COVID-19 Insights: Ongoing Health and Safety Concerns Will Drive More Travel Dollars to Domestic Vendors in 2020 and Beyond

With many travel itineraries waylaid by COVID, 70%+ of consumers plan to stick closer to home for their vacation fix

Have your 2020 travel plans been busted? Ours too. Gone are the days when we could simply hop online, book an all-inclusive package and whisk ourselves away to paradise for a week… at least for the time-being.

Our survey results show that the COVID pandemic and its ongoing effects on consumer health, wealth and personal lives will have significant repercussions on travel plans for many Canadians: More than half of consumers report they won’t be travelling anytime in 2020—even once non-essential travel becomes available—and 60% are unlikely to vacation somewhere warm this winter.

Given these results, we were curious to understand whether the funds earmarked for international travel in 2020 and beyond will be diverted to destinations closer to home. And, true to our reputation both here and on the world stage, Canadians seem to take pride in their local environs, and more than 70% would prefer visiting domestic destinations (including cottages and campgrounds, RVs and road trips) over international travel in the balance of the year.

Let’s dive into the responses from the past month to learn more.

Get insights into Canadian consumer habits, straight to your inbox. Subscribe to receive our free, weekly summaries now!

WHAT’S HAPPENED TO CANADIANS’ TRAVEL PLANS?

More than three-quarters of Caddle’s 9,000-strong user panel have not arranged any summer travel plans—particularly the eldest respondents, including Baby Boomers, at 82%.

In fact, over half of respondents indicated that they won’t take non-essential trips by plane in the balance of the year, even once travel becomes more available to them. (Gen Zers are slightly more amenable, almost 15% of whom indicating they’ll travel as soon as possible. At the same time, respondents in the Maritimes seem especially reticent to fly, especially 65% of Newfoundlander respondents.)

