Canadians Excited for Products That Help Them Get a Better Night’s Sleep

How the importance of sleep is driving product innovation

Published on May 4, 2021

We’re Losing Sleep Over What?!

COVID-19 has changed the world forever. What may have been the leading stressor in many of our lives just one year ago, has expedited the rise of a more alluring leader in sleep loss – social media use.

One in three Canadians between ages 35 to 64 report not getting enough sleep in general. When we dig deeper, approximately 19 percent of respondents between ages 15-64 said they had lost sleep as a result of social media use in the previous 12 months. The association between social media and negative experiences was higher in younger respondents, with about 47 percent of 15-19 year-olds and 28 percent of 20-24 year olds reporting losing sleep from social media use.

In 2019, the global sleep economy was valued at about $432 billion USD. This industry was forecast to be worth $585 billion USD by 2024. With the increase of sleep loss among Canadians, what are brands doing to capture this growing market?

The Sleep-Aid Market

According to Canadian Grocer, and other reports, the functional beverage market is a big bet.

“In 2016, the Canadian functional beverage market had $1.4 billion in sales—a figure that’s expected to reach $1.6 billion in 2021, according to Euromonitor International. And according to Mintel’s figures, 14% of Canadians say they drink “hybrid/fusion drinks” on a typical day.”

This past year, we have seen an increase in product innovation in these categories. For example, Pepsi launched Driftwell to capture the new, growing market of sleep-aid beverages. Caddle asked our Daily Panel what they think about the sleep-aid beverage market, and here’s what we found.

When it comes to what influences consumers’ likelihood to try, free samples are not always the No. 1 factor

For sleep aid beverages, we discovered that the top 3 influencing factors for product trials are “free samples”, “doctor referral”, and “curiosity”. It’s interesting to note that 25% of consumers are willing to try a sleep aid beverage upon doctors’ orders. With “free samples” only 5 basis points higher than “doctor referral”, perhaps this indicates that consumers are on the fence on actually trying the product without a professional’s guidance.

From the following options, what would most likely influence you to try a sleep aid beverage?

Caddle also asked our Daily Survey Panel about cannabis-infused beverages, and had some surprising results.

Unlike sleep aid, cannabis drinkables’ top influencing factor is “curiosity”. This suggests that consumers who are curious about the product category are the most likely to try, regardless of price. Though this does not mean price is irrelevant, since “free samples” is the No.2 influencing factor, it’s still notable that curiosity trumps freebies in this case. We see “doctor referral” ranked as the third most influencing factor. This potentially highlights the growing demand for cannabis products in the health & wellness space.

Interested to learn how Canadians celebrate 420 this year? Read our blog post here. Caddle also put out a full report on how brands can Cultivate Success in the Canadian Cannabis Business.

From the following options, what would most likely influence you to try cannabis beverages?

Key Takeaways

No.1 |

The functional beverages market- specifically products aiding sleep- is on the rise, and will continue to grow in the coming years.

No.2 |

Consumer curiosity can be a strong driver to new product trials – keeping your hand on the pulse on what consumers are actually curious about, and willing to try can make or break a product.

No.3 |

Free trial is not always the best way to conduct new product trials. However, market research is always the best way to learn what is. Contact Caddle to get started.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle insights? Sign up to our mailing list below!

All-Natural & Sustainable:

What Canadian Parents Want for their Baby

Published on December 22, 2020

After our parenthood post , Caddle wondered what factors influence Canadian parents on their baby product purchases.

On November 30, here’s what we found:

1.

What labels are important when deciding what baby products to buy? (e.g. all natural, organic)

Over half of respondents ranked All-Natural and Sensitive as important labels when purchasing baby products

2.

Where do you get your information on what baby products to buy?

Over half the respondents get their information on baby products from friends/family as well as self-discovery (personal research)

3.

What would most influence you to purchase a new baby product based on environmental sustainability?

78% of consumers believe that environment sustainability is important, and the top 2 most influential factors of a new baby product being reusable packaging and paper-based packaging

Key Takeaways

All-natural and sensitive

are ranked as the most important labels to consider when purchasing baby products

Parents rely on word-of-mouth and personal search

to discover what baby products to purchase

Reusable packaging & paper-based packaging

are the most influential factors when purchasing a new baby product based on environmental sustainability

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle Insights?

Sign up to our email list!

COVID-19 Did Not Steal Canadians' Holiday Spirit

Canadians plan for holiday celebrations at home

Published on December 10,2020

This holiday season: how are Canadians celebrating?

Canadians are planning to keep up holiday spirits by cooking & baking at home this year.

Caddle found out that everyone is reducing gatherings over the holiday season.

