Report: Stocking Up in the Freezer Aisles

The Pandemic’s Effect on the Frozen Food Category in Canada

Published on May 26, 2021

Frozen foods were already popular before COVID-19 hit, especially among the “Fast Food = Convenience” subset of consumers. Yet, specific factors dictated by the pandemic—and the ways that consumers have had to transform their lives because of it—have led to a sales explosion in several frozen categories over the last year. For instance, between March 2019 and 2020, frozen fruit and vegetable sales increased by 117% and 129% respectively and sales of frozen potatoes rose by more than 60%.

What's Inside

- Frozen Foods Figure Heavily in

Canadian Consumption Patterns - Canadians Love Their Frozen Snacks

- 4 Main Drivers for Canadian

Shoppers’ Increased Frozen Foods

Consumption - The Frozen Pizza Wars: Local

Favourites Gain Traction through

Variety and Innovation - Conclusion: What Will It Take to Win

the Frozen Food Category? - About Caddle Inc

Are Canadians shopping behaviours different? Find out in our Ethnic Grocery Report: South Asian & Southeast Asian Canadians | Understanding Factors Driving Share of Wallet Among Key Canadian Demographic

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Get better business insights, faster, with Caddle.

Want more Caddle Insights? Sign up to our email list!

Canadian Grocer News Feature | Out with Sustainability?

Factors driving grocery revenues now and post-pandemic

Published on May 18, 2021

Caddle is thrilled to announce our partnership with Canadian Grocer by sharing our first contributed column to their magazine subscribers this month.

Caddle CEO Ransom Hawley discusses factors driving grocery revenues now and post pandemic. According to Caddle supported data, value, convenience and selection trump eco-consciousness for COVID-stressed Canadians.

Subscribe to Canadian Grocer here to view the full magazine

Is Outdoor Advertising On Its Way Out?

And could a return to work bring it back?

Published on May 12, 2021

If there is one thought in every Canadian’s mind these days… it’s certain to be when will things go back to normal?

With Canada’s vaccination campaign ramping up, news of other countries and cities opening, consumers and brands alike are in the hope that things will start to go back to normal sooner rather than later.

As Canada works towards a pre-pandemic reality, Caddle wondered: How has pandemic closures and stay at home orders affected out of home advertising? And how much attention should brands be paying to this traditional method of advertising once things are back to normal?

Panel stats

Earlier in March, close to 9,000 Canadians were surveyed through Caddle’s panel on the topic of outdoor advertising, and whether billboards, bus stop displays, window ads and the like are actually catching consumers’ attention. With the rise of online shopping expedited by the pandemic, Caddle was curious to find out if physical outdoor advertising is still relevant in today’s digital age.

And the results are in

While digital methods of consumption are increasing since the start of COVID-19, such as the use of QR codes (24% of Canadians use QR Codes more frequently than before the pandemic) and contactless payment (53% of Canadians use contactless payments more frequently than before the pandemic), Canadians are getting outside when they can and stopping to smell the roses.

In general, 90% of Canadians appreciate their outdoor surroundings. Since COVID-19, 55% appreciate the outdoors even more now than before the pandemic. This likely explains why 14% of respondents notice outdoor ads more now frequently compared to 6 months ago.

Around 66% of Canadians notice outdoor ads while driving, whether that be in their hometowns or while visiting a city or town they don’t live in.

How frequently do you notice outdoor ads now compared to 6 months ago?

When we look at generational differences, about 20% of Millennials and Gen Z notice outdoor ads more frequently, despite being digital natives.

Interested in online advertising? First read Caddle’s findings on the Death of the Third-Party Cookie, Rise of FLoC.

From brand awareness to purchase, outdoor advertising can do it all

Beyond catching consumers’ attention, outdoor advertising is also influencing consumer behaviour. 25% of respondents state that outdoor ads have informed them of a product in the past 12 months, and 20% of respondents state that outdoor ads have influenced them to buy a product or service Given that outdoor advertising have minimal ways to segment the target audience, these numbers are significant.

How do you feel about the statement: “An outdoor ad informed me about a new brand in the past 12 months?”

How do you feel about the statement: “Outdoor ads influenced me to buy a product / service?”

Main Takeaways

No. 1|

Outdoor advertising is still an effective channel despite being overlooked by many brands. Canadians are paying attention to outdoor advertising even more so compared to a year ago.

No. 2|

When return to normal comes back full throttle, outdoor ads are still a core channel brands should consider. Brands who invest in this channel are sure to capture the eyes of consumers, especially Millennials and Gen Z.

No. 3|

Though it may not be top of mind for marketers, product awareness and sales conversion are metrics outdoor advertising can deliver on. Don’t overlook the power of a billboard or bus stop display.

Are consumers tuning out COVID-19 advertisements? See how opinions have changed one year ago compared to now.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle insights? Sign up to our mailing list below!

Wellness, Stress Management, and Food

Packing on the Pandemic Pounds

Published on May 5, 2021

Almost three out of five adult Canadians report undesired weight changes since the COVID-19 pandemic began.

The Agri-Food Analytics Lab at Dalhousie University, in partnership with Caddle, released a new report on wellness and stress management. This survey’s intent was to measure how the pandemic has affected Canadians’ health and food habits, and how well they have been coping with stress generated by the public health crisis. A total of 9,991 Canadians were surveyed on wellness in April 2021 through the Caddle app.

In this report we cover:

- Eating habits

- Weight management

- Meal management

- Snacking

- Pandemic stressors

Director of the Agri-Food Analytics Lab at Dalhousie University, Sylvain Charlebois, breaks down the findings on CTV News, The Province, and Winnipeg Free Press.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle Insights? Sign up to our email list!

Canadians Excited for Products That Help Them Get a Better Night’s Sleep

How the importance of sleep is driving product innovation

Published on May 4, 2021

We’re Losing Sleep Over What?!

