90% of Canadians Are Writing Off Their Summer Vacation Plans

Study shows long term COVID implications on travel

Almost 9 in 10 Canadians expect their summer vacations plans to be disrupted by COVID 19, new Caddle research shows.

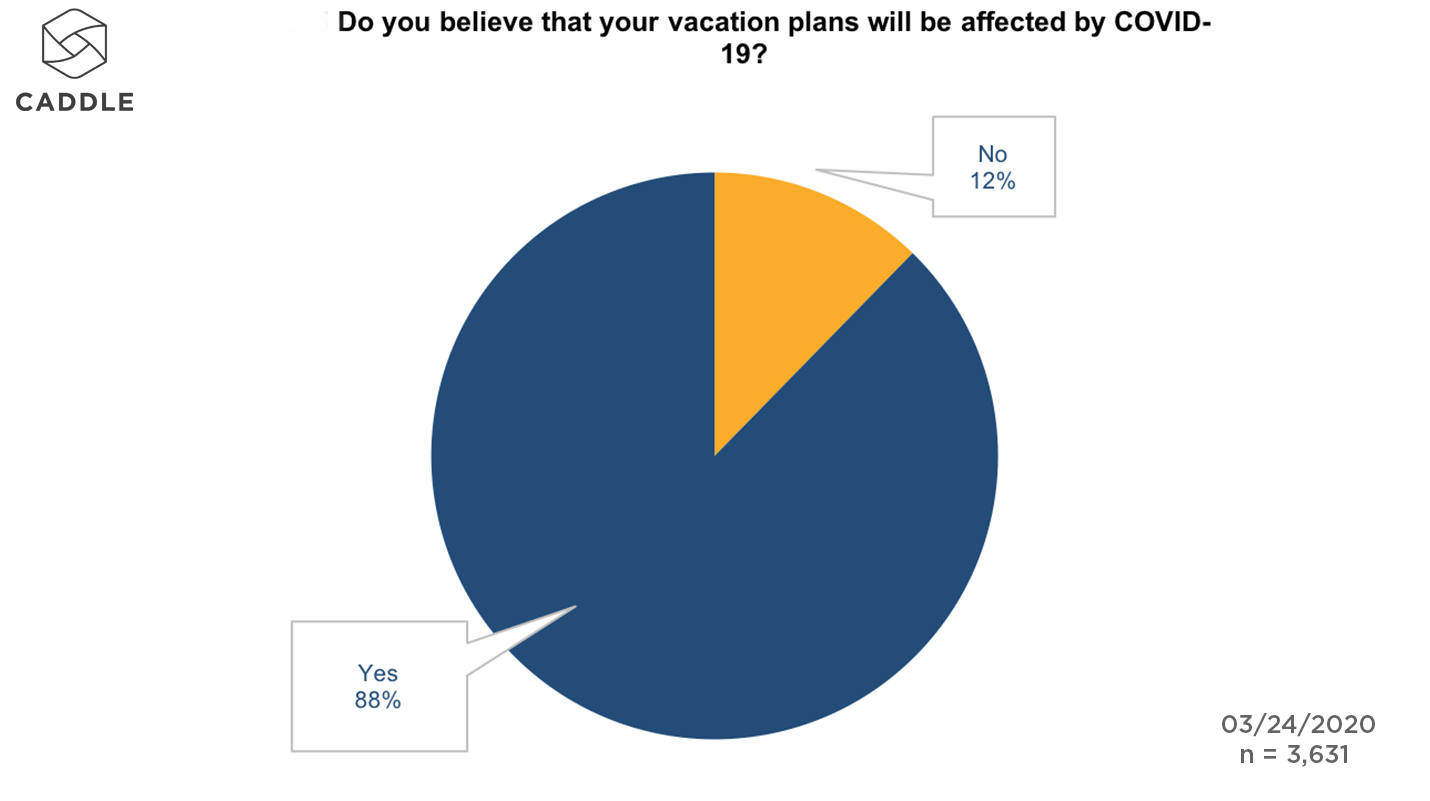

An estimated 30% of Caddle’s 12,000 daily survey respondents reported they had vacation plans in the next 6 months. Of those, 88% say they now expect their plans to be disrupted.

This new data shows the degree to which Canadians are facing up to the long term implications of the coronavirus pandemic. Canadians with trips as far forward as September are uncertain they will still happen.

It isn’t just pending trips that are being disrupted. The Caddle data suggests there could be lasting implications for how we travel.

Does this mean less overseas travel?

Already we are seeing that the pandemic could affect how and where Canadians travel even after the crisis has passed.

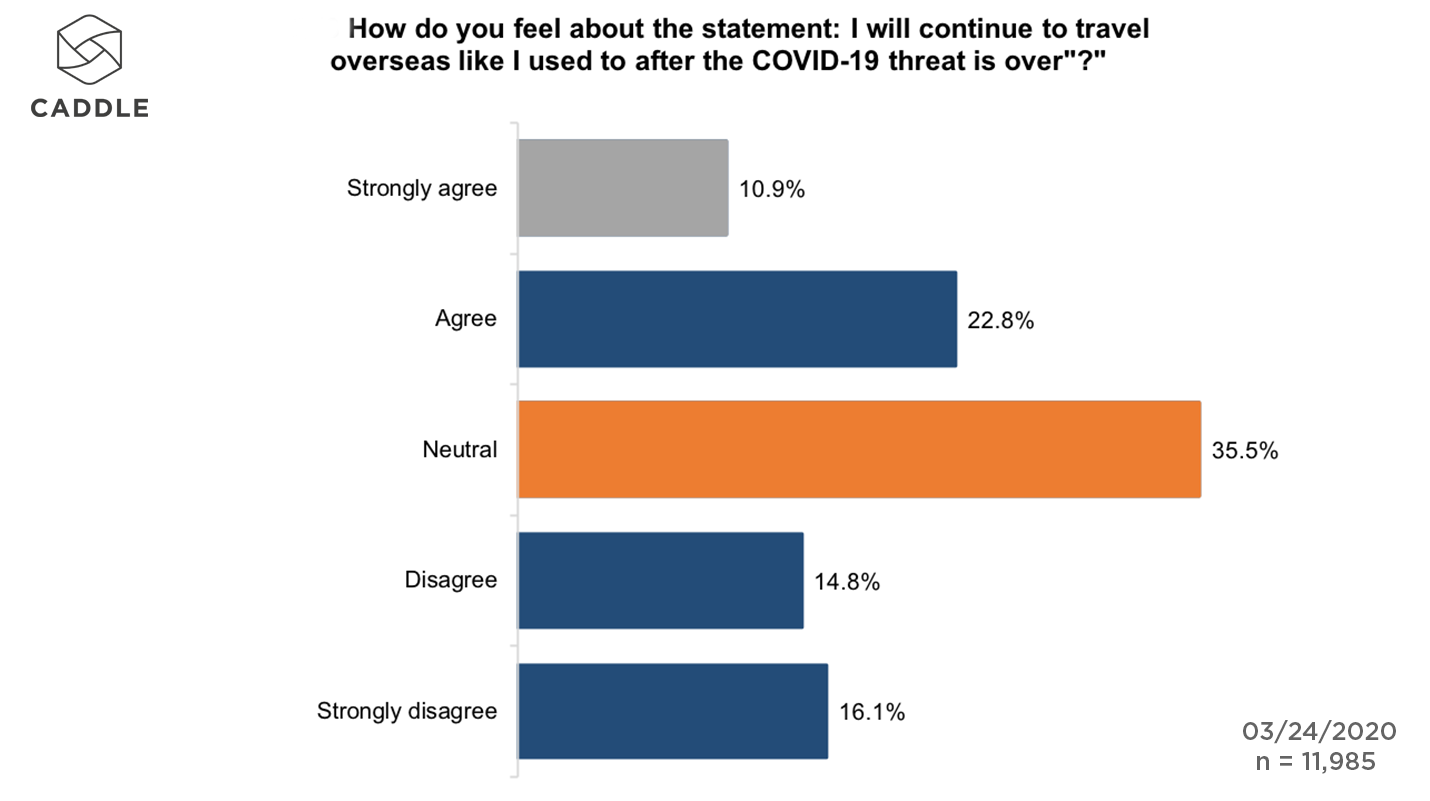

We asked our panel if they agreed that they would travel overseas just as they did before once things got back to normal. Here’s what they told us:

The results are striking. Only 1 in 3 of our panel agreed that they would continue traveling overseas as they did before. At the other end of the spectrum, 31% indicated that they would be reluctant to travel overseas as they had done before.

The remaining third of respondents are still up for grabs, with 35% reporting they were neutral on the issue.

Clearly travel companies will have their work cut out to convince people to take overseas trips again — even once restrictions have been lifted.

Will we see a rise in staycations?