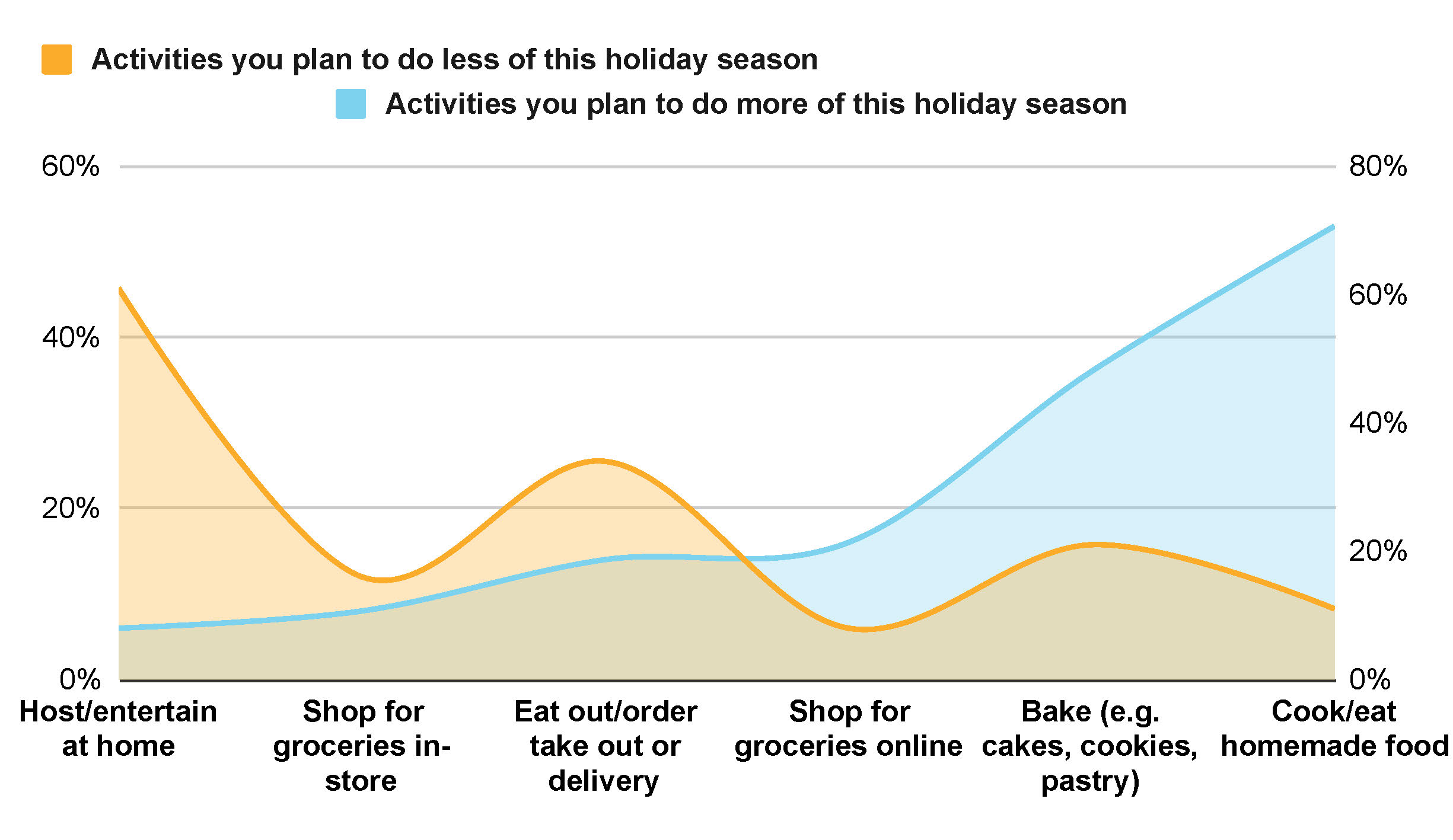

What are Canadians planning to do more/less of this holiday season?

Let’s find out.

Canadians plan to…

entertain less,

host less gatherings, &

shop for groceries less in-store due to the pandemic.

Instead, consumers are

cooking more,

baking more, &

shopping for groceries online.

In fact,

Over 87% of Canadians plan to cook or bake at home this year.

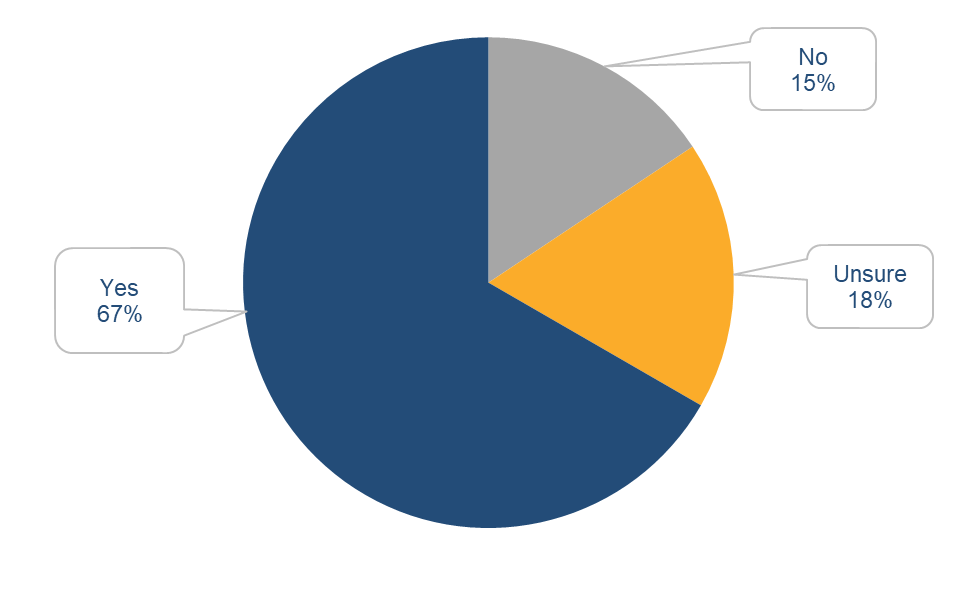

Tis' the Season of Baking: 67% of Canadians

are planning on doing some form of baking over the holidays.

Q: Are you, or someone in your household, planning to bake during the holidays?

