continue into the holiday season and possible COVID-19 spikes, are shopping malls the fitness solution we’re all in need of?

So, are consumers using shopping malls for mall-walking to stay fit?

We asked over 8500 Canadians

last week and almost half of all respondents are worried about sticking to their fitness routines this winter. For Canadians who visit malls,

47% are interested in visiting a shopping mall for exercise during the winter. Surprisingly, Gen Z are the most interested

in visiting a shopping mall to exercise during the winter.

Are Gen Z the new generation of “mall-walkers”?

Are walk/run lanes at shopping malls a hot thing this winter?

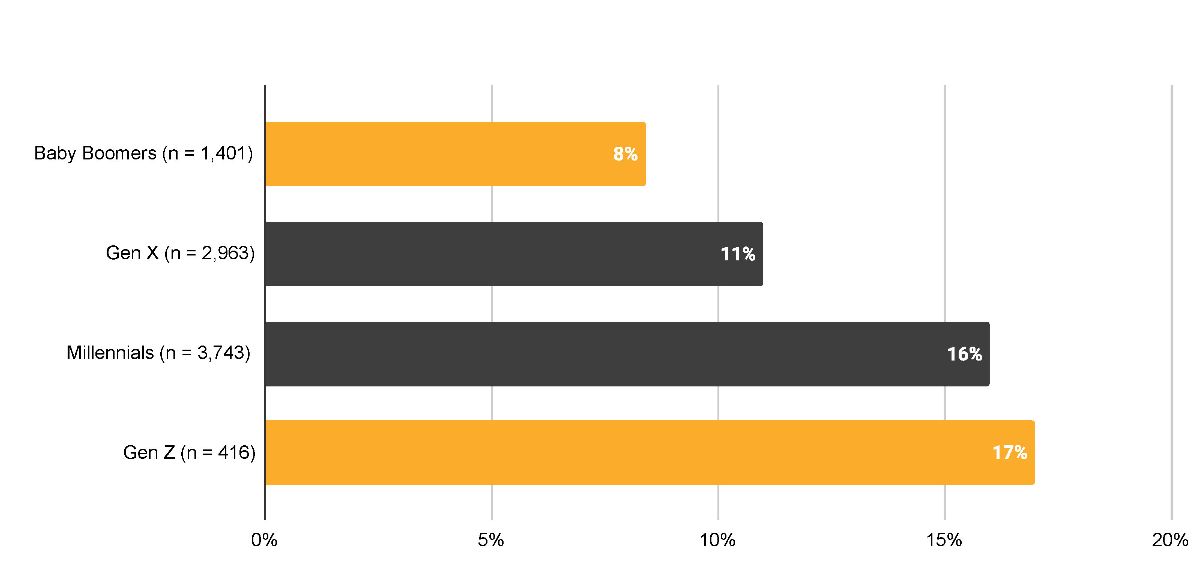

Gen Z are Twice as Worried About Exercise

n = 8,577 | November 15, 2020

Gen Z over-index more than 2X when compared to Baby Boomers and say they are

“extremely worried”.

As a result,

many are looking to shopping malls as their physical activity of choice in order to get their daily steps in.

Again, of the consumers that visit malls often or sometimes,

Gen Z are 2X as interested in a run/walk lane at their local shopping mall when compared to Baby Boomers!

Caddle is the largest mobile provider of Canadians insights with 10,000+ daily active panel members. Our data is used by research firms including Nielsen, Environics, & major CPG/retailers like P&G, Coca Cola, Nestle, Walmart, Canopy and many more.

Sign-Up for Caddle’s Weekly Insights Report and never miss a beat on the newest Canadian consumer insights!

2020 U.S. Election Would Have Different Results in Canada

see how the 2020 U.S. election would have panned out if Canada was voting

Published on November 16, 2020

How closely did you follow the 2020 U.S. election? This is a question we wanted to know at Caddle… and we found the answers!

As Canadians, our close ties with the U.S. cannot be disregarded. As such, here at Caddle, we want to know not only how many Canadians were following the election, but WHY.