COVID-19 has changed the world forever. What may have been the leading stressor in many of our lives just one year ago, has expedited the rise of a more alluring leader in sleep loss – social media use.

One in three Canadians between ages 35 to 64 report not getting enough sleep in general. When we dig deeper, approximately 19 percent of respondents between ages 15-64 said they had lost sleep as a result of social media use in the previous 12 months. The association between social media and negative experiences was higher in younger respondents, with about 47 percent of 15-19 year-olds and 28 percent of 20-24 year olds reporting losing sleep from social media use.

In 2019, the global sleep economy was valued at about $432 billion USD. This industry was forecast to be worth $585 billion USD by 2024. With the increase of sleep loss among Canadians, what are brands doing to capture this growing market?

The Sleep-Aid Market

According to Canadian Grocer, and other reports, the functional beverage market is a big bet.

“In 2016, the Canadian functional beverage market had $1.4 billion in sales—a figure that’s expected to reach $1.6 billion in 2021, according to Euromonitor International. And according to Mintel’s figures, 14% of Canadians say they drink “hybrid/fusion drinks” on a typical day.”

This past year, we have seen an increase in product innovation in these categories. For example, Pepsi launched Driftwell to capture the new, growing market of sleep-aid beverages. Caddle asked our Daily Panel what they think about the sleep-aid beverage market, and here’s what we found.

When it comes to what influences consumers’ likelihood to try, free samples are not always the No. 1 factor

For sleep aid beverages, we discovered that the top 3 influencing factors for product trials are “free samples”, “doctor referral”, and “curiosity”. It’s interesting to note that 25% of consumers are willing to try a sleep aid beverage upon doctors’ orders. With “free samples” only 5 basis points higher than “doctor referral”, perhaps this indicates that consumers are on the fence on actually trying the product without a professional’s guidance.

From the following options, what would most likely influence you to try a sleep aid beverage?

Caddle also asked our Daily Survey Panel about cannabis-infused beverages, and had some surprising results.

Unlike sleep aid, cannabis drinkables’ top influencing factor is “curiosity”. This suggests that consumers who are curious about the product category are the most likely to try, regardless of price. Though this does not mean price is irrelevant, since “free samples” is the No.2 influencing factor, it’s still notable that curiosity trumps freebies in this case. We see “doctor referral” ranked as the third most influencing factor. This potentially highlights the growing demand for cannabis products in the health & wellness space.

Interested to learn how Canadians celebrate 420 this year? Read our blog post here. Caddle also put out a full report on how brands can Cultivate Success in the Canadian Cannabis Business.

From the following options, what would most likely influence you to try cannabis beverages?

Key Takeaways

No.1 |

The functional beverages market- specifically products aiding sleep- is on the rise, and will continue to grow in the coming years.

No.2 |

Consumer curiosity can be a strong driver to new product trials – keeping your hand on the pulse on what consumers are actually curious about, and willing to try can make or break a product.

No.3 |

Free trial is not always the best way to conduct new product trials. However, market research is always the best way to learn what is. Contact Caddle to get started.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle insights? Sign up to our mailing list below!

Cannabis During COVID-19

Did 420 Get Overlooked This Year?

Published on April 21, 2021

Celebrating 420

According to Wikipedia, 420, 4:20, or 4/20 (pronounced four-twenty) is cannabis culture slang for marijuana and hashish consumption, especially smoking around the time 4:20 p.m., and also refers to cannabis-oriented celebrations that take place annually on April 20. From Statistics Canada, prevalence of cannabis consumption in Canada has been steadily increasing across all consumption levels. Now, Canada’s cannabis industry is operating at an annual run rate of about CAD $3.13 billion.

Let’s dive into how Canadians view cannabis in 2021, and whether they planned to celebrate the iconic 420 holiday during a pandemic.

COVID-19 Can’t Break Tradition

Caddle found out that 22% of Canadians who consume cannabis celebrated 420 last year, and 39% plan to celebrate this year. In actuality, some have gathered in small groups to celebrate 420, others moved the festivities online, but official numbers will likely be limited since official gatherings were cancelled due to safety concerns. As this is a holiday typically celebrated outdoors, perhaps the rise in interest is not surprising. This increase in participation may be attributed to COVID-19 coping mechanisms, or simply following the trend as we’ve seen in the past decade of increasing interest in cannabis use.

Cannabis Users Are Consistent

Due to COVID-19 restrictions this year, many 420 celebrations have been cancelled due to safety concerns. For example, Vancouver’s 420 protest and cannabis celebration with over 100,000 in attendance and over 500 vendors every year has been cancelled. In honor of 420 this week, we’re sharing some recent cannabis data.

