Eat your frozen dessert cake & have it too: industry insights

Just when you thought cake couldn’t get any better, they came out with frozen dessert cakes. You knew it was going to be a great birthday when you were presented with one of them. Although those days might be long gone for some of us, it appears that we’ve passed down the tradition to younger generations.

Overall, the global frozen dessert market is forecasted to reach $228.56 billion by 2024 with a compound annual growth rate of 5.32 percent from 2019-2024, reports Mordor Intelligence. Much of the market is driven by rising disposable incomes, the introduction of new flavours, and increasing impulse purchasing habits.

In Canada alone, there were 131 frozen dessert and ice cream manufacturing establishments in 2016 in which the whole industry saw a $385 million revenue in 2018.

Here at Caddle we wanted to have our cake and eat it too. So, we sought out and asked over 8,100 survey respondents their purchasing habits when it came to frozen dessert cakes.

The cake that won’t go straight to your hips

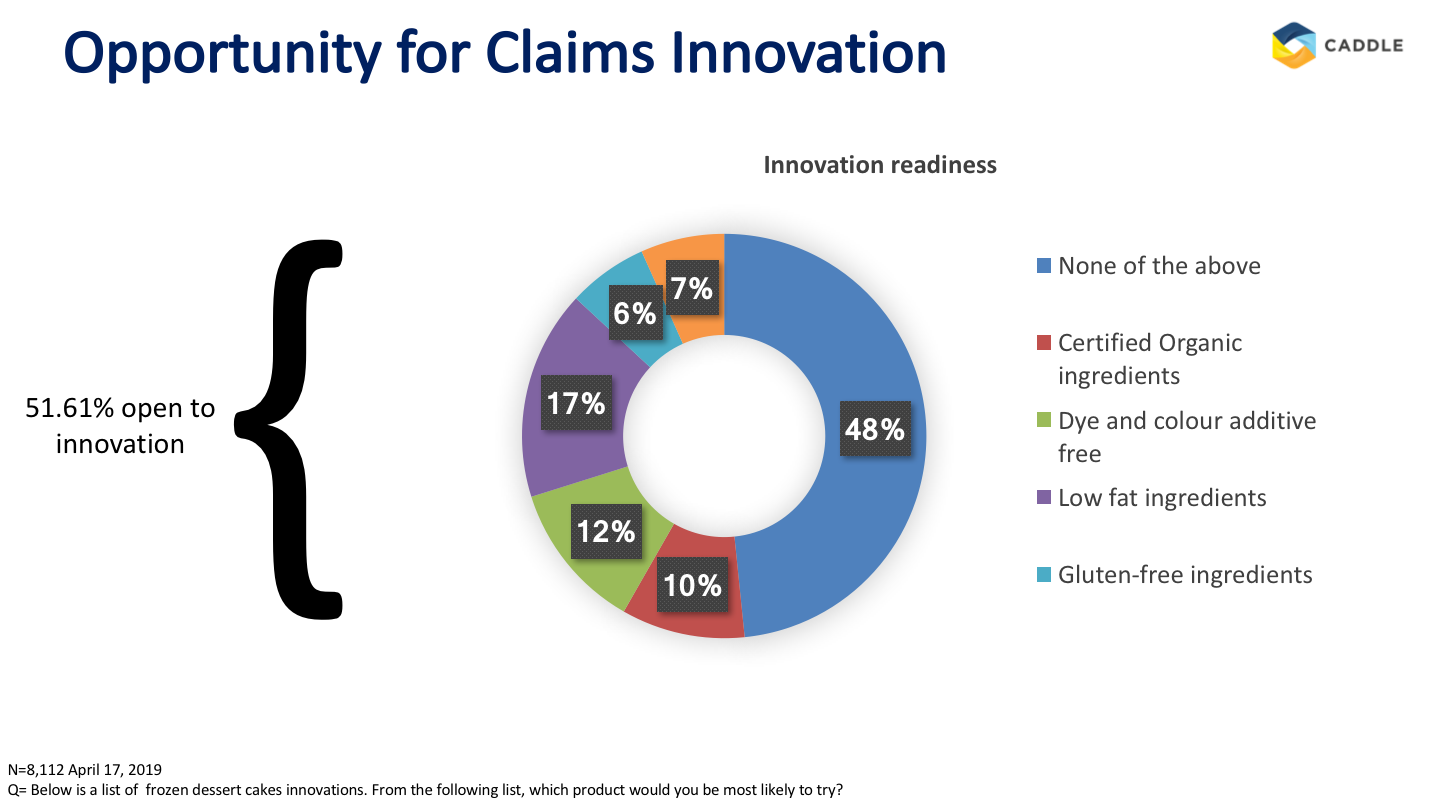

While frozen dessert cakes are elaborate as is, this leaves little room for innovation when it comes to aesthetics. This doesn’t mean that there isn’t the opportunity at all for innovation – 52% of respondents indicated that they would be open to trying a frozen dessert cake innovation.

