COVID-19 Insights: The Future of Live Events is Uncertain as Canadians Still Wary of Mass Gatherings

“Take me out to the ballgame” has new meaning with only a third of respondents interested in attending live sports as soon as they become available

Sports and live event sponsorships are a huge business: This past January, Marketing Dive predicted the strongest increase in global sports sponsorships spend (+5%), to a total of $48.4 billion by the end of 2020. But, that was pre-pandemic. More recently, it was estimated that the NFL could lose a reported $5.5 billion in stadium revenues (the sum of tickets, concessions, sponsors, parking and team stores) from playing to empty stadiums. And that’s just one professional sports league among the many worldwide…

From the NFL to NHL, NBA to MLB, MLSE and CFL, not to mention other billion-dollar leagues, venues, musical events and so much more—the pandemic has hit live entertainment hard over the last four months, and event life isn’t expected to get back to “normal” for some time.

Meanwhile, plenty of stories have emerged about how brands are attempting to “stay the course” amid ongoing attendance uncertainties:

- Sports teams are playing to empty or half-empty stadiums; some are even subbing in cut-outs, dolls or digital representations of fans in the stands to make it seem more “normal” for viewers at home.

- Property management company Cadillac Fairview has piloted drive-in theatres to bring traffic back to mall parking lots.

- Musical artists are taking to digital performance app Side Door to perform, build communities around their art, and recoup lost revenues due to cancelled concerts, appearances and album launches.

We here at Caddle are no less fanatic about our sports and entertainment than other Canadians. And so, we were curious to understand what the future of sponsorships will look like moving forward, under ongoing pandemic restrictions and after.

Specifically, we wanted to know how fans feel about the lack of live sports and entertainment in their lives. Would they return to live sporting and entertainment events? And if so, when? What terms would make attending live events acceptable? And, are Canadian consumers open to other forms of events, such as drive-in concerts.

Read on to learn what we discovered when we asked industry experts like Chris Shewfelt of Maple Leaf Sports & Entertainment (MLSE), as well as our 10,000+ daily user panel, about the outlook for sports and entertainment in the coming months.