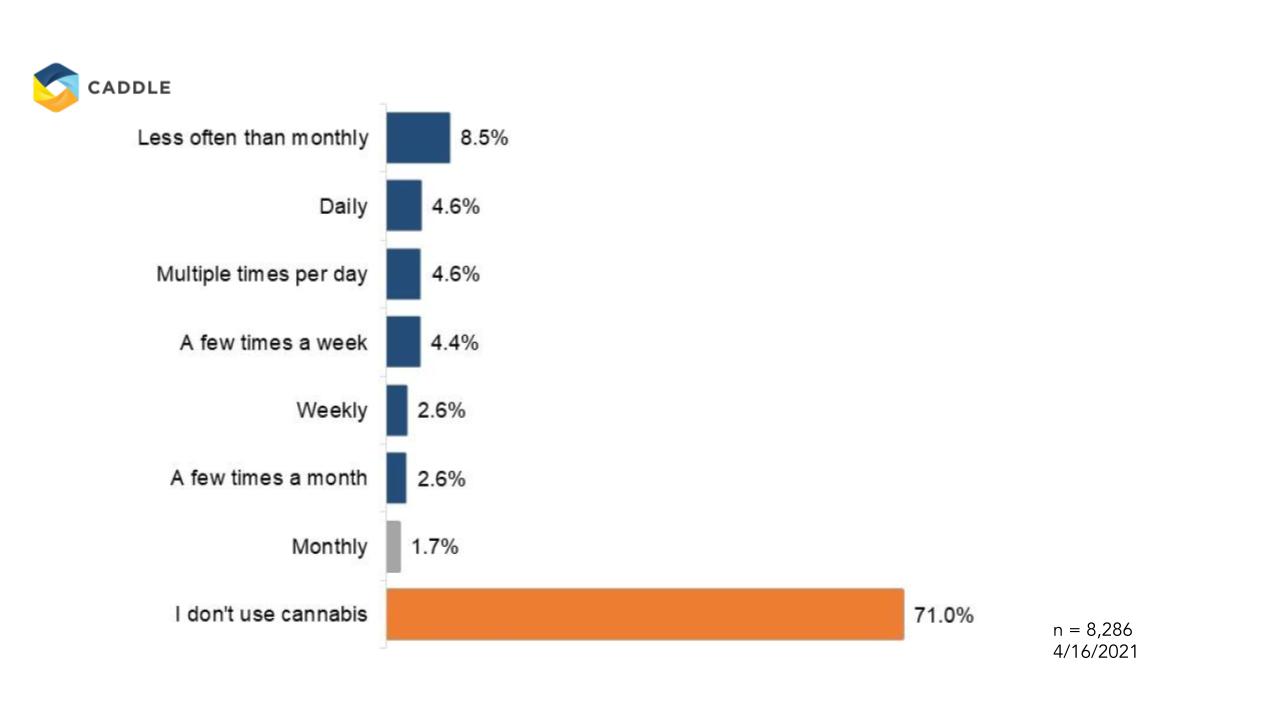

Caddle found that for the general population, most are not participants of cannabis culture: Over 70% indicate they do not use cannabis at all.

How often do you use cannabis?

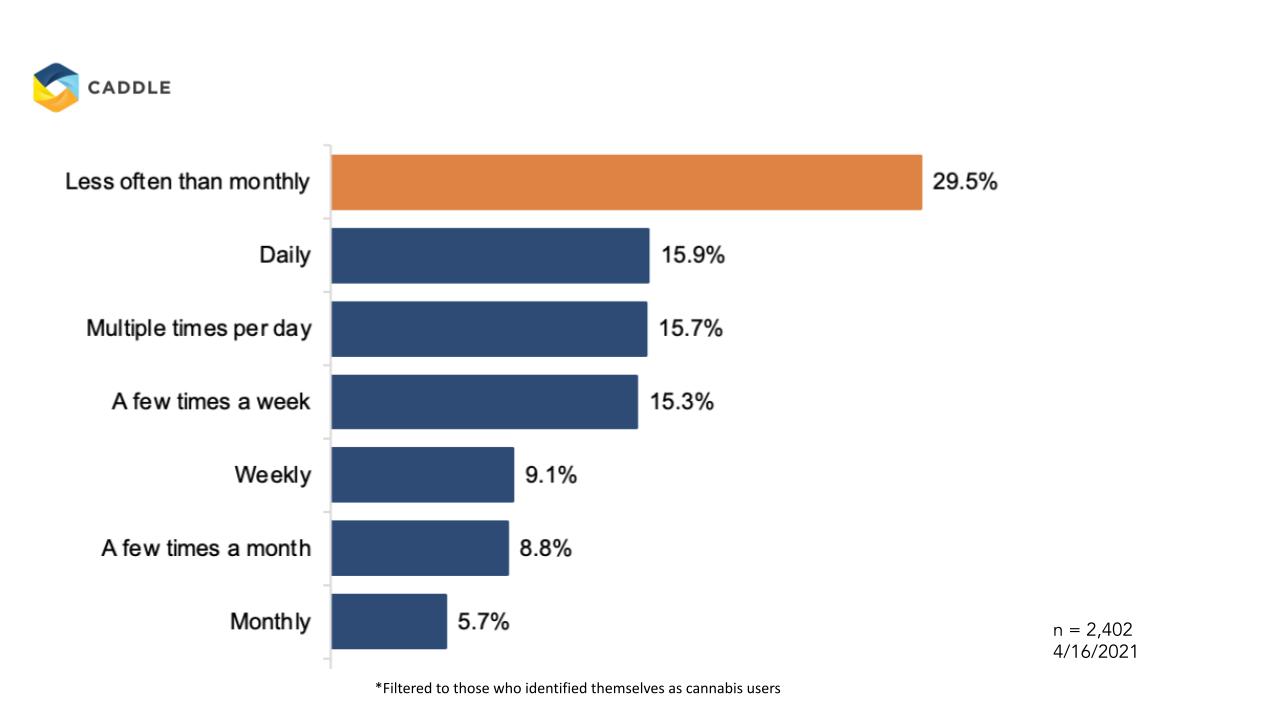

However, if we look at the data at those who do use cannabis, there is a clear picture that emerges when it comes to familiarity, usage, and participation in the celebration of cannabis.

Caddle found that of the Canadians who use cannabis, 56% use cannabis at minimum on a weekly basis, if not daily.

If we look further, we find that younger generations are more likely to use cannabis more frequently. When we look at gender differences, men are 11 basis points higher than women when we look at consumers who are daily to weekly users (61% vs. 52% respectively).

Why may this be the case? Younger generations are potentially more educated on cannabis and its medicinal and recreational uses. Millennials and Gen Z could also be more receptive to normalizing cannabis use, especially after its legalization in 2018. As for the gender differences, we can possibly look to the different societal pressures that may be put on men vs. women when it comes to cannabis use, and the possible stigmatization that is still present surrounding cannabis users.

