COVID-19 Insights: Ongoing Health and Safety Concerns Will Drive More Travel Dollars to Domestic Vendors in 2020 and Beyond

With many travel itineraries waylaid by COVID, 70%+ of consumers plan to stick closer to home for their vacation fix

Have your 2020 travel plans been busted? Ours too. Gone are the days when we could simply hop online, book an all-inclusive package and whisk ourselves away to paradise for a week… at least for the time-being.

Our survey results show that the COVID pandemic and its ongoing effects on consumer health, wealth and personal lives will have significant repercussions on travel plans for many Canadians: More than half of consumers report they won’t be travelling anytime in 2020—even once non-essential travel becomes available—and 60% are unlikely to vacation somewhere warm this winter.

Given these results, we were curious to understand whether the funds earmarked for international travel in 2020 and beyond will be diverted to destinations closer to home. And, true to our reputation both here and on the world stage, Canadians seem to take pride in their local environs, and more than 70% would prefer visiting domestic destinations (including cottages and campgrounds, RVs and road trips) over international travel in the balance of the year.

Let’s dive into the responses from the past month to learn more.

Get insights into Canadian consumer habits, straight to your inbox. Subscribe to receive our free, weekly summaries now!

WHAT’S HAPPENED TO CANADIANS’ TRAVEL PLANS?

More than three-quarters of Caddle’s 9,000-strong user panel have not arranged any summer travel plans—particularly the eldest respondents, including Baby Boomers, at 82%.

In fact, over half of respondents indicated that they won’t take non-essential trips by plane in the balance of the year, even once travel becomes more available to them. (Gen Zers are slightly more amenable, almost 15% of whom indicating they’ll travel as soon as possible. At the same time, respondents in the Maritimes seem especially reticent to fly, especially 65% of Newfoundlander respondents.)

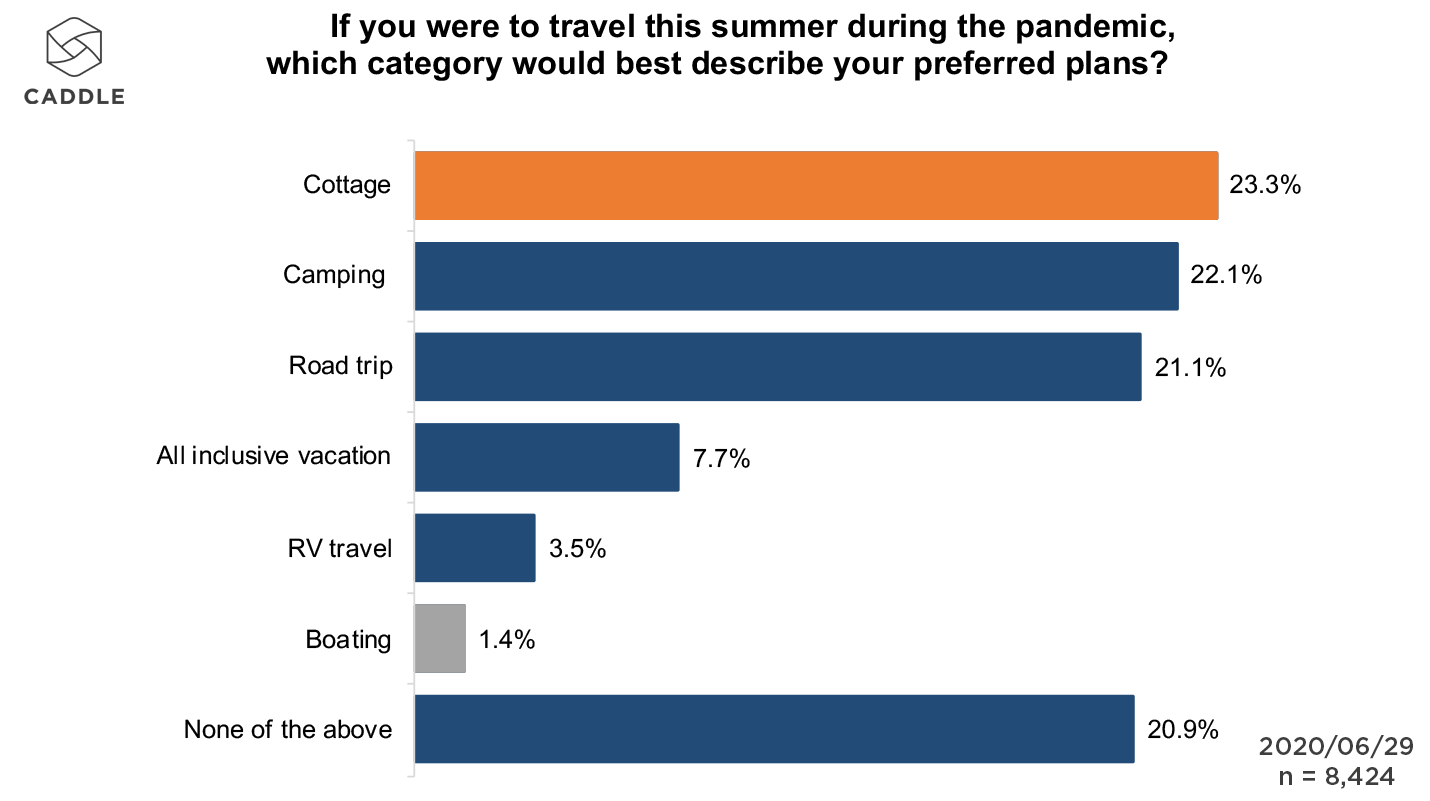

If they were to travel this summer, respondents again overwhelmingly favour domestic excursions over international destinations. Among Caddle’s general population, road trips as well as local destinations like cottages and campgrounds ranked equally well, at just under a quarter of respondents each.

However, it’s interesting to note that these preferences fluctuate by region, which may be indicative of differential access to accommodations and/or local destinations. So, while Albertan respondents prefer camping and road trips (at about 27% each) and Manitobans prioritize camping and cottaging (31% and 23%, respectively), Ontarians prefer cottaging 2x more than camping and road trips and British Columbians and Saskatchewanians rank camping at 2x the rate of cottaging.

WHAT ARE SOME OF THE FACTORS CONCERNING CANADIANS MOST ABOUT TRAVEL THESE DAYS?

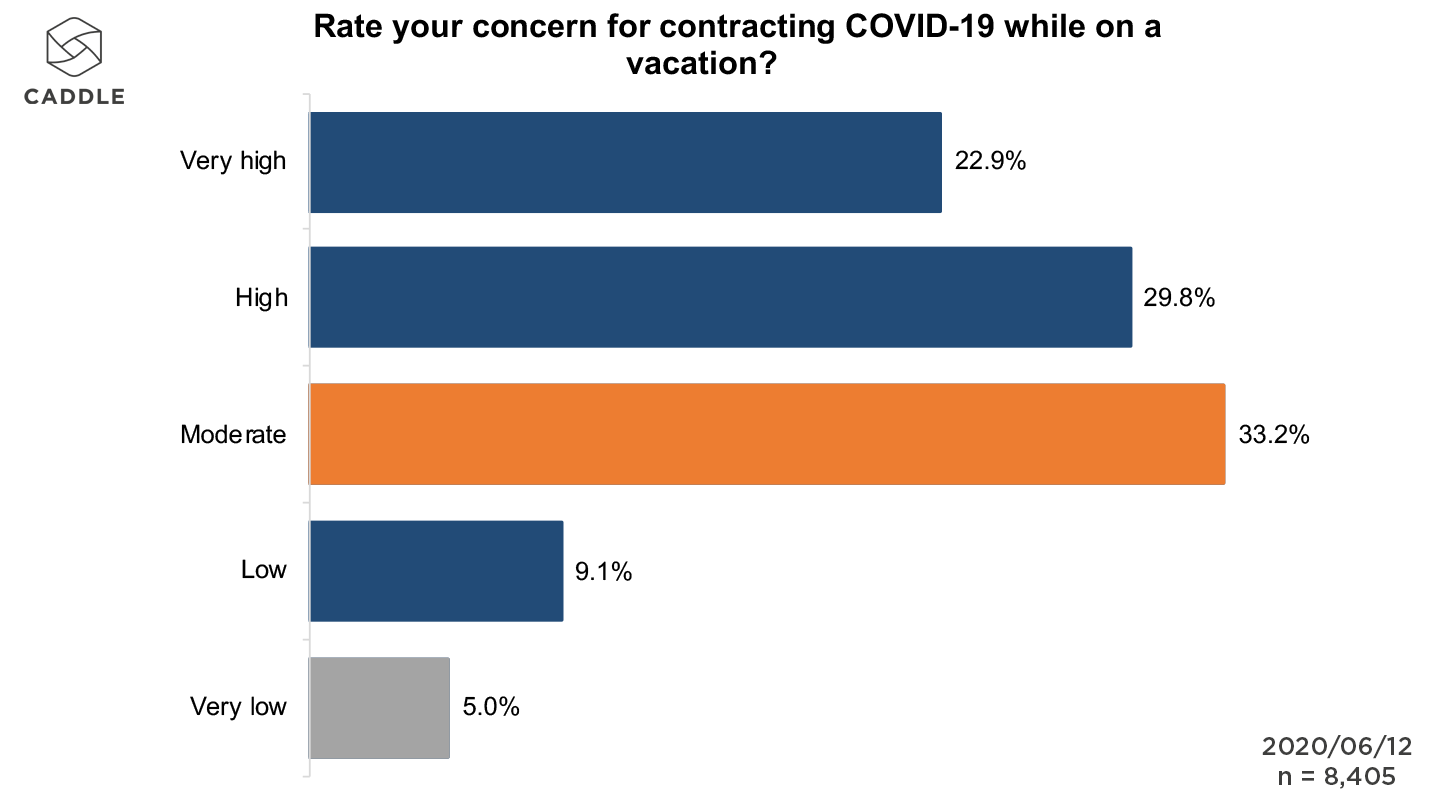

On the one hand, respondents are overwhelmingly concerned about contracting COVID-19 while on vacation.

This is consistent across all generations, though the eldest respondents (including those among the Greatest Generation, Baby Boomers and Gen X) over-indexed on “high”/”very high” concerns. This is perhaps most understandable given senior populations’ increased susceptibility to the virus.

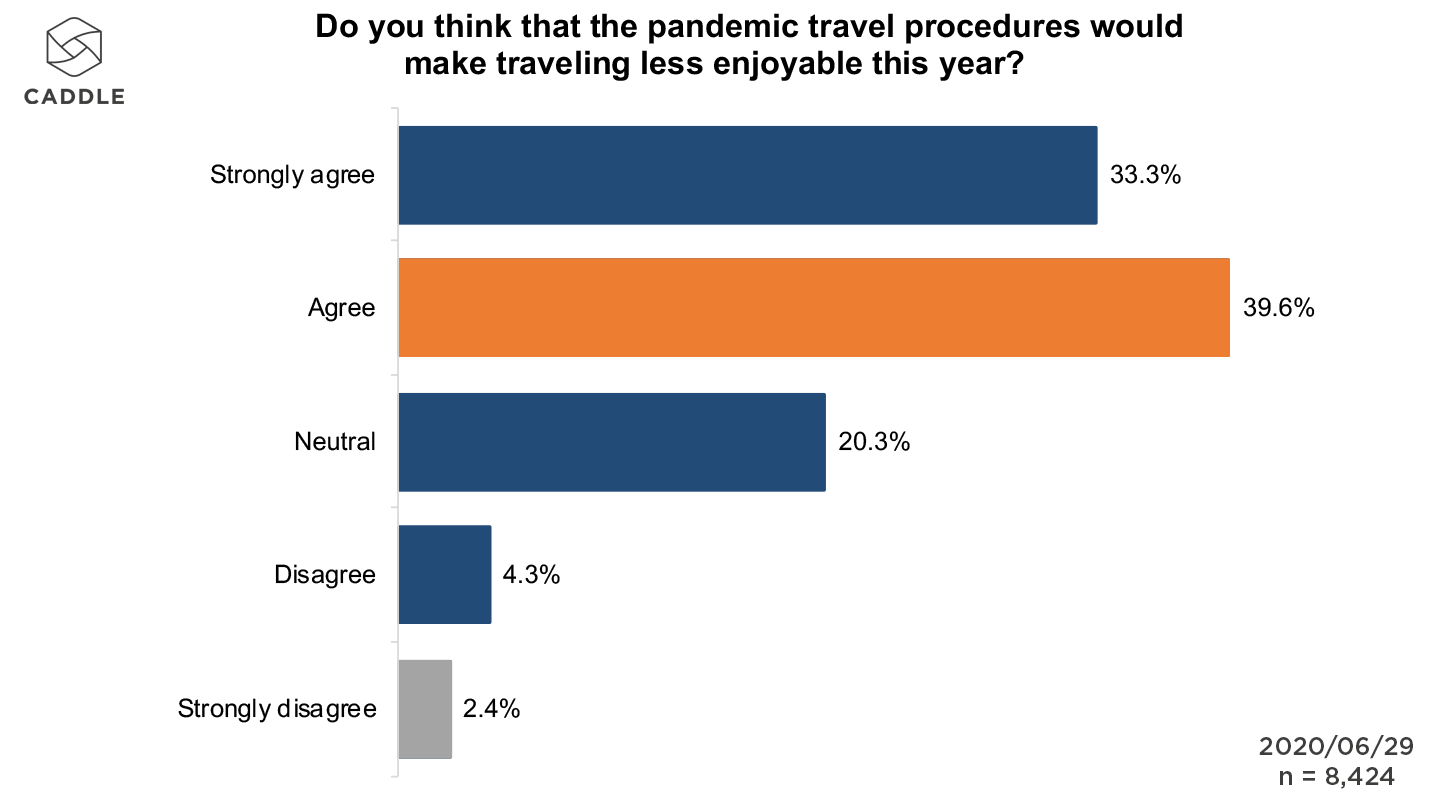

Caddle users also overwhelmingly agree that health and safety procedures introduced due to the pandemic would make travel less enjoyable this year, especially Baby Boomers (75%), Gen Xers, Gen Zers and Millennials (72% each) and the Greatest Generation (70%).

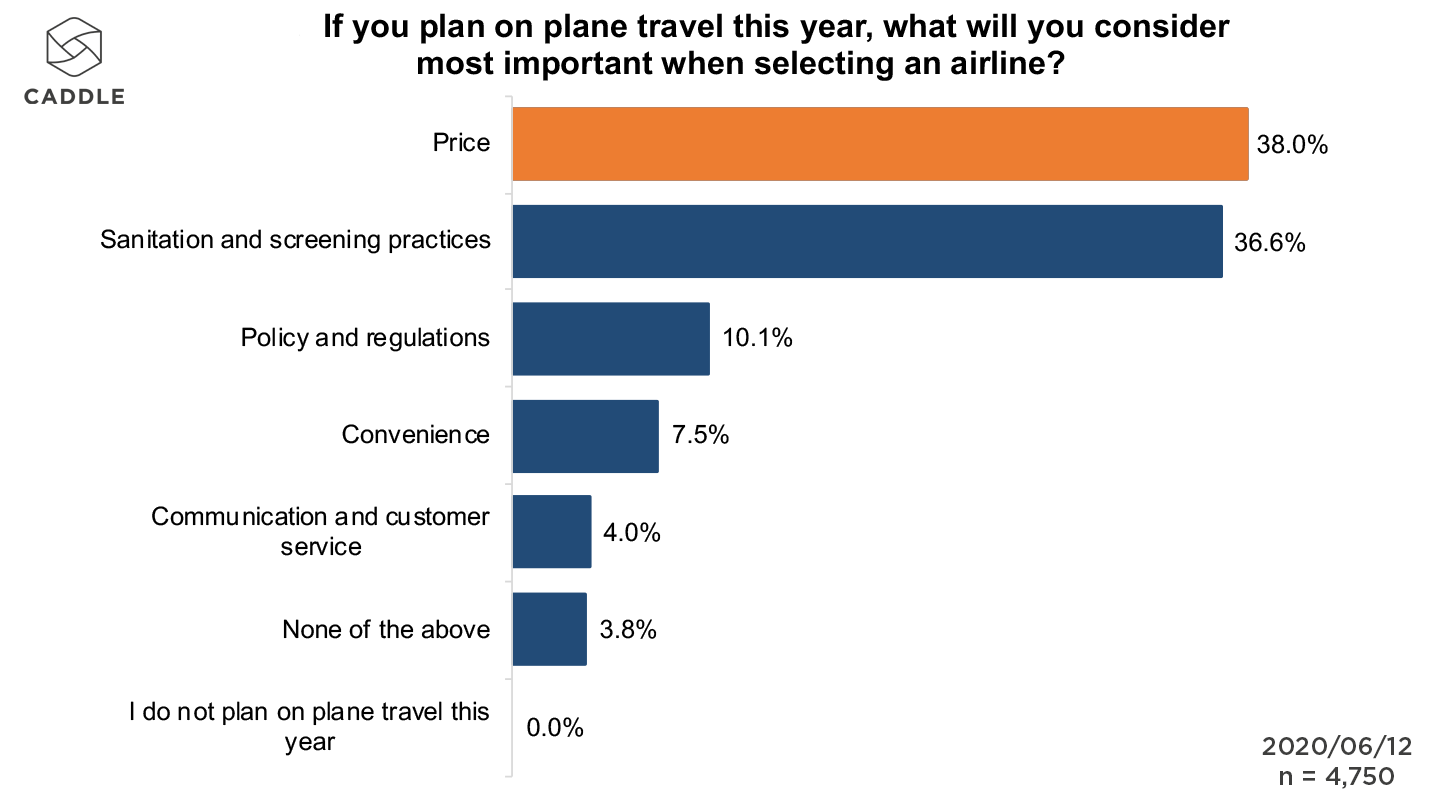

Finally, among those who plan to travel by plane in the second half of 2020, price and sanitation/screening practices rank equally high among their considerations, at 37–9% each.

From a regional perspective, Albertans, Quebeckers, Newfoundlanders and Labradorians prioritize price, while Saskatchewanians value sanitation and screening practices more highly.

Taken together, these consumer insights suggest that the international travel industry will continue to have a tough hill to climb to win back Canadian vacationers in the months and possibly years to come.

KEY TAKEAWAYS

CANADIANS ARE WILLING TO “THINK LOCAL” WITH THEIR TRAVEL PLANNING

From campsites to cottages to RVs to Airbnbs, Canadians seem to be shifting allegiances from international travel destinations to ones closer to home.

When you combine respondents’ health and safety concerns with the very real threat of contracting COVID-19 through plane travel, we expect that this trend will have positive implications for the restaurant and hotel industries, tourist attractions, campgrounds and equipment vendors, among many other suppliers across Canada.

HEALTH AND SAFETY ARE TOP CONCERNS FOR TRAVELLERS (BUT SO IS PRICE)

With the pandemic continuing to rage south of the border, it’s no wonder that Canadians are increasingly afraid of contracting the virus. Such concerns are likely to persist through the latter half of 2020 and, no doubt, until a viable vaccine is made available in the coming years.

As such—and even as provincial restrictions continue to ease—it’ll be important for travel and tourist suppliers to keep health and safety standards top-of-mind among their grassroots-level employees, both to keep the chance of contracting COVID at bay but also in order to alleviate potential customers’ concerns.

At the same time, because the pandemic has put a major strain on Canadian populations (particularly when it comes to financial concerns), hotel, airline and travel brands should equally prioritize pricing and value if they’re going to attract those Canadians who are willing to take a vacation in the coming months.

GEN ZERS MAY BE THE LOWEST-HANGING FRUIT FOR CANADIAN TRAVEL AND TOURISM SUPPLIERS

In tandem with their relatively more active pandemic lifestyles and interest in healthier eating, Gen Zers are also more likely than other generations to take non-essential trips by plane in the coming months. This makes them a ripe target for travel and tourism suppliers, especially as restrictions ease and favourite restaurants, attractions and other haunts become more accessible to them.

