COVID-19 Insights: Fast Food’s Trust Issue

59% concerned about contaminated packaging

The ability to reopen safely can’t come soon enough for Canadian restaurants of all sizes. But when they open, will consumers go?

We know from Caddle data that the consumer return to restaurants will be gradual, given concerns around social distancing. But as quick service restaurants explore how to make reopening work safely, we have found there is another dimension to the issue.

The results from our 10,000 daily survey panel members show that concerns about fast food extend beyond standing close to others in a busy restaurant.

How has COVID impacted fast food consumption?

Despite the slowdown in restaurant purchases, previous Caddle data has suggested some positive signs for fast food.

Canadians still look for quick and easy options for their meals and have reported a shift towards eating more comfort food. Yet with restaurants closed save for drive-through or delivery, this has not translated into higher consumption.

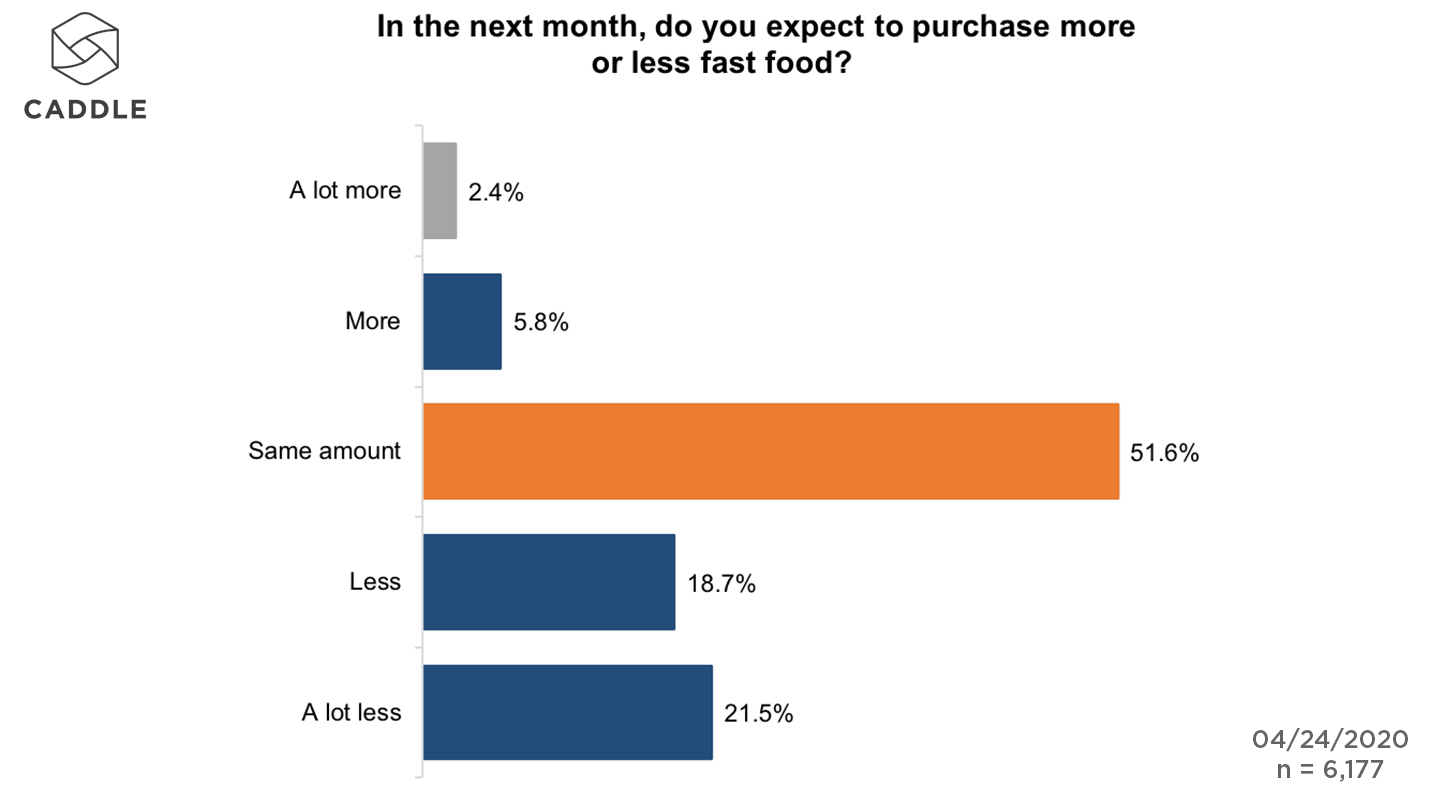

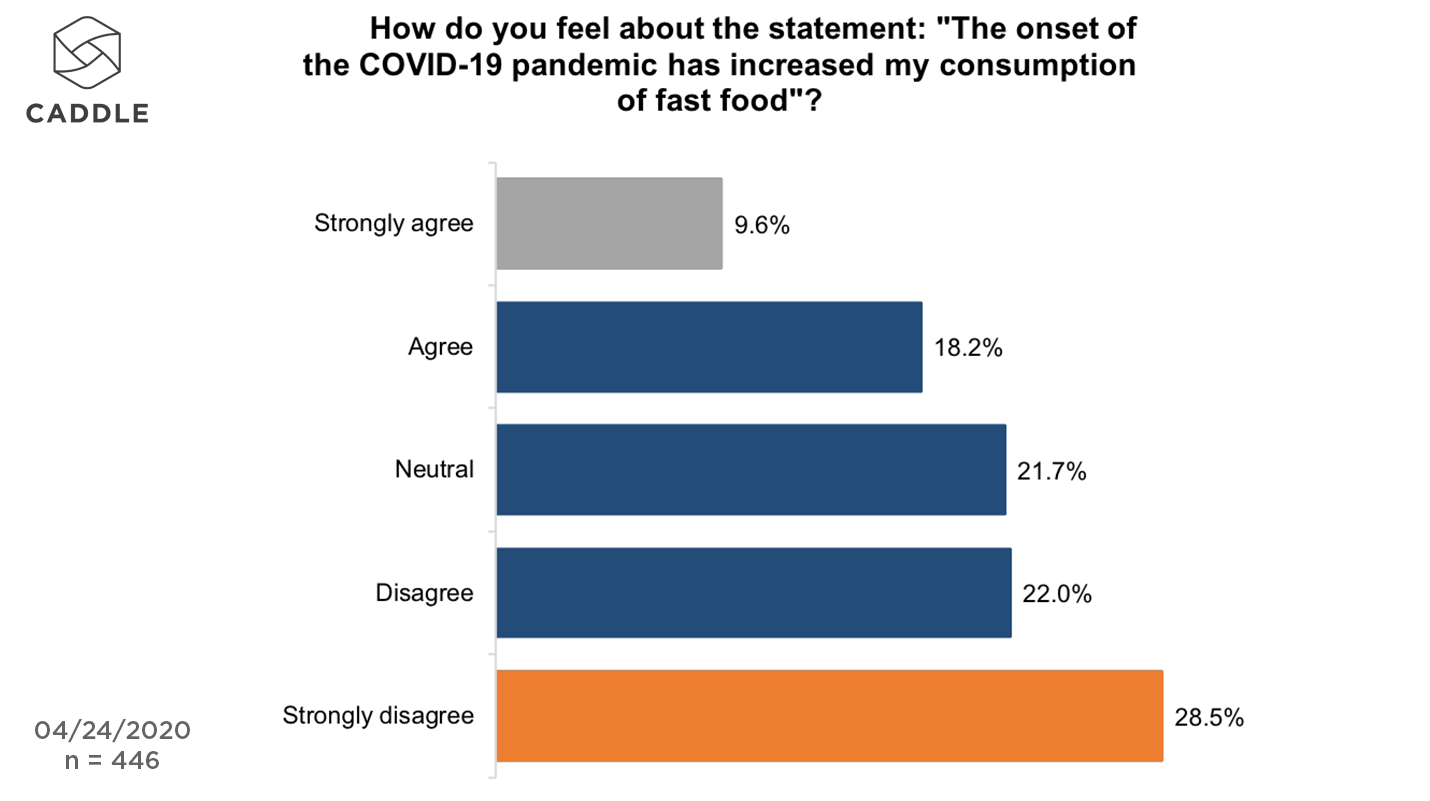

Just 15.5% reported they had been eating more fast food since measures to limit the spread of COVID-19 were introduced. On top of this, 40% said they expect to order less fast food in the month ahead.

Why are we ordering less?

The reduction in foot traffic from the closure of locations, coupled with a tightening of many consumers’ budgets would logically have an impact on consumption. However our data suggests another dimension to add to the mix; the safety of the product itself.