Celebrating 420 Amidst COVID-19

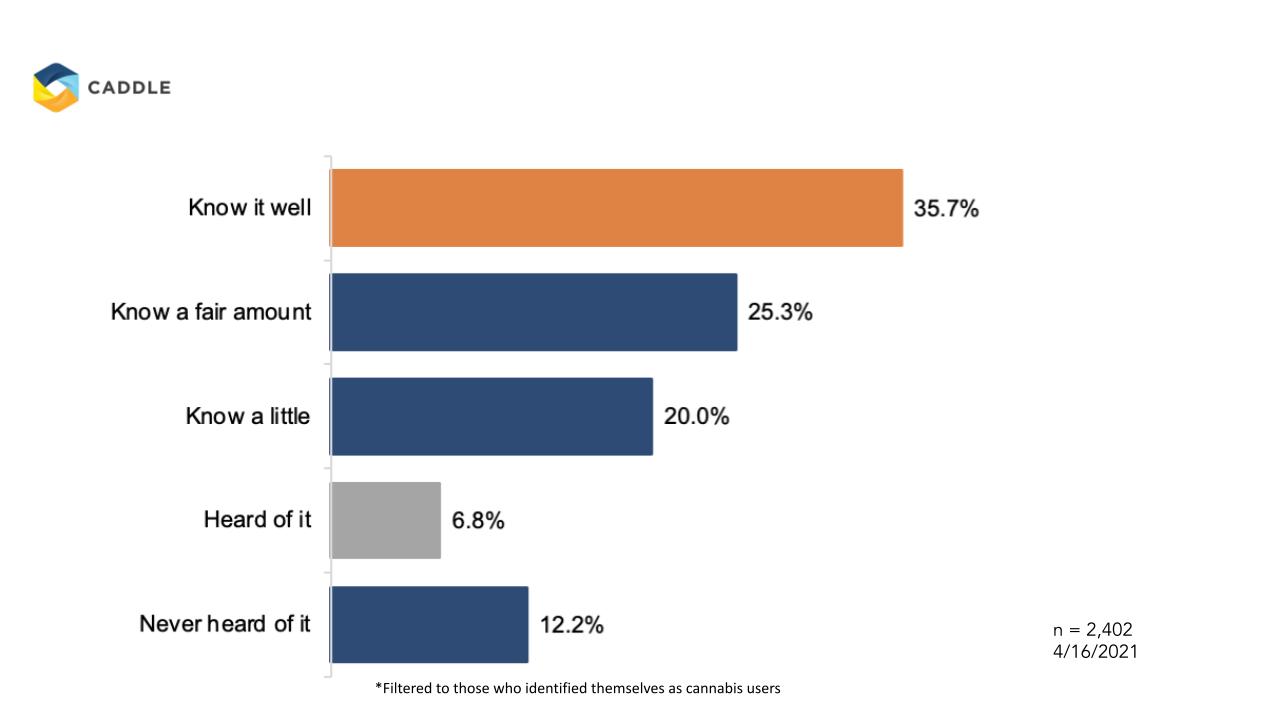

When it comes to celebrating cannabis, around 61% of Canadians who use cannabis are familiar with 420, and their reasons for participating may surprise you.

How familiar are you with 420?

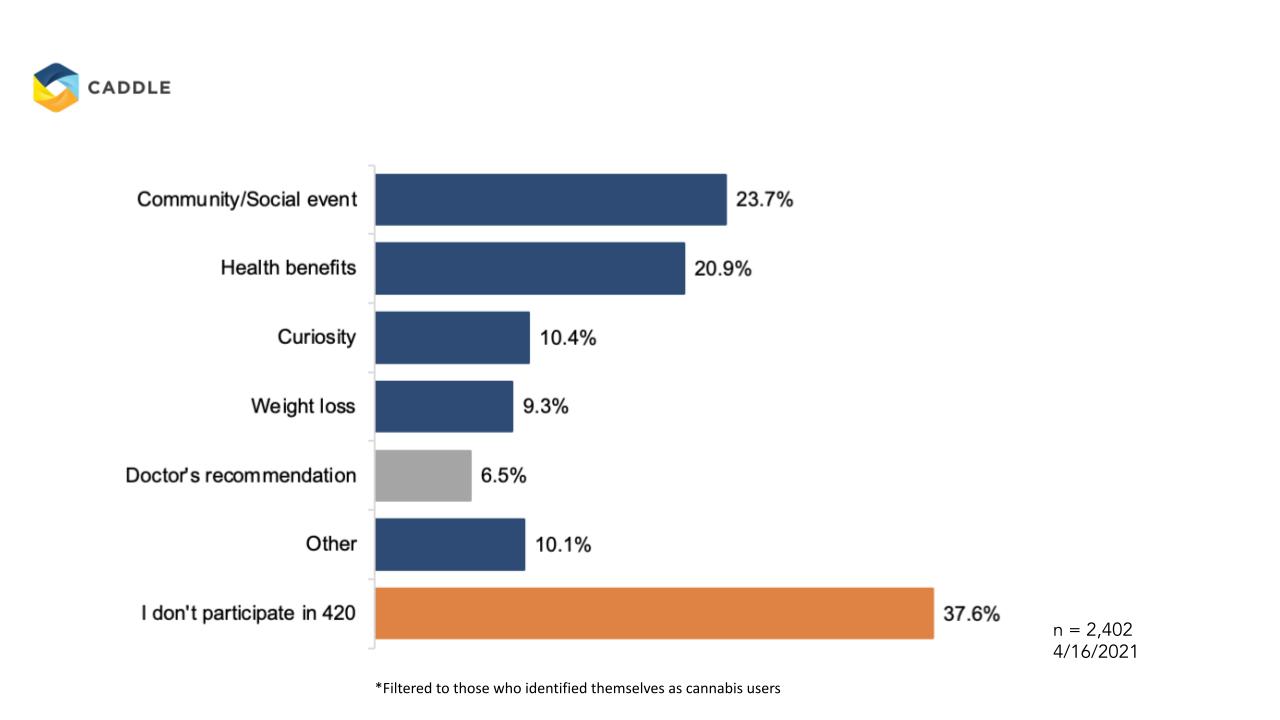

Why do you participate in 420? (select all)

The top reason for participating in 420 is its sense of community. Next is cannabis’ associated health benefits, followed by curiosity.