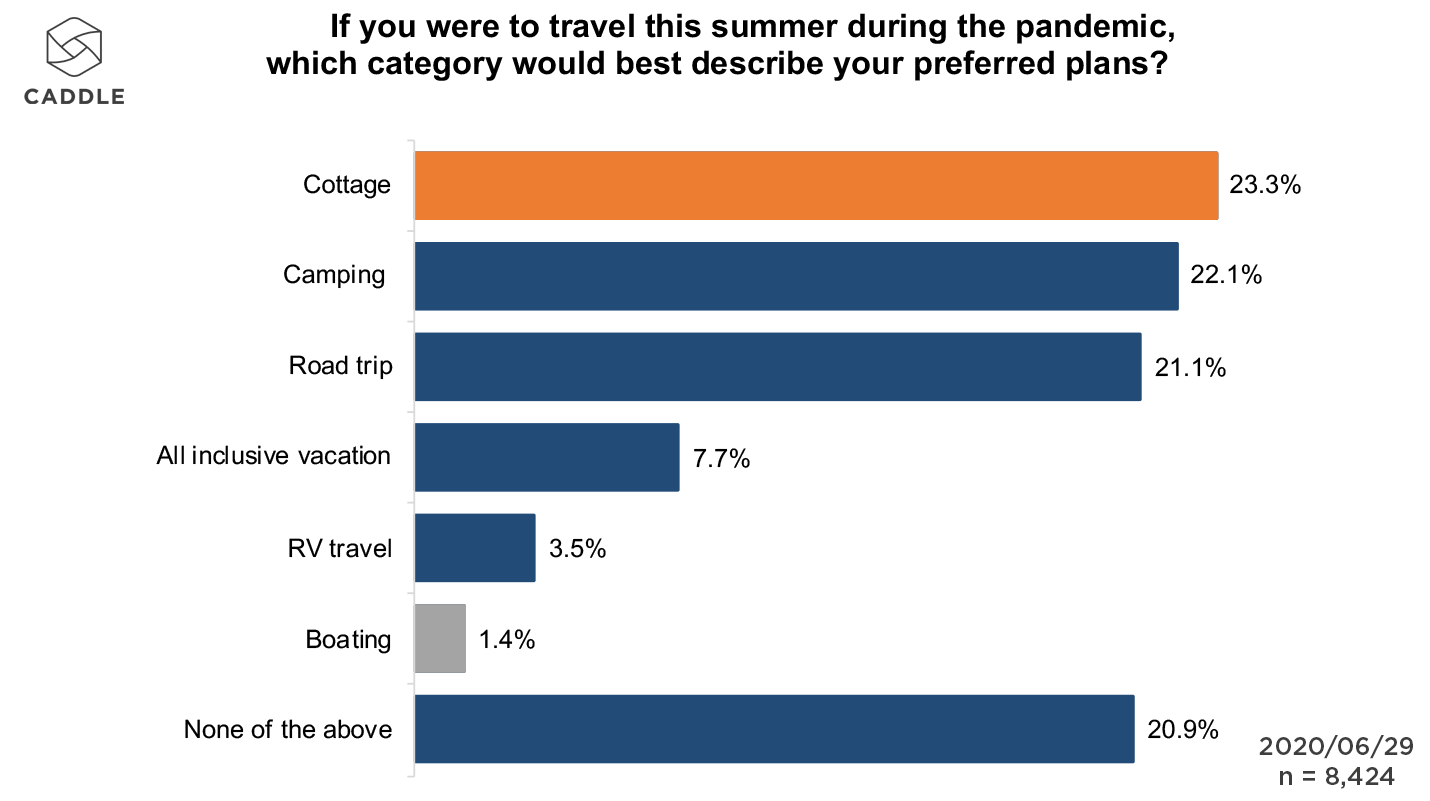

If they were to travel this summer, respondents again overwhelmingly favour domestic excursions over international destinations. Among Caddle’s general population, road trips as well as local destinations like cottages and campgrounds ranked equally well, at just under a quarter of respondents each.

However, it’s interesting to note that these preferences fluctuate by region, which may be indicative of differential access to accommodations and/or local destinations. So, while Albertan respondents prefer camping and road trips (at about 27% each) and Manitobans prioritize camping and cottaging (31% and 23%, respectively), Ontarians prefer cottaging 2x more than camping and road trips and British Columbians and Saskatchewanians rank camping at 2x the rate of cottaging.

WHAT ARE SOME OF THE FACTORS CONCERNING CANADIANS MOST ABOUT TRAVEL THESE DAYS?