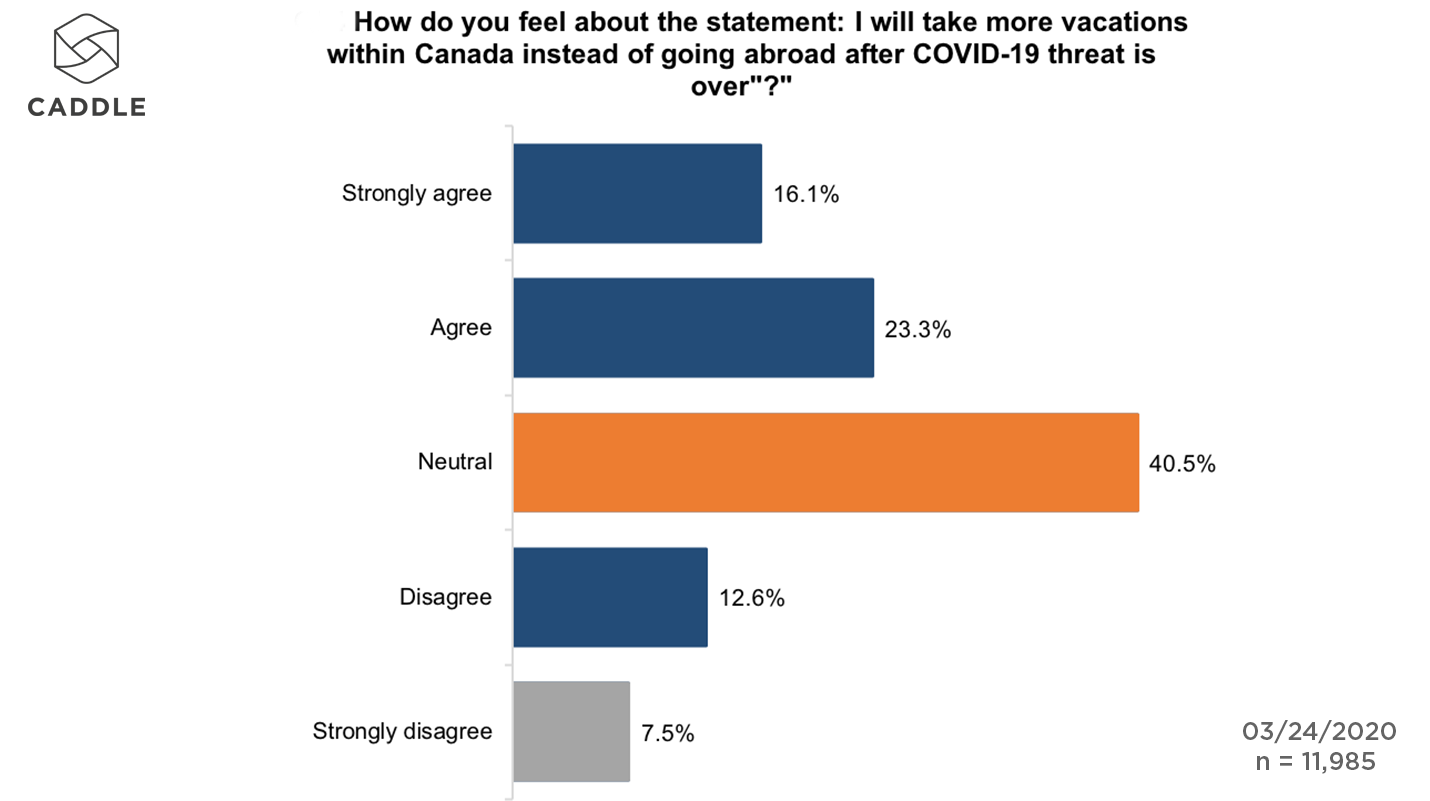

These attitudes could lead to a boost to the domestic tourism industry. Just under 40% of our panel agreed that they would take more vacations within Canada as a result of the COVID-19 pandemic.

Again, we saw a large proportion of people with no strong option yet suggesting again an opportunity to win even more people over to the concept of a staycation.

What will get people flying again?

The high level of uncertainty right now means people are understandably reluctant to book flights. What could airlines look at to convince people to make bookings?

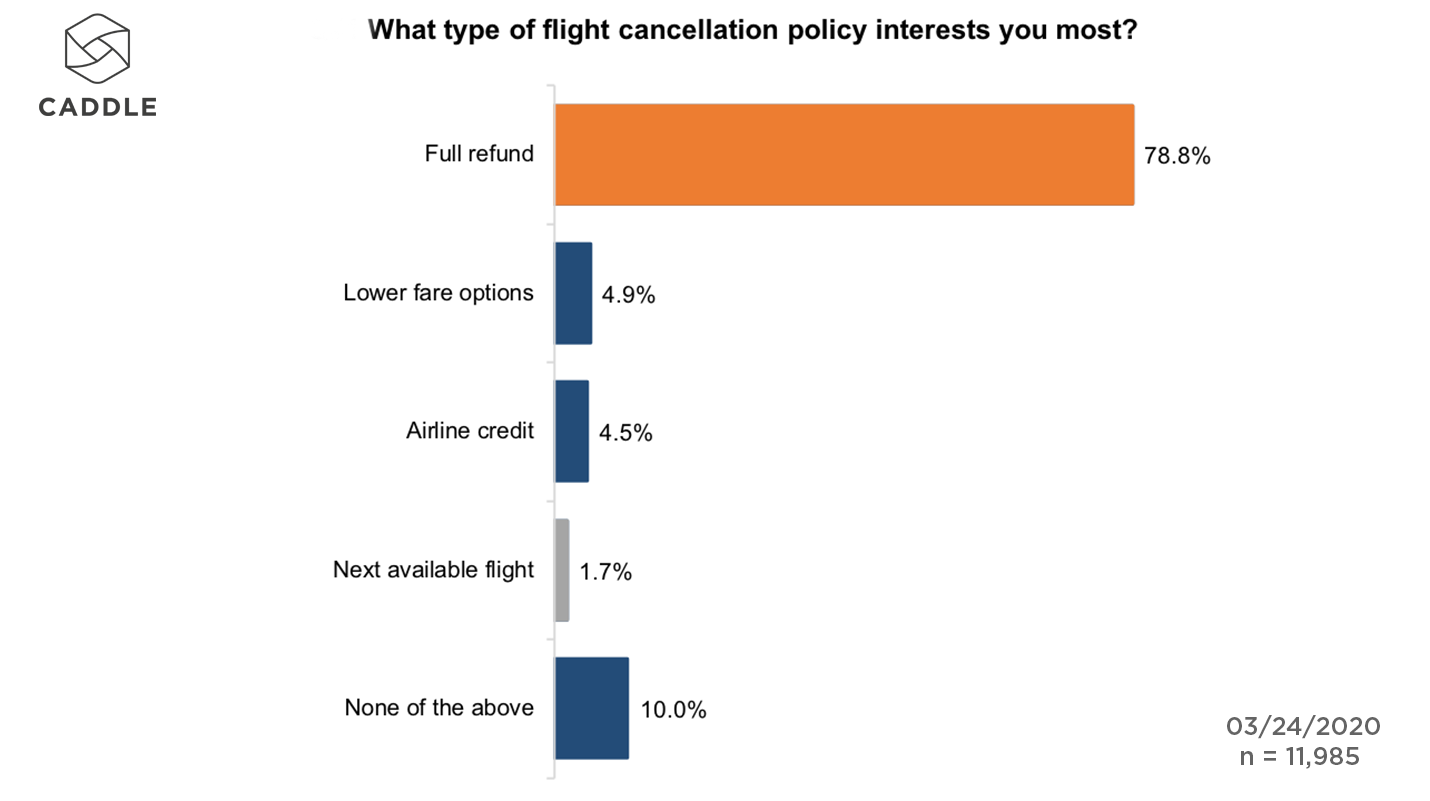

The Caddle Panel was clear on what airlines need to offer with their cancellation policy. They want flexible policies offering full refunds.

Given the option of lower initial fares, credit fares, or being placed on next available flights, 8 in 10 of our panel chose a full cash refund as the cancellation policy that they wanted to see.

What are Caddle Rapid Response Insights?

The data is based on 10,000 daily responses in the Caddle app. Anyone can join the panel. Just download the Caddle app to get started.

As Canada experiences the impact of COVID-19, we’ll be expanding and diversifying the topics we look at to understand the effects.

For a more details breakdown of this or any of our other COVID data, contact insights@caddle.ca

COVID-19 Insights: widespread social distancing sadness

We're feeling down due to lack of exercise, social contact

For over two weeks Canadians have been told to stay home to limit the spread of coronavirus.

How have we been responding so far? We turned to Caddle’s 10,000 daily survey responders to find out.

Responses to questions we posted last week show that while we’re concerned about going out in public, confinement at home is taking its toll as well.

While panel members gave themselves solid grades for their social distancing discipline, they cited concerns over lack of exercise, amount of time indoors, and limited social interaction.

But as we’ll see, not everyone is feeling down about needing to stay in.

Is the message getting through?

After repeated messages from political leaders, celebrities, and brands to stay home to slow the spread of the virus, it looks like the message is getting through.

The vast majority of the panel reported a high level of concern with going out in public. Roughly two-thirds said their concern was either ‘high’ or ‘very high’.