If you’re looking to win Gen Zers’ travel budgets, remember that they tend to be among the least brand-loyal of Caddle respondents and will switch to cheaper offerings as a way to save money. Thus, a focus on health and wellness at a discount is likely to win a greater share of this population’s spend than sticking to tried-and-true brand messaging.

COVID-19 Insights: Brand-Loyal Alcohol Consumers Ditch Diet Concerns in Favour of Flavour

51% of alcohol consumers never check the nutritional label on alcoholic beverages

Celebrating national holidays looks and feels quite different in 2020 than in years’ past. With many Canadian cities easing quarantine restrictions and hot weather driving more people out of doors, we were interested in understanding whether alcohol consumption patterns had changed in any discernible way over the last four months of lock-down, and what implications that might have on post-pandemic consumption habits.

We learned that, while staying six feet apart and wearing maple leaf–emblazoned face masks in public may have cut into many people’s fun-making this past holiday week, some things haven’t changed: Canadians know what they’re looking for in their alcoholic beverages of choice—with 51% of Caddle users prioritizing taste over nutritional content and 76% staying true to their preferred brands.

As more public spaces open up in the months ahead, we’ll continue to monitor Canadian consumers’ celebratory habits, including their consumption of alcoholic beverages during the hazy days of summertime and beyond. But it’s safe to say, the majority of Canadian respondents enjoy a tipple from time to time, and the stresses inflicted on people due to the pandemic have only served to reinforce that behaviour for about one in five respondents.

Stay in the know on Canadian consumer habits! Sign up to receive our free, weekly summaries.

ARE CANADIANS DRINKING MORE DURING THE PANDEMIC?

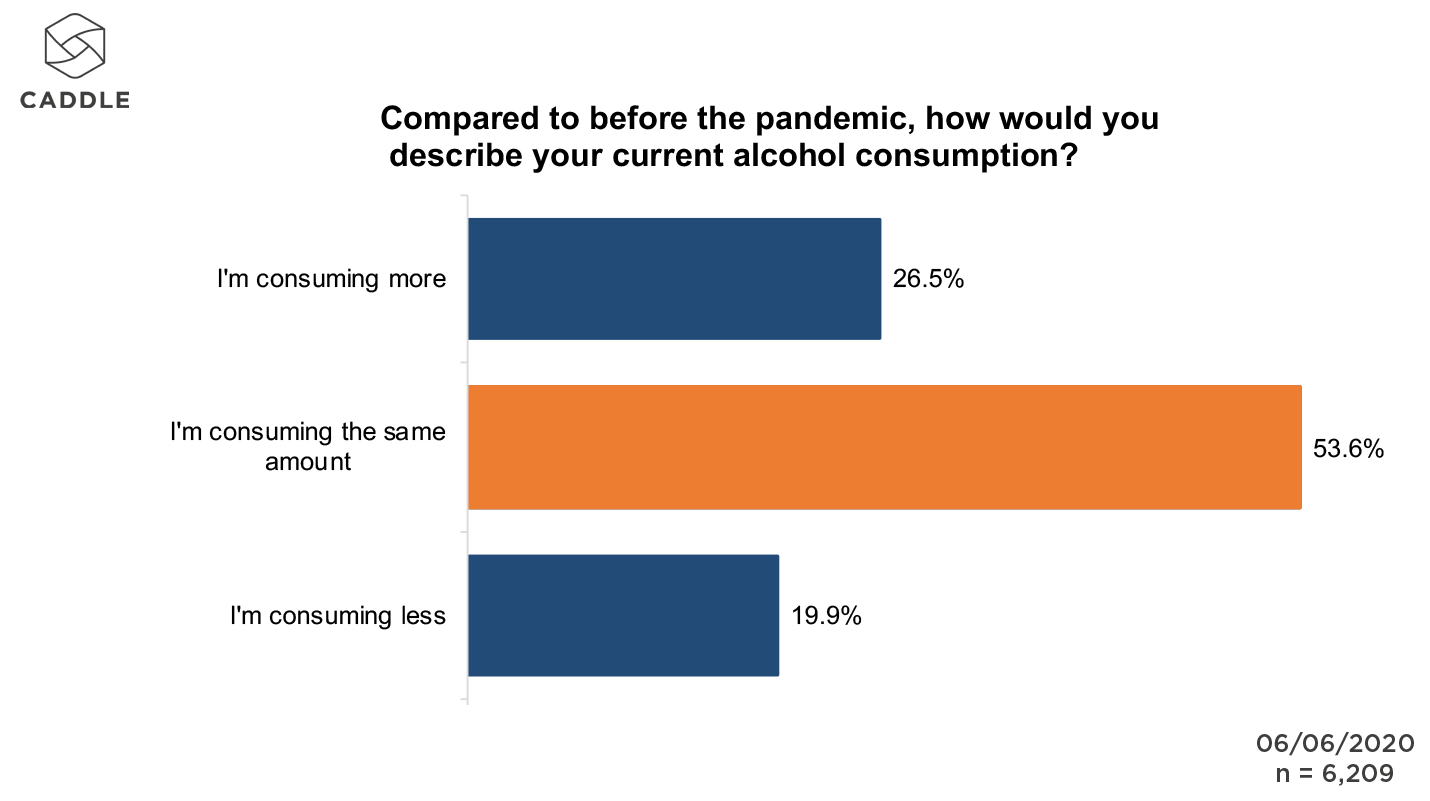

Across all demographics, 80% of those who drink are consuming the same amount of alcohol or more, compared to before the pandemic.

Their spirit of choice? Unequivocally, vodka is most popular among Caddle respondents, at 21%. The next most popular spirit is rum, at 11%, while whisky comes in at 8%. This ranking is consistent across all age and geographical segments, except the Greatest Generation (born 1900–45)—who prefer whisky most, followed by rum and liqueurs—and Quebeckers—who prefer rum most, followed by vodka and gin.

Vodka is also the most popular spirit (39%) among those who reported consuming more alcohol since the pandemic began.

When we look at potential differentiation based on gender, the top three (vodka, rum and whisky) remain the same for both males and females, but while women’s preferences compare positively to the general population—with vodka leading at double the rate of rum—men seem to prefer the three spirits in equal proportion. This suggests that men perhaps enjoy the deeper flavour profile of darker spirits like rum and whisky as much as the lighter flavour of clear spirits like vodka.

HOW BRAND-LOYAL ARE CANADIAN CONSUMERS WHEN IT COMES TO THEIR ALCOHOLIC BEVERAGES?

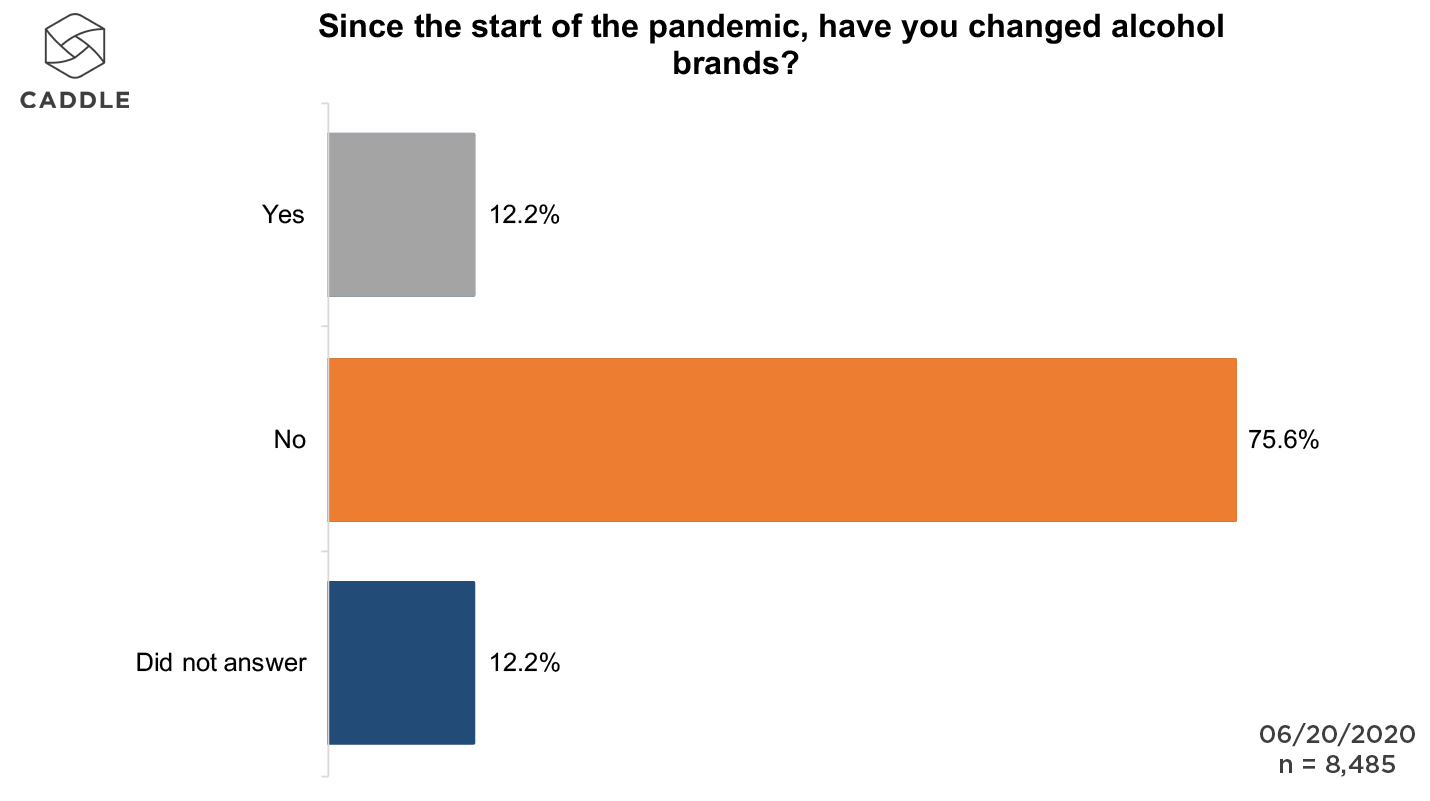

The simple answer is “very”! More than three-quarters of respondents have stuck with their preferred alcohol brands since the start of the pandemic. This is consistent across gender and age divides, though Gen Zers seem to be more open to trying different brands, compared to other generations.

Brand image plays an important role in decision-making around alcoholic beverage purchases for a third of consumers, though an equal percentage are neutral on the subject, across the general population.

Among those panel respondents who have changed brands, 77.5% expect to continue to purchase the new brand after the pandemic.

WHAT OTHER MAJOR FACTORS HAVE AFFECTED CONSUMER DECISION-MAKING ON ALCOHOLIC BEVERAGES DURING THE PANDEMIC?

Broadly speaking, flavour, community consciousness and availability all seem to factor into consumer interest in alcoholic beverages—especially during the pandemic—while nutritional content seems to be the least of consumers’ worries.

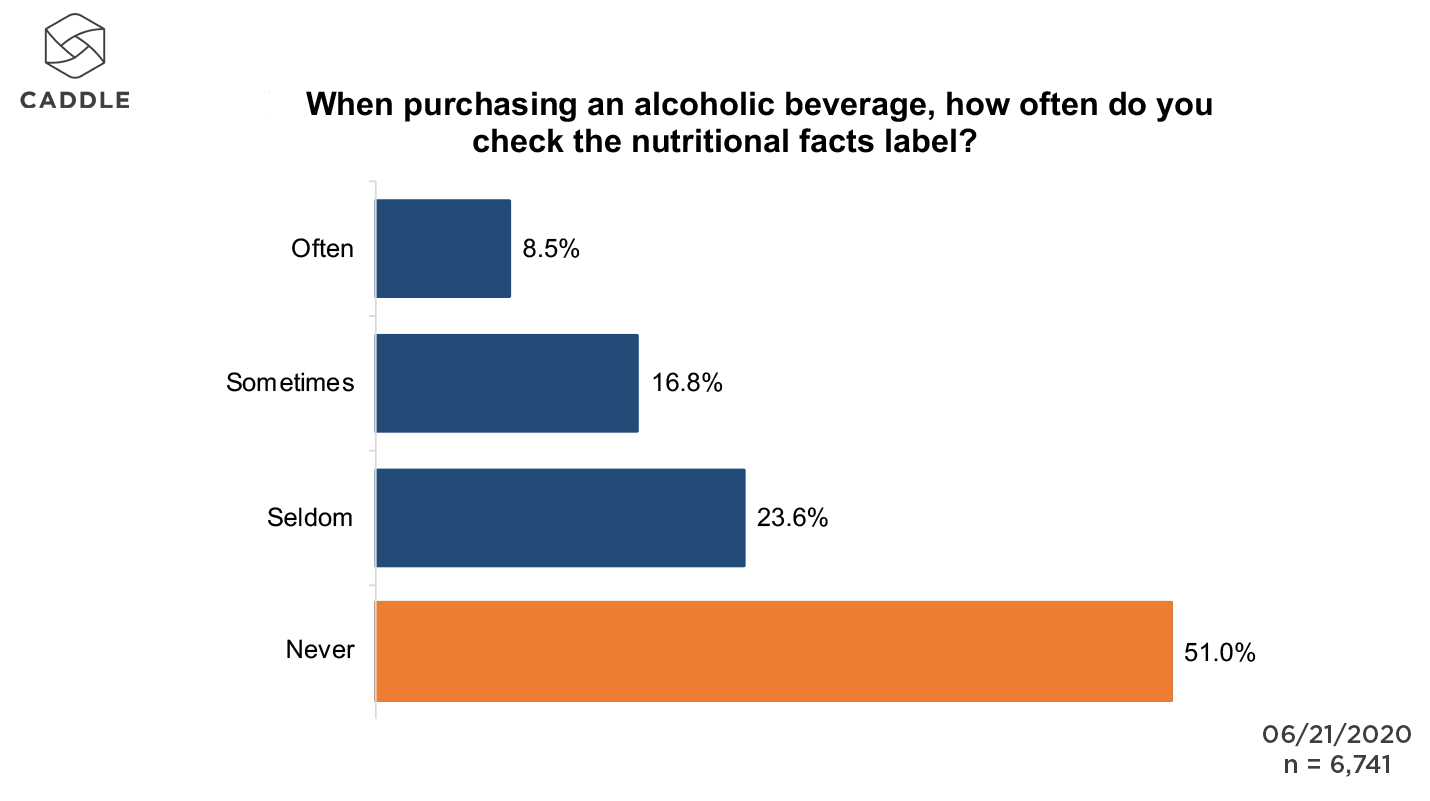

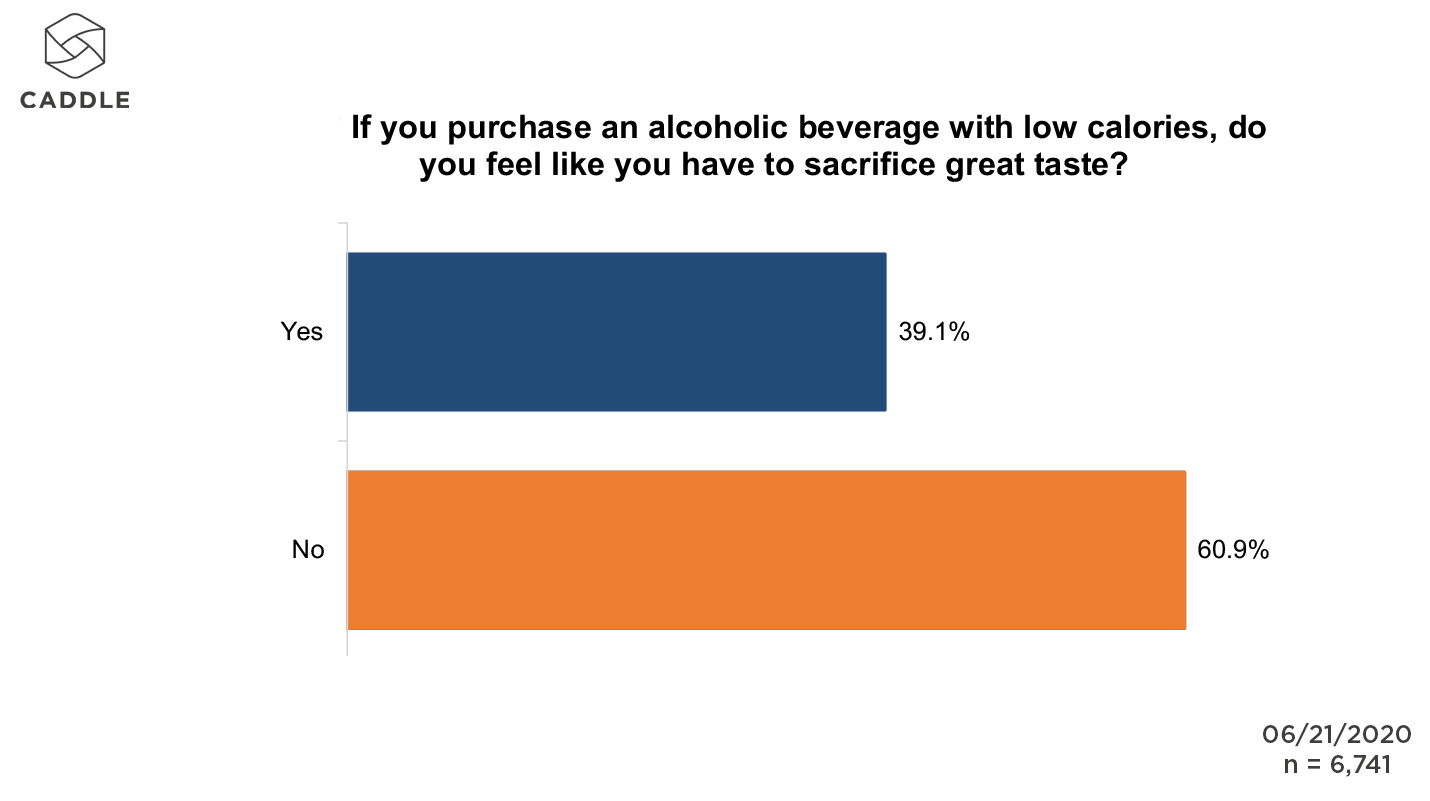

So, while 51% or more of Canadian alcohol consumers “never” check nutritional facts listed on alcoholic beverages (Quebeckers over-index at 52%, while Boomers come in at 60%), 61% feel that they should not have to sacrifice great taste when purchasing a low-calorie alcoholic beverage.

At the same time, 60% reported that they’re interested in purchasing alcohol from companies that provided communities with hand sanitizer during the pandemic (including major international players like AB InBev, as well as independents like Yukon Brewing, Niagara’s Dillon’s Small Batch Distillers, Smooth 42 Craft Distillery in Saskatchewan, Montreal’s Duvernois Creative Spirits and Vancouver Island’s Victoria Distillers), while a little over a third of respondents were indifferent.

And, a further 22% of alcohol consumers on the Caddle panel have been purchasing more alcoholic beverages from grocery stores, compared to pre-COVID times.

Taken together, this suggests that a reasonably sized segment of the Canadian population is open to discovering and trying new brands. And, if those brands deliver value—particularly in terms of flavour or community spirit (pun intended)—even better!

KEY TAKEAWAYS

VODKA EMERGES THE SPIRIT OF CHOICE DURING THE PANDEMIC

Relatively flavour-neutral, and therefore easier to mix with a variety of other ingredients, vodka comes out on top as the spirit of choice among the majority of Canadian alcohol drinkers. (The fact that it also comes with fewer calories probably doesn’t hurt. See Takeaway #2, below.)

