COVID-19 Insights: Surge in Grocery Delivery Likely Short Term

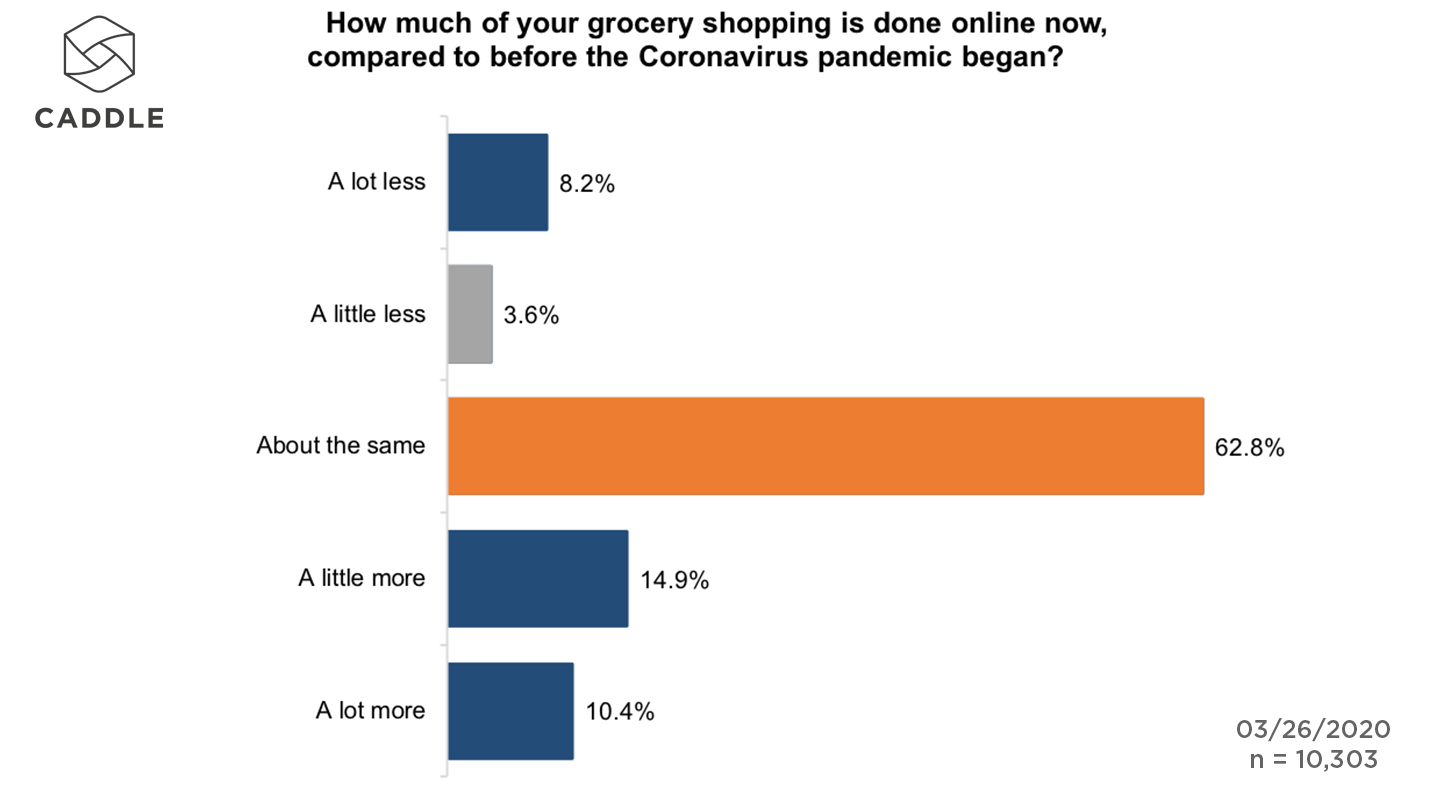

25% ordering more online than before pandemic

The impact of the COVID-19 pandemic should mean a big boost to online grocery delivery.

The reported struggles of consumers to book time slots for deliveries suggest a major increase in online grocery purchase.

However this week’s COVID-19 Rapid Response report suggests that the pandemic is impacting how we buy groceries in more ways than a simple shift to online ordering.

On the evidence from Caddle’s 10,000 daily survey responders, Canadians are switching to different grocery stores as well as ordering more online.

If you’re not already on the mailing list, sign up for our free weekly summary here.

Are we buying more online?

According to our research, about 1 in 4 of us are ordering more groceries online than we did pre-pandemic, while 13.4% of our panel tried grocery delivery service for the first time.

Similarly, 22% expected that they would use an online grocery service in the next month.

