Research 101: Applying case study analysis for content creation

Ah, the beloved case study analysis. If you ever took business when you were in school the odds are you’ve likely heard this term before. Although, if business was mandatory or an elective for you, odds are might you either loved or hated case study analysis.

We hope it’s the latter because we’re about to dive into the topic and explain how we use its principles in our content creation. Not to worry though, you won’t be tested on this afterwards, so sit back and enjoy!

What is a case study analysis?

First of all, we should define what a case study is. According to Ashford University, a case study analysis requires you to investigate (but is not limited to) a business problem, examine alternative solutions, and propose the most effective solution using supporting evidence.

So how do we apply the principles of case study analysis to our content generation?

From case study to insights

If you’ve been following us through our blog or on social media, you’d know that we collect data in the consumer packaged goods (CPG) industry in order to accelerate our clients’ time to insights. This is where the case study principles start to come into play.

When learning how to write a case study it’s important to examine the case and determine where you want to focus your analysis on. Similarly, we do the same when we look at CPG markets.

We’ll look at markets that we believe are largely untapped, have the potential for new innovations, or investigate how new trends could influence the industry.

One way we do this by looking at our data results that our member base gives us when they answer our surveys. Once we’ve gathered this data, we’ll cross-reference these insights and see how they could provide solutions to a specific industry.

Case study, to insights, to content

Now that we have our insights gathered and we’re ready to make educated conclusions, we’ll take the principles of case study analysis and apply it to our content creation.

Introduction & Background

In this phase, we’ll set the scene with the information we know about the industry such as the market size, trends, and revenue. From there we’ll examine some problems or situations that impact the industry. For example, these may be decreased consumer spending, changing demographics or environmental impacts.

Evaluation of the case

From there we’ll see what our data provides and how our insights could benefit the industry. For example, we compared consumers who consume cannabis and drink beer. While the industry indicated consumer interest in cannabis-infused beer, our data showed that millennial males would be the best demographic to target this innovation.

Proposed solution or changes

Sometimes secondary research doesn’t show innovations or trends that an industry could benefit from. This is when we at Caddle shine! One of the goals of our survey is to find insights that suggest innovations that haven’t hit the market yet.

It’s important to ensure that these solutions are specific and realistic. Take for example half loaves of bread. Many European countries sell loaves of bread for half the size, and our survey members showed an interest in this innovation. Introducing this innovation into the North American market could help reduce food waste.

Recommendations

When finalizing our “case study” we provide suggestions for which innovation would equally benefit both the industry and the consumer. This could be through gaining brand loyalty, developing a competitive edge, or implementing environmentally friendly initiatives.

That’s a wrap

In this short little lesson, we’ve taught you how we apply case study analysis when creating content. With its principles, we’re able to compare our data to secondary research and examine how our insights suggest innovations that could benefit a market in the CPG industry.

Don’t worry about spending time using case study analysis yourself, Caddle is here to accelerate your time to insights! If you are looking for insights that could benefit your industry, fill out the form below and we’d be happy to see how we can help.

[simple-author-box]

Bone broth: what's the hype?

Caddle recently surveyed its members to understand their shopping behaviours when purchasing soup broth. An interesting finding was the interest in ready-to-drink bone broth as an innovation shoppers would be interested in purchasing. With all the hype around bone broth, we decided to dig into the industry a bit further.

Stock, Broth, Bone Broth – what’s the difference?

Good question! It all comes down to the ingredients and how long the product is cooked. Traditional broth is water simmered with vegetables, aromatics, and meat, and can include some bones. It is cooked for a short period of time—usually 45 minutes to 2 hours—then strained and seasoned. Stock is water simmered with vegetables, aromatics, and animal bones, sometimes roasted, and sometimes with some meat still attached. It is cooked for a medium period of time—usually 4 to 6 hours—then strained. Bone broth is similar to stock, but with a longer simmer time – often more than 24 hours, allowing for more nutritious minerals to be extracted

So what’s the hype on bone broth?

The emerging popularity of bone broth has been synonymous with developing health trends, education around the benefits of this product and more recently, the rise of product availability. Popular food trends such as the Whole 30, Keto and AIP diets are helping to drive the increased awareness of the supposed benefits of bone broth. While medical opinions differ on the effectiveness of the ‘bone broth diet’, some suggested benefits include:

- Reduction of Leaky Gut syndrome – linked to acne, allergies, celiac disease, depression, eczema, migraines, rosacea.

- Reduction in inflammation in the body and fighting joint health – particularly arthritis.

- Collagen – this essential nutrient is attributed to improving recovery time in sports, increasing skin elasticity for skincare benefits and reduce cellulite.

- Sports recovery and nutrition

- Animal health – in addition to humans, animals can benefit from this nutrition-rich option and bone broth soup can aid in joint recovery particularly for older animals.

Who are the current market players?

Research from Innova Market Insights looked at the top 100 sales companies in the CPG industry, particularly in food and beverage. The results show that General Mills and McCormick are the only parent companies in this category with a bone broth product in their US portfolio – both from acquisitions rather than internal innovation.

With year-over-year industry growth, the VC community has taken an interest, investing in smaller, privately held companies. Kettle and Fire, an industry competitor, started by a bone broth devotee, recently secured an $8 million Series A investment. Reporting that sales have tripled each year since inception in 2015, with 2018 sales forecasted at over $20 million. The investment will primarily go towards marketing efforts and allowing for more working capital as they haven’t been able to keep up with the product demand. Another market leader in the space, Ancient Nutrition secured $103 million in 2018 with a mix of private and investment funds, lead by VMG Partners.

What are the innovations?

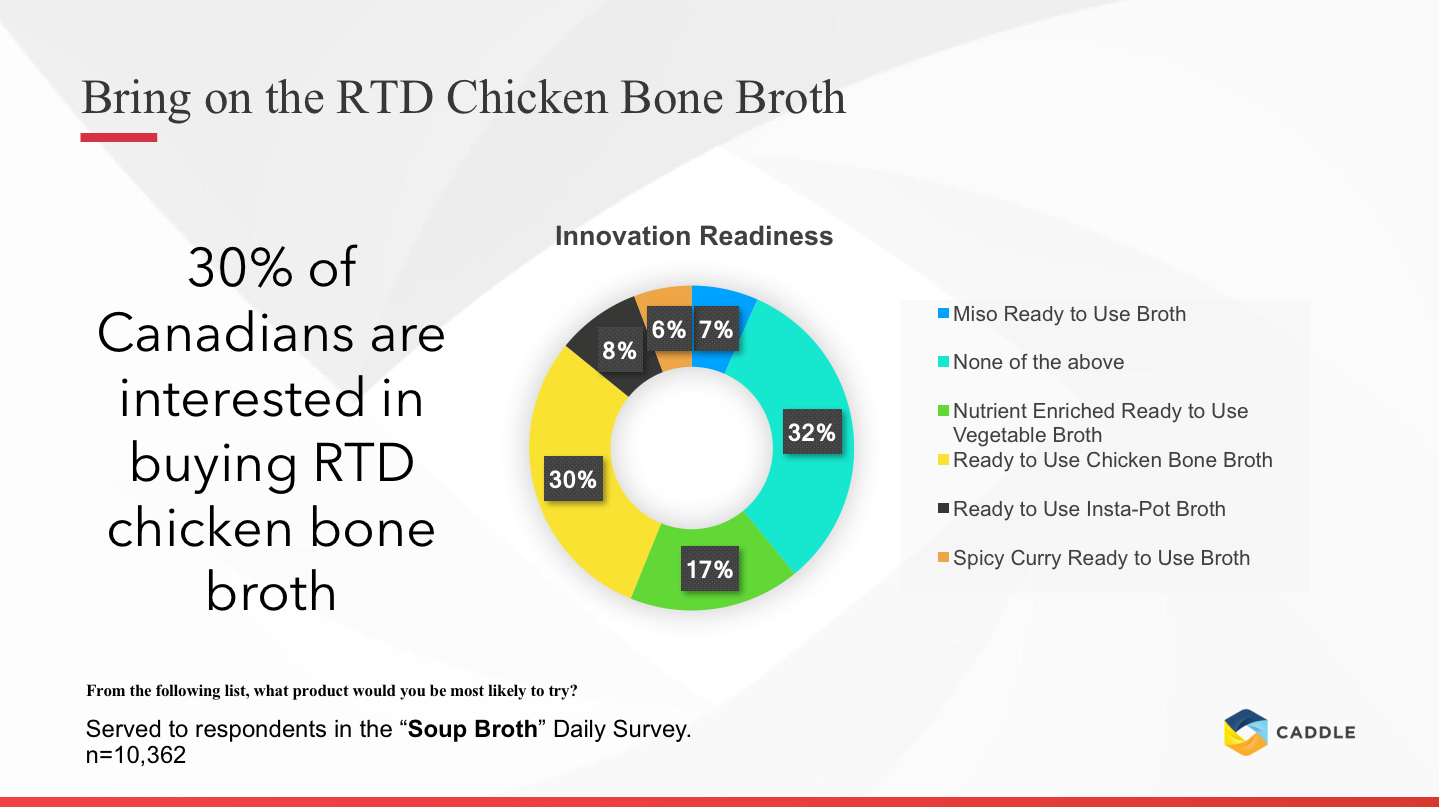

While currently available bone broth is sold in powder form, insights from our research suggest that 30% of Canadians would be interested in a ready-to-drink (RTD) format. Whole Foods recently jumped on this trend when they partnered with start-up Ossa Organic to launch a pop-up ‘bone broth bar’ in one of their UK stores; introducing consumers to what is being marketed as “the new coffee”.

One of the biggest appeals for bone broth soup is the time-saving factor of purchasing RTD products. Caddle users indicated that one in three Canadians are interested in a RTD chicken bone broth. While ready-to-drink formats are a relatively new trend, bone broth is leading the interest in fortified food and beverage products in a ready-to-go availability. This indicates that combined products such as the like of drinkable bone broth will become the norm. With its ease of maintaining one’s health, this is thus driving the demand for products such as these.

Wrapping up

With consumers being so readily concerned about their health, it appears that bone broth will become an emerging trend that will see a rise in demand in the coming years. With its many health benefits and ease of consumption, this will create an enticing opportunity for industry leaders to jump on this trend — or allow new entrants to enter the market as well.

Caddle is a consumer insights platform that allows consumer packaged goods companies to link directly to their target audience via surveys. As part of our daily survey activity, Caddle examined the decision-making process for consumers choosing their preferred brand of soup broth.

Are you launching a new product or looking to get insights before innovating? Connect with us to find out how Caddle can help.

Is eco-friendly bagged salad the way to brand loyalty?

Who’s got time to chop vegetables up and throw them in a bowl these days? No one! We truly live in an age of convenience where the laborious duties of making a meal are taken care of for us. For the convenience of bagged salad, all the chopping is done for us and all we have to do is open the bag, pour it in a bowl, and presto! Veggie goodness in a matter of seconds.

With the absolute ease of making, it’s no wonder why bagged salad has increased in market revenue over the years. In the span of a year in 2016, the bagged salad industry brought nearly $4 billion in annual sales, which was a 5.7% increase from the year previous. Additionally, the salad kit category saw the most revenue with $950 million in sales (31% higher from the year previous) and prepackaged organic salads are on the rise with a 12% increase from the year previous as well.

The numbers certainly speak for themselves, showing that the bagged salad industry is a booming one, but with consumer concerns for how safe these products really are with claims of bacteria still being found in the nooks and crannies of the leaves, the team here at Caddle was interested in diving deeper to understand consumer trends with relation to the industry. From a survey asking over 8,000 of our members, here’s what we discovered.

Lettuce tell you our insights

Salads don’t have to be a boring thing or only eaten for weight loss, in fact, that is the last thing you want when you’re the one trying to sell the salads. It’s easy to go to the grocery store and end up staring at a leafy green wall having absolutely no clue which one to pick. Romaine, spinach, iceberg, or kale salad. What’s the difference? They all taste the same!

With there being so many bagged salad brands on the shelves, it’s critical for new innovations to hit the market to gain a competitive edge.

“The ability to continuously innovate is the most important factor in remaining relevant,” said Vicky St. Geme, vice president of marketing for Taylor Farms, Salinas California.

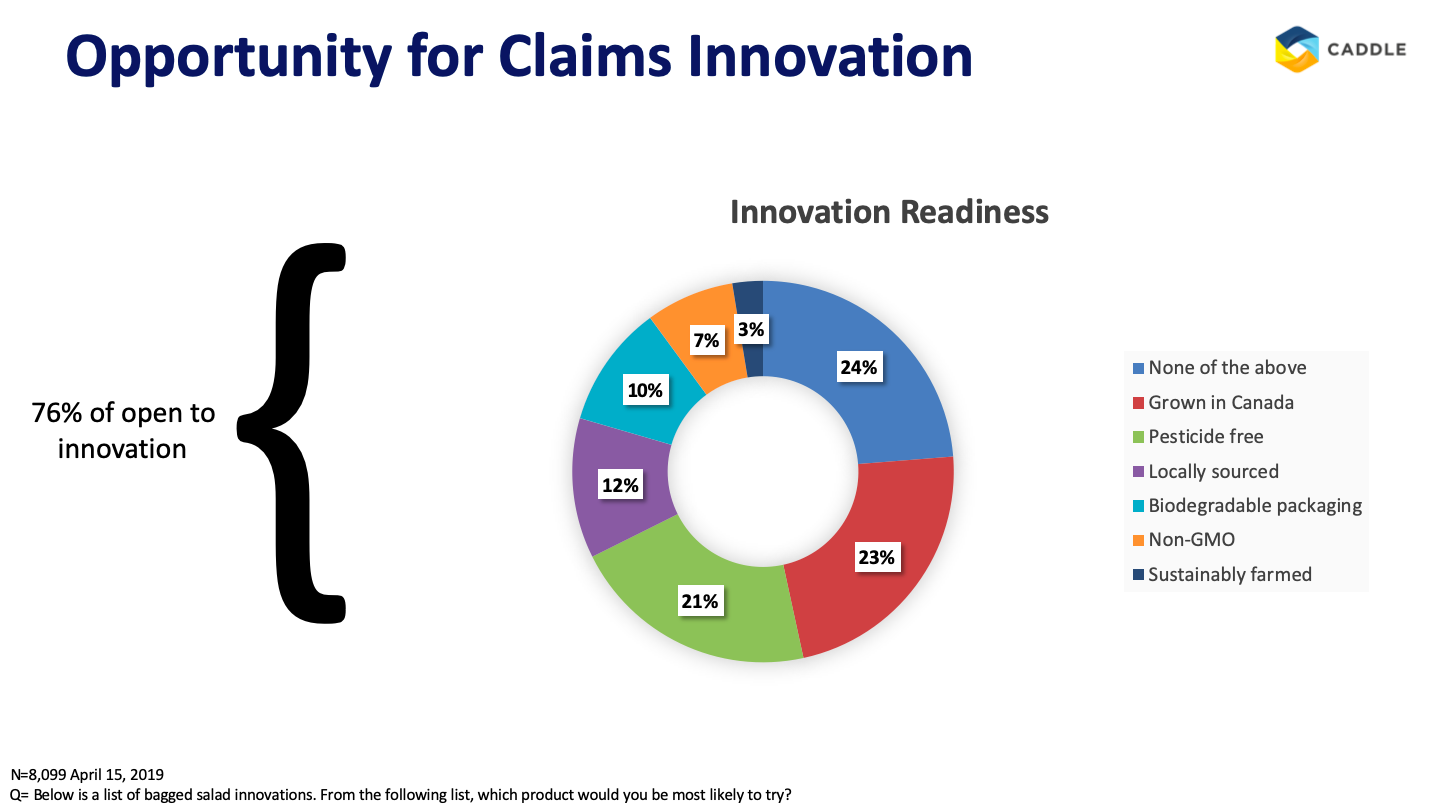

Well start the brainstorming session bagged salad brands because this one’s for you (yes, you!). When we asked our members their openness to bagged salad innovations, 76% of our members said that they would be open to new bagged salad innovations.

