Cultivating Success in the Canadian Cannabis Business

Exclusive Cannabis Report 2021

Published on February 1, 2021

Caddle is launching our eagerly-awaited comprehensive report on Cannabis: Cultivating Success in the Canadian Cannabis Business

What’s inside:

- How consumers perceive cannabis

- Deep insights into consumer need states

- The next big cannabis retail opportunity

- and much more!

Are you looking for insights on the Canadian Cannabis market? Is your company in need of innovation? How does your Cannabis brand stand out amongst competition?

Engage with 18,000+ monthly active cannabis users (including 6,000+ daily active cannabis consumers) and get the insights you need to make decisions, faster! See details about our 18,000+ Cannabis Panel here.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Sign up to our email list to get more exclusive first access to Caddle Insights!

CPG Bites: Taste is Key to Sparkling Waters' Success

Sparkling water is prime to compete for beverage of choice when relaxing at home

Published on January 18, 2021

According to Statista.com,

Retail sales of plain sparkling water amounted to around $555.64 million CAD ($435.7 million U.S.) in Canada in 2018, making it the most popular type of carbonated water. Sales of flavoured sparkling water are, however, expected to outperform sales of plain sparkling water in coming years in Canada.

RETAIL SALES VALUE OF SPARKLING WATER IN CANADA FROM 2015 TO 2022

BY TYPE (IN MILLION U.S. DOLLARS)

SO, WITH THE RISING DEMAND, WHAT DID CADDLE FIND OUT ABOUT CONSUMPTION? 50% of consumers said they have never consumed flavoured sparkling water, while 23% consume sparkling water daily or multiple times per day.

Brands have one question in mind: What factors make a good flavoured sparkling water?

Taste/flavour is the clear deciding factor when it comes to why consumers drink flavoured sparkling water, followed by low calorie count. 1 in 3 consumers selected taste/flavour as most important when selecting a sparkling beverage

Only looking at the consumers that drink flavour sparkling water, we dove into when they consume it most, and here’s what we found: 54.9% said when relaxing at home, 9.9% said when out and about, 8.9% said when eating out, 8.5% said while working, and 8.3% said at an event or social gathering. This held true among all demographics. (n = 4,756)

Main Takeaway?

BRANDS BUILT ON TASTE WILL WIN IN THE LONG-TERM.

See more research-based insights from Caddle here.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle insights? Sign up to our mailing list below!

Amazon Prime Stealing More Share of Canadian Wallets

Prime Day Scoops Holiday Sales Much Earlier

Published on January 14, 2021

Due to high demand, we turned this into a white paper! Download the free report here.

Growing from a Bellevue, Washington garage–based online marketplace to a worldwide omnichannel eCommerce behemoth in about 25 years is no mean feat. But leave it to former Wall Street executive and “richest man in modern history” Jeff Bezos to make it happen.

In 2019, the omnichannel powerhouse was responsible for close to half of all eCommerce dollars in a high-spending U.S. market. What’s more, the company registered its most profitable quarter ever in the three months ended September 30, 2020, as North American revenues increased by 39% YOY amidst the pandemic-driven surge in online shopping. Meanwhile, quarterly net income reached a whopping $6.33 billion (an increase of 196.7% over Q3-2019).

A core group of Amazon shopping devotees contributes to this massive revenue haul—with an average of more than 200 million unique visitors to Amazon sites each month (for comparison, that’s near-equivalent to the population of Brazil, the fifth most populous country in the world).

But it’s the estimated 150 million+ Amazon Prime members around the world (up from 100 million in April 2018) who typically spend the most—

over $1,000 per year, according to recent stats. Said Bezos in his Q4-2019 earnings statement, “Prime memberships continue to get better for customers year over year. And customers are responding—more people joined Prime this quarter than ever before… We’ve made Prime delivery faster—the number of items delivered to U.S. customers with Prime’s one-day and same-day delivery more than quadrupled this quarter compared to last year.”

Even with the shift of their largest annual promotion, Prime Day, from July to October 2020, Amazon sales continue to grow, as do membership numbers; many say that’s in great part due to COVID-19 pandemic restrictions, combined with the perceived and real benefits of membership (including lower relative pricing, broader product assortment and delivery options, and availability of product reviews).

In today’s blog post,

we pull back the curtains on the sales juggernaut that is Amazon, to look specifically at the influence of Amazon Prime on sales in the Canadian marketplace.

With a 10,000-person Daily Panel reaching all age groups and regions across Canada—nearly half of whom are currently Amazon Prime program members—we’ve gathered key data points that you won’t find anywhere else on this key segment of omnichannel shoppers, including:

-

membership numbers and demographic characteristics

-

likelihood to join and/or renew

-

the value of different Amazon Prime services and benefits

-

how shopping behaviour is influenced by Prime membership—particularly spending and search habits around holiday shopping

-

and more.

Let’s dig into the data to learn more.

WHO ARE CANADA’S AMAZON PRIME MEMBERS?

As in the U.S., younger people are more likely than their elders to be Prime members. Specifically,

Canadian Millennials are 15% more likely to be Prime members than Baby Boomers, and are among the top 2 age groups who have been Prime members for 2–5 years (surpassed only by Gen Xers by 1%).

Putting this into context: As we learned in our COVID-19 report, “The Great Divide: One Country, Multiple Cohorts,” though Millennials and Gen Zers are nearly 2x more likely than Baby Boomers to make luxury purchases to keep their spirits up, they’re also far less prepared to support themselves should their regular incomes dry up. Thus, the fact that Millennials predominate among Canada’s Prime members makes sense, as younger, digital-native Canadians are more likely to search for online deals, and Prime membership comes with a host of budget-conscious perks, including “fast, free delivery on millions of items.” (Further incentive: student memberships are discounted by 50% and they also get a free 6-month trial.)

Interestingly, among those self-identified Prime members (n = 3,859), 11% use another person’s account to access member benefits, including a significant percentage of Millennials and a lesser but still significant degree of Gen Zers. This perhaps suggests that younger members are in fact benefitting from their parents’ accounts and/or shopping budgets.

WILL PRIME MEMBERSHIP CONTINUE TO CLIMB IN CANADA?

If you are not currently an Amazon Prime member, how likely are you to join in the next 6 months?

Signalling the continued growth of the program—among Amazon Prime non-members, 29% are “somewhat likely”/”very likely” to join in the next 6 months.

And once again, younger Canadians indicate higher receptiveness to joining the Prime program than older generations: Gen Zers over-index against the general population by about 10% (compare this to Canadian Baby Boomers, who under-index by about 10%).

WHAT FACTORS INFLUENCE PRIME MEMBERSHIP?

In a time of hoarding behaviour and product shortages, fulfillment issues and locked-down brick-and-mortar shopping opportunities due to the COVID scare, three interconnected factors seem to matter most to Prime members—pricing, convenience, and breadth of offering.

