Caddle Answers: How to take the best picture for receipt approval

Have you been scoring some sweet offers on our platform and are ready to upload your receipt to our app to earn cashback? There are three ways to take pictures for upload, this is how you do it for each option.

First off, make sure you’re taking pictures in a well-lit area and that your receipt is as smooth as possible. Free from folds, creases and wrinkles as much as possible.

Note – It is important that you upload a picture of the whole receipt so we are able to validate your offer.

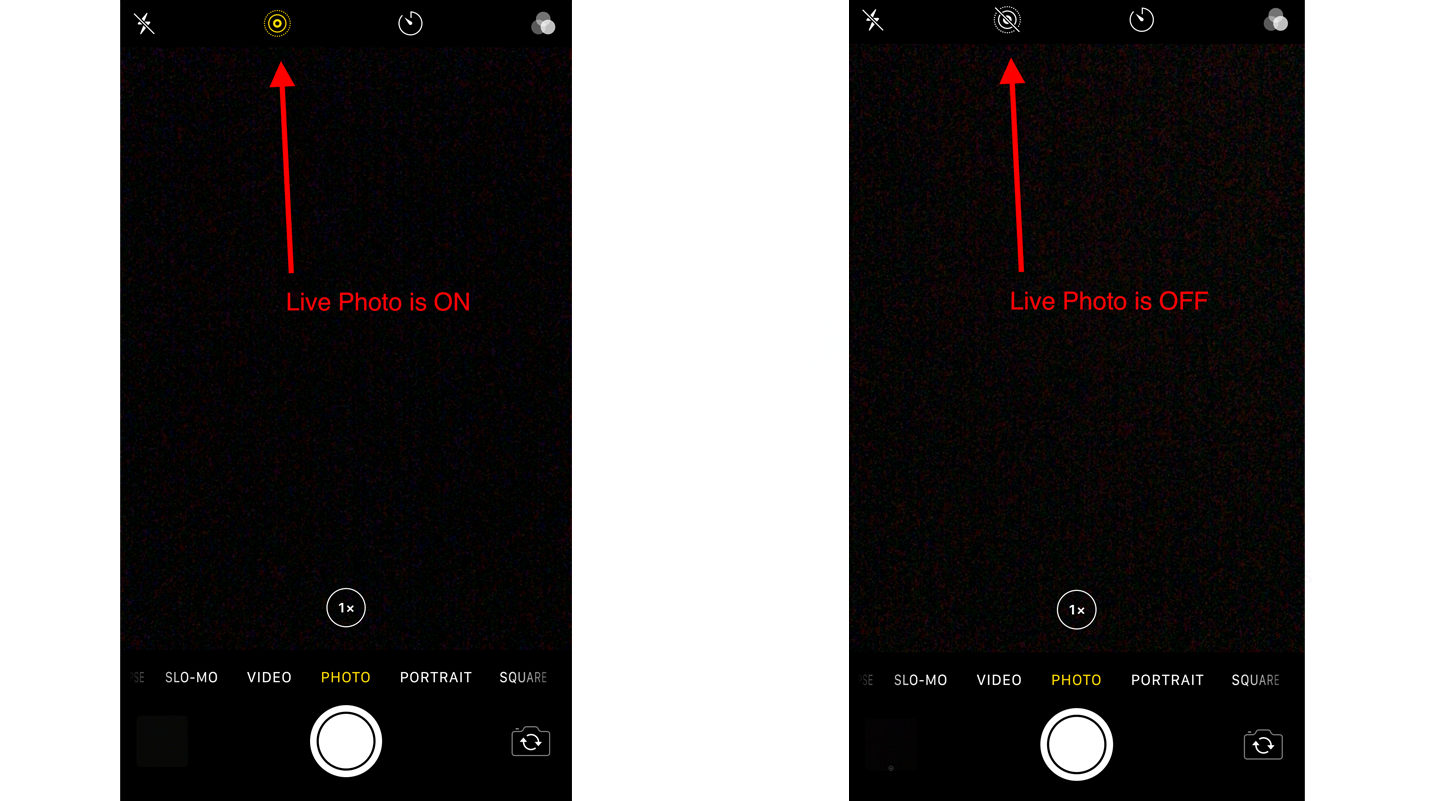

iOS Users – Make sure that Live Photos is turned OFF. Not sure what that is or how to do that? Read all about it here

In-App Camera (Automatic mode): In Automatic mode, our camera is automatically detecting a receipt image. When you want to use the automatic mode, our suggestion is to move slowly and with purpose. Set your receipt up against a dark background in a well-lit area. Hold the phone above the receipt and wait for the camera to highlight the full receipt (on Android devices, it outlines the receipt in white, and on Apple devices it highlights the full receipt in blue). If the highlighted area selects the full receipt, you’re all set! If not, simply select ‘retake’ until you see a clear photo of the full receipt.