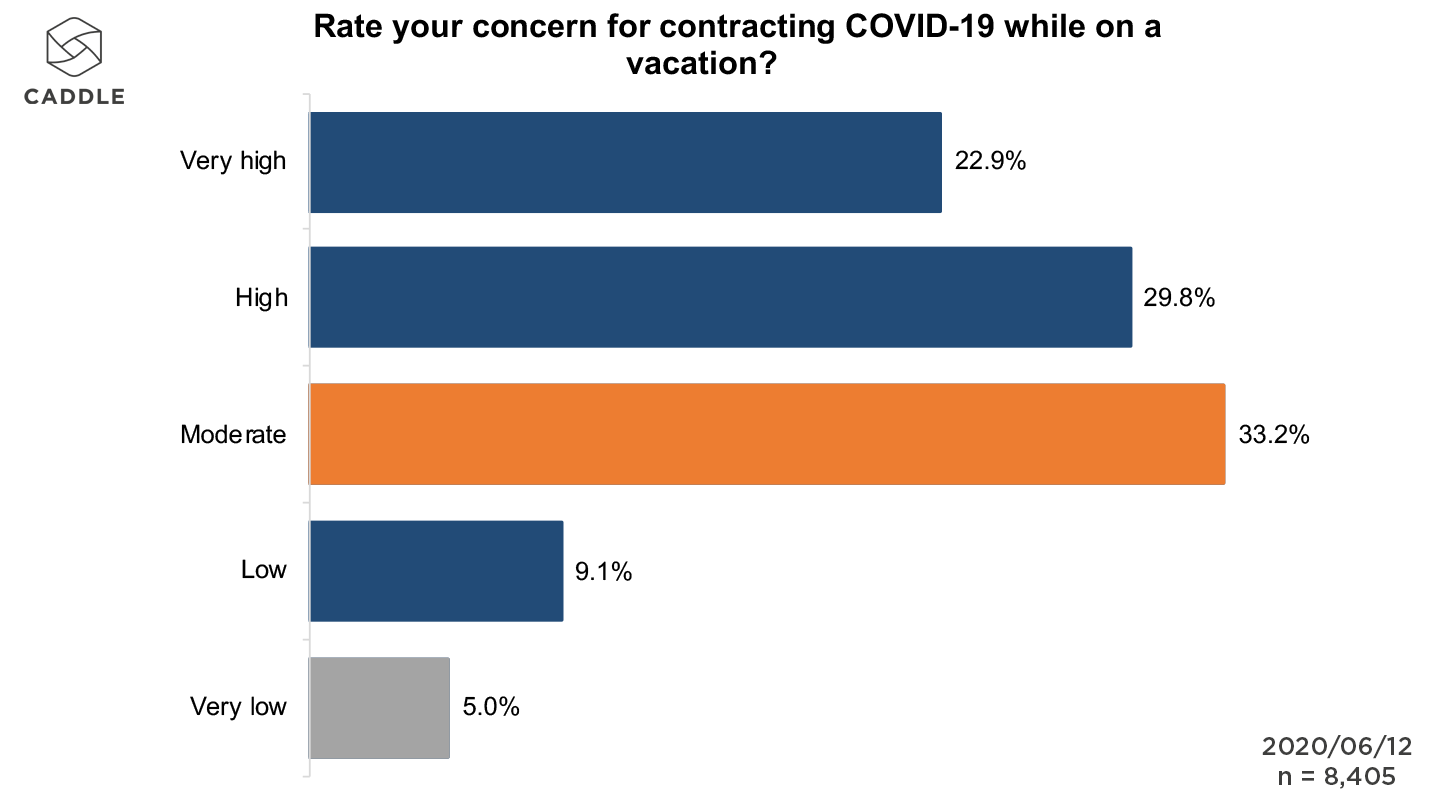

On the one hand, respondents are overwhelmingly concerned about contracting COVID-19 while on vacation.

This is consistent across all generations, though the eldest respondents (including those among the Greatest Generation, Baby Boomers and Gen X) over-indexed on “high”/”very high” concerns. This is perhaps most understandable given senior populations’ increased susceptibility to the virus.

