Bone broth: what's the hype?

Caddle recently surveyed its members to understand their shopping behaviours when purchasing soup broth. An interesting finding was the interest in ready-to-drink bone broth as an innovation shoppers would be interested in purchasing. With all the hype around bone broth, we decided to dig into the industry a bit further.

Stock, Broth, Bone Broth – what’s the difference?

Good question! It all comes down to the ingredients and how long the product is cooked. Traditional broth is water simmered with vegetables, aromatics, and meat, and can include some bones. It is cooked for a short period of time—usually 45 minutes to 2 hours—then strained and seasoned. Stock is water simmered with vegetables, aromatics, and animal bones, sometimes roasted, and sometimes with some meat still attached. It is cooked for a medium period of time—usually 4 to 6 hours—then strained. Bone broth is similar to stock, but with a longer simmer time – often more than 24 hours, allowing for more nutritious minerals to be extracted

So what’s the hype on bone broth?

The emerging popularity of bone broth has been synonymous with developing health trends, education around the benefits of this product and more recently, the rise of product availability. Popular food trends such as the Whole 30, Keto and AIP diets are helping to drive the increased awareness of the supposed benefits of bone broth. While medical opinions differ on the effectiveness of the ‘bone broth diet’, some suggested benefits include:

- Reduction of Leaky Gut syndrome – linked to acne, allergies, celiac disease, depression, eczema, migraines, rosacea.

- Reduction in inflammation in the body and fighting joint health – particularly arthritis.

- Collagen – this essential nutrient is attributed to improving recovery time in sports, increasing skin elasticity for skincare benefits and reduce cellulite.

- Sports recovery and nutrition

- Animal health – in addition to humans, animals can benefit from this nutrition-rich option and bone broth soup can aid in joint recovery particularly for older animals.

Who are the current market players?

Research from Innova Market Insights looked at the top 100 sales companies in the CPG industry, particularly in food and beverage. The results show that General Mills and McCormick are the only parent companies in this category with a bone broth product in their US portfolio – both from acquisitions rather than internal innovation.

With year-over-year industry growth, the VC community has taken an interest, investing in smaller, privately held companies. Kettle and Fire, an industry competitor, started by a bone broth devotee, recently secured an $8 million Series A investment. Reporting that sales have tripled each year since inception in 2015, with 2018 sales forecasted at over $20 million. The investment will primarily go towards marketing efforts and allowing for more working capital as they haven’t been able to keep up with the product demand. Another market leader in the space, Ancient Nutrition secured $103 million in 2018 with a mix of private and investment funds, lead by VMG Partners.

What are the innovations?

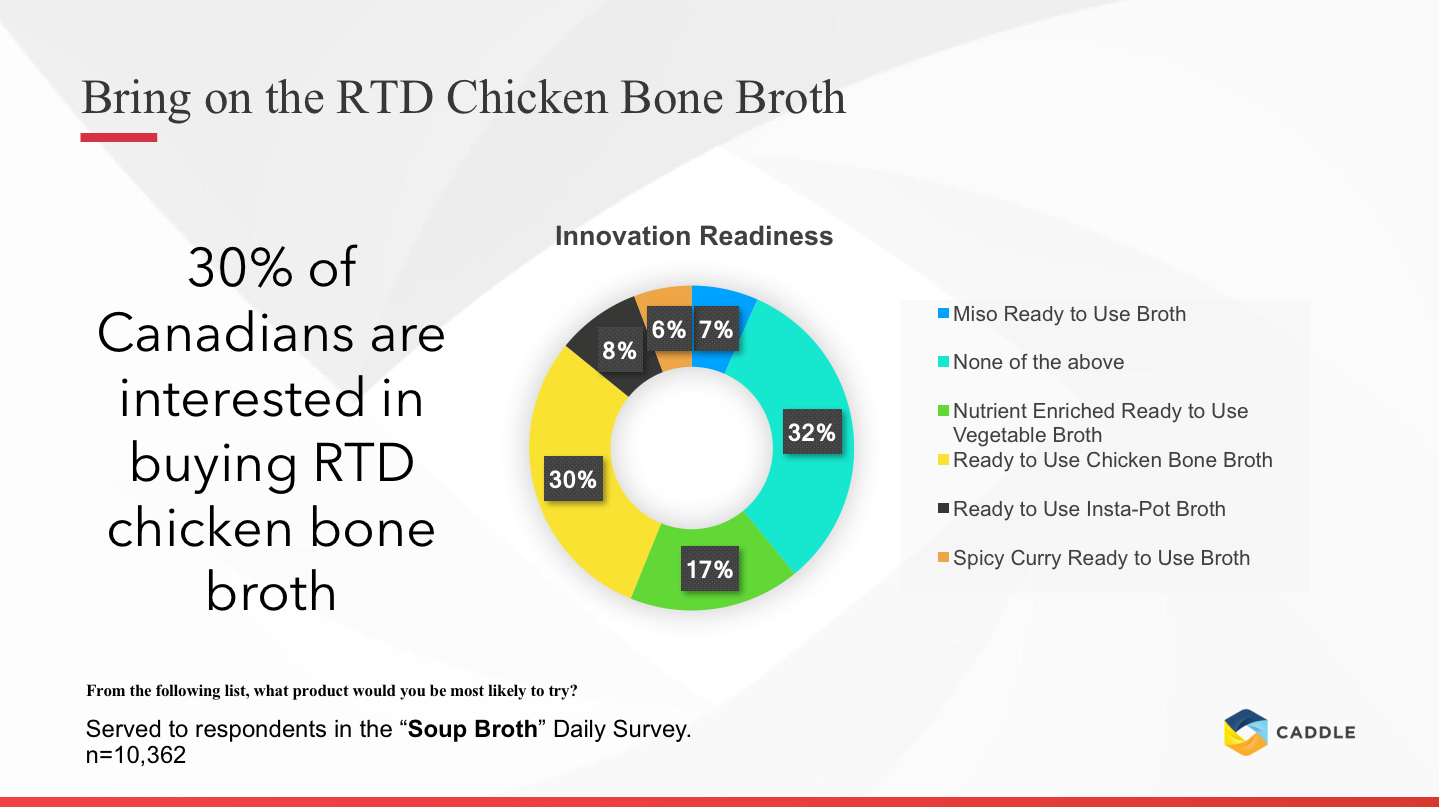

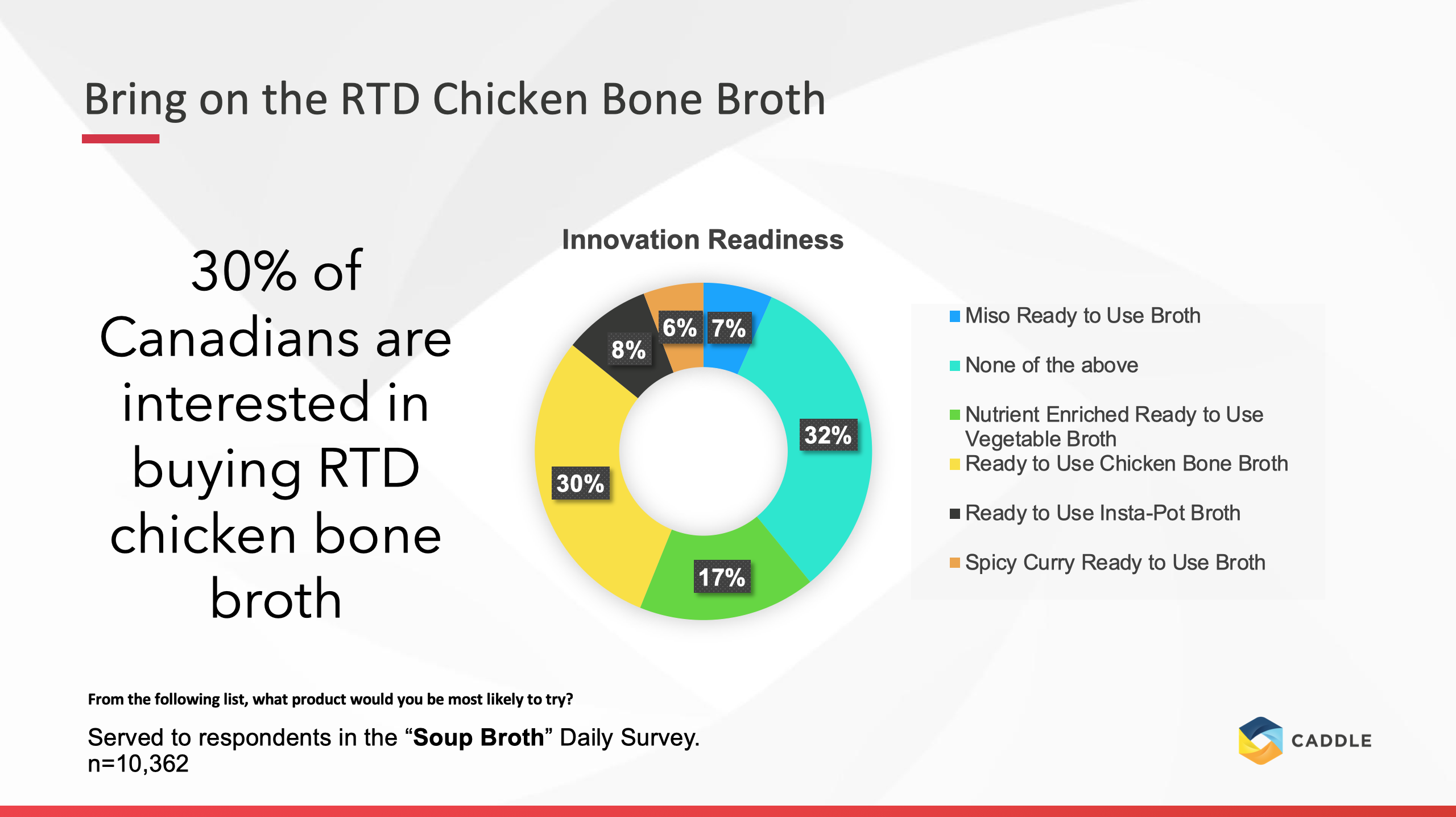

While currently available bone broth is sold in powder form, insights from our research suggest that 30% of Canadians would be interested in a ready-to-drink (RTD) format. Whole Foods recently jumped on this trend when they partnered with start-up Ossa Organic to launch a pop-up ‘bone broth bar’ in one of their UK stores; introducing consumers to what is being marketed as “the new coffee”.

One of the biggest appeals for bone broth soup is the time-saving factor of purchasing RTD products. Caddle users indicated that one in three Canadians are interested in a RTD chicken bone broth. While ready-to-drink formats are a relatively new trend, bone broth is leading the interest in fortified food and beverage products in a ready-to-go availability. This indicates that combined products such as the like of drinkable bone broth will become the norm. With its ease of maintaining one’s health, this is thus driving the demand for products such as these.

Wrapping up

With consumers being so readily concerned about their health, it appears that bone broth will become an emerging trend that will see a rise in demand in the coming years. With its many health benefits and ease of consumption, this will create an enticing opportunity for industry leaders to jump on this trend — or allow new entrants to enter the market as well.

