Mystery of the Home Buying Process

How it works now, and how it’s changing

Published on April 6, 2021

According to the The Canadian Real Estate Association, the Canadian housing markets set records again in February this year. Home sales climbed 6.6% between January and February 2021 to set another new all-time record. With average house prices surpassing the $600,000 mark, Costa Poulopoulos, Chair of the Canadian Real Estate Association (CREA), declares:

“It’s official, despite all the challenges, 2020 was a record year for Canadian resale housing activity.”

From Statista, house sales in Canada are expected to increase to over 583,600 in 2021, compared with the 2019 figure of 489,873. With growing demand in the housing market across the nation, are Canadians seeking out more education on the home buying process?

Caddle wondered how financially literate new and experienced home buyers are when it comes to home mortgages, and the results may surprise you.

Transparency is lacking in the market to educate Canadians.

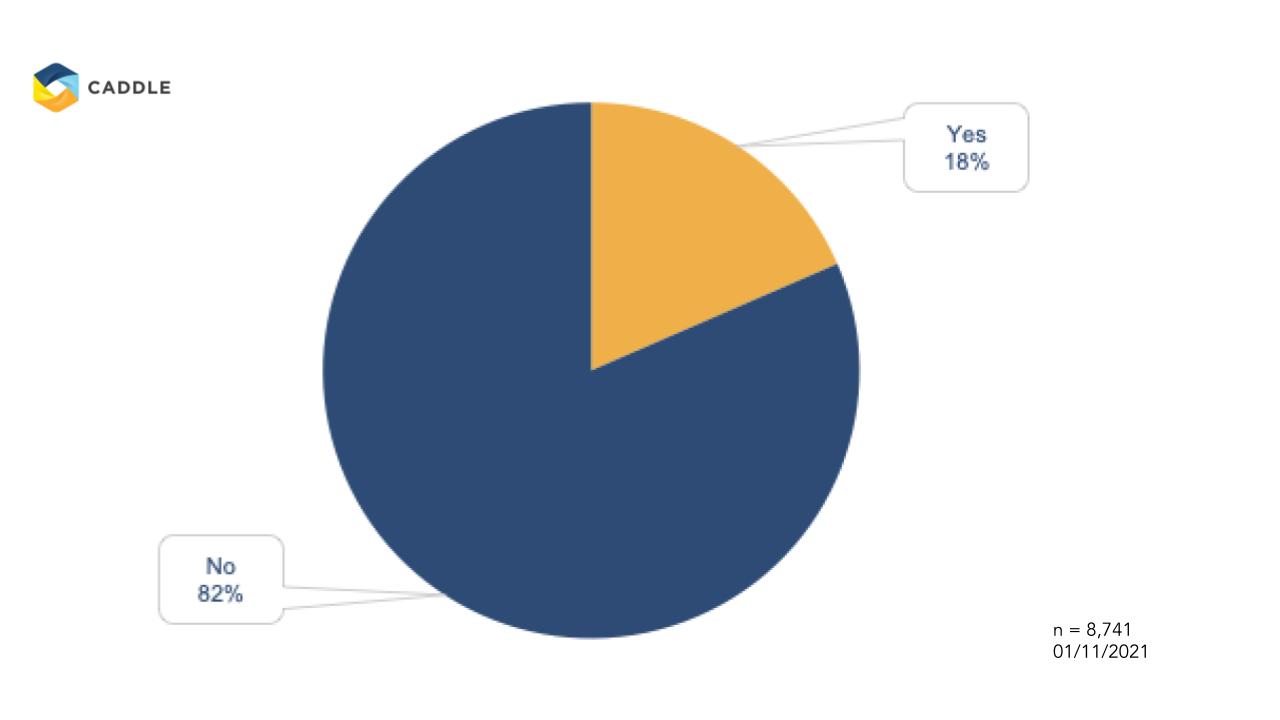

Caddle found out more than 80% of Canadians don’t know how much a mortgage broker makes for processing a mortgage.

Did you know brokers make an average of 0.8% of the mortgage size for facilitating a mortgage application?

This suggests that transparency is severely lacking when it comes to the costs associated with getting a mortgage. Financial literacy will help Canadians to be more aware of this. By increasing transparency in the home buying process, home buyers will have a clearer understanding of their options of how to apply for their next loan. This financial education will help them save more money for the future. There is huge potential to educate Canadians on all the costs, features and benefits of mortgages. This will help them understand what they are getting into, as results clearly show that many have little awareness as we are a trusting society.