In-App Camera (Manual mode): In manual mode, you are able to make sure that your receipt is scaled properly before you take the picture. If your receipt doesn’t fit in all one picture, you can take several pictures of the receipt and upload it to our platform.

Device Camera: You are also able to upload pictures of your receipt that you’ve previously taken on your phone. This option is ideal because once you’ve taken the picture, it stays on your phone until you delete it. This is great in the event you’ve lost or thrown out the original receipt!

Got more questions about how we run things at Caddle?

Great! We love answering your questions. To look for more answers to other questions, you can refer to our FAQ page or take a look through this blog page for more in-depth explanations on how we roll here at Caddle.

Still can’t find what you’re looking for? You can contact us and we’ll get back to you with the answer!

Caddle Answers: What is a Live Photo (iOS)?

Live Photos are a new feature on iPhone devices. These photos are a 3-second moving image that allows you to select the best picture.

While great for selecting the best picture, this feature isn’t so great for uploading pictures of receipts to Caddle.

Since live photos are technically a 3-second video, if you upload your receipt to Caddle as a Live Photo, the image format will be incorrect and we won’t be able to review your receipt.

To turn Live Photo off, tap this icon:

With Live Photo off you can upload pictures of receipts to Caddle with ease!

Got more questions about how we run things at Caddle?

Great! We love answering your questions. To look for more answers to other questions, you can refer to our FAQ page or take a look through this blog page for more in-depth explanations on how we roll here at Caddle.

Still can’t find what you’re looking for? You can contact us and we’ll get back to you with the answer!

Caddle Answers: How long do I have to wait for approval?

Haven’t heard from us in a while and are beginning to wonder when your uploaded offer will be approved? Here is a quick guide on how long our approval process takes!

How long does it take to process receipts?

The quick answer: 72 hours. But there are many factors that can raise or lower the expected approval process. Here are the most common reasons that receipt approval may be delayed.

- Volume of submissions – we love it when our members are excited about our offers. Chances are if you’re interested in redeeming, so are many others. This is great! However, because each upload is reviewed individually when we have high volumes of submissions, our processing times increase.

- Receipts from retailers who do not use UPCs – Universal Product Codes help our automated system breeze through receipts. UPCs make item identification easier for validation. If your receipt upload is from a retailer who does not use UPCs, that upload is pushed to a human reviewer and they just don’t work as quickly as robots!

- Technical issues – these are the worst! If something is going wrong in the app or in our processing system, which might be affecting receipt images and their readability, we are likely a bit behind in our processing and working to catch up.

Got more questions about how we run things at Caddle?

Great! We love answering your questions. To look for more answers to other questions, you can refer to our FAQ page or take a look through this blog page for more in-depth explanations on how we roll here at Caddle.

Still can’t find what you’re looking for? You can contact us and we’ll get back to you with the answer!

Canadian Debt:

Are Canadians struggling with debt?

There is an old, unwritten rule, that goes a little something like this “Don’t talk about your finances with anyone”. Some quotes like this are timeless but I think that this one has run its course. Canadian debt is becoming a serious problem that definitely requires more attention.

Financial education is something that should be widely accepted and embraced by all. According to CBC news, Millennial debt has shown a 12.3% increase since 2018 and sits around $515.9 billion dollars. To make matters even more concerning, its younger counterpart, Gen-X is hovering around $767.4 billion.

Now, this statistic does not happen to consider if this is “good debt” or “bad debt”, which we will cover later, but is still cause for concern. We must start asking ourselves serious questions about how we are spending our money, where we should we invest our money, and pursue a new standard that allows for more openness about our financial situations.