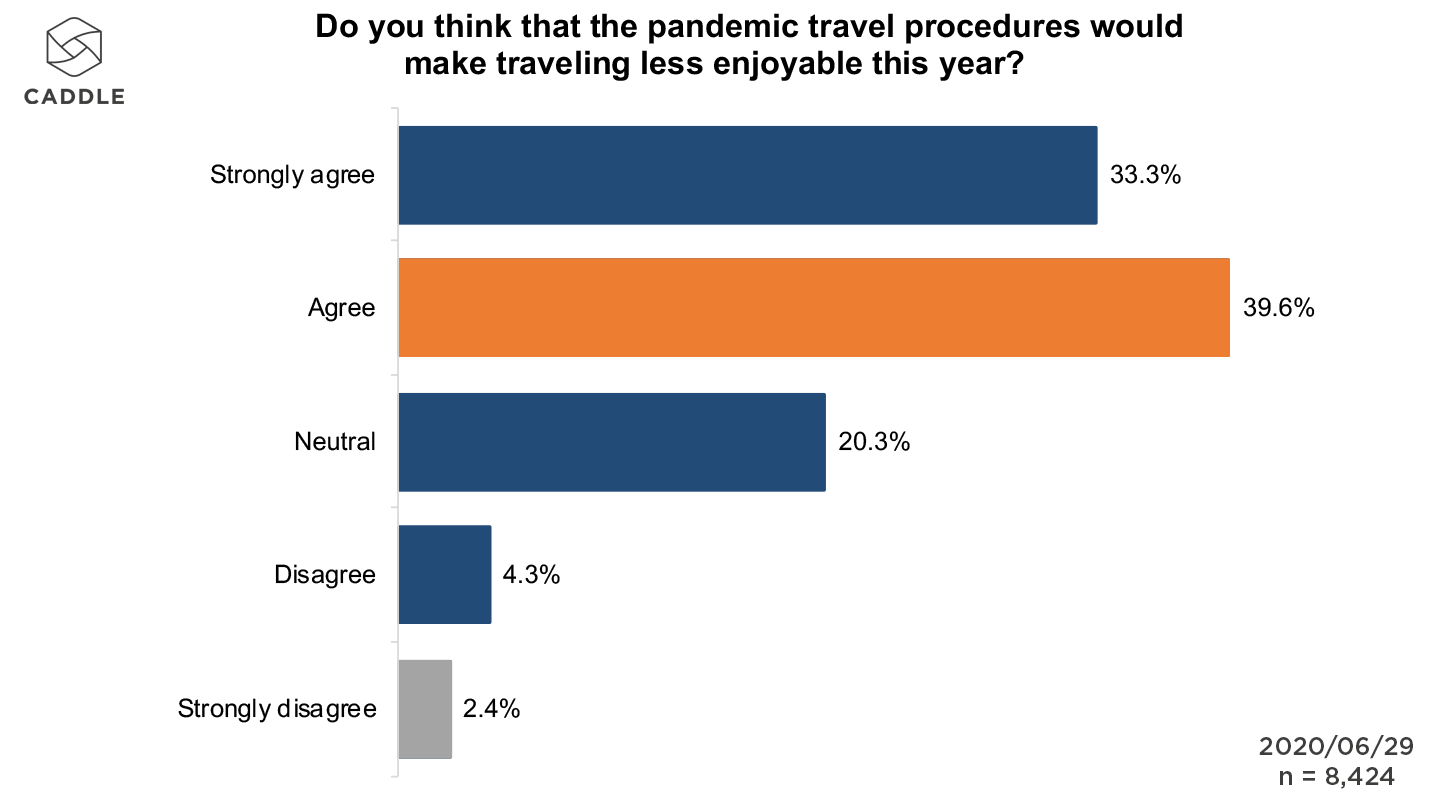

Caddle users also overwhelmingly agree that health and safety procedures introduced due to the pandemic would make travel less enjoyable this year, especially Baby Boomers (75%), Gen Xers, Gen Zers and Millennials (72% each) and the Greatest Generation (70%).