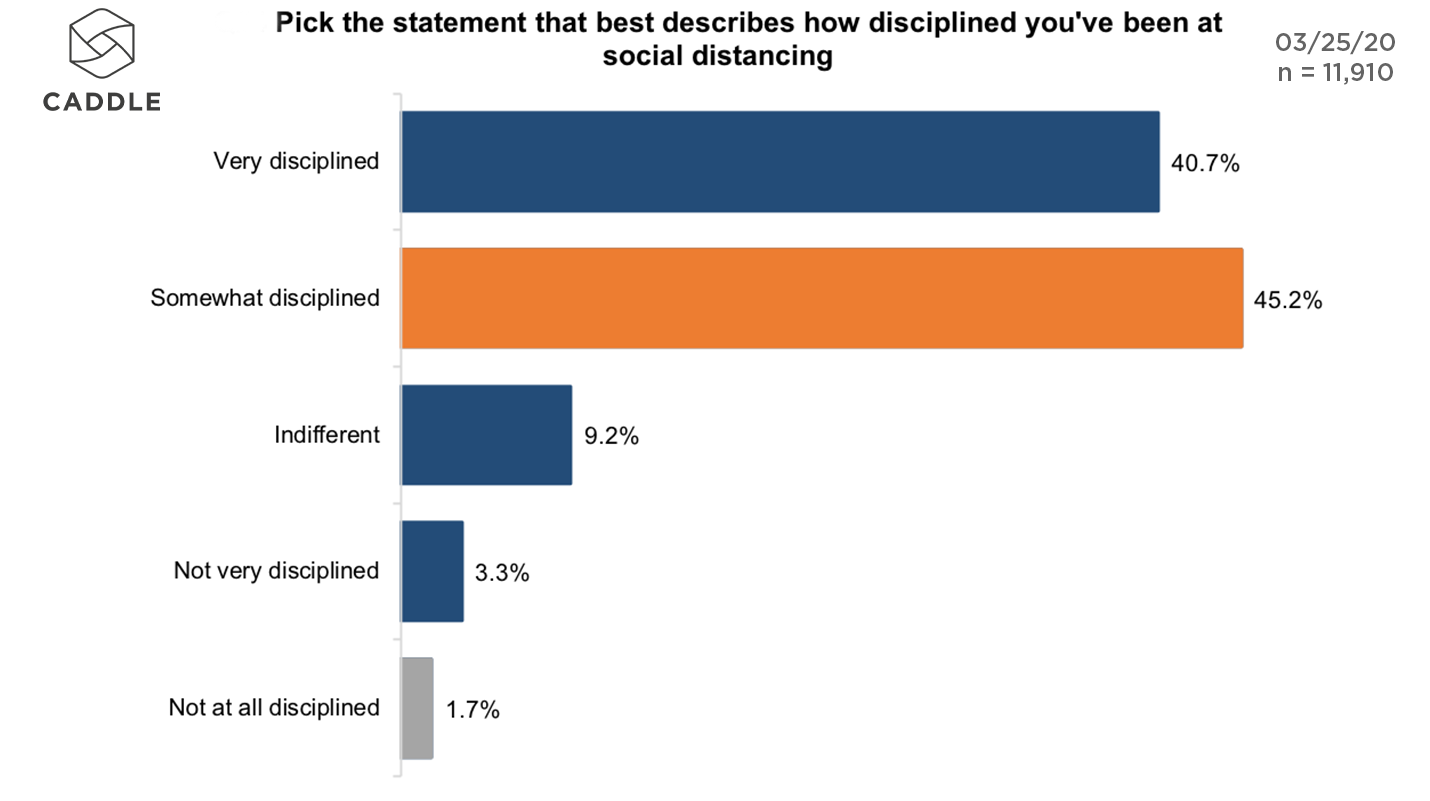

This heightened concern also appears to be translating into stricter observance of social distancing guidelines. We asked our panel to give their opinion on how closely they had followed the guidelines.

Over 85% of people rated their discipline as high or very high for social distancing.

Who’s the most lax at social distancing?

Despite telling us in previous coronavirus surveys that they are the least optimistic about Canada’s ability to manage the coronavirus outbreak, Gen Z is also the least disciplined when it comes to social distancing.

One in ten said they had not been particularly disciplined with their distance – twice level for the whole panel.

Meanwhile only 70% said they had been disciplined or very disciplined with distancing. This compares with 85% for millennials and almost 90% for both Gen X and Baby Boomers.

As we’ll see below, this could be because younger generations are more likely chafe at needing to stay home all the time.

How are we coping?

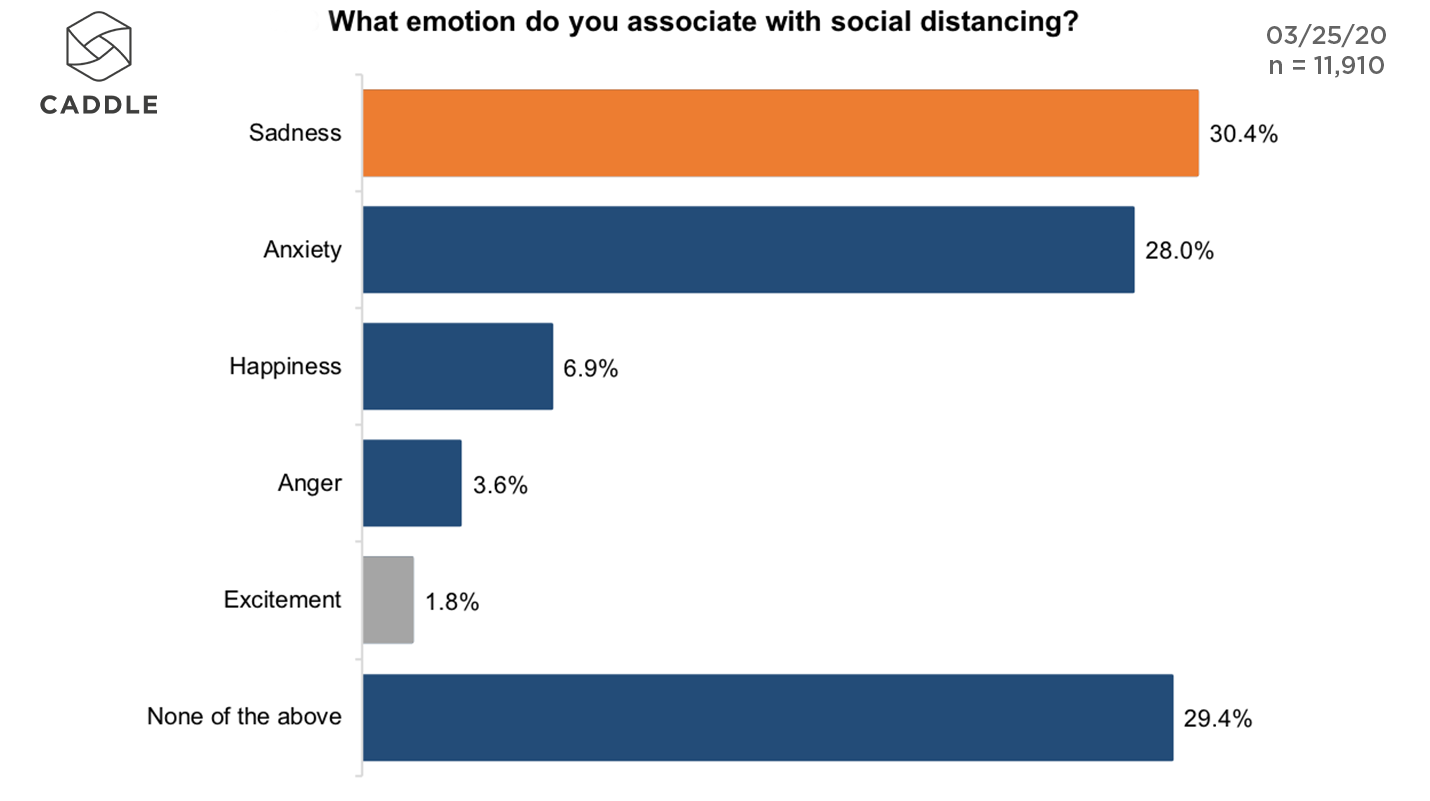

Despite feeling like we’re following the rules, this isn’t without an emotional burden.

Almost 1 in 3 of the Caddle panel reported sadness as the overriding emotion they associated with social distancing. This trend was repeated across all age groups and with men and women.

What is it that’s getting us down?

Overall, it’s the lack of exercise and lack of outdoor time that worries our panel most about staying home.

For younger age groups in particular, not being able to get as much exercise was their biggest concern. Of the available options and ‘none of the above’, both Millennials and Gen Z selected less exercise as their top concern.

What would you like to ask the Caddle panel? Give us your suggestions here

So far at least, worries about a less healthy diet, or drinking more alcohol do not appear to be top of mind. Just under 1 in 7 panel members cited worries about their diet as their chief concern with social distancing.

With grocery stores and supermarkets remaining open, albeit with reduced hours, is the coronavirus actually having a relatively modest impact on what we eat? We’ll be exploring this in an upcoming report.