The beverage industry should continue to take this to heart and look for new ways to integrate vodka into their alcoholic drink assortment, perhaps leveraging strong brand recognition among compatible mix ingredients (e.g., soft drinks, juices, etc.) to enhance their brand image and influence purchasing decisions. Cases in point: Mark Anthony Group’s White Claw; Constellation’s Svedka Spiked Premium Seltzer; and MillerCoors’ Cape Line and Henry’s Hard Soda.

CANADIANS VALUE TASTE OVER LOW-/NO-CAL CLAIMS

Though a significant number of alcoholic beverage manufacturers, including Molson, Labatt, and numerous craft brands, continue to launch ever-new low- or no-calorie options into the ready-to-drink (RTD) market, their efforts may in fact be better applied to introducing new and enticing flavour profiles to attract alcohol-drinking Canadians.

From a marketing perspective, they’re likely to be especially successful targeting Gen Zers, who are more open to trying new brands, especially during COVID lockdown.

COMMUNITY SPIRIT DRIVES CONSUMER INTEREST DURING COVID

With more than 60% of alcohol consumers expressing interest in purchasing alcohol from manufacturers who pivoted their production to hand sanitizer in the early days of the pandemic, it’s becoming abundantly clear that many Canadians, true to their international image, value community-driven initiatives.

The alcoholic beverage industry in Canada has an opportunity to further entrench the “feel good” nature of their product marketing, taking a page from such companies as Tito’s Handmade Vodka in the U.S. and Brewgooder in the U.K., by giving back to communities that most consume their products.

COVID-19 Insights: The War Against Chronic Pain Rages On for Many Canadians

Chronic pain is the norm for 20% of Canadians, impacting 1 in 2 households across the country

One in five Canadians are living with chronic pain. When left unmanaged, it can lead to sleeplessness, depression and anxiety, lower quality of life, and isolation, and in extreme cases, poverty, homelessness and even suicide.

This is supported by our research, which indicates that 51% of Caddle respondents or someone close to them suffer from chronic pain and related issues:

- 75% of respondents suffer from headaches; 25% of those get them “often.”

- 52% of respondents suffer from migraines; nearly 25% of those experience them “sometimes” and a further 11% “often.”

- 52% of respondents suffer from arthritis pain; almost 10% of those “always” have pain and a further 30% “often” or “sometimes” do.

- 69% of respondents suffer from anxiety.

- 61% of respondents suffer from the blues (i.e., feeling sad and helpless); 30% experience it “sometimes,” while a further 23% deal with it “often”/“always.”

HOW ARE CANADIANS MANAGING THEIR CHRONIC PAIN TODAY?

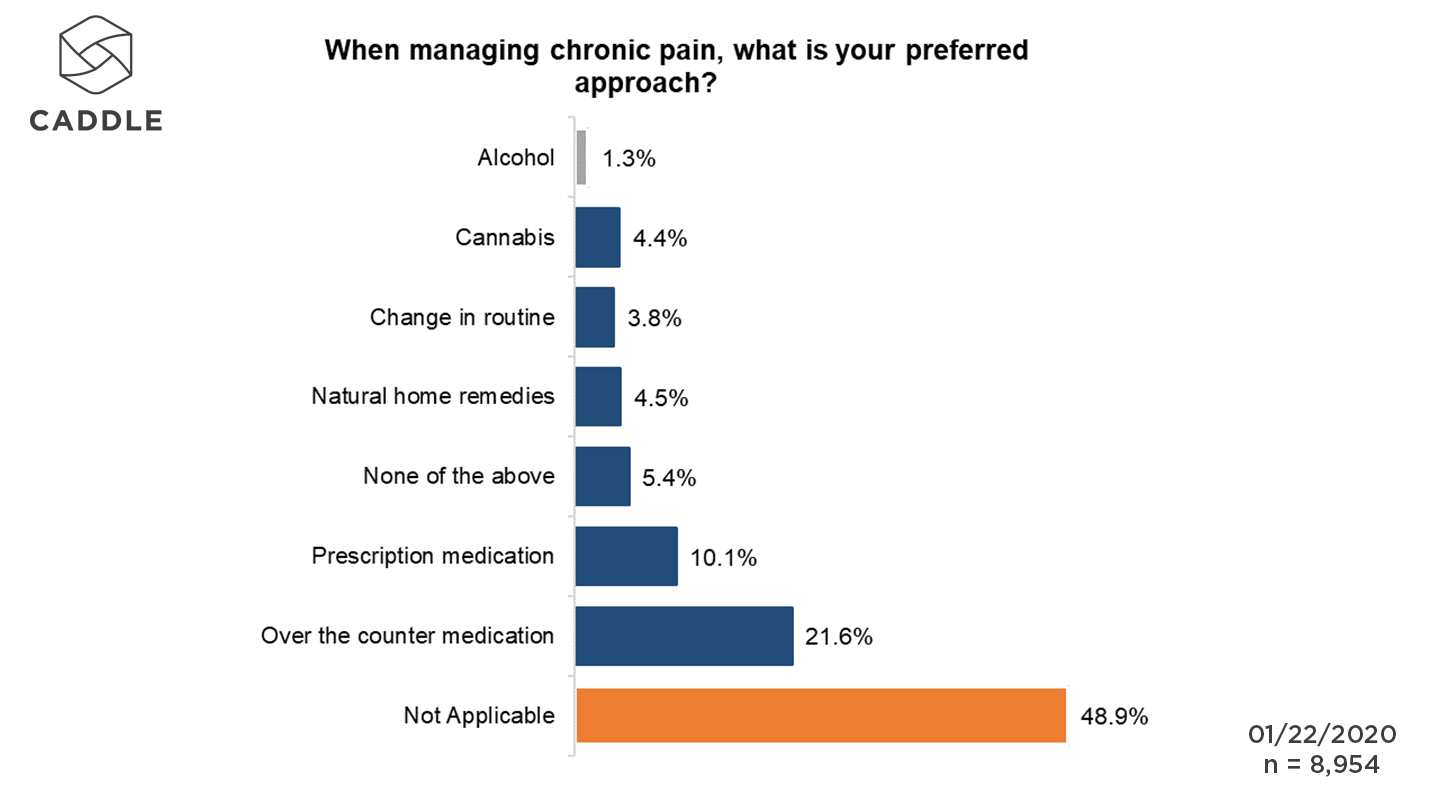

Unsurprisingly, over the counter (OTC) medication and/or licensed prescriptions are the first line of defense for many Canadians—in part due to the broad availability and overall familiarity with these types of products.

Among the 51% of our 9,000-strong audience who suffer from chronic pain (or have someone close to them who does), almost a quarter manage it using OTC products, while a further 10% take prescribed medication for this purpose.

In terms of medication consumption, the vast majority of Caddle users (84%) are familiar with the benefits of OTC pain relievers, while almost 50% are likely to try new pain relief products. (Among those, Gen Zers in Quebec, Manitoba, Ontario, Alberta and British Columbia are least likely to try new OTC pain products, while Baby Boomers in the Maritime provinces, Saskatchewan and Ontario are most likely.)

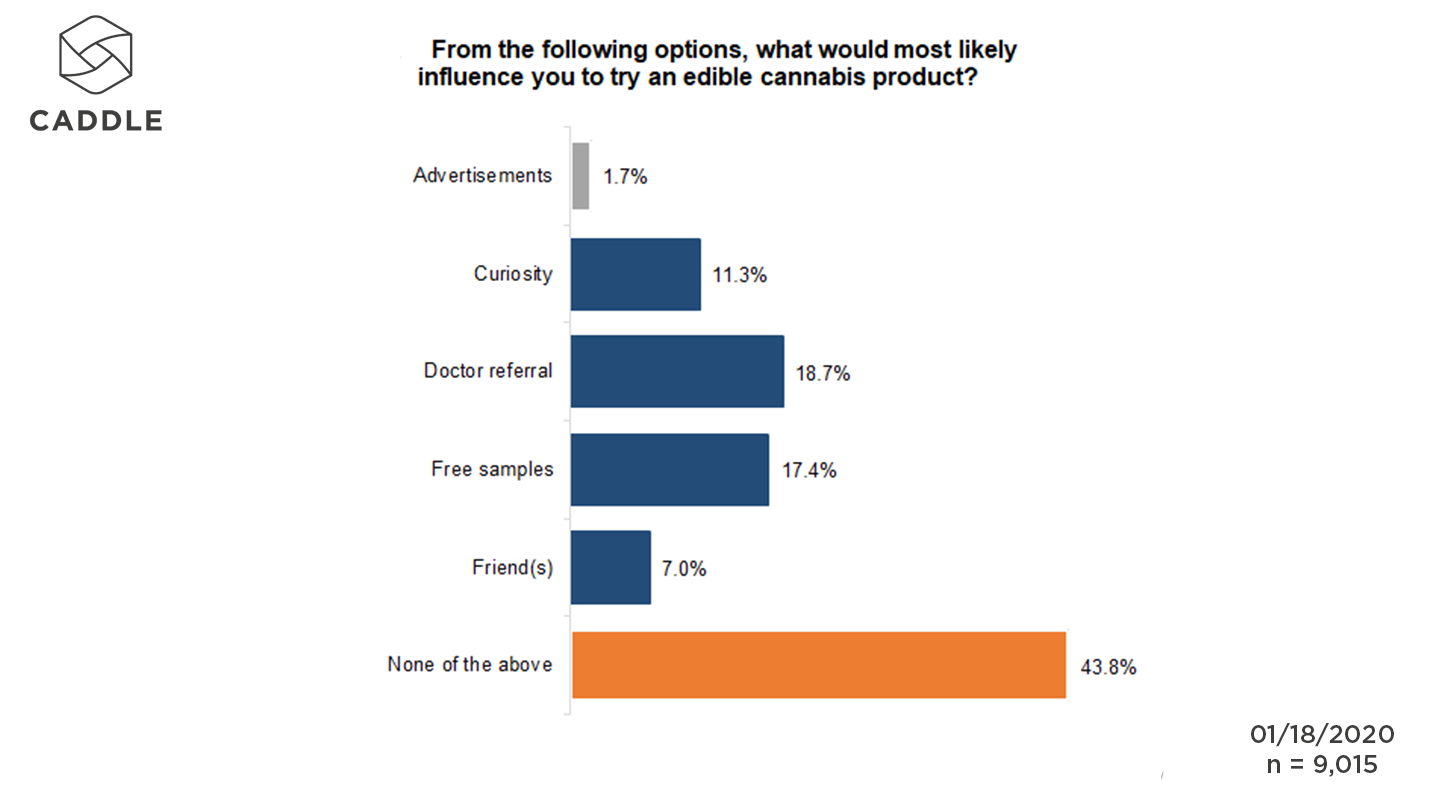

And, while only 4.4% of respondents identified cannabis as their method of choice for managing chronic pain, additional survey results indicate that nearly 20% of people would try edible cannabis products based on doctor referral.

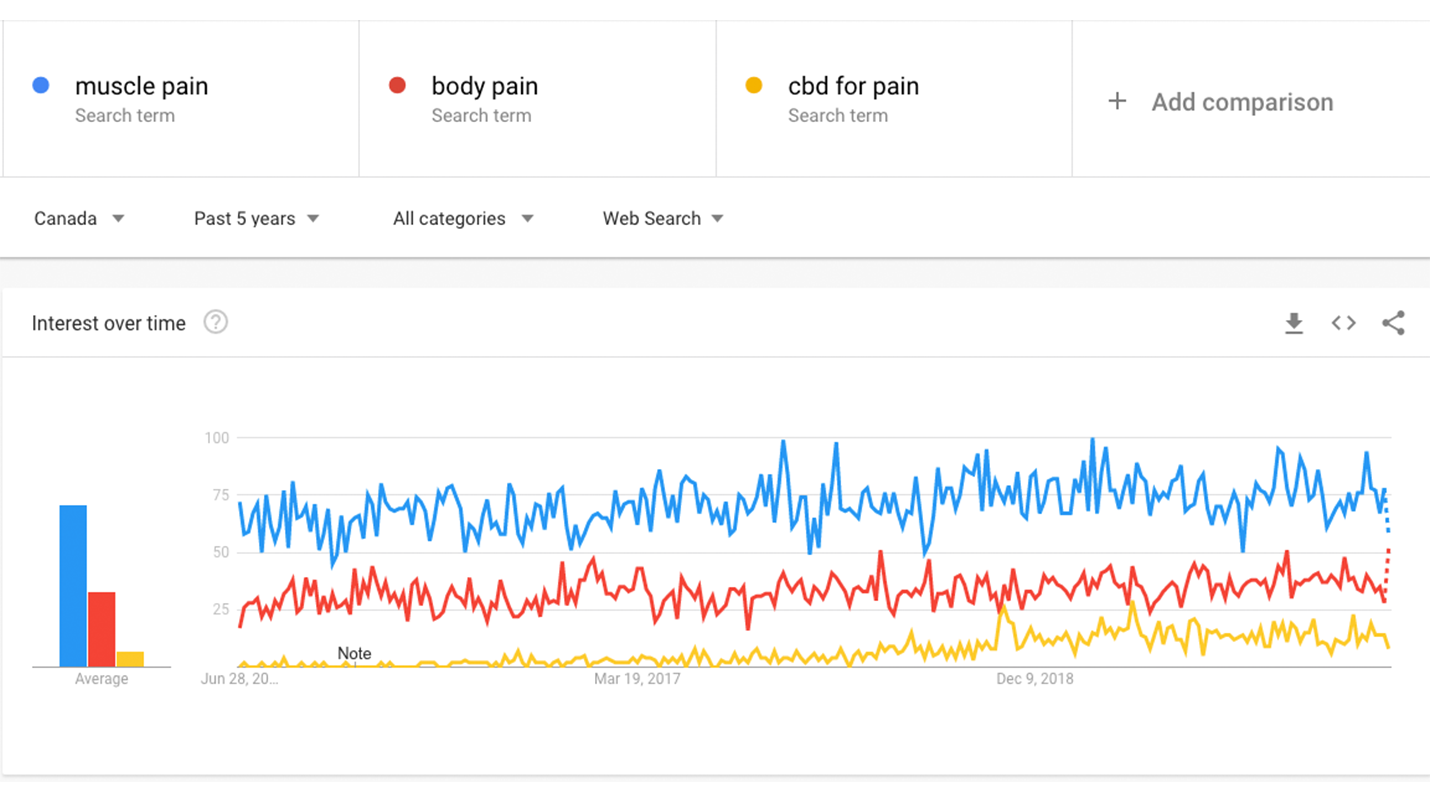

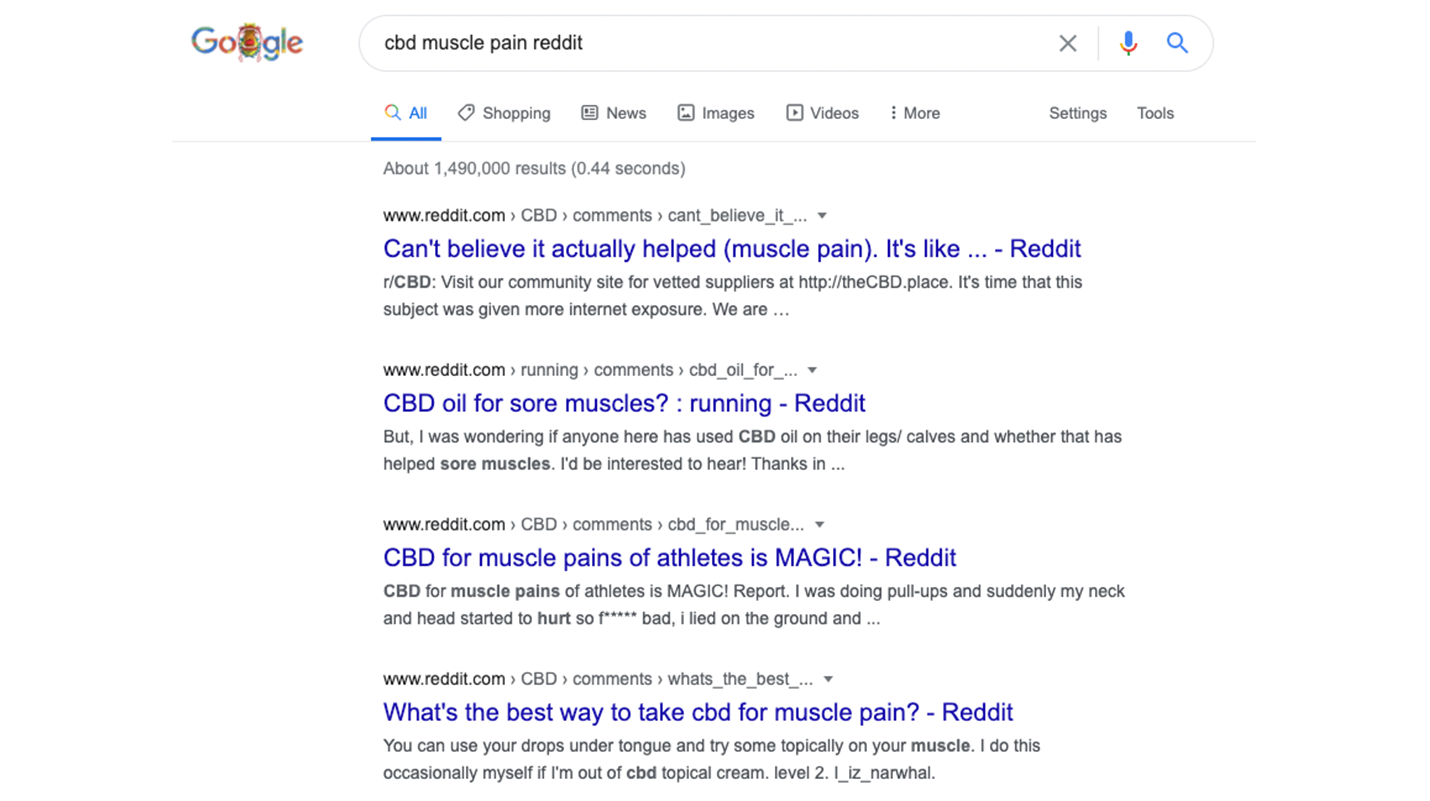

Meanwhile, a simple Google Trends or Reddit search uncovers the fact that Canadians are increasingly interested in potential pain-relieving benefits of CBD-based products.

Note, especially, the uptick in searches for “CBD for pain” over the last few months—perhaps an indication of the co-existence of COVID-19 symptoms and consideration of CBD use for muscle aches and pains, or alternatively, reinforcing the use of CBD-based products for the secondary symptoms of chronic pain, such as anxiety and depression, which have been affecting more people under COVID lockdown.

HOW HAS COVID-19 AFFECTED PEOPLE SUFFERING WITH CHRONIC PAIN?

Issues around COVID-19 and chronic pain are beginning to intersect: We’ve learned that COVID-19 can infect just about anybody but is especially dangerous for older adults, young children, and people in marginalized communities. Chronic pain, too, is most common among older adults, children and adolescents, Canada’s Indigenous Peoples (including First Nations, Métis and Inuit populations) and other populations affected by social inequities and discrimination.

Not coincidentally, conditions like depression, anxiety and social isolation have been shown to cause chronic muscle aches and body pain. With the increased incidence of anxiety, depression and loneliness in Canadians due to the financial worry, employment impact and exposure to COVID-19, there’s a high likelihood that people across the country are feeling the effects of the pandemic, both mentally and physically.

If a second wave of COVID hits Canadian communities (as it’s predicted to, in Fall 2020), there could be an interesting synchronization and likely exacerbation of people’s chronic pain and related conditions, especially among increasingly susceptible, older age groups and marginalized populations.