Caddle is a consumer insights platform that allows consumer packaged goods companies to link directly to their target audience via surveys. As part of our daily survey activity, Caddle examined the decision-making process for consumers choosing their preferred brand of soup broth.

Are you launching a new product or looking to get insights before innovating? Connect with us to find out how Caddle can help.

Oil free, cruelty free & anti-aging serum among moisturizer wants

Time and time again we hear in advertisements that moisturizer is the key to healthy, long-lasting skin. And quite frankly, they’re right! You never really realize how great moisturizer is until you’ve got uncomfortably dry skin that is begging for a little TLC.

But we all use moisturizer for different wants and needs, which is exactly why the market has such a high demand for product innovations that can tend to several different audiences. Market Research Future reports that Manufacturers have been focusing on developing unique formulations and adding it to the existing product line in order to enhance the value of their product range. Therefore, this industry is a very customer-oriented market in order to meet their needs.

With the market constantly in the battle to develop new and improved innovations and integrate them into their product lines, the industry is expected to have a calculated 5.7% compound annual growth rate during 2013-2023.

But what kind of innovations do consumers want from their moisturizer? You’re in luck, Caddle has the answers! Recently, we surveyed over 11,000 of our members on their moisturizer purchasing habits, and we were intrigued when comparing our results with industry trends. Let’s find out what we learned.

A product for any skin type

Ah, the battle of the generations. You’ve heard it before, “those darn millennials” or “those outdated baby boomers”. Believe it or not, the battle between generations has been an argument that has been passed down for generations and will continue to do so.