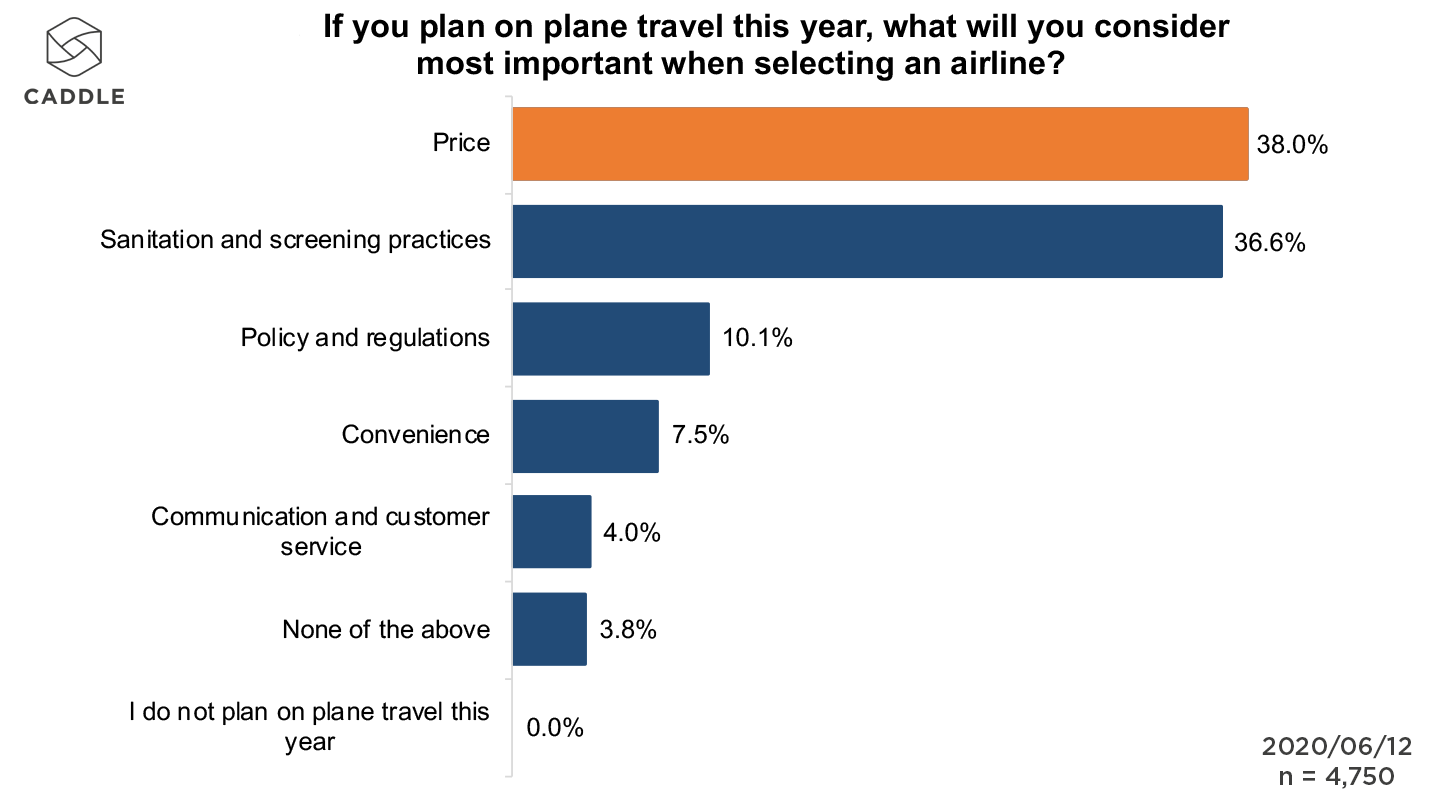

Finally, among those who plan to travel by plane in the second half of 2020, price and sanitation/screening practices rank equally high among their considerations, at 37–9% each.

From a regional perspective, Albertans, Quebeckers, Newfoundlanders and Labradorians prioritize price, while Saskatchewanians value sanitation and screening practices more highly.

Taken together, these consumer insights suggest that the international travel industry will continue to have a tough hill to climb to win back Canadian vacationers in the months and possibly years to come.

KEY TAKEAWAYS

CANADIANS ARE WILLING TO “THINK LOCAL” WITH THEIR TRAVEL PLANNING

From campsites to cottages to RVs to Airbnbs, Canadians seem to be shifting allegiances from international travel destinations to ones closer to home.

When you combine respondents’ health and safety concerns with the very real threat of contracting COVID-19 through plane travel, we expect that this trend will have positive implications for the restaurant and hotel industries, tourist attractions, campgrounds and equipment vendors, among many other suppliers across Canada.

HEALTH AND SAFETY ARE TOP CONCERNS FOR TRAVELLERS (BUT SO IS PRICE)

With the pandemic continuing to rage south of the border, it’s no wonder that Canadians are increasingly afraid of contracting the virus. Such concerns are likely to persist through the latter half of 2020 and, no doubt, until a viable vaccine is made available in the coming years.

As such—and even as provincial restrictions continue to ease—it’ll be important for travel and tourist suppliers to keep health and safety standards top-of-mind among their grassroots-level employees, both to keep the chance of contracting COVID at bay but also in order to alleviate potential customers’ concerns.

At the same time, because the pandemic has put a major strain on Canadian populations (particularly when it comes to financial concerns), hotel, airline and travel brands should equally prioritize pricing and value if they’re going to attract those Canadians who are willing to take a vacation in the coming months.

GEN ZERS MAY BE THE LOWEST-HANGING FRUIT FOR CANADIAN TRAVEL AND TOURISM SUPPLIERS

In tandem with their relatively more active pandemic lifestyles and interest in healthier eating, Gen Zers are also more likely than other generations to take non-essential trips by plane in the coming months. This makes them a ripe target for travel and tourism suppliers, especially as restrictions ease and favourite restaurants, attractions and other haunts become more accessible to them.

If you’re looking to win Gen Zers’ travel budgets, remember that they tend to be among the least brand-loyal of Caddle respondents and will switch to cheaper offerings as a way to save money. Thus, a focus on health and wellness at a discount is likely to win a greater share of this population’s spend than sticking to tried-and-true brand messaging.