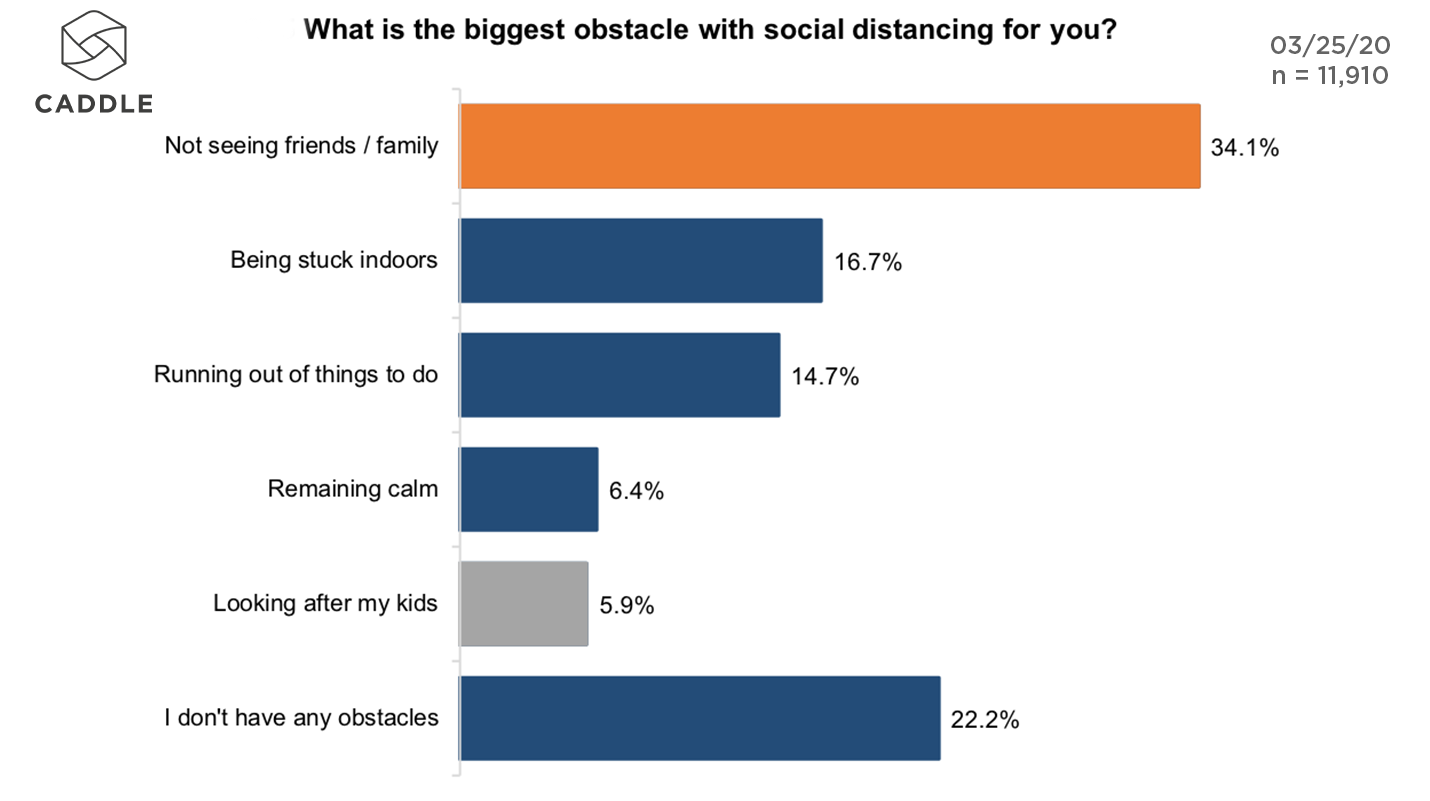

The biggest obstacle with social distancing for all age groups was with not seeing friends and family. Roughly 1 in 3 respondents reported this was the main issue they encountered with social distancing.

However this is a much more pronounced response for Baby Boomers, 40% of whom cited this as their main problem.

Has boredom kicked in yet?

For younger Canadians, the next biggest concerns were being stuck indoors, and running the risk of boredom.

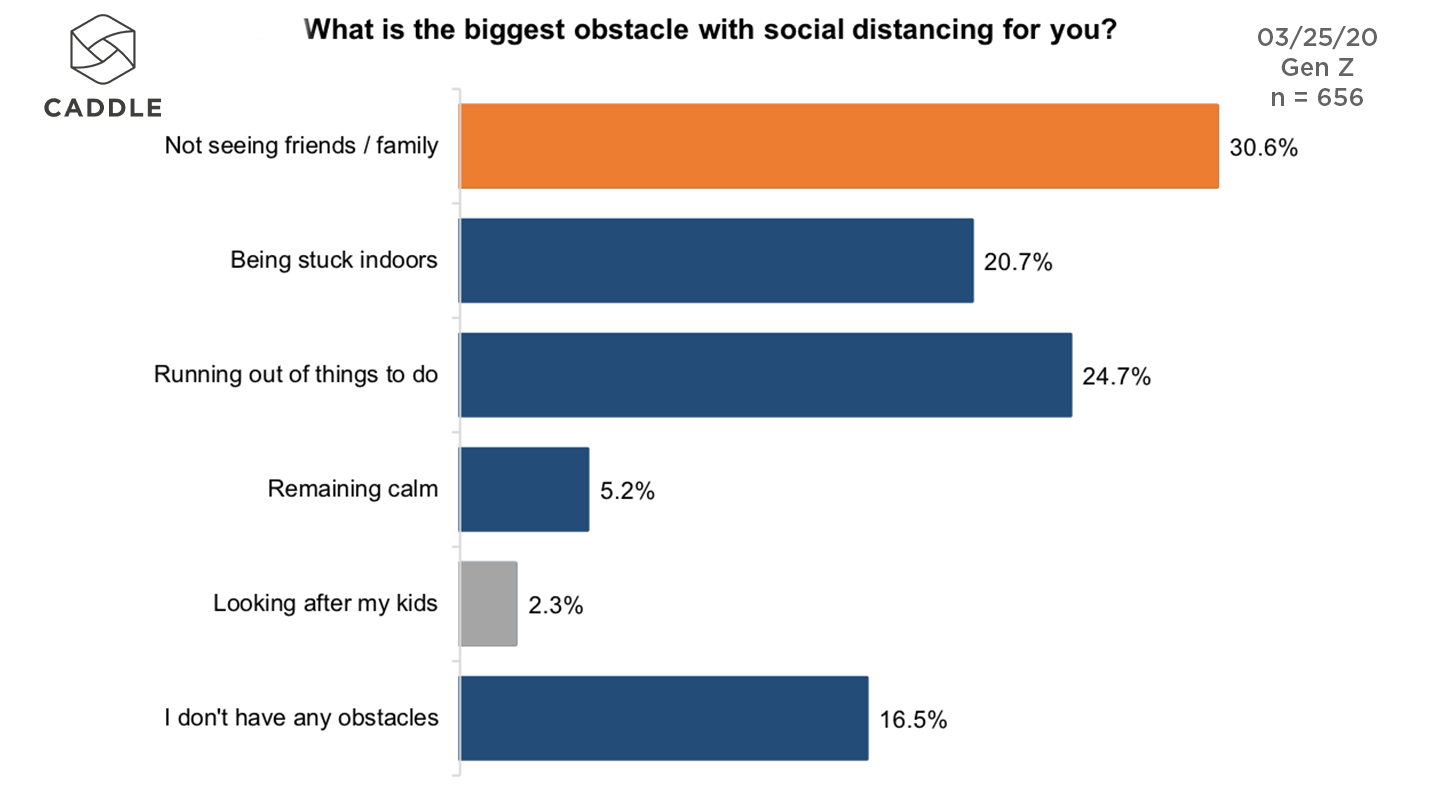

Both Gen Z and Millennials over-indexed on a frustration of not being able to go out. Canadians in Generation Z were by far the most likely to cite running out of things to do as an obstacle with social distancing.

Nearly 1 in 4 of Canadians born after 1996 reported not having enough to do as their biggest barrier to getting through social distancing. That’s potentially a lot of people waiting for inspiration of something new to try, if brands are able to reach them.

Is anyone seeing the bright side?

Beyond the topline numbers, there are groups that are feeling more positive about social distancing.

Men it seems are a bit more comfortable with it. Just over 10% reported happiness as the emotion they associate with social distancing.

While only 3% of men reported feeling excitement about social distancing – this markedly higher than the 0.7% of women who selected ‘excitement’ as the main emotion.

Younger Canadians were also more likely to see the positive side of social distancing. The percentage of Gen Z panel members identifying happiness as their main emotion was 9.8%, compared to 5.4% for Baby Boomers.

What are Caddle Rapid Response Insights?

The data is based on 10,000 daily responses in the Caddle app. Anyone can join the panel. Just download the Caddle app to get started.

As Canada experiences the impact of COVID-19 we’ll be expanding and diversifying the topics we look at to understand the effects.. If there’s a crucial issue to your business that we can ask, reach out to a Caddle rep to find out more.

Caddle Rapid Response Insights - COVID-19

General sentiment: growing anxiety among Canadians

Our focus at Caddle is accelerating time to insight. Now more than ever, these rapid insights matter.

That’s why starting today we’ll be dedicating our entire daily survey schedule to coronavirus issues in order to provide our readers with rapid access to the most in-depth cross section of Canadian-specific coronavirus insights.

If you’re not already on the mailing list, sign up for our free weekly summary here.

So what are Canadians thinking right now? Well, we’ve seen a big shift in attitudes — changes that we’ll likely keep seeing as Canadians respond to an unprecedented and fast-changing time.

Recap: What events are driving these results?

A lot happened between when we first surveyed the panel, and when we followed up.

Prime Minister Justin Trudeau called on Canadians abroad to return home, the US and Canada closed their border to non-essential travel, and provincial governments brought in a range of measures to promote social distancing.

How did this affect Canadian attitudes to the COVID-19 pandemic?

Understandably, this impacted sentiments for all Canadians, as we begin to realize the impact this will have on our lives.

What’s the one emotion we’re feeling?