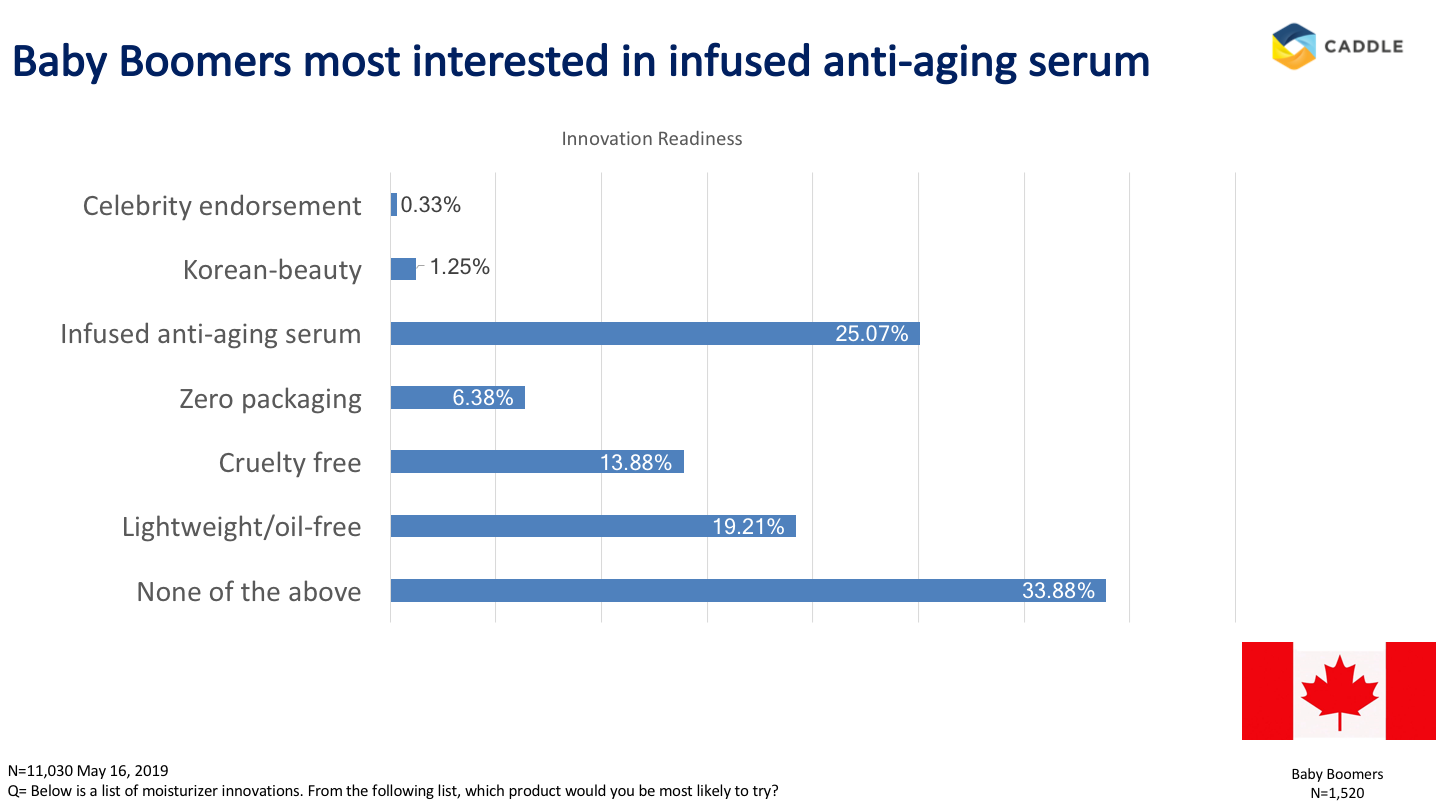

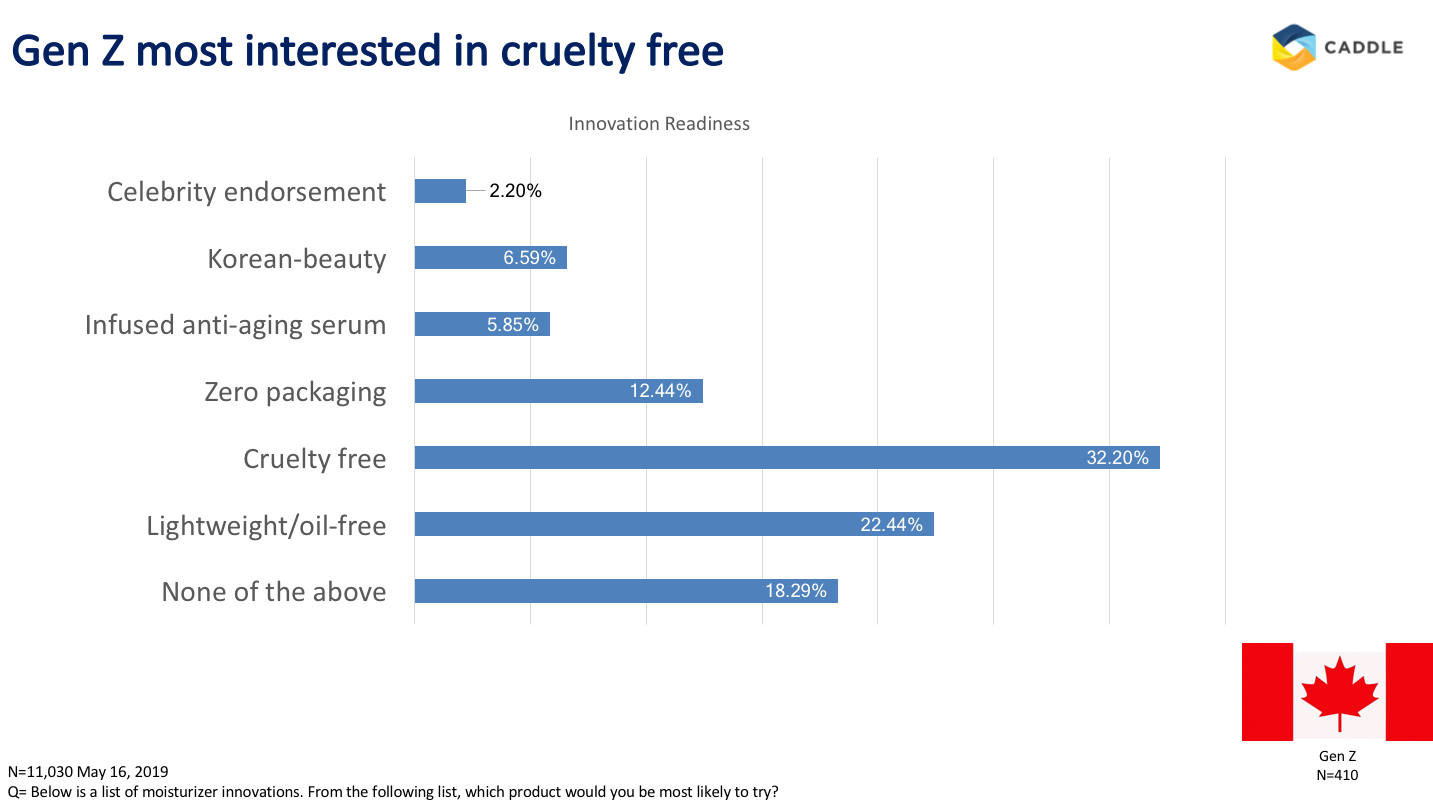

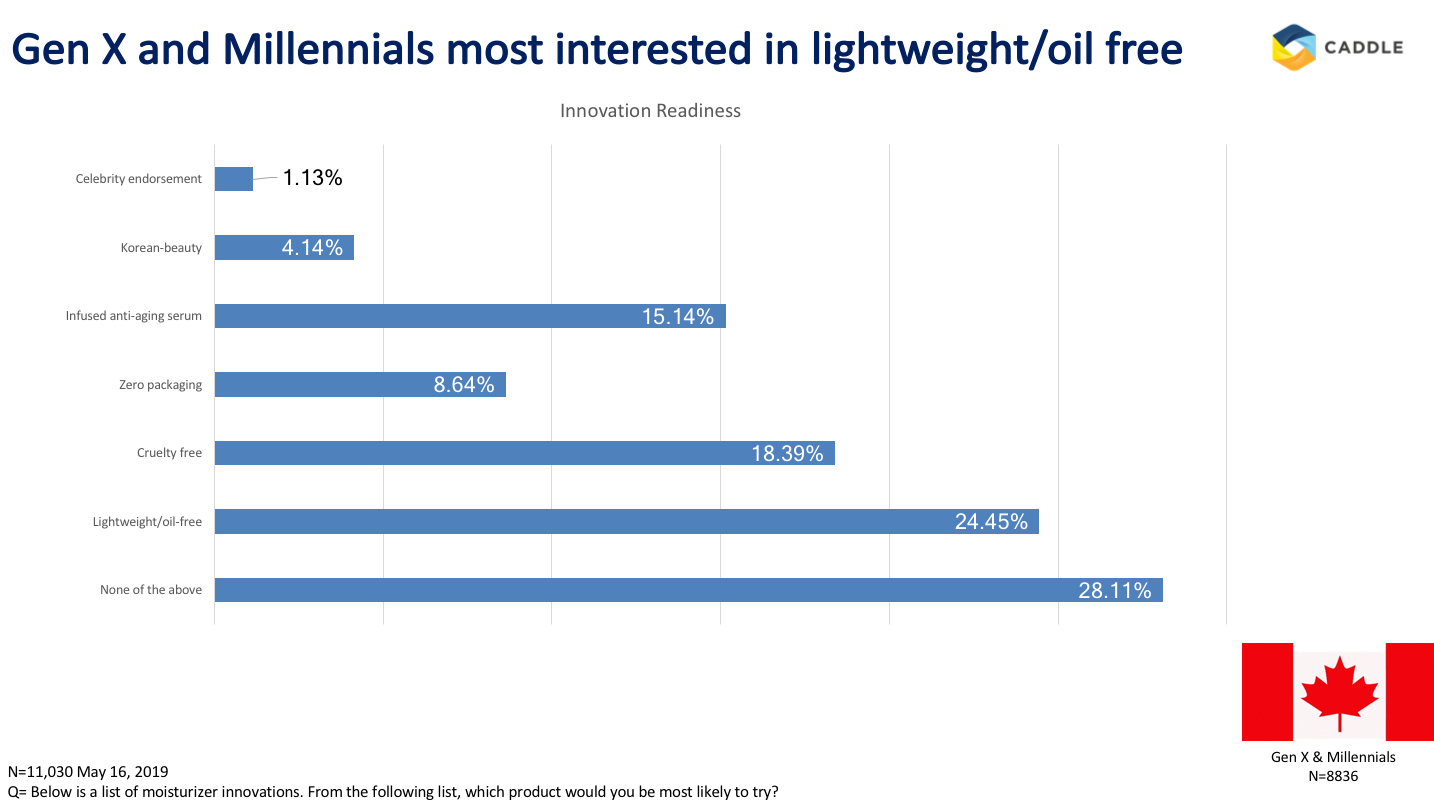

But maybe that’s because we all want different things? This certainly seems to be a possibility when it comes to moisturizer. When we asked our members what innovations they would be most interested in trying, each generation voted for something different. This is fluid with the industry itself as moisturizing cream has been segmented on the basis of specialty attributes. These attributes consist of:

- Natural & organic

- Herbal

- Cruelty-free

- Anti-aging

- Acne

Let’s face it, a 60-year-old baby boomer is less likely to apply acne prevention moisturizer on their face than what a 16-year-old would, and the same can be said that a 16-year-old is less likely to apply anti-aging moisturizer to their face.

The point is, each generation is going to want something different out of their moisturizer, so it’s only fair that those in the industry meet each generation’s needs. And, why wouldn’t they? More wants lead to more opportunities for innovation, which leads to new product lines, which lead to profit!

Vegan Moisturizer?

Not quite, but close! Being vegan means more than just cutting meat out of your diet, it means taking care of those little critters too. In turn, this rapidly increasing lifestyle is having a big effect on the CPG industry. In particular, “market share of cruelty-free moisturizing cream is found to be growing at a higher rate due to the rising population of vegan consumers,” noted Market Research Future.

This is something that holds true to Gen Z members. When asked what innovations they would be most interested in trying, 32% of Gen Z members indicated that they would be most interested in trying cruelty-free moisturizer. When compared to other beauty products, this seems to be a common trend. When we asked our members, what cleansing wipe innovations they would be most interested in trying, Gen Z members again indicated that they would be interested in a cruelty-free product.

It appears that veganism is a relatively new lifestyle, so where do Gen X and Millennials fit into this category? They too are following suit. While these members indicated that they would be most interested in Oil free/lightweight moisturizer, their second common innovation turned towards, — you guessed it – cruelty-free.

This creates the perfect opportunity for industry leaders to develop products that meet the needs of multiple consumers wants. Take Alba Botanica for example. Their Acnedote Oil Control Lotion is a lotion that is not only oil-free but cruelty-free too.

Certainly, creating a single product that meets the needs of multiple audiences is bound to turn a profit.

Is K-beauty the road to healthy skin?

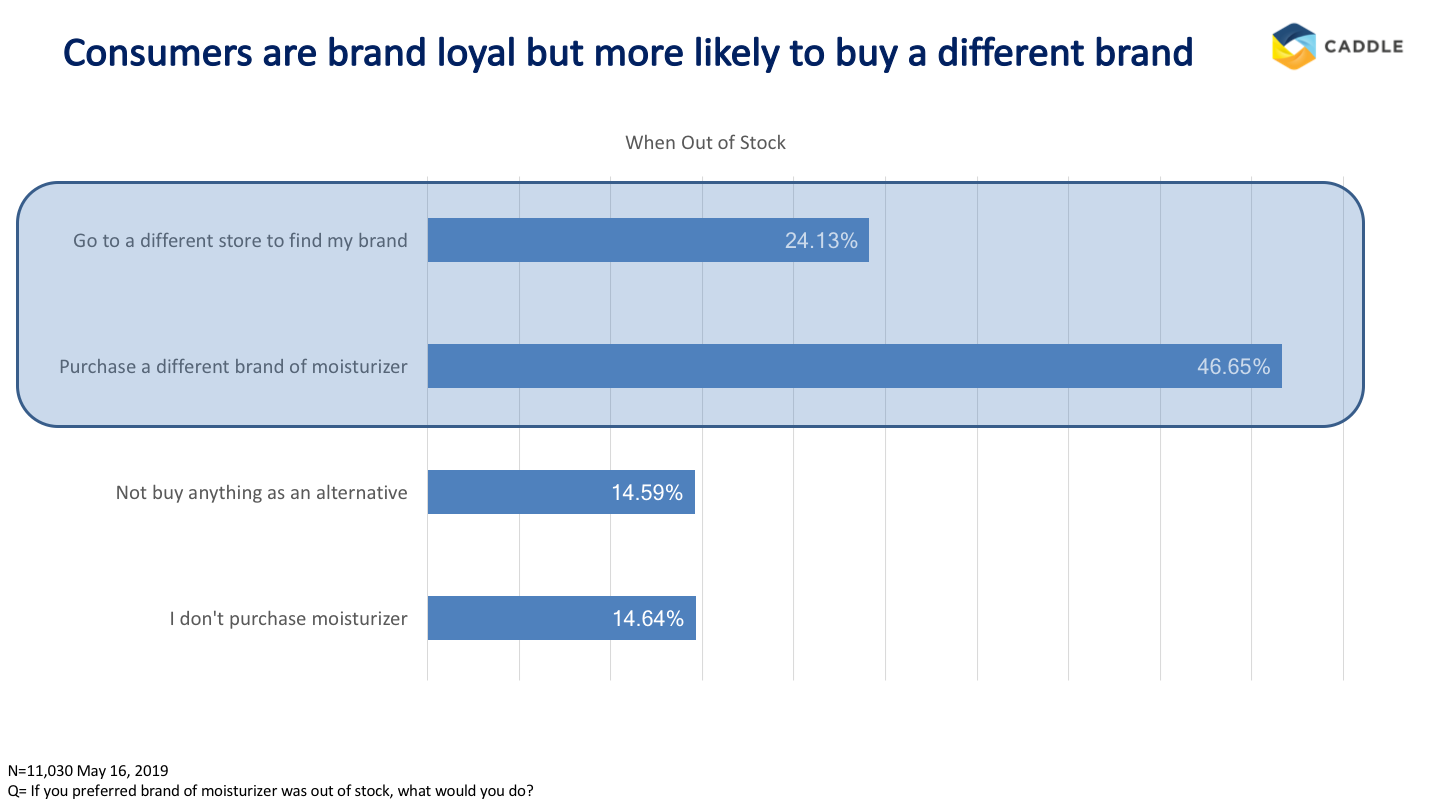

With some products, we tend to be brand loyal beings. In the case of moisturizer, while 46% of members indicated that they would purchase a different brand of moisturizer if their preferred brand was out of stock, a surprising 21% said that they would go to a different store to find their preferred brand.

But when it comes to your face, your main concern shouldn’t be brand says beautytap.com. Skin manufacturers don’t know every skin type, let alone your own, so it’s important to be loyal to your skin’s needs and the ingredients that meet them.

“The options come directly to us by the brands themselves, which is why K-beauty (Korean beauty) stands mostly apart from the pack. You see, as a general rule, we’re pursuing them instead of the other way around,” Tracy Teel of beautytap.com mentions.

Teel makes a good point. Perhaps consumers are spending too much time being brand loyal instead of researching which brand is best for their skin. She also makes note of K-beauty. A form of beauty products that are focused on health, hydration, and naturalness.

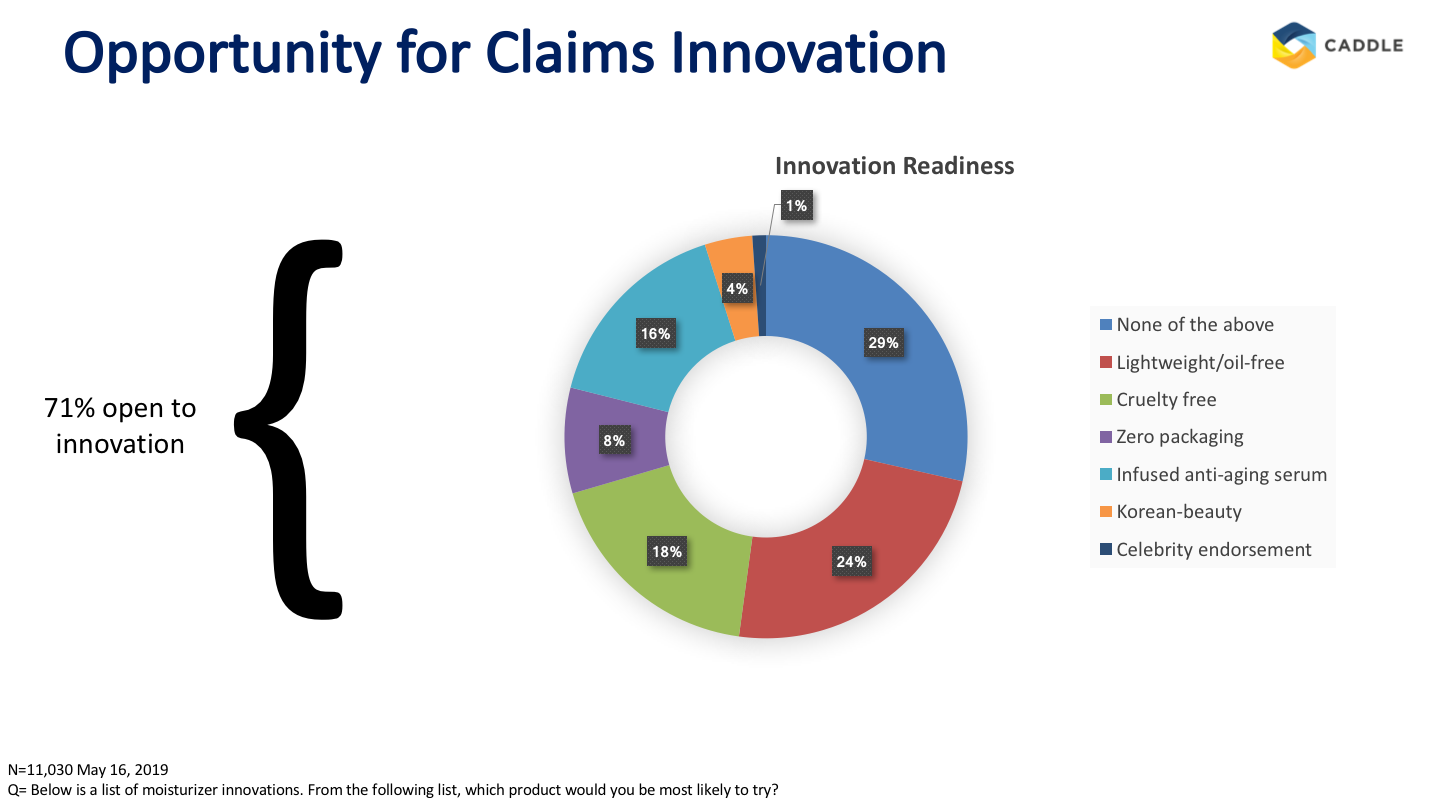

K-beauty ranked as one of the lowest innovations that our members would be most interested in trying. Perhaps this is an untapped market that industry leaders could integrate into their product line and marketing campaigns to bring more awareness about the benefits of K-beauty.