St. Geme continues, “standing out amongst our competition and incentivizing the consumer to purchase your product over another by giving consumers new flavour combinations in new packaging formats, and ensuring that the product is the freshest it can be in all segments – organic, kits and blends”.

Of these said innovations, our insights correlate with what St. Geme has mentioned, among some other innovations our members indicated an interest toward. We’ve got you covered bagged salad brands.

Green veggies, green packaging: the perfect combination

If you’re eating salads on a regular basis, you’re likely invested in your health and want to maintain a healthy diet. So why not go the extra step and maintain a healthy planet with biodegradable packaging?

While bagged salad is quick and easy for the consumer, there is a lot more effort that gets put into producing such a product as opposed to going to the store and picking up the ingredients yourself. Not only does the production process involve a lot of water to clean the veggies, but there is also a lot of plastic packaging that gets used. Especially when producing the kits that contain several plastic bags within one package.

To resolve this problem, there are a few alternatives that can be considered:

1. Buy a head of lettuce and make the salad yourself

2. Use biodegradable packaging for the bagged salads

Now, considering how well the bagged salad market is doing and how “time-consuming” it is to make a salad, it’s likely that option two is the best alternative for both the consumer and production companies.

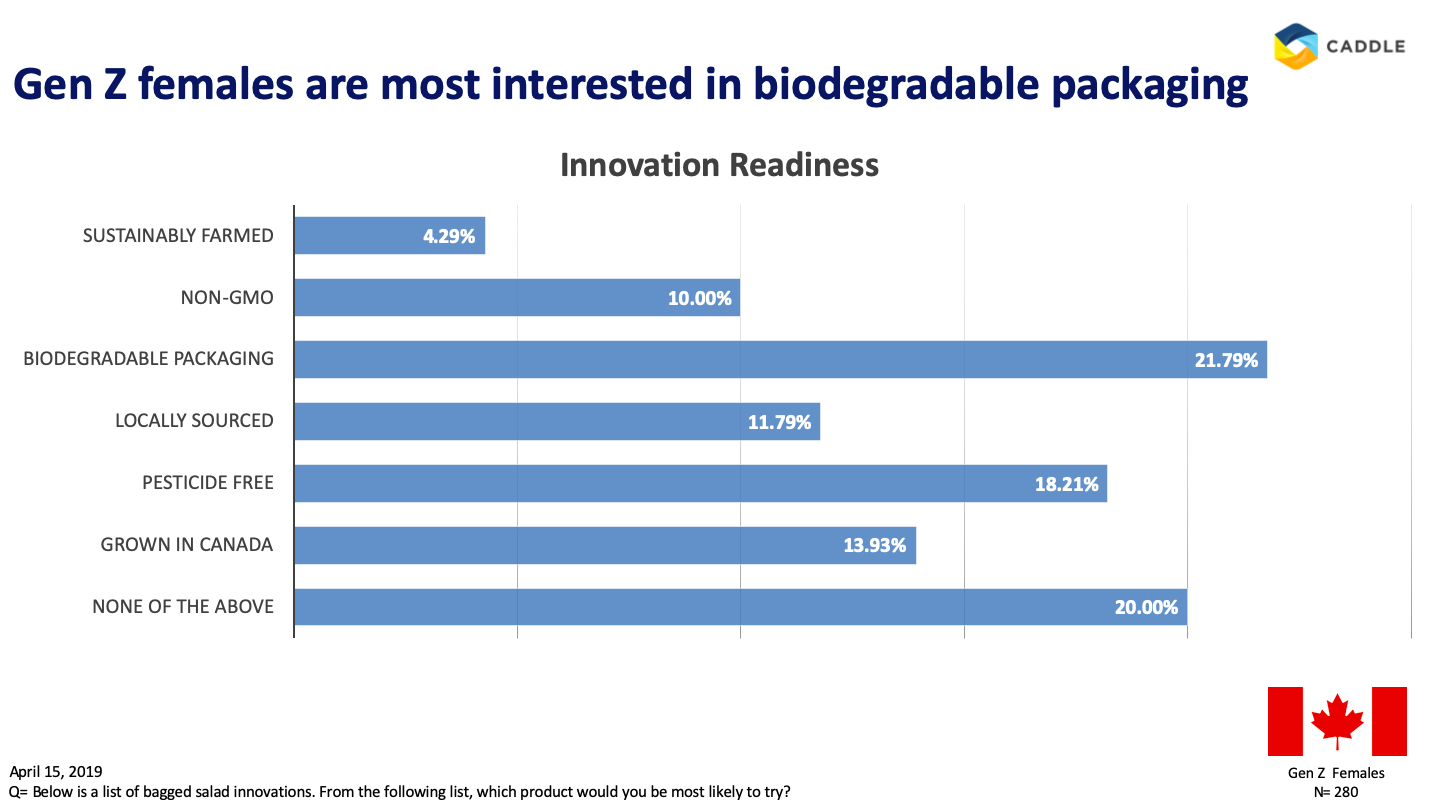

At least that’s what our Gen Z members seem to indicate. When asked what innovation they would be most interested in, female Gen Z members indicated that they would be most interested in biodegradable packaging.

Considering that there is the likelihood of there being a single-use plastic ban in Canada come 2021, this would be an innovation that could not only do some good to the environment, but could create brand loyalty for the potential brand’s social awareness and come as a trendsetter for other bagged salad brands to reduce the plastic world we’re consumed in.

“Don’t eat your greens”

Ha – bet you wish you heard that as a child, don’t you? While you likely wished that this is what your parents told you, the circumstances may be a little different from then compared to now. It’s not that we don’t want you to eat your green because they don’t taste good, but rather because they could be harming you.

Now, let’s not get ahead of ourselves here. Eating bagged salad likely won’t kill you, but some people are certainly concerned about the number of chemicals and pesticides that are used in the making of bagged salad. And rightfully so.

In the Treehugger blog, Melissa Breyer mentions that “lettuce, spinach, kale and collard greens all score in the top 16 for chemical load in EWG’s [Environmental Working Group] annual ranking of pesticide residues. Conventional greens will likely have equal pesticides regardless if they’re pre-packaged or not, but there are other chemicals to consider as well [such as chlorine]”.

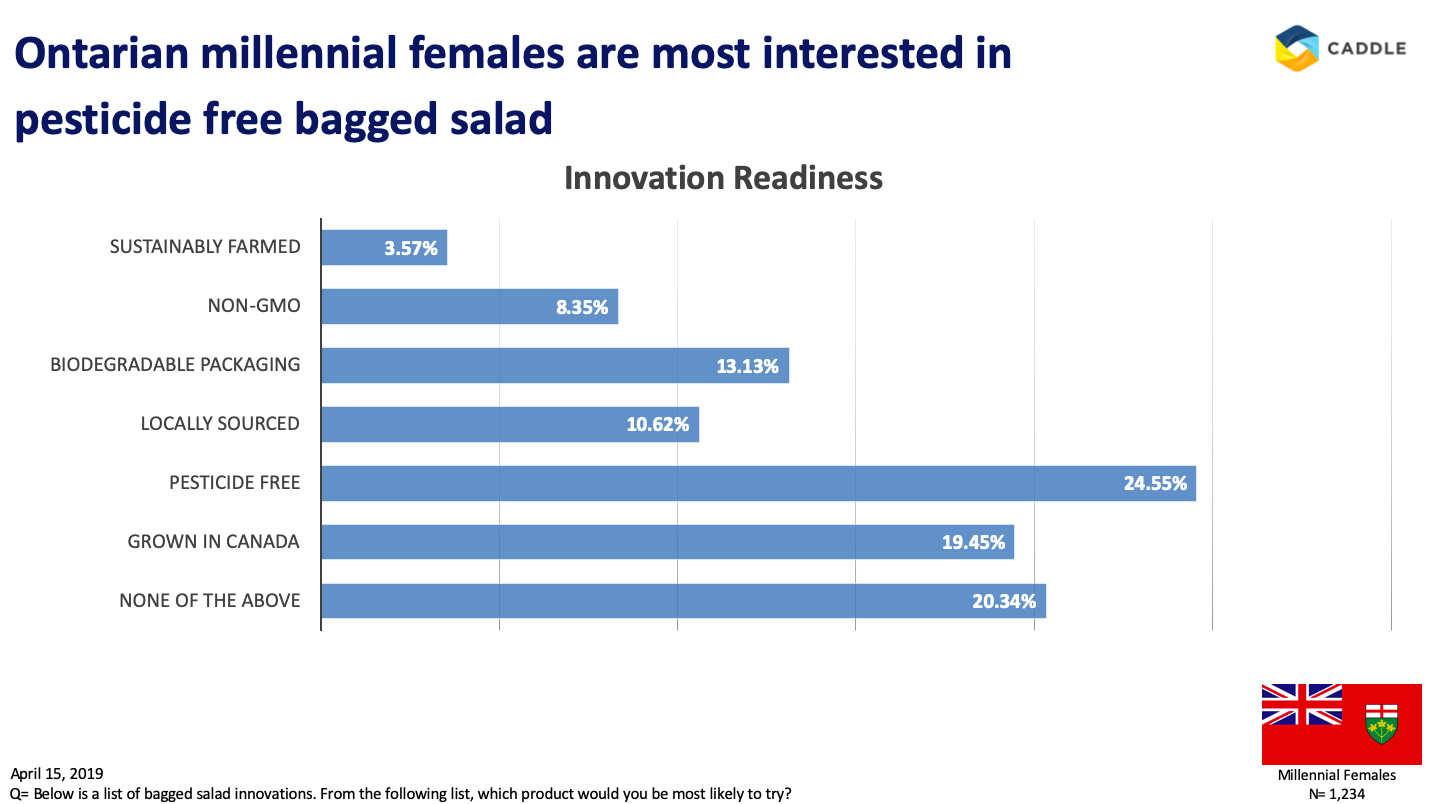

It appears that this concern is among Ontario female millennials as those members indicated that they would be most interested in a pesticide-free bagged salad innovation.

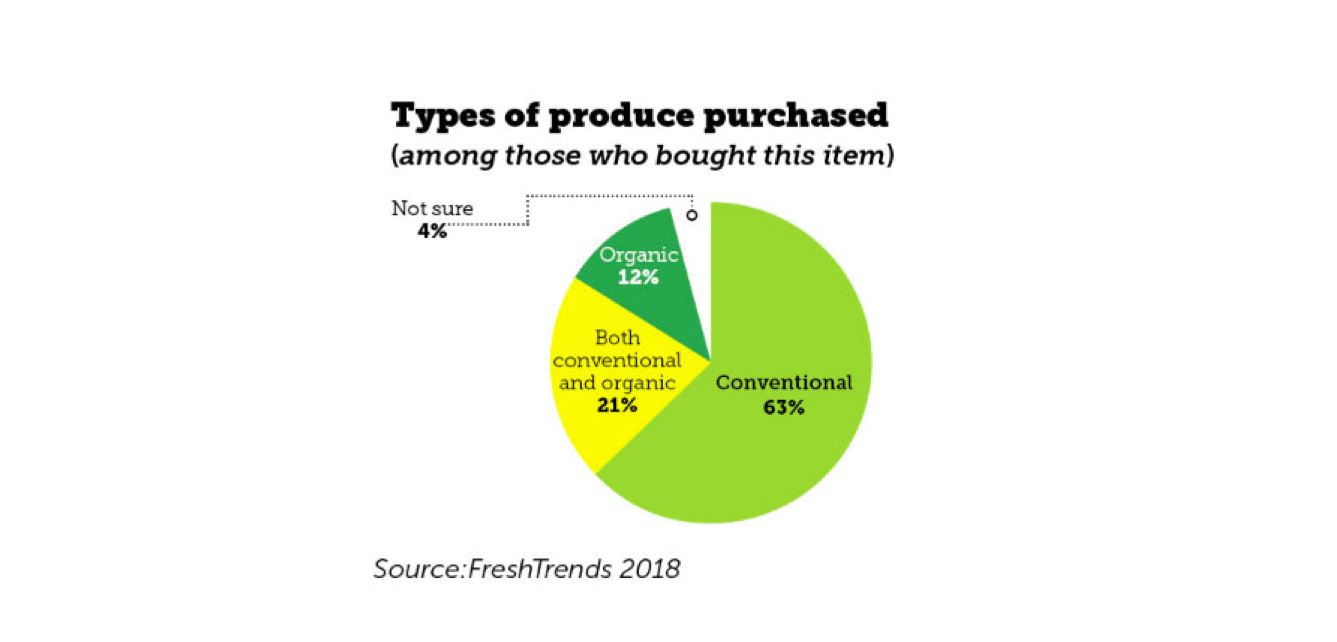

But are consumers willing to put their money where their mouth is? In a survey done by FreshTrends 2018 where they gathered information about the types of products consumers buy, 63% of respondents indicated that they purchase conventional produce while only 12% purchase organic produce.

While pesticide-free and organic are different but have similar qualities when it comes to bagged salad, if consumers truly are willing to purchase these products, similar to biodegradable packaging, this would contribute to a cleaner environment and in turn create brand loyalty for the green efforts bagged salad brands are initiating.

So what?

You must admit, there’s no better feeling than eating poorly over the course of a few days than opening a bag of salad and munching on that for the evening. Its refreshing crunch puts you in a good mood because you know your body is thanking you.

While the bagged salad market is an extremely high grossing industry, there are some areas that could use some improvement in order to keep a competitive edge and ease of mind for consumers. In relation to industry trends and what our members indicated in our survey, it appears that biodegradable packaging and pesticide-free bagged salad is an open opportunity. If you CPG’ers, choose to accept such innovations, we hope you see brand loyalty for your initiatives.

If you’re in the CPG industry and you want to learn more about your consumers and how you can create a competitive edge to your brand, reach out to us so we can accelerate your time to insights and provide you with the information you need.

[simple-author-box]

Eat your frozen dessert cake & have it too: industry insights

Just when you thought cake couldn’t get any better, they came out with frozen dessert cakes. You knew it was going to be a great birthday when you were presented with one of them. Although those days might be long gone for some of us, it appears that we’ve passed down the tradition to younger generations.

Overall, the global frozen dessert market is forecasted to reach $228.56 billion by 2024 with a compound annual growth rate of 5.32 percent from 2019-2024, reports Mordor Intelligence. Much of the market is driven by rising disposable incomes, the introduction of new flavours, and increasing impulse purchasing habits.

In Canada alone, there were 131 frozen dessert and ice cream manufacturing establishments in 2016 in which the whole industry saw a $385 million revenue in 2018.

Here at Caddle we wanted to have our cake and eat it too. So, we sought out and asked over 8,100 survey respondents their purchasing habits when it came to frozen dessert cakes.