Canadian Debt: You are not alone

Do you feel like you are constantly running away from your credit card statement, mortgage payments, and utility bills? Truth be told, you are not alone. Consider these Canadian statistics for a moment:

- 94% of Canadians agree that the average household has to much debt (Manulife Bank Debt Survey)

- 84% state that getting out of financial debt is their number one priority

- 30% feel that they can’t do things they enjoy because of debt

- 67% of Canadians assume that others are also in debt

- 40% think that they will not become debt free in their life-time

Canadian Debt: Good debt versus bad debt

When we hear the word debt, usually the worst comes to mind. What if I were to tell you that debt can be broken down into two categories: good and bad? A survey with over 8000 respondents, conducted by our team at Caddle, indicated that 54% of our members are only slightly familiar with the concept of bad debt. That being said, let’s analyze the differences.

Good Debt

This form of debt involves taking out a loan or refinancing a property in order to use the equity to invest into something that will ultimately generate income. Good debt includes, but is not limited too, investing in your education, opening a small business, or real estate and homeownership. This type debt is two-fold because as you are making the payments for your loan you are developing a relationship with your financial institution and therefore, increasing the likelihood of getting a larger loan in the future.

Bad Debt

Bad debt is when you borrow money in order to purchase a product or service that will decrease in value instantaneously or over time. Some examples of bad debt include cars, jewellery, clothing, consumables, and credit cards. Not only is the product or service that you have purchased going to decrease immediately, but you will also have to pay interest on the amount spent.

Canadian Debt: Credit Card Debt

With Canadian’s debt statistics on an upward trajectory, it’s important to identify some of the key contributors. With low interest rates, low unemployment, and rising wages, it is uncommon for us to be experiencing this particular issue. The most common culprit when it comes to bad debt is the credit card. Average non-mortgage debt per Canadian citizen is predicted to hit $31,000 by the start of 2020.

Consequently, we are also seeing increases in Canadians carrying credit card balances, in the amount of $4,465 on average. Now, depending on your existing credit card provider you may be able to leverage the benefits and mitigate the risks. Most credit cards come with some sort of rewards incentive to differentiate themselves from the competition. You can make the most out of these rewards if you are diligent and pay your owing balance by the end of each billing cycle. Some of the common credit card benefits include:

- Cash back

- Travel rewards

- No annual fee

- Purchase insurance

- Travel insurance

If you are not aware of your credit card rewards system, go check right now! Most companies incentivize certain purchases such as gas, grocery, or pharmaceutical.

Canadian Debt: Saving Money

Saving is one of the those concepts that sounds and looks easy, but never works out the way you planned. For me, I decided to look back at one of my most recent financial statements and see what I am spending money on. I had over 5 different monthly subscriptions! Why am I paying for Crave, Netflix, and Amazon video? Whether it is our skin care products, coffee, food, streaming services, or web services, we often don’t realize how complacent we become with our spending habits. Let’s dive deeper and look at what Caddle members had to say about savings.

Canadian Debt: Saving... why is it so hard?

The following statistics are a representation of over 8000 Canadians opinions on financial debt and savings.

- Only 28% of members are likely to seek out information about saving money

- 23% state that the cost of living (goods and services) are the main reason why they can’t save money

- 21% state that their regular expenses restrict their ability to save money

- 27% are somewhat likely to consider using a financial savings app to help track and assist with their savings goals

Canadian Debt: Recommendations

Debt is something that can be conquered if you are willing to invest your time and become a diligent record keeper. It is important to utilize the available assets and never be afraid to ask questions. Often, people are intimidated by advisors and have preconceived notions about the amount of money required to begin saving and get out of debt. As someone who is currently working in the financial industry no amount is too little to begin saving. There is no better time than now to evaluate your financial future. Get started by using some of the tips provided below:

- Use the Caddle app to earn cash back and save on your monthly expenses, obviously 😉

- Use financial apps like Mylo in order to save the additional change on every purchase

- Talk to your financial advisor or do some window shopping (make sure you are getting the best services on the market)

- Ask questions about your credit card and rewards programs (check out this list: best credit card Canada)

- Look into debt consolidation if you owe money to multiple institutions

- Open a High Interest Savings Account (HISA), Tax Free Savings Account (TFSA), and a Registered Retirement Savings Plan (RRSP)

Good luck with your savings and remember to answer those surveys to help create awareness about topics that interest you. They can help promote product changes and influence brands to provide you with more of the services you desire.

More About Caddle

Thanks for reading our blog post! If this is your first time on our webpage you may be wondering who we are and what we do?

Caddle is a data insights company that has a passion for understanding market trends. This information is then translated to the market industry leaders for the benefit of understanding the buying behaviours of their consumers. We keep our finger on the pulse of Canadians with over 8000 daily survey respondents and 300,000 monthly app users. Contact us for more information and resources.