Key Takeaways

No.1 |

Consumers continue to show increasing interest in cannabis products. This is especially true among Millennials and Gen Z, and men.

No.2 |

Over 60% of Canadians who use cannabis are familiar with 420, and the top 3 reasons for participating are a sense of community, health benefits, and curiosity.

No.3 |

Over half of cannabis users are using cannabis products at minimum on a weekly basis. This signals to cannabis brands that these products are becoming a habitual part of consumers’ routines, indicating strong potential to cultivate loyal customers in the cannabis market.

Want to learn more about the Canadian cannabis industry? Caddle put out a full report on how brands can Cultivate Success in the Canadian Cannabis Business. Want specific data points on the Cannabis market? Get in touch.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle insights? Sign up to our mailing list below!

Contact Us

Is Online Learning Over-Hyped?

It may just be the future of education

Published on April 13, 2021

Since the start of the pandemic, Canadians have been turning to a multitude of hobbies to keep themselves busy while stuck at home. We saw demand skyrocket for home gardening, DIY projects, and at-home fitness regimes. Besides exercising and DIY home makeovers, many of us also took up online learning to find new interests and sharpen existing skills. According to Forbes, even before the pandemic, Research and Markets forecasts the online education market as $350 Billion by 2025:

“[Online learning platforms] such as Udemy, Coursera, Lynda, Skillshare, Udacity serve millions of people…Top tier universities are also democratizing the learning by making courses accessible via online. Stanford University and Harvard University give access to online courses under categories of computer science, engineering, mathematics, business, art, and personal development. These all show one thing, there’s a huge demand from people to learn online.”

With COVID-19 accelerating the need for accessible and quality online education, Caddle asks: What is all the fuss about online learning?

We asked Caddle’s Daily Active Panel of over 8,500 Canadians in March:

How familiar are you with online learning?

52% of respondents said they are familiar with online learning. Is this lower than you may expect?

A possible explanation for this is that between generations, there are big differences with how they view online learning. For example, when we look at Generation Z, they are almost 5 times more likely than Baby Boomers to be familiar with the concept of online learning.

For the next few data points, let’s look at Millennials and Baby Boomers in specific.

When it comes to learning, Millennials say online is as valuable as traditional education.

Based on your experience, how likely are you to recommend online learning to others?

When we look at the general population, about half of the respondents rate their likelihood of recommending online learning as a 5 (Extremely likely) or 4 (Very likely)

However, when we examine Millennials and Baby Boomers, there are clear generational differences between Millennials and Baby Boomers on the topic of learning online. Millennials are twice as likely as Baby Boomers to be extremely likely to recommend online learning to others. Millennials are almost twice as likely as Baby Boomers to feel very positively about online learning. Finally, Millennials are 10% more likely than Baby Boomers to believe that online learning provides the same value as traditional education.

What does this tell us?

This means younger generations – in this case Millennials – are more likely to be advocates for online learning. More broadly, this translates to a possible shift in the education sector as a whole as more and more young Canadians look towards unconventional channels to further their education journey, off campus.

Full-time job training or side hustle advancements?

So, what are Canadians taking these online courses for? Well, about 43% of respondents take online courses to stay updated in their work/profession. While about 3 in 10 respondents take online courses for reasons attached to their side hustle/hobby.

How do you feel about this statement: “I take online courses for continuous learning purposes”?

How do you feel about the statement: “I take online courses for my side hustle/hobby”?

Again, we see stronger indications from younger generations that they are eager to advance their side hustles and hobbies through online learning. Caddle found that Generation Z are almost four times more likely than Baby Boomers to take online courses for their side hustle/hobby.

Key takeaways

No.1 |

Younger generations – in this case Millennials – are more likely to be advocates for online learning.

No.2 |

Gen Z are 4X more likely to take online courses for side hustles/hobbies when compared to Baby Boomers.

No.3 |

The possible shift in the education sector as a whole is imminent, as more and more young Canadians look towards unconventional channels to further their education journey, off campus.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle insights? Sign up to our mailing list below!

Mystery of the Home Buying Process

How it works now, and how it’s changing

Published on April 6, 2021

According to the The Canadian Real Estate Association, the Canadian housing markets set records again in February this year. Home sales climbed 6.6% between January and February 2021 to set another new all-time record. With average house prices surpassing the $600,000 mark, Costa Poulopoulos, Chair of the Canadian Real Estate Association (CREA), declares:

“It’s official, despite all the challenges, 2020 was a record year for Canadian resale housing activity.”

From Statista, house sales in Canada are expected to increase to over 583,600 in 2021, compared with the 2019 figure of 489,873. With growing demand in the housing market across the nation, are Canadians seeking out more education on the home buying process?

Caddle wondered how financially literate new and experienced home buyers are when it comes to home mortgages, and the results may surprise you.

Transparency is lacking in the market to educate Canadians.