For changes that took place in a matter of weeks, that’s a relative big shift in use — which would explain stories about capacity issues.

But will the surge last?

Is this a permanent shift to online grocery?

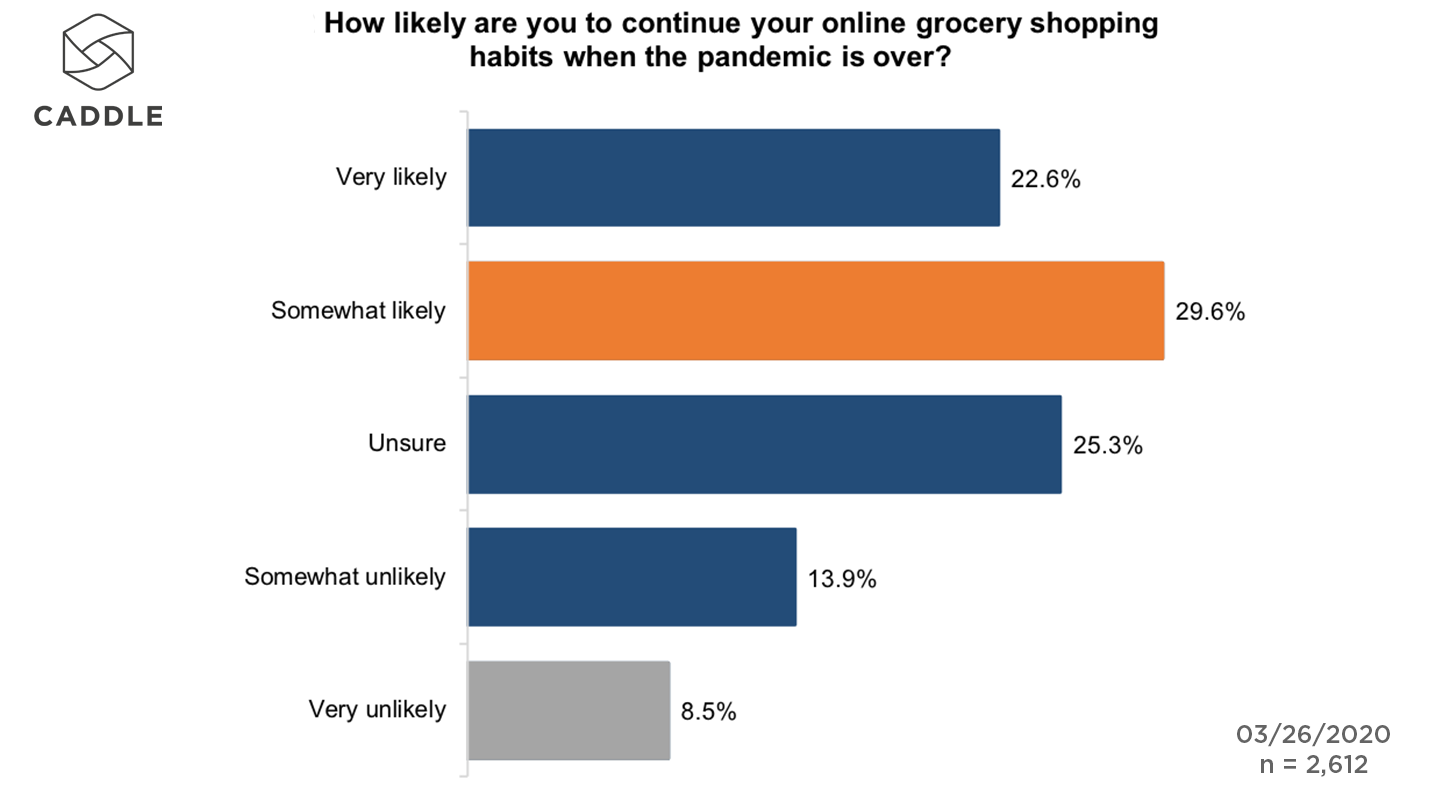

Not completely. How much of these new online shopping habits will keep up once the pandemic is over? Based on our panel responses, about half of them.

Of people who told us they were shopping for groceries online more since the start of the pandemic, 52% said they would continue at this level after the crisis.

Some of the new users will also be converted into long-term customers. 60% of the shoppers who told us they tried getting groceries delivered for the first time, said they anticipated they would use delivery services more at the end of 2020 than at the start.

So what will the net impact be? Just over 13% of people say they expect to use online grocery delivery more after the pandemic than at the start 2020. The figure tends to be higher for those with children under 18, who are also the primary shopper, suggesting a stronger overall impact.

What’s happened to in-store visits?