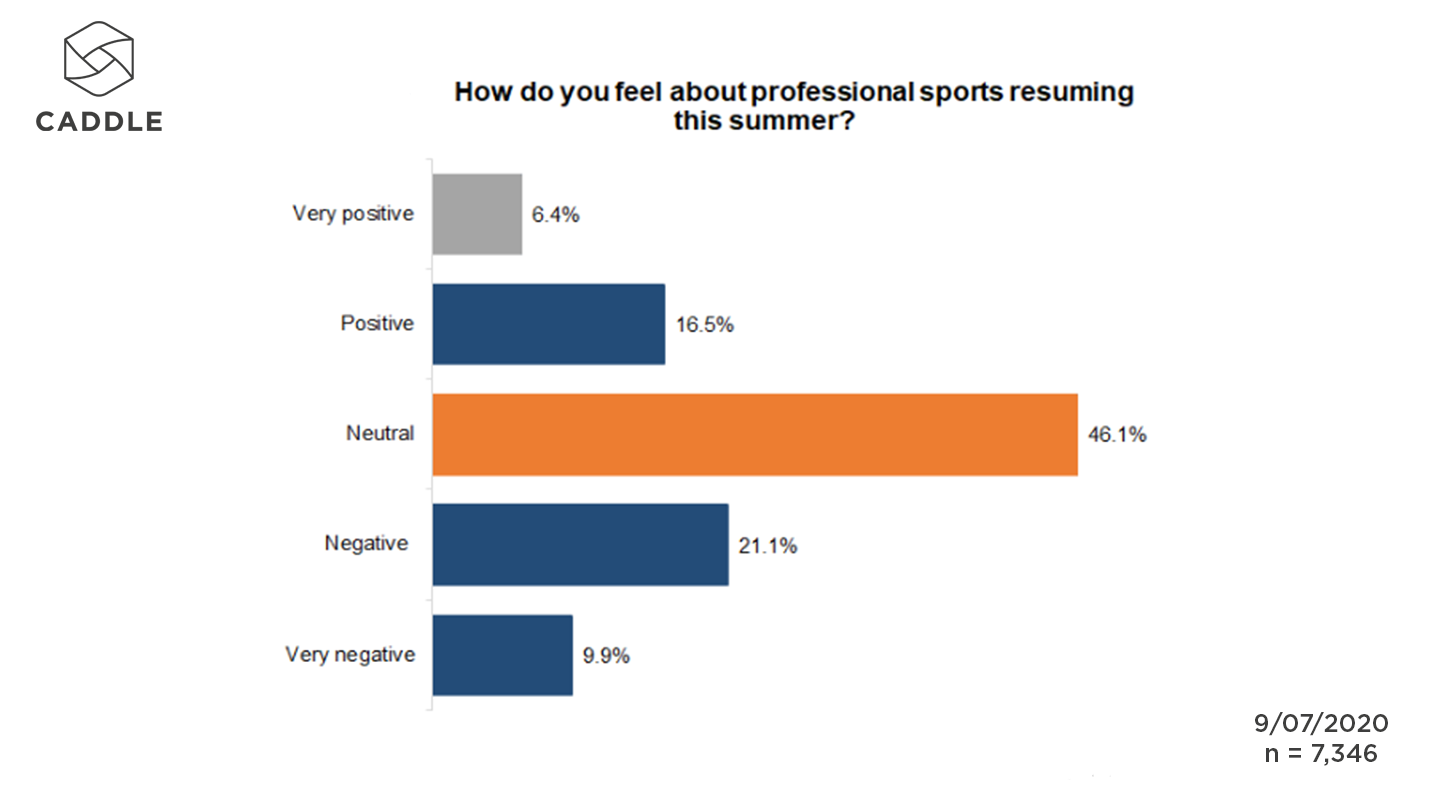

HOW DO CANADIANS FEEL ABOUT PROFESSIONAL SPORTS RESUMING IN SUMMER 2020?

Almost half of respondents on our Canadian panel are neutral on the subject of the return of professional sports this summer, while in general, more respondents are negative about the resumption of sports than positive (31% vs. 23%, respectively).

Who seems most excited about the return of professional sports? Saskatchewanians over-index on positivity (at 30%), along with Manitobans (28%), Prince Edward Islanders (27%), Albertans (26%) and Quebeckers (25%).