Sign up for Caddle Insights

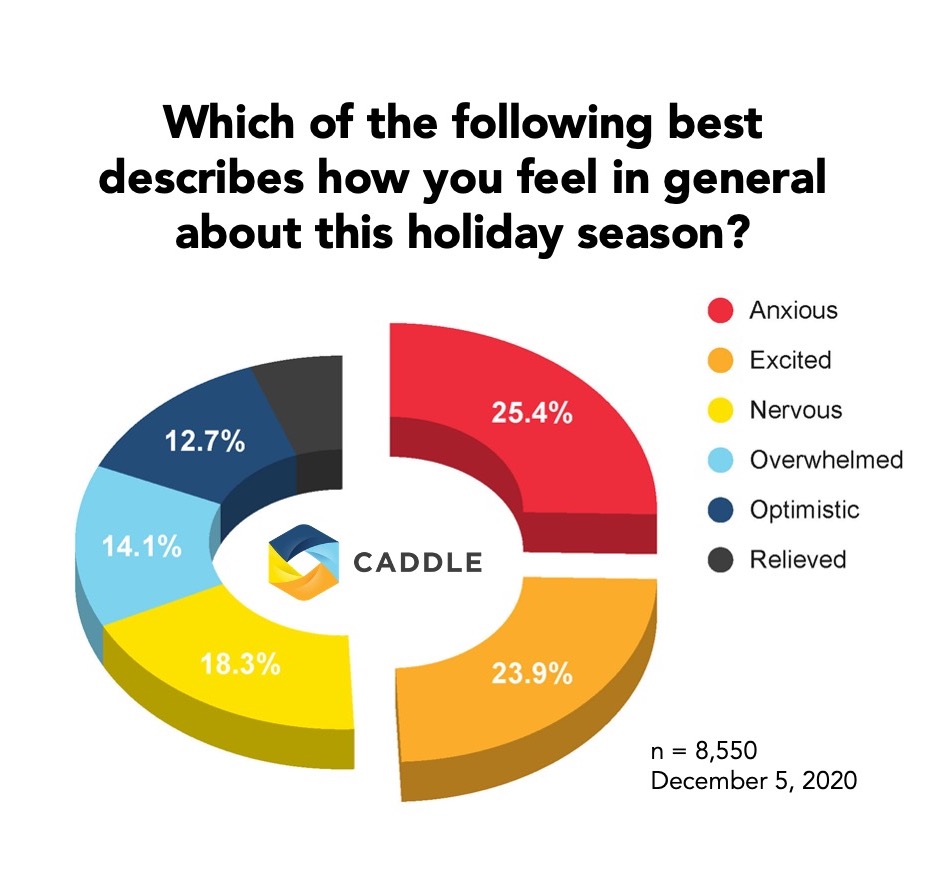

But how are Canadians feeling about the holiday season? Anxious? Excited? Nervous?

Finally,

Holiday cheer is strongest among the youngsters as

Gen Z are 15% more excited for the holidays compared to Baby Boomers,

with 24% vs. 9% respectively.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle insights? Sign up to our mailing list below!

Sustainability: Canadians are All Talk with a Slow Walk

90% of Canadians say they care about sustainability, but COVID-19 has affected whether we act on these values.

Published on December 2, 2020

At its broadest, sustainability is “development which meets the needs of the present without compromising the ability of future generations to meet their own needs”.

Canadians have by and large been held up as sustainability conscious consumers.

Back in 2017, a report from the Business Development Bank of Canada showed that more Canadians were integrating environmentally responsible practices into their lifestyles—

and they expected companies to do the same.

Whether it’s recyclability, biodegradability, less waste going into landfills… Caddle wanted to test the assumptions that Canadians are environmentally driven. We were also curious as to whether Canadians would keep to their values in the face of pandemic restrictions that make it harder to lead an environmentally conscious lifestyle.

Did you know?

Caddle® is the largest daily and monthly active panel in the Canadian market.

Receive Our Free Weekly Insights Newsletter!And so,

Caddle dug into consumer sentiments and behaviour on sustainable practices and products. Let’s start with

whether Canadians really do consider sustainability in their daily lives.

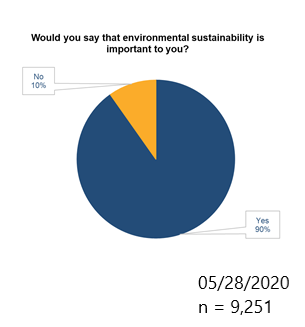

Sustainability is important to the vast majority of Canadians.

Do Canadians Actually Care?

Back in May 2020, the answer was a resounding ‘yes’—across all demographic groups and regions.

Does Consumer Sentiment on Sustainability Actually Influence Behaviour?

While many Canadians raise clear concerns about sustainability practices, their actions don’t always match —especially during COVID-19. Let’s look at how sustainability figures in Canadian consumers’ daily lives.

Use of Plastics

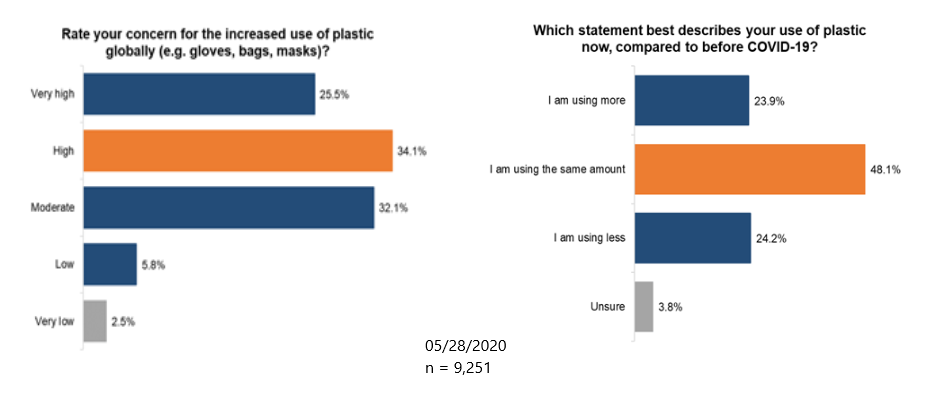

While 60% of consumers were concerned about the increased use of plastic during COVID-19 (especially Gen Zers and Millennials),

50% of respondents are using the same amount of plastic compared to pre-pandemic,

and almost

1 in 4 consumers are using more!

(Gen Zers and Millennials over-index at 26.5% and 25.7% respectively).

Curiously,

consumers in British Columbia—the stereotypically eco-conscious—seem to be the least aligned with sustainability efforts. Though B.C. consumers expressed the greatest concern with the global increase in plastic use, they also reported the

highest % of single-use plastic usage since the pandemic began!

In contrast, Maritimers—who draw tourism dollars for its scenic landscapes like the West Coast—walk the sustainability talk a bit more, over-indexing on lower plastic use in general.

Use of Plastics in Shopping

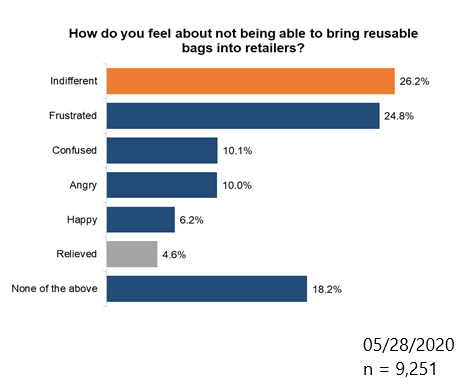

Most consumers are either “frustrated” or “indifferent”

about not being able to make use of reusable shopping bags in-store.