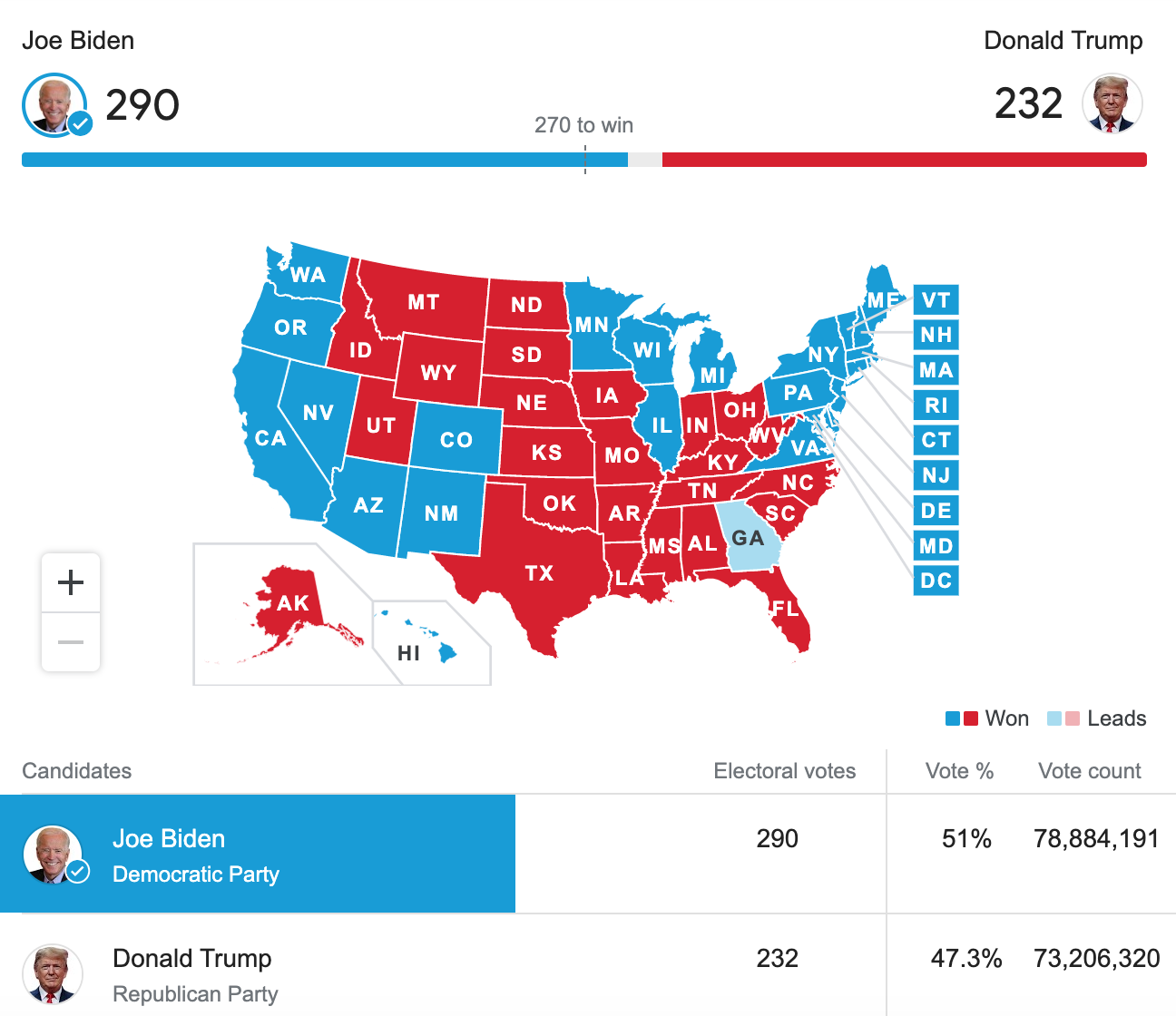

2020 U.S. Election Results

After the announcement of Joe Biden winning the 2020 U.S. presidential election, Caddle put together a Rapid Response survey to our 10,000+ daily member panel to find out what Canadians think about the 2020 U.S. election.