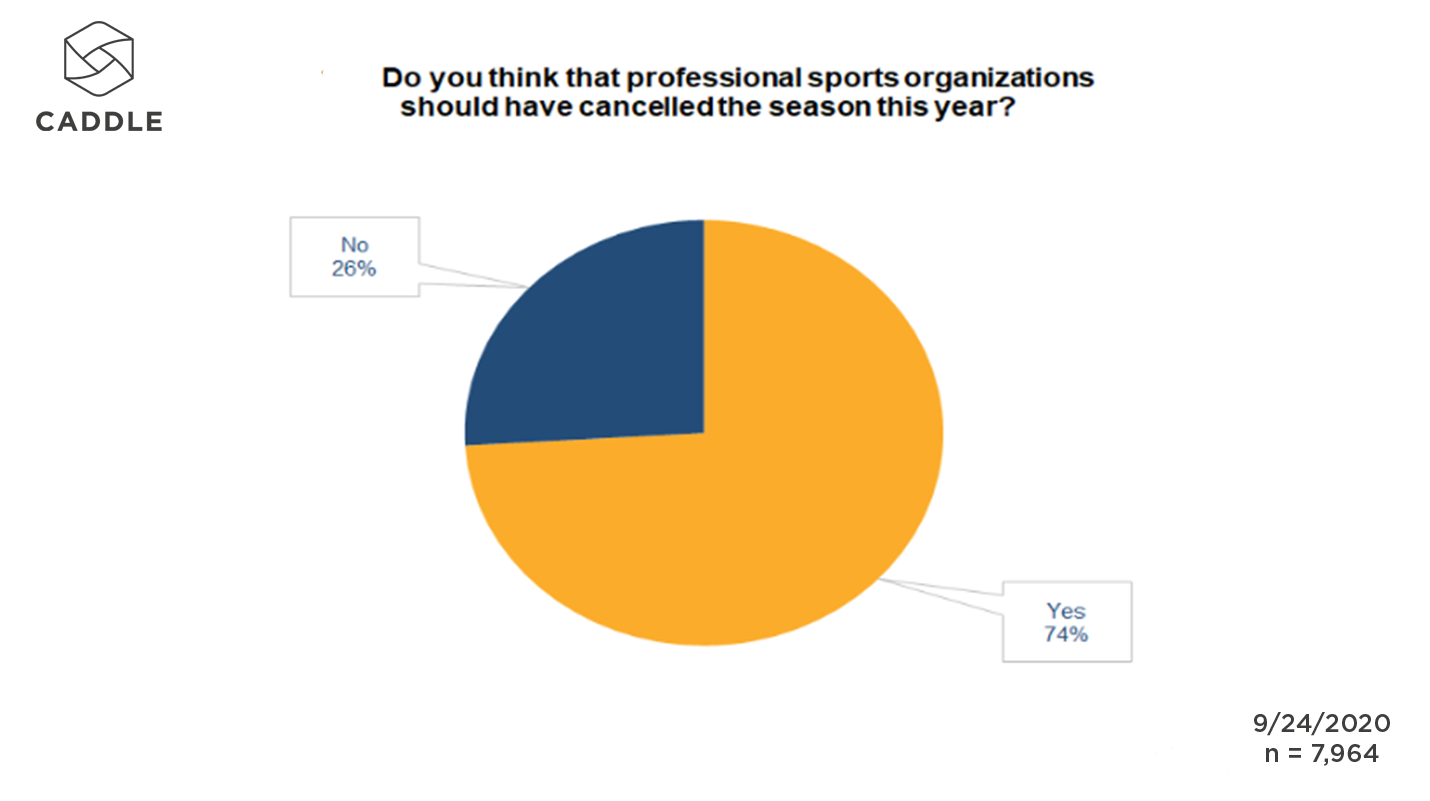

IS IT TOO SOON FOR PROFESSIONAL SPORTS TO RETURN?

Following on the above question, we asked whether professional sports organizations should have cancelled their 2020 seasons. In response, 74% of the general population said “yes.” [Female-identifying respondents and those living in the Yukon, the Maritimes, British Columbia and Saskatchewan seem especially adamant (over-indexing up to 80%).]

