Egg consumption: Our data compared with the industry

The Egg Industry

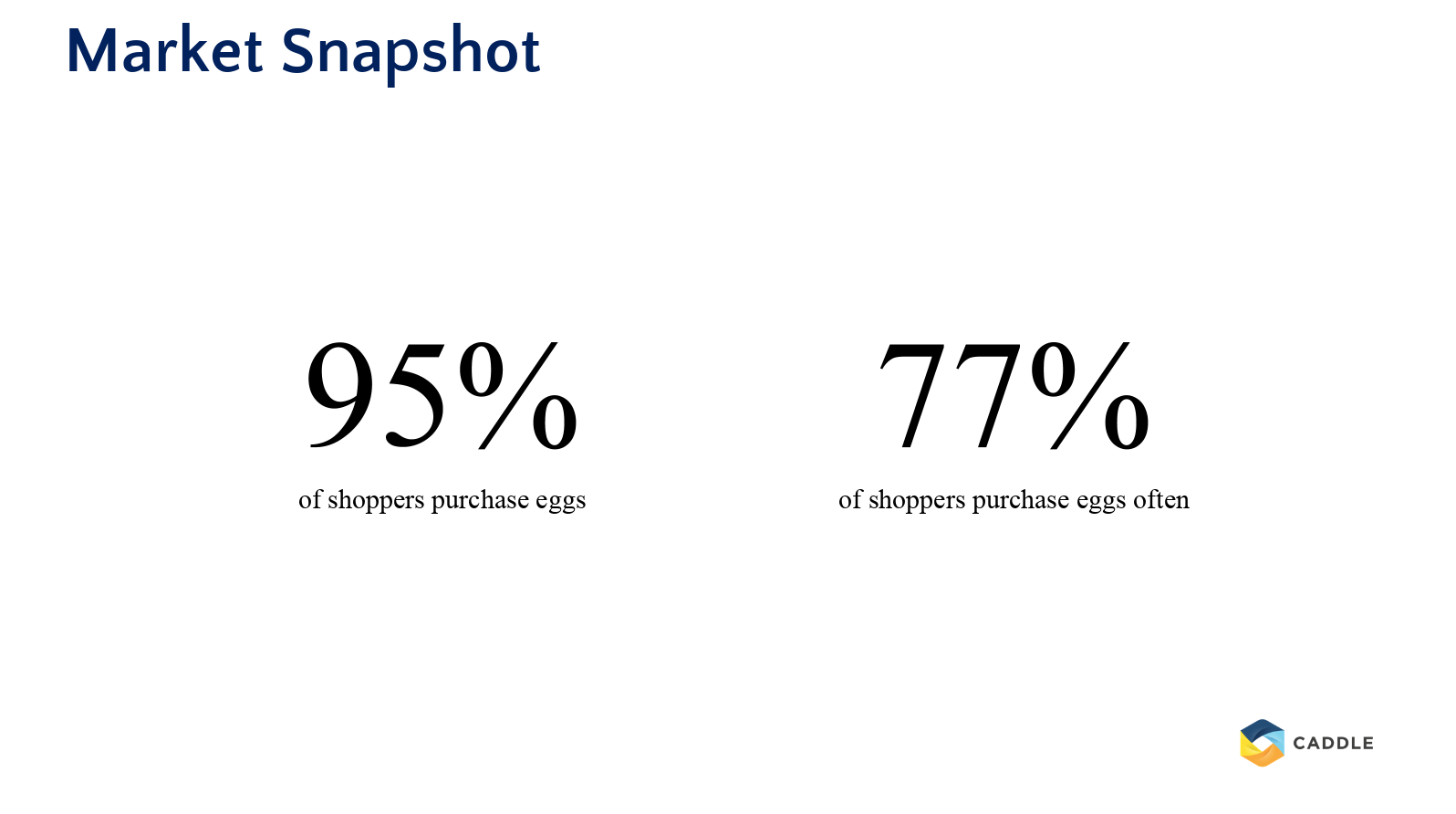

Who doesn’t like waking up to the smell of bacon and eggs in the morning? Besides, breakfast is one of the most important meals of the day. Whether you have them for breakfast, lunch or dinner, eggs have been a staple in everyday Canadian lives. Recently, we surveyed our users asking them their purchasing habits when it came to eggs. After gathering the results from 7,481 respondents we found that 95% of shoppers purchase eggs while 77% of shoppers purchase eggs often. With a large majority of our users purchasing eggs this reflects well when comparing it to the egg industry itself. 2017 proved to be a profitable year as egg sales saw a 4.1% growth in Nielsen rating sales which was the second highest growth in the past 10 years. The Canadian government also reported a per capita disappearance (food available per person, per year) of 20.2 dozen eggs. The factors that have led to this increase in egg purchases is felt to be due to:

- Shift in consumer attitude toward eggs;