So What?

After comparing industry trends to what our members indicated in our survey, it is evident to see that the moisturizer industry is full of potential. With the opportunity to create products that tend to specific generations, or even a collective of generations in one product, or the potential marketing strategy K-beauty products could adapt, the industry is certain to see the CPAG increase as forecasted.

If you’re in the CPG industry and you’re wanting to gain insights on your consumers without lengthy wait times, please reach out to us here at Caddle so we can accelerate your time to insights.

[simple-author-box]

Drink em' if you got em' - cannabis infused beer

There’s nothing like cracking open a cold one on a hot summer’s day or after a long day at work. Beer is something that we Canadians drink with pride and is ingrained into our identity. Heck – we love it so much we built a beer fridge that opens when we proudly say, “I am Canadian”. With the bubbly beverage being such a large staple in our lives, it only makes sense why the industry is booming. In just one year alone the Canadian beer industry went from 817 to 995 breweries; that’s a 21.8% increase from 2017 to 2018. To further instil beer into our Canadian identity, the industry saw a 0.3% increase in domestic beer sales while import sales declined by -3.4%. That left the entire industry seeing total beer sales as 85% domestic and 15% imported.

Recently, the team at Caddle conducted a survey asking 5,632 respondents about the beer purchasing habits. Let’s crack open these insights and see how they can contribute to the industry.

Cheap and Tasty

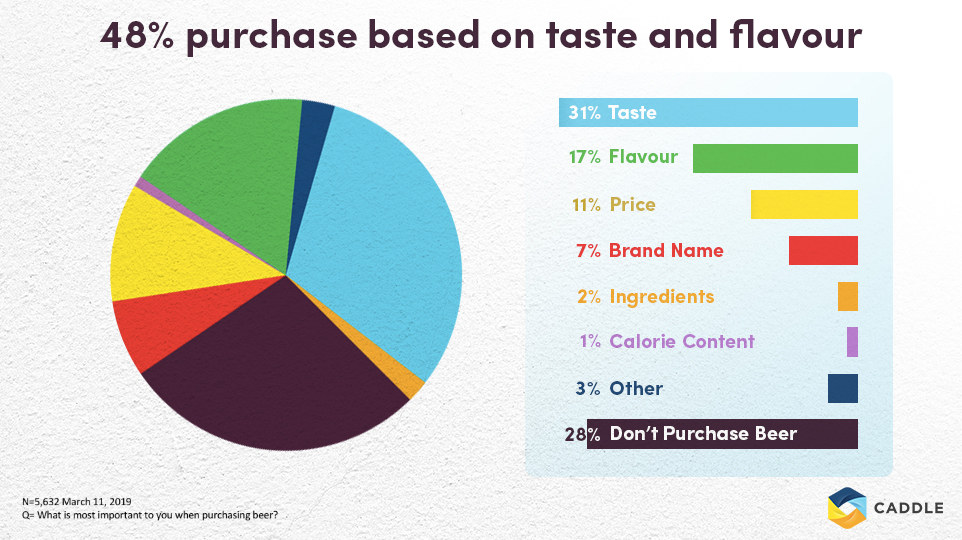

Turns out that consumers do care about the taste of their beer and don’t just drink it because everyone else does. When asking our consumers what is most important to them when purchasing beer, 48% of respondents said that taste and price are most important to their purchasing decision. With a 1.8% price increase in beer, maybe buck a beer isn’t such a bad idea after all as some may decide to purchase something else if the price doesn’t meet their budget.

There’s wine connoisseurs so why can’t there be beer connoisseurs? The same ol’stuff can start to taste bland and boring after a while. That’s what appears to have happened to Canadians in the 80’s as they realized there’s more than just Molson Canadian. Outside of Canada there were beers that had more taste and texture with other good qualities as well. This is arguably what started the development of craft beer market. If we’re good at drinking the stuff you darn bet we’re good at making it too!

A different kind of wobbly-pop

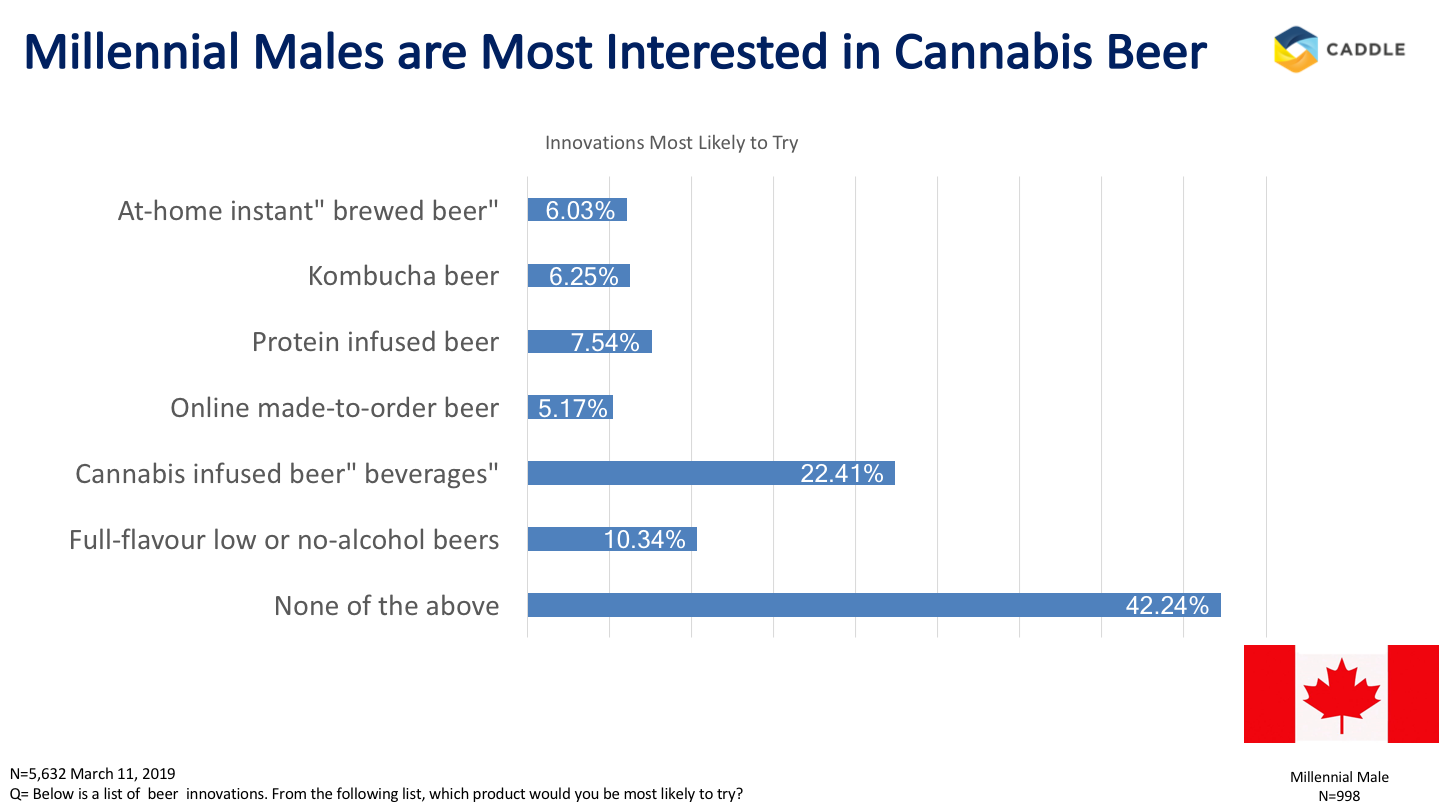

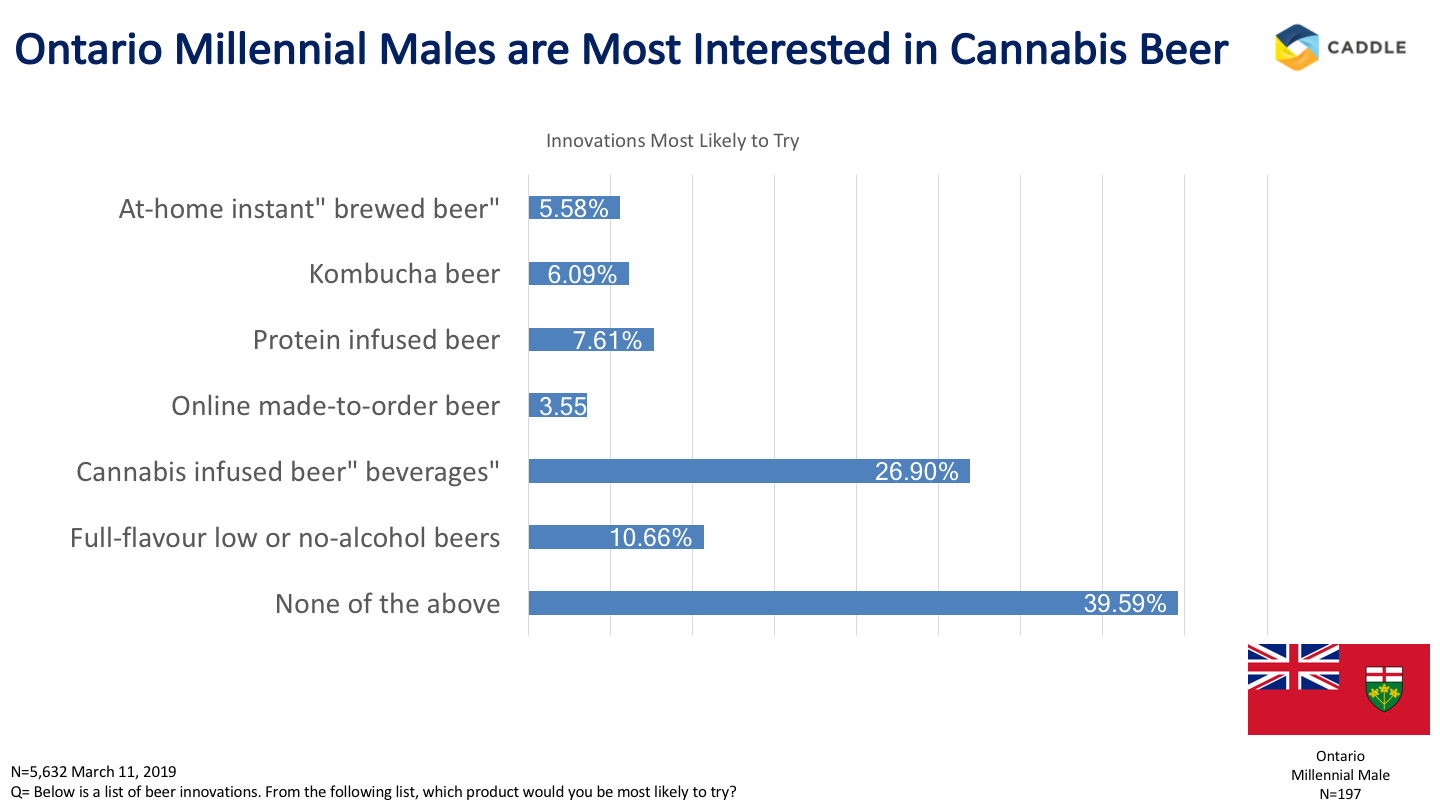

Since when did the younger generation start getting so responsible? When we asked our respondents what beer innovation they would be most interested in, we found that millennial males in Canada were most interested in cannabis infused beer.