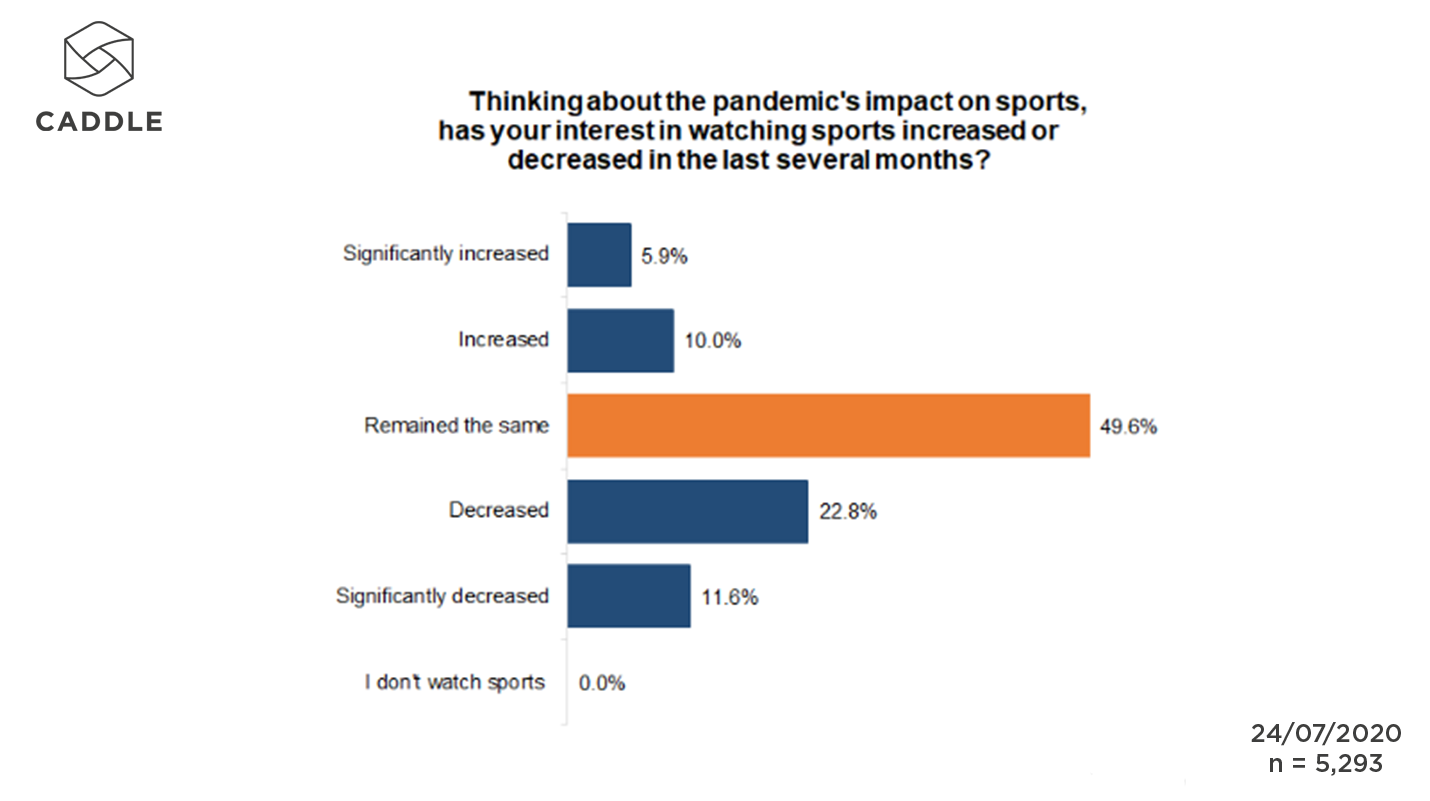

Perhaps this is because the level of interest in viewing sports has been affected by the pandemic blues: About 35% of the general panel of respondents indicated that their interest in watching sports has “decreased”/”significantly decreased,” while only 16% thought their interest had “increased”/”significantly increased.”

With the seeming effects of the pandemic on consumer interest in live sports, we wondered whether attendance would suffer once live venues re-open for widespread public turnout. And once again, our panel results show a clear uncertainty among Canadian consumers.