Factor #1: Pricing

Without a doubt,

price is one of if not the primary consideration when Canadians make purchases through Amazon, followed by product reviews (59%) and product descriptions (41%).

(Note: This is consistent with American consumers, 82% of whom list pricing as an important shopping consideration.)

What do you consider when purchasing a product on Amazon?

(select all that apply)

Interestingly in this case, Gen Xers and Baby Boomers slightly over-index on price as a consideration (at 82.5% and 81%, respectively), as do Maritimers (81–89%) with the exception of Prince Edward Islanders, British Columbians and Manitobans (81% each). Meanwhile, Millennials demonstrate marginally more interest in the “Subscribe and Save program” than the general population, as do Albertans, Ontarians, Prince Edward Islanders and Saskatchewanians (all at 12% each).

What factors do you consider when you shop on Amazon? (select all that apply)

Aside from purchasing a product for yourself, why are you most likely to visit Amazon?

This is reinforced by other Daily Panel results, where more than two-thirds of consumers consider price when shopping on Amazon (n = 8,497) and nearly 40% are likely to visit Amazon to compare product prices before making a purchase (n = 7,493).

Factor #2: Convenience (including free delivery options)

Convenience is king for just over half of participating Prime members—especially when it relates to “free same-day delivery”—ranking above any other reasons to have an Amazon Prime membership.

What is the main reason you have an Amazon Prime membership?

What Amazon Prime membership benefit(s) do you use? (select all that apply)

This is consistent with other Caddle findings: When asked of the member benefits they used, 61% of current Amazon Prime members ranked “shipping perk” at the top, second only to Prime Video by 10 points. And, in a Daily Panel survey from Dec. 13, 2020, nearly one in two consumers identified “shipping times” as a factor when shopping on Amazon. (We’re not surprised, mind you, as “flexible delivery options” is one of the features that Amazon hangs its hat on.)

Overall, younger Canadians lead the charge on convenience, with Millennials and Gen Zers making up the bulk of consumers who are interested in the variety of delivery options offered by the program.

With such consistent results on this measure, it’s feasible to consider that because digital-native consumers have access to so much information 24/7 via their smart devices, they’re looking for instant gratification (“I want what I want when I want it!”) and are thus less open to waiting for their purchases to arrive. In contrast, older generations—who we’ve learned are also less likely than younger demographics to make online purchases in general—have been conditioned to wait at least some of the time to receive their online shopping bounty.

Factor #3: Breadth of multi-channel platforms and features that no other retailer can match

While only about 20% of consumers identified Amazon’s various platforms as the main influencer in their current membership, almost three-quarters identified Prime Video as the top benefit of the program (Dec. 19, 2020; n = 4,577)—and other program features, including the Prime Music and Prime Reading, make up the remainder of the top 5.

This suggests that the omni-channel and omni-media nature of Amazon makes it an even more appealing and farther-reaching service than other retail-only platforms.

HOW HAVE THE PANDEMIC AND THE PRIME DAY DATE-SHIFT INFLUENCED SHOPPING BEHAVIOUR?

Has the pandemic prompted to you to become an Amazon Prime member?

About 20% of Canadian consumers were prompted to become Amazon Prime members due to the pandemic (and a further 30% were already Prime members before the pandemic hit).

Gen Zers were 13% more likely than Baby Boomers and 10% more likely than Gen Xers to become Prime members due to the pandemic, and Prince Edward Islanders, Newfoundlanders and Labradorians and Quebeckers were all more likely than the general population to join the Prime program because of the pandemic.

At the same time,

the pandemic has affected both purchase size and frequency on the Amazon platform: More than a third of consumers have increased the amount they purchase in addition to their frequency of purchasing on Amazon since the pandemic started.

What impact, if any, has the pandemic had on your Amazon purchase size vs. frequency?

Purchase Size vs. Purchase Frequency

Meanwhile, the shift of Prime Day from July to October didn’t seem to have kept Canadian shoppers away from spending their hard-earned COVID cash: While 43% of the general population had planned to participate in Prime Day in 2020, 37% identified that they did in fact shop on the special sales date (Millennials made up the largest group of Prime Day shoppers, at 30%, followed by Gen Zers, at 27%). And nearly the same percentage of consumers indicated that they weren’t affected by the change in date.

Consumers who planned on participating vs.

consumers who actually participated in Amazon Prime Day this year:

How did the change in date of Amazon Prime Day this year affect your purchase behaviour in general?

If you participated in Amazon Prime Day this year, what was the reason? (select all that apply)

Discretionary shopping was a clear driver for those people who took advantage of Prime Day deals—40% of consumers shopped for general holiday purchases, while another 38% shopped for early Black Friday deals.

KEY TAKEAWAYS

CANADIANS STILL HAVE MONEY TO SPEND AND AMAZON PROVIDES PRACTICAL BENEFITS FOR PANDEMIC-RESTRICTED SHOPPERS.

Amazon is committed to providing a consistent omnichannel shopping experience—perhaps most importantly, offering consistent shopping times that they deliver upon, time and time again.

If retailers are going to take a bite out of Amazon’s growing domination of the Canadian marketplace, they’ll need to improve the consumer experience they deliver post-sale. With more proactive communications around order and shipping status, reduced shipping time and consistency on all purchases, and a more customer-friendly return process, Canadian retailers would succeed in winning back customers who want to support local over multinational, and might also amp up their reputation in the process.

AMAZON PRIME DAY TOOK CONSUMERS’ PURCHASING POWER THIS PAST HOLIDAY SEASON

Undeterred by a shift in date, a significant proportion of consumers waited until Q3 to make holiday purchases. (This is an interesting counterpoint to earlier Daily Panel findings, which indicated that about 30% planned to start their holiday shopping in November.)

With this, it seems that once again, the benefits of Amazon Prime membership trump most other considerations in consumers’ shopping journey.

To compete against the Amazon Prime behemoth for a decent share of consumers’ holiday spend, retailers in Canada are going to need to plan even further ahead than they already were, getting their unique assortment in line while at the same time, improving their online fulfillment product mix in all warehouses, in order to make shipping times consistent across all categories—thereby easing the friction that many consumers have with online shopping closer to home.

Does Amazon’s sales volumes have you hungry to learn more? Reach out to us for more details on the Amazon Prime program and the customers that make it so successful.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle Insights?

Sign up to our email list!

CPG Bites: Is cereal a breakfast food or a snack food?

Redefining the Cereal Category

Published on January 5, 2021

According to IBISWorld,

There has been conflicting trends over last five years to 2020, hampering the Cereal Production industry in Canada. Demand has waned for cereal products as consumers shifted to pricier breakfasts as disposable incomes recovered. Moreover, as people returned to work, they had less time to prepare breakfast. Instead, Canadians opted to buy food at cafes or coffee shops, decreasing demand for cereal.