Who’s Most Frustrated of All?

Millennials (26%), though they’re also among the most indifferent consumers, tied with Gen Zers (at 28.2% and 28.5% respectively) and outflanking older generations for “indifference” by at least 3 points.

Meanwhile,

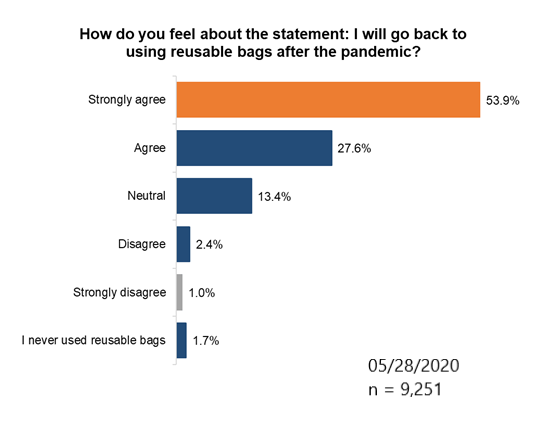

more than 50% of all consumers "strongly agree”

they’ll go back to shopping with reusable bags after the pandemic.

Who is least likely to go back to reusable bag use?

Gen Z! If you guessed the youngest generation, you’re right.

Sustainable Packaging

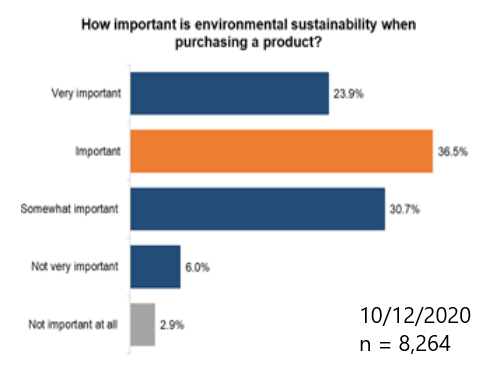

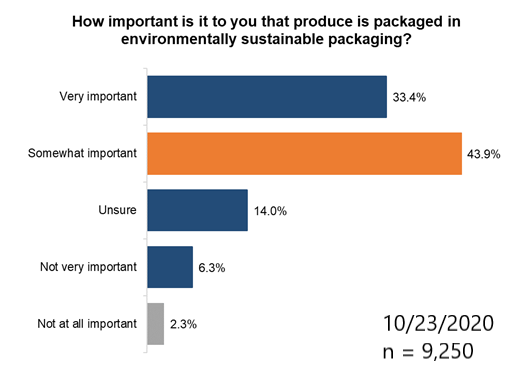

About 1 in 4 of all consumers find environmental sustainability “very important” when purchasing a product; this holds true across all demographic and geographic groups.

Consumers are especially interested in environmentally sustainable packaging for produce purchases. 80% of consumers suggest it’s “somewhat important”/“very important.”

In fact,

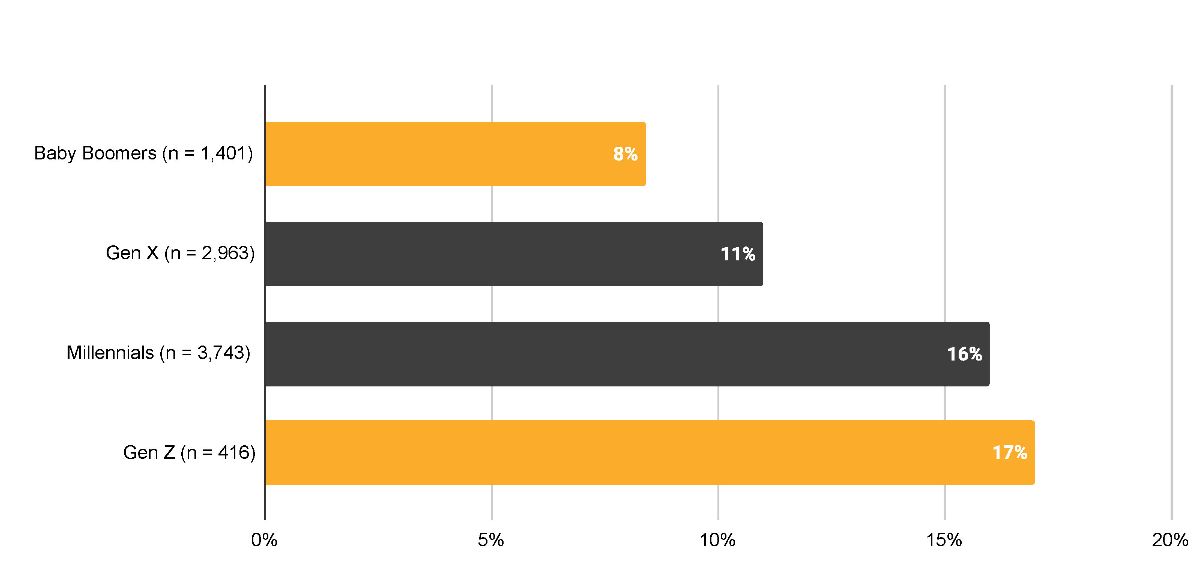

more than 40% of consumers are willing to pay up to 5% more for produce that is packaged sustainably,

though more so among older generations. Consistent with earlier findings, this suggests older consumers either have more dollars to spend on sustainable products OR have greater intent to do so.