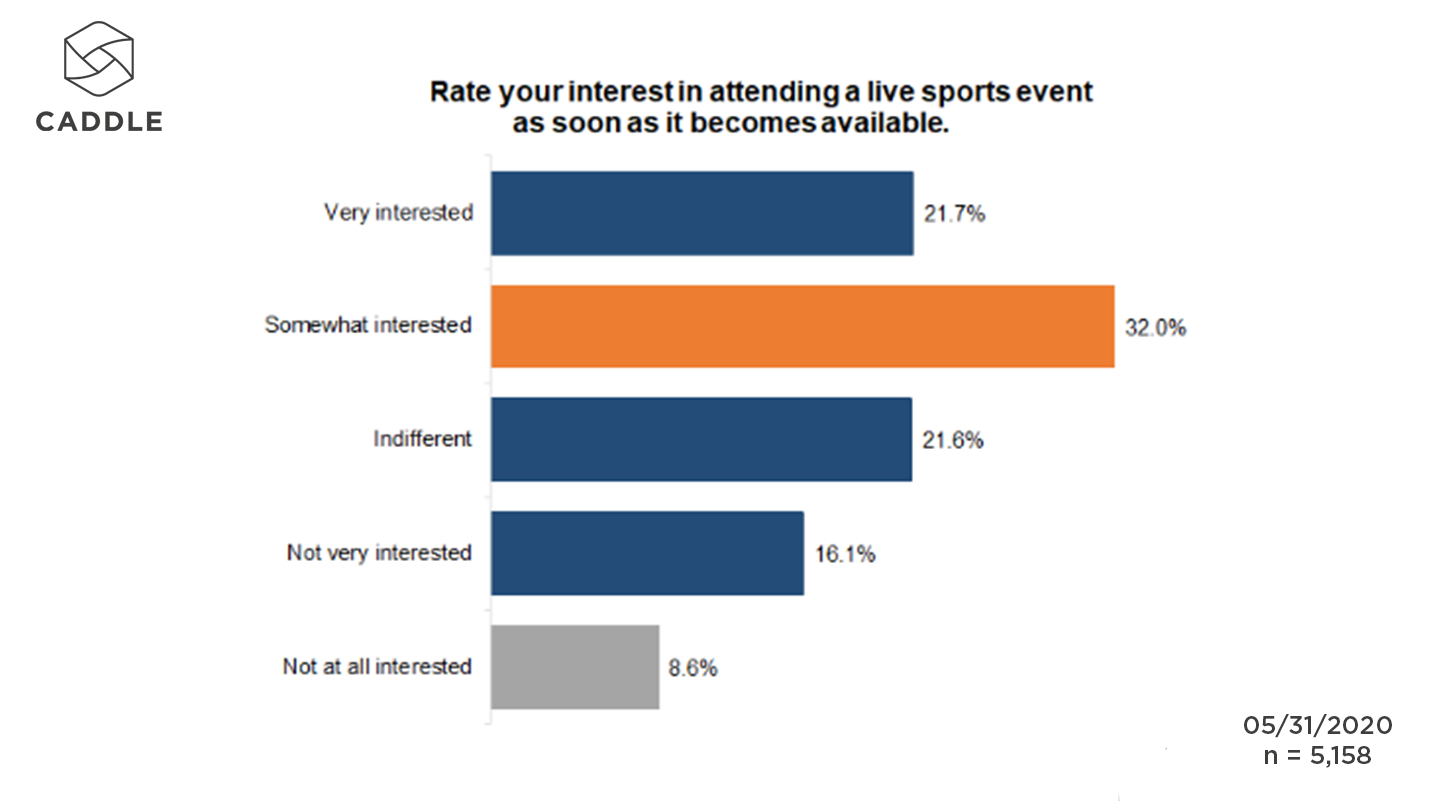

WILL CANADIANS ATTEND LIVE SPORTING EVENTS IN THE FUTURE?

Some Canadian sports fans are ready to head back to sporting venues once they’re made available to the public, though results are mixed. In a recent webinar, we learned from Chris Shewfelt, VP Business Operations with MLSE, that among their bread-and-butter attendees (i.e., season seat holders and members), a high percentage want to come back to MLSE venues.

This is supported by survey responses from our Caddle panel, where 54% indicated their interest in attending a live sports event as soon as it becomes available—especially Gen Zers (43%), Millennials (39%), Saskatchewanians (40%) and New Brunswickers (37.5%).

WHAT MIGHT BE HOLDING PEOPLE BACK FROM ATTENDING LIVE EVENTS?

Results indicate that social distancing isn’t a deciding factor for the majority of respondents: Almost 56% indicated that enforced social distancing would make them neither more nor less likely to visit a sports arena. This pattern holds across generational and geographic divides, though Gen Zers are slightly more likely to attend amid enforced social distancing and Gen Xers, the Greatest Generation, and respondents in the Maritimes and Quebec are less likely.

This could be reflective of the COVID-19 statistics, more so than interest in sports or other live events, as the Maritimes have had reasonably fewer cases than other provinces, and perhaps are eager to take precautions to stay that way. At the same time, older populations and folks in Quebec have been hit hard by the illness, and for that reason, might want to stay away from situations where they could be newly exposed.