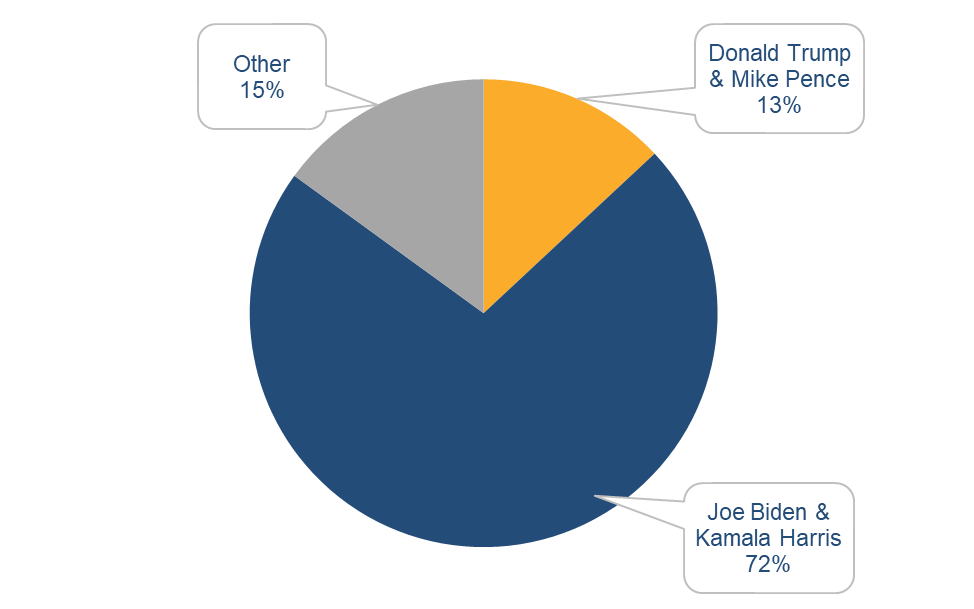

Over 70% of Canadians Would Vote Joe Biden & Kamala Harris

Which U.S. presidential candidate would you have voted for?

Baby Boomers are the most in favour for Joe Biden when you look across generation cohorts, while Generation Z is most in favour of Donald Trump when compared to other generation groups.

Are you surprised by these results?

With the presidential elect decided, we also want to know consumers’ opinions on Canada & U.S. relations.

How dependent do you believe Canada should be on the U.S.?

What is your top concern in regards to Canada-U.S. relations over the next 4 years?

Get in touch below and we will send you Caddle’s full report on how Canadians really feel about the 2020 U.S. election.

Canadian Millennials vs. Boomers & COVID-19 Habits

The Great Divide | One Country, Multiple Cohorts

Published on November 9, 2020

At Caddle, we’ve been collecting consumer insights on Canadian grocery retailers since the pandemic began. Why? To help brands and agencies understand COVID-19 & the Canadian Consumer. As a result, we’ve turned those insights into a short report as we head into the busiest retail season of the year!

Ransom Hawley

CEO at Caddle

Get the Report!“Now, as we stare down a second wave of COVID-19, and with learnings gathered from living through more than half a year of pandemic-driven ups and downs, we at Caddle know that consumer insights have never been more important.”

COVID-19: 5 Tips for Canadian Grocery Retailers in Q4 & the New Year

1. Don’t rely on old data

2. Don’t assume non-Canadian data is a “good enough” indicator of Canadian shopping preferences

3. Do talk to your audience throughout the purchase cycle

4. Do measure how you stack up against your competitors

5. Do invest in improving your omnichannel customer experience

So, the ongoing effects of COVID-19 on the Canadian retail sector is in for more tumultuous times – in December and most likely into 2021. As a result, brands need relevant and recent consumer data from a reputable source—and plan your holiday ramp-up accordingly.

So, What’s Inside?

- COVID-19 | The pandemic has brought Canadians together but has also driven them apart

- Retail is Failing | What consumers want vs. what they’re getting

- Millennials vs. Baby Boomers | How generations differ in grocery shopping habits & what that means for brands and retailers

- and more!

Sneak Peek

Grocery Retailers: Who is Winning & Who is Falling Behind?

Do any of these rankings surprise you? Want to know how Caddle can accelerate time to insight for you and your brand? Get in touch!

Full Insights Here: The Great Divide

Why you need to think about DIY in product innovation

When it comes to product innovation, people have always been interested in creating and developing products themselves. If you are a brand manager who is searching for a new market trend or product opportunity, look no further. According to technavio, the value of the DIY industry is estimated to climb to 13.1 billion by 2021. This is definitely not something you can just shrug your shoulders at! You should be extremely interested in leveraging and building DIY into your business strategy and I’m going to tell you the reasons why.

Do-it-yourself (DIY): The Research

In order for us to extract the most valuable insights and perspectives, we have to ask ourselves some stimulating questions. Why do consumers participate in DIY? What kind of DIY projects are they creating and consuming? Where do people get information about DIY? Considering these questions, we were able to propose the following hypothesis:

Consumers are shifting their focus from ready-made products and alternatively, they are creating/customizing their own.