The cake that won’t go straight to your hips

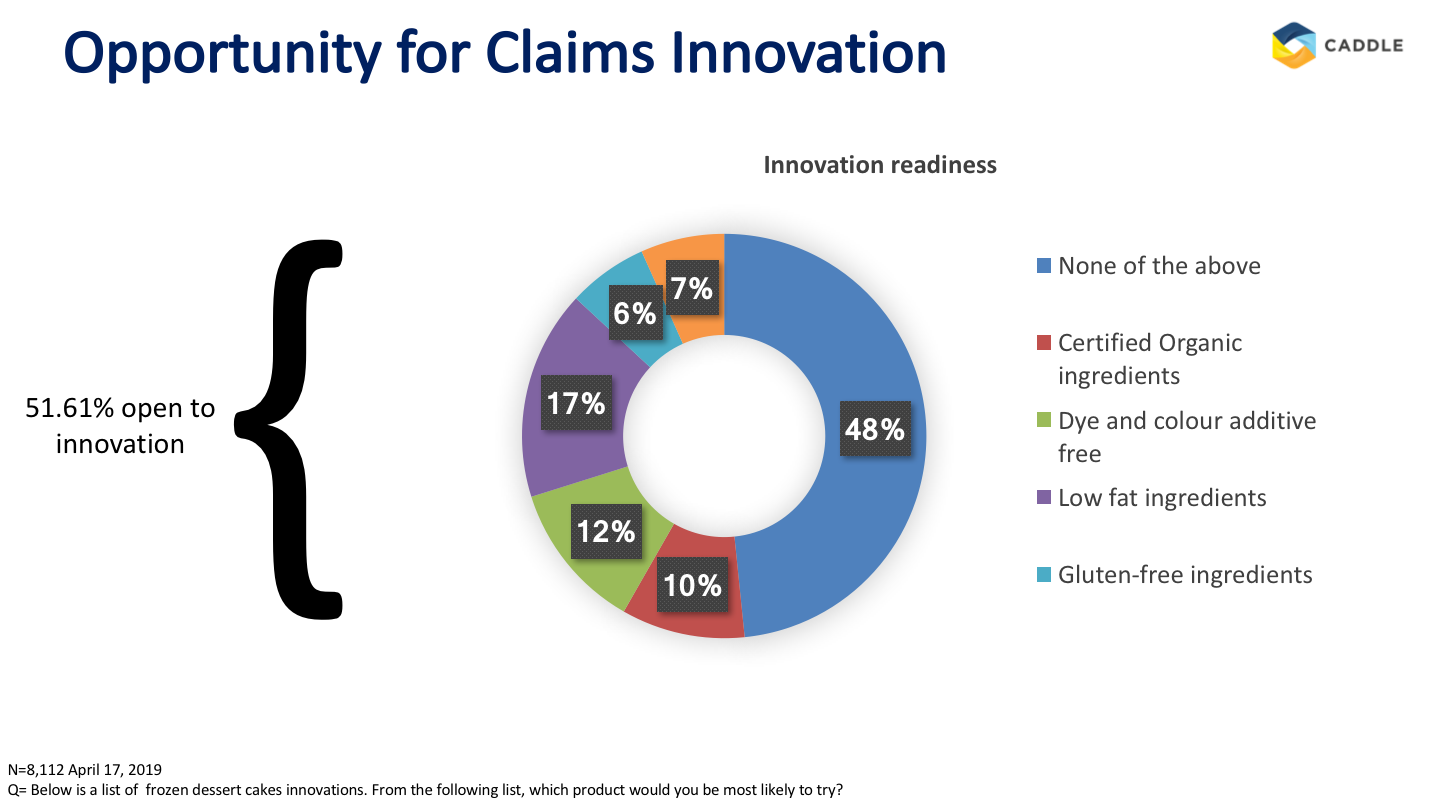

While frozen dessert cakes are elaborate as is, this leaves little room for innovation when it comes to aesthetics. This doesn’t mean that there isn’t the opportunity at all for innovation – 52% of respondents indicated that they would be open to trying a frozen dessert cake innovation.

Looking toward market insights, it appears that ingredients play a large role in consumer wants when it comes to dessert. Low sugar/salt, plant-based health and nutrition have become megatrends that are driving product development across the dessert production.

Interestingly, dietary trends themselves have become a major aspect of product development. Plant-based diets along with an interest in vegan and vegetarian lifestyles have created an 11 percent compound annual growth rate from 2013-2017, as reported by Food Ingredients First

Ice cream for insights

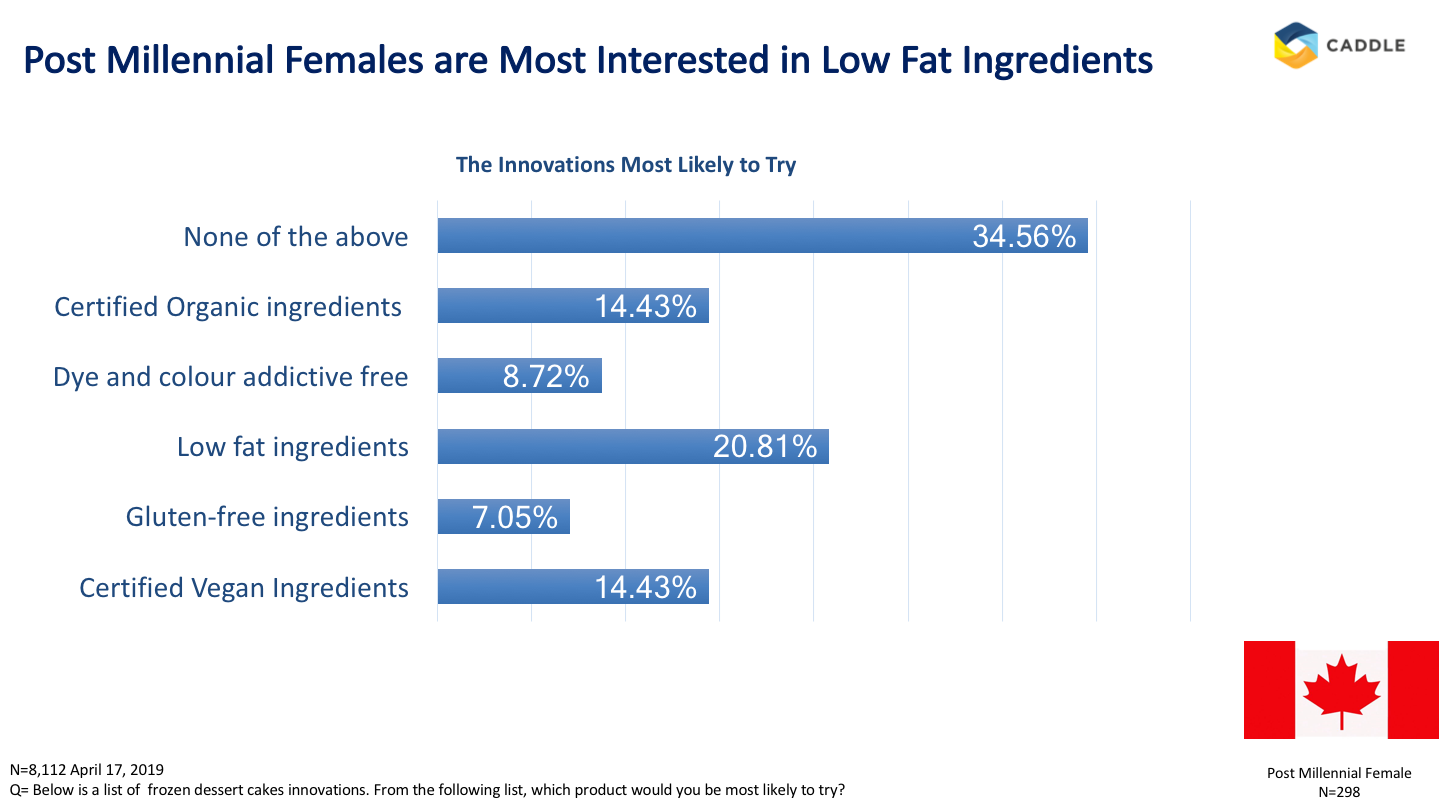

In our survey, we asked respondents what type of innovation they would be most interested in trying and 20% of post-millennial females in Canada agreed that they would be most interested in trying a frozen dessert cake with low-fat ingredients. This is an interesting insight as ice cream — the cousin to frozen dessert cakes — have become a trendsetter with its adaptation to low-fat ingredients.

Take, for example, Halo Top which sold 3 million units since its launch, and Oppo who made more revenue in the first seven weeks of their 2018 financial year than their whole year previous, as reported by The Guardian The reason: low-fat ice cream. On top of that, Dairy Queen — a frozen dessert cake specialist — listed “focus on healthy treats proposition” as an opportunity in their SWOT analysis.

The proof is in the pudding (or ice cream in this case) that low-fat ingredients are key to market profit. Perhaps if the frozen dessert category adhered to their distant relative’s process by incorporating low-fat ice cream into their frozen dessert cakes, this would be a key innovation to profit.

I see it, I want it

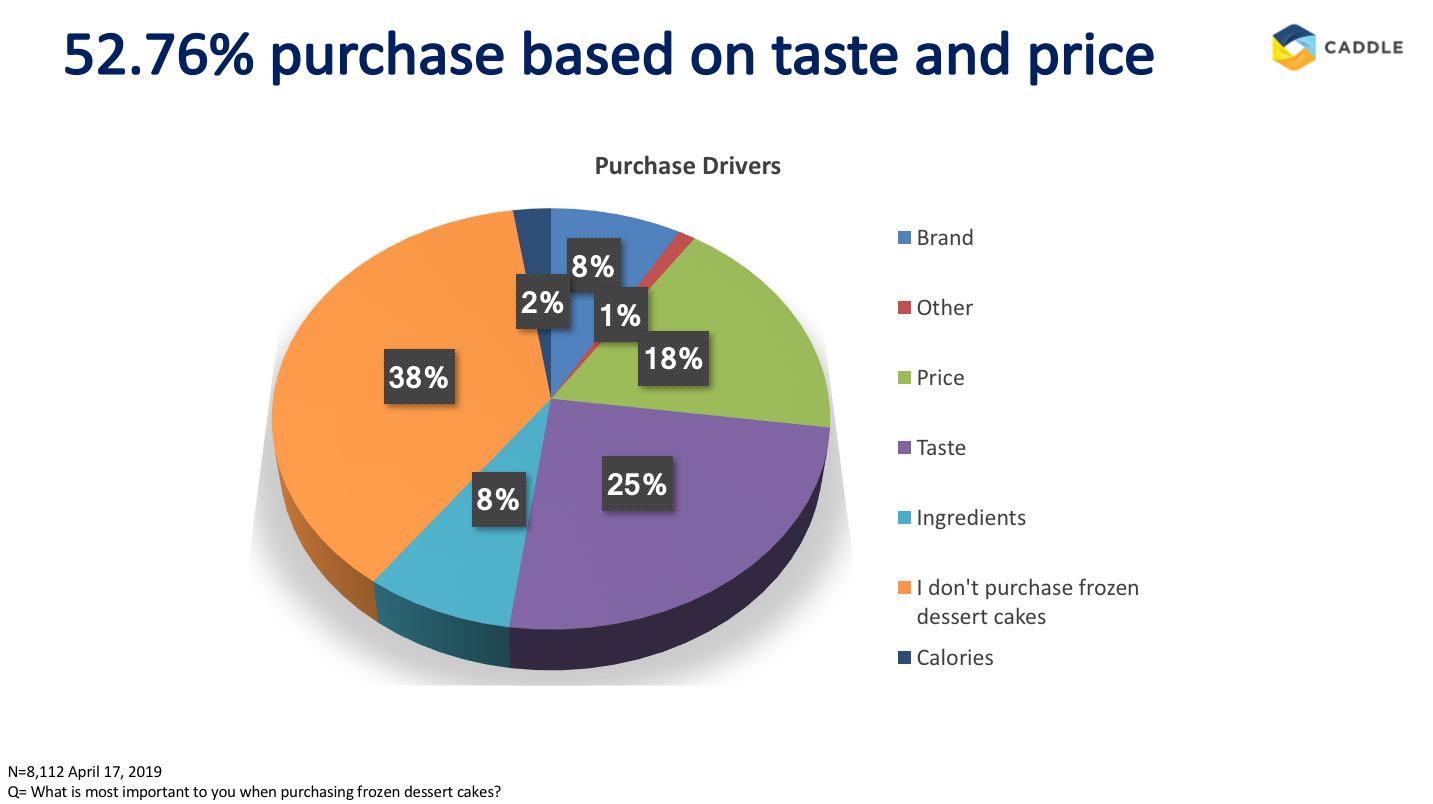

When it comes to purchasing frozen dessert cakes, 47% of consumers indicated that they won’t put it on their grocery list, but will purchase it when they see it in the store. Continually, 53% of respondents indicated that price and taste are the two main purchase drivers when it comes to purchasing the sweet, frozen treat.

Respondents indicated that they will purchase frozen dessert cakes when they see it in the store aligns with market trends indicating that the market is growing due to increasing disposable incomes.

Further, MarketResearch.biz found that the introduction of new innovative products with different tastes and flavoured frozen desserts is expected to have a positive impact on market growth. Certainly, with respondents indicating that they purchase the sweet treat based on taste, consumers will be enticed to purchase these new flavours when they see them in their local grocery store or ice cream stand.

So what?

Frozen dessert cakes are a treat that anybody at any age can enjoy. With the increase in disposable income and health trends, it appears that consumers are looking for a sweet treat with low-fat ingredients in them. If industry leaders follow this trend, they should be certain for a path of success.

If you’re in the CGP industry and are interested in gaining insights on your consumers, we encourage you to reach out to us and see how we can transform your questions into insights.

[simple-author-box]

Oil free, cruelty free & anti-aging serum among moisturizer wants

Time and time again we hear in advertisements that moisturizer is the key to healthy, long-lasting skin. And quite frankly, they’re right! You never really realize how great moisturizer is until you’ve got uncomfortably dry skin that is begging for a little TLC.

But we all use moisturizer for different wants and needs, which is exactly why the market has such a high demand for product innovations that can tend to several different audiences. Market Research Future reports that Manufacturers have been focusing on developing unique formulations and adding it to the existing product line in order to enhance the value of their product range. Therefore, this industry is a very customer-oriented market in order to meet their needs.

With the market constantly in the battle to develop new and improved innovations and integrate them into their product lines, the industry is expected to have a calculated 5.7% compound annual growth rate during 2013-2023.