Also: These statistics were collected in May, at a time when Alberta, British Columbia and other harder-hit provinces hadn’t yet experienced spikes in COVID cases that they would later in the summer months. In a follow-up panel from June 3, 50% of respondents said they would attend live entertainment events at the same rate as they did pre-pandemic.

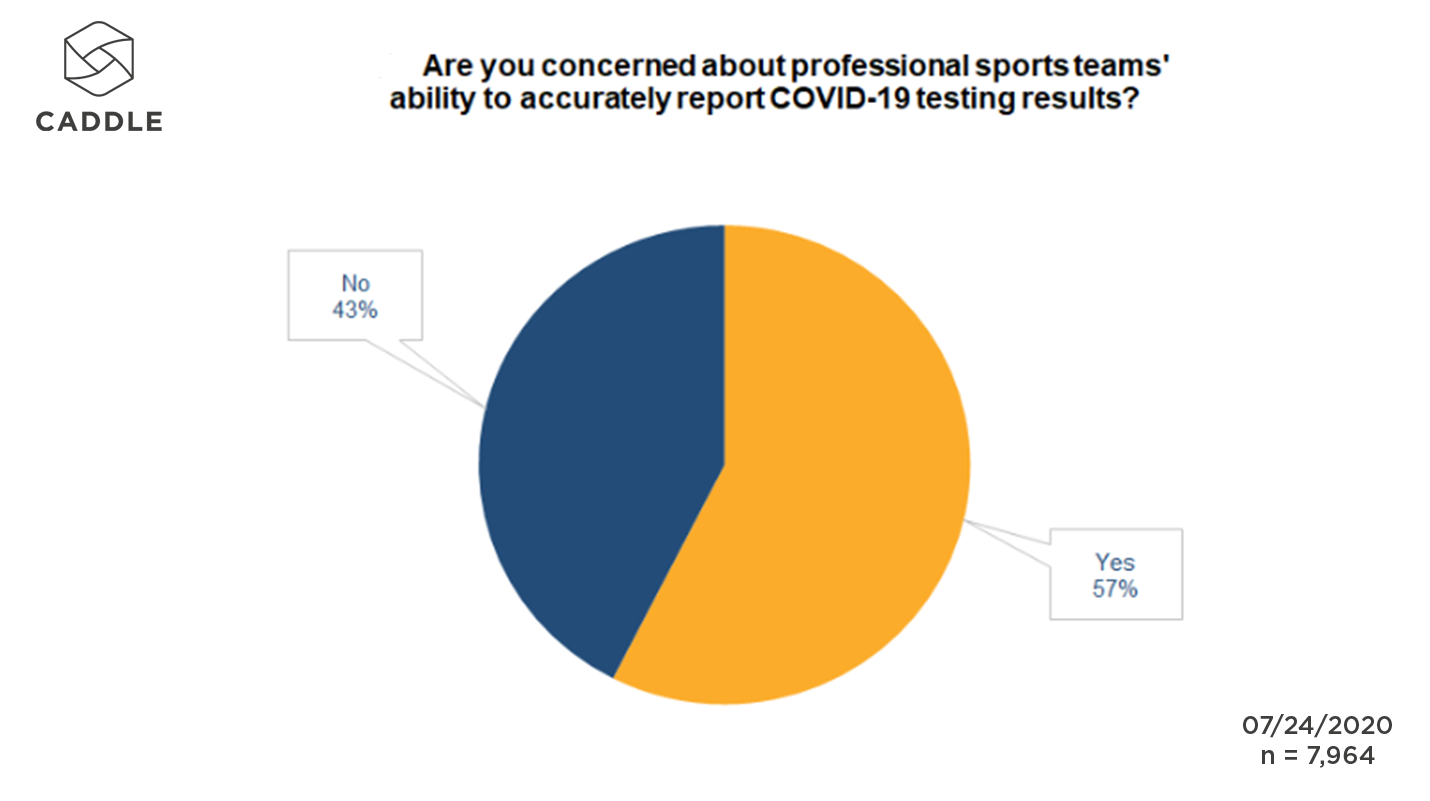

Meanwhile, about the same percentage of the general population (57%) also indicated their concern over professional sports teams’ ability to accurately report COVID-19 testing results. This indicates that the pandemic remains of concern for Canadians, but it won’t necessarily stop them from attending live events moving forward.