Now, I know what you’re thinking – “that’s not responsible at all!” — but believe it or not, younger people are drinking less and looking for healthier options. They also want to be in control of themselves and not have embarrassing drunk stories told at their wedding in front of their new in-laws. Queue: cannabis infused beer. This innovation acts as an alternative in which cannabis is infused in a non-alcoholic beer where consumers can still get a buzz but feel more relaxed and in control of their actions.

Is that you cuz?

Cannabis and hops are actually distant cousins to each other (huh – learn something new every day eh?)! This is great news because if you’re a millennial male and you’re from Ontario, then you know that beer and cannabis go hand-in-hand with each other. Our survey results didn’t seem to shy away from this fact as millennial Ontarians were most interested in cannabis infused beer when compared to other provinces.

This is worth considering because due to the spike in the Ontario craft beer market, this leaves some left on their own with no future of success since there is simply starting to be too much competition to compete with. If you find yourself in this situation, perhaps cannabis infused beer is the answer. Millennials (especially Ontarian millennials) love the idea, so why not take a chance and see if you can start climbing the ranks to success?

IPA (Insights Provided Accurately)

We showed you the industry and our insights to go with it; so now what? It’s clear to see that the beer industry is a growing one and consumers are looking for more than their everyday kind of beer. They want something that comes at a good cost and taste. If you’re a beer advocate, than you know that beer is a big part of our Canadian identity and it’s fair to say that cannabis is as well, so why not give the people what they want and infuse the two in a socially acceptable beverage?

Caddle is a data insights company that works with a variety of organizations in the CPG industry who are looking to understand their consumers better. If you’ve got questions about your audience and how you can increase revenue, drop us a line and ask how we can help you.

[simple-author-box]

Egg consumption: Our data compared with the industry

The Egg Industry

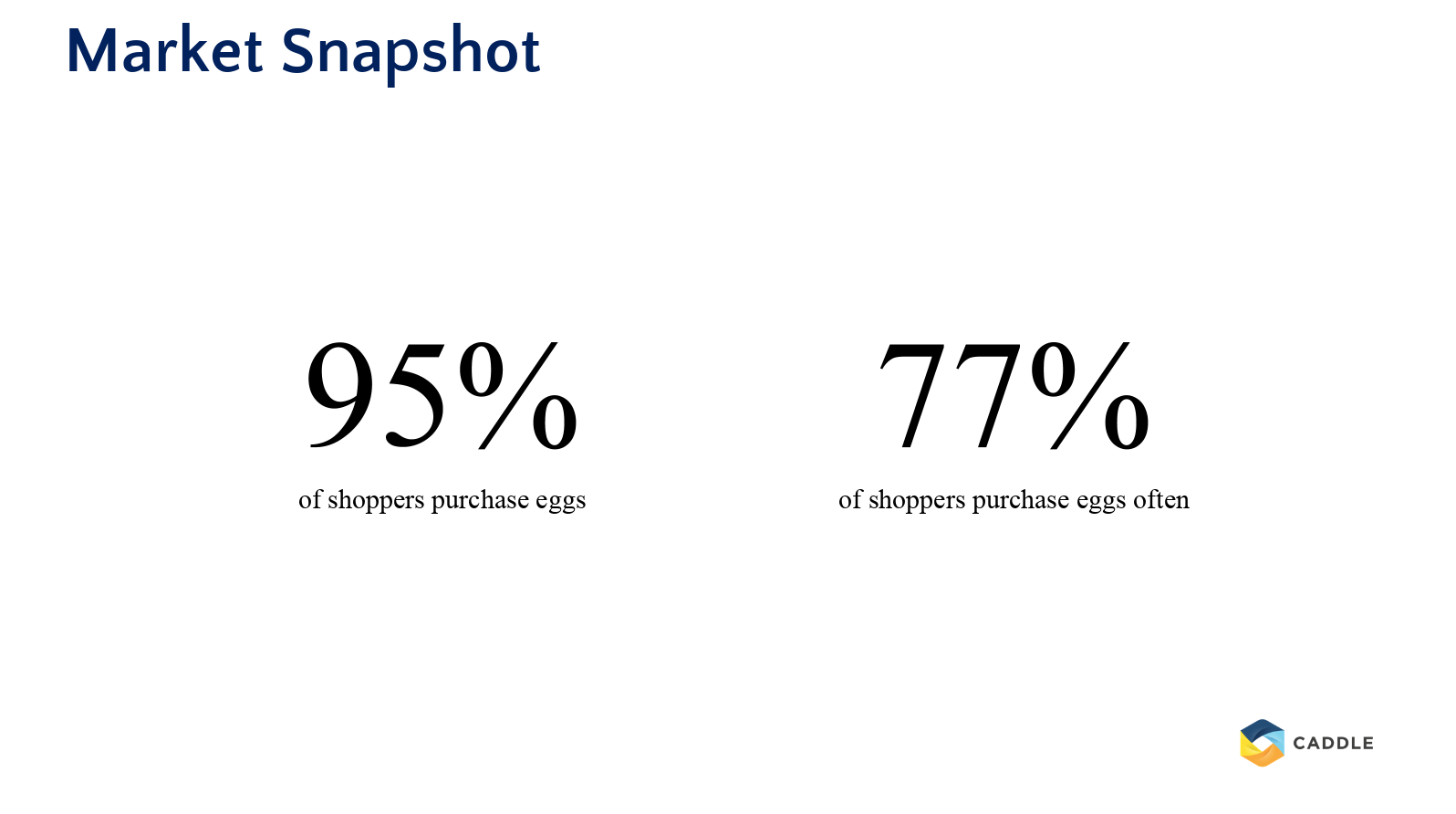

Who doesn’t like waking up to the smell of bacon and eggs in the morning? Besides, breakfast is one of the most important meals of the day. Whether you have them for breakfast, lunch or dinner, eggs have been a staple in everyday Canadian lives. Recently, we surveyed our users asking them their purchasing habits when it came to eggs. After gathering the results from 7,481 respondents we found that 95% of shoppers purchase eggs while 77% of shoppers purchase eggs often. With a large majority of our users purchasing eggs this reflects well when comparing it to the egg industry itself. 2017 proved to be a profitable year as egg sales saw a 4.1% growth in Nielsen rating sales which was the second highest growth in the past 10 years. The Canadian government also reported a per capita disappearance (food available per person, per year) of 20.2 dozen eggs. The factors that have led to this increase in egg purchases is felt to be due to:

- Shift in consumer attitude toward eggs;

- Shift towards more protein driven diets with egg nutrition offering a cheaper protein source;

- Decrease in cold cereal food availability for breakfast;

- Increased demand for products containing liquid egg whites only, such as yolk-free omelettes and breakfast sandwiches

Let’s get crackin’

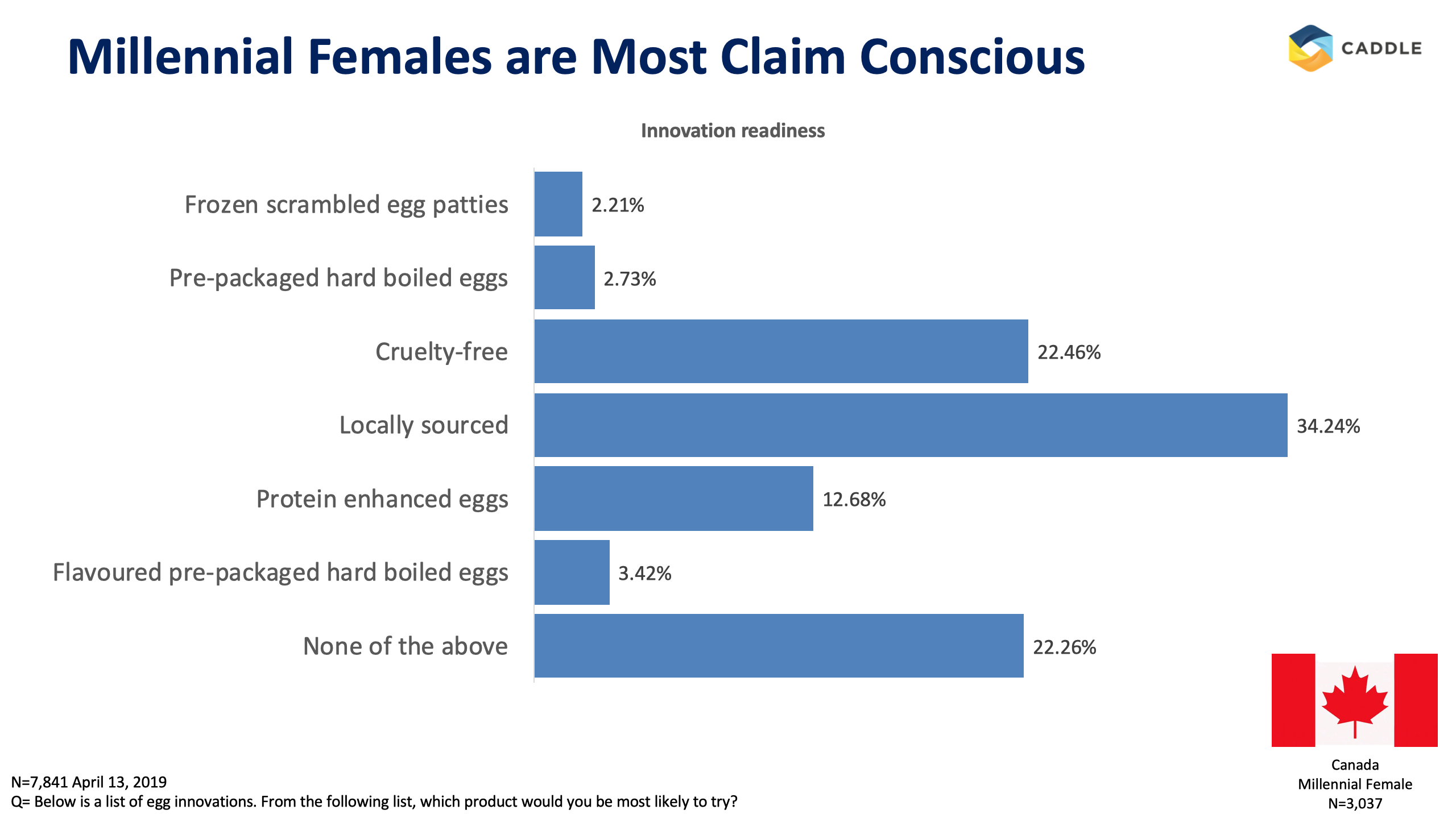

With the egg industry in Canada showing a progressive rise, we’re intrigued to see what our respondents want the most out of when purchasing eggs. Interestingly, 22.46% of millennial females in Canada indicated that they want cruelty-free eggs. This is something that the Egg Farmers of Canada (EFC) has taken into consideration. With the redevelopment of the national Animal Care Program, the EFC has worked to fast-track the implementation of new housing requirements which guide farmers and align their facilities with the standards of the Animal Care Program. These standards ensure that our egg laying friends are living with the basic needs such as shelter, adequate light and air, a well-balanced, nutritious diet, fresh water and clean surroundings.