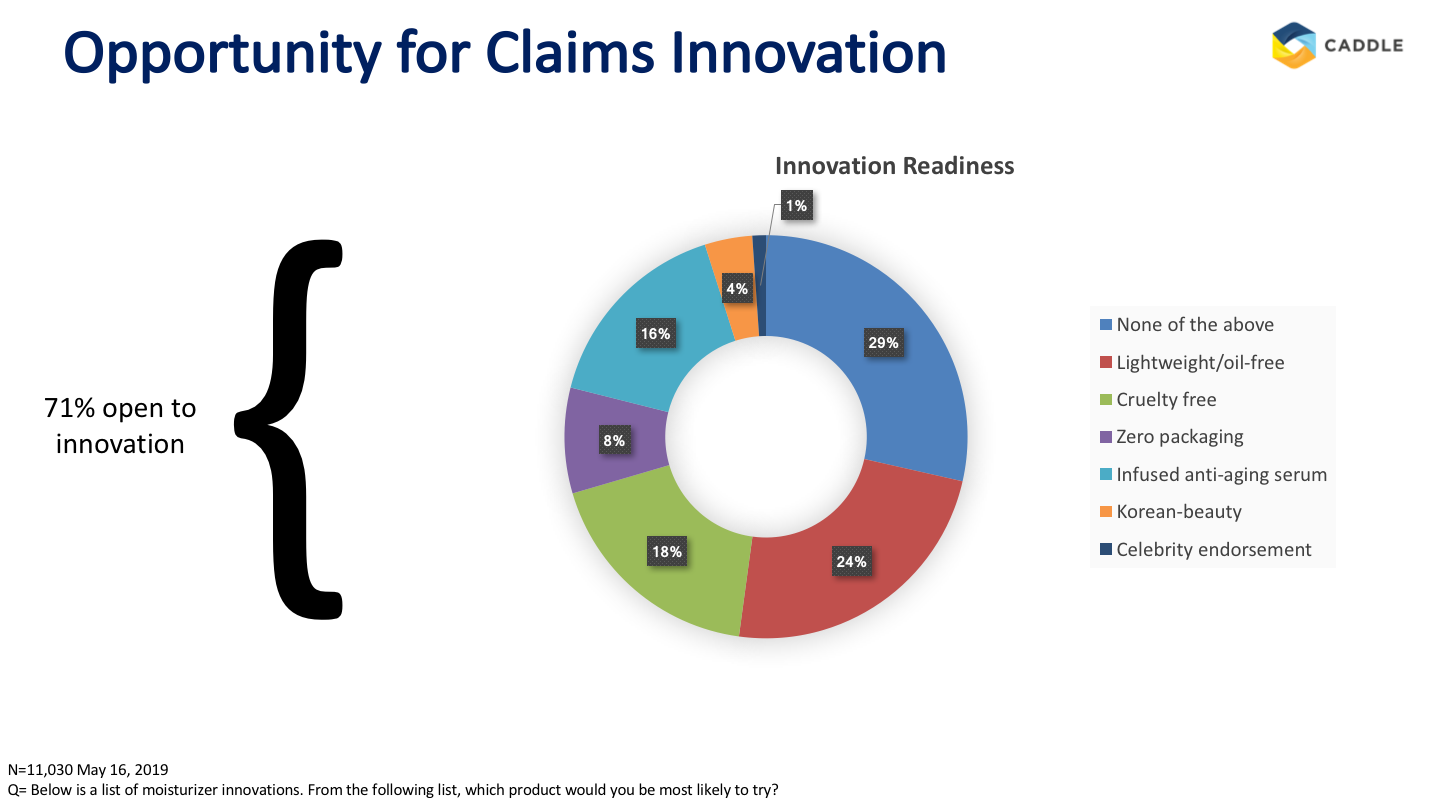

But what kind of innovations do consumers want from their moisturizer? You’re in luck, Caddle has the answers! Recently, we surveyed over 11,000 of our members on their moisturizer purchasing habits, and we were intrigued when comparing our results with industry trends. Let’s find out what we learned.

A product for any skin type

Ah, the battle of the generations. You’ve heard it before, “those darn millennials” or “those outdated baby boomers”. Believe it or not, the battle between generations has been an argument that has been passed down for generations and will continue to do so.

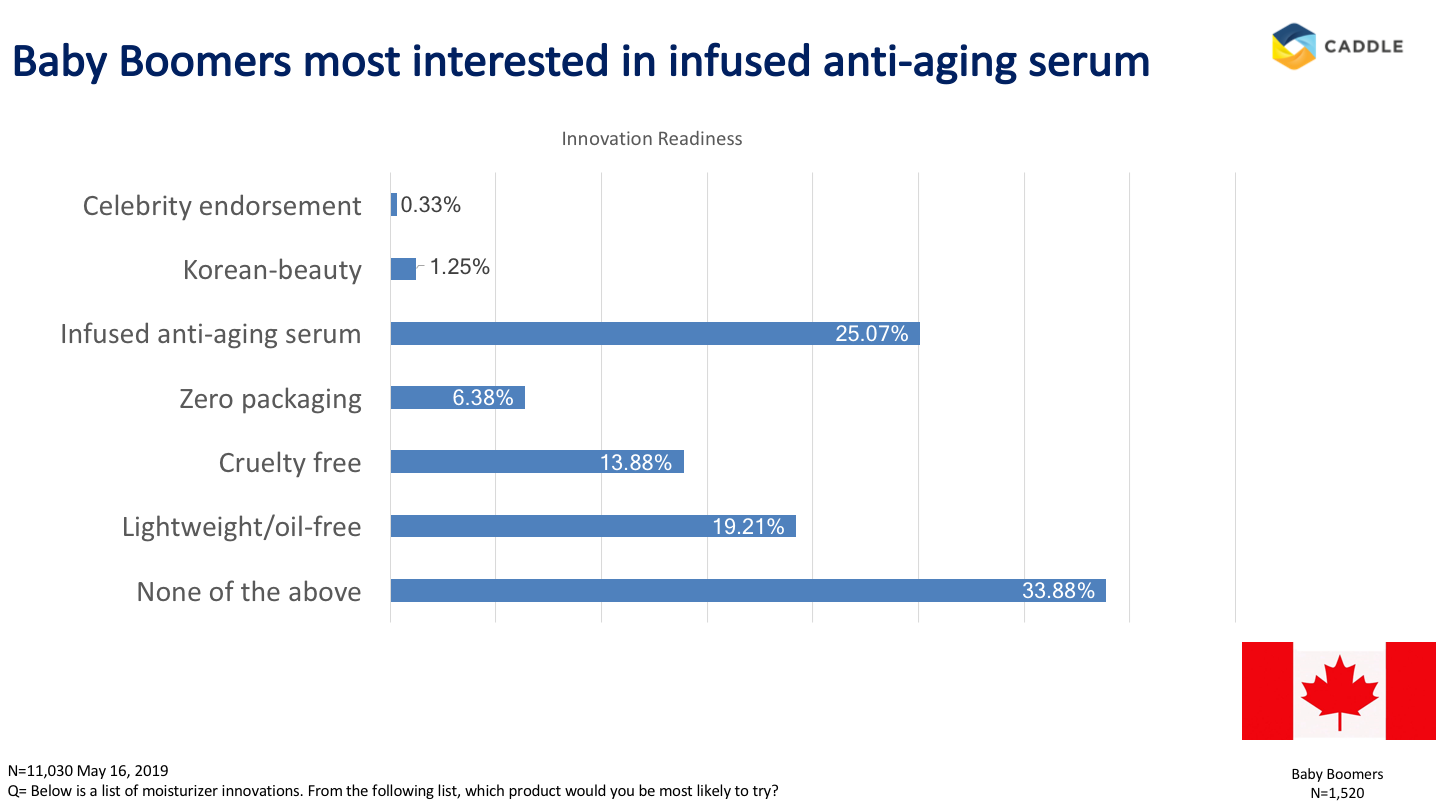

But maybe that’s because we all want different things? This certainly seems to be a possibility when it comes to moisturizer. When we asked our members what innovations they would be most interested in trying, each generation voted for something different. This is fluid with the industry itself as moisturizing cream has been segmented on the basis of specialty attributes. These attributes consist of:

- Natural & organic

- Herbal

- Cruelty-free

- Anti-aging

- Acne

Let’s face it, a 60-year-old baby boomer is less likely to apply acne prevention moisturizer on their face than what a 16-year-old would, and the same can be said that a 16-year-old is less likely to apply anti-aging moisturizer to their face.

The point is, each generation is going to want something different out of their moisturizer, so it’s only fair that those in the industry meet each generation’s needs. And, why wouldn’t they? More wants lead to more opportunities for innovation, which leads to new product lines, which lead to profit!

Vegan Moisturizer?

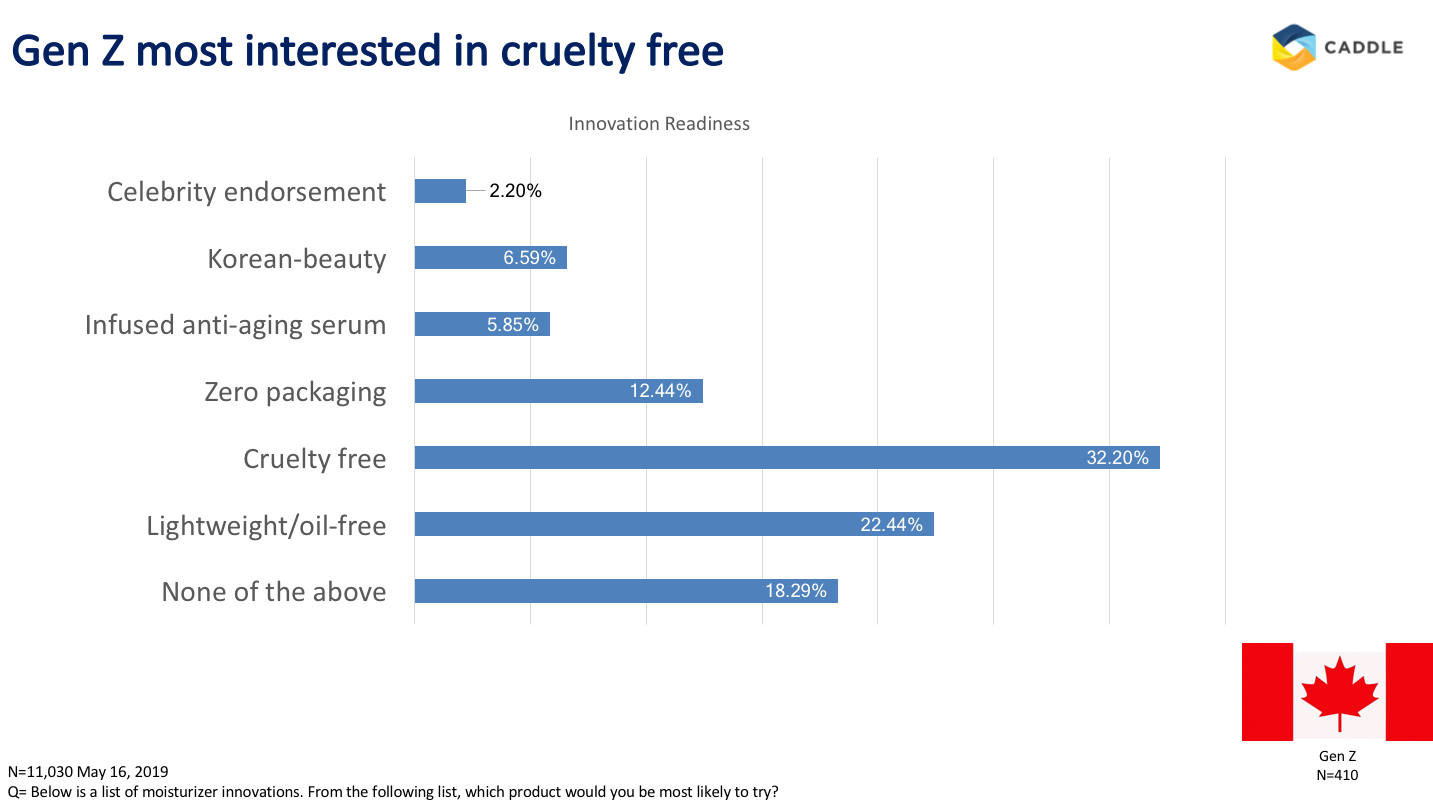

Not quite, but close! Being vegan means more than just cutting meat out of your diet, it means taking care of those little critters too. In turn, this rapidly increasing lifestyle is having a big effect on the CPG industry. In particular, “market share of cruelty-free moisturizing cream is found to be growing at a higher rate due to the rising population of vegan consumers,” noted Market Research Future.

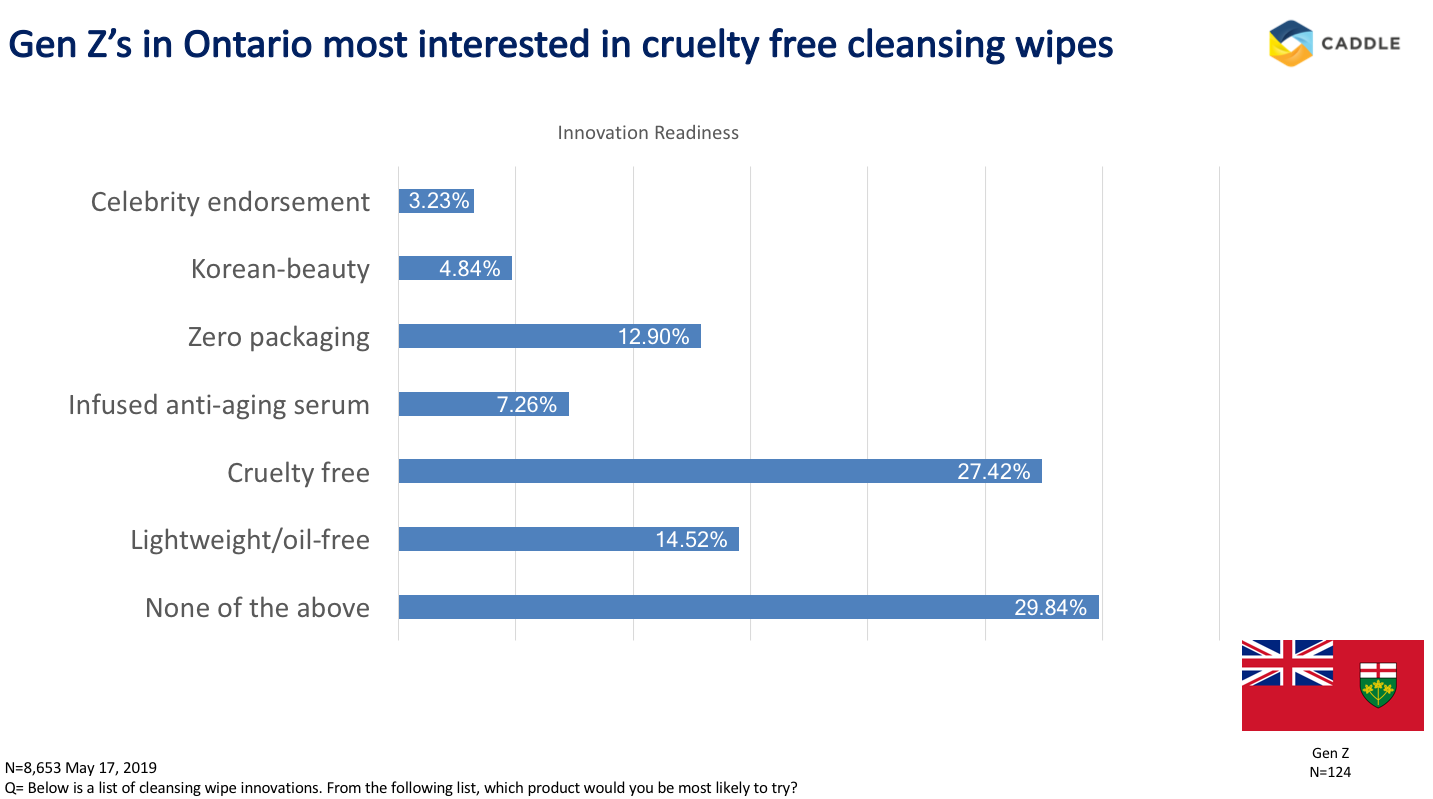

This is something that holds true to Gen Z members. When asked what innovations they would be most interested in trying, 32% of Gen Z members indicated that they would be most interested in trying cruelty-free moisturizer. When compared to other beauty products, this seems to be a common trend. When we asked our members, what cleansing wipe innovations they would be most interested in trying, Gen Z members again indicated that they would be interested in a cruelty-free product.