Do-it-yourself (DIY): Survey Analysis

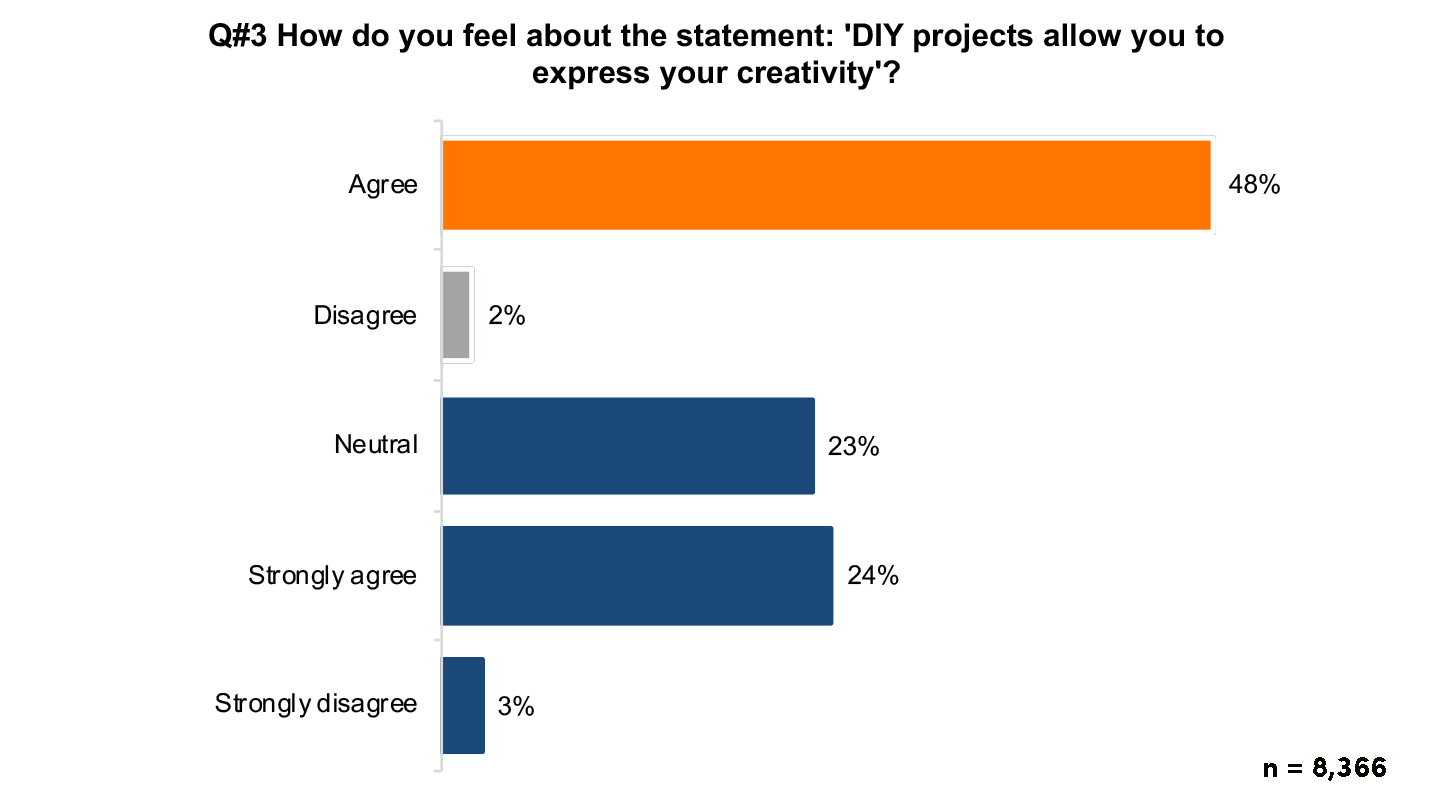

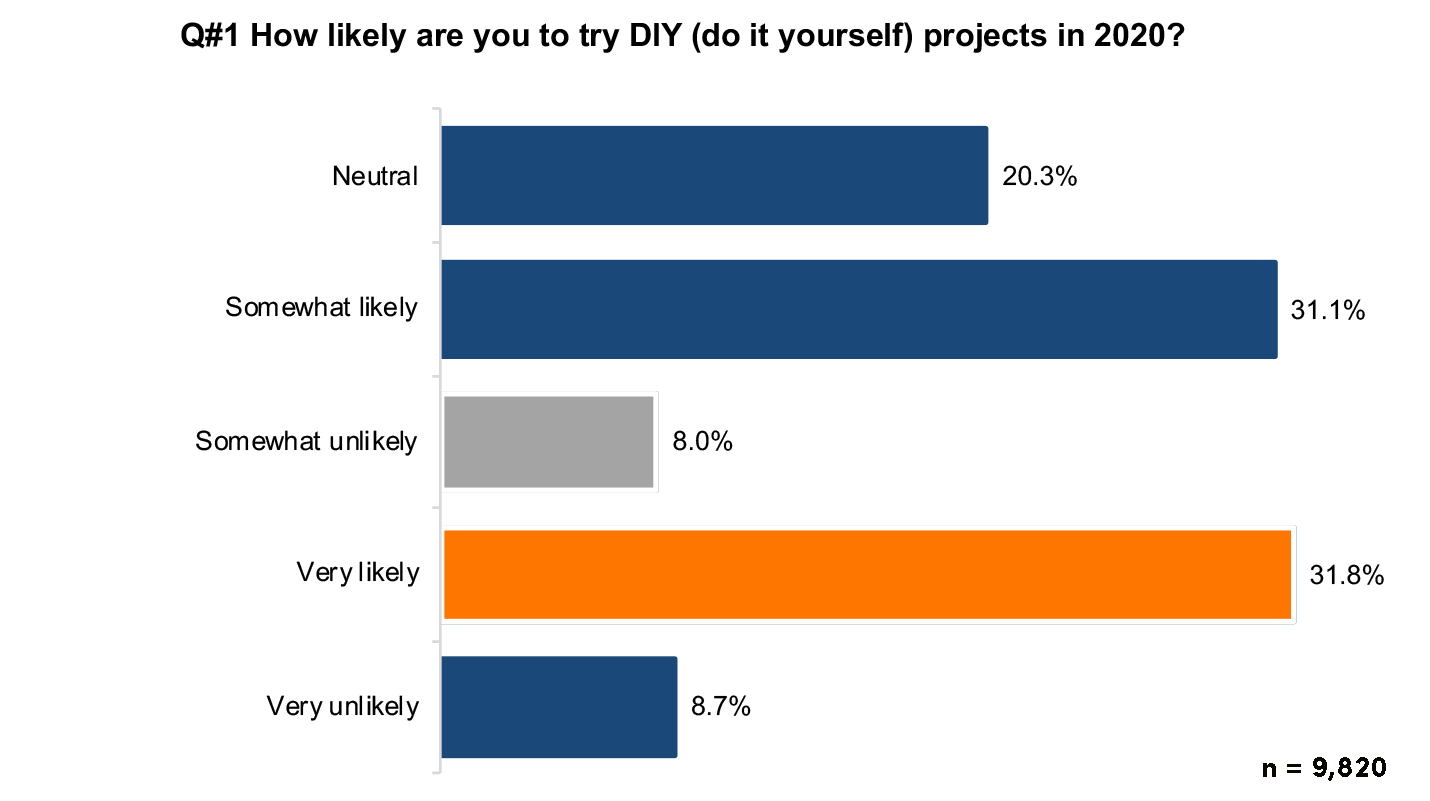

The survey results are outstanding. We did not expect to have so many DIY advocates using our program. Here are some of the high impact results that we obtained during our research. As you are reading, please keep the following details in mind:

- Respondents are predominately females – 80%

- Millennials and Gen X account for the majority of the responses – 81%

- Approximately 40% of respondents are located inside Ontario

Almost 50% of our members indicated that DIY projects allow them to express their creativity. This is an interesting finding on two levels.

First, you can empower your customers by providing them with access to DIY resources,

Second, by embracing DIY, your customers will feel a stronger connection to your brand.

Our members are going into 2020 feeling empowered to create products on their own terms! When it comes to DIY projects, people will often use platforms such as: Google, YouTube and Pinterest in order to watch and consume instructional content for product development.