WHAT OTHER THINGS ARE RESPONDENTS DOING TO ALLEVIATE THEIR CHRONIC PAIN SYMPTOMS?

Numerous sources, including the Canadian Pain Task Force, identify various pain management options beyond pharmaceutical interventions. These include modified diet and exercise plans.

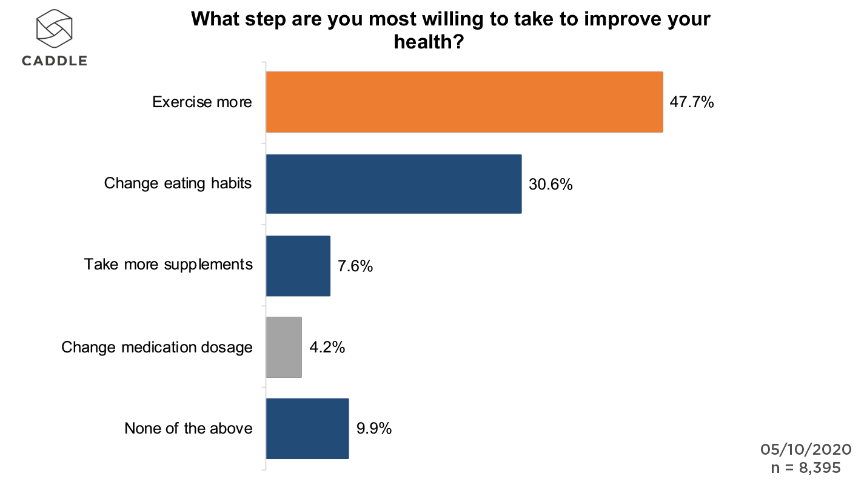

Our research bears this out, as the majority of Caddle users indicate they’re likely to take proactive steps towards improving their health, including 48% of respondents who are willing to exercise more often and an additional 31% who are willing to change their eating habits.

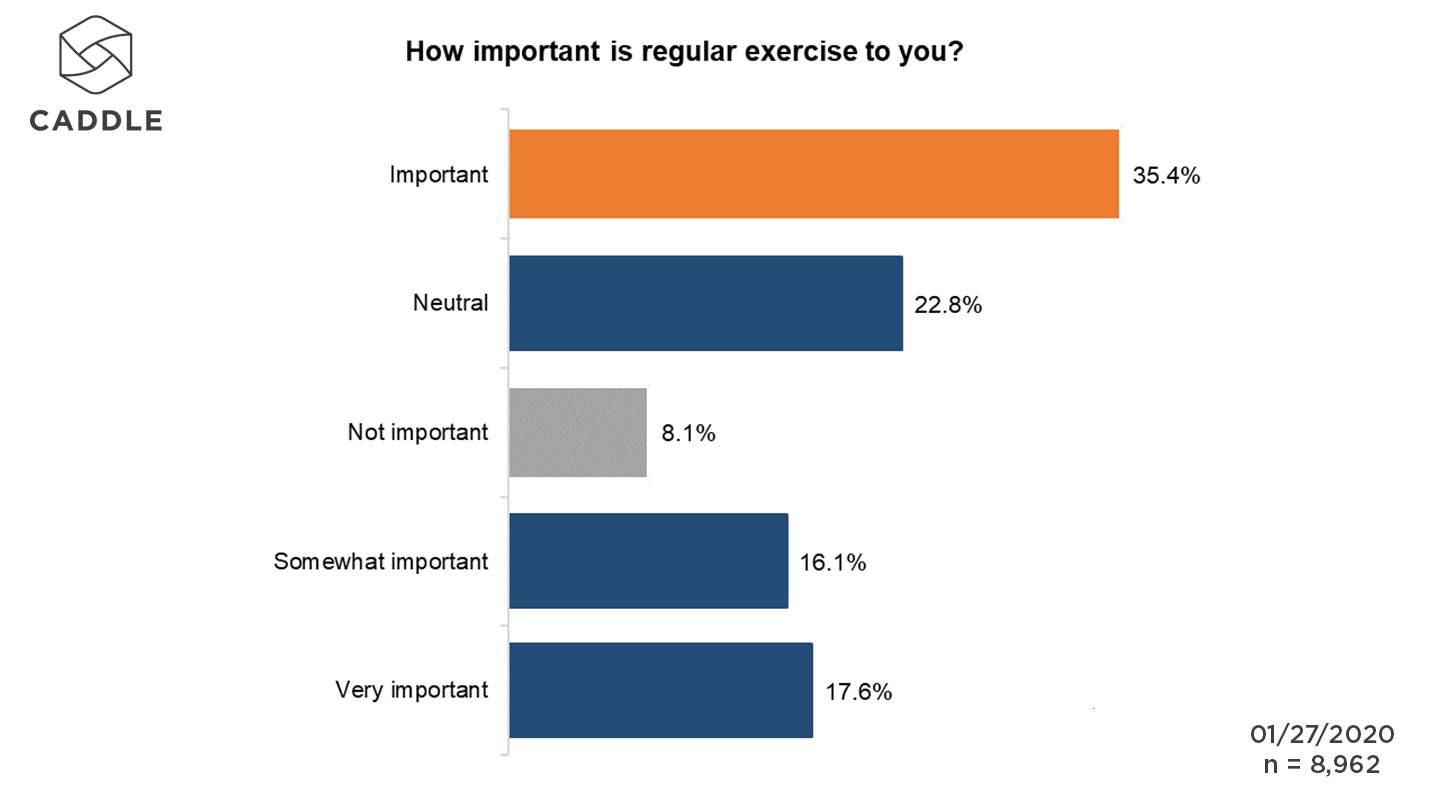

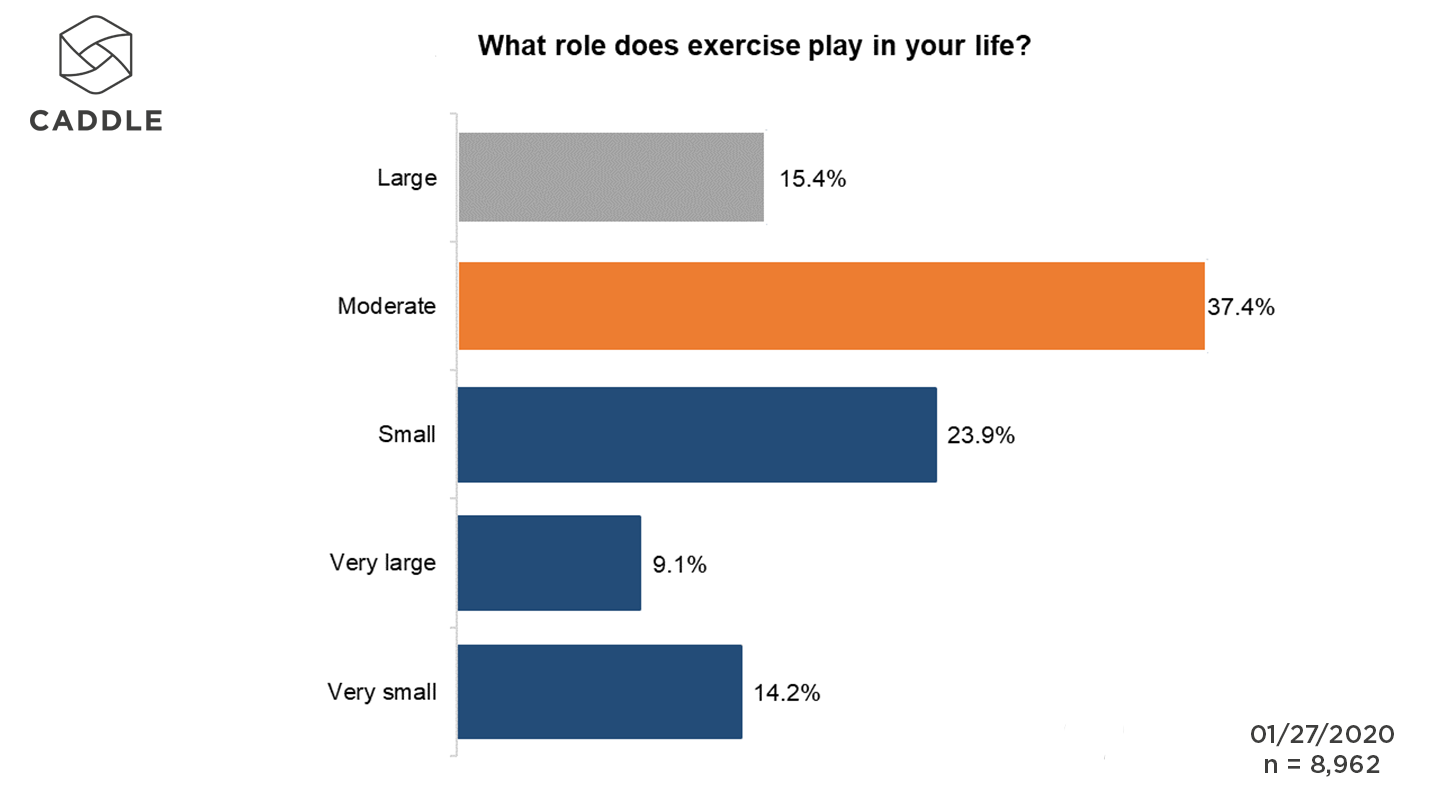

Breaking this down further, over a third of Caddle respondents agree that regular exercise is important to them, and it plays a “moderate” to “very large” role in 62% of respondents’ lives.

From a healthy eating perspective: We’ve seen that older generations are less likely to change their eating habits. What’s more, the Greatest Generation and Boomers tend to lag behind in their knowledge of diet regimens that can help in the management of chronic pain, such as anti-inflammatory diets.

If older generations are, for the most part, uninterested in adapting their eating habits, and many will continue to medicate to manage their chronic pain, this could result in a nice boom for drug makers—especially those who are able to address the underlying conditions that cause chronic pain as well as the anxiety and depression that tend to plague patients with pain symptoms.

KEY TAKEAWAYS

CANADIANS ARE EAGER TO TRY “NEW” PAIN-RELIEF SOLUTIONS

Whether in the form of prescribed drugs or OTC products, doctor-recommended remedies are still #1 for more Canadians when it comes to managing chronic pain.

Yet, at the same time, certain demographics are open to solutions that fall outside of the mainstream. Taking into account the 50% of respondents who are likely to try new pain-relief products, then, it makes sense that people with friends who consume cannabis products would be more likely to try these alternative solutions without a doctor’s referral.

As such, marketers will need to make a bigger push—and use authoritative data from medical professionals to back it up—if they’re going to see cannabis products pick up a greater share of the pain-relief market moving forward.

CBD PRODUCTS ARE DEVELOPING A MARKET IN PAIN MANAGEMENT

Though CBD isn’t without its own issues, all indications suggest that consumer interest is flourishing, and the category is only going to continue to grow in availability and consumer uptake.

As more cannabis-based products enter the Canadian marketplace, traditional OTC manufacturers will need to keep a keen eye on innovation—watching in-store planograms as well as new products being launched direct-to-consumer on sites like Amazon—to consider how they can stake a bigger claim in the cannabis-for-pain-relief arena.

INCREASED ANXIETY DUE TO COVID-19 IS FUELLING CHRONIC PAIN (AND VICE VERSA)

Even if younger generations are much more likely to transition to a healthier diet and a more active lifestyle—both of which could lead to lower rates of chronic pain—they may still experience symptoms associated with the condition, especially under the unprecedented circumstances dictated by the ongoing COVID scare.

Experiencing frequent feelings of fear, worry and anxiety can impact the body in real ways, contributing to muscle tension and pain.

Marketers who are trying to relieve Canadians’ chronic pain struggles are best to pursue a holistic approach that considers how different generations are affected by both physical and psychological symptoms of pain and how those individuals prioritize the pain-relief options available to them.

COVID-19 Insights: Heightened Awareness of Health and Wellbeing Issues Prompt Better Exercise and Dietary Choices

Almost half of respondents prioritize healthy eating as a result of the pandemic

At a time of year when Canadians would typically be setting their sights on summer activities, for many people, it’s been difficult to look past the troubles that have been brought about by the COVID-10 pandemic. (Take, for instance, the finding that almost two-thirds of Caddle users are foregoing visits to the cottage this summer.)

From vacation plans to shopping habits to food and drug consumption and beyond, COVID has affected just about every aspect of Canadians’ lives and has brought about heightened awareness of health issues—particularly in respondents’ eating and cooking habits, supplement use, and longer-term intentions for improving their overall health and wellbeing.

Get your weekly consumer insights fix! Sign up here for our free summaries, issued weekly.

HAS ANYTHING CHANGED ON THE HEALTH FRONT FOR CONCERNED CANADIANS?

At a high level, it’s safe to say that COVID-19’s ongoing progression (and ever-so-slowly flattening curve) in Canada has only served to increase consumers’ health concerns over time.

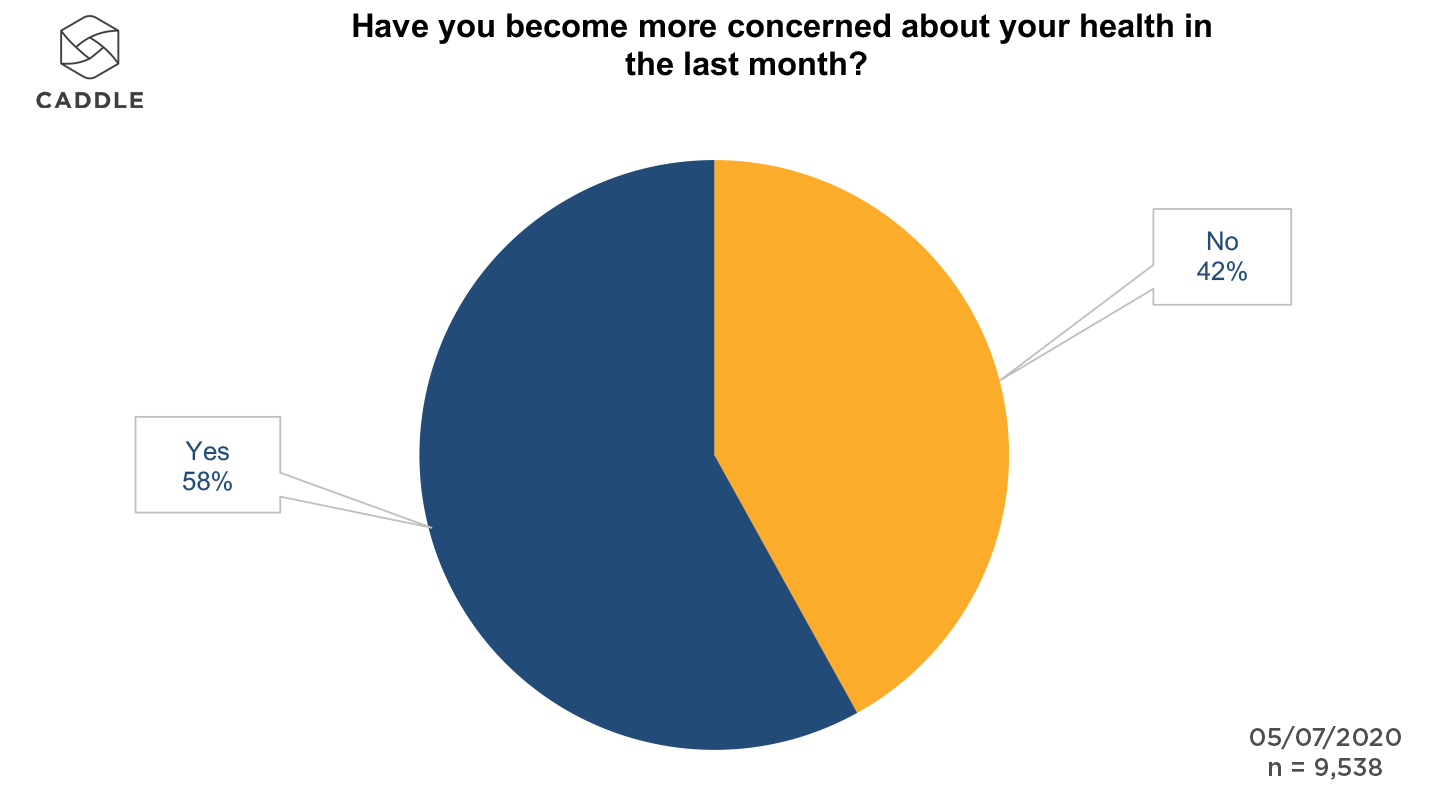

Among our 9,538 user–strong panel, three in five people agreed that they’ve become more concerned about their health in the last month.

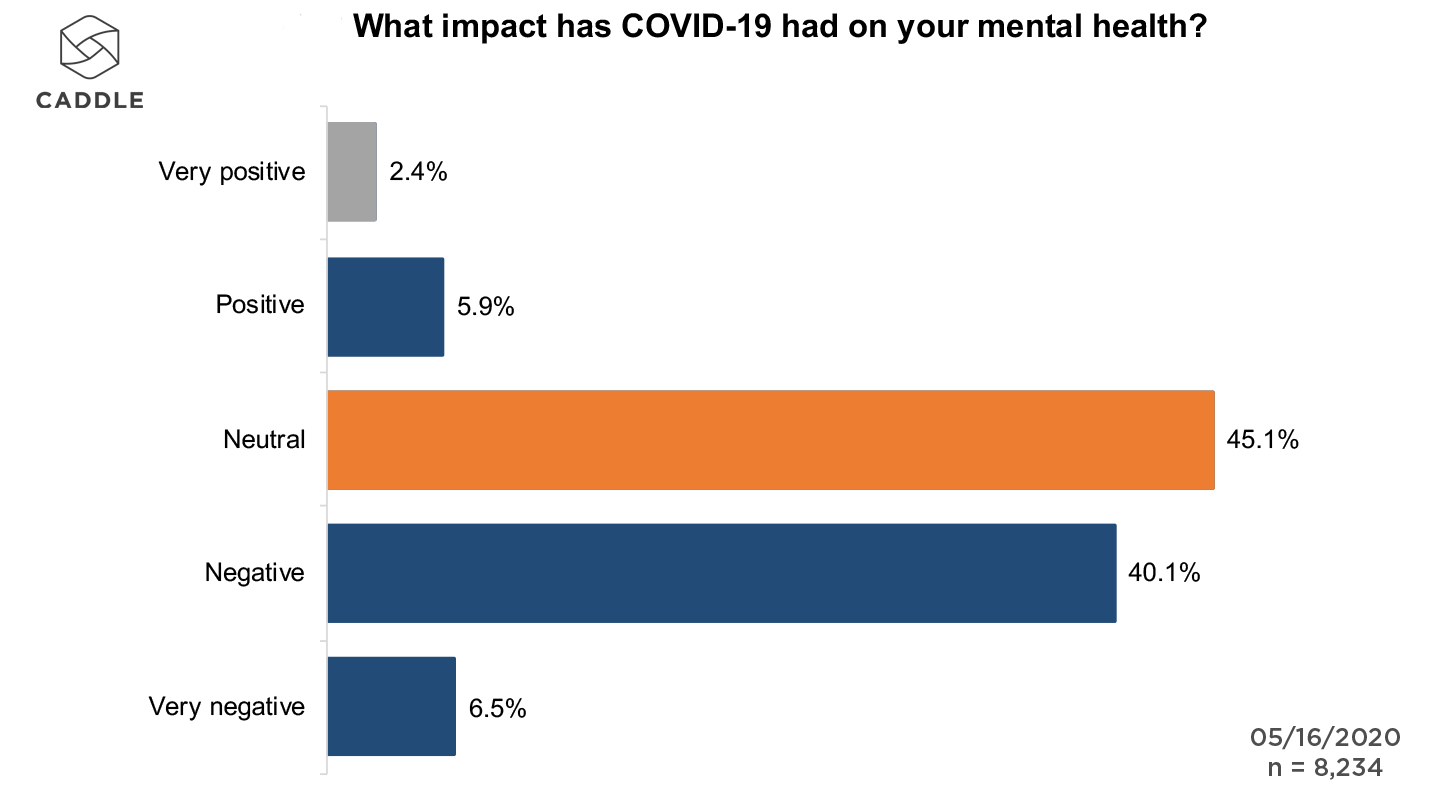

Add in the fact that 46% of Caddle users have experienced a negative impact on their mental health as a result of COVID-19—extrapolating the effect that such psychological concerns may have on people’s physical wellbeing—and we believe that Canadians will continue to feel the health implications long after the curve has finally flattened. And that includes prolonged effects on people’s mental health.