What came first, the chicken or the egg?

In this industry – the chicken (sorry folks). Even though we know that our eggs came from the chicken, a lot of people want to know where their eggs came from. When asking our respondents which egg innovation they would most likely like, 34.44% of millennial women in Canada said that they would like locally sourced eggs. In their 2017 report, the EFC explained that in 2018 they will be printing an identifiable mark on the egg carton. This mark is in line with a new Egg Quality Assurance program which tells consumers that their eggs are produced by local Canadian egg farmers who are producing and have met the highest food safety and animal care standards. So now consumers can be reassured that when they see an egg logo with a checkmark and red maple leaf on their carton, their eggs are Canadian sourced and are of top quality.

White or brown eggs?

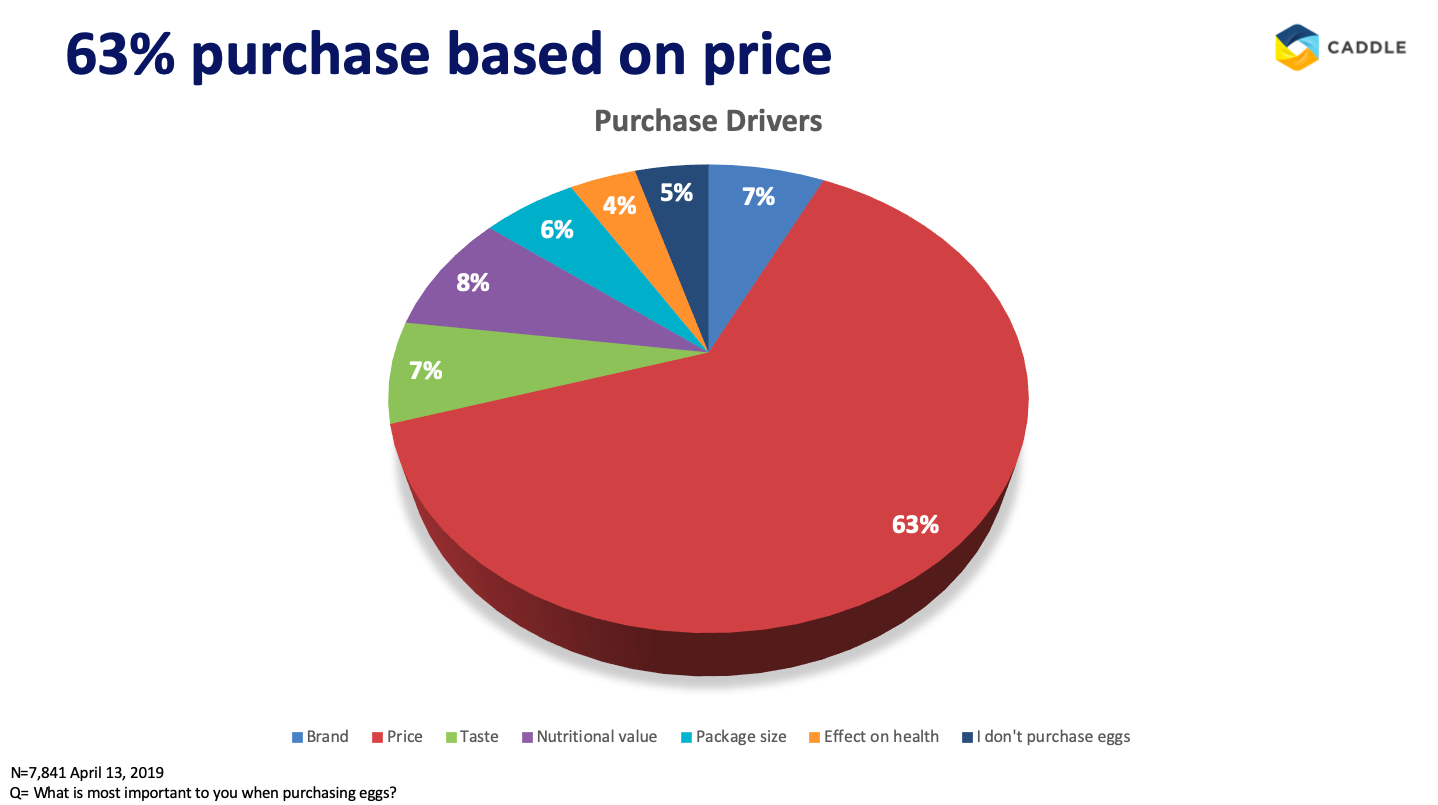

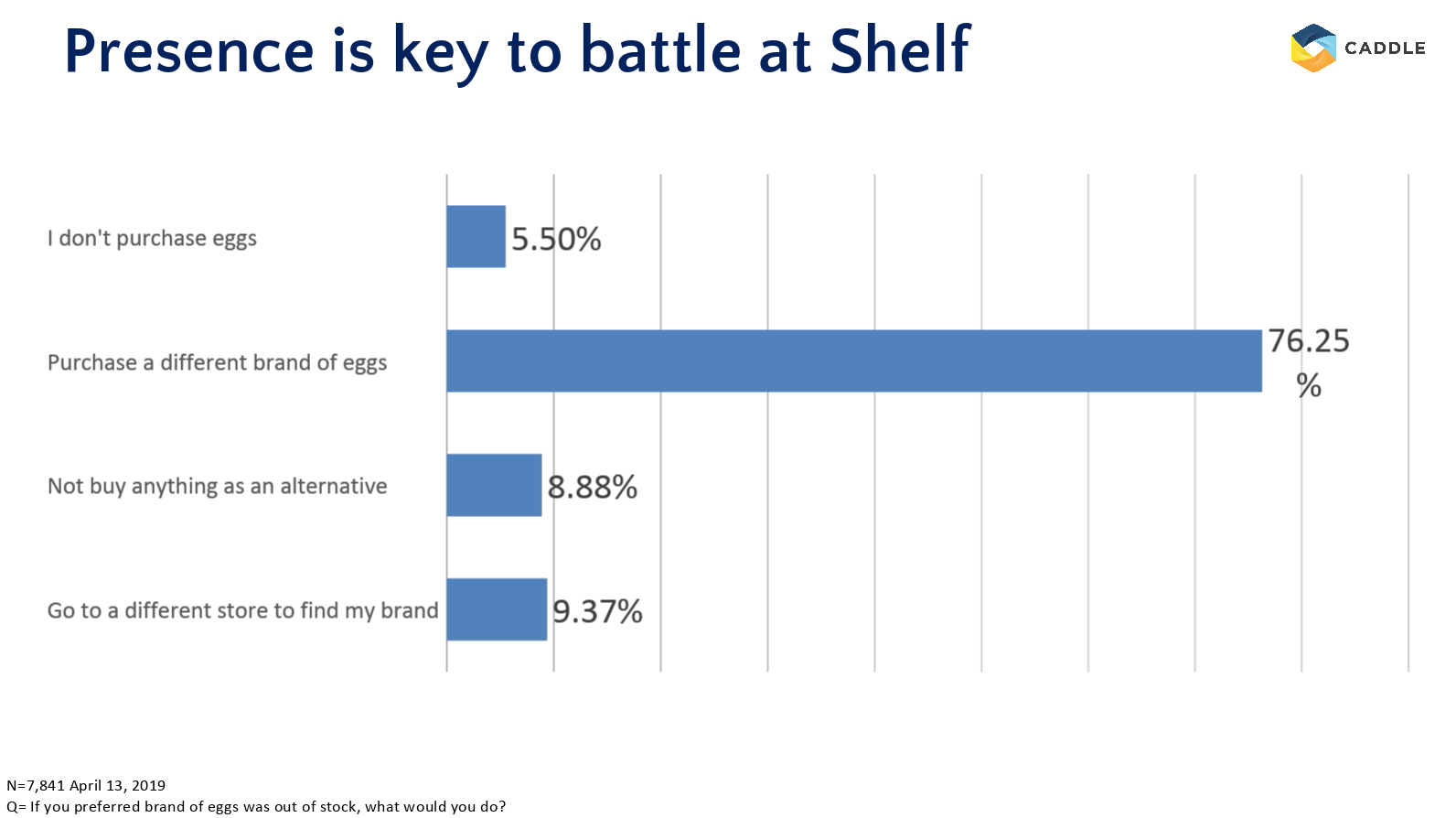

Whether they’re large, small, white, or brown all eggs taste the same. Which is likely why consumers aren’t necessarily loyal to one specific brand of eggs. When asking respondents what is most important to them when purchasing eggs, 63% of respondents said they base their egg purchases on price. Similarly, 76.25% of respondents said that they would purchase a different brand of eggs if their preferred brand was out of stock. This is intriguing when comparing the average cost of production and retail price of eggs over the years. The EFC reported that pricing trends in 2017 saw an increase in the average national COP and producer price of eggs while there was a decrease in the national retail price of eggs at $2.48 per dozen. This is something worth analyzing over the years as it might suggest that egg producers will have to make sure that there is an even balance between the COP, producer price and retail price as consumers have noted that they will purchase a different brand of eggs if it doesn’t meet their price range.

So what?

Caddle is a data insights company that is driven at understanding market and industry trends for the benefit of those in the industry. Our recent survey indicates that egg producers are meeting the wants and needs of consumers purchasing eggs such as providing appropriate living for hens, and informing consumers that their eggs are locally sourced. If you’re feeling scrambled with how you can increase the profitability of the industry you’re in, connect with Caddle to get the data insights you need.

[simple-author-box]

What trends are approaching the soup broth industry?

The Soup Market

Soup – it’s been a staple in our lives from the time we were children. A nice tomato soup accompanied with a grilled cheese, or a hearty bowl of chicken noodle to help fight off a cold. Soup has been around for generations and will continue to be a staple, allowing the opportunity for industry leaders to grow their market share, provided they understand their consumer’s behaviour.