Looking toward market insights, it appears that ingredients play a large role in consumer wants when it comes to dessert. Low sugar/salt, plant-based health and nutrition have become megatrends that are driving product development across the dessert production.

Interestingly, dietary trends themselves have become a major aspect of product development. Plant-based diets along with an interest in vegan and vegetarian lifestyles have created an 11 percent compound annual growth rate from 2013-2017, as reported by Food Ingredients First

Ice cream for insights

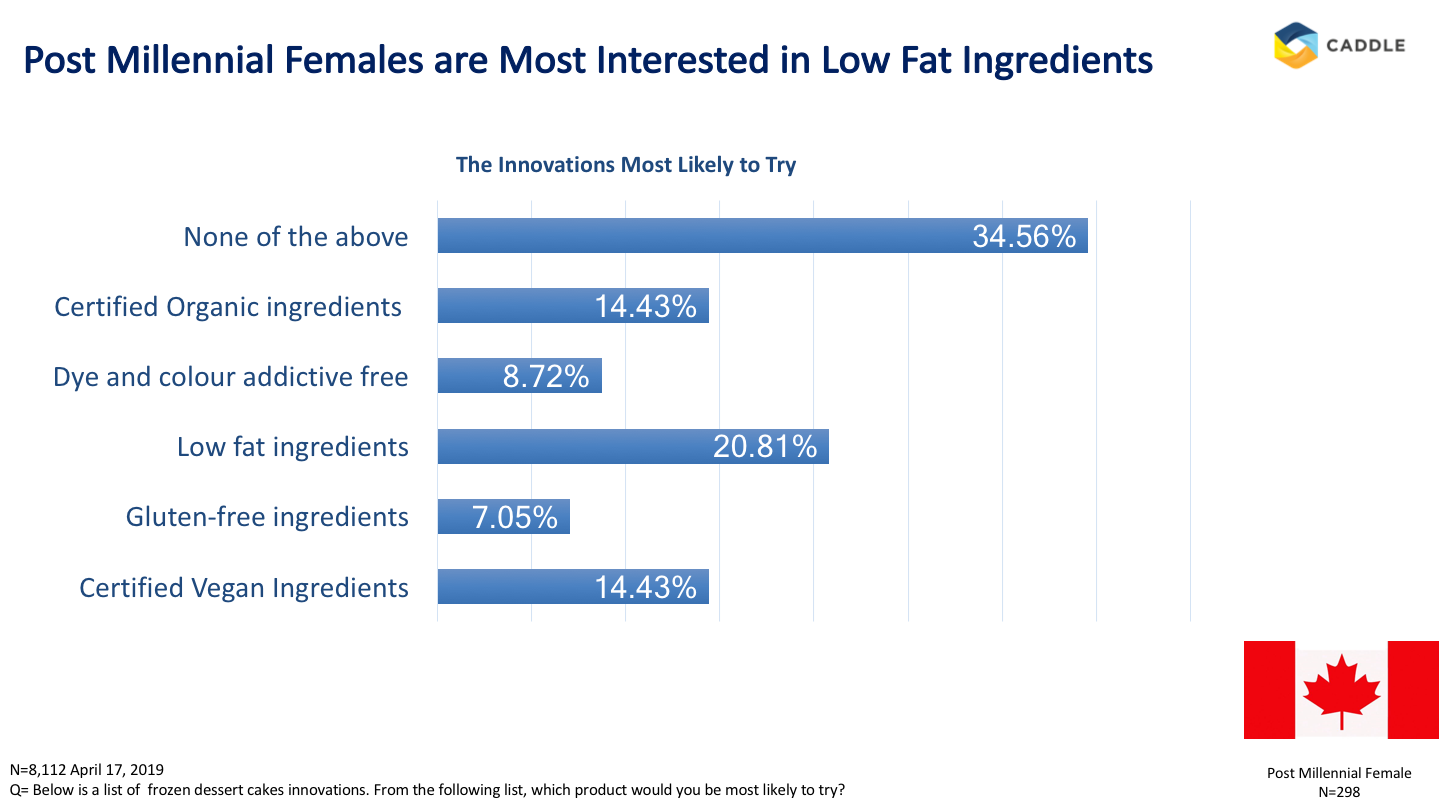

In our survey, we asked respondents what type of innovation they would be most interested in trying and 20% of post-millennial females in Canada agreed that they would be most interested in trying a frozen dessert cake with low-fat ingredients. This is an interesting insight as ice cream — the cousin to frozen dessert cakes — have become a trendsetter with its adaptation to low-fat ingredients.

Take, for example, Halo Top which sold 3 million units since its launch, and Oppo who made more revenue in the first seven weeks of their 2018 financial year than their whole year previous, as reported by The Guardian The reason: low-fat ice cream. On top of that, Dairy Queen — a frozen dessert cake specialist — listed “focus on healthy treats proposition” as an opportunity in their SWOT analysis.

The proof is in the pudding (or ice cream in this case) that low-fat ingredients are key to market profit. Perhaps if the frozen dessert category adhered to their distant relative’s process by incorporating low-fat ice cream into their frozen dessert cakes, this would be a key innovation to profit.