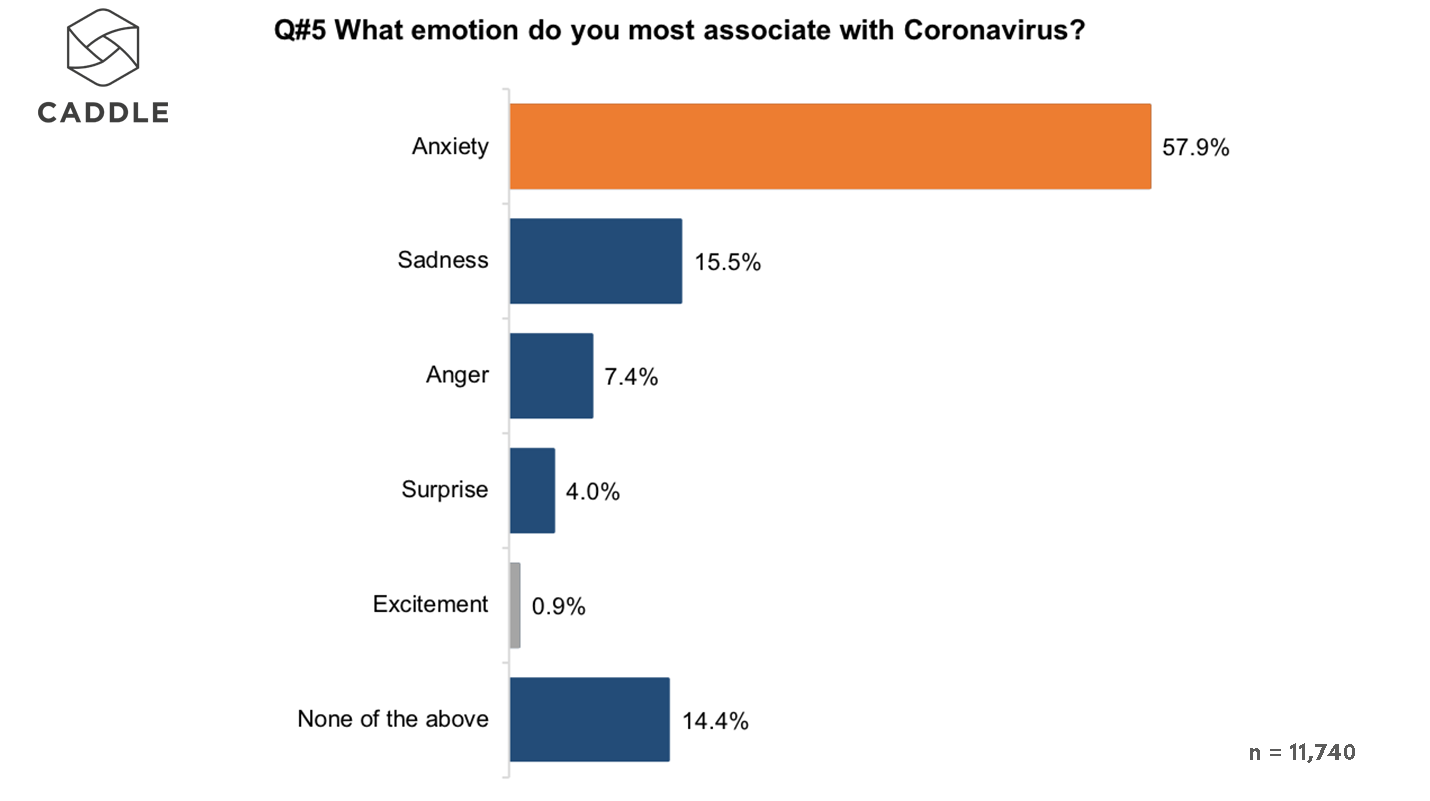

Since we last asked the Caddle panel, anxiety has become the dominant emotion Canadians associate with the COVID-19 pandemic.

When asked on February 29th, 41% of respondents cited anxiety as the emotion they associated most with coronavirus. As of last week that figure was 58%.

This is at the expense of other types of reactions to the crisis. Every other sentiment tracked by Caddle, including ‘none of the above’ decreased between the two surveys.

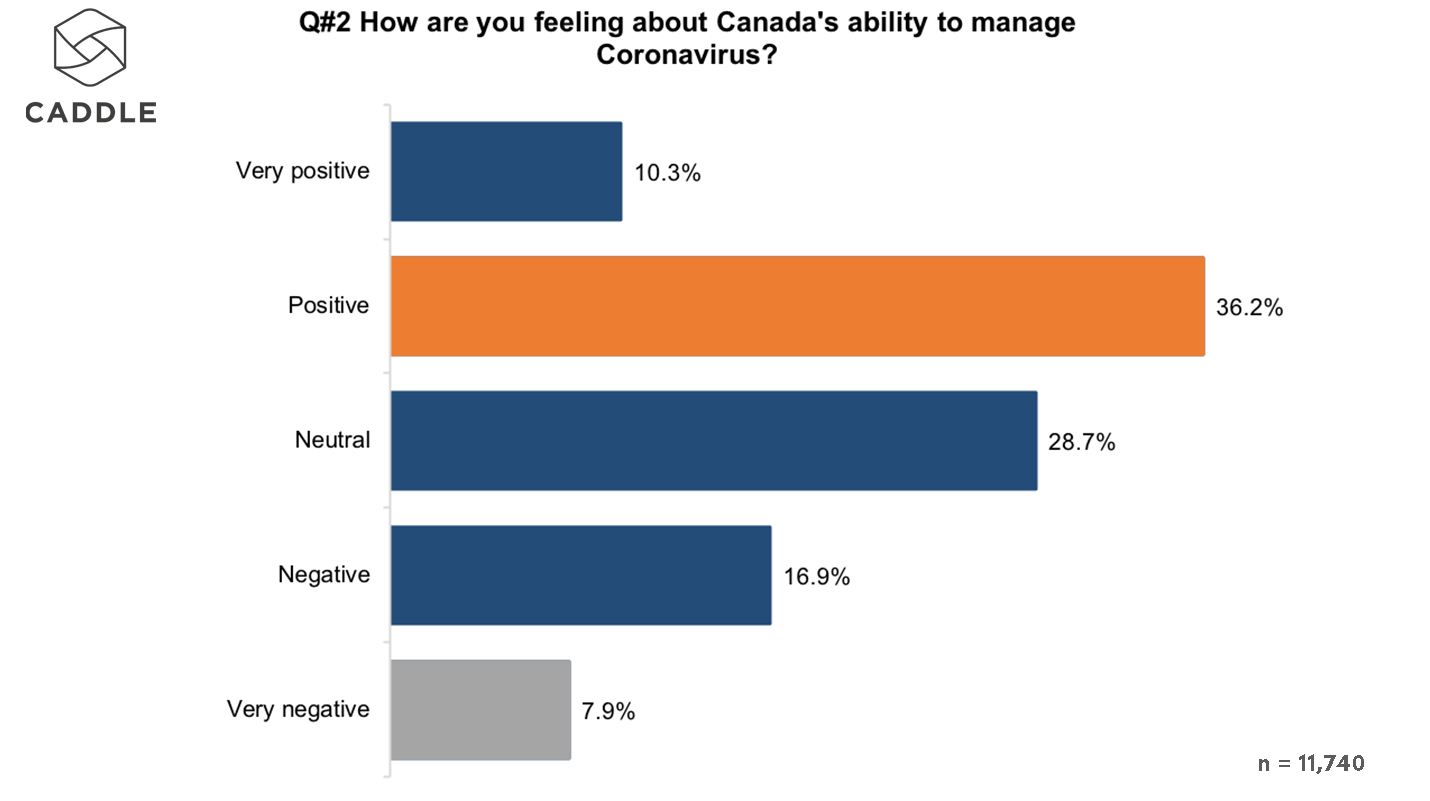

But despite this widespread unease, there is still an underlying sense of confidence for how Canada will come through the pandemic.

Close to half of Canadians say they feel positive about Canada’s ability to manage coronavirus, compared to only a quarter who feel negatively. We’ll be keeping a close eye on this metric and will be reporting back in the weeks ahead.

Have we realised how big this is?

Unsurprisingly, Canadians everywhere are facing up to the impacts of the COVID-19 outbreak.

It has increasingly dominated conversation. Approximately 90% of respondents stated that they have often heard about the pandemic in the past week, compared to 68% three weeks ago.

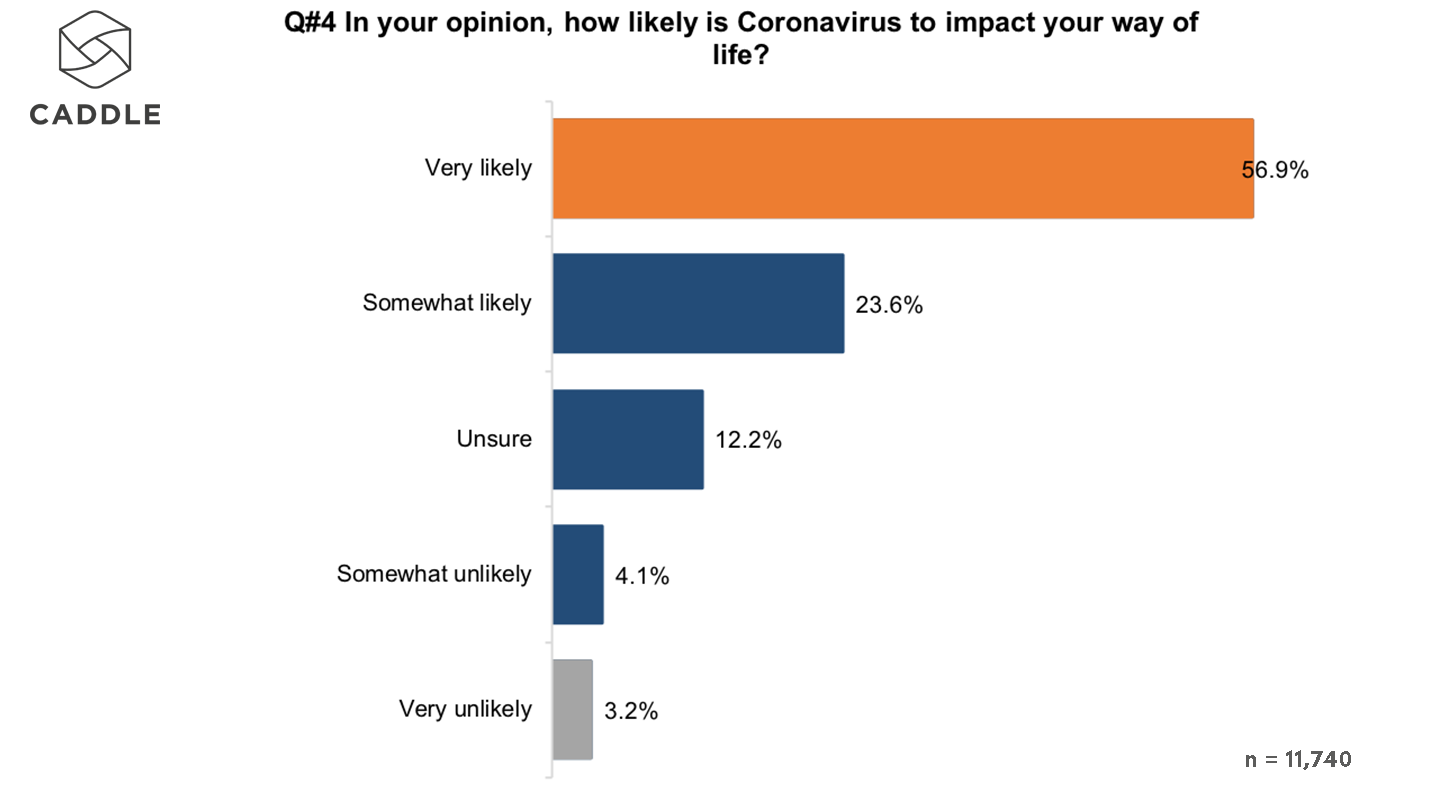

When we first asked Caddle members about coronavirus, just 37% said concerns were impacting their way of life.