Friends Reboot: Will the anticipated reboot arrive?

Are you a fan of the television hit series ‘Friends ’?

What if the cast got together for a reboot – would you watch it?

The hit show that we came to know and love during the late ’90s and early 2000s was a show that broke television records. With an average rating of 23 million views per episode, the Friends cast began earning close to $1,000,000 per episode in their final three seasons.

Given these astonishing statistics, a recent study gathered some insights to provide additional staggering results to determine the interest in a Friends reboot.

With the ability to binge-watch our favourite television shows, the team at Caddle conducted a survey with nearly 10,000 responses to determine the interest in watching a Friends reboot, and which platform they’d prefer to watch it on.

Here’s what we learned:

- 62% of respondents are interested in watching a Friends reboot

- 57% showed a preferred interest in watching the reboot on a streaming service (e.g., Netflix)

- 20% felt that the reboot would be almost as good as the original

- 43% felt that the reboot would be just as good as the original. This segment of respondents is over-indexed.

- Millennial viewers showed the highest interest in a Friends reboot

- 57% of Millennials showed an interest in a Friends reboot

- 52% of Gez Z respondents showed an interest in a Friends reboot

- 49% of Gen X respondents showed an interest in a friends reboot

- 42% of Baby Boomers showed an interest in a Friends reboot

Viewers have been demanding a Friends reboot for years but haven’t seen any success in getting one. While this may not encourage a reboot, this provides insight into the potential profitability the series could have in the industry if a reboot was decided.

Would you be interested in a Friends reboot? Would you like to learn more from this report? Let us know your thoughts or request a report download in this form!

Black Friday & Cyber Monday: Earn Money While Spending

The Exclusive Handbook for Canadians

Black Friday and Cyber Monday Canada

The long-awaited and long-anticipated Black Friday deals are just around the corner. We know that you are starting to gather some holiday gift ideas or maybe you are planning on treating yourself to some new electronics this year.

You are one of the many consumers who plan on participating in holiday shopping this year. According to CNBC, the average consumer is looking to spend at least $1300 this holiday shopping season!

In the past, Black Friday has definitely got out of control. We have all seen the YouTube clips of shoppers fighting over the last TV or bursting through the doors as stores open as early as 7:000 a.m. However, things are changing in the digital age, and this may be for the better.