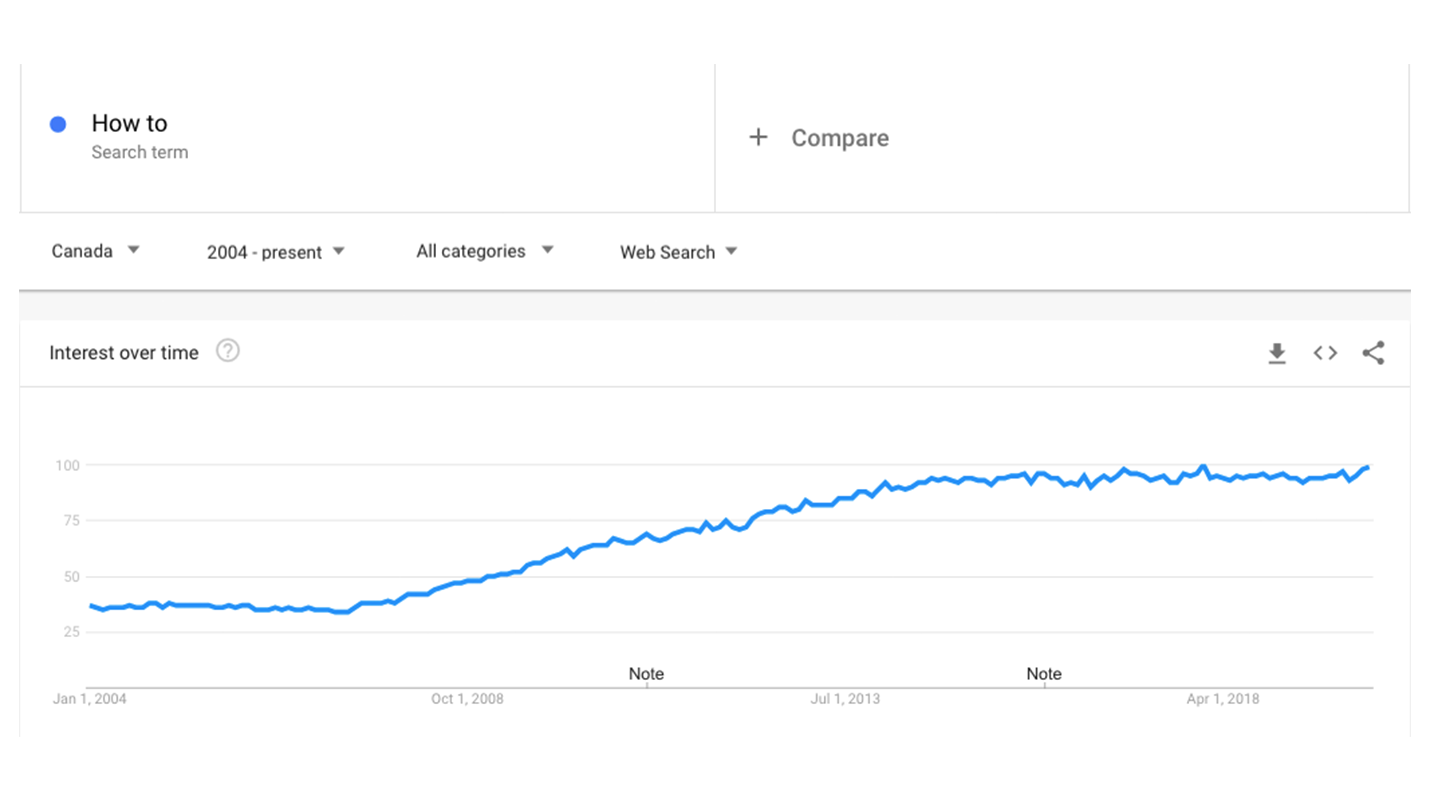

For example, the graph provided below is the number of times someone has entered the key phrase “how to” into Google search, a common phrase that indicates someones intention to complete a task independently. As a brand manager, you want to communicate with your digital team and offer “tutorial” style videos to your consumers to encourage DIY using your products. This graph reinforces that DIY is not temporary, but for the last 15 years has experienced steady increases.