Since then, with school closures, border closures, and many companies moving to remote working, 80% of survey respondents said the pandemic was likely to impact their way of life.

Which generation is the most concerned?

Despite frequent reports of younger generations failing to heed social distancing guidelines, it is actually younger Canadians who appear to be most concerned about Canada’s prospects during the crisis.

In every age group, more respondents feel more positively than negatively about Canada’s capacity to cope with coronavirus. However, there is a trend towards lower confidence among younger Canadians.

More than half of Baby Boomers have a positive outlook on Canada’s ability to handle the crisis with fewer than one in five in this group (19.4%) holding a negative outlook.

But the younger the generation the more negative the outlook gets. More than a quarter of Millennials feel negatively about Canadian’s capacity to cope, while 30% of Gen Z have either a negative or very negative outlook.

Age also seems to shape the emotions we feel about coronavirus. Anxiety, unsurprisingly was the overriding emotion across all age groups. Behind this, Gen Z Canadians were more likely to say they felt anger and surprise. In contrast, older generations were more likely to feel sadness.

Which province is most worried?

According to our data, how optimistic you are about Canada’s ability to cope with the COVID-19 depends on which region you live in.

Provinces with the higher number of cases were more pessimistic in outlook.

The province with the highest number of reported cases at the time of the survey, British Columbia, had the smallest proportion of respondents with a positive outlook with 36% compared to a national average of 47%.

Canada’s westernmost province was also the most pessimistic. Almost one third of respondents feeling negatively about Canada’s ability to manage the crisis. In fact, the net positivity in British Columbia was just 6%, compared to 21.7 for Canada as a whole.

Quebec is the province the next highest proportion of people with a negative view, with 28% feeling pessimistic about how our nation will cope.

However, this doesn’t mean Quebecers on the whole negative in outlook. Residents were more inclined to express an option either way.

People in Ontario or Alberta, where confirmed cases are also in the hundreds, are much more likely to neutral when it comes to Canada’s coronavirus prospects.

Social media information is vital

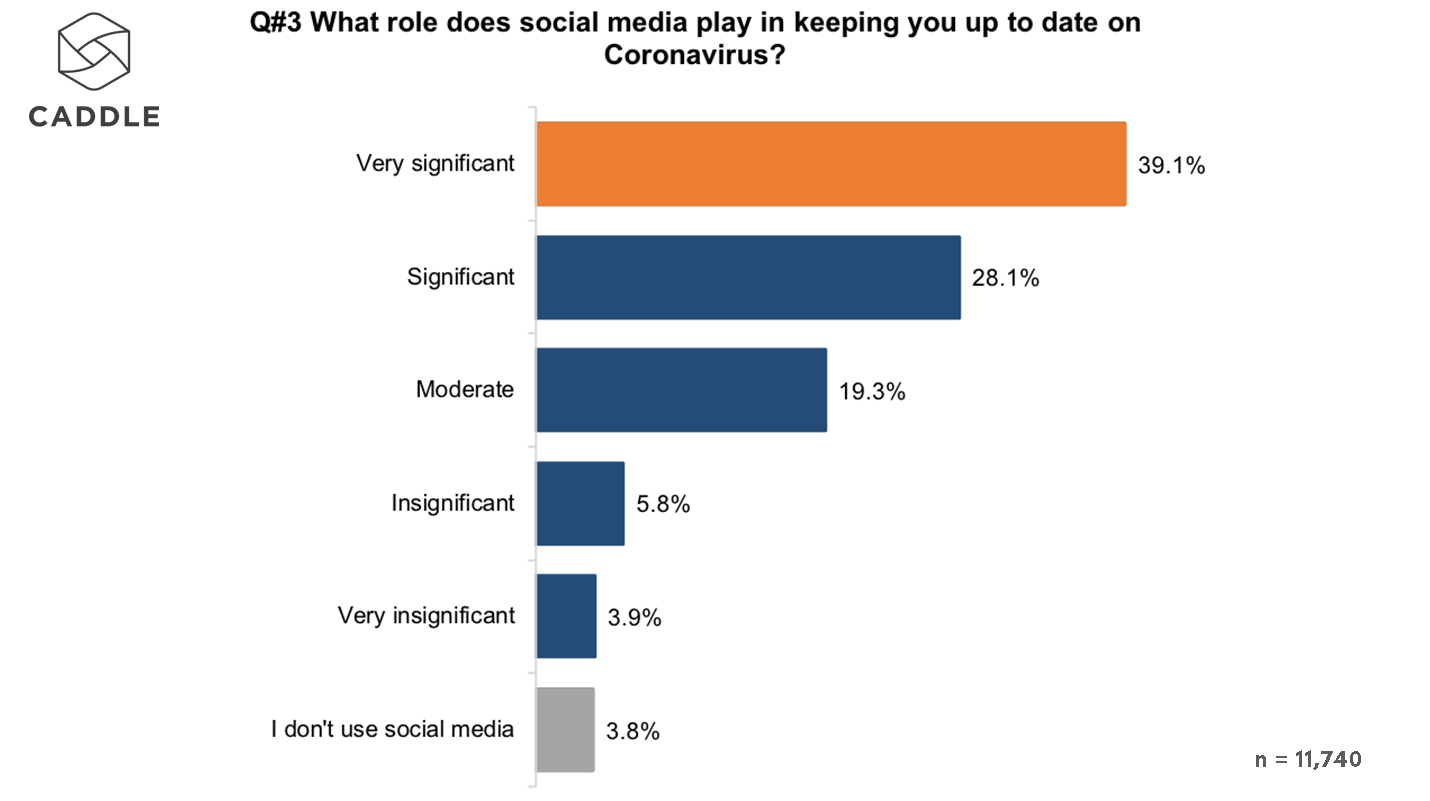

The combination of a rapidly-evolving situation, as well as the increased isolation of social distancing means we will become increasingly reliant on what we hear through social media.

This is something not lost on all generations of Canadians. Across the Caddle panel, more than two thirds stated that social media plays a significant or very significant role in keeping them up to date on coronavirus.

With such a crucial role being played by social media, the reliability of that information becomes even more important, across the world. It even led to last week’s unusual joint statement from Facebook, Google, Microsoft, Twitter, and others that they would be working closely to fight misinformation on the internet.

Will social live up to its potential to be a crucial source of truth? Our panel will be able to give us their thoughts as the situation unfolds.

What are Caddle Rapid Response Insights?

The data is based on 10,000 daily responses in the Caddle app, available for free. Anyone can join the panel. Just download the Caddle app to get started.

These are the findings from our initial surveys. From here, we’ll be expanding and diversifying the topics we look at. If there’s a crucial issue to your business that we can ask, reach out to a Caddle rep for find out more.

Millennials in Eastern Canada are ready for eSports

20 years ago did you ever think that a 16-year-old would become a multimillionaire athlete just by playing video games at home? Me neither. If I knew that was how the future of video games was going to pan out I would have told my parents I was investing in my future by staying in bed playing video games all day.

The surge of eSports globally is projected by The Canadian Business Journal to be a $1.5 billion dollar industry in annual revenue this year alone. Which means for brands in Canada, the opportunity to invest and align in this industry is a huge one.

What is eSports?

For those of you new to the lingo, eSports is a form of online sports where multiple players compete against one another often in front of a spectating crowd – sometimes virtual crowds but also at live events held in big arenas or conference centres.

To give reference to how big the e-gaming industry is, 16-year-old Kyle Giersdorf won $3 million from winning Fortnite, a Battle Royal shooter game, in a single tournament alone.

With North America proving to be the biggest revenue market for eSports, there is a big opportunity for brands in Canada to capitalize on this market, in more ways than one.

So who is watching?

Our survey results suggest that Millennials are eSports ready

Instead of streaming the eSporting events via Twitch, an opportunity might arise for sport broadcasts to display the game on television. Caddle insights suggest that 24% of Millennial males in Canada would be interested in watching an eSports game on TV at a bar or restaurant.

Watch the Leafs win the Stanley Cup (vicariously through an eSports Tournament)

Ontario fans no longer have to be disappointed to see the Leafs get cut from the playoffs for another season.

Ontario Millennials showed an over-indexed interest (26%) in watching eSports at a bar or restaurant. Perhaps now they could have the hope of watching the Leafs win the Stanley Cup virtually, if not in reality.

Are Habs fans interested in eSports too?

With how the Canadiens season is going this year, Quebec millennial males might be trading in their actual team for a virtual viewing experience; these Quebecers (36%) show an interest in watching eSports at a bar or restaurant which continues to suggest an opportunity for brands to tap into eSports viewing outside of the home.