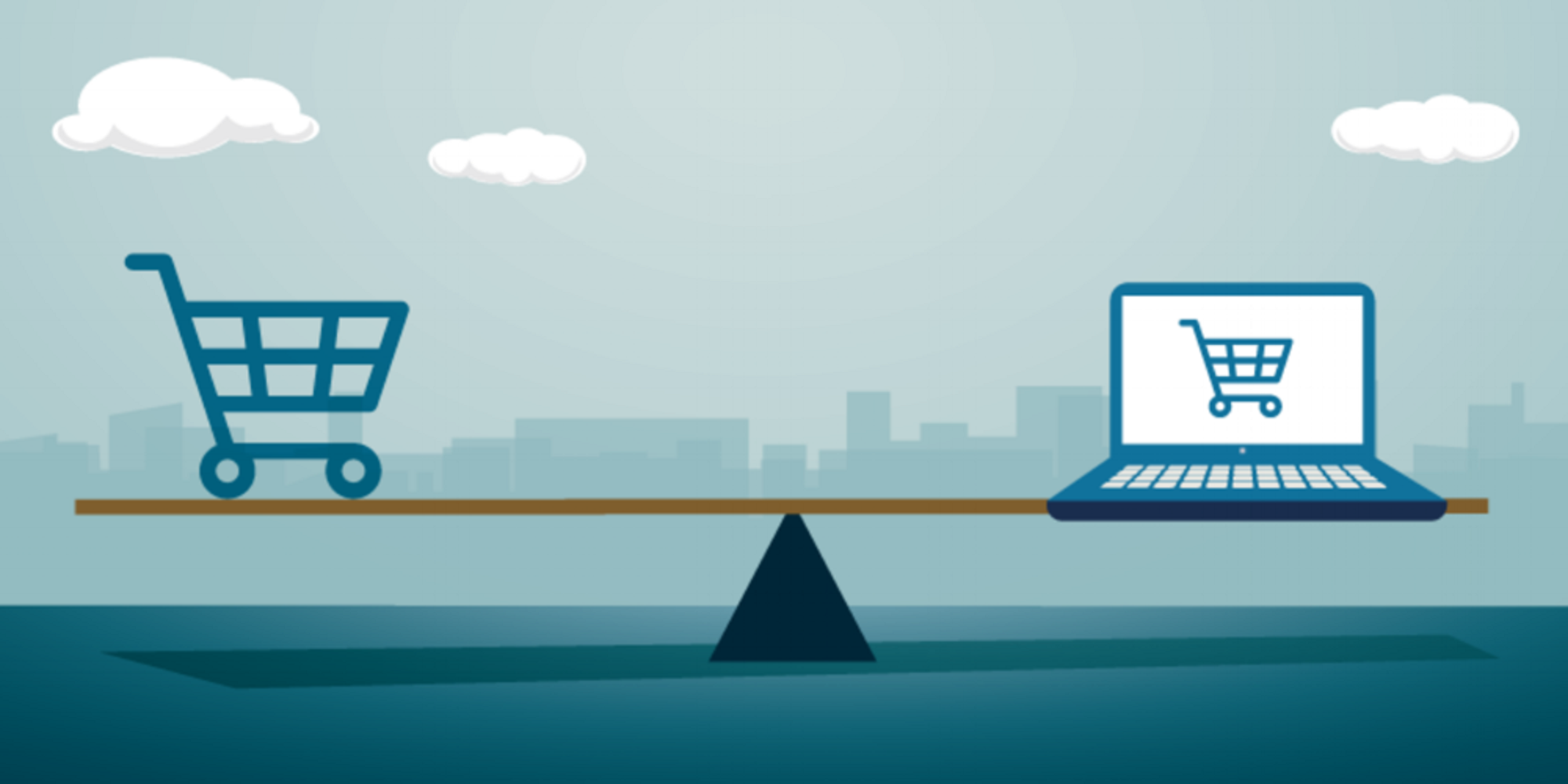

Black Friday is beginning to face some new competition from its younger sibling, Cyber Monday, which is predicted to generate approximately 10 billion dollars in 2019. A healthy amount of competition may drive prices even lower.

We also see deals starting earlier and running later as the competitive climate begins to boil for Canadian retailers. Between Boxing day, Cyber Monday, and Black Friday your head might start to spin.

When is Black Friday and Cyber Monday in Canada?

Black Friday deals may have already been activated depending on the retailer and the type of product that you are searching for. The traditional date that is associated with this shopping holiday is November 29th. Usually, there are additional, exclusive promotions that are announced on this day.

Retailers such as Amazon, Best Buy, Walmart, Canadian Tire, Chapters, Costco and Ikea, are already promoting their Black Friday deals. According to Business Insider, in-store Black Friday discounts often outweigh the online offerings. It is also recommended that you purchase “big-ticket items” on Black Friday as opposed to Cyber Monday.

Black Friday Purchases

- TV’s

- Laptops

- Video game consoles

- Furniture and appliances

- Travel (hotels, flights, all-inclusive packages)

If at first you don’t succeed try, try again. If a product sells out, or you couldn’t make it to the store because of work, or you simply can’t justify the existing price, you have a second opportunity to get those items on your wish list.

Cyber Monday lasts 24 hours starting December 2nd and has been deemed as the best time to purchase tech products, especially niche gadgets. Some of the early discounts that have already been released are listed below.

Cyber Monday Purchases

- Wireless earphones

- Smart speakers, watches, and appliances

- Security systems

- Phones and tablets

- Clothing and accessories

Black Friday and Cyber Monday: Caddle Members

In order for us to give you the best advice and deals at Caddle we wanted to know how you plan on purchasing your products this holiday shopping season.

We conducted two surveys 1) Black Friday and 2) Cyber Monday, to see if our members are going to take advantage of the huge savings. The average number of respondents was 8,350 and the majority of the members ranged between the ages of 27 and 36.

Member Responses

Black Friday:

- 68% of members are interested in participating and shopping on Black Friday

- 56% of members are going to use their credit card to make purchases

- When asked if Black Friday was better than Cyber Monday over half of the members felt neutral (indifferent)

Cyber Monday:

- 57% are interested in Cyber Monday and 32% of members plan on participating

- 66% of members make purchases online

- 35% stated that they are going to browse the deals

- 45% of our members feel that online shopping is safe and secure

Consider these two tips:

- If you are paying with a credit card make sure you are receiving cash back or travel rewards points. Make money while spending money.