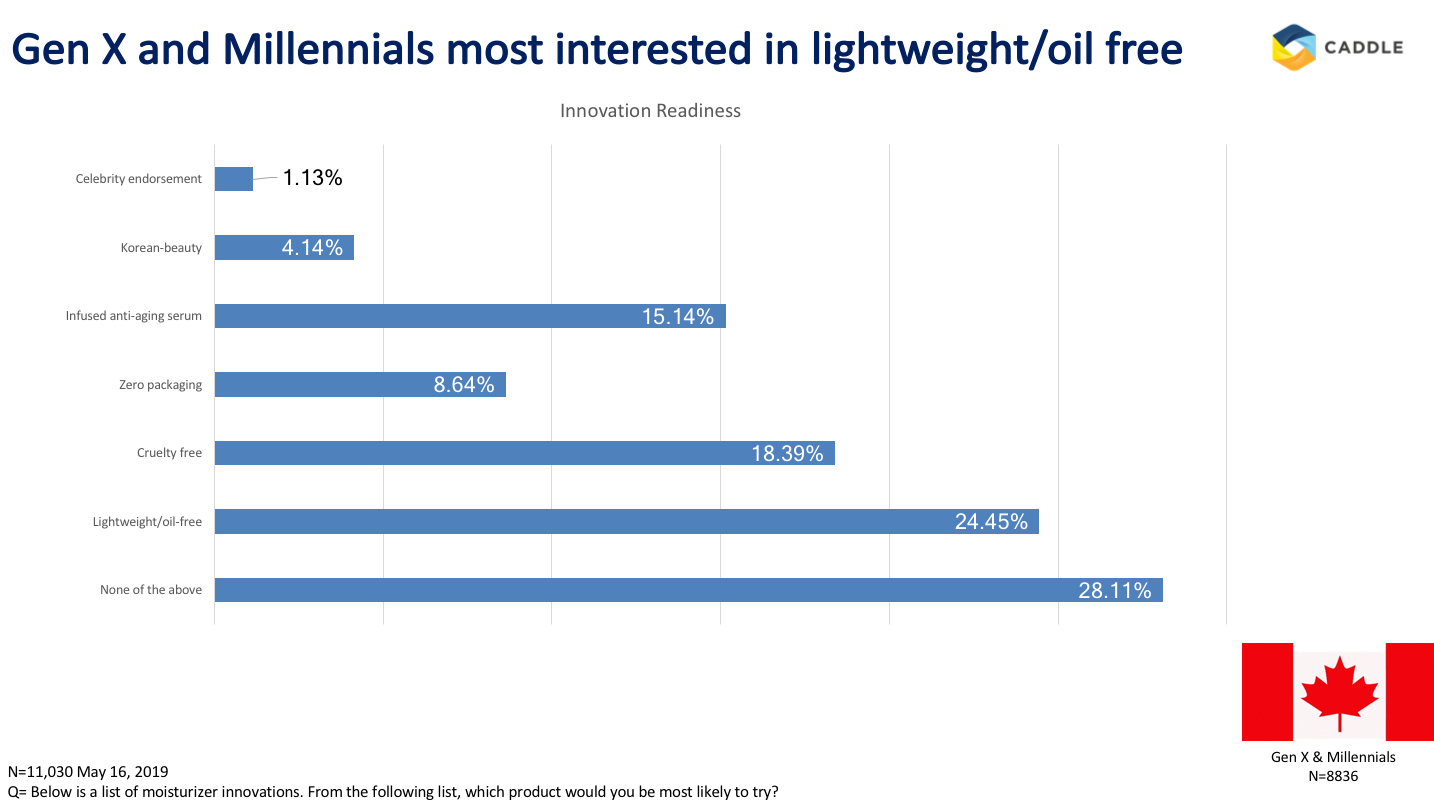

It appears that veganism is a relatively new lifestyle, so where do Gen X and Millennials fit into this category? They too are following suit. While these members indicated that they would be most interested in Oil free/lightweight moisturizer, their second common innovation turned towards, — you guessed it – cruelty-free.

This creates the perfect opportunity for industry leaders to develop products that meet the needs of multiple consumers wants. Take Alba Botanica for example. Their Acnedote Oil Control Lotion is a lotion that is not only oil-free but cruelty-free too.

Certainly, creating a single product that meets the needs of multiple audiences is bound to turn a profit.

Is K-beauty the road to healthy skin?

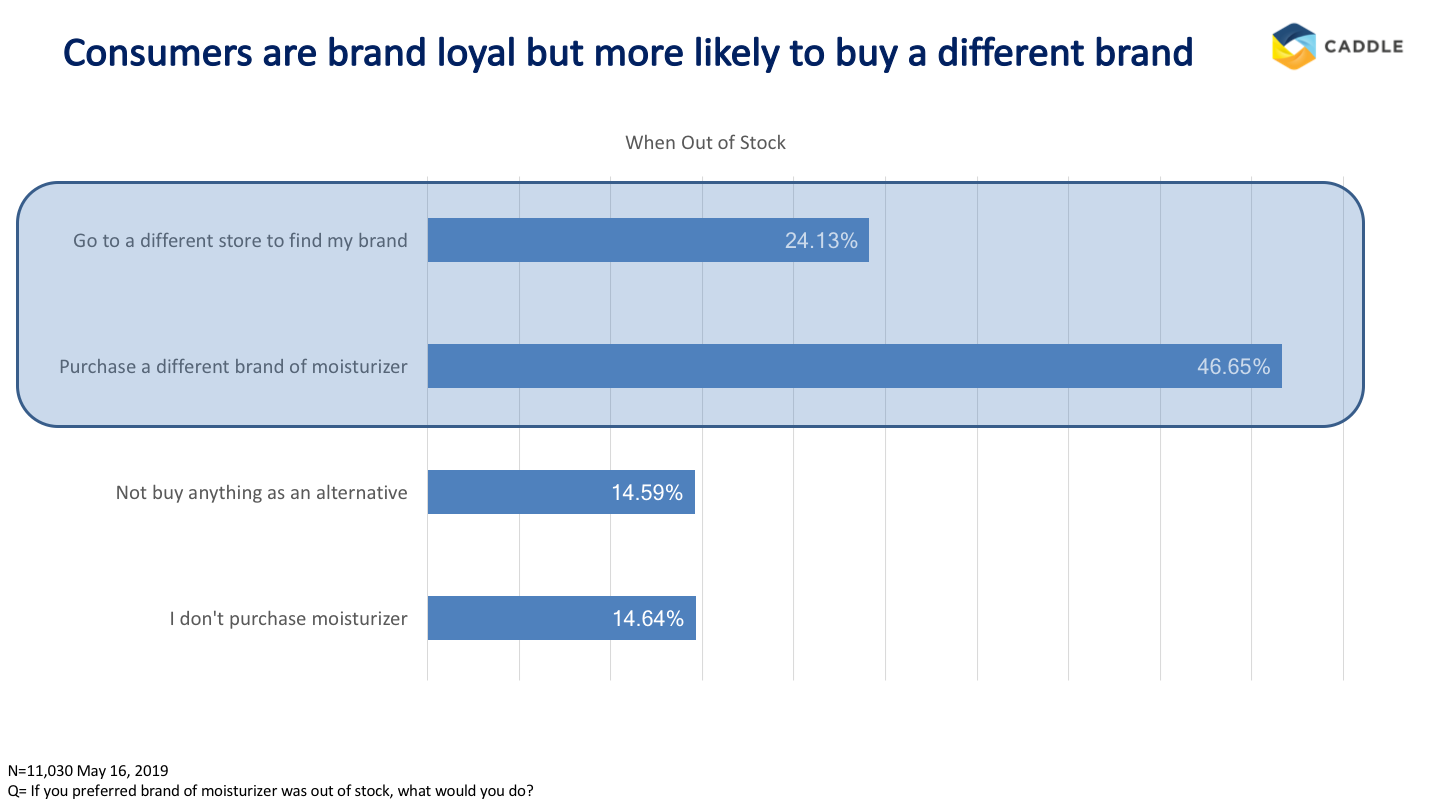

With some products, we tend to be brand loyal beings. In the case of moisturizer, while 46% of members indicated that they would purchase a different brand of moisturizer if their preferred brand was out of stock, a surprising 21% said that they would go to a different store to find their preferred brand.

But when it comes to your face, your main concern shouldn’t be brand says beautytap.com. Skin manufacturers don’t know every skin type, let alone your own, so it’s important to be loyal to your skin’s needs and the ingredients that meet them.

“The options come directly to us by the brands themselves, which is why K-beauty (Korean beauty) stands mostly apart from the pack. You see, as a general rule, we’re pursuing them instead of the other way around,” Tracy Teel of beautytap.com mentions.

Teel makes a good point. Perhaps consumers are spending too much time being brand loyal instead of researching which brand is best for their skin. She also makes note of K-beauty. A form of beauty products that are focused on health, hydration, and naturalness.

K-beauty ranked as one of the lowest innovations that our members would be most interested in trying. Perhaps this is an untapped market that industry leaders could integrate into their product line and marketing campaigns to bring more awareness about the benefits of K-beauty.

So What?

After comparing industry trends to what our members indicated in our survey, it is evident to see that the moisturizer industry is full of potential. With the opportunity to create products that tend to specific generations, or even a collective of generations in one product, or the potential marketing strategy K-beauty products could adapt, the industry is certain to see the CPAG increase as forecasted.

If you’re in the CPG industry and you’re wanting to gain insights on your consumers without lengthy wait times, please reach out to us here at Caddle so we can accelerate your time to insights.

[simple-author-box]

Anti-aging & cruelty free: cleansing wipes that are more than skin deep

Let’s do a quick pros and cons list here for makeup.

Pro: it can enhance your natural beauty

Con: it can clog your pores leaving your skin vulnerable to acne

But how do we cure this dilemma? Well, surely by now you know the answer. A quick use of a cleansing wipe after a long day at work or night out with friends will leave your face feeling fresh and rejuvenated.

Facial wipes are a staple to maintaining healthy skin and is a key contributor in the facial care market. Through the years, Canadean Consumer Market Data reports that the product has seen a steady rise with a 5.2% compound annual growth rate from 2000 through 2019. Additionally, while the global skin care market currently grows at around 6%, the facial cleansing wipe market is growing with a projected 10% annual growth rate over the next few years.

In one of our Daily Surveys, the Caddle team ventured out to discover how our members purchasing habits match up to industry trends. As Technavio highlights the industry, consumers aged 20-39 are high facial wipe purchasers for their personal grooming habits and rising disposable incomes. This is an interesting relation to our findings as this age group provided the most insight regarding their use of facial wipes. Additionally, this helps explain why 70% of our members indicated that they purchase cleansing wipes.

How else can our findings provide insights into the industry?

Dismissing the one size fits all approach

While you may not look a day over 20, your skin likely isn’t the same when you celebrated your third 20th birthday. But that’s okay, you want a product that offers something different from what your children are using and the industry understands that.

Developing products that can reach a wide span of different generations is something that the skincare industry works hard at investigating.

“The age group of target consumers is another major factor considered by skincare product manufacturers. For instance, Estée Lauder, through its brand CLINIQUE and LVMH, [and] through its brand philosophy, offer facial wipes for different age groups such as teens, age groups of 20-29 years, and age groups 30-39 years,” says Brijesh Kumar Choubey, a lead cosmetics and toiletry analyst at Technavio.

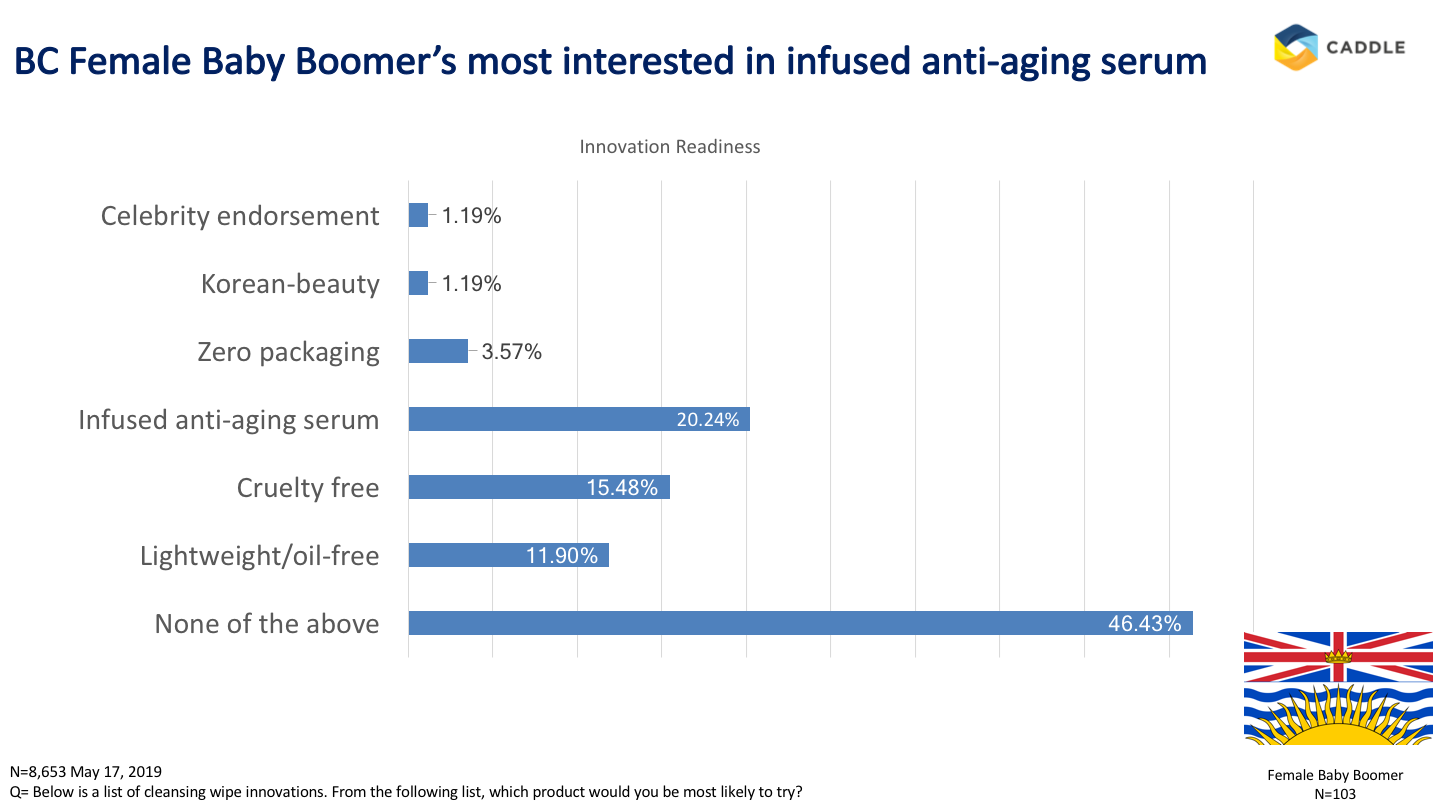

Did you notice the keyword there? It is in their brand philosophy to provide facial wipes that are useful to different age groups. This is reassuring as our members indicated that they were interested in different innovations generally based off their generation. I.e., baby boomers are more interested in anti-aging cleaning wipes while Gen Z members are more concerned about cruelty free products. By continuing to integrate the needs and wants of the consumer in their brand philosophy this would be a wise objective to maintain as industry leaders can expect to see brand loyalty. And who doesn’t love brand loyalty? That means more money!

Age is beauty

Don’t be ashamed of your age, embrace it! In the Canadian report “Redefining Anti-Aging Marketing Strategies for the Beauty Industry” it was discovered that consumers are now embracing their age and rather than striving to look younger, consumers are now interested in simply looking their actual age instead of trying to hide it. Older women are no longer trying to be hip with the younger generation by trying to dress and look younger than what they are. And beauty products are helping women embrace this natural gift so they can be the best version they can be.

Looking at our insights it appears that the industry is listening to their audiences. When asking members what cleansing wipe innovations they would be most interested in, BC female Baby Boomers indicated that they would be most interested in an anti-aging infused serum in their facial wipes. By developing a product as such, this would allow for women to maintain the health of their skin without premature aging and women can be confident with their age and embrace their natural beauty.

Leave no market untapped

While the skin care market is deep in research and development on new innovative products, the global skin care trends are not currently well-addressed in the wipes market. Becoming more aware of global skin care trends opens a whole new world of opportunity for market leaders and manufacturers as they can begin to predict what the next generation of wipes may look like.