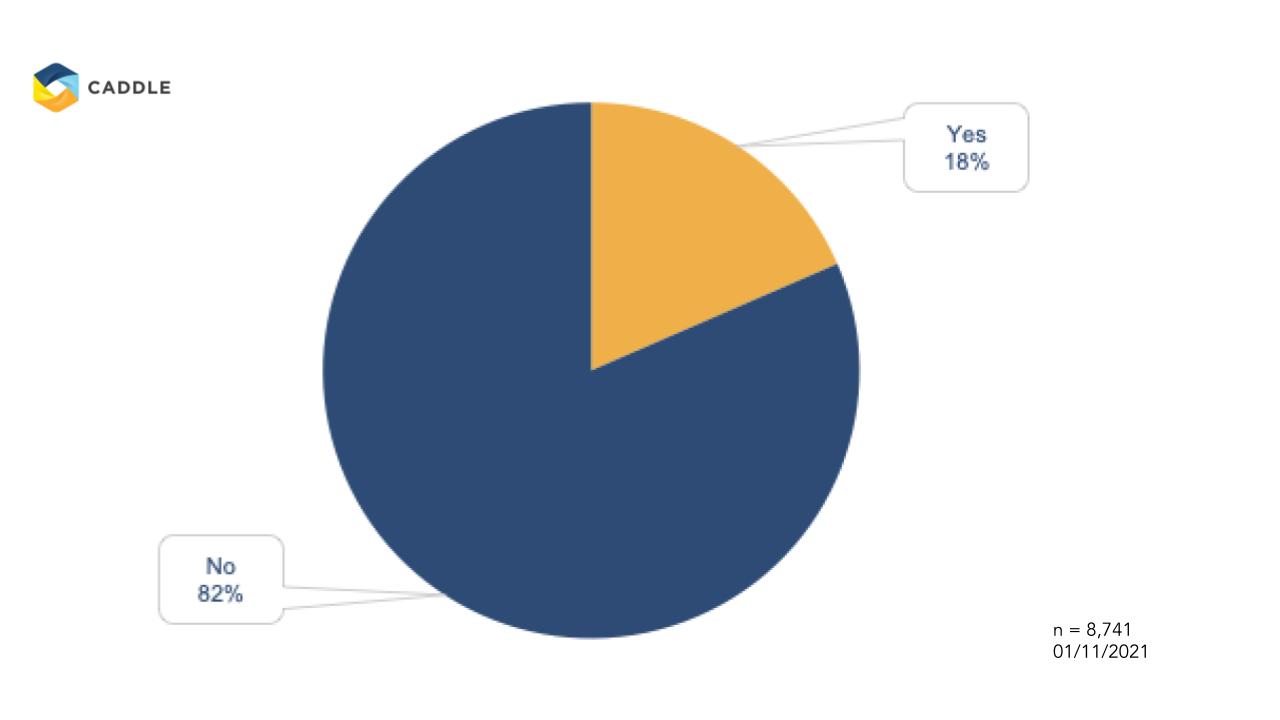

Caddle found out more than 80% of Canadians don’t know how much a mortgage broker makes for processing a mortgage.

Did you know brokers make an average of 0.8% of the mortgage size for facilitating a mortgage application?

This suggests that transparency is severely lacking when it comes to the costs associated with getting a mortgage. Financial literacy will help Canadians to be more aware of this. By increasing transparency in the home buying process, home buyers will have a clearer understanding of their options of how to apply for their next loan. This financial education will help them save more money for the future. There is huge potential to educate Canadians on all the costs, features and benefits of mortgages. This will help them understand what they are getting into, as results clearly show that many have little awareness as we are a trusting society.

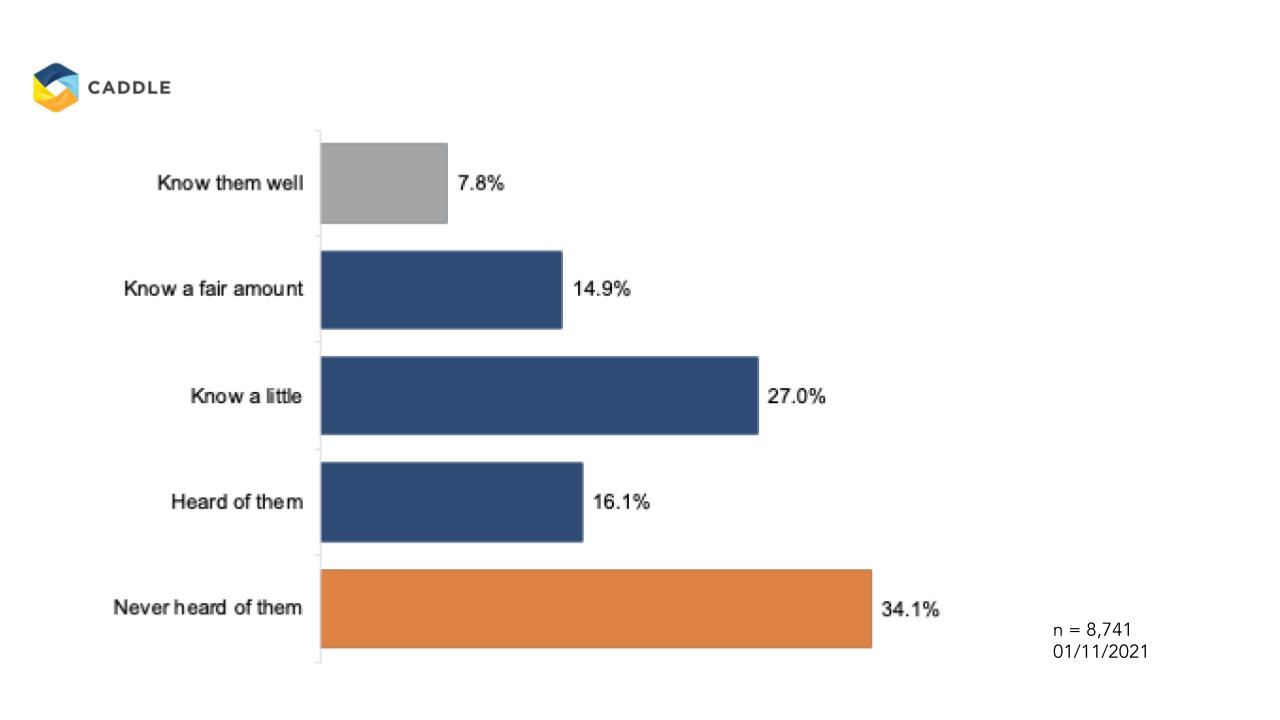

How familiar are you with breakage fees in mortgage products?