What’s more, diet trends are on the rise, with intermittent fasting being the most popular diet trend among consumers. 40% of consumers have already tried intermittent fasting, with breakfast being the most likely meal they give up. This may be the new cereal killer threatening the humble cereal category.

What does this mean for cereal brands?

Caddle asked the questions and here are the answers:

Have you heard the phrase: Good habits start in the morning? Well, Caddle found out that consumers who eat cereal for breakfast are stickier compared to consumers who eat cereal as a snack throughout the day.

HOW OFTEN DO YOU EAT CEREAL?

Habitual Cereal-ists

Cereal Snackers

But, are there any generational differences? Yes!

Gen Z snacks more than the average consumer:

- More than 14% of Gen Z cereal snackers consume daily

- Functional products are logical choice for innovation in cereals

- Gen Z are all about taste, but as consumers age, healthy options become more important

Generation Z

HOW OFTEN DO YOU EAT CEREAL?

Key Takeaways

People are asking more of cereal

1. “Cereal for breakfast” consumers remain the most lucrative for cereal brands

2. Healthier options & functional products are areas of innovation for the cereal aisle

So, is cereal a breakfast food or a snack food?

This is important because with increasing diet trends like intermittent fasting, the morning breakfast cereal occasion is likely to be threatened. Consumers have cereal playing the biggest role during breakfast, but younger generations, such as Gen Z, are letting cereal shine throughout their day as a snack food item.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle Insights?

Sign up to our email list!

CPG Bites: Post-Shower Rituals Support Body Moisturizer Sales

A product insulated from seasonality

Published on February 3, 2021

To help brands better understand the purchase factors when consumers buy body moisturizer, we asked our 8,000+ daily panel across multiple factors and here’s what we found out.

When it comes to frequency of usage, body lotion is truly an evergreen product in many Canadian households. Caddle’s daily panel says that body moisturizer is a staple skincare item they keep stocked up all year around. In fact, over 70% of Canadian consumers use body moisturizer on a weekly basis. What’s more, 40% of consumers use body moisturizer every, single, day!

According to Statista.com, hand and body moisturizers ranked in second place with sales of around $282 CAD million dollars.

When is body moisturizer most used?

Caddle found out that it’s less about the specific brand of body moisturizer, but more about the occasion in which consumers use body moisturizer.

As it turns out, body moisturizer is used most often right after the shower, leading as the No.1 occasion, more than 2x greater than the next best occasion – when skin feels dry.

Q: When do you use body moisturizer?

As a result, because body moisturizer is a product based on occasion rather than need-state, it is a product with strong insulation to seasonality and trends. This resilient personal care item is a product retailers can count on to continue to fly off the shelves.

What else goes into the consumer decision-making process in the personal care aisle for lotion? What attributes are consumers considering?

When it comes to decision factors, 48% of consumers consider effectiveness to be the most important, followed by price at 16%, and brand at 9%. As it turns out, 2 in 3 consumers spend less than $10 on moisturizer purchases on a monthly basis. While this personal care category only receives a small share of consumer wallets, that’s not to say this is a small product category, just a price sensitive one. What’s more, over 50% have more than 3 different brands currently in their household. This suggests the brand may very well be an afterthought when it comes to deciding which body moisturizer to purchase. Instead, consumers are making their purchase decisions based on effectiveness of the product.

KEY TAKEAWAYS:

-

Body moisturizer is a product everyone uses throughout the year, no matter the season or hottest beauty trend

-

Consumers are not brand loyal when it comes to body lotion

-

Effectiveness is the No.1 factor consumers consider when deciding which body moisturizer to buy in the personal care aisle

See how things have changed from one year ago.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle insights? Sign up to our mailing list below!

All-Natural & Sustainable:

What Canadian Parents Want for their Baby

Published on December 22, 2020

After our parenthood post , Caddle wondered what factors influence Canadian parents on their baby product purchases.

On November 30, here’s what we found:

1.

What labels are important when deciding what baby products to buy? (e.g. all natural, organic)

Over half of respondents ranked All-Natural and Sensitive as important labels when purchasing baby products

2.

Where do you get your information on what baby products to buy?

Over half the respondents get their information on baby products from friends/family as well as self-discovery (personal research)

3.

What would most influence you to purchase a new baby product based on environmental sustainability?

78% of consumers believe that environment sustainability is important, and the top 2 most influential factors of a new baby product being reusable packaging and paper-based packaging

Key Takeaways

All-natural and sensitive

are ranked as the most important labels to consider when purchasing baby products

Parents rely on word-of-mouth and personal search

to discover what baby products to purchase

Reusable packaging & paper-based packaging

are the most influential factors when purchasing a new baby product based on environmental sustainability

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle Insights?

Sign up to our email list!

Canadians' Parenthood Plans Continue While American Parents Dwindle

COVID-19 hasn’t stopped Canadians from planning for parenthood, but it has amplified the concerns of those wanting to have a child in the next five years.

Published on December 16, 2020

You’ve likely heard stories for years now about how Canada’s population is shrinking. Yet the latest population data indicates otherwise: Canada experienced a 1.4% YOY increase in the number of people living in the country in 2019—the highest growth rate since 1989–90.

Though this increase was driven mostly by immigration, it’s still noteworthy for several reasons: First, Canada’s growth rate is the highest among G7 counties and more than 2x that of the U.S. Second, these statistics were gathered months before the COVID-19 pandemic hit global markets. With this in mind, we wondered:

- Would all of the uncertainty around the pandemic colour Canadians’ perspectives around parenthood?

- If, pre-pandemic, people were planning on having children, would they still want to after experiencing the effects of the lockdown and other restrictions?

- And, what factors come into play in Canadian consumers’ parenthood planning?

Let’s dig into the results to learn more.

HOW MANY PEOPLE HAVE KIDS AND HOW MANY PEOPLE WANT THEM?