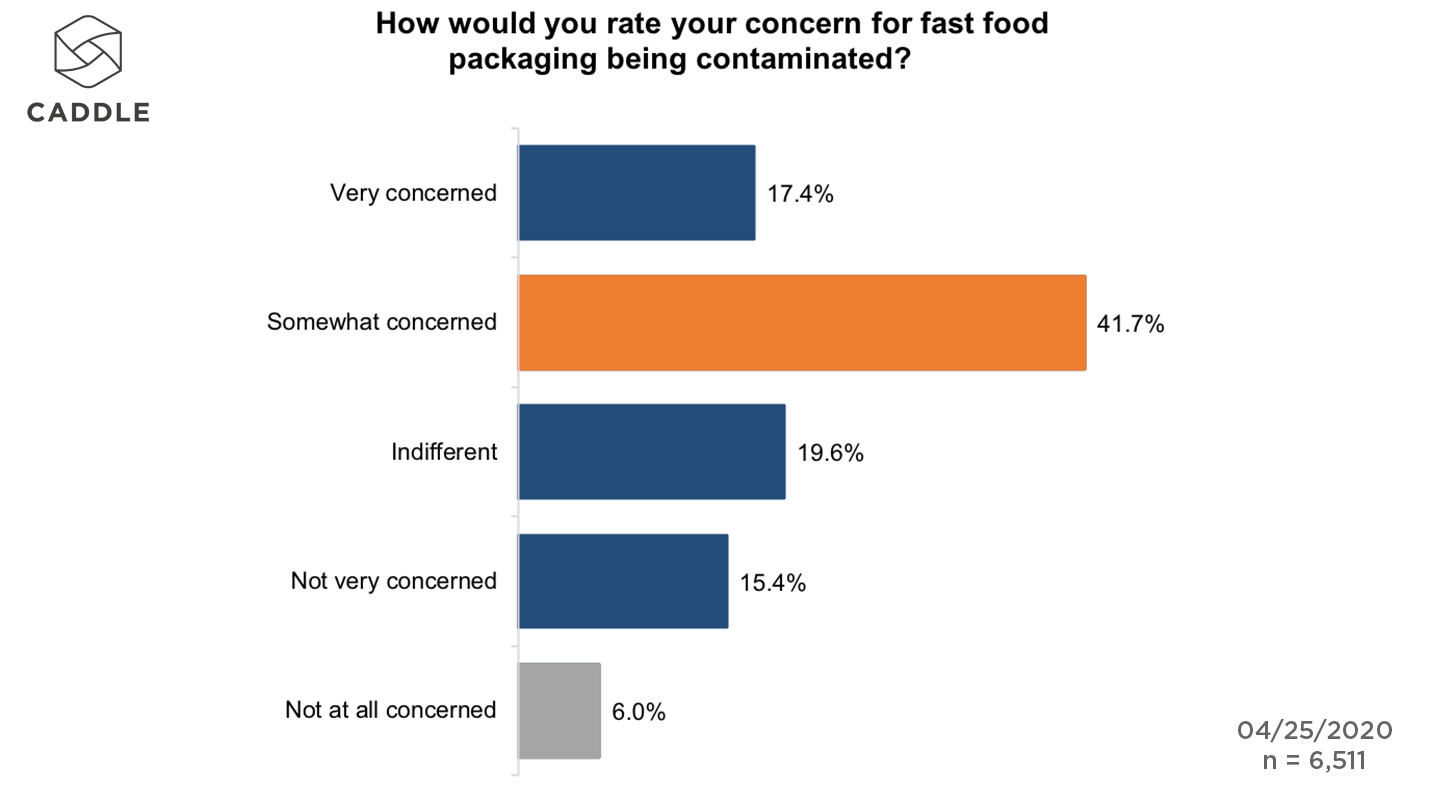

59% of the Caddle panel told us they were concerned about fast food packaging being contaminated. Meanwhile 65% disagreed with the statement that ordering fast food was the safest way to eat during the pandemic.

Customers are unconvinced that employees at fast food restaurants are observing social distancing measures. Over a quarter of respondents (27.3%) say they don’t think restaurant staff are observing social distancing protocols, compared to 18.7% who believe they are.

The one silver lining is that there was a net positive score on the issue of sterilization. 35% of our panel said they believed restaurants were implementing effective sterilization procedures, compared to 19% who thought they weren’t.

Do we trust food delivery?