- If you are making online purchases ensure that your payment method is secured, keep a record of your transaction number, and see what fraud policy your bank offers.

Black Friday & Cyber Monday: Price Matching

Trust me, I’m not talking about that person at the grocery store who says “I know I have a coupon for that somewhere”. Price matching has become easier than ever with the help of our smartphones!

Most stores are beginning to offer a low price match guarantee in order to keep your business and decrease the number of product returns. Not to mention the accessibility of receipt uploading, browsing digital store flyers, creating a digital wish list or shopping cart, viewing promotions, registering for email lists, and coupon apps (yours truly, Caddle) that are all available at the touch of a button.

Institutions such as Meridian Credit Union have also implemented a new system called price drop. You upload your receipt and the app will notify you about any price adjustments and deposit the difference right into your bank account.

Black Friday & Cyber Monday: Online Versus In-Store

So you might be wondering, what platform is going to offer the best deals. The fact of the matter is that it’s actually quite subjective and product-specific. An article by Time Trade indicates that:

“The bottom line is customers value the personal experience of the physical store,” said Gary Ambrosino, CEO of TimeTrade. “We found that shoppers have done their shopping or discovery online, then go into the store to get help with their final purchase decision.”

Some products are just better to purchase in-store, especially when it comes to customizable products. Let’s be honest, when you purchase a tech gadget online you know what you’re going to get, the equipment is relatively standardized.

On the other hand, if you are purchasing a mattress you probably want to test out the comfort level, look at the size, and ask some specific questions.

If you do purchase online just make sure that you are able to return the product if it doesn’t satisfy your needs. Some retailers will charge you an additional shipping expense when you return the product, so it’s important to keep that in mind.

Lastly, there is no exact formula that determines which method leads to more cost savings but shopping online does have its perks. It will certainly provide you with more product selection, increased availability, and convenient shipping.

Get a Competitive Edge

Now that you are fully informed about Cyber Monday and Black Friday here are some tips to stay up to date with the deals:

- Subscribe to email newsletters

- Abandon your cart

- Look for updates on social media

- Use coupon apps

- Read the reviews

About Caddle

Thanks for reading our blog post! If this is your first time on our webpage you may be wondering who we are and what we do?

Caddle is a data insights company that has a passion for understanding market trends which can be translated to the market industry leaders for the benefit of understanding the buying behaviours of their consumers.

Click this link to find out more and earn some cash back from our surveys!

[simple-author-box]

The Canadian Food Guide: No longer a prescription diet

The push towards a plant based diet

Canada’s Food Guide

We are constantly changing the way that we are eating. It could be because of something you read in a weight loss magazine, heard through the grapevine, or maybe even a new trending diet on Instagram. In today’s technological era it’s tough to determine what’s authentic and what’s just straight-up fake. One resource that you can trust has just presented us with a new guide to healthy living. Enter – the new and improved Canadian food guide!

It’s getting three cheers from some and eye rolls from others.

Canada’s Food Guide: So what has changed?

It is no surprise that the Canadian food guide has seen its fair share of changes since its publication in 1942. That being said, the guide has been in a 12-year hiatus and Canadians are eager to see what changes are being made.

The process has so far taken three years, with Health Canada hiring various market research companies to consult with more than 26,000 Canadians. Health Canada has also held briefing sessions with various health associations and industry groups. – CBC News

As Canadians, we rely on the national food guide to decrease the number of nutritional deficiencies and increase overall health. In the past, it has provided us with portions sizes, food groups, cooking tips, and scientific research. It helps us ensure that our loved ones live long and healthy lives. We can see that the updated guide is exploring a new direction that reinforces a vegetarian style diet (plant based) and kicks the food groups to the curb.

That being said, the food guide is a one size fits all approach. It may not be considering your personal deficiencies, body type, lifestyle choice(s), and you should use it as a reference when planning meals. The best course of action is to consult a nutritionist or specialist before making significant changes to your own diet.