Said agency health expert Richelle Colbear from Arrivals + Departures: “I think one shift we will continue to see is the increase in conversation around mental health. We will have to see how brands want to be a part of that conversation more.”

Yet, rest assured: we’re not going down without a fight! In fact, based on research from mid-May, almost three-quarters of Caddle users indicated they’re “very likely” or “somewhat likely” to take proactive steps towards improving their health. This is especially the case among older respondents, including Baby Boomers (77%) and the Greatest Generation (i.e., those born between 1900–45; 76%).

WHAT STEPS ARE CANADIANS WILLING TO TAKE TO IMPROVE THEIR HEALTH?

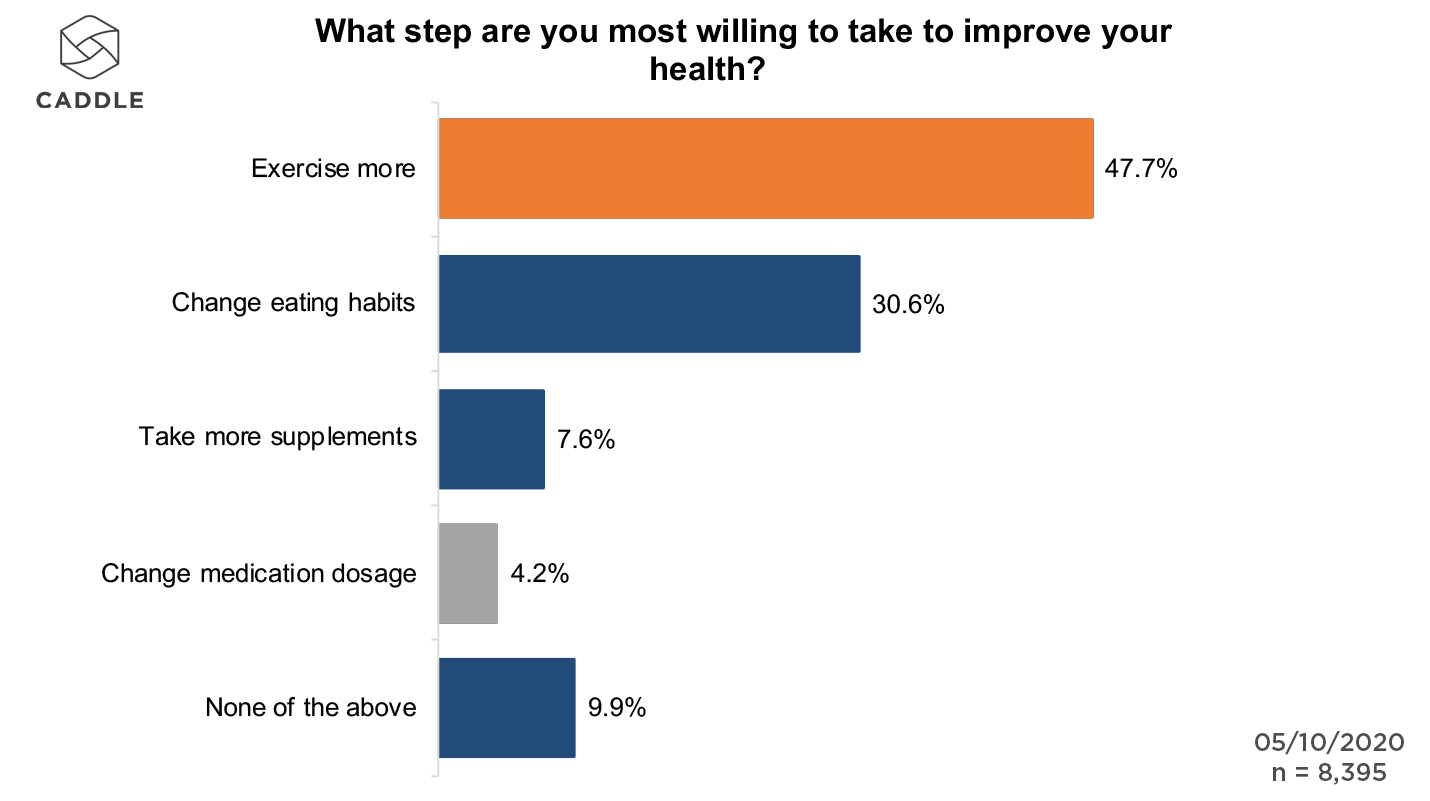

In that same study, we found that Caddle users are prioritizing two key activities in order to improve their health: exercise and food and supplement consumption.

Specifically, nearly half of all respondents (48%) are willing to exercise more often. Meanwhile, 31% of Caddle users indicate a willingness to change their eating habits, and a further 8% will up their consumption of supplements to stay healthy during the pandemic.

Interestingly, while the Greatest Generation are most willing to amp up their exercise regimen, they’re least willing to adapt their eating. (Admittedly, this could be an indication of the practicality of adding more exercise and nutritious food to their daily patterns.)

Now, let’s take a closer look at each of these—exercise, eating and supplements—in turn.

HOW IS COVID-19 SHAPING EXERCISE HABITS?

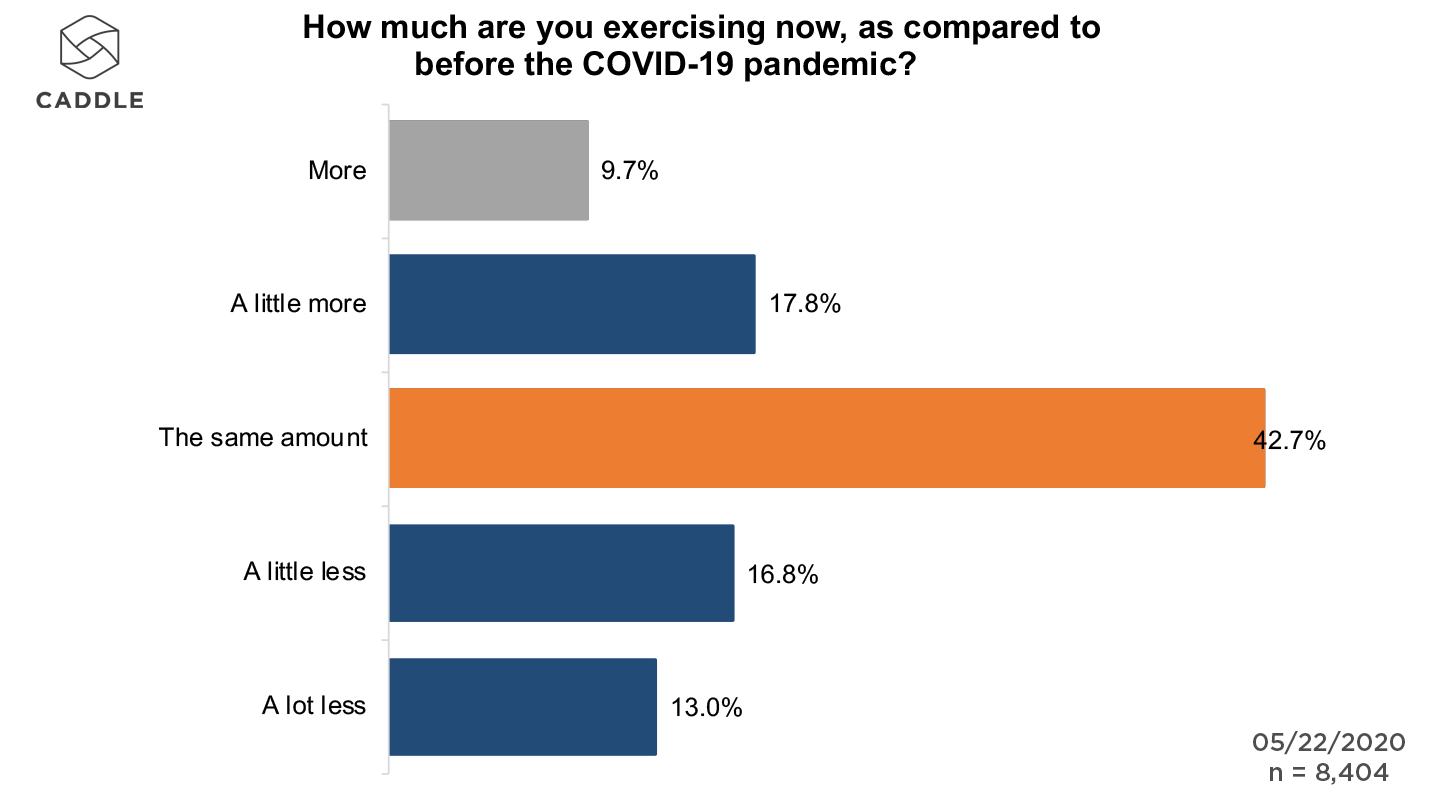

While 37% of respondents across the country are concerned about their fitness levels amid social distancing protocols, 43% indicated that they’re maintaining the same level of exercise as before COVID-19 hit Canadian populations. (By comparison, 27% of respondents say they’re exercising “more”/“a little more” and 30% are exercising “a lot less”/“a little less.”)

Which segments are exercising most during the pandemic compared to pre-COVID? Gen Zers, for one, almost 40% of whom are “more”/“a little more” active now than before.

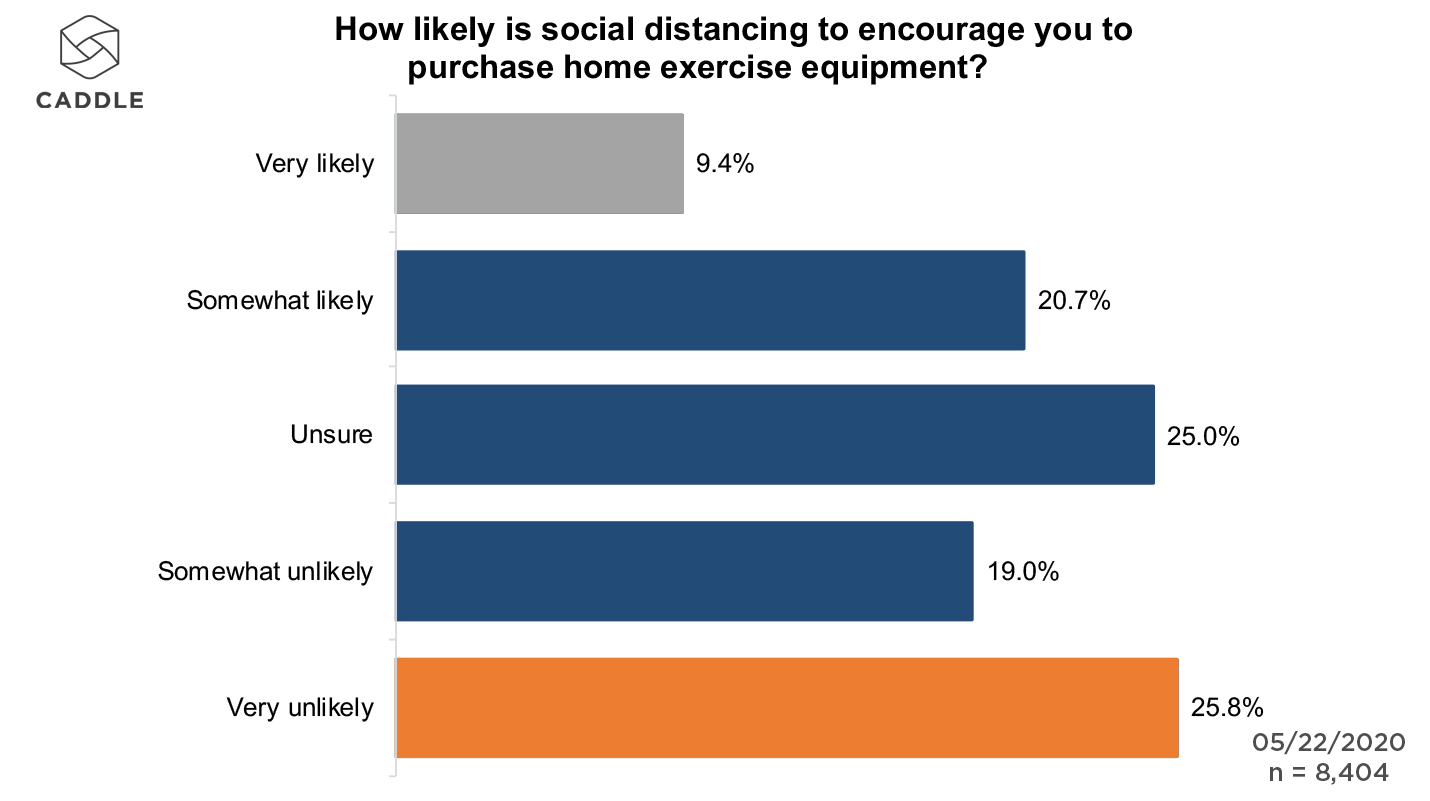

Yet, based on that same survey, it looks like the fitness equipment boom that retailers witnessed earlier in the spring may have come to an end: An equal percentage of Caddle users are “very unlikely” as “unsure” about purchasing new home exercise equipment (25.8% and 25%, respectively), while only marginally more users responded positively (“very likely”/”somewhat likely”).

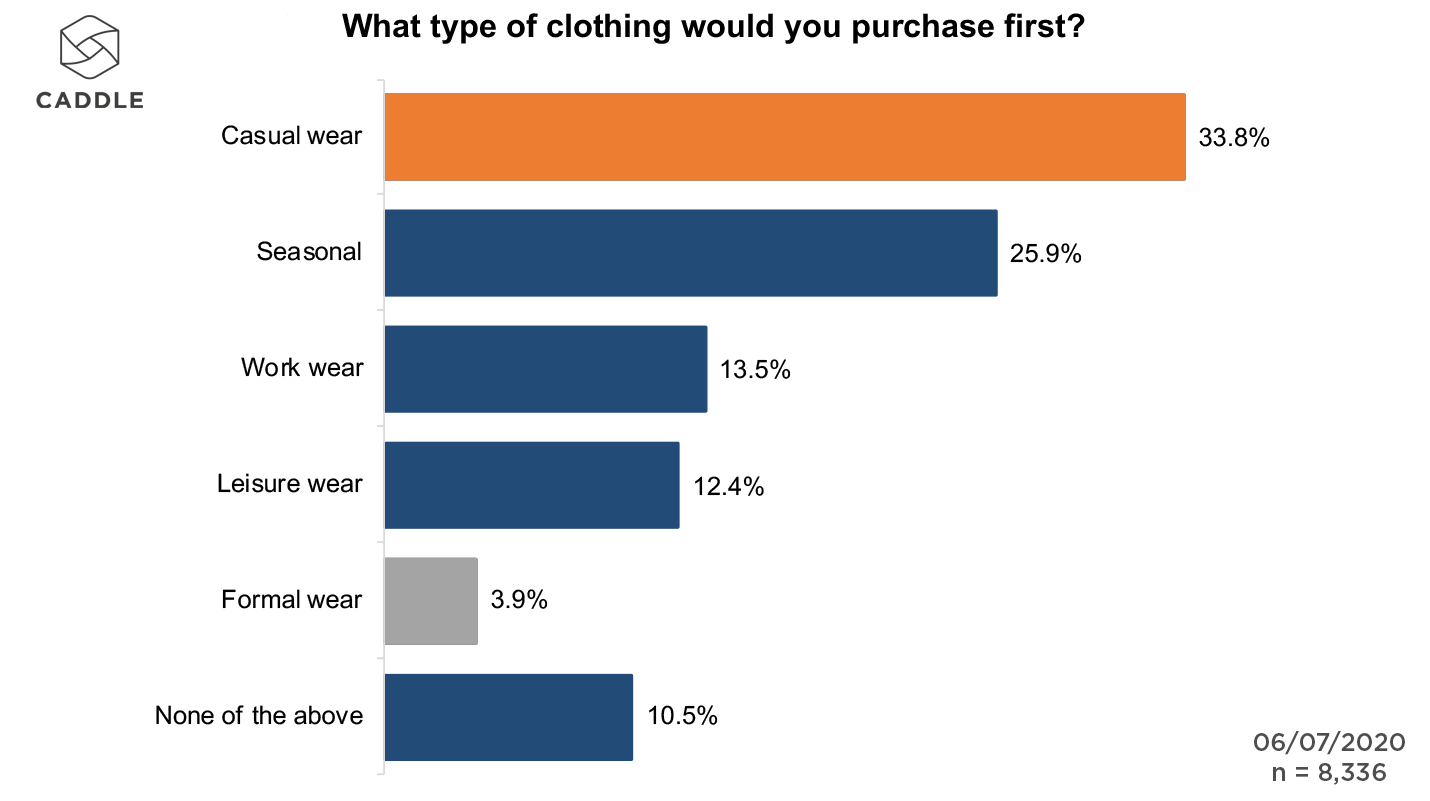

Be that as it may, the athleisure market continues to excel in the face of the social distancing, with nearly 15% of Caddle users anticipating the purchase of leisurewear once stores finally re-open to the public.

With 69% of respondents indicating that they exercised at home before social distancing curtailed their movement, we can deduce that they’re either not willing to spend their hard-earned cash on what might be considered a non-essential fitness equipment purchase. Or, perhaps they’re already equipped well enough at home to keep up their exercise regimens.

Does this pattern tie into consumption behaviour during COVID-19? Let’s explore the influence of the pandemic on eating habits.

HOW IS COVID-19 SHAPING EATING HABITS?

Based on surveys conducted during mid-May, healthy eating has become more important for almost half of our 8,252 respondents as a result of the pandemic. This is especially the case among Gen Zers located in Saskatchewan (67%), Quebec (63%) and Ontario (61%).

The question then is: Will increased interest in healthy eating extend beyond the pandemic?

Results indicate a resounding ‘yes,’ as almost three-quarters of Caddle users are interested in maintaining healthier eating habits post-COVID. This rises to 86% among respondents who placed greater importance on healthy eating during COVID.

What constitutes healthy eating for Caddle users? In short, a diet with fewer animal products and more fruits and vegetables. So, while 27% of respondents typically consume meat as part of any meal each week, 42% are interested in transitioning to a diet that includes less meat and dairy (Gen Zers are especially interested in going plant-based, at 51%).