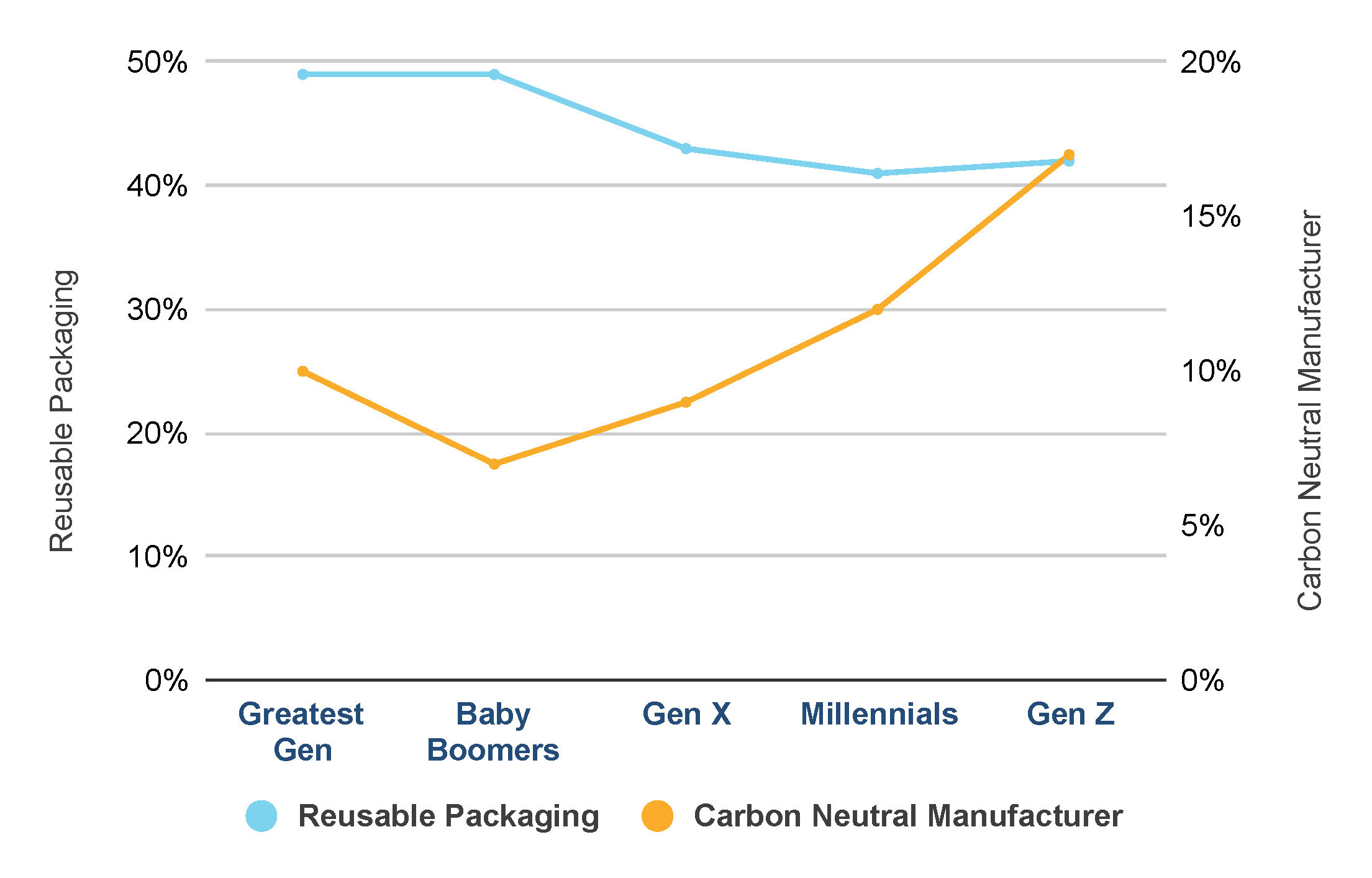

Reusable packaging is the strongest influence in purchasing a new product—

though the younger the consumer, the less they seemed to value reusable packaging.

Is this further indication that Canada’s youngest generations place more emphasis on other elements of sustainable consumption?

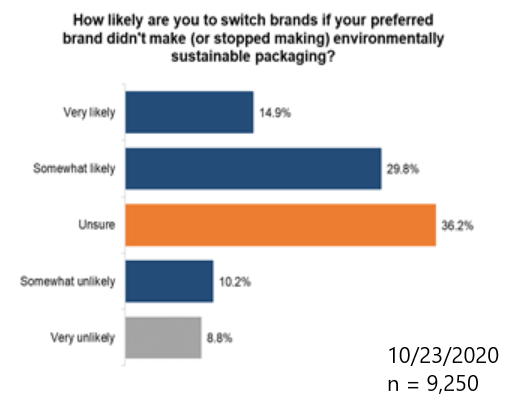

Finally, 40%

of Canadian consumers are likely to switch brands

if their preferred company didn’t make environmentally sustainable packaging. Note* packaging is a relevant concern for eco-conscious consumers.

KEY TAKEAWAYS

1. Canadian Consumers Care About the Type of Packaging that Manufacturers Use.

Canadian consumers don’t just think sustainable packaging is more important; many consumers (particularly older generations) would pay more

for sustainably packaged products and they’d ditch their preferred brands if they aren’t offered in environmentally sustainable materials.

The opportunity is ripe for retailers to increase share of wallet

by expanding their assortment of products that are packaged using sustainable and/or reusable materials.

And for retailers with white-label assortment: adapting packaging now to more sustainable options isn’t just a good environmental choice;

it may help you to better compete with global brands, too.

2. Younger Consumers Think About Sustainability Differently.

We’ve heard talk for years (and have copious evidence to back it up!) about how

Gen Zers and Millennials are leading the charge on environmental issues. Yet,

our results indicate that many of the measures we typically associate with “capital-S Sustainability” just don’t seem to mean as much to Canada’s younger consumers.

The fact of the matter is,

if you’re truly going to understand the thinking and behaviour of any demographic—whether Gen Z or the Greatest Generation or anyone in between

—you need plenty of good, reliable data.

And so, it’s incumbent on retailers and manufacturers to continue to work with partners like Caddle to gather as much broad-spectrum data as possible, if they’re going to really

get into the heads, hearts and wallets of these up-and-coming change-makers.

3. COVID-19 is Affecting Canadians in Surprising Ways

Perhaps it’s just the malaise we’re all feeling from the seemingly never-ending restrictions and changes to life as we know it. And you’d think with lockdowns and restricted comings-and-goings, people would be using less plastic—especially if they eschewed single-use plastics pre-pandemic.