Do-it-yourself (DIY): DIY Trends

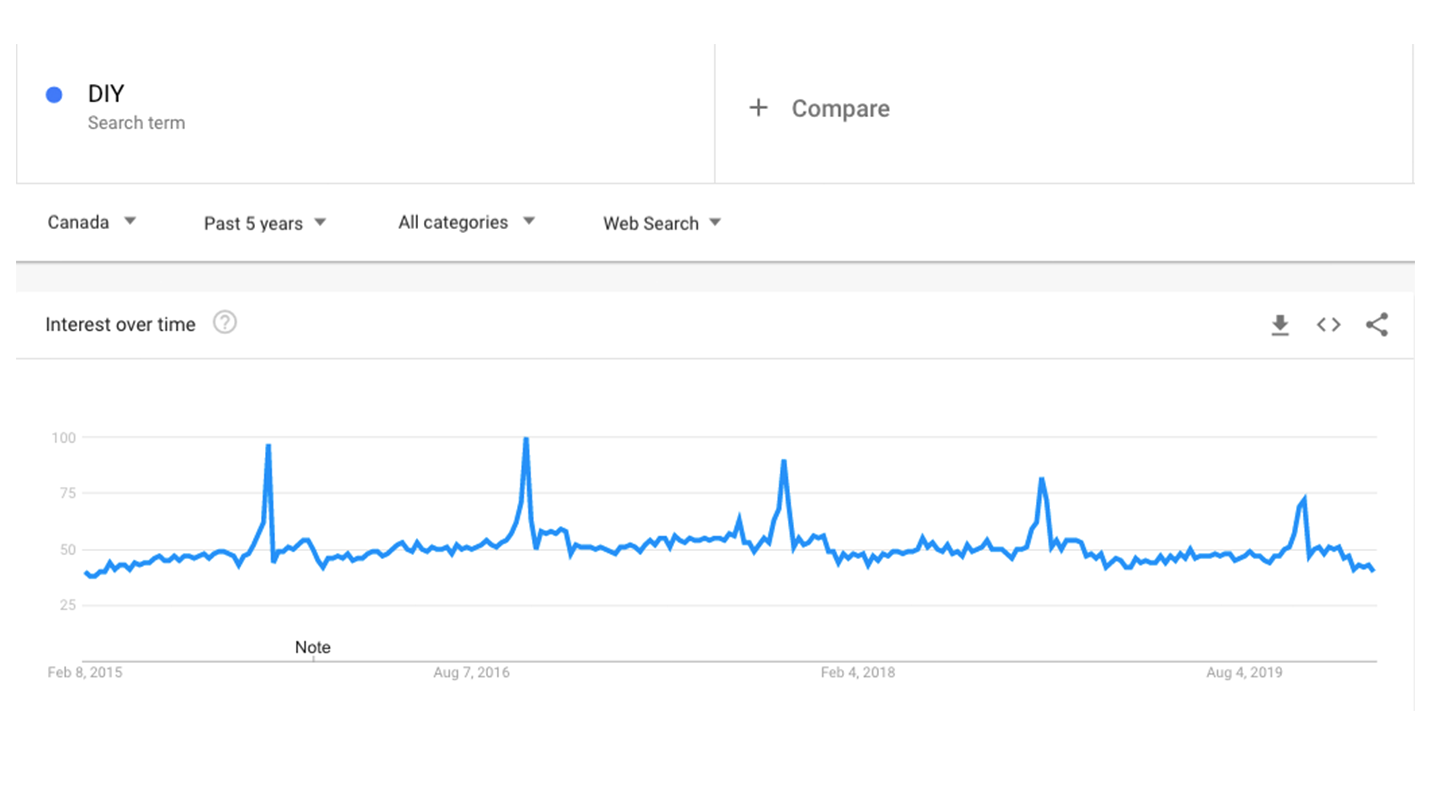

We decided to consult Google trends in order to identify correlations between our findings and the general search history online. We were able to find a consistent pattern in the DIY environment.

Based on the graph below it is evident that DIY search results peak in October for five consecutive years. When we asked out members on Caddle “what time of year do you prefer to create DIY projects?” we found that 45% said summer and fall. That being said, there are definitely some promising opportunities presenting themselves during Halloween.

If you are anything like us, you want to keep digging. Ask questions like, how can we increase DIY participation in the off season? Or, how does the DIY environment change based on time of year and are there any accessibility issues that may help bridge this gap?

Do-it-yourself (DIY): The DIY Difference

So why are people all about DIY?

Not only does DIY fulfill your need for a basic product or service, but it really provides the participant with a unique and intimate product experience. The ability to work within a strong DIY community is empowering – it requires you to challenge yourself both physically and intellectually.

As we identified in our surveys, DIY allows people to express their inner creativity. If you are able to provide customers with the ability to customize their products and have a stake in the process, you can begin to capitalize on this growing industry.

Do-it-yourself (DIY): Business Opportunities

Whether you are a business looking to tap into this market or someone who is trying to build a person brand and showcase your skills online, the following information will be extremely relevant. Consider the following tips.