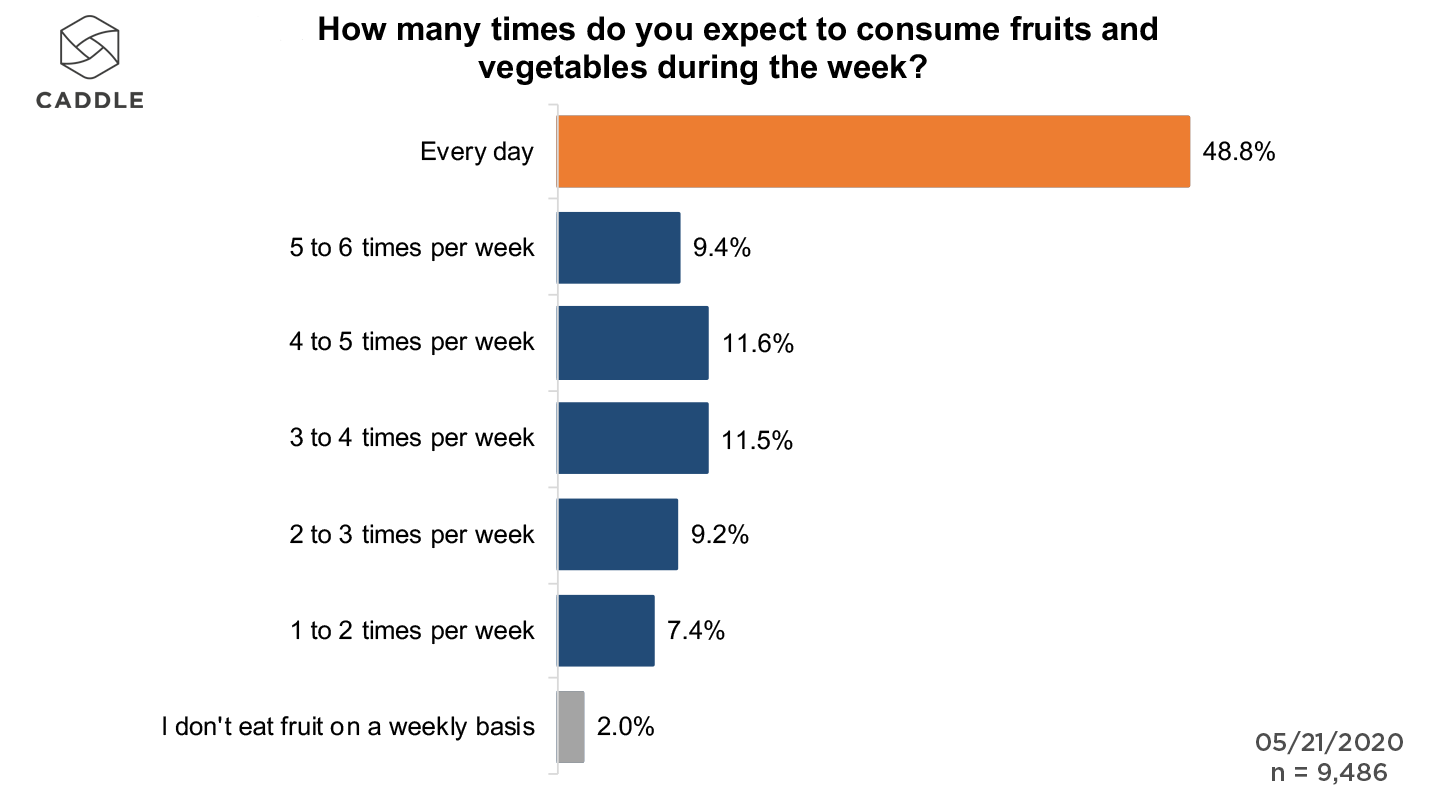

At the same time, almost half of respondents expect to consume fruits and vegetables every day of the week.

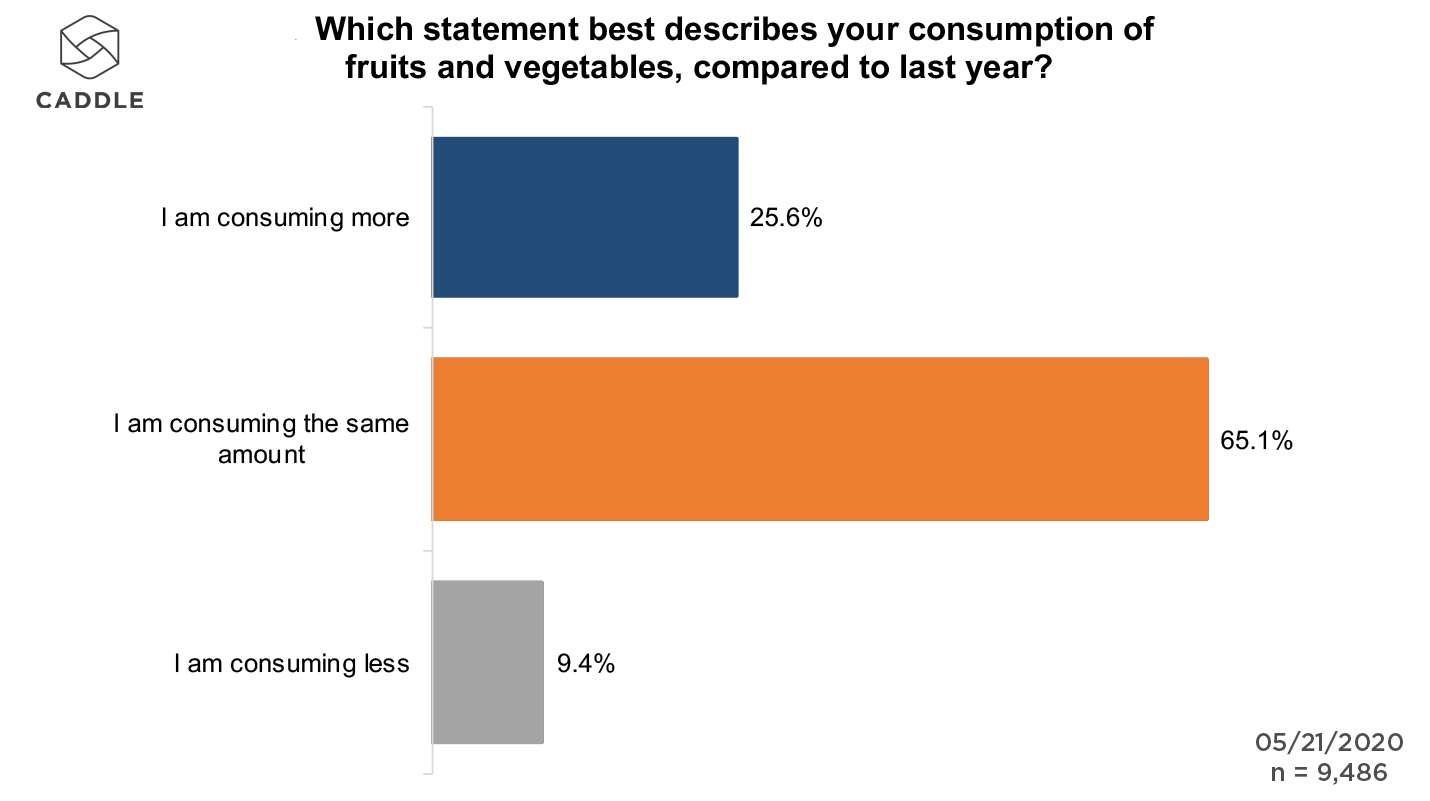

This is about the same rate of consumption as a year before, though more than a quarter of Caddle users indicate that they’re consuming more fruits and vegetables than this time last year—especially respondents in the Yukon (40%) and Gen Zers in all regions (35%).

Interestingly, this dovetails with an increasing trend for Caddle users to cook at home more often than before: 100% of respondents who were cooking 1–4 times per week pre-COVID now report cooking 6–7 times per week during the pandemic, and 83% of respondents who cooked 1–2 times per week now find themselves cooking more often at home than before.

Now, with a significant proportion of Canadians opting for healthier food choices, we would expect to also see the same, if not greater, usage of supplements to keep diets as robust and healthful as possible.

Let’s go deeper into the statistics to see if this is the case.

HOW IMPORTANT ARE HEALTH SUPPLEMENTS TO CANADIANS?

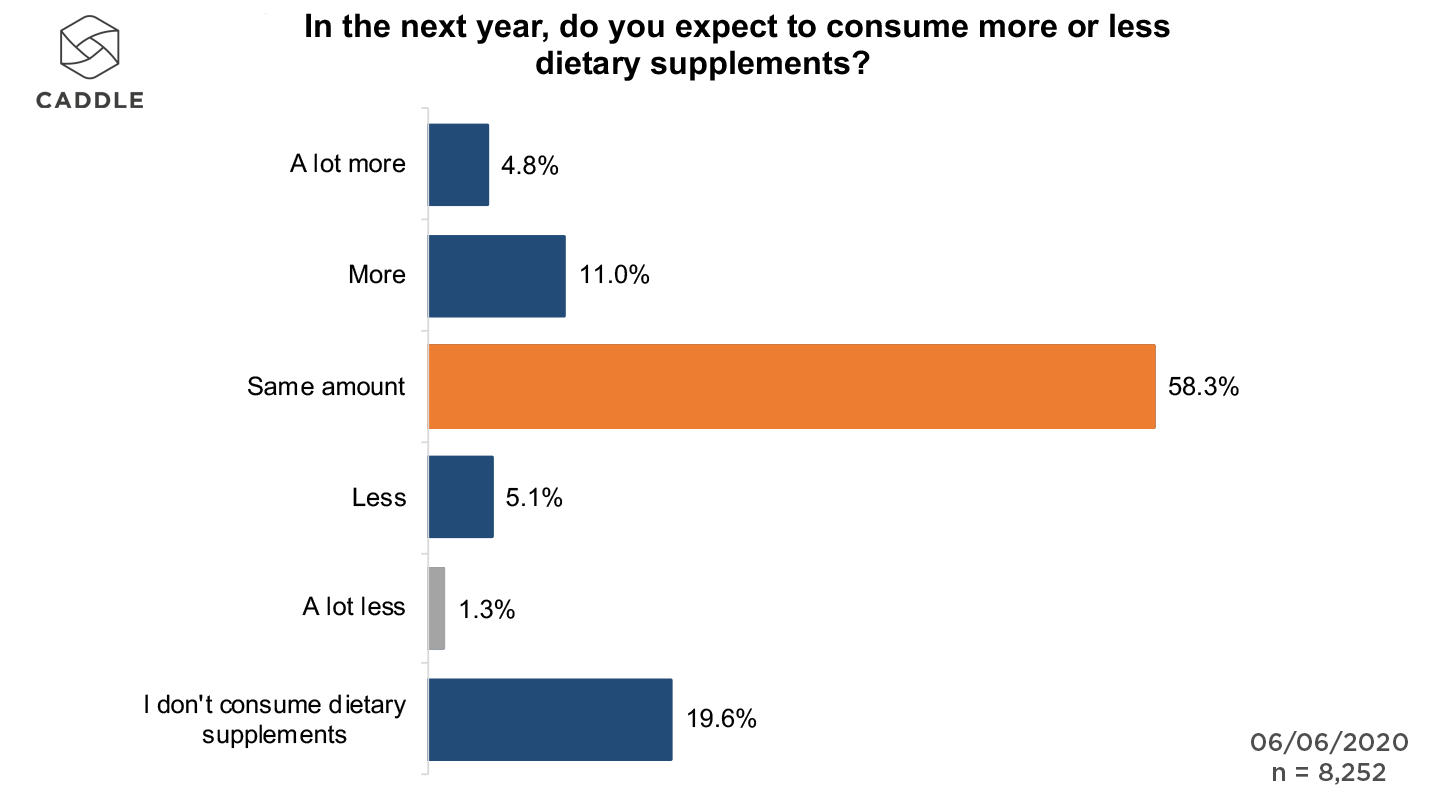

Results from a daily survey on June 6th indicate that about 20% of respondents don’t consume dietary supplements. But, of the people who do, 16% expect to increase their consumption in the year ahead, while upwards of 58% expect to use the same amount.

Gen Zers in the Prairies are outliers in this regard: Manitobans expect to increase their supplement consumption by 56%, while dietary supplementation among Saskatchewanians is expected to see a 50% increase in the coming months.

WHAT FACTORS COME INTO PLAY IN CONSUMERS’ HEALTH PRODUCT PURCHASING DECISIONS?

Canadian shoppers’ values differ when it comes to their preferred health and wellness products:

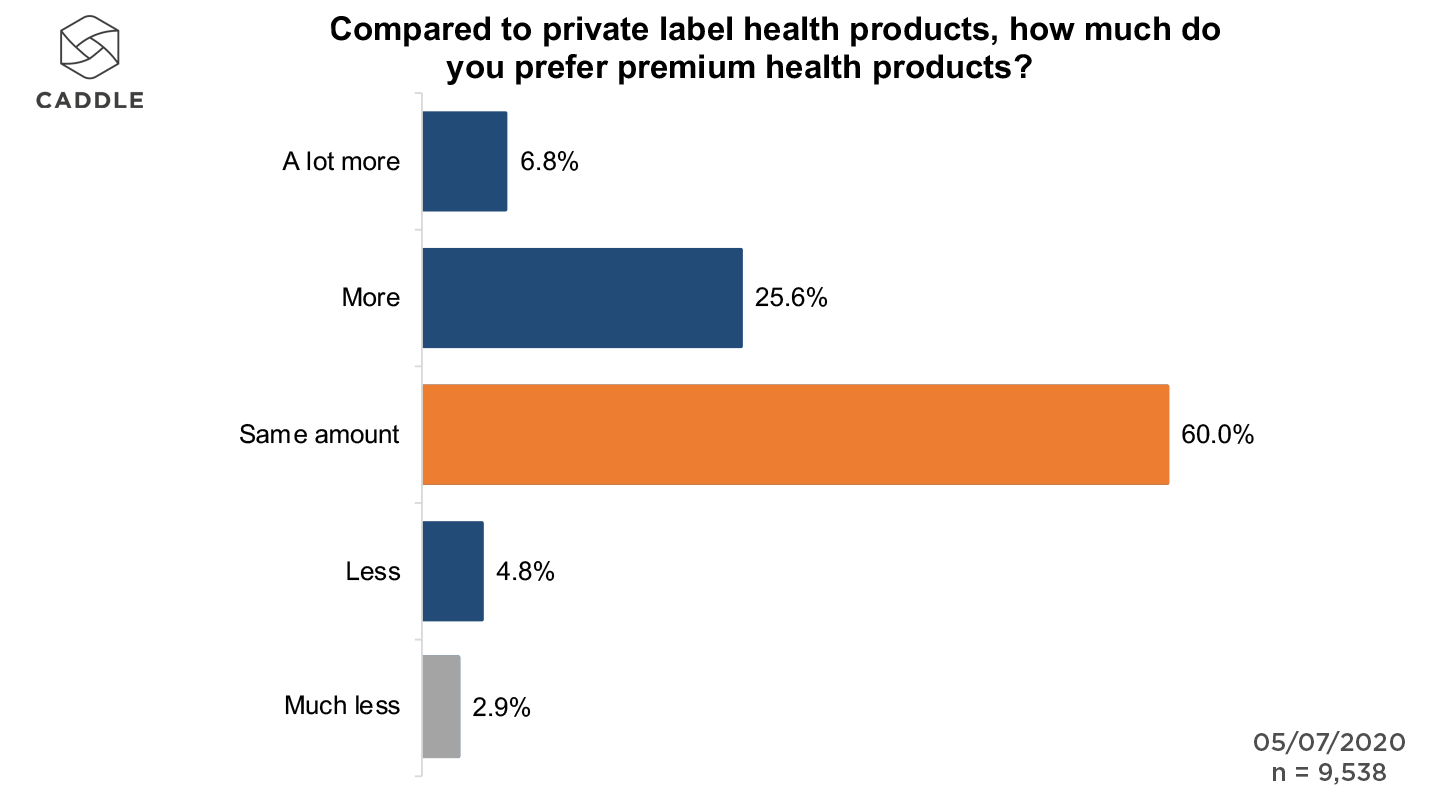

While upwards of 46% of consumers agree that a health brand’s reputation plays a role in their purchasing decisions, 60% of those same Caddle users argue that private label SKUs are just as good as premium-brand health products.

At the same time, premium products don’t seem to sway consumer preferences: Respondents are equally as likely (35.6%) to try new products to improve upon their health concerns as they are unsure (37.3%). (The most likely to try new health and wellness products? Millennials. And the least likely? The Greatest Generation, who perhaps are hesitant to spend money on untested products.)

Health product consumption extends to cannabis-based products, too: Since the onset of the pandemic, cannabis users on the Caddle panel have reported a slight increase in consumption; just over 25% told us that their usage had increased, compared to about 16% who reported a decline in usage.

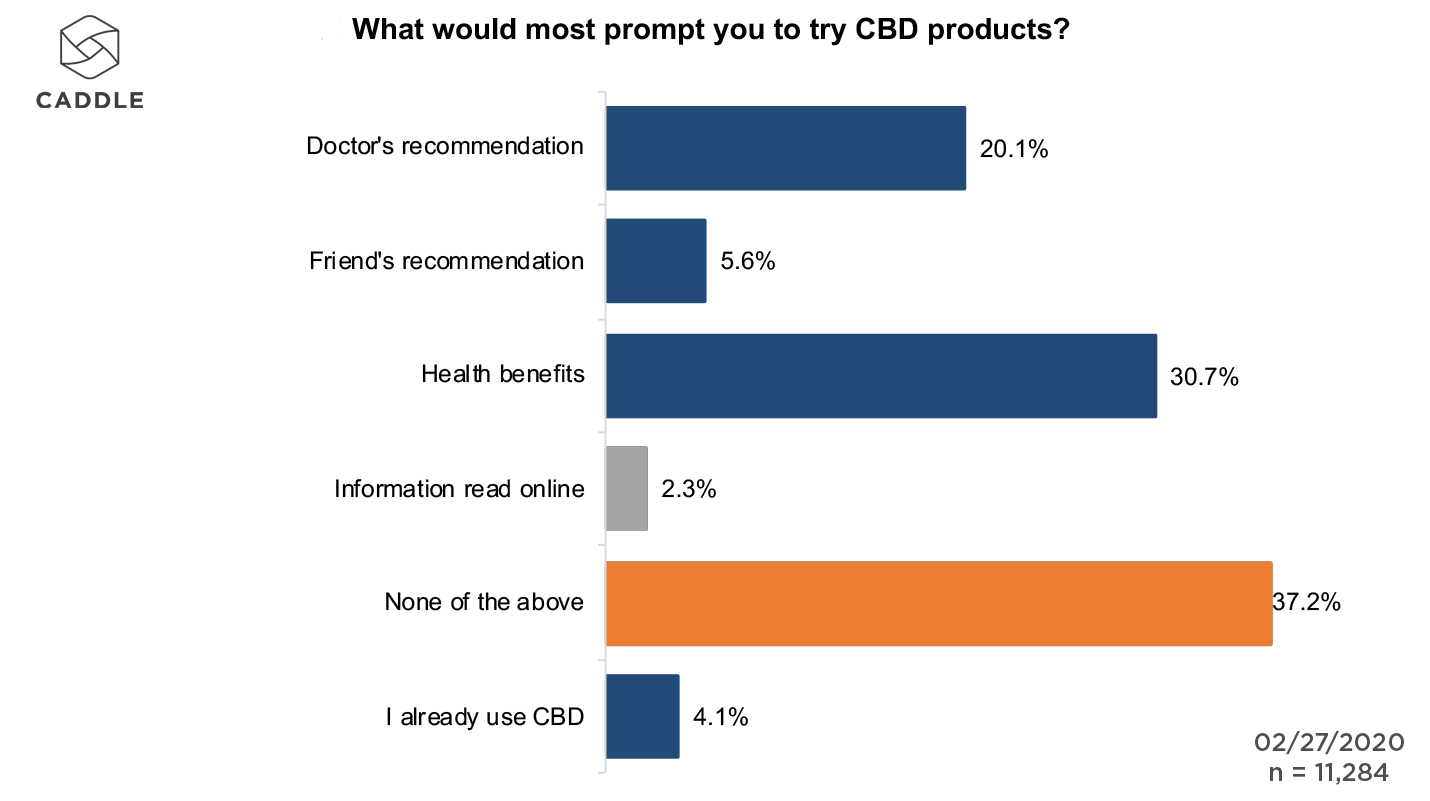

When asked about the key factors that would prompt people to try CBD products, health benefits came out on top (at 30.7%), followed by doctor’s recommendation (at 20.1%).