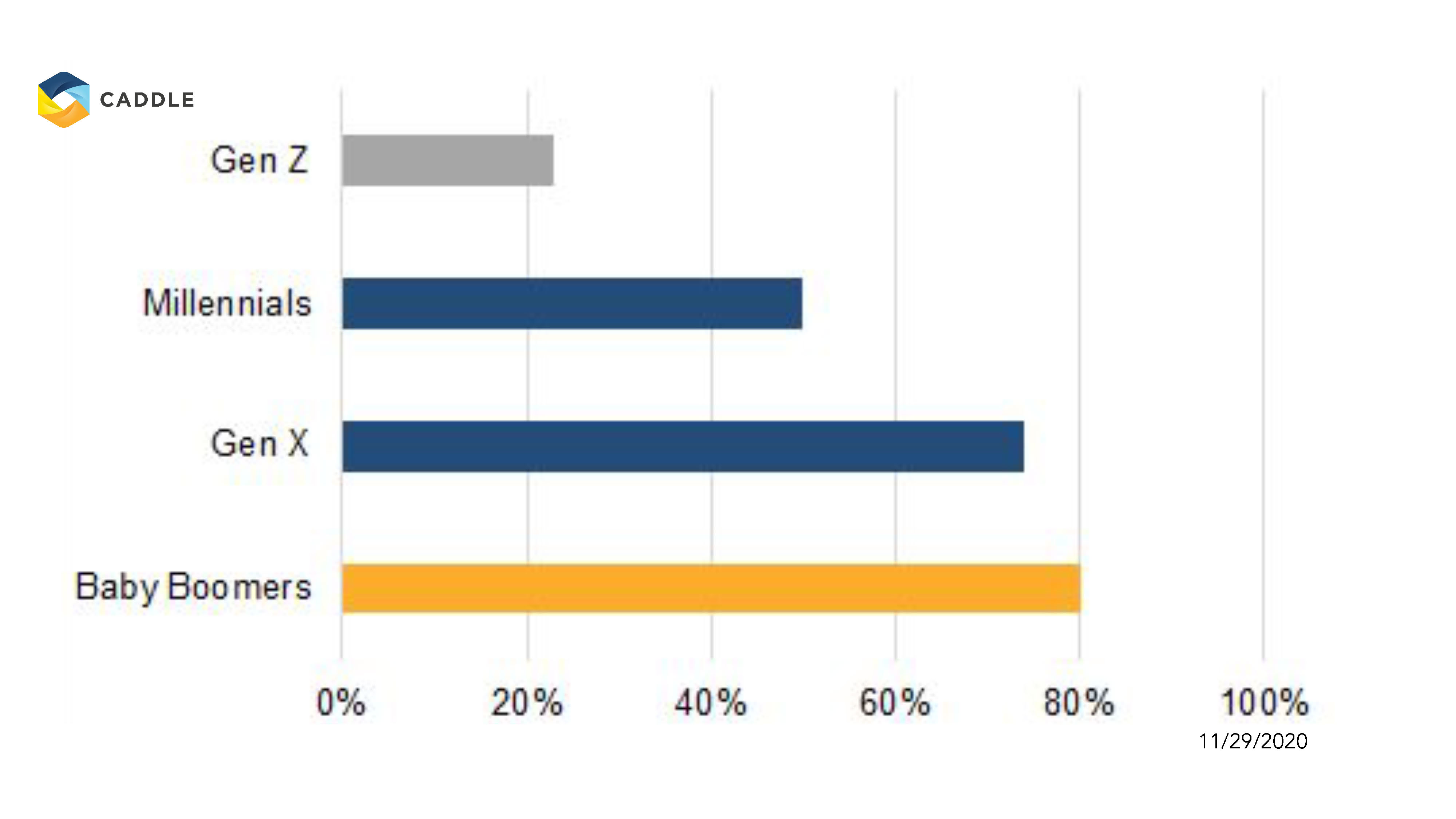

More than 60% of our 10,000-strong Daily Survey panel are currently parents—including 80% of Baby Boomer, 74% of Gen X, 50% of Millennial and 23% Gen Z respondents.

Among these current parents, nearly 1 in 5 people had been planning, pre-pandemic, to have children within the next five years. Only a small portion of this population (~8%) had changed their parenthood plans because of the pandemic.

In contrast, about a quarter of non-parent respondents had been planning, pre-pandemic, to have children within the next five years and an even smaller proportion of those (6.6%) had changed their minds due to COVID-19.

Compare this to stats gleaned on our neighbours to the south: 58% of Americans who, pre-pandemic, were planning to have children in the next five years say that COVID-19 have made them less likely to want to have children.

What might be driving this trend? Well, a whopping 93% of U.S. households with school-aged children reported having to accommodate distance learning at home during the pandemic. Could this major stressor, added on top of ongoing financial and health concerns, be the reason for Americans’ burst baby bubble? Or is it just another indication of the widespread decline in global fertility rates?

(Side note: The U.S. in particular has been reporting a steady decline in fertility rates for decades, with 2019 seeing the lowest number of births in 35 years.)

WHAT’S MAKING CANADIANS PUSH OUT THEIR PARENTHOOD PLANS?

A handful of concerns are weighing heavily on Canadian consumers’ minds when it comes to having children. No surprises here, as they’re life factors we’ve seen and talked about before in relation to the pandemic.