Opportunities for eSports in 2020

Hockey aside, data suggests millennials in Eastern Canada want to watch eSports from the comfort of their local watering hole.

So, what does that mean for your brand?

Here’s are some opportunities to align your brand to eSports in 2020:

- Sponsoring eSporting events and aligning your brand through media exposure

- Activating at bars/restaurants to engage captive eSports consumers

- Advertising your brand during eSport related events and passion points

- Partnering with female gamers to generate diversity and inclusion

- Working with platforms like Twitch to leverage eSports creators and influencers to co-create content for your brand

Green business sells: how to increase brand awareness

It seems like our phones are rising in notifications about climate change just as fast as global temperatures are rising. From Greta Thunberg to the Australian Wildfires the constant reminder about how our planet is in a global crisis is almost unsurprising at this point.

Climate change is a very real and topical conversation that is happening among the world right now and Canadians are particularly feeling the heat.

How does climate change affect Canada?

With the rise in global temperatures, our nation has experienced a higher rate of warming than most other regions of the world and this appears to be affecting Canadians personal lives in one way or another.

From a pool of over 10,000 respondents, Caddle conducted a Rapid Research survey about Canadians thoughts towards climate change. The results – 63% of Canadians agreed that climate change has impacted their way of life. Additionally, social media is a significant contributing factor to Canadians awareness about climate change and is a primary source for their education on the topic:

- 37.8% of Canadians say that social media plays a significant role in keeping them up-to-date about climate change

- 55.7% of Gen Z’ers say social media plays a significant role in keeping them up-to-date about climate change

- 39.2% of Millennials say social media plays a significant role in keeping them up-to-date about climate change

Smart brands are shifting towards becoming eco-friendly companies to raise awareness about climate change and to make a tangible difference. Sharing these changes over social media can help a brand change perception and build affinity with today’s consumer and increase brand awareness.

Our solutions can help provide you with the insights you need to promote green businesses (without greenwashing) that will benefit both your brand health and the health of the planet.

Here are a few of our favourite brands going green and the social buzz they’ve stirred:

Eco-friendly companies: Seventh Generation

This laundry detergent company is taking a different route to the traditional spin cycle and is promoting green businesses through online branding.

By using the hashtags #ComeClean and #GenerationGood their creating conversations about going green with ingredients and packaging. Since then, the company has received numerous awards for dedicating to helping the environment.

Eco-friendly companies: Patagonia

You’d hope an outdoor apparel company would be an eco-friendly company. Despite admitting that they have used fossil fuels in the past, Patagonia has promoted eco-friendly initiatives to their customers, employees and mission statement.

Additionally, take a look through their online branding on Twitter and you’ll see environmentally conscious content riddled all over their feed.

Eco-friendly companies: TOMS

The popular shoe brand isn’t just supporting those by donating a portion of their sales to children who can’t afford shoes, but they’re also increasing brand awareness with the environmentally-conscious EARTHWISE products.

On their social platforms, you can learn all about how their products are eco-friendly.

Eco-friendly companies: [Insert your brand name here]

So we’ve shown you that Canadians feel affected by climate change and look to brands who are more eco-conscious and inform them over social media.

It’s time you put the social in corporate social responsibility and tell consumers what contribution you are making as a brand, and help educate and inform them about our planet.

At Caddle we can provide you with the insight solutions you need to best promote your eco-friendly business through online branding and rank among top leaders who are also contributing to the cause.

If you want to learn about how you can do that, drop us a line here.

If you would like to see the report from the insights we found, let us know here.

Or, if you’d like to contribute a question to this topic, let us know here.

Younger generations are most at risk for mental illness: 4 ways brands can help

Bell Let’s Talk is a campaign that most Canadians (and most brands) are familiar with by now. And if you don’t know, it promotes and supports mental health awareness by encouraging Canadians to share their battle with mental illness amongst fellow Canadians. And it’s been effective: over 86% of Canadians reported that they are more aware of mental health, due directly to Bell’s initiatives.

But Bell can’t do this alone. A Google Trends search suggests that the conversation is quickly started and then forgotten shortly after.

More and more Canadians are suffering from mental illness and this is a conversation that can’t be remembered for one day out of the whole year. This calls action on brands to join forces in sustaining the conversation around mental health.

We created a conversation about mental health with our Canadian panel and here’s what we found. This data can help shed light on how Canadians feel and further probe what brands need to do to take action on mental health.

Why is mental illness a problem?

Mental illness is a condition that can strike us all. The Canadian Mental Health Association reports that almost half of those who have suffered from depression or anxiety have never gone to see a doctor. Additionally, suicide accounts for 24% of all deaths among 15-24-year-olds and 16% among 25-44-year-olds. This is concerning considering that mental illness is widely stigmatized which presents a barrier for seeking help.

To delve deeper on this topic, we asked our Canadian panel of over 10,000 respondents their well being and these were the results.

Canadians are suffering from mental illness

- 70% of respondents said they or someone close to them suffer from anxiety

- 61% of respondent said they or someone close to them suffer from the blues (i.e., feeling sad, helpless)

Younger generations over-index on mental illness

- 73% of Millennials said they or someone close to them suffer from anxiety

- 80% of Gen Z’res said they or someone close to them suffer from anxiety

- 64% of Millennials said they or someone close to them suffer from the blues

- 78% of Gen Z’ers said they or someone close to them suffer from the blues

Despite this being such a heavily weighted topic, there are simple and effective ways that brands can help reduce feelings of anxiety and depression for their consumers.

How brands can combat mental illness and support health and wellness

According to the Global Wellness Institute, “wellness” is connected to weight loss, but consumers feel differently. They associate wellness with the mind, body and spirit. So how can brands jump at this opportunity even if they’re not associated with the health and wellness industry?

You’ve already seen how Bell Canada contributed to health and wellness by creating awareness about mental illness, but The Strategy points out a few other opportunities that brands can consider.

No. 1 – Natural materials

Including natural elements like wood, moss walls, and copper help the consumer feel soothed by being surrounded by “nature” so to speak. That is why you often see these elements in various retail stores.

No. 2 – Multi-sensory wellness

Soothing the senses has also proven to be a benefit for the consumer. By creating calming sounds and having quieter spaces have benefits of reducing anxiety.

Well Building Institute even took the simple route of having softer lighting in their buildings.

No. 3 – Minimalism

Packaging that is busy and in your face can bring added stress and results in choice paralysis for consumers. By taking the simplistic route on packaging, consumers don’t feel so pressured about purchasing products.

No. 4 – Partnerships

If changing your brand strategy isn’t on the agenda any time soon, then partnering with mental health organizations and generating a conversation about mental health could be an even more impactful opportunity to combat illness.

Over the years, several brands including Instagram and TheLADBible have taken this route and seen beneficial results.

How will your brand fight mental illness?

Truthfully the opportunities are endless. From small adjustments in your brand strategy to partnering with mental health organizations, your brand has the potential to help combat mental illness amongst generations young and old.

If you’d like to see the data we used let us know here and we’ll send you the full report.

If there are questions you want answered about this topic, drop us a line here.

Want to learn more about our capabilities? Let us know here!

Fitness junkies are interested in cannabis. Like, really interested

The stereotype of the lazy stoner sitting on the couch munching on a bag of chips might be finally over.

With the recent legalization of marijuana more conversations are had about how cannabis can improve one’s athletic performance. The pre and post-workout benefits have been lighting up.

Benefits include:

- Greater motivation and excitement when it comes to exercise

- Lower body fat index

- Better mental health and pain relief post-workout

Even microdosing can help users stay focused and beat personal records.

With cannabis being new to the market, this creates opportunities for those who are trying to include cannabis into their niche.

After asking our Canadian panel their thoughts on marijuana and fitness, we may have just found opportunities for:

1. Athletic brands who are trying to lead innovation

2. Cannabis brands who are trying to enter the market

Here’s our data.

Fit Canadians are interested in the devil’s lettuce

*Canadians who said exercise plays a “very large” role in their life*

- 37% of respondents are interested in consuming cannabis to improve athletic performance

- 24% are very interested

- 12.5% are somewhat interested

- 42.9% of Millennials are interested in consuming cannabis to improve athletic performance

- 29.7% of Millennials are very interested

- 14.2% of Millennials are somewhat interested

- 48.2% of Gen Z’ers are interested

- 37.9% of Gen Z’ers are very interested

- 10.3% of Gen Z’ers are somewhat interested

*Canadians who said exercise plays a “large” role in their life*

- 30% of Canadians are interested in consuming cannabis to improve athletic performance

- 8.7% are very interested

- 21.6% are somewhat interested

- 36.4% of Millennials are interested

- 10.2% are very interested

- 26.2% are somewhat interested

- 49.4% of Gen Z’ers are interested

- 21.2% are very interested

- 28.2% are somewhat interested

Cannabis could be rolling its way to athletics

So we’ve discovered a potential market fit. But how can you jump at this opportunity? Our solutions can gather data specific insights to your brand and how it fits in the cannabis-athletic industry.

Here’s what’s been going on currently in the cannabis-athletic space.

Cannabis balms for soreness and joint point

Dixie Elixirs offers a line tailored specifically for athletes who are looking to use marijuana for recovery from soreness and joint pain. Their products include balms, bath soaks, lotions, and more. Additionally, these products are promoted as natural and less harmful to the body than over-the-counter products like Advil or Icy hot.

Cannabis-infused Gatorade?

Cannabis producer Canopy Growth recently acquired a 72% stake in BioSteel Sports Nutrition. BioSteel currently produces sports proteins and hydration mixes. With their partnership and Canopy Growth’s recent announcement to launch cannabis drinks this month, perhaps we can expect to see cannabis-infused athletic drinks in a short period of time.