Regardless of age, Canadians are open to skip the store visit and apply online for a mortgage.

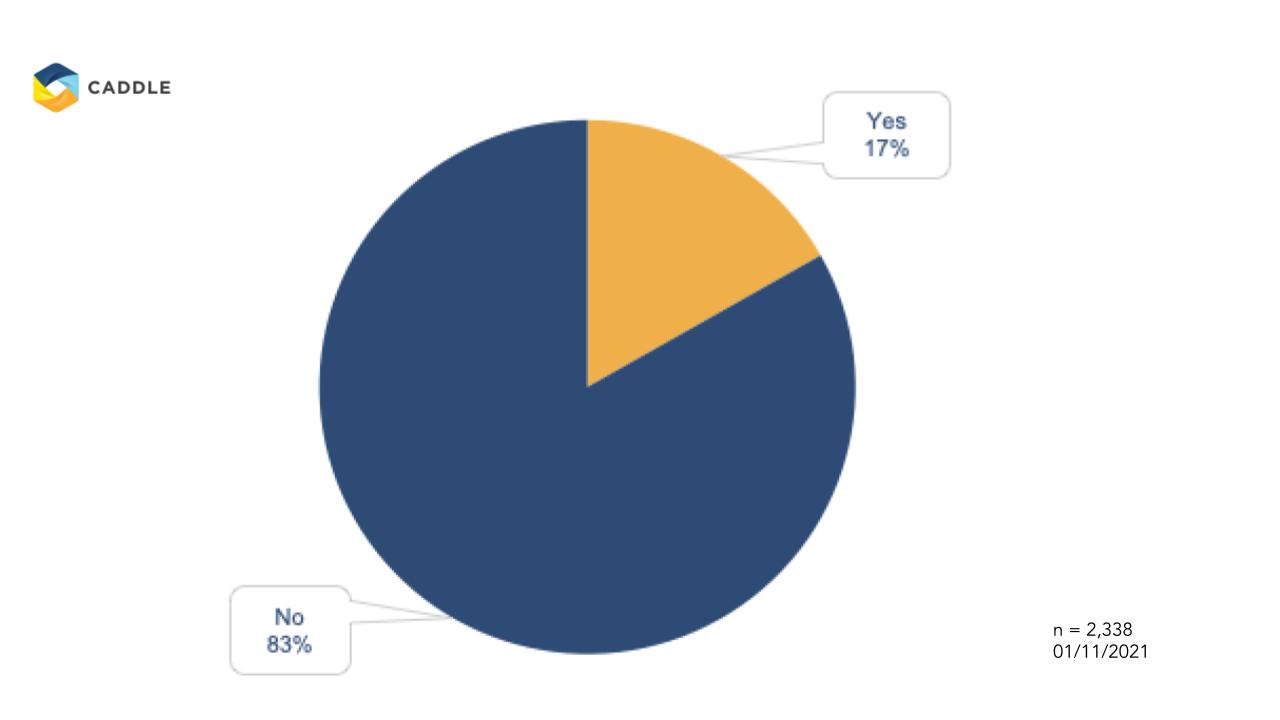

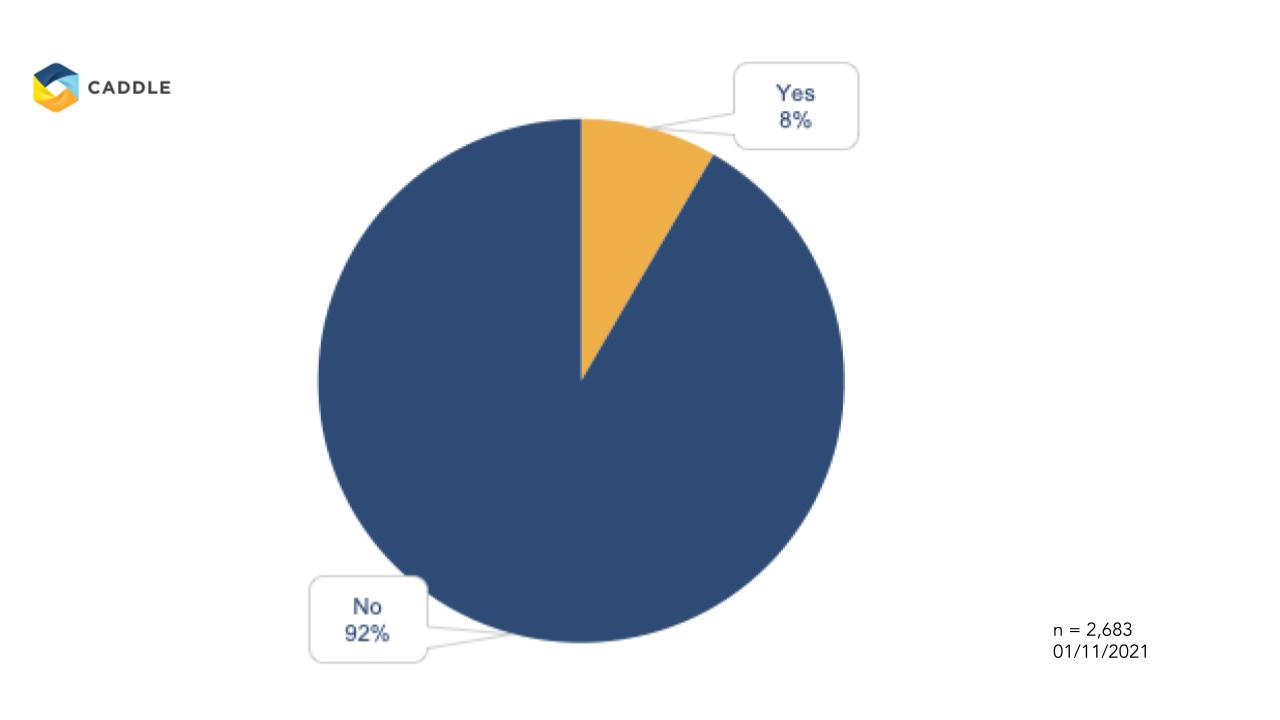

Millennials are the most familiar with online mortgage applications with 17% having applied in the past, compared to 8% of Baby Boomers.