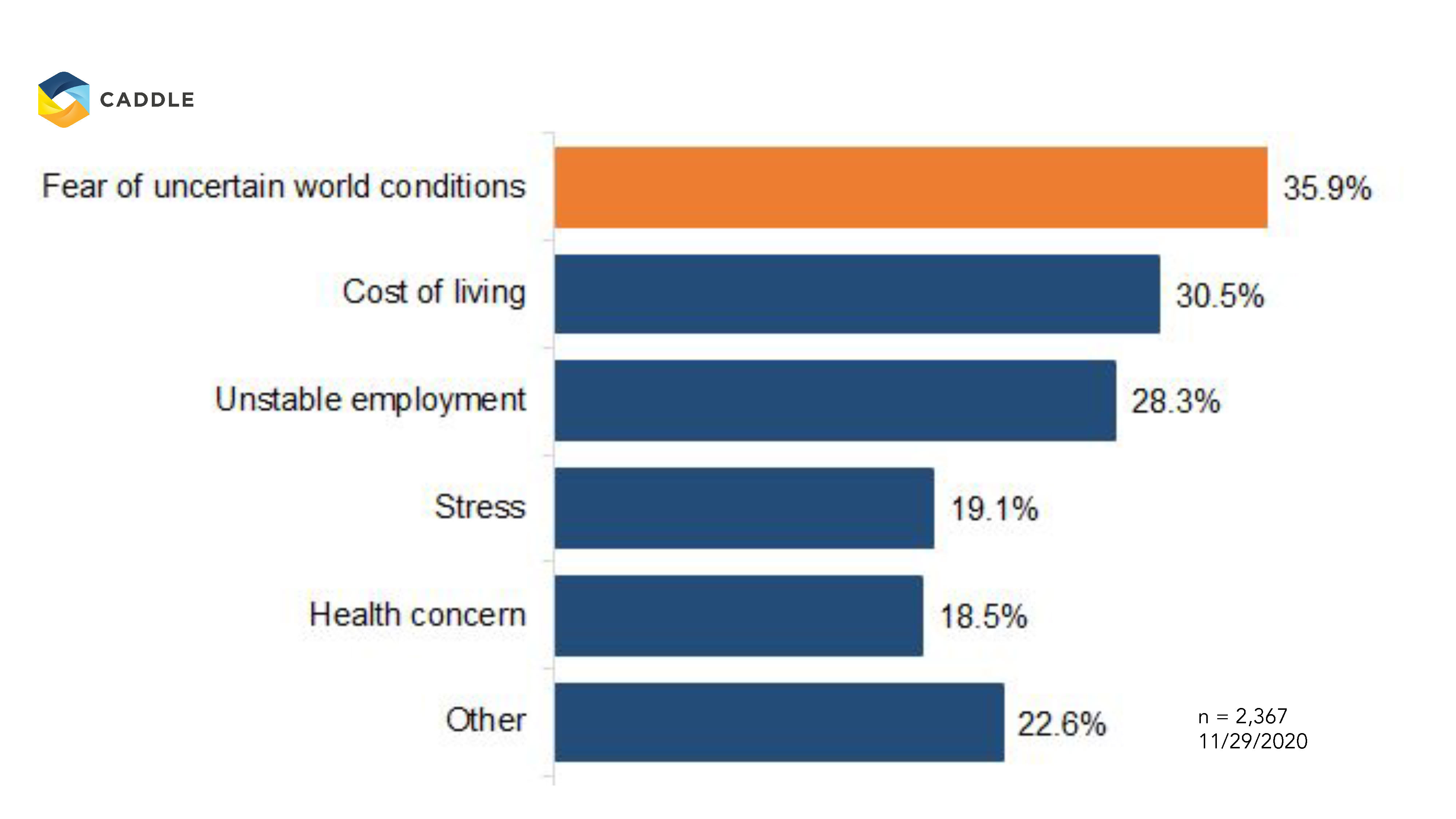

Whether it’s due to “fear of uncertain world conditions” (36%), the “cost of living” (30.5%), “unstable employment” (28%) or more generally, stress and health concerns (both about 19% each), it’s clear that the practical effects of the pandemic are leading some Canadians to postpone child-bearing to more than five years out.

Of note:

Though the top three concerns are consistent for both parents and non-parents, current parents over-index in their “fear of uncertain world conditions” (at 37.6%), while non-parents rank the “cost of living” as their biggest consideration (at 35%). This suggests that the factor of already having children in the household could have an amplifying effect on parents’ empathy responses. In contrast, non-parents seem to be thinking more practically about their financial futures and the implications of adding another family member to the household.

WHAT FACTORS INFLUENCE CANADIANS’ DECISION-MAKING AROUND WHETHER TO HAVE CHILDREN OR NOT?

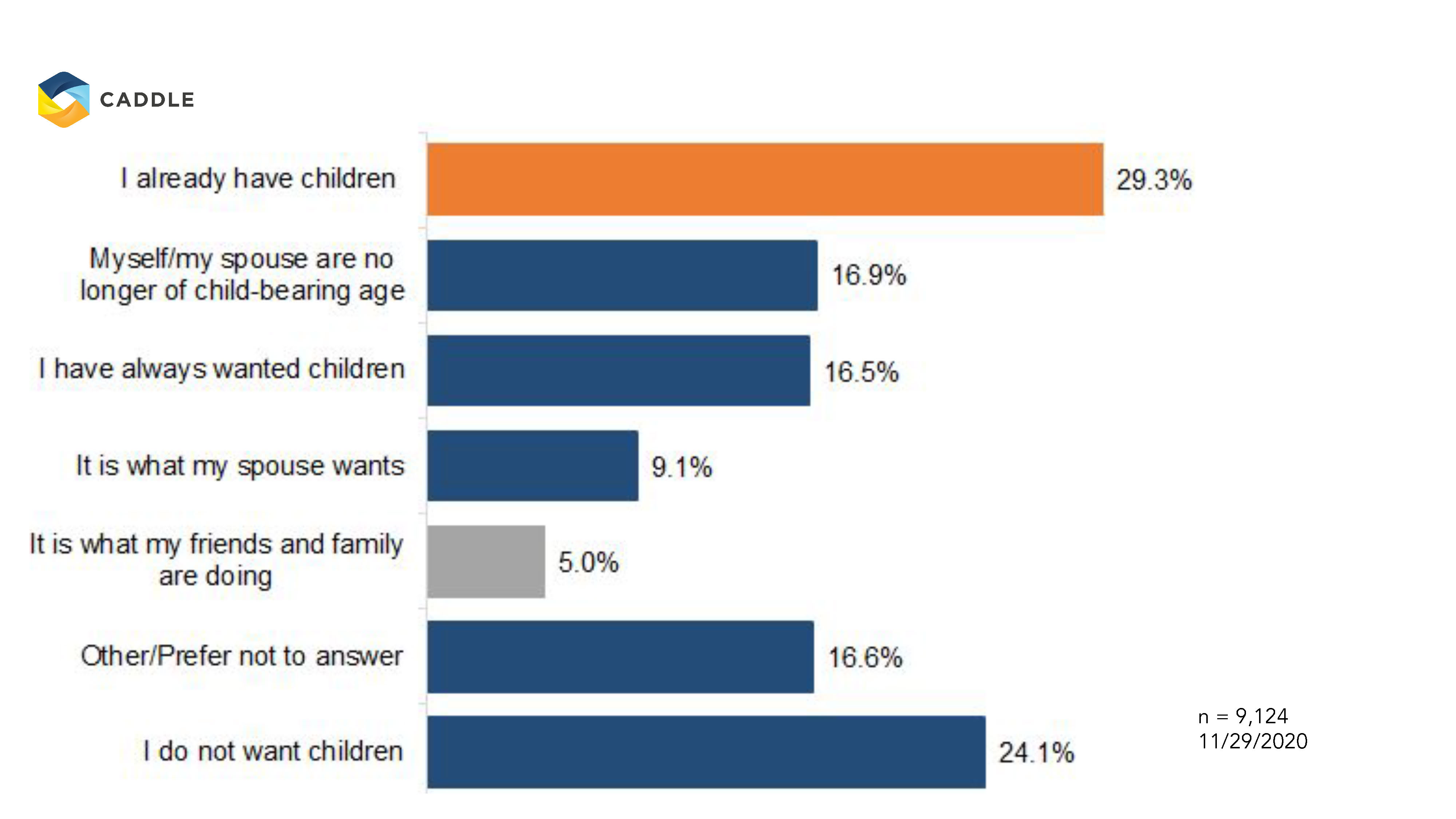

Not surprisingly, the factors that influence respondents’ mindsets around parenthood reflect a combination of both personal and societal norms: Interestingly, only about a third of respondents identified “already having children” as the reason to have more children in the future.

Following very closely behind are respondents who “do not want children at all” (24%) and, tied for third, is the fact that they “have always wanted children” and that their spouses or themselves are “beyond child-bearing age” (16.9% and 16.5 % respectively).