But,

up to 25% of Canadian respondents report using more single-use plastics now than before the pandemic struck.

This signals to us that

the pandemic will continue to throw some surprising curveballs at retailers and product manufacturers

in the coming months. To manage, retailers should maintain a holistic assortment of products and services. That way, regardless of inconsistencies that may occur between sentiment and behaviour, they’re still catering to as wide a population as possible at any given time.

Looking to know more about consumers and their views, intentions and habits towards plastics and sustainability? Contact us today.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Contact Us

Gen Z Joins Shopping Mall-Walking Trend as Exercise This Winter!

Published on November 20, 2020

With pandemic closures expected to continue into the holiday season and possible COVID-19 spikes, are shopping malls the fitness solution we’re all in need of?

So, are consumers using shopping malls for mall-walking to stay fit?

We asked over 8500 Canadians

last week and almost half of all respondents are worried about sticking to their fitness routines this winter. For Canadians who visit malls,

47% are interested in visiting a shopping mall for exercise during the winter. Surprisingly, Gen Z are the most interested

in visiting a shopping mall to exercise during the winter.

Are Gen Z the new generation of “mall-walkers”?

Are walk/run lanes at shopping malls a hot thing this winter?

Gen Z are Twice as Worried About Exercise

n = 8,577 | November 15, 2020

Gen Z over-index more than 2X when compared to Baby Boomers and say they are

“extremely worried”.

As a result,

many are looking to shopping malls as their physical activity of choice in order to get their daily steps in.

Again, of the consumers that visit malls often or sometimes,

Gen Z are 2X as interested in a run/walk lane at their local shopping mall when compared to Baby Boomers!

Caddle is the largest mobile provider of Canadians insights with 10,000+ daily active panel members. Our data is used by research firms including Nielsen, Environics, & major CPG/retailers like P&G, Coca Cola, Nestle, Walmart, Canopy and many more.

Sign-Up for Caddle’s Weekly Insights Report and never miss a beat on the newest Canadian consumer insights!

2020 U.S. Election Would Have Different Results in Canada

see how the 2020 U.S. election would have panned out if Canada was voting

Published on November 16, 2020

How closely did you follow the 2020 U.S. election? This is a question we wanted to know at Caddle… and we found the answers!

As Canadians, our close ties with the U.S. cannot be disregarded. As such, here at Caddle, we want to know not only how many Canadians were following the election, but WHY.

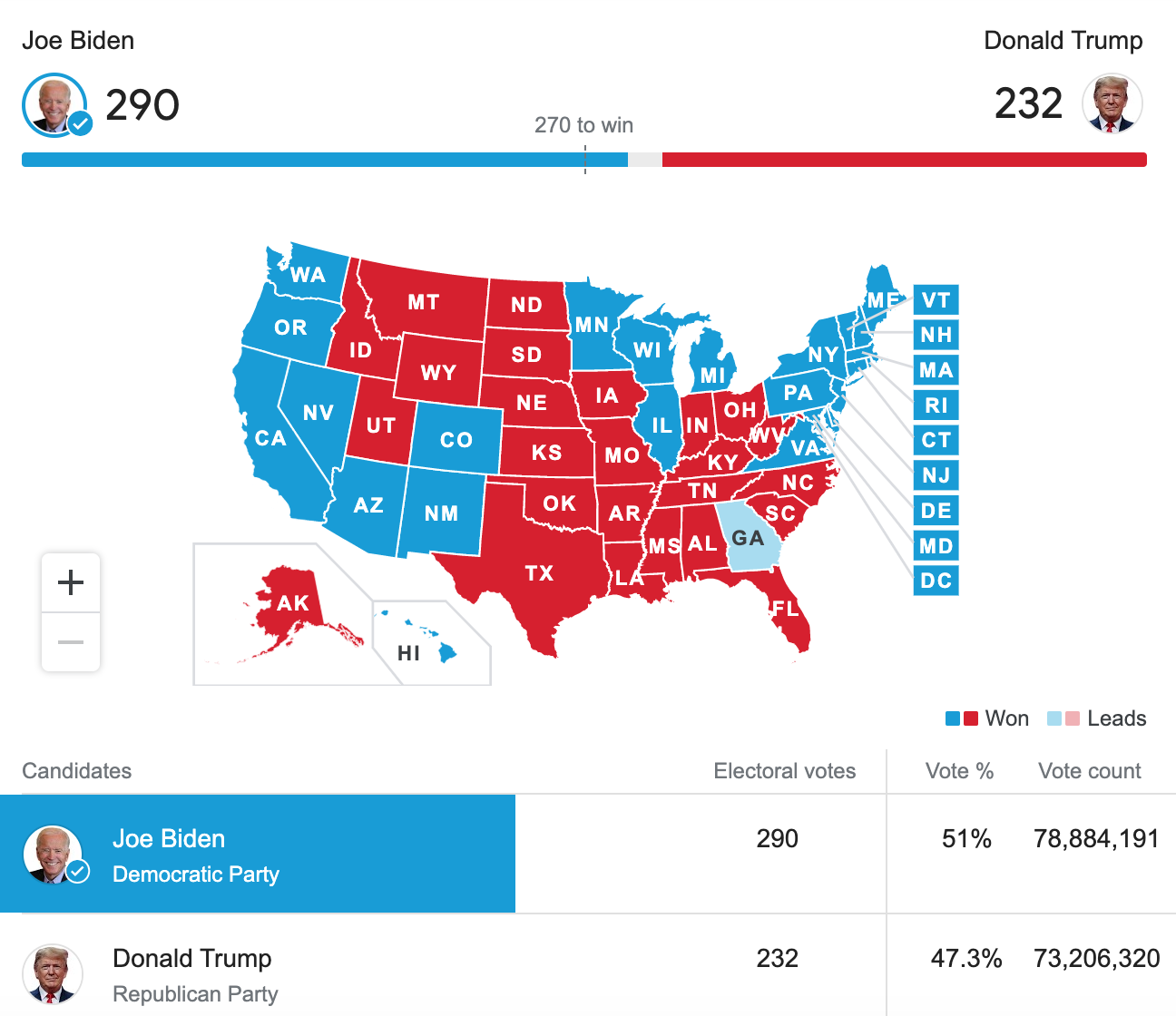

2020 U.S. Election Results

After the announcement of Joe Biden winning the 2020 U.S. presidential election, Caddle put together a Rapid Response survey to our 10,000+ daily member panel to find out what Canadians think about the 2020 U.S. election.