WHAT MIGHT INCENTIVIZE CONSUMERS TO COME BACK TO LIVE EVENT VENUES?

At least for Canadian sports viewers, alcohol consumption has proven to be a significant part of the experience, with nearly 15% agreeing that it improves their viewing. This is especially the case for Gen Zers and Millennials, and less so for Baby Boomers, Gen Xers and the Greatest Generation.

The message here, then, is that the experience in-venue has got to be as close to its earlier, pre-pandemic incarnation; this includes the necessity for concessions to sell alcohol to amplify the sports-watching experience.

Additionally, we know that COVID-19 has affected financial stability for many Canadians, and financial concerns seem to cast a shadow over their interest in attending live events. Specifically, over 50% of Canadians are not interested in live events if circumstances surrounding the pandemic cause an increase in ticket prices.

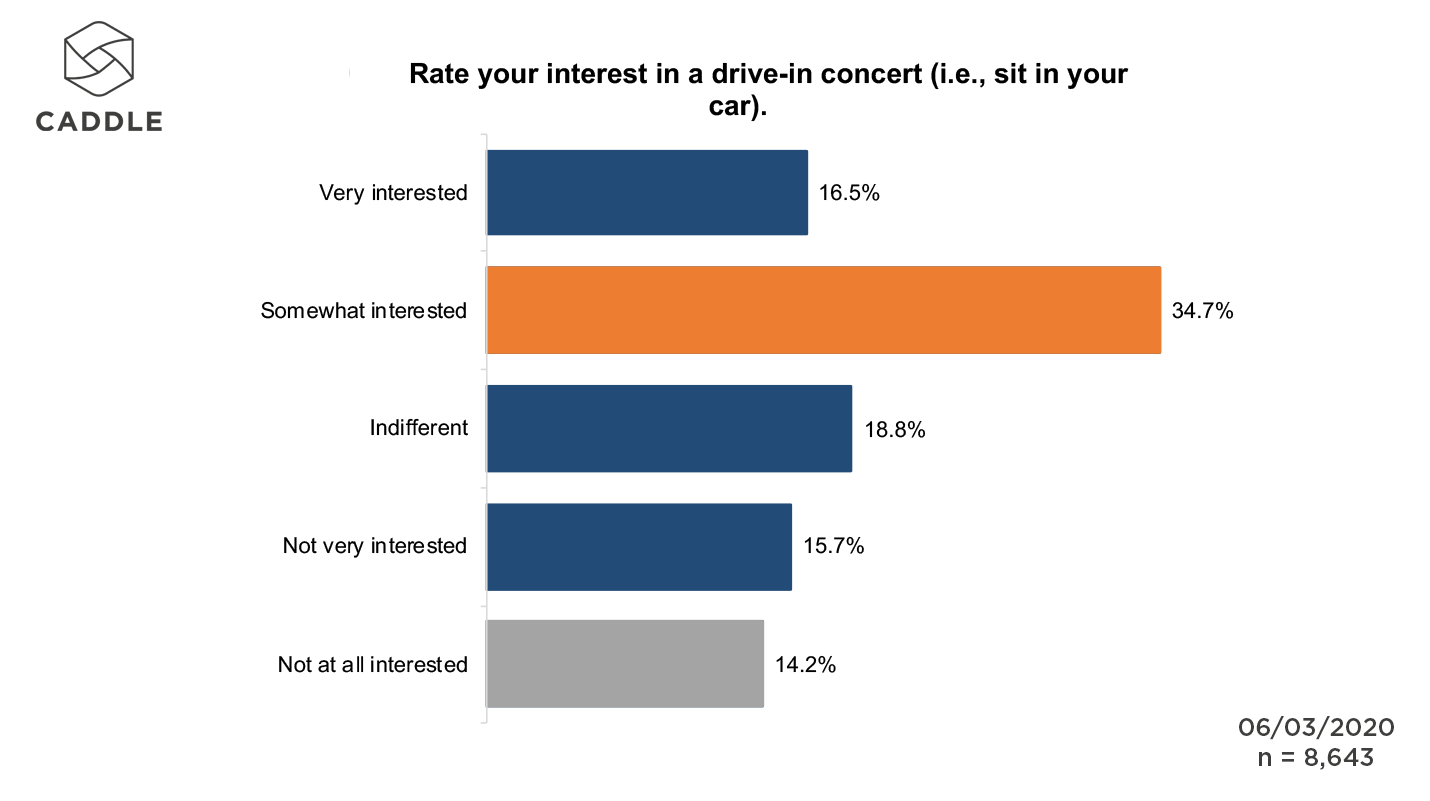

And finally, creative approaches to social distancing while also providing entertainment seem to be amenable for a significant number of Canadians. For instance, about 50% of Caddle users are “very interested”/”somewhat interested” in drive-in concerts.

This suggests that, even more so now than during pre-COVID times, brands who get creative with looking after consumers’ wants and needs will win back their attendance, and by extension, their share of entertainment revenues.

KEY TAKEAWAYS

EVENT PRIORITIES ARE GOING TO NEED TO CONTINUE TO PROVIDE FANS

In a recent webinar, retail industry insider Bruce Winder spoke of how retailers would need to work overtime to make sure that consumers feel comfortable in-store. This extends to live event venues, too: “[They] need to ensure that cleanliness and social distancing are in place… you’re really telling people that it’s safe to come back again.”

Chris Shewfelt of MLSE concurred: “The live sporting event has changed. When live events come back, there are certain aspects that the consumer is going to demand of those properties.”