Look no further as we have the insights for you! When asking our members what cleansing wipe innovations they were most interested in trying, our Ontario Gen Z members indicated that they were most interested in cruelty free wipes.

Among other product innovations such recyclable packaging and vegan/cleaner products, cruelty-free products is something that Gen Z consumers have highlighted as an important factor when considering a purchase. “They’re a very conscious consumer,” says Tara Simon, the retailer senior vice president of merchandising for prestige beauty at Ulta.

Gen Z customers have a deep passion for the wellbeing of animals and are especially double checking their beauty brands for the cruelty-free label on these products. If no such label is found, these customers are likely to turn on their brand.

This is something to seriously consider if it means generating and maintaining a brand loyalty to an emerging generation. It’s worthwhile and is in the industry’s best effort to consider producing products that don’t harm animals in anyway.

So what?

While the skincare market is steadily growing at comfortable levels of 5%-6%, the facial cleansing wipe market is one that is ahead of the curve with an annual growth of 10%. While such products provide effective needs of removing makeup and dirt, it would be beneficial for the market to evaluate global trends so that they can meet the needs and lifestyles of different generations. With reference to the industry, our insights suggest that developing cleansing wipes that tend to an older audience with anti-aging infused serum, and cruelty-free wipes are potential profit generators.

If you’re in the CPG industry and you’re wanting to get a better understanding of who your consumer is and their purchasing habits but don’t have months to wait for feedback, we encourage you to reach out to us so we can accelerate your time to insights.

[simple-author-box]

Fire up the barbecue for these smokin' hot BBQ seasoning insights

Fire up the barbie because summer is just around the corner. Everyone has their own secret stuff whether it be a sauce or dry rub. Currently the global spice and seasonings market is worth $3.76 billion and the global savory applications will register a compound annual growth rate of over 4.5% by 2025. This increase can be contributed due to growing disposable income and rapid product innovations that are increasing the industry size.

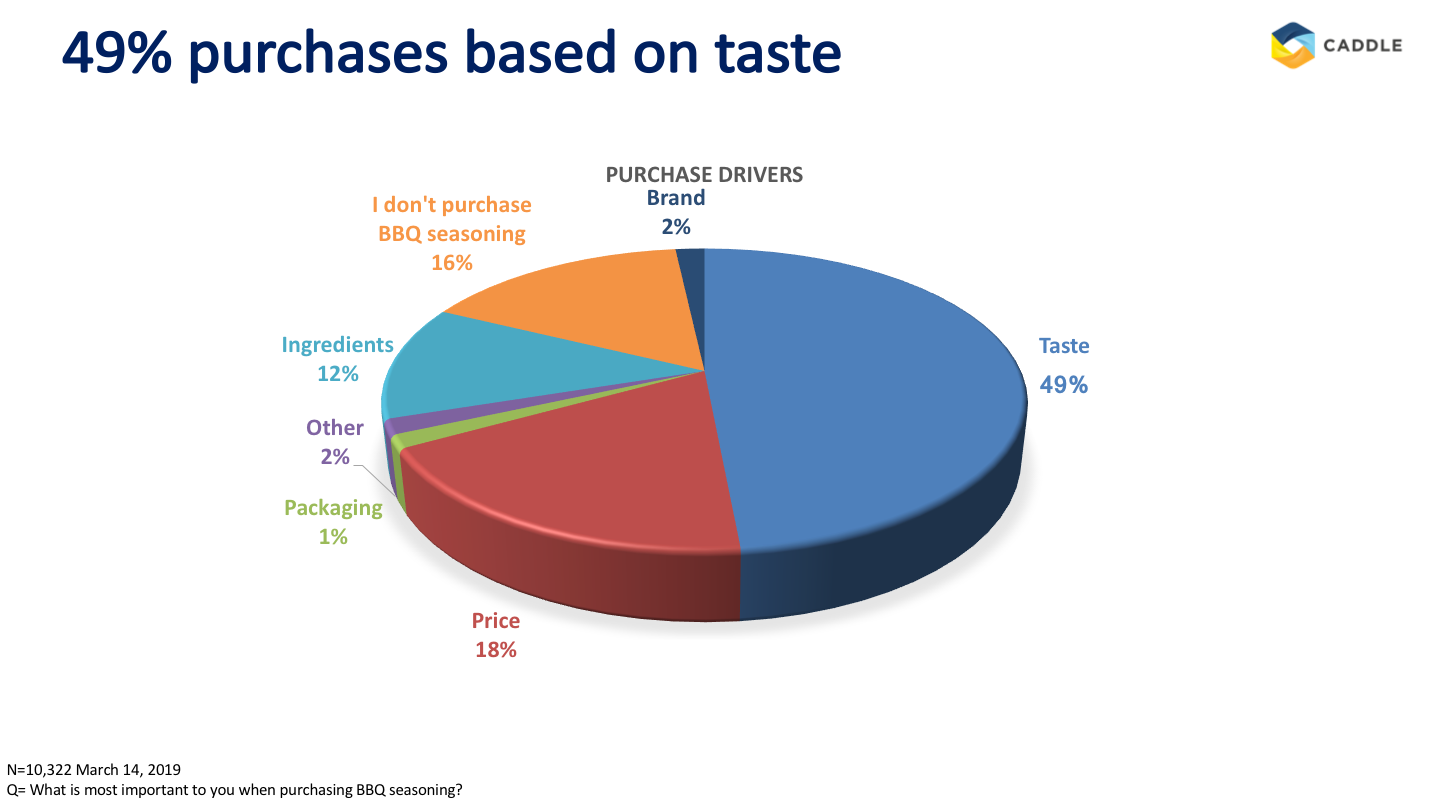

Recently, the team at Caddle sent out a survey to our users asking them what their purchasing habits are like when it comes to barbeque seasoning. After gathering the results from 10,322 respondents, we’ve generated some insights that align with the industry and potentially promote new ideas.

What’s cookin’?

I’ll tell you that I made it from a few spices I had laying around the kitchen, but really, it’s the name brand stuff (shh!). But that’s because it tastes so darn good! Our respondents seem to agree, as 49% of consumers said that they purchase their barbecue seasoning based off taste.

Studies have shown that we Canadians love our traditional sweet and sour sauces or anything with a bit of heat. But that doesn’t mean that the basics can’t be improved upon. The seasonings market works hard to manufacture and formulate several products that enhance the flavour, essence and taste that we know and love.

For those who are a little more daring, the industry thanks you! McCormick flavour solutions discovered that 12% of Canadians said that they like exotic or topical ingredients in their sauce. Not only does this contribute to our findings that consumers purchase their seasoning based off price, but this also allows for some interesting concoctions to be produced.

Spice up your life

Looking to travel the world from the comfort of your own home? Look no further because we have the solution for you. With the rise of ethnic food consumption being scattered throughout different lands, this foresees the opportunity for the seasonings market to increase. Having cultural rubs and sauces such as Jamaican, herbs de Provence, Japanese or African blends could become a real trend setter.

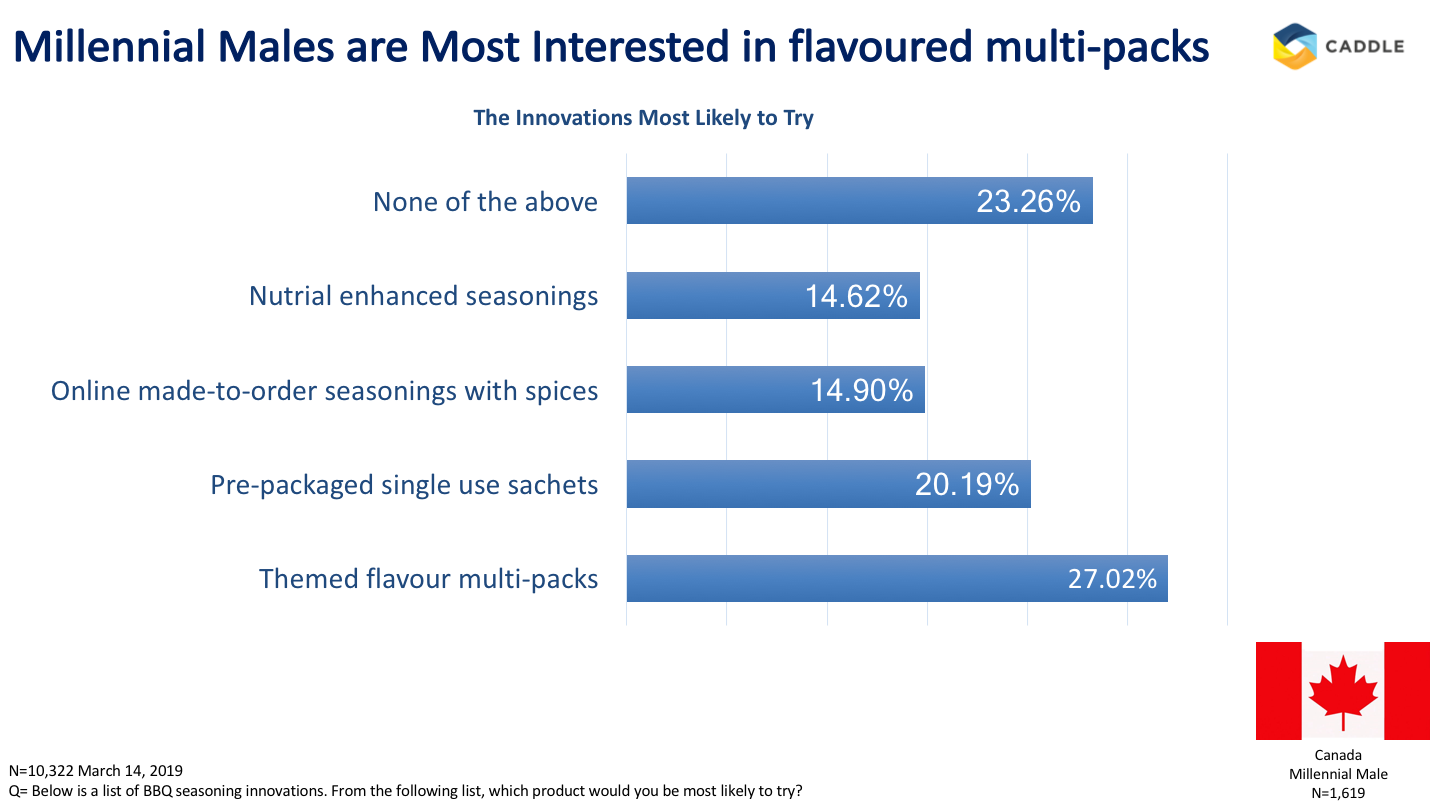

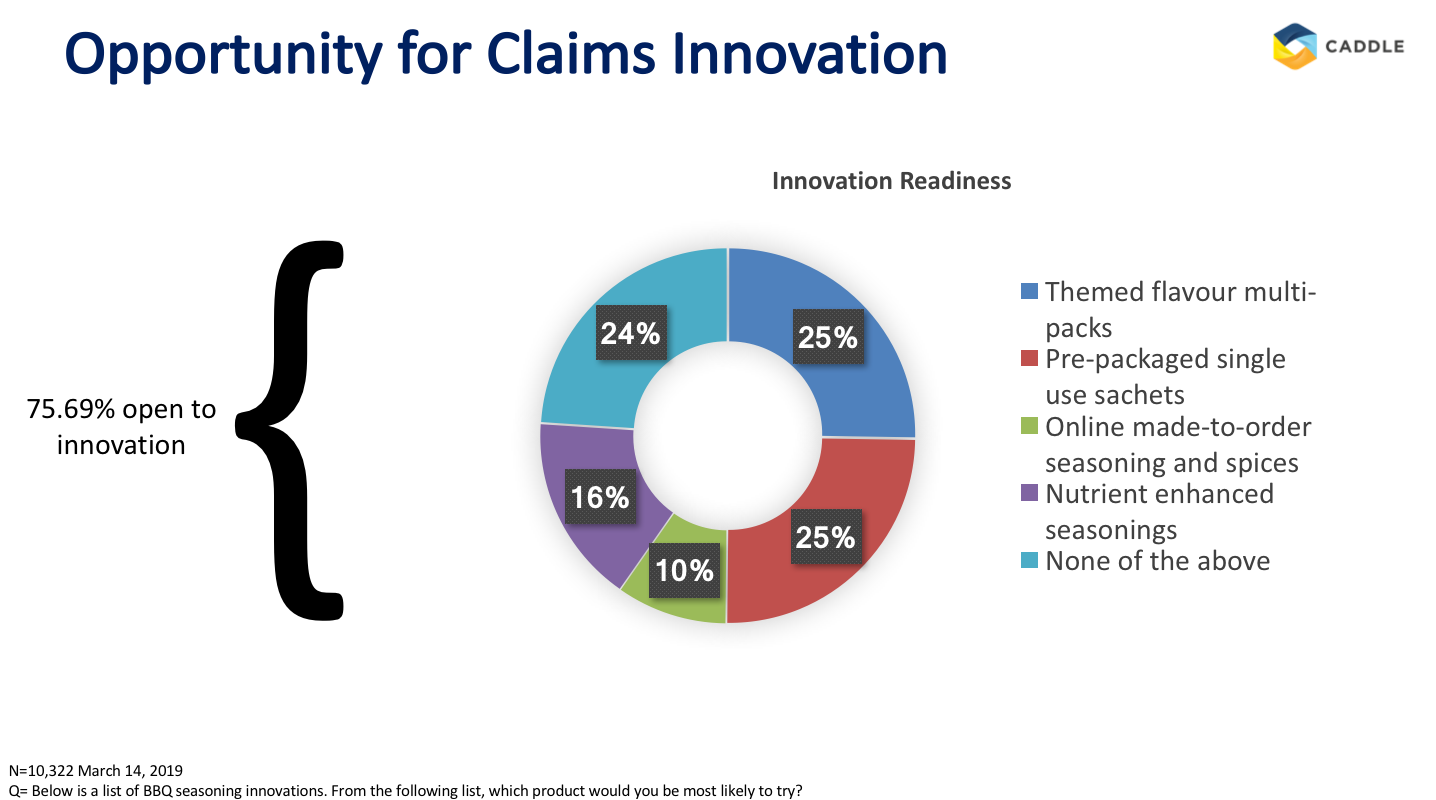

On the innovative side of barbecue seasonings 27% of respondents said that they are interested in themed flavour multi-packs when given a list of possible innovations. With a whole new cultural line added to their products this could allow for a competitive advantage for industry leaders. On the flip side, this could also allow new entrants who specialize in ethnically diverse spices to enter the market and generate a profit.

Fresh innovation

There’s nothing like making a delicious barbecue meal that is packed full of flavour. You can almost taste every spice that was used in the process of making it, but when you make it again the next month it just wasn’t as flavourful as the first time. Freshness is key. Consumers are more likely to feel that sauces are fresher when they don’t contain preservatives but rather contain spices and herbs in them instead. Perhaps another way to maintain freshness would be pre-packaged single use sachets. This is another innovation that 25% of our respondents said that they would be interested in trying. Instead of buying large containers of barbecue seasoning that doesn’t contain its freshness over time, single use sachets would be an innovation that not only allows for optimum freshness, but also allows for the diversity of trying different flavours.

So what?

There’s something about barbecue that has a spot in all our hearts. It acts as a great way to infuse all the seasonings into whatever we’re cooking. Whether it be the traditional sweet and sour, or Jamaican jerk spices, the seasonings industry is a large market that is proven to see growth over the coming years. With trends showing that consumers are interested in trying ethnically diverse seasonings while also maintaining optimum freshness, our survey results help provide insights into how industry leaders and new entrants can satisfy the wants of consumers via themed flavour packs and pre-packaged single use sachets.