This suggests that more Canadian consumers now look to cannabis-based products as an alternative but equally efficacious supplement that’s capable of improving their overall levels of health and wellbeing.

KEY TAKEAWAYS

COVID CONTINUES TO IMPACT CONSUMER WELLBEING (AND THAT’S AFFECTING PEOPLE’S EVERYDAY HABITS)

Amid ongoing concern for their physical and psychological health—as COVID case numbers rise and fall daily across the country—the majority of Canadian consumers are taking proactive measures to improve their overall health and wellbeing.

Whether they’re amping up their exercise regimens, seeking out more healthful food choices (including changing the composition of their diets and cooking at home more frequently), or enhancing their diets with health supplements, more Canadians are taking steps to look after themselves while continuing to social distance.

CANADIAN CONSUMERS ARE MAKING MORE HEALTHFUL FOOD CHOICES (AND IT’S EXPECTED TO STICK IN A POST-COVID WORLD)

With more shoppers now prioritizing product quality, freshness and “shop local” sourcing via farmers markets, it shouldn’t come as too big a surprise that Canadians are shifting away from predominantly animal-based meals and taking a greater interest in plant-rich diets. At the same time, they’re cooking more of their meals at home

While it’s unclear if cooking from home offers greater health benefits, or users are simply avoiding take-out or other meal solutions because of concerns over contamination (or for any number of other potential reasons), the retail sector can gain a stronger share of consumer budgets by catering to the at-home chef who’s looking for healthier food option, now and as COVID restrictions ease.

SUPPLEMENTATION IS A VIABLE METHOD OF MAINTAINING CONSUMERS’ HEALTH AND WELLBEING

A reported 80% of Caddle users use dietary supplements, and that number is expected to increase in the year ahead—particularly among consumers in the Prairie provinces. And while the premium nature of some health and wellness products doesn’t seem to sway consumers into increased purchases, brand reputation does.

This presents a novel opportunity for retailers and manufacturers alike to invest in strengthening the health and wellness claims on their products (both branded and private-label), to continue to drive consumer uptake through the tail end of the COVID pandemic and after.

COVID-19 Insights: Canadian COVID Concerns Rise as Stores Re-Open

52% express negativity about stores re-opening

With findings from mid-May indicating that COVID-19 has had a decidedly negative effect on Canadians mental health, we would expect to see shoppers eager to get back to their pre-pandemic ways of life—including heading back to brick-and-mortar stores to get their retail fix.

However, data from our 10,000 daily survey respondents suggests that Canadian consumers are still wary of stores re-opening if there’s any lingering concern over a COVID-19 resurgence.

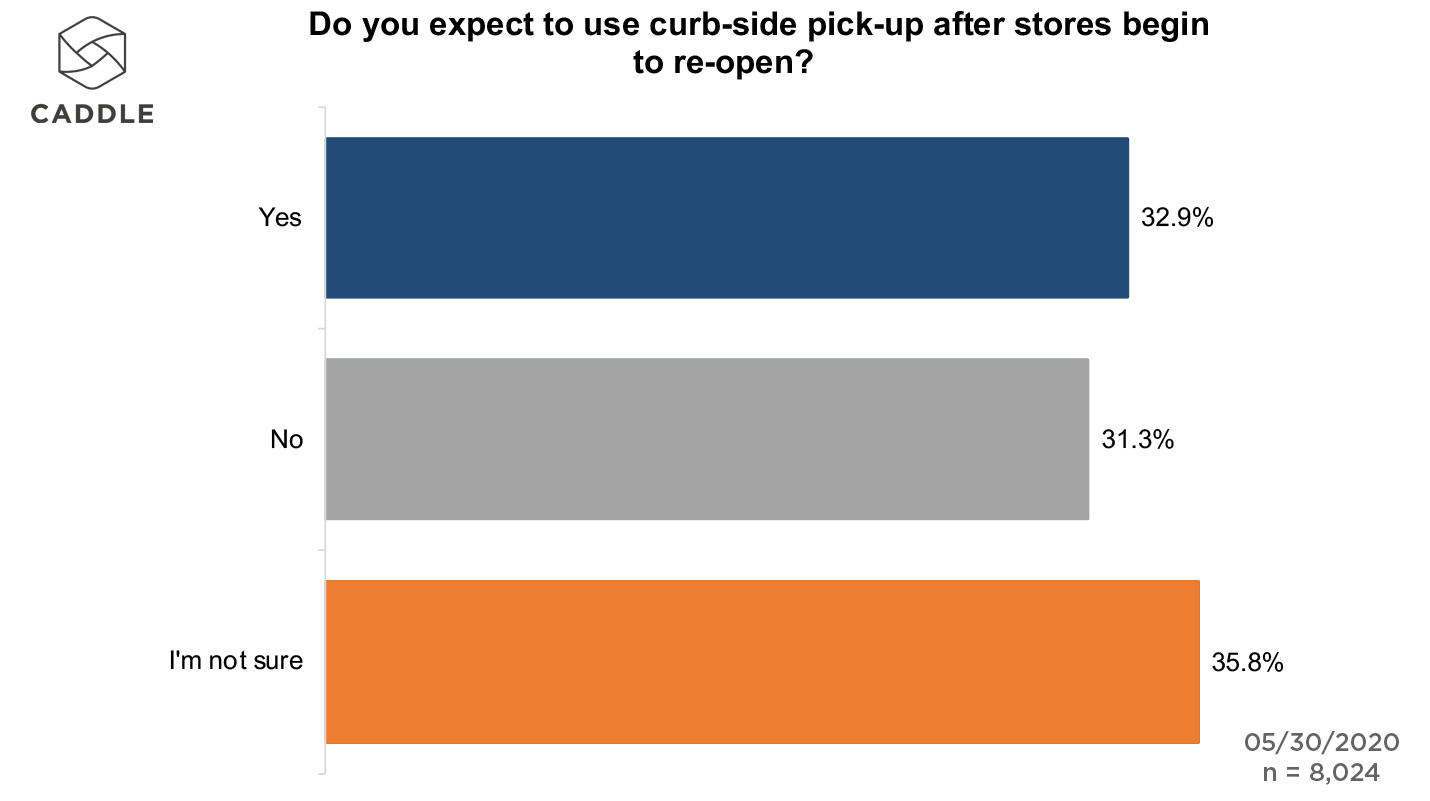

And that hesitation continues to have an influence on Canadian consumers’ shopping habits, with a third of respondents expecting to use curb-side pick-up services even after stores have re-opened.

Let’s dig into this week’s data in greater detail:

If you’re not already on the mailing list, sign up here for our free weekly summaries.

IS IT TOO SOON FOR STORES TO BE RE-OPENING?

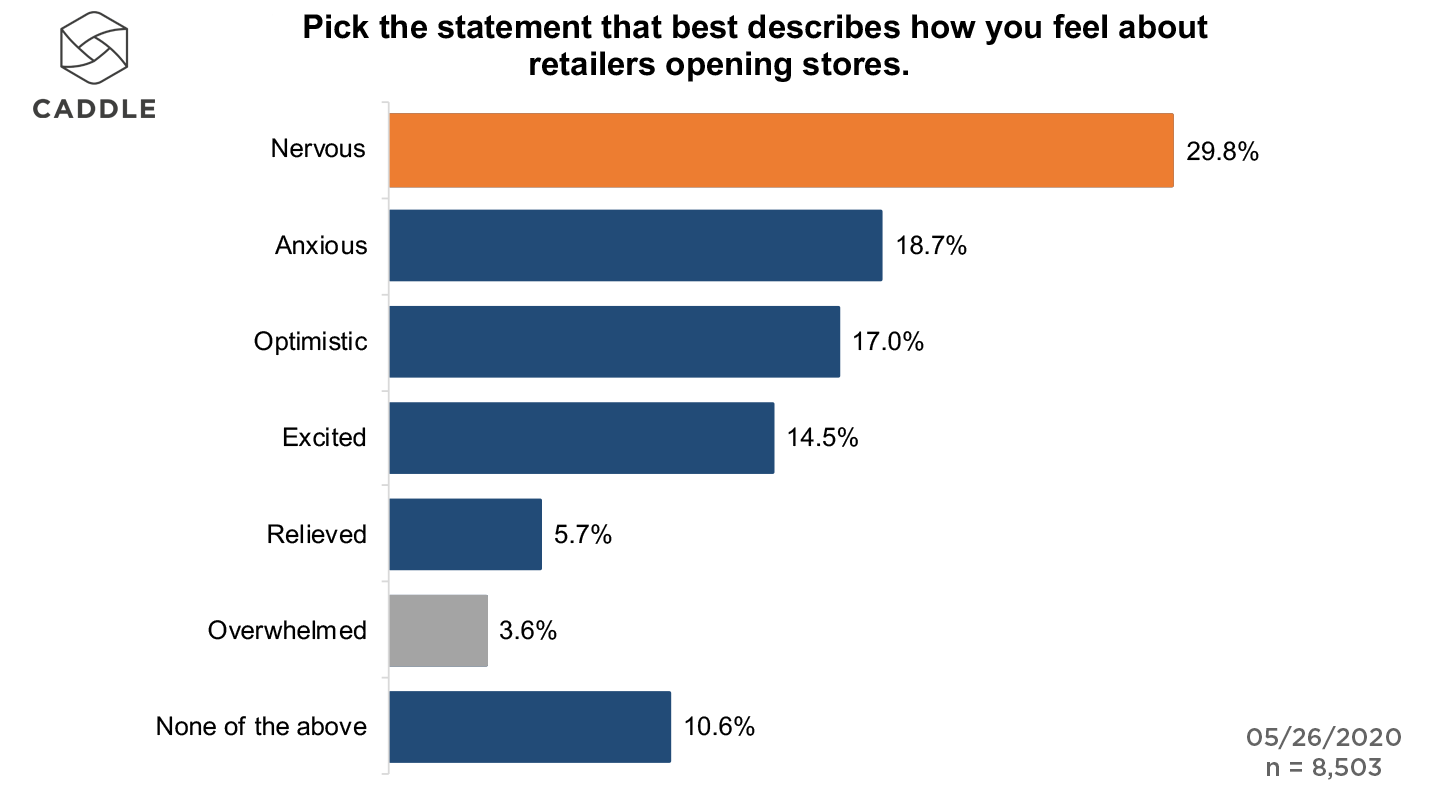

Based on our research, more than half of Canadian consumers have negative sentiments about the loosening of store restrictions: Almost 50% of respondents overall indicated they are “nervous” or “anxious,” while a further 3.6% are “overwhelmed” by the thought of retailers re-opening their stores while there’s still a threat of a COVID-19 resurgence.

In contrast, about 37% feel positive sentiments about retailers’ re-opening efforts.

These findings could be further indication of the negative impact that COVID has had on Canadians’ mental health. Yet, when we look deeper into this week’s results, it’s clear that other factors are at play as well.

WHAT’S HOLDING CONSUMERS BACK IN THE RETURN TO BRICK-AND-MORTAR RETAIL?

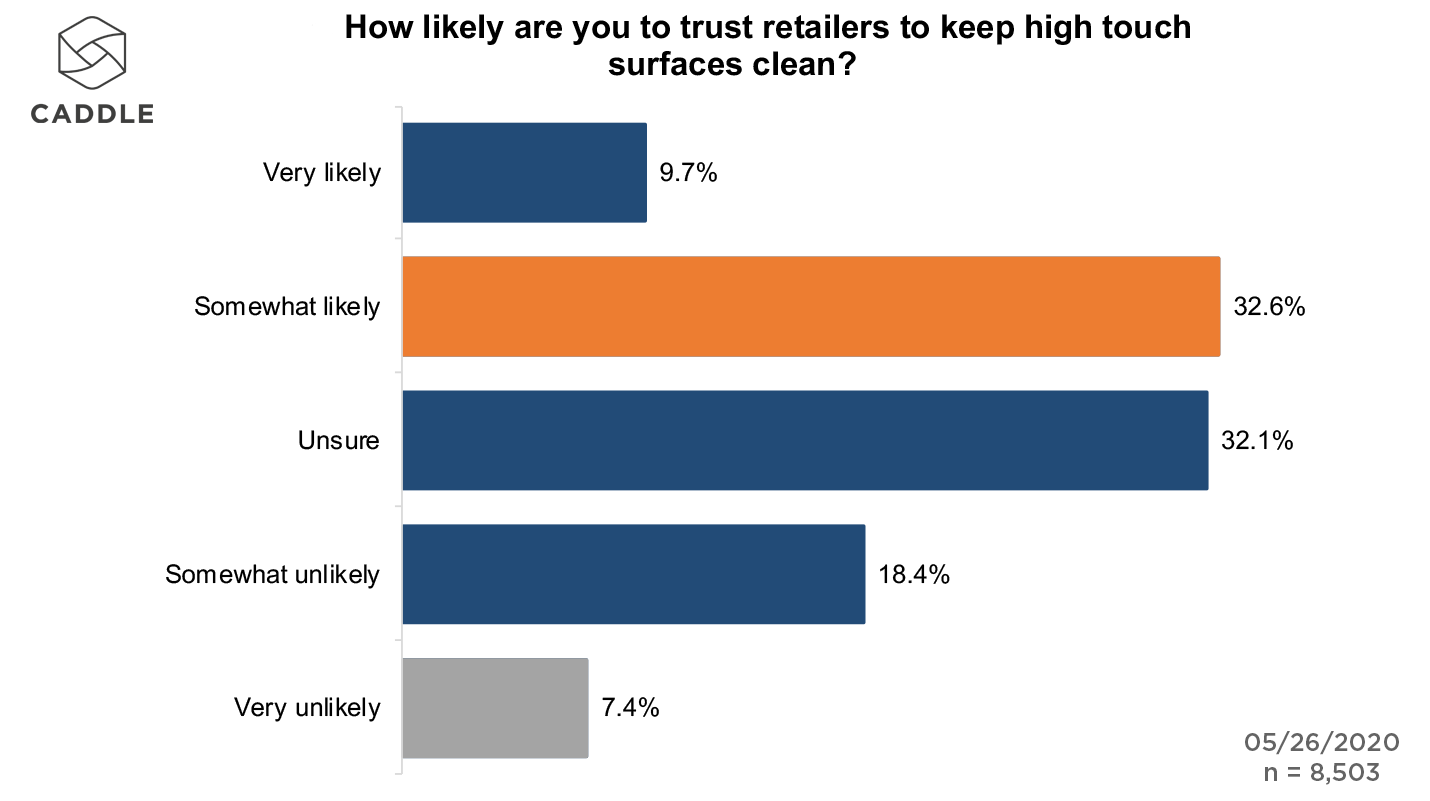

Cleanliness is one factor. In general, more than a quarter of respondents don’t trust retailers to keep high-touch surfaces clean.

Among these respondents, Millennials are least likely to trust retailers’ cleaning practices (28.5%), followed closely behind by Gen Zers (27%). Meanwhile, while Gen Xers (23%) and Baby Boomers (22%) are slightly more trusting overall.

With some consumers still leery of getting back to shopping in brick-and-mortar stores, it leads us to consider whether consumers will continue to favour online shopping—and in particular, curb-side pick-up options—even after legislation allows for progressive store re-opening.

WILL CONSUMERS STILL USE CURB-SIDE PICK-UP AFTER STORES RE-OPEN?

Based on our research, a significant portion of shoppers are satisfied with their curb-side pick-up experience, with 35% of Caddle respondents indicating that their most recent experience was “excellent” or “above average.” (Interestingly, New Brunswickers, Newfoundlanders and Labradorians skew even higher in their interest in curb-side pick-up, at almost 42% each.)

Yet, even so, consumers seem divided on whether they expect to use curb-side pick-up services after stores ease restrictions: About a third of respondents overall agreed that they would, while a slightly larger segment (36%) admitted that they were uncertain.

Among these respondents, Millennials are most likely to continue to use curb-side pick-up (38%), while Gen Zers and the Greatest Gen (born between 1900–45) are least likely (at 41% and 39%, respectively).

WHAT WOULD LEAD SHOPPERS TO ADOPT CURB-SIDE PICK-UP OVER THE LONG TERM?

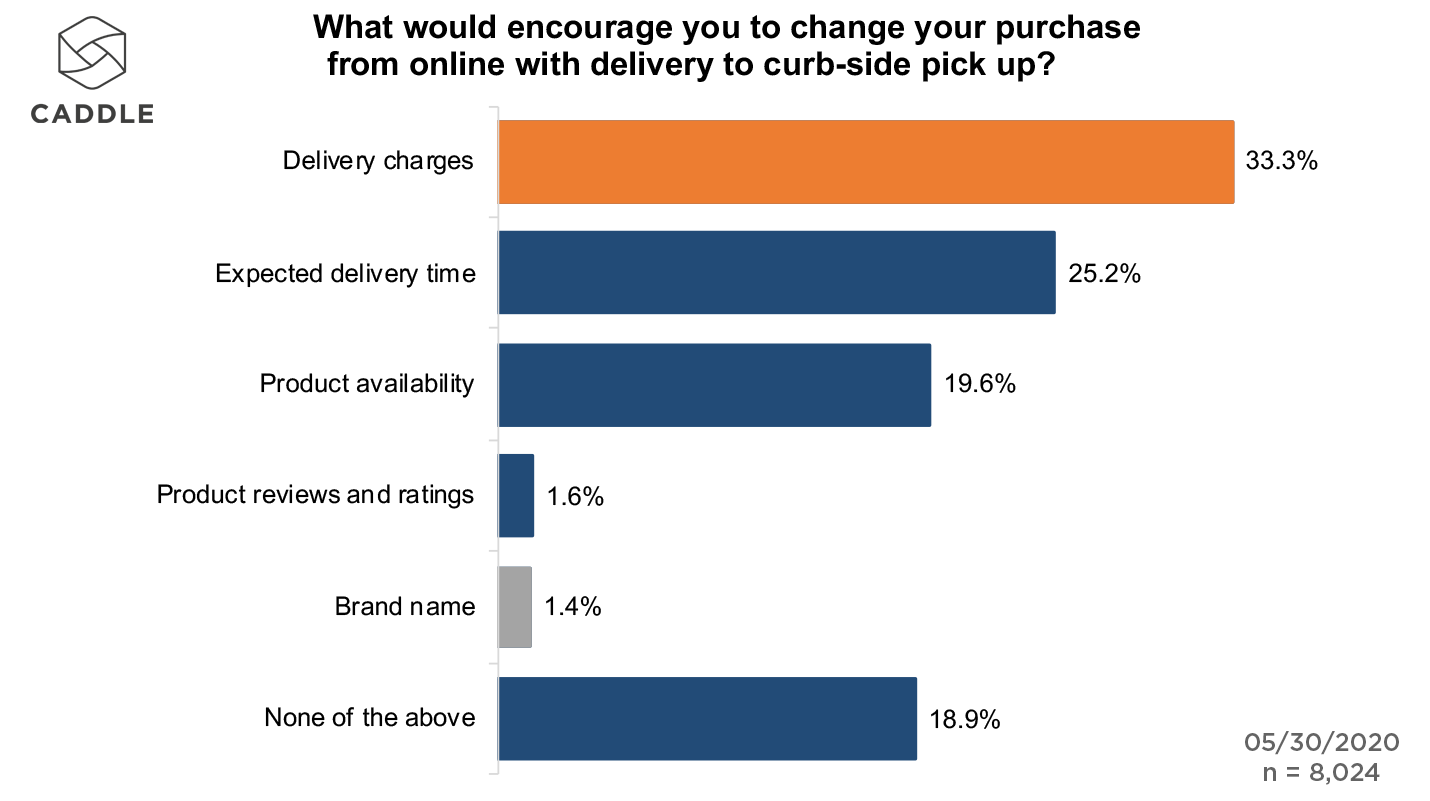

Faced with obstacles when using curb-side pick-up—including long wait times, lack of order accuracy, and length of time between placing and picking up orders—Caddle users identified several factors that come into influence their decision-making around using curb-side pick-up instead of online purchasing with delivery.