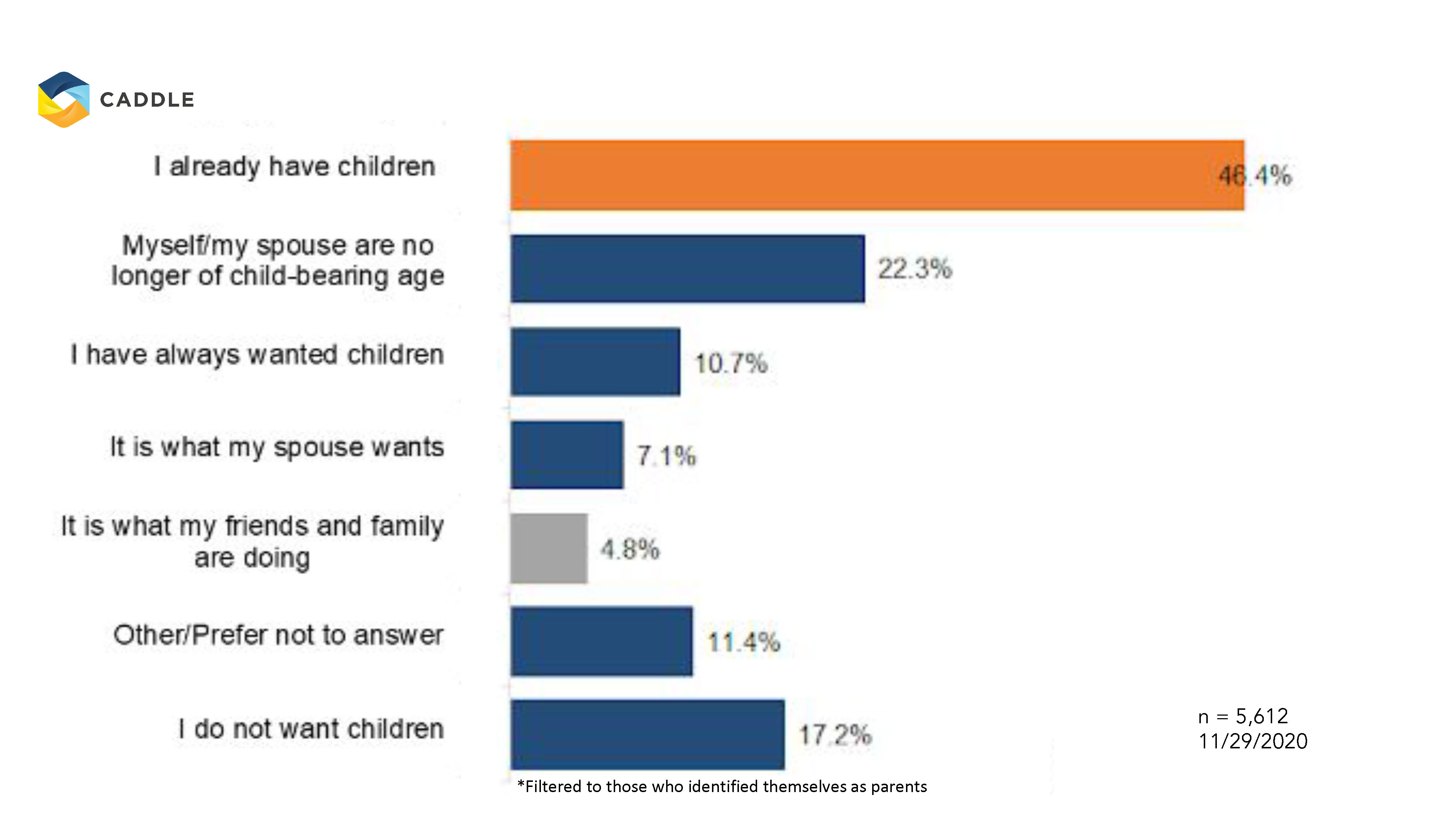

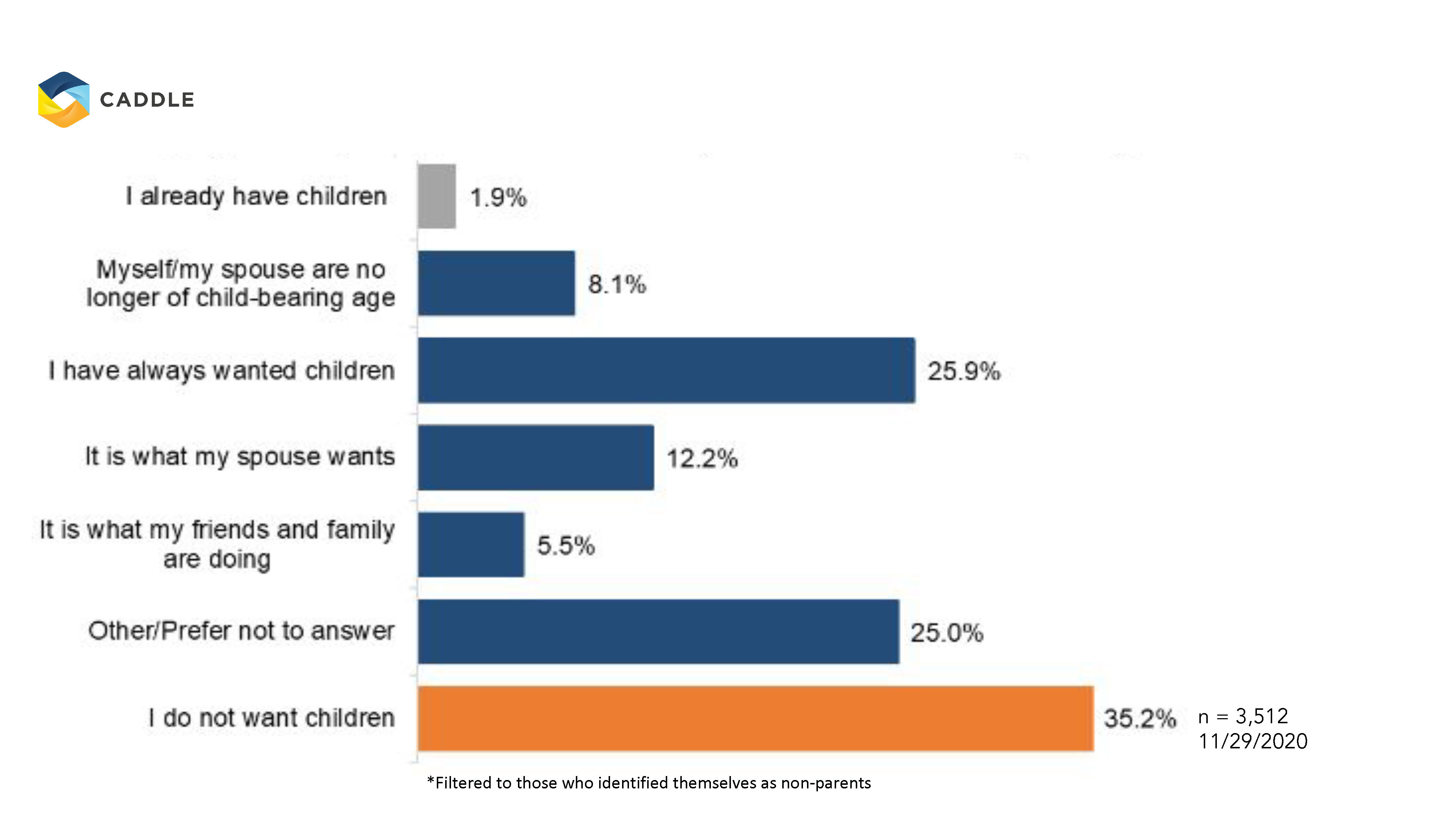

Does the factor of whether they’re already parents make a difference?