- Shift towards more protein driven diets with egg nutrition offering a cheaper protein source;

- Decrease in cold cereal food availability for breakfast;

- Increased demand for products containing liquid egg whites only, such as yolk-free omelettes and breakfast sandwiches

Let’s get crackin’

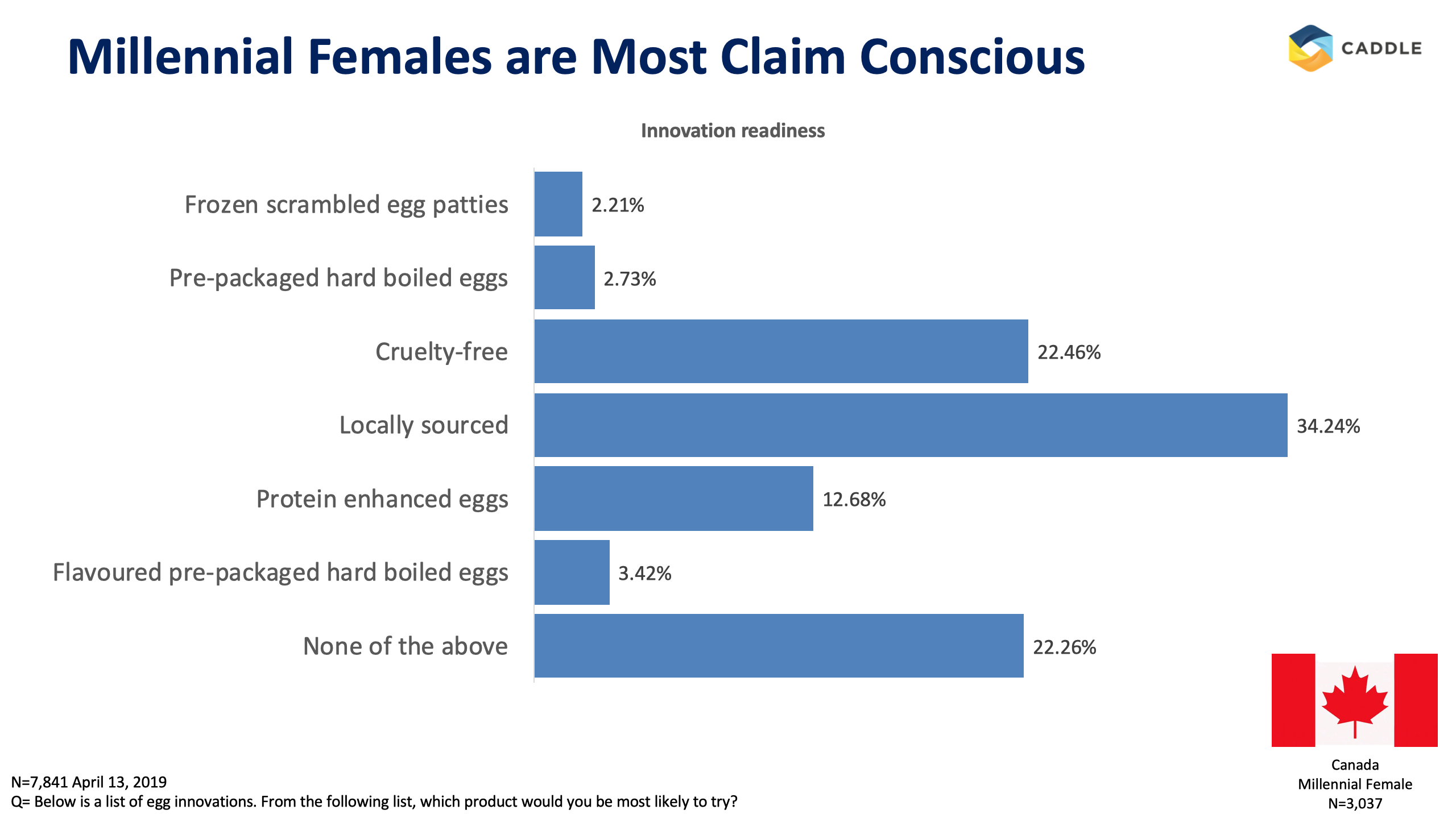

With the egg industry in Canada showing a progressive rise, we’re intrigued to see what our respondents want the most out of when purchasing eggs. Interestingly, 22.46% of millennial females in Canada indicated that they want cruelty-free eggs. This is something that the Egg Farmers of Canada (EFC) has taken into consideration. With the redevelopment of the national Animal Care Program, the EFC has worked to fast-track the implementation of new housing requirements which guide farmers and align their facilities with the standards of the Animal Care Program. These standards ensure that our egg laying friends are living with the basic needs such as shelter, adequate light and air, a well-balanced, nutritious diet, fresh water and clean surroundings.