The soup industry is one that has been around for a while with Campbell Soup Company and General Mills Inc. being the industry leaders. While IBISWorld reports a -2.8% decline in total revenue in the United States, as well as a soup sales decline in Canada to $699.9 million in 2017 from $709.4 million in 2012 (reports Financial Post), there has been a growth in the soup industry by 1.6% and projections show the market will have a compound annual growth rate of over 4% by 2024.

Hearty Data

Here at Caddle we conducted a survey asking over 10,ooo of our consumers their soup broth purchasing habits which we believe could help explain the current soup broth industry and forecast how it could be improved upon.

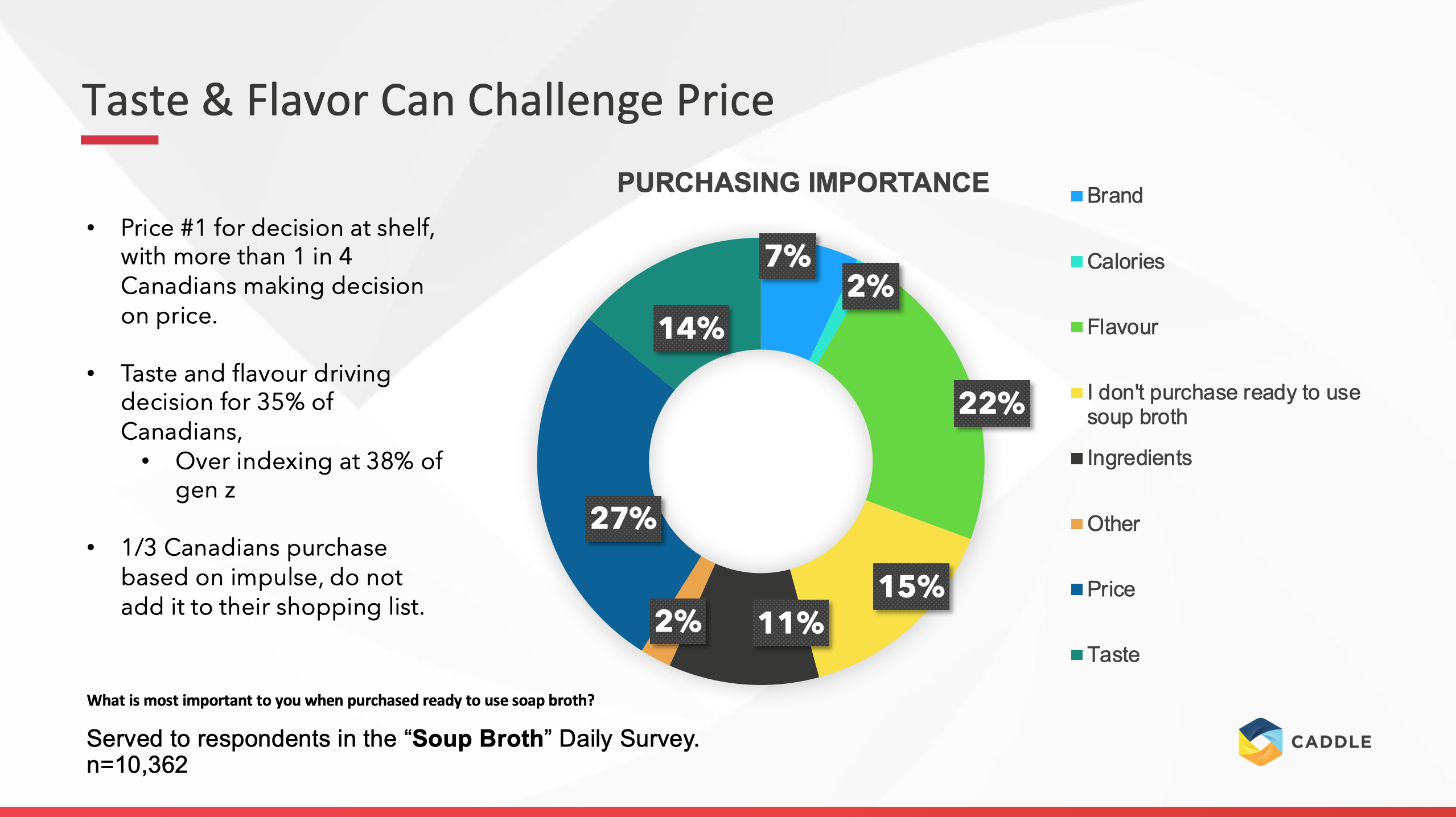

For starters, when we asked what is most important when purchasing ready to use soup broth, 35% of our members agreed that taste and flavour was the driving purchasing decision while there was an over-indexing score of 38% when targeting Gen Z consumers. This is interesting as global flavours such as Campbell’s introduction to Pho broth have become a popular choice. With the introduction of popular broths entering their product lines it’s also important to remember that “consumers want their food to be made with recognizable, desirable ingredients,” says Melissa Mendoza, director of marketing for Campbell Canada.

Soup Innovation

With the Millennial and Gen Z generations making their way to being the majority population, the soup industry may want to consider some newer innovations to increase revenue. To adhere to the demographics wants, Campbell’s has reduced sodium, added vitamin D to their condensed soups and only added ingredients that people can actually pronounce. While this is a step in the right direction to generating more revenue, our survey offers another innovation as well.

When presented with a list of options, we asked our members what product they’d most likely like to try and 30% of members said that they are interested in ready-to-drink chicken bone broth. While we thought this was surprising, after further research we found this data to be accurate when we discovered a +100 search intent on Google Trends. This new innovation is one that is on the rise in popularity for its collagen benefits, support in digestive health and arthritis relief. With a younger demographic wanting healthier options in their soup, perhaps bone broth is one innovation to consider.

Brand Loyalty

When you think of a soup brand perhaps one of the first brands that come to mind is Campbell, Knorr, or Progresso. But much to our surprise, we found that 1/3 Canadians are loyal to their broth brands. So how might a company in the industry increase brand loyalty? For starters, since the soup broth market projected to increase over 4% by 2024 this offers the opportunity for new entrants to be entering into a lucrative industry. On the other hand, this could also create significant competition between industry leaders and new entrants. Therefore in order to generate brand loyalty, it may be important for production companies to consider creating healthy broth alternatives such as lower sodium broths or ready-to-drink bone broth.

Now What?

Soup has been our lives since as long as we can remember, everyone loves a good soup and sandwich. But no one likes working in an industry that doesn’t know their demographics wants and needs. That is where Caddle steps in. We provide industry leaders with insights that will help them understand market trends and how they can increase revenue and brand loyalty. If you’re a soup broth industry, our insights suggest that there should be a continued effort to create broths that are flavourful and healthy. By creating a flavourful broth that attributes to the health trends such a bone broth, this could allow for the potential for consumers to regularly buy the product and in turn, increase brand loyalty.

[simple-author-box]

Price, taste and innovation: what's in your breadbasket?

The Bread Market

We all have a love for bread (maybe a little too much), and the global trends certainly appear to reflect that as the global bread market was valued at $201 billion USD and is showing no signs of a plateau in the coming years. Diving a little further into that figure and zeroing in on our homeland, Canada’s bread production industry has a collective of $8 billion CAD while showing an annual growth rate of 2.4%. While this is a flourishing market both globally and continently, recent market trends seem to show that consumers are looking for more healthy options as to avoid looking too doughy themselves. This would encourage the production of more nutritious, specialty and artisanal breads.

The Facts

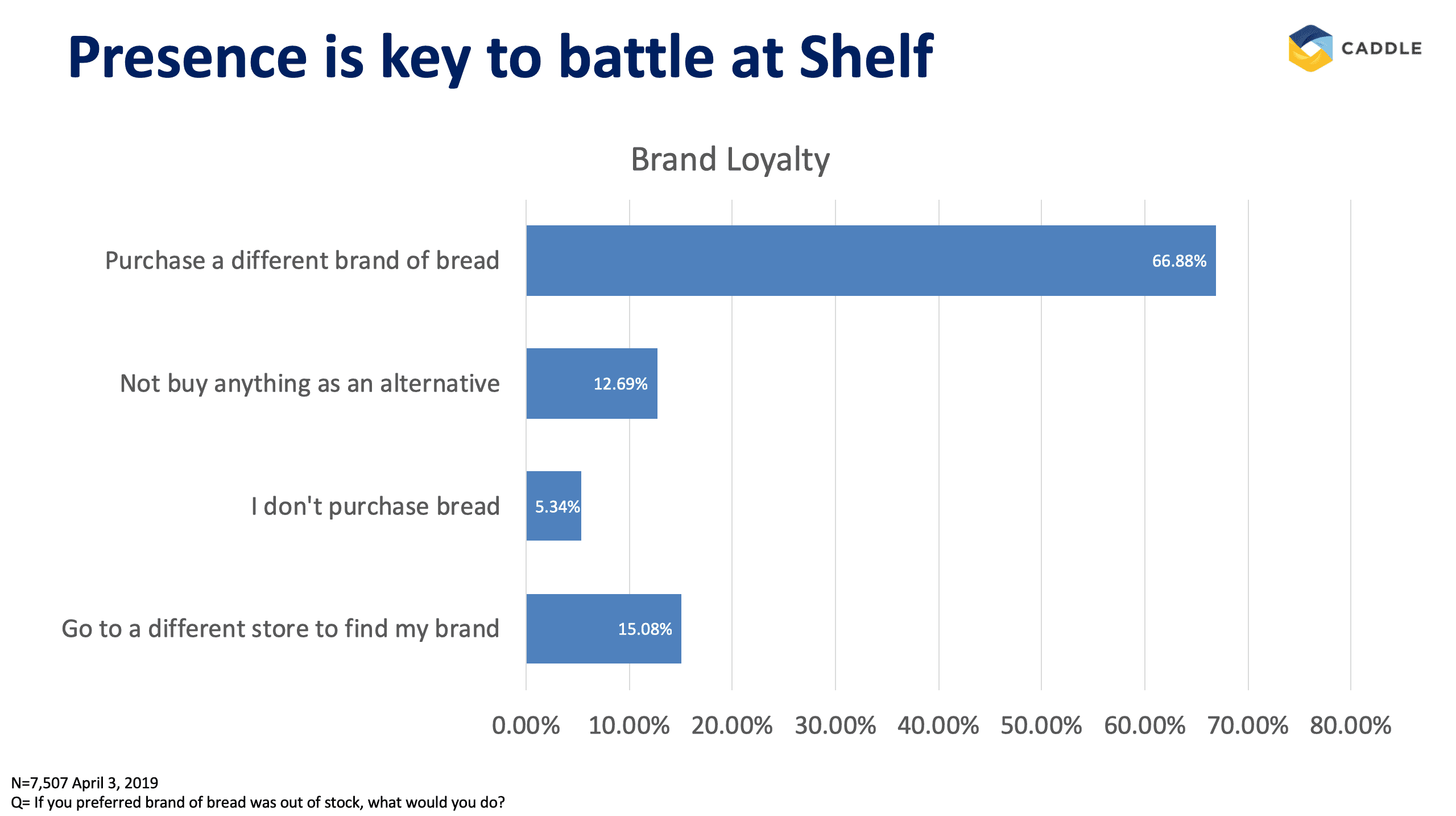

This is all very interesting to us as some of these trends appear to correlate with our survey findings. When asking consumers to select a statement that best describes their bread purchasing habits we found that 95% of people buy bread (I know, shocking right?). But as anticlimactic as this might seem, this is actually very intriguing considering the steady rise of bread (pun intended). When observing the market trends with regard to the price of bread, the prices are now 70.39% higher since 2000 with an average inflation rate of 2.84% per year; meaning that a loaf that would normally cost $5 in 2000 would now cost $8.52 in 2019. But what does this mean for the industry leaders? Well you better make sure that your brand is on the shelf because 66.88% of people said that they would purchase a different brand of bread if the one they normally purchase wasn’t available. Similarly this could mean consumers aren’t entirely loyal to their normal brand of bread and if there is a cheaper option available they could be likely to put that one in their basket instead.