There is a more pronounced, albeit short-term change in how we shop at brick and more stores.

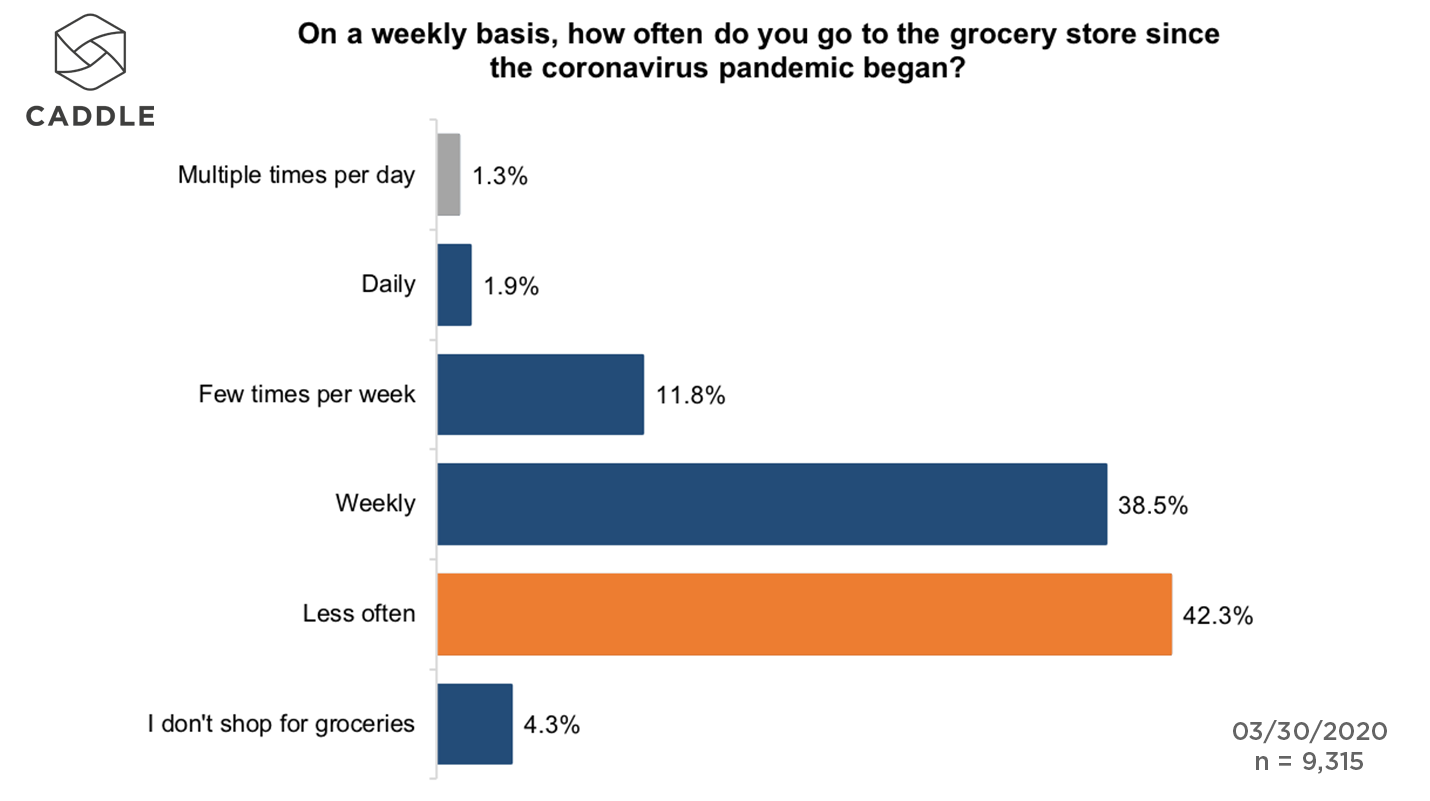

Since social distancing measures were implemented, going to the grocery store is something most Canadians do once a week at most.

Approximately 80% of our 10,000 daily panel say they shop weekly or less frequently, with 42% currently shopping less than once a week.

Not only are there less frequent store visits for stores to compete over, but shoppers are going to fewer stores on average. Just over 70% of our panel told us they went to fewer stores.