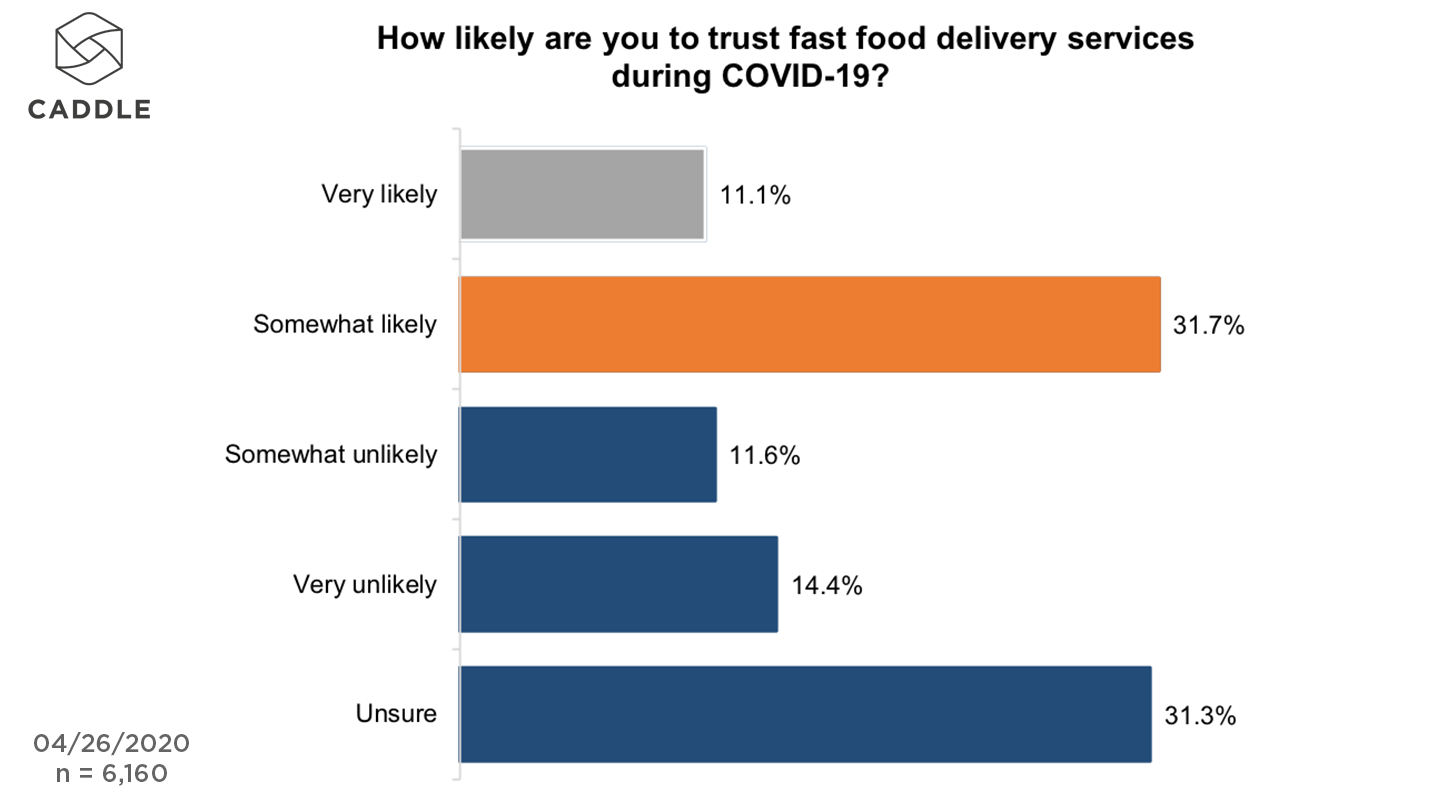

These concerns about safety do not appear to extend to the delivery of fast food. Just over 42% of the panel said they were likely or very likely to trust food delivery services during the pandemic. This compares with 26% saying they were unlikely to do so.

This hints at a significant issue for restaurants to address: consumers’ concerns with safety appear to be more directed at the in-restaurant procedures rather than the delivery process.

This means it is not a concern that will go away when restaurants are able to reopen. Brands will have to work hard to convince customers not just of the safety of coming into the store, but that behind the scenes proper measures are in place for food preparation as well.

Who is eating more fast food?

There’s no getting around the fact that most people are ordering less fast food, and envisage that being the case in the near future. But what of the people who told us they are ordering more?

This group makes up just under one in six of our panel. In a challenging situation, it is vital that brands find these people and communicate with them effectively.

So who should they be targeting?

Two key groups we have identified are younger males, and parents with more than two children. Both have higher proportions of respondents who said their fast food consumption had increased. However, these are still not groups where the majority report higher consumption overall.

In the case of younger males, 28% of those who eat fast food said they were consuming more as a result of the pandemic, compared to 15.5% in the panel overall. Likewise 17% say they expect to purchase more fast food in the next month — more than twice the 8.2% for the panel as a whole.

For parents with more than two children under the age of 18, 14.8% said they anticipated buying more fast food in the next month while 23.4% reported opting for fast food more since the start of the pandemic. In both cases the number filters out parents who indicated they did not eat fast food.

What’s driving purchase?