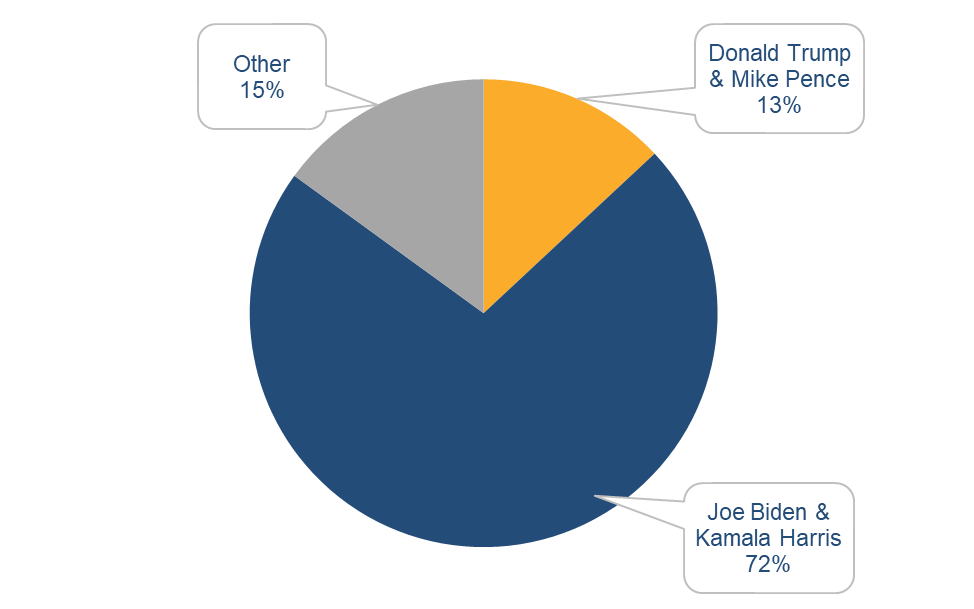

Over 70% of Canadians Would Vote Joe Biden & Kamala Harris

Which U.S. presidential candidate would you have voted for?

Baby Boomers are the most in favour for Joe Biden when you look across generation cohorts, while Generation Z is most in favour of Donald Trump when compared to other generation groups.

Are you surprised by these results?

With the presidential elect decided, we also want to know consumers’ opinions on Canada & U.S. relations.

How dependent do you believe Canada should be on the U.S.?

What is your top concern in regards to Canada-U.S. relations over the next 4 years?

Get in touch below and we will send you Caddle’s full report on how Canadians really feel about the 2020 U.S. election.

Friends Reboot: Will the anticipated reboot arrive?

Are you a fan of the television hit series ‘Friends ’?

What if the cast got together for a reboot – would you watch it?

The hit show that we came to know and love during the late ’90s and early 2000s was a show that broke television records. With an average rating of 23 million views per episode, the Friends cast began earning close to $1,000,000 per episode in their final three seasons.

Given these astonishing statistics, a recent study gathered some insights to provide additional staggering results to determine the interest in a Friends reboot.

With the ability to binge-watch our favourite television shows, the team at Caddle conducted a survey with nearly 10,000 responses to determine the interest in watching a Friends reboot, and which platform they’d prefer to watch it on.

Here’s what we learned:

- 62% of respondents are interested in watching a Friends reboot

- 57% showed a preferred interest in watching the reboot on a streaming service (e.g., Netflix)

- 20% felt that the reboot would be almost as good as the original

- 43% felt that the reboot would be just as good as the original. This segment of respondents is over-indexed.

- Millennial viewers showed the highest interest in a Friends reboot

- 57% of Millennials showed an interest in a Friends reboot

- 52% of Gez Z respondents showed an interest in a Friends reboot

- 49% of Gen X respondents showed an interest in a friends reboot

- 42% of Baby Boomers showed an interest in a Friends reboot

Viewers have been demanding a Friends reboot for years but haven’t seen any success in getting one. While this may not encourage a reboot, this provides insight into the potential profitability the series could have in the industry if a reboot was decided.

Would you be interested in a Friends reboot? Would you like to learn more from this report? Let us know your thoughts or request a report download in this form!

Fintech: 3 reasons why you didn’t like online banking

Fintech: Online Banking Adoption Rate

Online banking has seen tremendous growth and success in the Canadian market with an approximate 50% penetration rate. These numbers are constantly climbing and we could expect higher rates every year as the services become more user-friendly.

Online banking awareness is at an all-time high with 96% of people stating that they have at least heard about the services that are provided such as e-transfer, paying bills, depositing cheques and more.

Fintech can act as an extension for the existing physical spaces. For example, you could complete simple, mundane tasks online while using the available in-branch services to make more complex decisions

That being said, with the banking industry still shifting its focus from brick and mortar operations to digital servicing, it’s important to us at Caddle to determine what suggestions you would make to optimize this technology.

We got to hear from you!

Some of you still may be wondering, what is Fintech? It’s a combination of “Finance & Technology”. Fintech includes a variety of different services including:

- Insurance

- Transaction delivery

- Peer to peer lending

- Loans

- Digital wallets

- Online banking

So how does Caddle fit in? Caddle is a data insights company that has a passion for understanding market trends which can be translated to the market industry leaders for the benefit of understanding the buying behaviors of their consumers.

We took a look at what our members had to say about Fintech. With an average of about 8000 survey respondents approximately 80% of respondents were female, 50% were Millennials, and 40% were from Ontario. We hope that using this sample size we can garner a better understanding of Fintech and help provide the best insights.

Financial technology (Fintech) is used to describe new tech that seeks to improve and automate the delivery and use of financial services.

Based on the results we determined that our members are not supporters of this new technology for three major reasons.