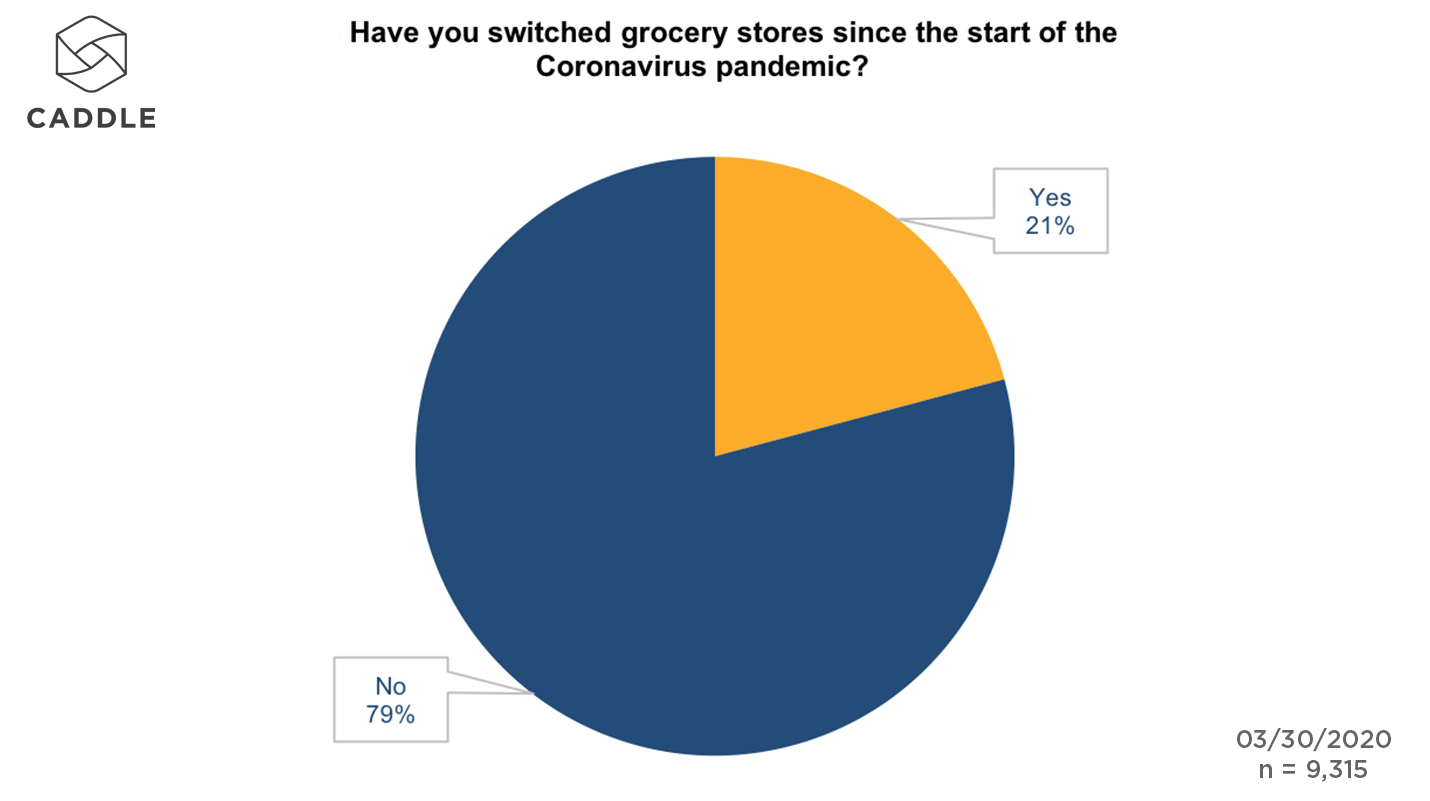

While we’re visiting less stores, we are willing to try different stores to our usual supermarket. Just over one in five of our panel said they had switched in the supermarket during the crisis.

What was the biggest reason to switch supermarkets? Rather than price or proximity, shoppers were more likely to switch due to availability of products.

As well as stocking what people are looking for, strong enforcement of social distancing in-store would win over shoppers. From a list of precautions listed, panel members selected this as they one that would reassure them most.

Why we’re cutting out takeout

With restaurants already taking a hit due to enforced closures, operating exclusively as takeout or delivery-only businesses, Caddle’s data has more bad news for restaurants: Canadians are also reducing the amount of takeout we order.

Just 8.5% said they’d had food delivered in the last week, and 34% said they were ordering much less takeout than prior to the pandemic.