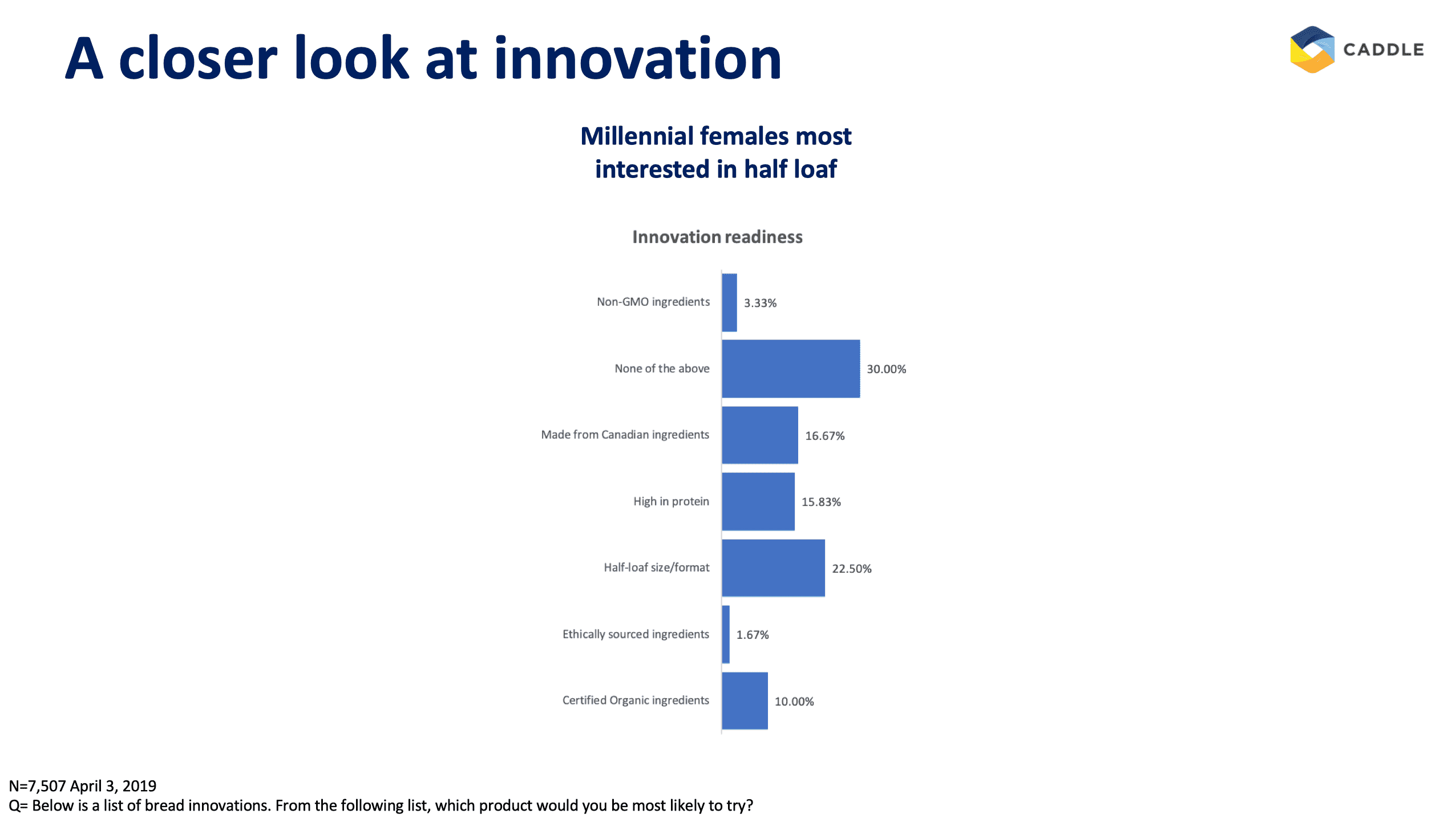

The best invention since sliced bread

Who doesn’t love new innovations? They make our lives easier without even realizing that the normal way of doing things was problematic. When it comes to bread there is nothing more frustrating when you’re making the dream sandwich only to find out that your delicious bread is moldy and you’re forced to throw out the bread. Food waste has become a real issue with reports of 1/3 of food produced goes to waste and equates to $1 trillion wasted globally. Comparably, our survey results indicate that millennial females are most interested in purchasing half loaves of bread. While this innovation isn’t a solution to all food waste, it’s certainly one that is plausible as half loaves have been available in the European market for quite some time. To further this idea, our Ontario demographic stated that 1 in 4 females would be interested in purchasing half loaf bread. This appears to align with market trends as Supermarket News states that while bread remains a staple, people are consuming less of it. Perhaps by then having the option to purchase half loaves of bread could help contribute to the prevention of food waste and align with the trend that bread just isn’t being consumed in the same quantity anymore.

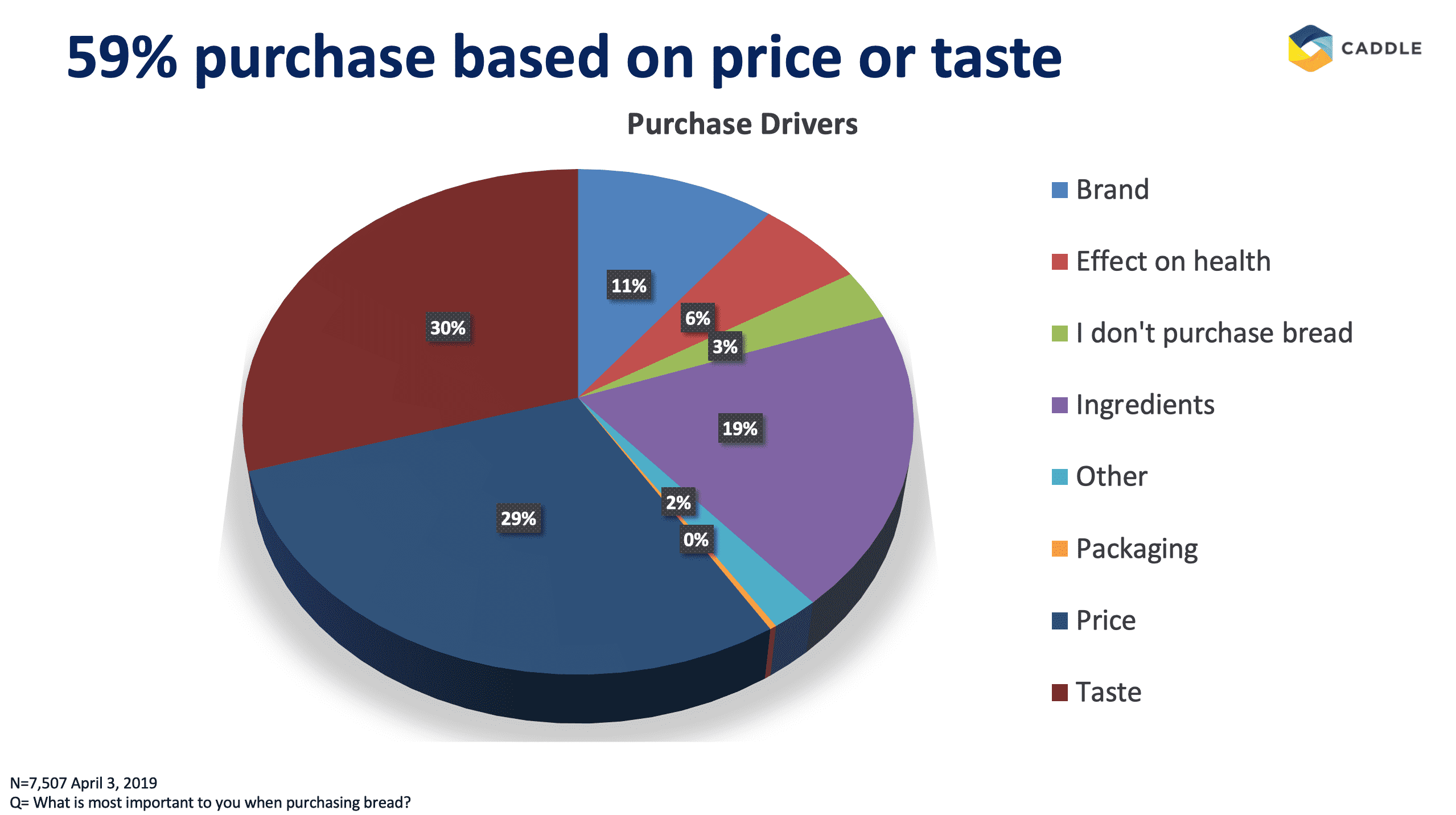

Great taste at the right price

It’s fair to say that every purchase we make we want the most bang for our buck. So why should we have to sacrifice taste for the price of bread or vice versa? That’s something that struck with our respondents. 59% of our users said that their bread purchases are based on the price and taste. This again correlates with the research done by Supermarket News as they found that two-thirds of their respondents stated that price is the most important attribute when purchasing bread while taste placed second with 57% of respondents citing taste as the second most important attribute when purchasing bread. As much as we love the smell, taste, and comfort bread brings to us, it still seems to have a negative image due to its health aspects. With the high levels of carbs, sodium and fat levels “operators have had to scramble to keep up with changing fads like low-calorie, whole grains, artisanal and gluten-free [breads]” says Supermarket News. For industry leaders knowing what consumers want such as well priced, tasty and healthy products, this is the daily bread that keeps the company ahead in the market.

So what?

Based off of our results from respondents, we can see that a large majority of consumers are purchasing bread but there are certain aspects that determine their purchasing habits. Consumers want bread that is well priced, tasty, healthy and quantifiably efficient. Aside from half loaf of bread, our Canadian consumers also reported that they are interested in innovations such as high protein bread and Canadian sourced ingredients. From the quick survey that we had our consumers respond to, it’s evident to note that our findings align with current market trends. That is why we strive and have the passion to work with market leaders to help them understand their consumers purchasing behaviours in order to increase the industry leaders revenue and brand loyalty.

Who Are We?

If you’re unsure by now, Caddle is a data insights company that has a passion for understanding market trends which can be translated to the market industry leaders for the benefit of understanding the buying behaviours of their consumers. Most recently Caddle conducted a survey with a sample size of 7,507 respondents in which we asked consumers their buying decisions when it came to bread. Given today’s market trends, we found the results to be quite interesting and we hope you do too.

[simple-author-box]