1) Fintech: Digital Banking Awareness

We conducted a digital bank survey that was focused on determining our member’s awareness and preferences when it comes to conducting their finances online. For this particular survey, we are talking about banks that are solely online with no available storefronts.

We found that more than half of our members were familiar with digital banking. That being said, 54% did not use digital banks and the next best option was Tangerine. All those Toronto Raptors commercials are paying off!

What is interesting is that digital banks have a multitude of advantages that traditional banks don’t. For example, they can offer you higher interest rates and lower banking fees because they have cheaper operating costs than brick and mortar locations.

Fintech: Why not make the switch?

If people are willing to sacrifice earning more money there must be some underlying issues. Banks have invested plenty of money into targeting Millennials and onboarding them to digital platforms.

What is causing people to be so skeptical?

This could be a result of respondents feeling neutral when it comes to their personal info and data being safe with digital banks. Does that mean you heard about the Capital One security breach?

Members simply had no interest when it comes to switching to a digital bank. This could be a result of banks failing to address your concerns:

- Where do I deposit my cash?

- How do I talk to a real person?

- What type of insurance coverage do I get?

2) Fintech: The Banking App Experience

The findings from the banking app experience survey helped us identified that only 34% of members had a “good” experience when conducting transactions online. This includes them logging on a few times a week to check the status of their accounts.

Members were comfortable completing simple transactions such as:

- Transferring money (e-transfer)

- Paying bills

- Checking account balances

Fintech: Online Banking Stops Here

The previous results were anticipated but when asked if members conducted any other activities like communicating with advisors, applying for loans or mortgages, or opening accounts, the majority said they don’t complete any activities.

This is important because it is evident that members are not comfortable making certain decisions using online platforms whether or not it is an issue of privacy, lack of financial guidance, or inaccessibility.

3) Fintech: The New Digital Wallet

How many of you carry cash? Probably not often right? What if I told you now you don’t have to carry your wallet. The future is here, all you have to do is tap your phone to make a purchase! (ie: apple pay)

To be honest, it’s an interesting experience and there are valid points made from each side of the spectrum.

67% of you said that you don’t currently use a digital wallet.

Here are the following reasons why our members are skeptical about making the leap to digital wallets:

- Safety and security. Members disagreed with the following statement, ‘my personal information and money is safe with digital wallets’.

- Over half of the respondents were Millennial’s (1978-1996). A large portion of these members are not digital natives.

- There is a lack of awareness and perceived functionality.

- Digital wallets are a relatively new concept (less than 10 years). This technology is still in the early adoption stage.

- Out of the respondents that did use digital wallets they preferred Apple Pay.

Fintech: Digital Transactions Experience Steady Increase

According to a study completed by Payments Canada, they found that “in 2016, the number of contactless transactions increased significantly, to almost 2.1 billion transactions worth $67.1 billion.

This represents an 81% and a 78% increase over 2015, in both volume and value terms (respectively).”

At Caddle, we feel that the lack of presence and usage of digital wallets lies in the hands of the organizations. There is just simply a lack of education and promotion surrounding the benefits associated with this technology.

Hotspot shield also conducted a survey and found similar results.

“A strikingly small 12 percent had ever used any of the applications at all. Of those who had used the technology, PayPal was the runaway favorite, while second-place Google Wallet had been used by only 8 percent of the survey subjects”.

Consequently, our respondents displayed minimal interest in converting their handheld wallets to be linked to their mobile devices.

What’s that old saying? If it ain’t broke, don’t fix it?

The Saftey Guide

For those of you that are going to be cashing in those Caddle earnings and saving more money by shopping online, we have a safety guide just for you. Get your pen and paper ready. Whether or not you will be browsing Amazon or taking advantage of Cyber Monday/Black Friday, this guide will protect your money!

- Review your bank statements (every month)

- Don’t make purchases on PUBLIC wifi

- Secure your home wifi

- Use two-factor authentication (2 passwords for your banking)

- Change the password for your email/bank after the holidays

- Don’t share your PIN(s) with anyone

- Look for spelling errors or inconsistencies on websites

- Use 3rd party sources (PayPal) to secure your funds

In Canada alone, there were over 1.2 million in compromised funds last holiday shopping season with a total of 1179 victims.

Now that you have got some good tips and tricks we want to hear from you! Check out our daily surveys on the Caddle app and share some of your insights using this link. Whats are some of the holiday gifts that you will be purchasing? Are you going to be shopping online or in-store? We want to hear it first!

Thanks for reading! Follow us on social media and register online to have access to more blogs and surveys.

[simple-author-box]

Dark Mode Hockey?

What if the NHL went Dark Mode like your cell phone?

It may sound like sacrilege to die-hard hockey fans, but wouldn’t it be easier for viewers to follow a white puck against black ice than the current standard of a tiny black puck on an ice surface?

A recent survey found a surprising number of Canadians would be willing to watch our national game in a radical new light.

Given the recent run of Dark Mode software releases, which are designed to improve customer experience, the team at Caddle decided to investigate what other Dark Mode experiences might be of interest to Canadians. We decided to start with Canada’s favourite game – hockey.

Our survey received more than 8,000 responses from Canadians of all ages to gauge their receptiveness to watching NHL games in Dark Mode.

Here’s what we learned:

- 28% of overall respondents are interested in NHL Dark Mode, compared to 40% opposed

- 31% of respondents who identified as serious hockey fans – those who watch at least one game per week – would be interested in NHL Dark Mode. This segment of respondents is over-indexed

- Younger Canadians are more open to Dark Mode hockey than older Canadians.

- 36% of Gen Z interested in NHL Dark Mode

- 30% of Millennials interested in NHL Dark Mode

- 26% of Gen X interested in NHL Dark Mode

- 22% of Baby Boomers interested in NHL Dark Mode

- 27% of Silent Generation interested in NHL Dark Mode

“This research may not pave the way to black ice hockey rinks across the country, but what shows very strongly is that Canadians have a huge appetite for new experiences – even when it comes to a game like hockey with very strong traditions,” says Caddle CEO Ransom Hawley.

So what do you think – would you be interested in making the switch to black and white? Let us know your thoughts in this form.