Yes, indeed!

Respondents who are currently parents over-index significantly in already having children, and at the same time, weigh their and/or their spouses’ ability to have children more highly than the general population. In contrast, non-parents differed significantly, with more than a third indicating they don’t want children and another 26% suggesting they always wanted children.

Important side note: Millennials make up 58% of the non-parent segment in this sample, which goes a long way to explaining the relatively small proportion of responses that indicate age as an influence on child-bearing. In contrast, Gen Xers and Millennials are more evenly represented in the “current parents” segment (at 41% and 37% respectively), which edges them somewhat closer to the point in life where bearing children becomes a more complicated prospect, though not completely out of the question.

KEY TAKEAWAYS

Canadians are still planning on having babies—especially younger folks

Caddle Daily Panel survey results suggest that a decent proportion of the Canadian population are still intent on bearing and rearing children. And while Baby Boomers are getting too old to have kids (they now account for the majority of seniors in Canada) and Gen Xers feel that they’ve had enough kids already, Millennials want children and aren’t letting the pandemic stand in their way. Meanwhile, Gen Zers have always wanted kids and still do.

This poses an opportunity for forward-looking retailers to think about the varying demographics of parents, and further tailor their baby assortment to the tastes of different parental age groups. For instance, we know that younger generations tend to be more tech savvy and sustainability conscious. So, consider bringing more innovation and technology to traditional baby categories with game-changing products like smart diapers that notify parents when they need changing or pacifiers made from sustainably sourced latex rubber.

COVID-19 will continue to give would-be parents pause for thought

The pandemic has and continues to play mind games with many Canadians: On the one hand, we know that COVID has had a negative effect on Canadians’ mental health, and the potential for postpartum depression could only make this worse. Yet, we also know that many Canadians (and especially younger segments) are looking for any silver lining they can find from 2020—and what better silver lining is there than welcoming a new baby into the family in the New Year?

As such, retailers should expect steady business from baby- and child-care categories through 2021 and beyond, though some non-essential purchases may come in fits and starts as COVID-driven concerns dovetail with pregnancy side effects for new parents.

Financial and health concerns are unlikely to go away anytime soon

Our Daily Panel surveys have uncovered a consistent pattern of financial and health concerns among the majority of Canadians. Such concerns are obviously weighing heavily on people’s minds and though it hasn’t completely deterred people from starting or expanding their families, it’s definitely made them question their priorities.

Forward-thinking retailers will want to keep such concerns in mind and consider ways to make child-rearing a less financially taxing endeavour. Some ideas: Extend rewards programs to cover the many costs associated with newborns, perhaps considering cash-back as an option to cover childcare. Or, deploy lifecycle marketing campaigns that track and reward parents for their children’s milestones.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle Insights?

Sign up to our email list!

Caddle’s Exclusive End of 2020 Webinar

Canadian Insights in Grocery Sector | Customer Experience from In-store to Online, Holiday & Beyond

Who was the top online grocery retailer in 2020?

Which retailer scored highest in Customer Experience (CX) in the grocery aisle?

What factors influence consumers’ shopping experience in-store vs. online?

Caddle’s exclusive end of year webinar,

where we shared new Canadian eCommerce Grocery CX Insights, and Seasonal Consumer Shopping Habits straight from Canada’s largest daily active consumer research panel of 10,000+, 6-figure monthly active panel, and growing every day.

In this webinar, we took you through:

1. Top trends from the first-of-its-kind Canadian eCommerce Grocery CX Report

2. Highlights from the In-store Grocery Shopper CX Report

3. Exclusive first-look at our Holiday Shopping Consumer Behaviour Tracker

4. What’s next for retailers and brands in 2021

It’s was a jam-packed event filled with surprising insights that help brands and retailers pivot to improve customer retention and engagement.

Relive our exclusive end of year event here!

COVID-19 Did Not Steal Canadians' Holiday Spirit

Canadians plan for holiday celebrations at home

Published on December 10,2020

This holiday season: how are Canadians celebrating?