Have a strong social media presence

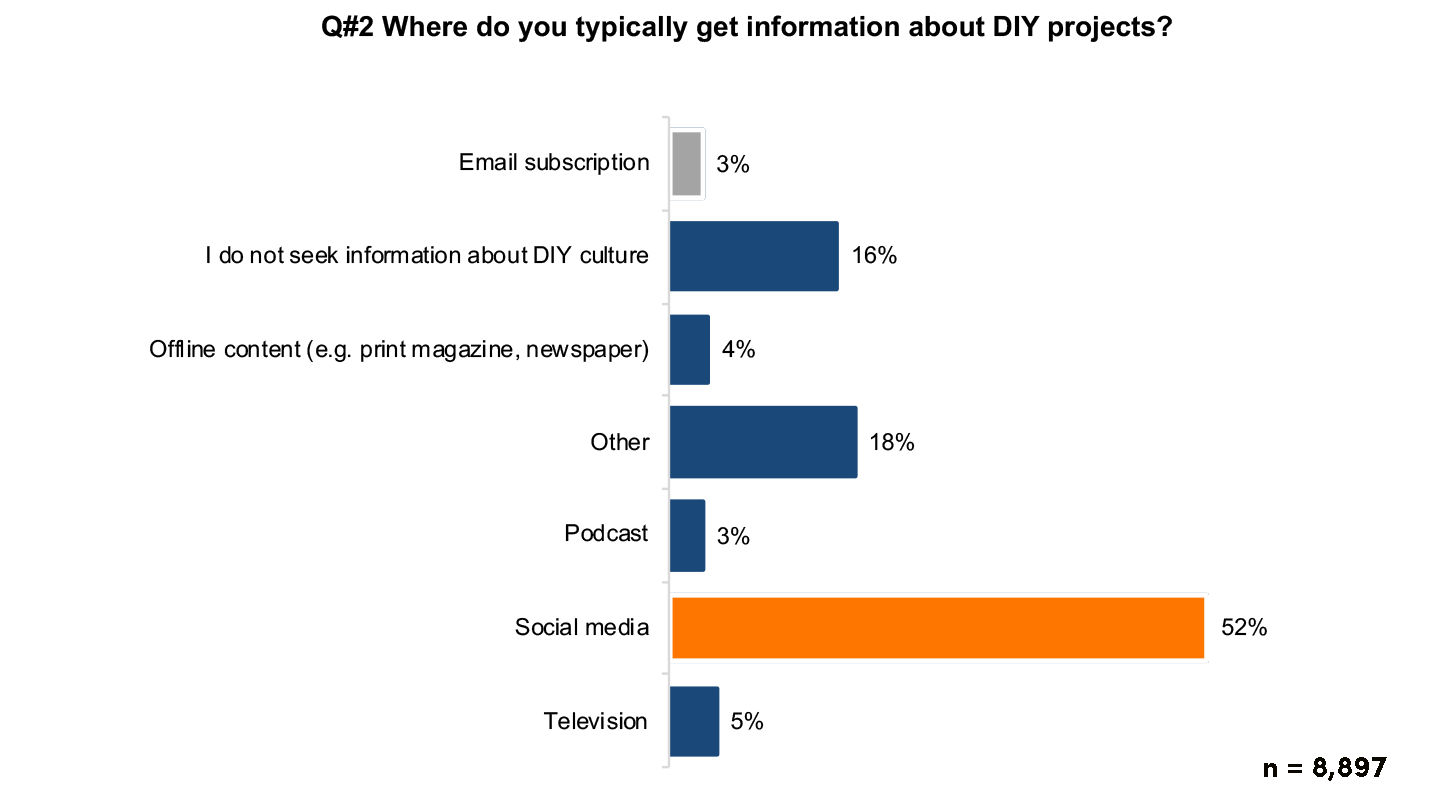

Just being online doesn’t cut it anymore, there is a lot of noise in the DIY community. The DIY business model has become reliant upon video and image based applications (Pinterest, Instagram and YouTube). In order to truly showcase the importance of social media in DIY we asked our members the following question, “where do you typically get information about DIY?”

The response was 52% of our members are using social media to get information about DIY. If you are a digital manager this is right in your wheelhouse. Take this opportunity to make your presence known by leveraging all of the available platforms and create content that is both informative and aesthetically pleasing.

Our advice to you…start building your brand on Pinterest! A whopping 32% of respondents said they get their insights from Pinterest, prior to browsing other platforms. If you are having trouble building this content from scratch, browse social media influencers to get a good idea of the do’s and don’ts.

Buying DIY

So get this, DIY supporters are creating their own products, but they also express interest in buying other peoples projects. 40% of our survey respondents indicated that they are interested in purchasing other peoples DIY offerings.

This type of purchase is far more complex and unique that than the traditional shopping experience. DIY products offer more transparency, sellers are often inspired to showcase their personality, their story and their development process. In a digital age people are basically begging to feel a personal connection between the brands they are purchasing from. Obviously they need to see value in the product, but ultimately customers will choose to connect with brands that embody their values over others.

Supporting Sustainability

There are many different reasons why people participate in DIY and evidently environmental sustainability seems to have the biggest impact. Why is this? Well, DIY advocates pride themselves on their ability to not let anything go to waste!

NBC states that that search requests for sustainability on Pinterest are up 108% since 2018! Traditional manufacturing and mass production is messy and it often leads to excess amounts of waste and environmental damage. A Neilson study indicates that 42% of North Americans are willing to pay more for companies that champion sustainability and social responsibility.

Based on our findings we don’t see this trend to becoming to a halt anytime soon. Consumers, more than ever, are advocating for more transparency amongst brands and they are willing to abandon long time loyalty for better values. Companies and D2C brands that embody this mantra will have better success with the DIY demographic. If you need more evidence of these changes, feel free to check out of blog on plastic and sustainability.

More about us

Thanks for taking the time to read our blog post. If you want to get your hands on some more data just shoot us a message, we are happy to help. If this is your first time on our webpage, you might be wondering what we do.

Caddle is a data insights company that has a passion for understanding market trends. We collect, sort and analyze data in order to provide businesses with the upper hand against their competitors. You can certainly never know too much about your consumers.

We pride ourselves on having our finger on the pulse of Canadians and our 300,000 monthly user base helps do some of the talking. What are you waiting for, let’s work together!