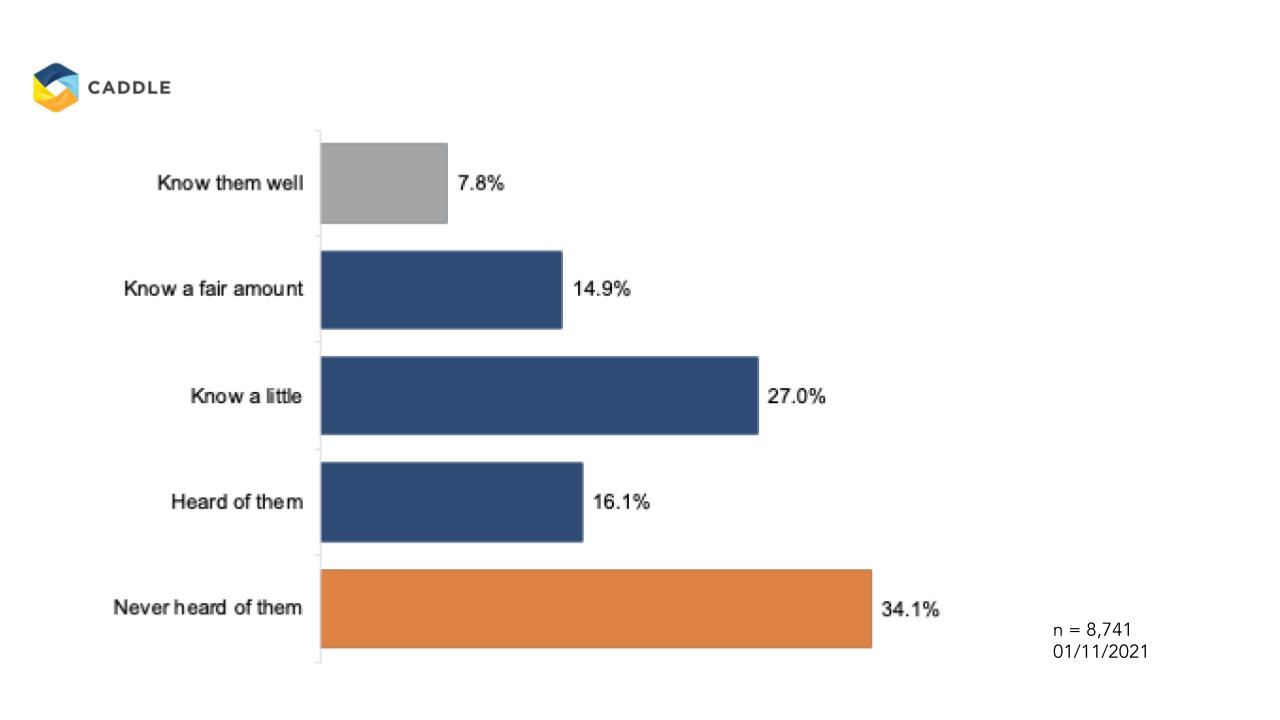

How familiar are you with breakage fees in mortgage products?

Regardless of age, Canadians are open to skip the store visit and apply online for a mortgage.