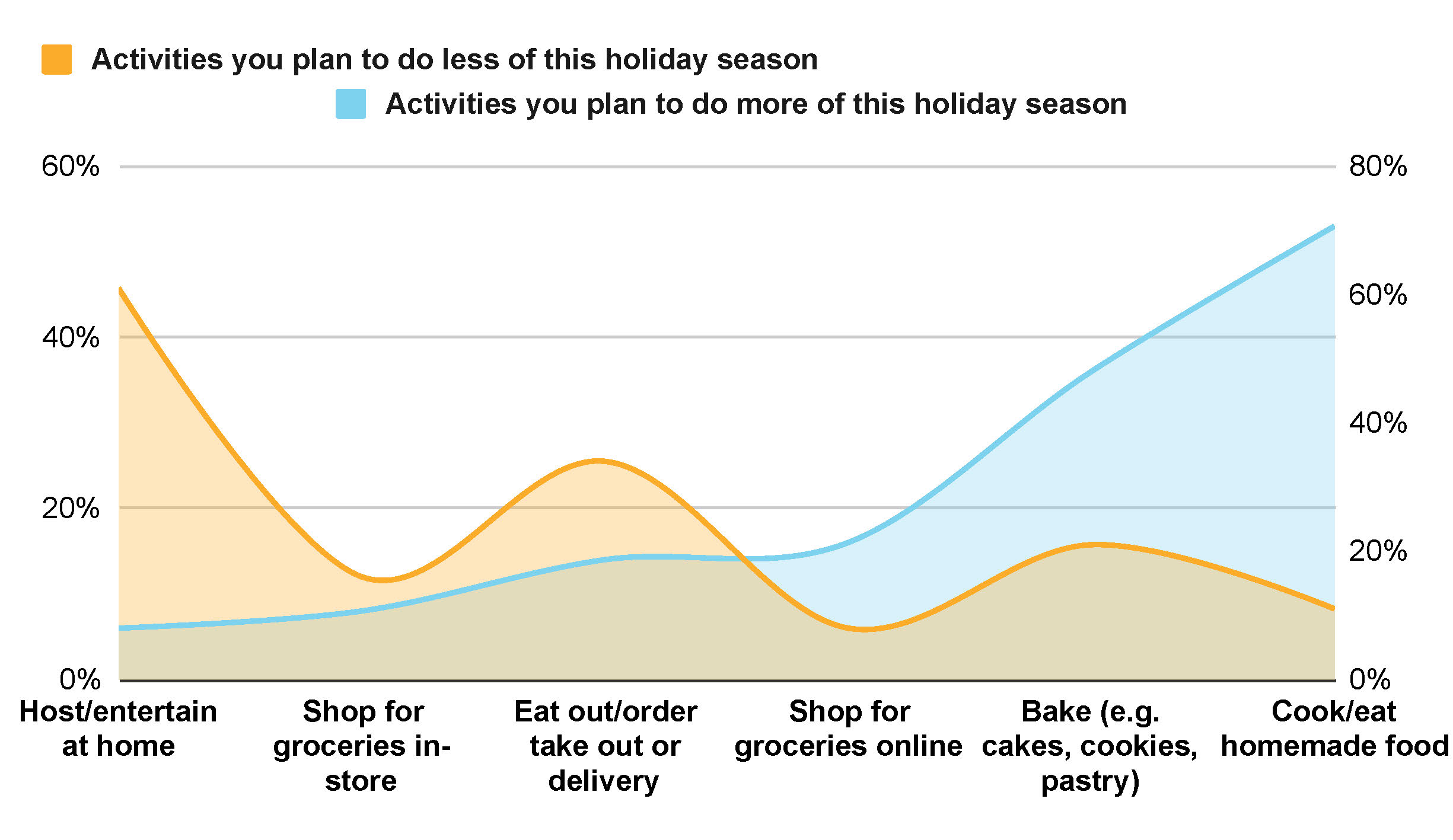

Canadians are planning to keep up holiday spirits by cooking & baking at home this year.

Caddle found out that everyone is reducing gatherings over the holiday season.

What are Canadians planning to do more/less of this holiday season?

Let’s find out.

Canadians plan to…

entertain less,

host less gatherings, &

shop for groceries less in-store due to the pandemic.

Instead, consumers are

cooking more,

baking more, &

shopping for groceries online.

In fact,

Over 87% of Canadians plan to cook or bake at home this year.

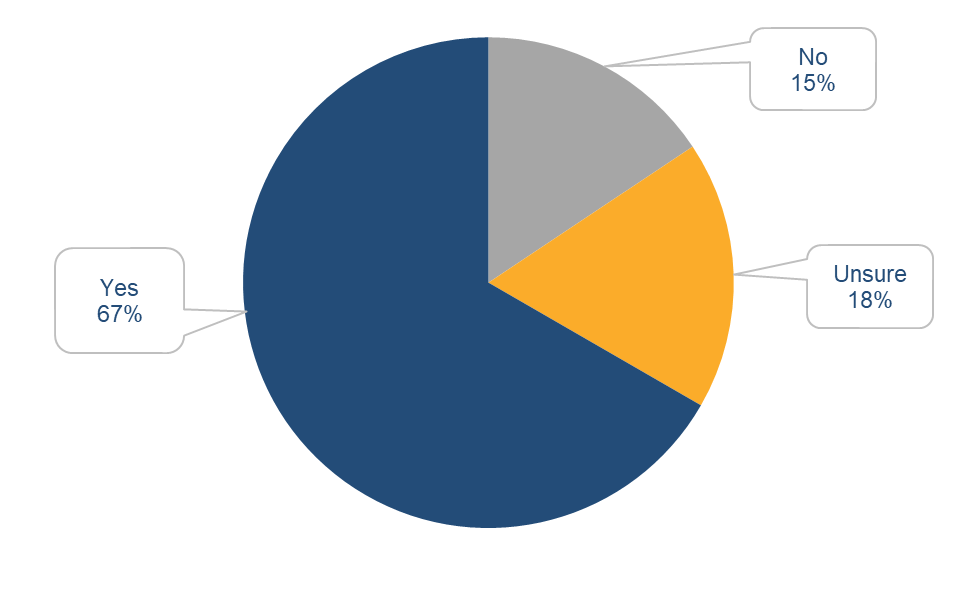

Tis' the Season of Baking: 67% of Canadians

are planning on doing some form of baking over the holidays.

Q: Are you, or someone in your household, planning to bake during the holidays?

Sign up for Caddle Insights

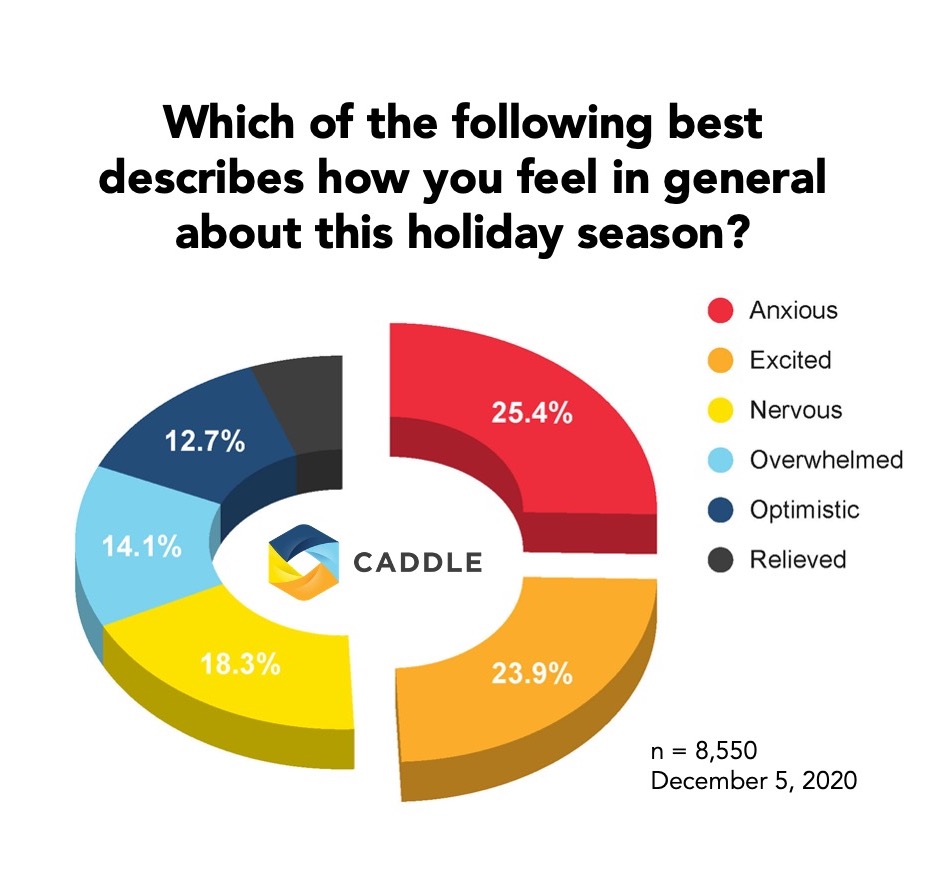

But how are Canadians feeling about the holiday season? Anxious? Excited? Nervous?

Finally,

Holiday cheer is strongest among the youngsters as

Gen Z are 15% more excited for the holidays compared to Baby Boomers,

with 24% vs. 9% respectively.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle insights? Sign up to our mailing list below!