I see it, I want it

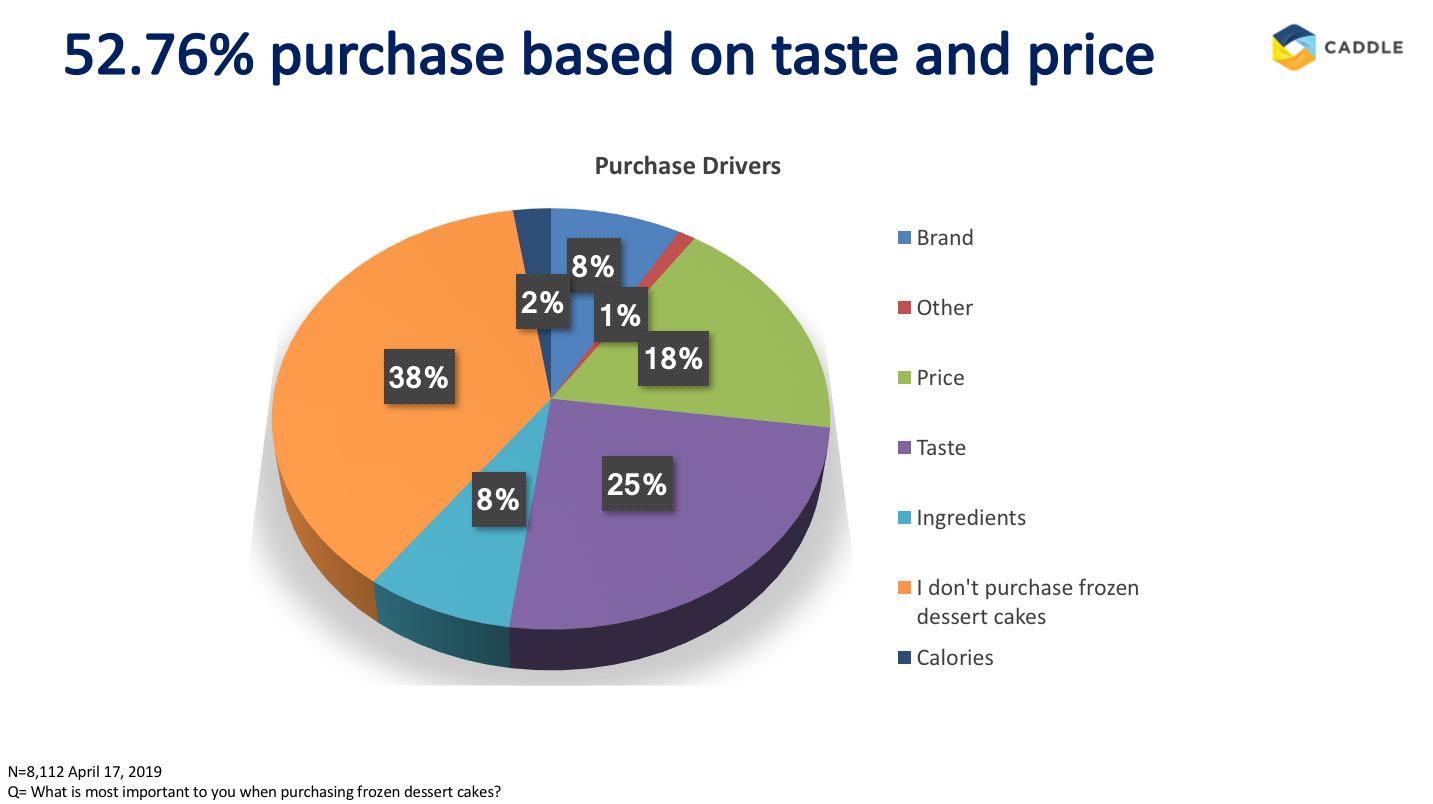

When it comes to purchasing frozen dessert cakes, 47% of consumers indicated that they won’t put it on their grocery list, but will purchase it when they see it in the store. Continually, 53% of respondents indicated that price and taste are the two main purchase drivers when it comes to purchasing the sweet, frozen treat.

Respondents indicated that they will purchase frozen dessert cakes when they see it in the store aligns with market trends indicating that the market is growing due to increasing disposable incomes.

Further, MarketResearch.biz found that the introduction of new innovative products with different tastes and flavoured frozen desserts is expected to have a positive impact on market growth. Certainly, with respondents indicating that they purchase the sweet treat based on taste, consumers will be enticed to purchase these new flavours when they see them in their local grocery store or ice cream stand.

So what?

Frozen dessert cakes are a treat that anybody at any age can enjoy. With the increase in disposable income and health trends, it appears that consumers are looking for a sweet treat with low-fat ingredients in them. If industry leaders follow this trend, they should be certain for a path of success.

If you’re in the CGP industry and are interested in gaining insights on your consumers, we encourage you to reach out to us and see how we can transform your questions into insights.

[simple-author-box]