If you’re in the CPG industry and are interested in gaining insights on your consumers, we encourage you to reach out to us and see how we can transform your questions into insights.

[simple-author-box]

Sunscreen: UV protection is important, but what is it?

Aside from being great summer activities, what do picnics, swimming, hiking and camping all have in common? Sunburns. Yes, as much as we all love the summer time for the endless opportunities it gives us to come out of our winter hibernation, there are some risks that come along with spending too much time unprotected from the sun.

The global sun care market is a profitable one that was valued at $14.8 billion in 2015. This market is expected to see a 5.8% compound annual growth rate which is expected to value the market at $24.9 billion by 2024.

With North America accounting for 35% of the global sun care market in 2015, Caddle sent out a survey to our users asking them their purchasing habits when it came to purchasing sunscreen. When comparing our insights to market trends we believe they could shed some rays on how those in the industry could maintain profitable gains.

Burning to be in your shopping cart

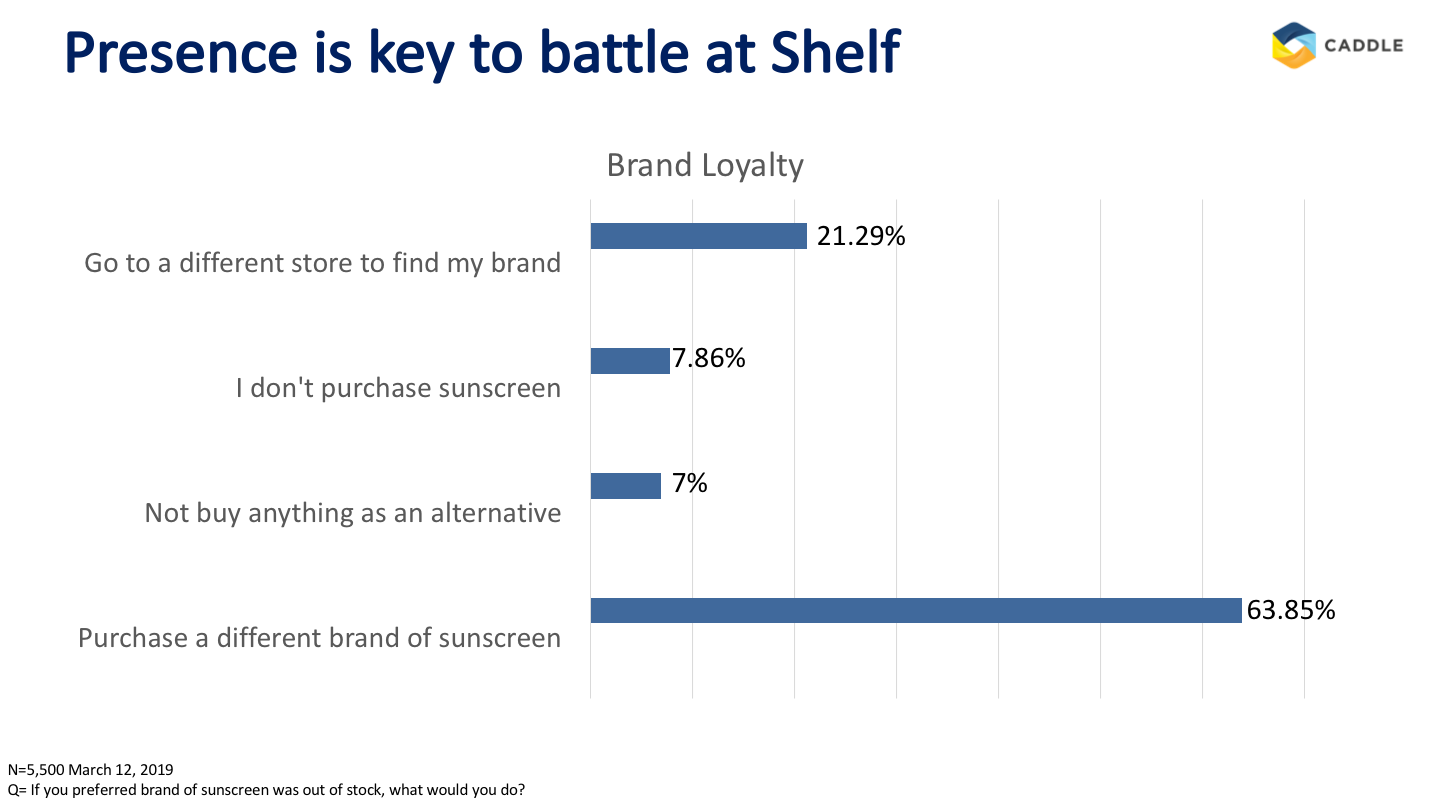

If your preferred brand of sunscreen was out of stock, what would you do? According to our survey results, 64% of you don’t seem to be too concerned as those respondents indicated that they would simply purchase a different brand of sunscreen. To industry leaders this hurts more than a sunburn. Leading vendors such as Estee Lauder, L’Oreal, Johnson and Johnson, Beiersdorf AG and Unilever are focused on maintaining their brand image.

While another study found that one-third of sunscreen users are brand loyal, they also found that 62% of users aren’t picky and will use “whatever they have”, further justifying that consumers aren’t completely brand loyal when it comes to purchasing sunscreen.

While loyalty is hiding in the shade, leaders are focusing on including innovative products to their portfolio.

Au naturel

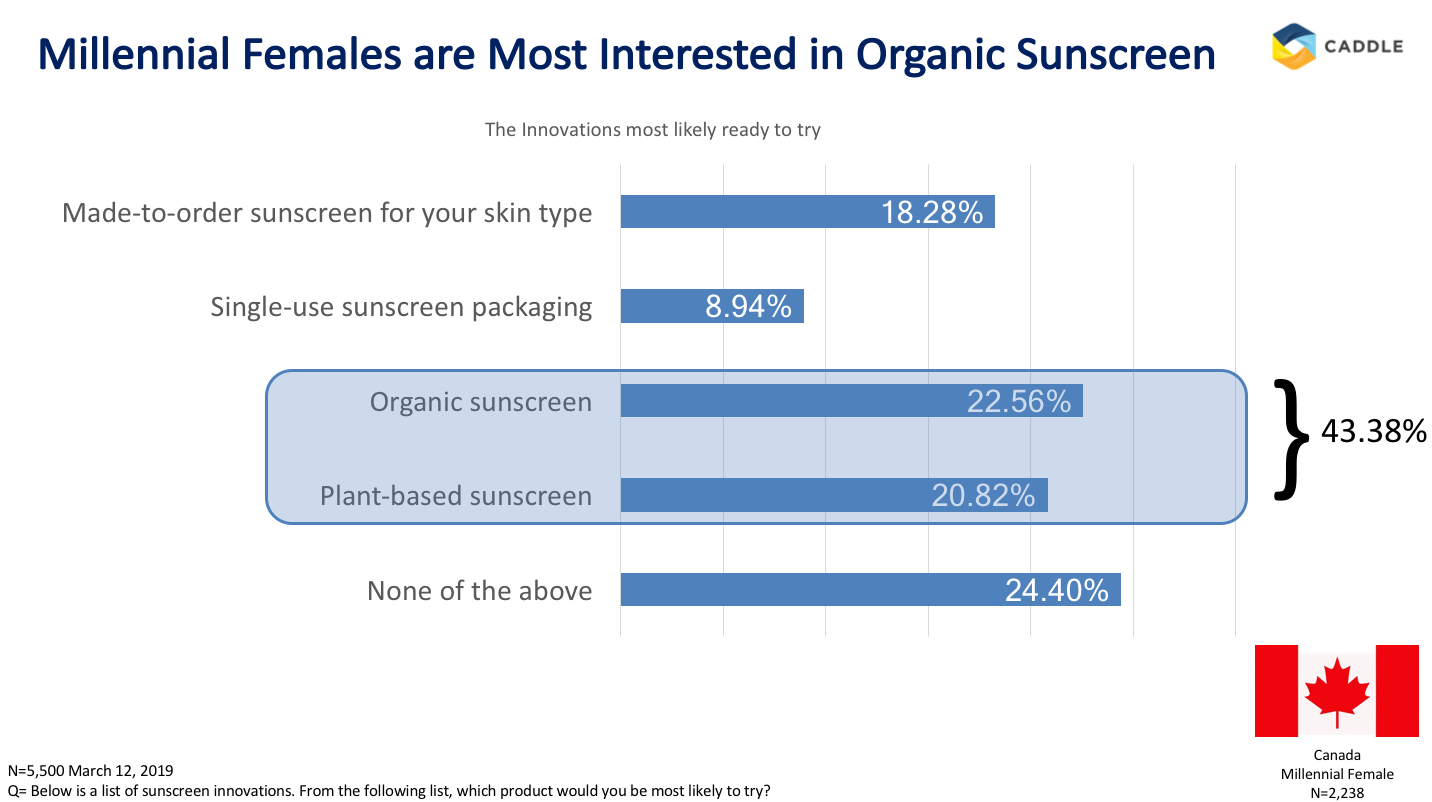

The whole purpose of sunscreen is to prevent the sun’s rays from burning your skin and causing more detrimental effects such as skin cancer. But consumers have also expressed the concern of using products that contain unsafe ingredients and can also cause severe conditions after prolonged exposure. The transition from unnatural products in cleaners and shaving creams have shifted towards organic and natural products. Similarly, sunscreen is the next runner up. The booming organic personal care markets have been additionally added to the general development of the sunscreen market. This is a step in the right direction as 43% of millennial females are most interested in organic or natural innovative sunscreens.

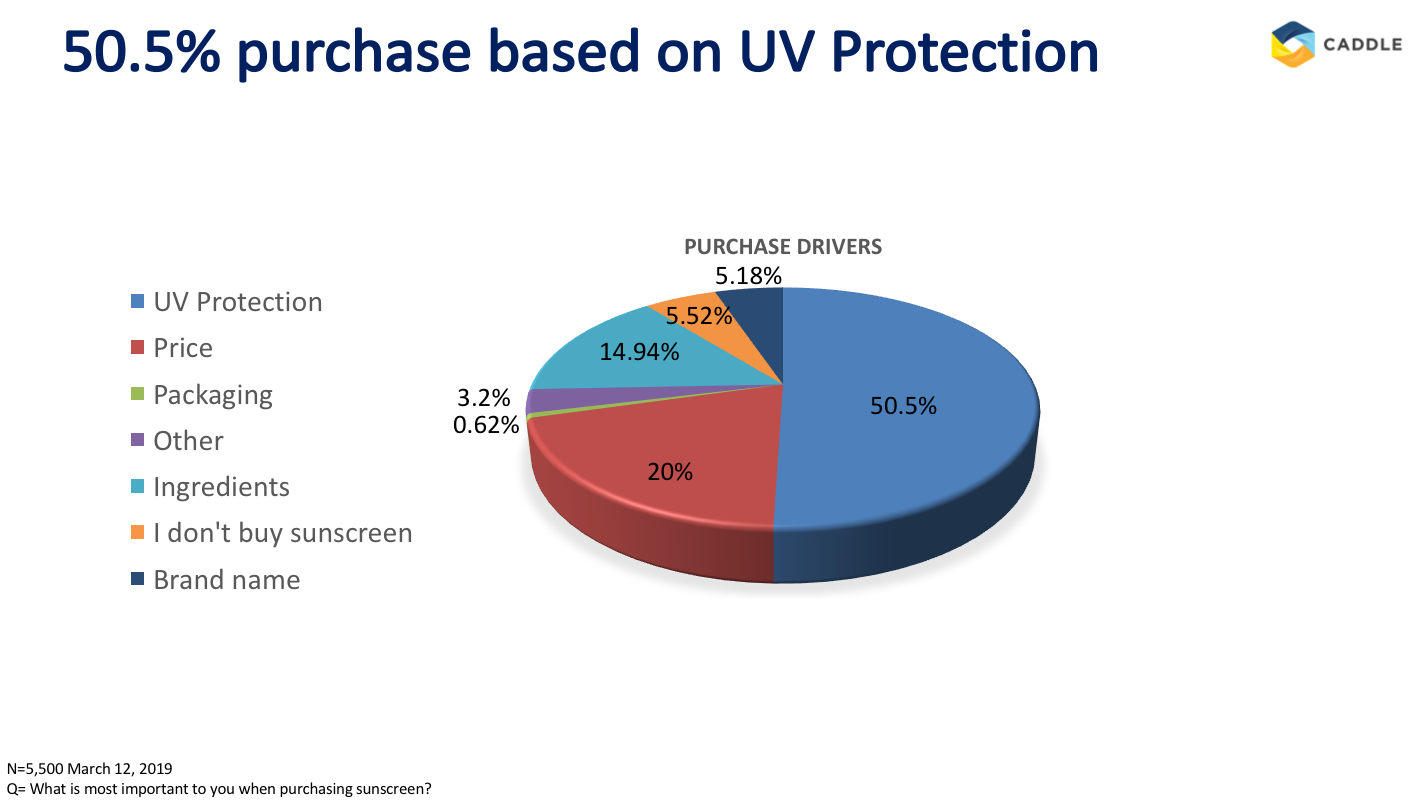

UV Protection

While brand might not necessarily be the purchase driver for sunscreen, UV protection certainly is. When asking our respondents what’s most important when purchasing sunscreen, 51% of respondents said that they purchase sunscreen based off UV protection. Time magazine quoted that UV protection/SPF number was the No.1 reason why consumers bought one brand of sunscreen over the other. Interestingly, only 43% of consumers know what SPF means. While simple, perhaps developing a product that informs consumers of the SPF numbers and what the numbers mean is an innovation that industry leaders could adopt to their products.

So what?

The sunscreen industry certainly is a hot topic which is showing rapid growth over the coming years. If you’re in the industry, don’t get burned from not following industry trends. Our insights align with the industry to show that consumers are most interested in chemical free sunscreens that provide effective UV protection. Furthermore, while leaders are focused on adding new innovations to their product lines, it may be beneficial to incorporate the meaning of SPF numbers as consumers aren’t entirely sure of its meaning and how it can be a benefit to them.

If you’re in the CGP industry and are interested in gaining insights on your consumers, we encourage you to reach out to us and see how we can transform your questions into insights.

[simple-author-box]

Get instant relief with these allergy medication insights

Spring has sprung, the grass has riz, I wonder where the allergy medication is. Yes, while the snow and gloom of winter has finally been done away with, the new season we welcome brings on rejuvenation of life and air borne pollen.

If you’re living in parts of North America and suffer from allergies then you know that allergy season is no joke. Due to the high pollen levels in North America, allergy medication has the highest demand in this region. As such, this high demand has created a very lucrative industry for stakeholders in the global allergy treatment market. With a market that brought in $9,706.0 US million in 2017 and an expected compound annual growth rate of 5.5% from 2017-2025, Canada and the US have become a market with high interest in new advanced allergy medication.

With so much opportunity floating in the air, the team at Caddle has just been itching at the opportunity to get our hands on some insights and compare industry trends to how our user base reacts to their allergy medication purchasing habits. After conducting a survey, we were able to obtain 6,308 responses that gave us instant relief on what our users want out of their allergy medication.