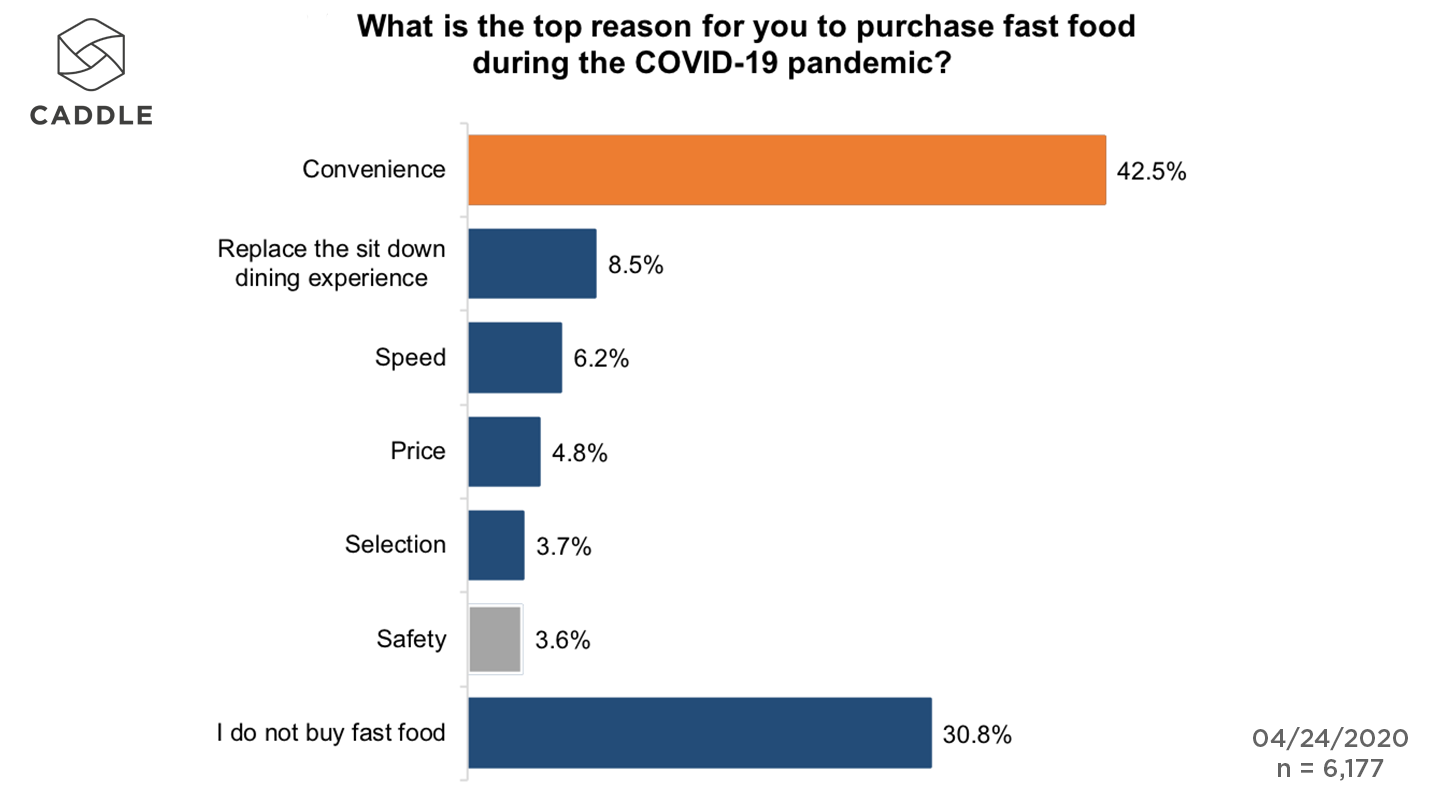

For these groups and the panel more generally, convenience remains the key to QSR purchases. Over 50% of those who usually consume fast food cite convenience as they top reason for purchase during the pandemic.

Key Takeaways

1. Communicate Safety In Every Area

The importance consumers put on COVID-19 safety should never be underestimated. This data shows clear concerns when it comes to fast food. These extend well beyond the enforcement of social distancing within restaurants once they re-open. Brands need to communicate what is happening in areas such as food preparation to reassure customers.

2. Offer convenience, but not at any cost

Customers clearly value the convenience QSRs offer. The more a restaurant opens up the more convenient it can become. However, there is a limit to how far brands can go. Our analysis in other segments suggests responsible social distancing policies could themselves become a driver of purchase decisions.

3. Dig into growth segments

Not everyone is cutting back on fast food. As this data shows, the situation created by the pandemic is leading to increased consumption for some groups. Even as restriction ease, brands need to focus on understanding and reaching these segments.