What came first, the chicken or the egg?

In this industry – the chicken (sorry folks). Even though we know that our eggs came from the chicken, a lot of people want to know where their eggs came from. When asking our respondents which egg innovation they would most likely like, 34.44% of millennial women in Canada said that they would like locally sourced eggs. In their 2017 report, the EFC explained that in 2018 they will be printing an identifiable mark on the egg carton. This mark is in line with a new Egg Quality Assurance program which tells consumers that their eggs are produced by local Canadian egg farmers who are producing and have met the highest food safety and animal care standards. So now consumers can be reassured that when they see an egg logo with a checkmark and red maple leaf on their carton, their eggs are Canadian sourced and are of top quality.

White or brown eggs?

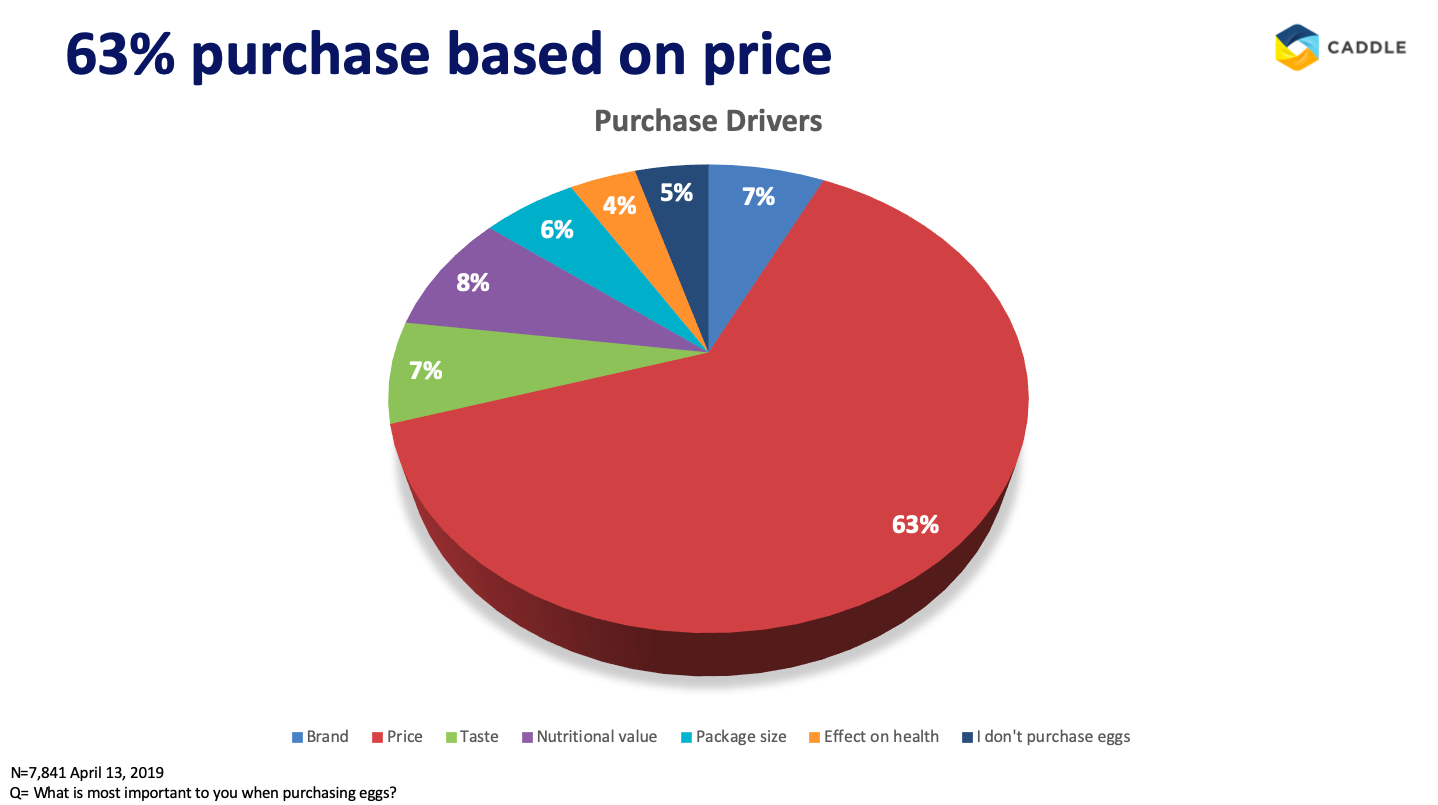

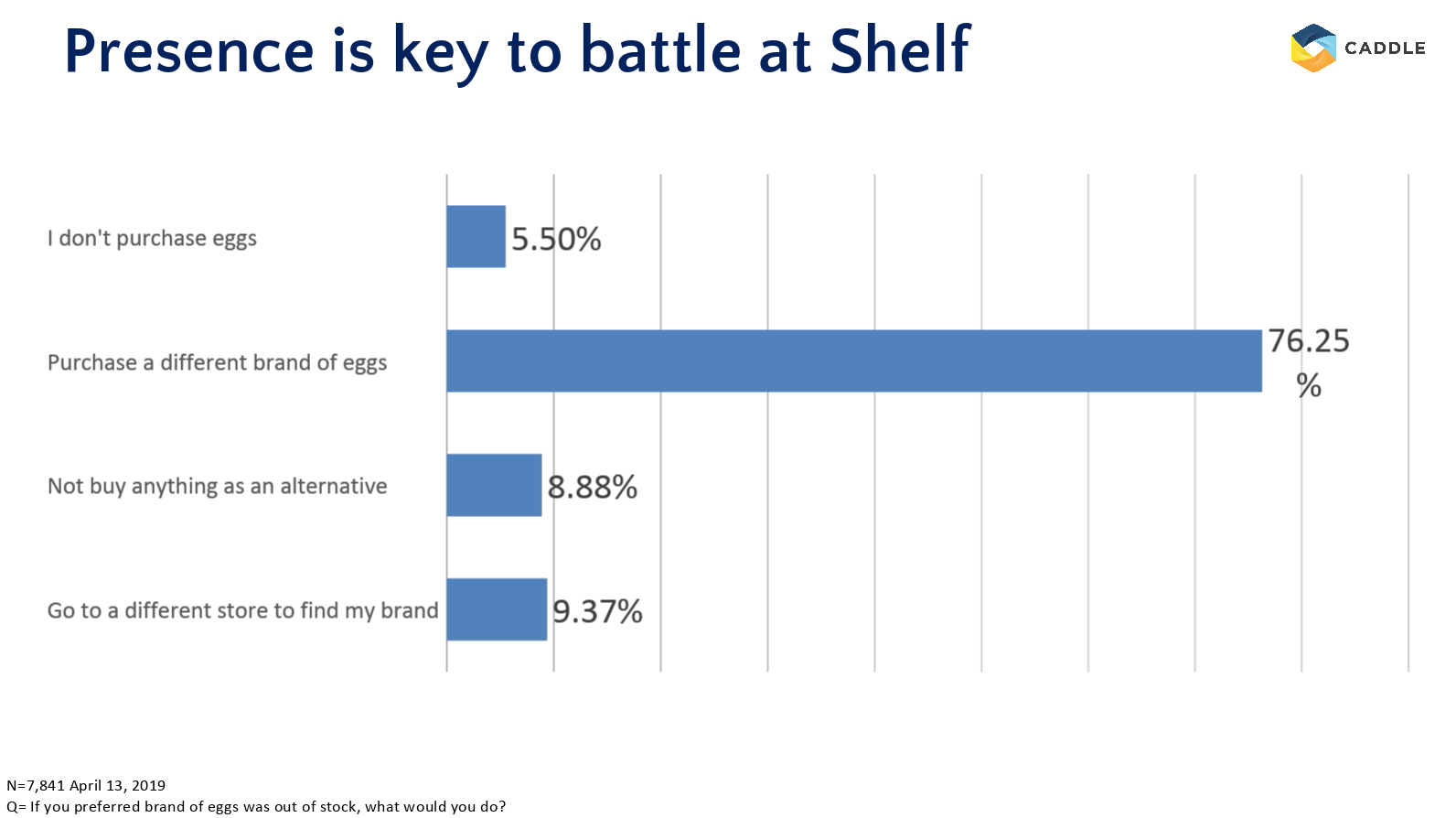

Whether they’re large, small, white, or brown all eggs taste the same. Which is likely why consumers aren’t necessarily loyal to one specific brand of eggs. When asking respondents what is most important to them when purchasing eggs, 63% of respondents said they base their egg purchases on price. Similarly, 76.25% of respondents said that they would purchase a different brand of eggs if their preferred brand was out of stock. This is intriguing when comparing the average cost of production and retail price of eggs over the years. The EFC reported that pricing trends in 2017 saw an increase in the average national COP and producer price of eggs while there was a decrease in the national retail price of eggs at $2.48 per dozen. This is something worth analyzing over the years as it might suggest that egg producers will have to make sure that there is an even balance between the COP, producer price and retail price as consumers have noted that they will purchase a different brand of eggs if it doesn’t meet their price range.

So what?

Caddle is a data insights company that is driven at understanding market and industry trends for the benefit of those in the industry. Our recent survey indicates that egg producers are meeting the wants and needs of consumers purchasing eggs such as providing appropriate living for hens, and informing consumers that their eggs are locally sourced. If you’re feeling scrambled with how you can increase the profitability of the industry you’re in, connect with Caddle to get the data insights you need.

[simple-author-box]