Have you applied for a mortgage online before?

Millennials

Baby Boomers

Younger generations have a need for speed

Interestingly, when it comes to securing a mortgage lender, more Millennials and Gen Z are willing to pay when compared to Baby Boomers to get instant gratification of knowing who can underwrite their mortgage. Millennials and Gen Z over-index around 20 basis points more than Baby Boomers.

Are you willing to pay to find out instantly online which Canadian lenders would accept you for a mortgage?

Generation Z

Millennials

Baby Boomers

Ryan Sharma, CEO of JustCompare, says:

“With the pandemic, digital banking usage in Canada is on the rise. Coupled with the Canadian government exploring the benefits of open banking, Canadian banks will need to improve their transparency, digital user experience, and partnerships with firms like JustCompare.ca. Canadians are looking for impartial, online capabilities, like the ability to search, compare, & apply for personal lending products. This will influence lenders to be more transparent with their product fees and terms in order to remain competitive within the Canadian lending market.”

Key Takeaways

No.1 |

Financial literacy is immensely important and lacking in the mortgage industry for home buyers, existing and new. Companies who can provide more knowledge and transparency to the home buying process will alleviate much of the uncertainty associated with mortgage lending.

No.2 |

Canadians are open to going digital with their home buying journey. No matter who the consumer is, the traditional home buying process may soon be outdated to a more frictionless and transparent journey.

No.3 |

Consumers have never demanded more from companies, and that includes their mortgage lending process as well. Companies who can pivot and meet consumers’ increasing need for convenience and speed will come out on top in the coming years.

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle Insights? Sign up to our email list!

Death of the Third-Party Cookie, Rise of FLoC

Use Caddle to Better Understand Your Audience

Published on March 31, 2021

It’s been in the works for some time, but recent major headlines speak to what the end of Google’s third party cookies mean for marketers and their companies. If you’re not up to speed, Google’s announcement of ending its third-party cookies potentially sets a new industry standard, limiting companies’ abilities to retarget consumers on the web.

“Users are demanding greater privacy–including transparency, choice, and control over how their data is used–and it’s clear the web ecosystem needs to evolve to meet these increasing demands,” says Google.

According to The Drum, Google is gearing up to replace third-party cookies with something called the Federated Learning of Cohorts (FLoC) – a privacy-focused solution intent on delivering relevant ads “by clustering large groups of people with similar interests”. Accounts are anonymized, grouped into interests, and more importantly, user information is processed on-device rather than broadcast across the web. Google will make FLoC-based cohorts available for the public this month. By Q2, advertisers can start testing FLoC-based cohorts in Google Ads.

While many marketers have been preparing for this day for a while, we wanted to find out from Canadians what consumers think about the use of their data for marketing purposes.

Turns out, most consumers are in the know about what data privacy means.

About 4 in 5 of respondents have at least “a little” familiarity with data & privacy laws/regulations.

How familiar are you with data and privacy laws/regulations?

About 74% of respondents believe that Facebook and Google use their data for personalized ads.

Which of the following companies do you believe uses your data for personalized ads? (select all)

Do consumers care about third-party cookies?

While data privacy seems to be on consumers’ minds, there may be an opportunity to educate on the different types of data collection, and what they’re used for. From the Caddle panel, we discovered that while 4 in 5 respondents don’t think that personal data should be used for commercial purposes, approximately 50% of respondents still prefer to see ads online that are relevant to them. This conflicting response suggests that personal data is something consumers are willing to provide if it means seeing more ads relevant to them (personal marketing).

Unsurprisingly, younger generations (Millennials and Generation Z) are less likely than older generations (Baby Boomers) to be against the commercial usage of personal data. Again, this supports the notion that consumers are not opposed to data collection, but merely require better knowledge on the collection process to understand its purpose. And perhaps, companies should start thinking about ways to compensate users for their personal data.

Caddle found out that consumers want to be compensated for their data if companies are collecting it. Only 4.4% of respondents do not seek compensation of any kind for personal data collection from companies.

How would you want to be compensated for sharing your personal data? (select all)

Now at the end of the third-party cookie, the importance of first-party data has never been more pertinent to a company’s success. Caddle’s first-party data has the wealth of insights waiting to be discovered by you and your brand. With Google’s plans to replace third-party data with FLoC, Jed Schneiderman– marketing, media, and tech executive- says that Caddle can help you navigate this new, uncharted territory of FLoC:

“Use Caddle to better understand your audience and then you can make better use of the new cohort way of targeting.”

Key Takeaways

No.1 |

50% of Canadians still prefer to see ads online which are relevant to them, therefore the end of third-party cookies should not equate to the end of personalized marketing for brands.

No.2 |

Consumers are not against personal data collection, but do require better knowledge on the collection process to understand its purpose, and how it brings value to them.

No.3 |

User compensation for personal data collection is looking like a viable strategy for advertisers, with 1 in 3 consumers in favour of sharing data for improved advertising. As we see further proliferation of platform as a service (PaaS) business models, the market for first-party consumer panels will be at the forefront of many industry conversations in the coming years.

No.4 |

Caddle grants access to a first-party audience for marketers to test a multitude of important company-wide considerations including ad creatives, messaging, and consumer profiles. Caddle even offers first party acquisition with rewards!

Interested to learn more about Caddle Capabilities?

Reach out to learn about a free demo!

*Disclaimer: all data presented is owned by CaddleⓇ and has a Margin of Error of 1% or lower.

Want more Caddle Insights? Sign up to our email list!