From delivery charges tacked on to digital orders (33%) and expected delivery time (25%) to inconsistent products being made available via the different services (almost 20%), it’s clear that retailers have an opportunity here to give consumers more of what they want from their shopping journey, whether that involves delivery to their homes, curb-side pick-up, or buy-online-pick-up-instore (BOPIS) as restrictions ease on brick-and-mortar visits.

If that’s the case, then, we’d expect to see increased consumer willingness to support retailers who are working harder to provide a better customer experience. Indeed, this extends to other pain points that consumers experience from click-and-collect and curb-side pick-up.

Take, for example, the product assortment available to shoppers during the COVID-19 lockdown: A quarter of respondents indicated that they’re unwilling to forgive brands who are producing more single-use plastic due to the pandemic’s safety precautions. (Quebecers are the least forgiving, at 35%, while respondents in the Maritime provinces and Canada’s northern territories are most forgiving.)

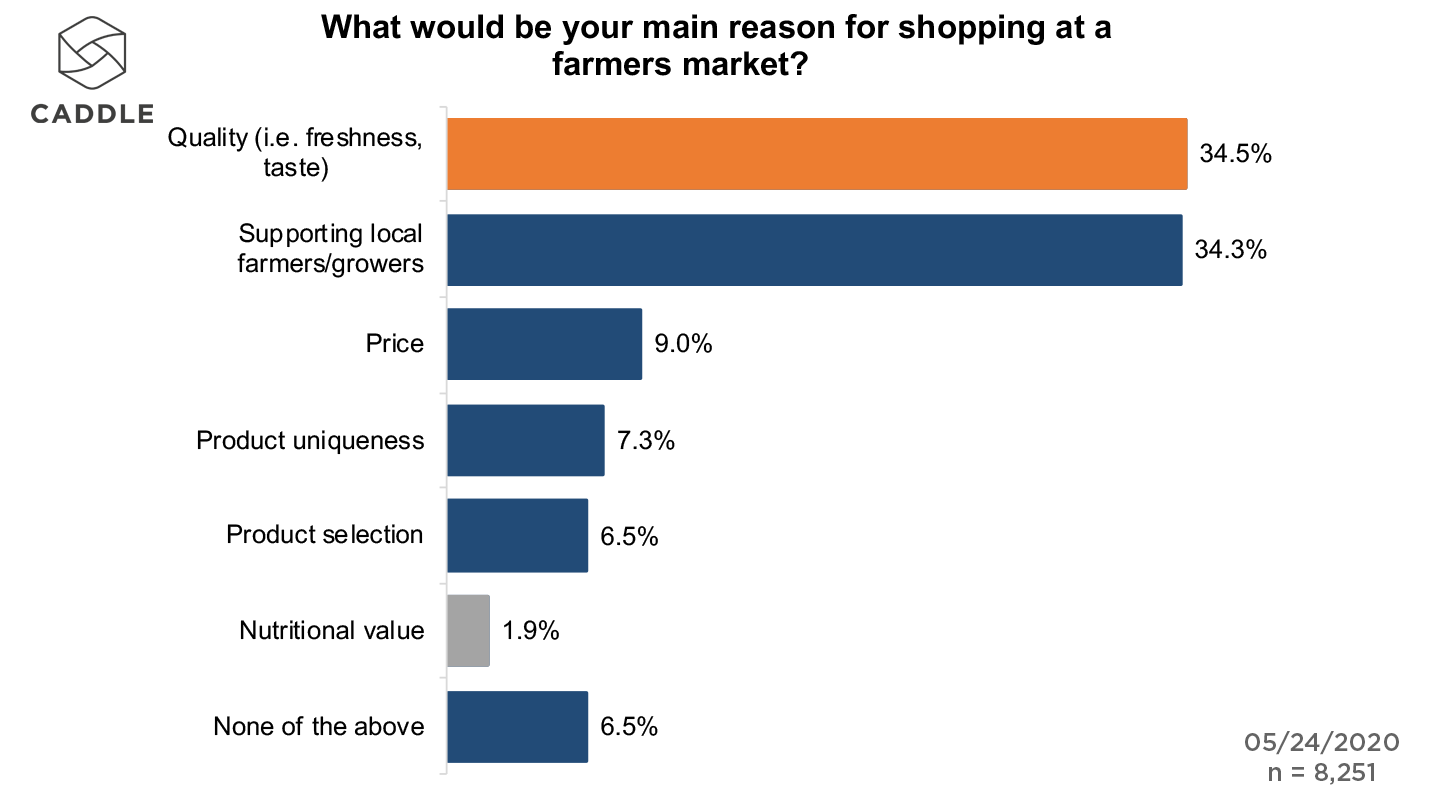

Further, product and service quality can be hit and miss with curb-side pick-up, which might explain why such factors as quality and the “shop local” trend each influence about 35% of Caddle respondents to shop at farmers markets, where “farm-to-table” freshness and seasonality are prioritized.

The question then is: What are the implications of ongoing COVID-19 restrictions on non-essential purchases?

HOW HAS THE PANDEMIC AFFECTED NON-ESSENTIAL PRODUCT PURCHASES?

According to our research, 50% of respondents have been forced to abandon a non-essential purchase due to COVID-19, and only 34% of those respondents who abandoned a non-essential purchase put that money in savings, while almost 25% plan to save the money until the purchase becomes available in the future.

With almost 72% of non-essential purchases coming in at an average of $0–300, we can conclude that retailers should expect a reasonable windfall of discretionary purchases to take place once consumers feel confident that the pandemic is firmly under control and stores begin to open up more broadly across the marketplace. (This is further supported by our findings from May 8, 2020, wherein 31% of respondents across our 9,273-strong sample indicated that they were planning an online shopping spree over the next month.)

KEY TAKEAWAYS

CANADIAN CONSUMERS ARE DIVIDED ON THEIR PREFERRED SHOPPING EXPERIENCE AS COVID-19 RESTRICTIONS EASE

Not all consumers are ready to head back to brick-and-mortar stores—especially those who have concerns about retailers’ abilities to keep surfaces clean during a potential resurgence of the pandemic.

A sizeable swath of Canadian consumers have taken up curb-side pick-up in place of in-store shopping, and a third of those shoppers expect to use curb-side pick-up even after stores begin to re-open—suggesting that retailers will need to be hypervigilant about delivering as many positive customer experiences as possible to keep consumers shopping in their stores, whether online or, as restrictions ease, in-store.

TRADITIONAL BRICK-AND-MORTAR RETAILERS CAN LEARN FROM LOCAL SELLERS

Shoppers who prioritize product quality, freshness and “shop local” sourcing are supporting farmers markets with greater frequency.

Traditional brick-and-mortar retailers can take a page from farmers markets’ playbooks, by prioritizing the quality and availability of their products and services, while also working to keep prices down (including delivery charges) and using less single-use plastics while doing so.

SOME NON-ESSENTIAL PURCHASES ARE BEING DEFERRED, BUT THEY’RE NOT NECESSARILY BEING CANCELLED FOREVER

Though a significant number of consumers have had to abandon non-essential purchases because of the pandemic, the dollars they would have spent aren’t necessarily going away for good. Instead, Canadian consumers have deferred those purchases—which means that retailers may see a return of non-essential purchases, as stores open up and greater product assortment hits shelves in the months to come.

Millennials in Eastern Canada are ready for eSports

20 years ago did you ever think that a 16-year-old would become a multimillionaire athlete just by playing video games at home? Me neither. If I knew that was how the future of video games was going to pan out I would have told my parents I was investing in my future by staying in bed playing video games all day.

The surge of eSports globally is projected by The Canadian Business Journal to be a $1.5 billion dollar industry in annual revenue this year alone. Which means for brands in Canada, the opportunity to invest and align in this industry is a huge one.

What is eSports?

For those of you new to the lingo, eSports is a form of online sports where multiple players compete against one another often in front of a spectating crowd – sometimes virtual crowds but also at live events held in big arenas or conference centres.

To give reference to how big the e-gaming industry is, 16-year-old Kyle Giersdorf won $3 million from winning Fortnite, a Battle Royal shooter game, in a single tournament alone.

With North America proving to be the biggest revenue market for eSports, there is a big opportunity for brands in Canada to capitalize on this market, in more ways than one.

So who is watching?

Our survey results suggest that Millennials are eSports ready

Instead of streaming the eSporting events via Twitch, an opportunity might arise for sport broadcasts to display the game on television. Caddle insights suggest that 24% of Millennial males in Canada would be interested in watching an eSports game on TV at a bar or restaurant.

Watch the Leafs win the Stanley Cup (vicariously through an eSports Tournament)

Ontario fans no longer have to be disappointed to see the Leafs get cut from the playoffs for another season.

Ontario Millennials showed an over-indexed interest (26%) in watching eSports at a bar or restaurant. Perhaps now they could have the hope of watching the Leafs win the Stanley Cup virtually, if not in reality.

Are Habs fans interested in eSports too?

With how the Canadiens season is going this year, Quebec millennial males might be trading in their actual team for a virtual viewing experience; these Quebecers (36%) show an interest in watching eSports at a bar or restaurant which continues to suggest an opportunity for brands to tap into eSports viewing outside of the home.

Opportunities for eSports in 2020

Hockey aside, data suggests millennials in Eastern Canada want to watch eSports from the comfort of their local watering hole.

So, what does that mean for your brand?

Here’s are some opportunities to align your brand to eSports in 2020:

- Sponsoring eSporting events and aligning your brand through media exposure

- Activating at bars/restaurants to engage captive eSports consumers

- Advertising your brand during eSport related events and passion points

- Partnering with female gamers to generate diversity and inclusion

- Working with platforms like Twitch to leverage eSports creators and influencers to co-create content for your brand

Green business sells: how to increase brand awareness

It seems like our phones are rising in notifications about climate change just as fast as global temperatures are rising. From Greta Thunberg to the Australian Wildfires the constant reminder about how our planet is in a global crisis is almost unsurprising at this point.

Climate change is a very real and topical conversation that is happening among the world right now and Canadians are particularly feeling the heat.

How does climate change affect Canada?

With the rise in global temperatures, our nation has experienced a higher rate of warming than most other regions of the world and this appears to be affecting Canadians personal lives in one way or another.

From a pool of over 10,000 respondents, Caddle conducted a Rapid Research survey about Canadians thoughts towards climate change. The results – 63% of Canadians agreed that climate change has impacted their way of life. Additionally, social media is a significant contributing factor to Canadians awareness about climate change and is a primary source for their education on the topic:

- 37.8% of Canadians say that social media plays a significant role in keeping them up-to-date about climate change

- 55.7% of Gen Z’ers say social media plays a significant role in keeping them up-to-date about climate change

- 39.2% of Millennials say social media plays a significant role in keeping them up-to-date about climate change

Smart brands are shifting towards becoming eco-friendly companies to raise awareness about climate change and to make a tangible difference. Sharing these changes over social media can help a brand change perception and build affinity with today’s consumer and increase brand awareness.

Our solutions can help provide you with the insights you need to promote green businesses (without greenwashing) that will benefit both your brand health and the health of the planet.

Here are a few of our favourite brands going green and the social buzz they’ve stirred:

Eco-friendly companies: Seventh Generation

This laundry detergent company is taking a different route to the traditional spin cycle and is promoting green businesses through online branding.

By using the hashtags #ComeClean and #GenerationGood their creating conversations about going green with ingredients and packaging. Since then, the company has received numerous awards for dedicating to helping the environment.

Eco-friendly companies: Patagonia

You’d hope an outdoor apparel company would be an eco-friendly company. Despite admitting that they have used fossil fuels in the past, Patagonia has promoted eco-friendly initiatives to their customers, employees and mission statement.

Additionally, take a look through their online branding on Twitter and you’ll see environmentally conscious content riddled all over their feed.

Eco-friendly companies: TOMS

The popular shoe brand isn’t just supporting those by donating a portion of their sales to children who can’t afford shoes, but they’re also increasing brand awareness with the environmentally-conscious EARTHWISE products.

On their social platforms, you can learn all about how their products are eco-friendly.

Eco-friendly companies: [Insert your brand name here]

So we’ve shown you that Canadians feel affected by climate change and look to brands who are more eco-conscious and inform them over social media.

It’s time you put the social in corporate social responsibility and tell consumers what contribution you are making as a brand, and help educate and inform them about our planet.

At Caddle we can provide you with the insight solutions you need to best promote your eco-friendly business through online branding and rank among top leaders who are also contributing to the cause.

If you want to learn about how you can do that, drop us a line here.

If you would like to see the report from the insights we found, let us know here.

Or, if you’d like to contribute a question to this topic, let us know here.

Younger generations are most at risk for mental illness: 4 ways brands can help

Bell Let’s Talk is a campaign that most Canadians (and most brands) are familiar with by now. And if you don’t know, it promotes and supports mental health awareness by encouraging Canadians to share their battle with mental illness amongst fellow Canadians. And it’s been effective: over 86% of Canadians reported that they are more aware of mental health, due directly to Bell’s initiatives.

But Bell can’t do this alone. A Google Trends search suggests that the conversation is quickly started and then forgotten shortly after.

More and more Canadians are suffering from mental illness and this is a conversation that can’t be remembered for one day out of the whole year. This calls action on brands to join forces in sustaining the conversation around mental health.

We created a conversation about mental health with our Canadian panel and here’s what we found. This data can help shed light on how Canadians feel and further probe what brands need to do to take action on mental health.

Why is mental illness a problem?

Mental illness is a condition that can strike us all. The Canadian Mental Health Association reports that almost half of those who have suffered from depression or anxiety have never gone to see a doctor. Additionally, suicide accounts for 24% of all deaths among 15-24-year-olds and 16% among 25-44-year-olds. This is concerning considering that mental illness is widely stigmatized which presents a barrier for seeking help.

To delve deeper on this topic, we asked our Canadian panel of over 10,000 respondents their well being and these were the results.

Canadians are suffering from mental illness

- 70% of respondents said they or someone close to them suffer from anxiety

- 61% of respondent said they or someone close to them suffer from the blues (i.e., feeling sad, helpless)

Younger generations over-index on mental illness

- 73% of Millennials said they or someone close to them suffer from anxiety

- 80% of Gen Z’res said they or someone close to them suffer from anxiety

- 64% of Millennials said they or someone close to them suffer from the blues

- 78% of Gen Z’ers said they or someone close to them suffer from the blues

Despite this being such a heavily weighted topic, there are simple and effective ways that brands can help reduce feelings of anxiety and depression for their consumers.

How brands can combat mental illness and support health and wellness

According to the Global Wellness Institute, “wellness” is connected to weight loss, but consumers feel differently. They associate wellness with the mind, body and spirit. So how can brands jump at this opportunity even if they’re not associated with the health and wellness industry?

You’ve already seen how Bell Canada contributed to health and wellness by creating awareness about mental illness, but The Strategy points out a few other opportunities that brands can consider.

No. 1 – Natural materials

Including natural elements like wood, moss walls, and copper help the consumer feel soothed by being surrounded by “nature” so to speak. That is why you often see these elements in various retail stores.

No. 2 – Multi-sensory wellness

Soothing the senses has also proven to be a benefit for the consumer. By creating calming sounds and having quieter spaces have benefits of reducing anxiety.

Well Building Institute even took the simple route of having softer lighting in their buildings.

No. 3 – Minimalism

Packaging that is busy and in your face can bring added stress and results in choice paralysis for consumers. By taking the simplistic route on packaging, consumers don’t feel so pressured about purchasing products.

No. 4 – Partnerships

If changing your brand strategy isn’t on the agenda any time soon, then partnering with mental health organizations and generating a conversation about mental health could be an even more impactful opportunity to combat illness.

Over the years, several brands including Instagram and TheLADBible have taken this route and seen beneficial results.

How will your brand fight mental illness?

Truthfully the opportunities are endless. From small adjustments in your brand strategy to partnering with mental health organizations, your brand has the potential to help combat mental illness amongst generations young and old.

If you’d like to see the data we used let us know here and we’ll send you the full report.

If there are questions you want answered about this topic, drop us a line here.

Want to learn more about our capabilities? Let us know here!

Fitness junkies are interested in cannabis. Like, really interested

The stereotype of the lazy stoner sitting on the couch munching on a bag of chips might be finally over.

With the recent legalization of marijuana more conversations are had about how cannabis can improve one’s athletic performance. The pre and post-workout benefits have been lighting up.

Benefits include:

- Greater motivation and excitement when it comes to exercise

- Lower body fat index

- Better mental health and pain relief post-workout

Even microdosing can help users stay focused and beat personal records.

With cannabis being new to the market, this creates opportunities for those who are trying to include cannabis into their niche.

After asking our Canadian panel their thoughts on marijuana and fitness, we may have just found opportunities for:

1. Athletic brands who are trying to lead innovation

2. Cannabis brands who are trying to enter the market

Here’s our data.

Fit Canadians are interested in the devil’s lettuce

*Canadians who said exercise plays a “very large” role in their life*

- 37% of respondents are interested in consuming cannabis to improve athletic performance

- 24% are very interested

- 12.5% are somewhat interested

- 42.9% of Millennials are interested in consuming cannabis to improve athletic performance

- 29.7% of Millennials are very interested

- 14.2% of Millennials are somewhat interested

- 48.2% of Gen Z’ers are interested

- 37.9% of Gen Z’ers are very interested

- 10.3% of Gen Z’ers are somewhat interested

*Canadians who said exercise plays a “large” role in their life*

- 30% of Canadians are interested in consuming cannabis to improve athletic performance

- 8.7% are very interested

- 21.6% are somewhat interested

- 36.4% of Millennials are interested

- 10.2% are very interested

- 26.2% are somewhat interested

- 49.4% of Gen Z’ers are interested

- 21.2% are very interested

- 28.2% are somewhat interested

Cannabis could be rolling its way to athletics

So we’ve discovered a potential market fit. But how can you jump at this opportunity? Our solutions can gather data specific insights to your brand and how it fits in the cannabis-athletic industry.

Here’s what’s been going on currently in the cannabis-athletic space.

Cannabis balms for soreness and joint point

Dixie Elixirs offers a line tailored specifically for athletes who are looking to use marijuana for recovery from soreness and joint pain. Their products include balms, bath soaks, lotions, and more. Additionally, these products are promoted as natural and less harmful to the body than over-the-counter products like Advil or Icy hot.

Cannabis-infused Gatorade?

Cannabis producer Canopy Growth recently acquired a 72% stake in BioSteel Sports Nutrition. BioSteel currently produces sports proteins and hydration mixes. With their partnership and Canopy Growth’s recent announcement to launch cannabis drinks this month, perhaps we can expect to see cannabis-infused athletic drinks in a short period of time.

How can you incorporate cannabis into your brand?

Research suggests that there are benefits to consuming marijuana both pre and post-workout for active individuals. Additionally, industry leaders both in the cannabis and athletic realms seem to see the value in this opportunity and are partnering in creating innovative products.

Our insights suggest that there is a market for this in Canada. If you want to know how your brand can fit in this space or which demographics to market to, we can deliver you the insights you need to make better decisions, faster.

If you’d like to see the data we used let us know here and we’ll send you the full report.

If there are questions you want answered about this topic, drop us a line here.

Want to learn more about our capabilities? Let us know here!