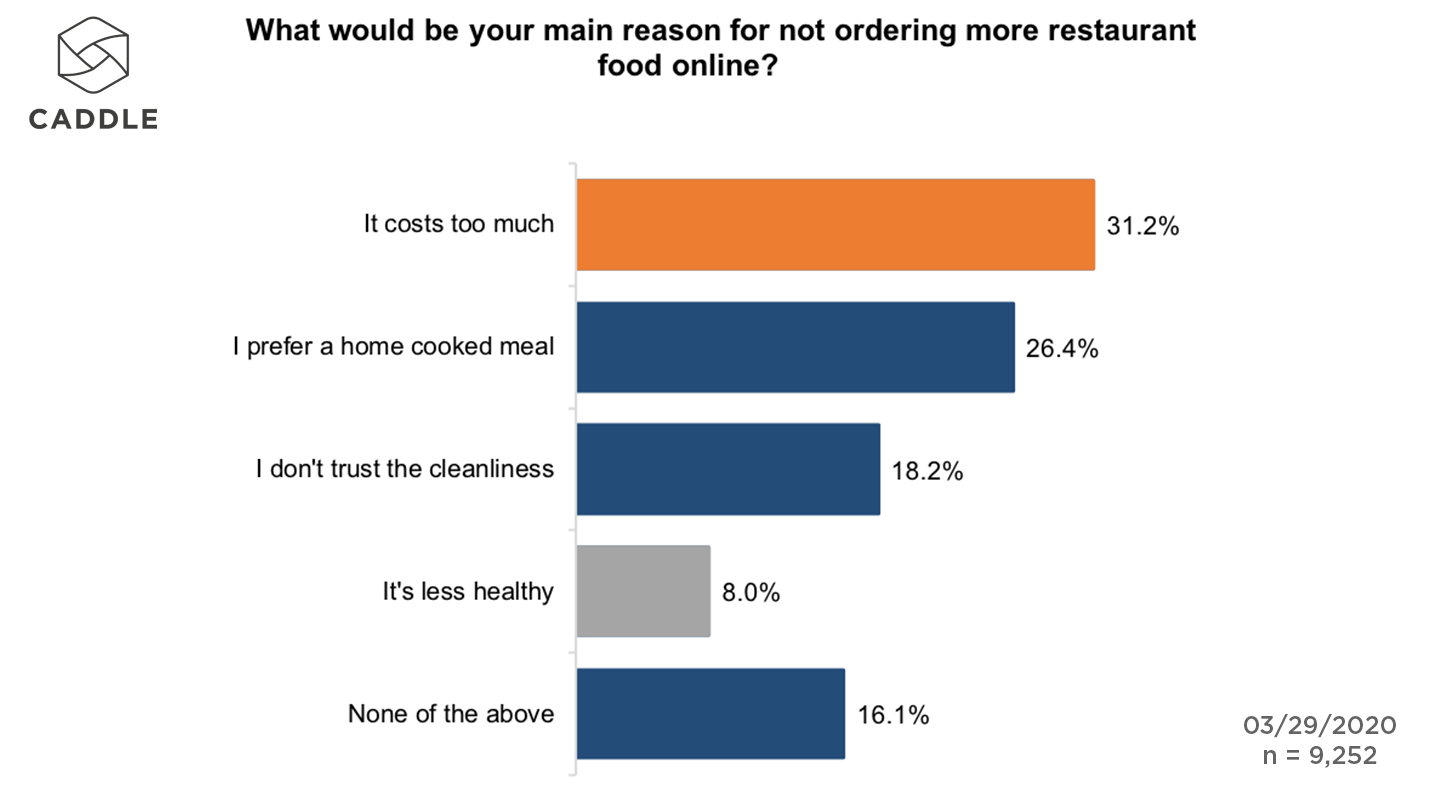

Given the uncertain economic situation, money was, unsurprisingly, a big reason people gave for ordering less takeout. But it isn’t the only reason.

Preference played a part too. 26.4% told us they just preferred having home cooked meals. Concerns over cleanliness, potentially due to the pandemic was the reason for 18% of people ordering less takeout.

Support for local businesses

Despite the reduction in purchases from local restaurants, Canadians are very much alive to the problems being faced by local businesses — and they want to help. Despite their own economic hardships, they are doing what they can to support.

Just less than a third of the panel said they were buying more local goods and services compared to before the pandemic. 42% said they had made a purchase specifically to support a local business during the pandemic.

They also want to see other businesses doing what they can to support local producers. Almost three quarters of our panel told us they want to see grocery stores stocking more local goods to support businesses.

Key Takeaways

No mass switch to online grocery yet

As it stands only 1 in 8 of us think we’ll order more of our groceries online after pandemic than we did before.

First trial key to growing online grocery

Those who used it for the first time were much more likely to say they will use it more than prior to the pandemic. With little over 10% of the panel reporting they have tried for the first time, businesses should be doing all they can to encourage this first trial.

Competition for store visits hotting up

People are visiting fewer grocery stores and going less frequently – increasing competition between stores, to gain or retain customers – especially when 1 in 5 people have already switched stores.