Whether it’s taking measures to emphasize their cleanliness protocols, revising floor plans to allow for streamlined entrance and exit, or offering incentives like reasonable ticket prices even while social distancing, brands are going to need to continue to provide fans with reassurance that they’re taking precautions to make live event venues as safe and yet, still enjoyable, as possible.

BRANDS WILL NEED TO INNOVATE THEIR SPONSORSHIP PROGRAMS TO BE MORE COMPETITIVE IN “THE NEW NORMAL”

Brands are facing a new marketplace where some of their most effective promotional opportunities are simply no longer available, including in-venue advertising and promotions, broadcast plays, major event sponsorships like the Summer Olympics, plus countless other traditionally high-ticket placements.

In their stead, Shewfelt suggests that the brands must be prepared to innovate. “Maybe they weren’t thinking about virtual ads in the past… we need that evolution to happen in real time in order for sports teams to pay their expenses.”

New promotional placements, including virtual ad insertions and high-impact fan engagement in real time, are likely to revolutionize the future of live events, and Shewfelt believes that the winners in this brave new marketplace will be those who recognize the opportunities and are first to take advantage of them.

TECHNOLOGY IS A REVENUE-ENABLER FOR LIVE EVENT VENUES

In addition to the safety and health-related upgrades and initiatives suggested above, consumer demands will continue to emphasize convenience and (relatively instant) gratification. And though this isn’t new among the considerations for most modern sports and entertainment venues, technological innovations have a role to play in continuing to advance consumers’ interests in attending live events, instead of just catching them at home or online.

For instance, Shewfelt explains, “The new normal doesn’t necessarily mean lining up at a concession.” MLSE had already gone mobile with all of their venues from a retail and food perspective. But he acknowledges that venues need to make the path to purchase quicker. Cashless transactions will likely be a key component in this process, as “conversion in venues to a more tech-driven environment is going to be very important with the sports and entertainment world in the months to come.”