How can you incorporate cannabis into your brand?

Research suggests that there are benefits to consuming marijuana both pre and post-workout for active individuals. Additionally, industry leaders both in the cannabis and athletic realms seem to see the value in this opportunity and are partnering in creating innovative products.

Our insights suggest that there is a market for this in Canada. If you want to know how your brand can fit in this space or which demographics to market to, we can deliver you the insights you need to make better decisions, faster.

If you’d like to see the data we used let us know here and we’ll send you the full report.

If there are questions you want answered about this topic, drop us a line here.

Want to learn more about our capabilities? Let us know here!

Millennials are not buying into VR

Did you think VR was going to be the next big thing? You might want to guess again.

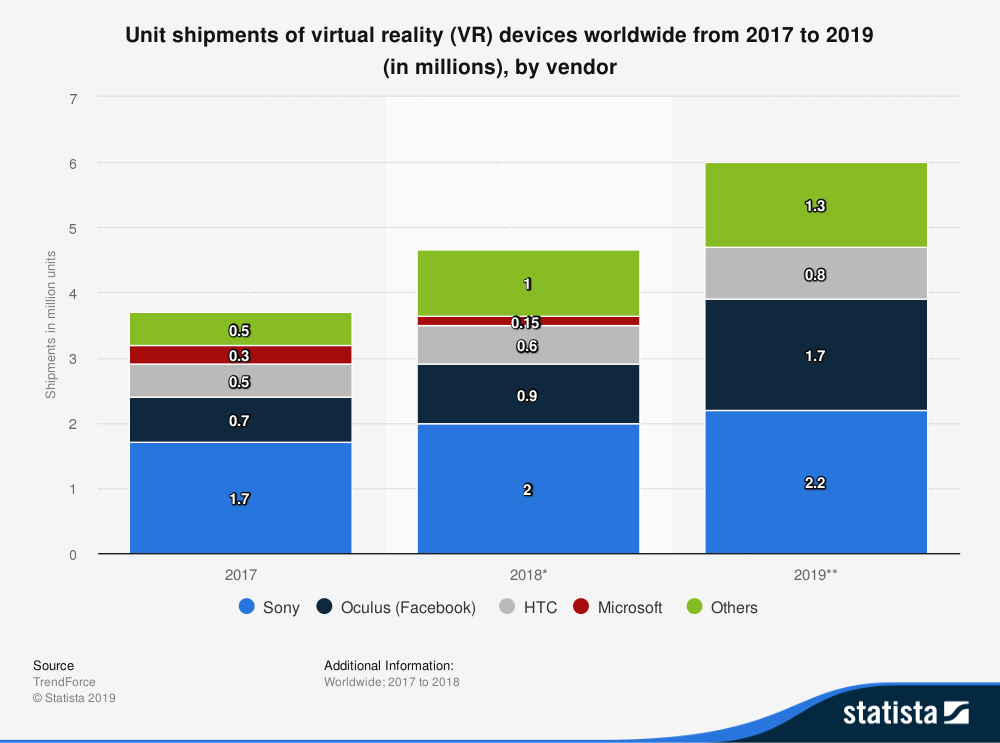

Over the past few years, VR sales have proven to be at a crawl. Last year alone, Statista reported that only 6 million VR units were sold… worldwide. To give some point of reference to that stat, Sony sold 19 million PlayStation 4 consoles in one single year globally.

While 6 million is no number to scoff at, Google Trends suggests that the majority of these sales were during the holiday time frame and VR was given as a gift. But are those consumers using them?

As The Motley Fool reminds us, increased sales during the holiday season don’t accurately reflect long-term value as some consumer goods tend to boom during the holiday season and bust the rest of the time.

Curious about this, we asked our Canadian panel their thoughts on purchasing a virtual reality headset. With a sample size of just over 8,500 respondents here are the insights we found.

Virtual Reality is facing a tough crowd

- 9.6% are likely to purchase a VR headset

- 2.9% are very likely to purchase

- 6.7% are somewhat likely to purchase

- 75.3% are unlikely to purchase a VR headset

- 13.7% are somewhat unlikely to purchase

- 61.6% are very unlikely to purchase

- Only 5.4% are willing to try virtual reality

Younger generations are interested in VR though, right?

Guess again. Despite having their phones glued to their face, VR might be a little too up close and personal for Millennials and Gen Z’ers.

- 72.8% of Millennials are unlikely to purchase VR

- 58% are very unlikely to purchase

- 14.8% are somewhat unlikely to purchase

- 6,3% are willing to try VR

- 61.8% of Gen Z’ers are unlikely to purchase VE

- 39.3% are very unlikely to purchase

- 22.5% are somewhat unlikely to purchase

- 12.4% are willing to try VR

So why the lack of interest in Virtual Reality?

It may seem that VR is just too early on in the market. The technology has a lot of potential but research suggests that there are a few variables that are deterring consumers from purchasing.

Just not that interested in VR

A study conducted by Nielsen found that of nearly 1,000 survey members, 53% of them were not interested in trying out the headset.

No Call of Duty to Play VR Games

The whole point of using VR is to feel like you’re actually in the game right? That can make things a little difficult when there aren’t many games you can play on VR. Games often don’t meet the quality as other gaming consoles do, or games last a total of an hour and have no sense of wanting more afterword.

Need a virtual wallet to buy VR

If potential buyers were to do a cost-benefit analysis of purchasing a VR headset, consumers might stick to the traditional gaming platforms.

On the lower end, VR products appear under $200 and reach costs over $600. Cell Phone companies might be able to charge high prices for their products, but VR just doesn’t have that kind of audience just yet.

Caddle Panel Agrees

Our Canadian panel of survey respondents tend to agree with the above mentioned.

The top three reasons why Canadians would consider trying VR are:

- Attractive pricing (28%)

- Curiosity (22.5%)

- New VR games (14.6%)

2020 Predictions for Social Media: What platforms are right for your brand?

Social media marketing is a necessity in your brand marketing and everyone is using it. Facebook alone has 89% of marketers on the platform for their brand marketing efforts. But are consumers still engaging? Are certain platforms more favourable than others?

While Facebook holds strong amongst the platforms for the most demographic groups, they lag behind Instagram when it comes to younger groups, specifically Gen Z.

We asked our 9,000 Canadian panel directly what platforms they use the most – here’s the goods:

Facebook holds strong amongst other social media platforms

- 65% of Baby Boomers use Facebook the most

- 50% of Millennials use Facebook the most

- 67% of Gen Xers use Facebook the most

Instagram has a strong hold on younger social media users

- 34% of Gen Z members report using Instagram the most

So what are the projections for 2020?

Instagram Continues to Rise

Are Canadians starting to realize that the book of faces is starting to become the book of advertisements? Despite most survey demographics saying they use Facebook the most now, 2020 projections look more towards Instagram as the popular social platform.

- 42% of Gen Z’ers think Instagram will be most popular in 2020

- 43% of Millennials think Instagram will be most popular in 2020

- 32% of Gen X’ers think Instagram will be most popular in 2020

- 38% of Baby Boomers think Facebook will be most popular in 2020

New Platforms will Emerge

Amongst Instagram and Facebook taking the No. 1 and No. 2 spot for 2020 projections, “Something new” took the No. 3 spot.

15% of members agreed that a new social platform could become popular in 2020. Additionally, Boomers (19%) and Gen X’ers (17%) over-indexed in this insight.

New Platforms: What Are They?

If you want to take the traditional route, then, by all means, use Facebook or Instagram. But if you want to get ahead of the curb here are some social media platforms we suggest for your brand marketing in 2020.

Social Platform No. 1 – Lasso

Are you looking to reach your Facebook user base but aren’t gaining much engagement in the oversaturated platform? Give Lasso a shot!

Lasso is a similar platform to TikTok where users can upload short videos with filters and music overlays.

The pro: Lasso is owned by Facebook which means you could leverage Facebook members to follow your Lasso account.

The con: the audience on Lasso is still rather small so gaining tracking may take awhile. But hey – they early bird gets the worm!

Those who are looking to market their brand in a creative and entertaining way, Lasso might be the app to tie your audience into.

Social Platform No 2. – Vero

Are Instagram algorithms and data mining getting in the way of your social reach? Then Vero might be the next best thing.

This social platform is similar to Instagram in which users can share content such as photos, music and videos.

The pro: Vero doesn’t use any data mining or algorithms so you can share your content with the masses without fear of your content not reaching out to as many consumers as possible.

The con: Vero’s tagline is “True Social ” meaning they don’t have any ads on their platform. So be ready to get creative if Vero is the route you take. Tactics such as influencer marketing and quality content posts could help you get a leg up on this platform.

Social Platform No. 3 – Steemit

Let’s be honest – whether you’re an avid Instagram or Facebook user, who wouldn’t love getting paid just for being on social media. Our survey panel seems to agree, 59% of consumers are looking for rewards-based engagement platforms.

Those who over-index are Baby Boomers (68%) and Gen X’res (60%).

This reason alone is why we believe Steemit, which rewards members with cryptocurrency based on the content they write, is a good platform to use to create engagement in brand marketing.

The pro: Those who are looking for a side hustle, this platform is a great way to engage in influencer marketing.

The con: with the success of cryptocurrency still up in the air, this platform could be hit or miss.

Which social platform is best for your 2020 marketing strategy?

Facebook and Instagram prove to be going strong in terms of “traditional” social platforms. But if you’re trying to get ahead of the curb and be an early adapter to new platforms, then these new platforms might be the ones for you.

- Looking to target Instagram users, give Vero a shot.

- Trying to target your Facebook user base, give Lasso a chance.

- If you want to take the influencer marketing route, Steemit might be the platform for you.