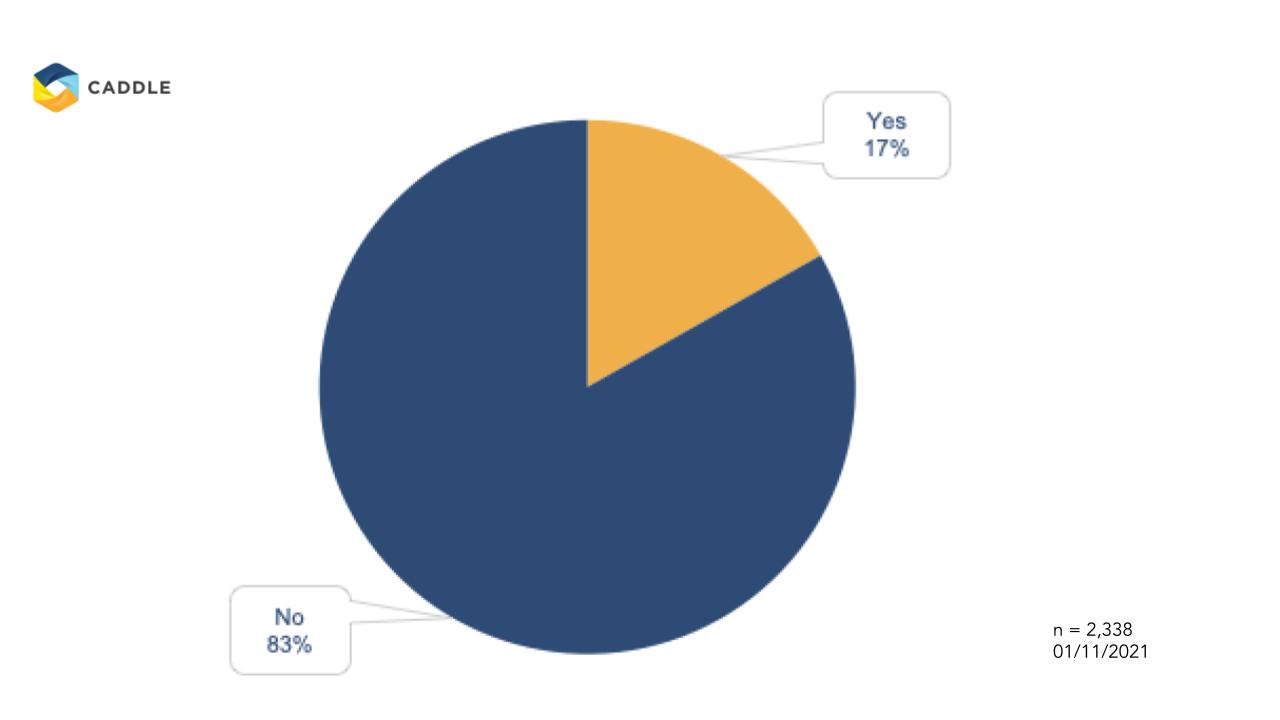

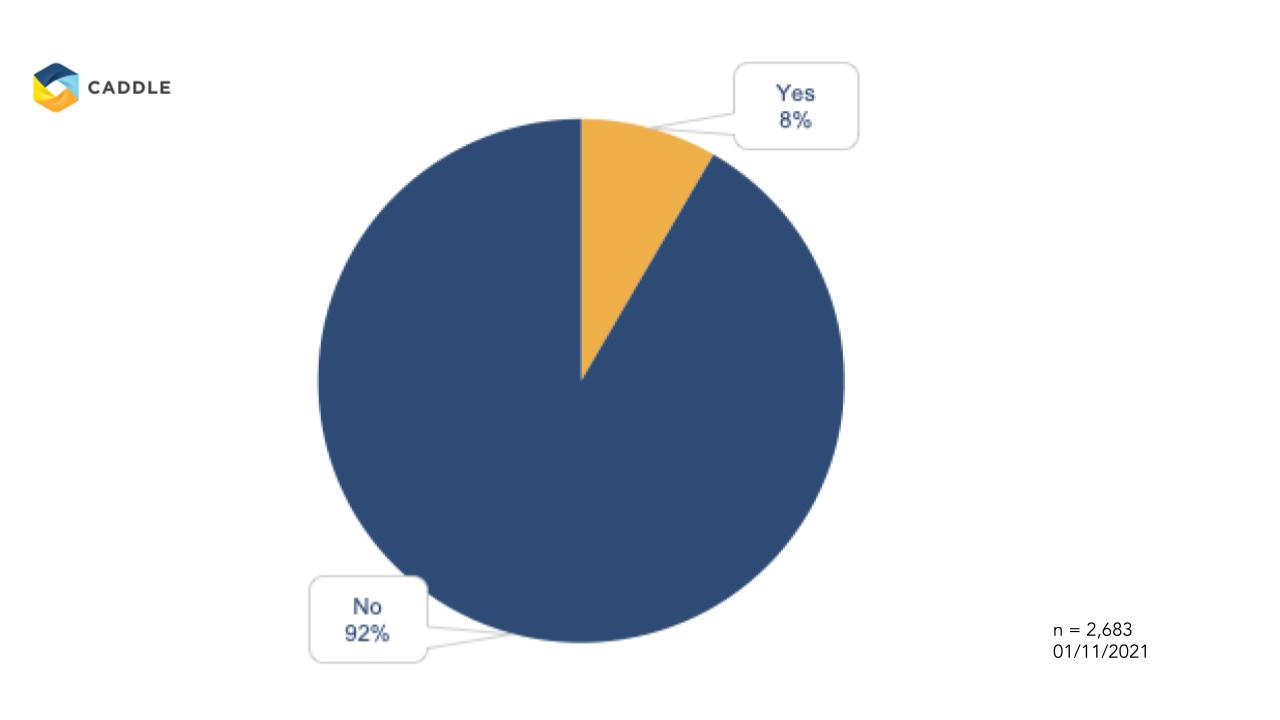

Millennials are the most familiar with online mortgage applications with 17% having applied in the past, compared to 8% of Baby Boomers.