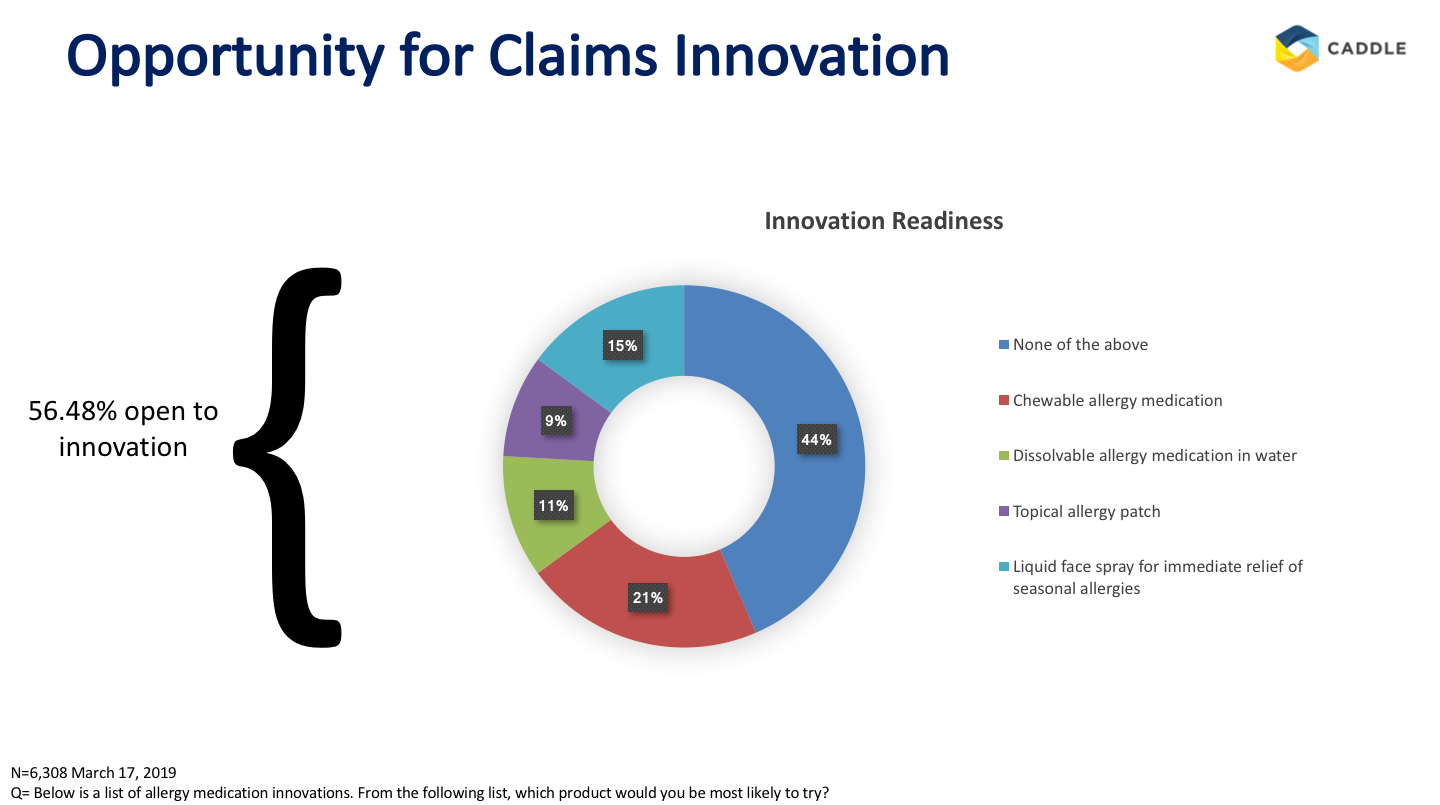

Sunny with a high chance of pollen

Are you an industry leader and you just can’t shake the headache of trying to figure out what your consumers want out of their allergy medication? Fear no more because 57% of our respondents indicated that they are open to new allergy medication innovations. Seeing as advanced methods of allergy medication are in high demand, this leaves you as an innovator in the perfect opportunity to experiment with what consumers might want to try.

You check the weather, don’t you? So, what’s better than an app that tells you what the allergens are like in your surrounding area? This is something that Johnson & Johnson has begun to implement with their AllergyCast® app.

“We looked at when consumers were buying and taking their allergy medications and found that, for some reason, they were taking them when the pollen count was low and that seemed a little off,” said Sean Belke, Associate Brand Manager for Zytrec®. “Consumers didn’t really have the information they needed to understand what the allergy situation would be for them on a given day in their region.”

By uploading their area code into the app, the app will give you a scale of how bad the allergens are in the air and will thus help you predict how much medication you should be taking throughout the day.

Instant Relief

Do you ever find yourself in an awkward situation where your allergies hit you at the worst time possible so you pop a “fast acting” pill only to find out it’s not really all the fast acting? Well truth be told, you might not be taking your allergy medication fast enough!

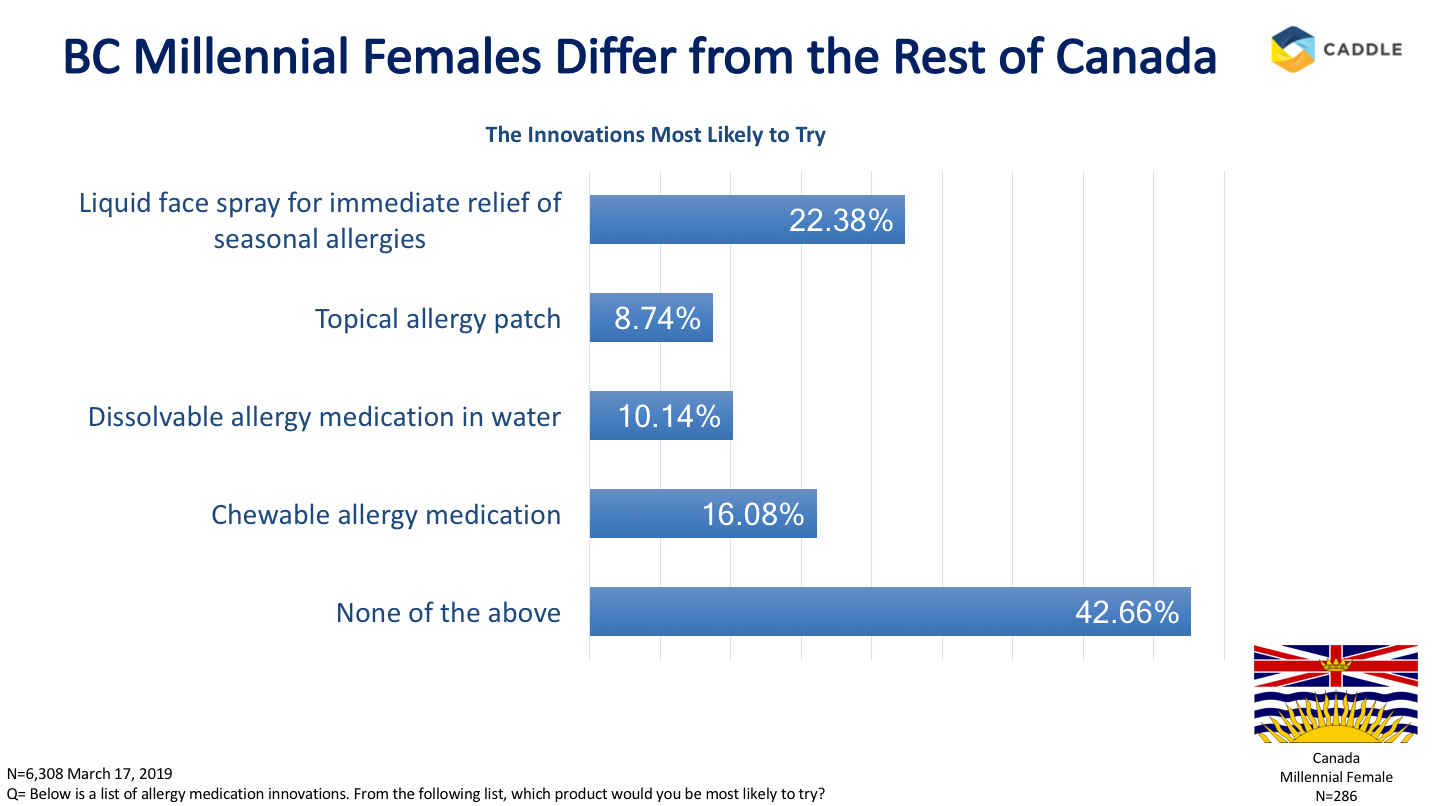

Zeroing in on our survey results, while most of Canada is most interested in a chewable medication, we found that BC females are most interested in a fast acting face spray. But why the difference BC?

Well according to Global News, BC is seeing the worst allergy season ever in 2019 with Vancouver and Victoria seeing higher levels of pollen than usual. Similarly, “many allergy sufferers are making the mistake of waiting until they are experiencing symptoms before taking allergy medication,” said London Drugs Pharmacist Lily Liange.

On behalf of London Drugs, Insights West conducted a survey and found that four in 10 aren’t taking allergy medications early enough. Perhaps with the higher than usual pollen levels in British Columbia and the finding that individuals are often waiting too long before they start to take allergy medication is the reason why they’re looking for a fast acting, instant relief face spray to relieve them of their allergy symptoms.

Catching some Zzz’s

Have you ever been unable to sleep and ended up popping an allergy pill to help you doze off to a restful slumber? Odds are you’re aware that taking allergy medication makes you sleepy due to the antihistamines in them. But if you’re taking one of these at 3:00 p.m. on a Wednesday, you’re likely in trouble.

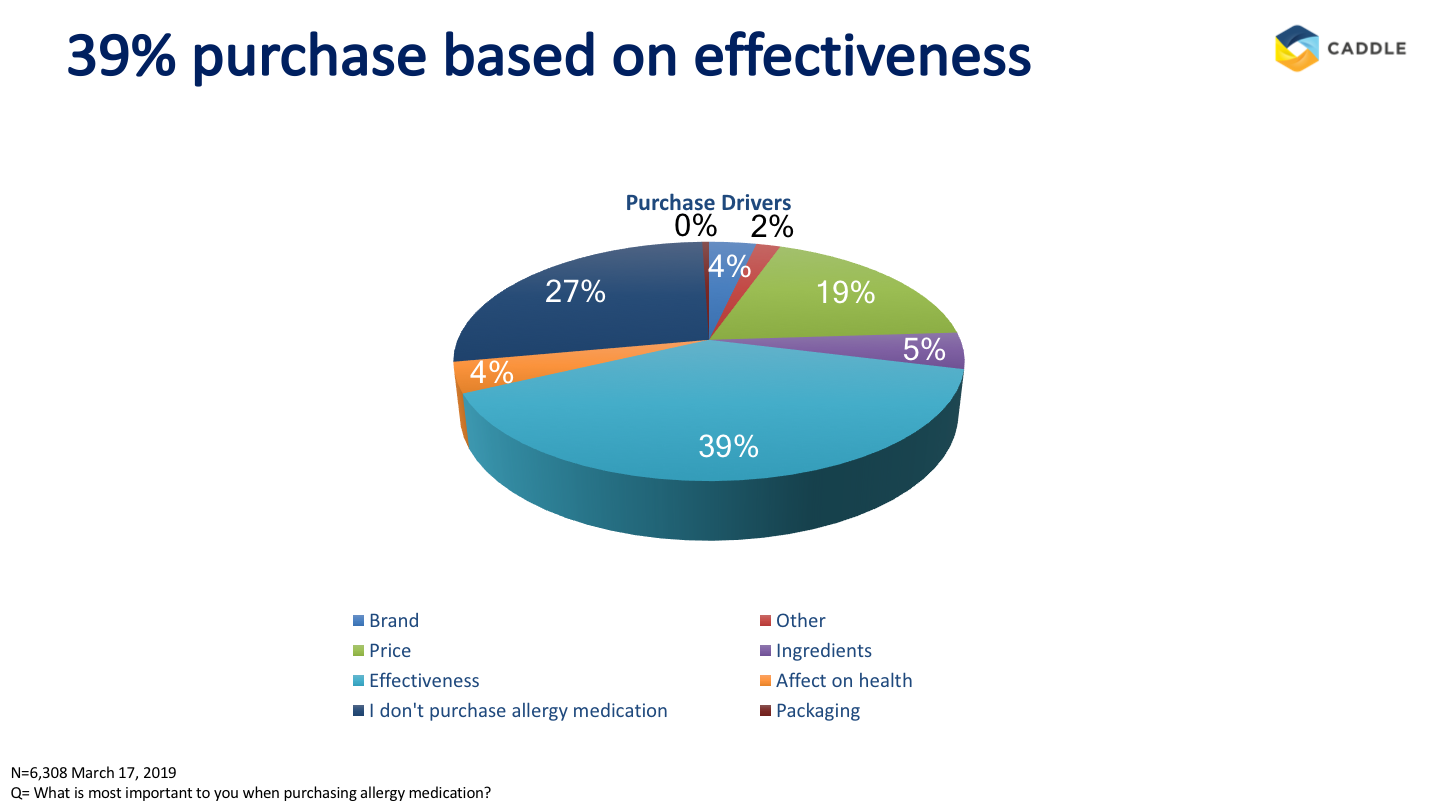

Yes, they work but the side effects aren’t necessarily beneficial to our daily routine. That’s why we believe that 39% of our respondents indicated that “product effectiveness” is one of their main purchase drivers when purchasing allergy medication.

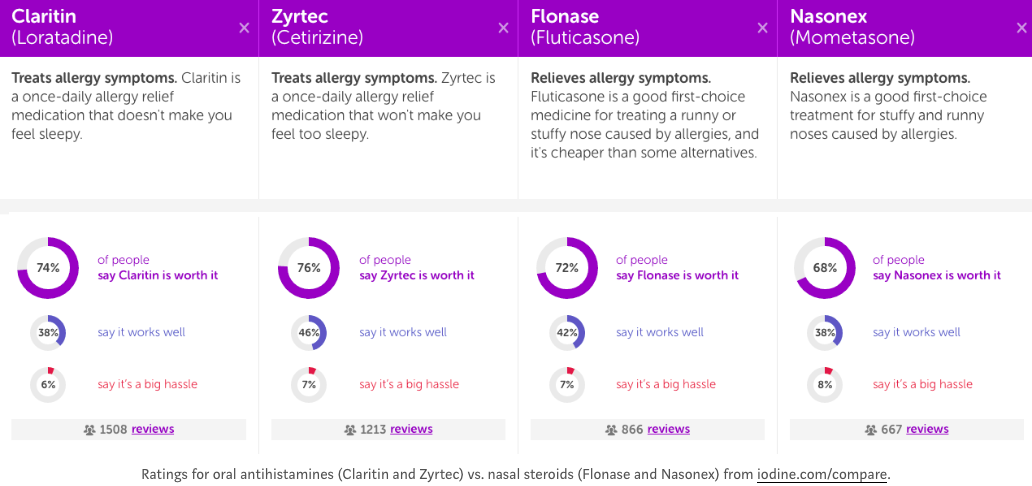

When comparing different brands of allergy medication, Iodine gathered results and found that while users of Claritin, Zytrec and Nasonex reported that the allergy medication is worth it, users followed up with lower results stating whether or not the medication worked well.

We all want our medication to work, but we don’t want to be face down on our keyboard as the boss walks by. #awkward.

So what?

Allergy season is a time of year that affects many of us. Unfortunately, there is no curable options that have hit the market just yet but there is certainly countless options that can help reduce the symptoms of allergies. Our survey results indicate that there is a high demand for new innovative products that are fast acting and effective. The allergy medication market is in high demand for new medications so perhaps developing a fast acting face spray or chewable medication that reduces symptoms without feeling sleepy afterword s a trend that should be developed.

Caddle is a data insights company that strives to gather insights in the CPG industry to benefit those who are looking for a fast turnaround on what their consumer purchasing behaviours are like. If you’re in the CPG market and are looking to gather insights on your consumers, please feel free to reach out to us.

[simple-author-box]