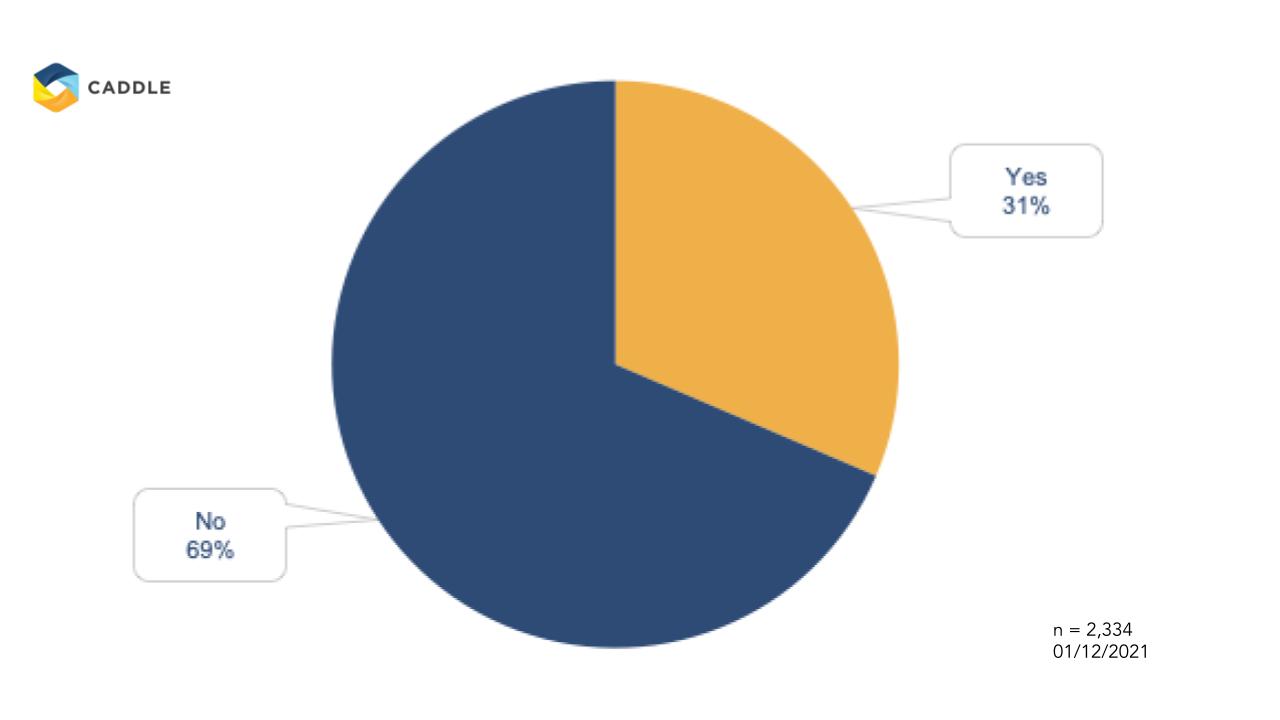

Have you applied for a mortgage online before?

Millennials

Baby Boomers

Younger generations have a need for speed

Interestingly, when it comes to securing a mortgage lender, more Millennials and Gen Z are willing to pay when compared to Baby Boomers to get instant gratification of knowing who can underwrite their mortgage. Millennials and Gen Z over-index around 20 basis points more than Baby Boomers.

Are you willing to pay to find out instantly online which Canadian lenders would accept you for a mortgage?

Generation Z

Millennials

Baby Boomers

Ryan Sharma, CEO of JustCompare, says:

“With the pandemic, digital banking usage in Canada is on the rise. Coupled with the Canadian government exploring the benefits of open banking, Canadian banks will need to improve their transparency, digital user experience, and partnerships with firms like JustCompare.ca. Canadians are looking for impartial, online capabilities, like the ability to search, compare, & apply for personal lending products. This will influence lenders to be more transparent with their product fees and terms in order to remain competitive within the Canadian lending market.”

Key Takeaways

No.1 |

Financial literacy is immensely important and lacking in the mortgage industry for home buyers, existing and new. Companies who can provide more knowledge and transparency to the home buying process will alleviate much of the uncertainty associated with mortgage lending.

No.2 |

Canadians are open to going digital with their home buying journey. No matter who the consumer is, the traditional home buying process may soon be outdated to a more frictionless and transparent journey.

No.3 |

Consumers have never demanded more from companies, and that includes their mortgage lending process as well. Companies who can pivot and meet consumers’ increasing need for convenience and speed will come out on top in the coming years.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle Insights? Sign up to our email list!