Here are the changes that we have identified

- More focus on a plant-based diet(s)

- Dairy and meat are being pushed out

- No more four food groups

- Eat more fruits and vegetables

- No more portion sizes

- Increase your water consumption

- Food philosophy (eating together)

Canada’s Food Guide: Time to take action

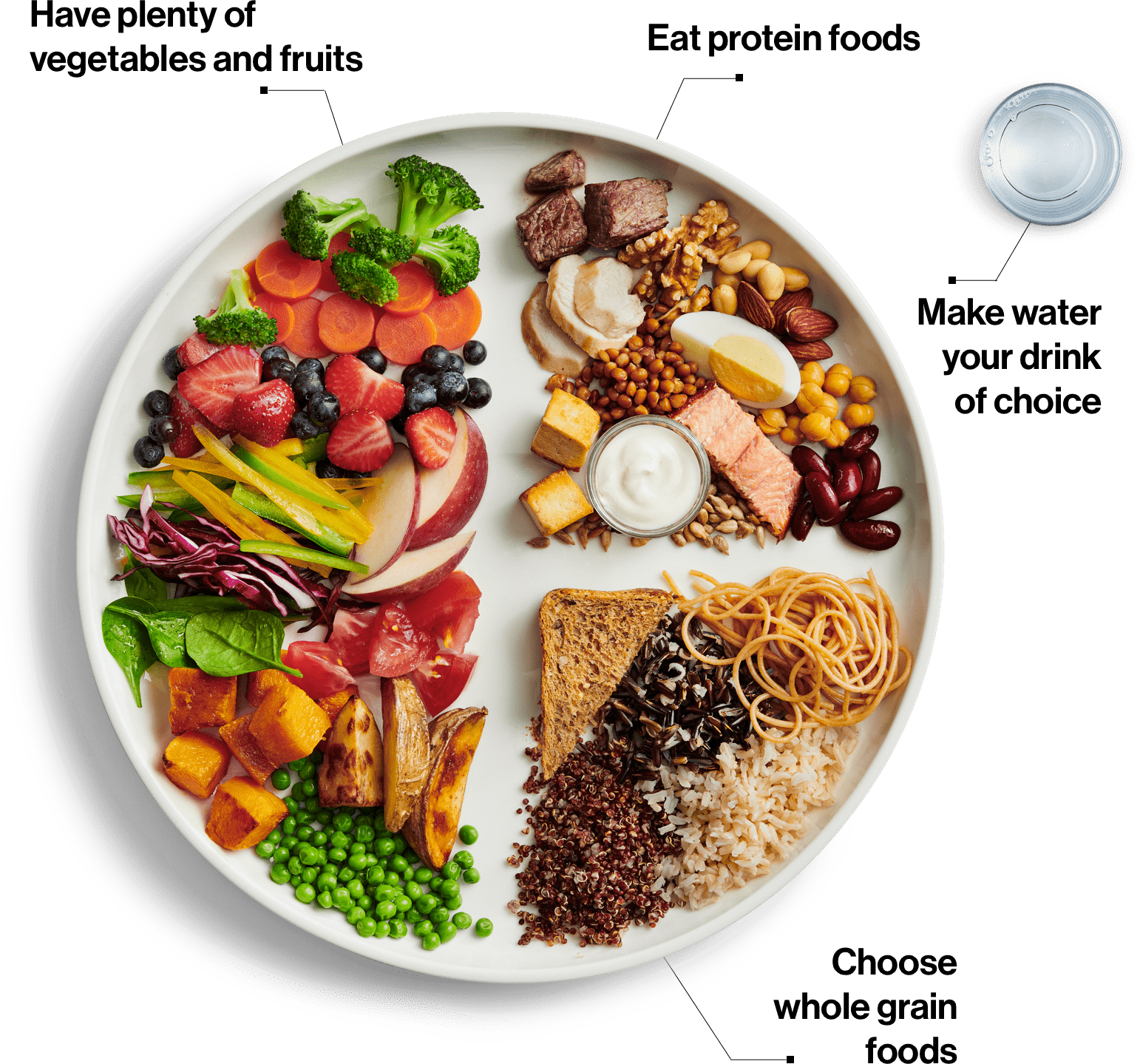

The new food guide image conveys a simple message according to Health Canada: Eat a diet made up of roughly half fruits and vegetables, and half of the remaining two categories — easy as that.

“It doesn’t need to be complicated folks,” Petitpas Taylor said. “It just needs to be nutritious, and, might I dare say, fun.”

However, the overall simplicity of the new guide is still receiving mixed reviews and skepticism.

If we look back at the previous prescription approach it was unachievable and quite frankly, directed towards children (you remember the four food groups rainbow in elementary school). The new food guide has simplistic yet powerful imagery that encourages people to make realistic changes to live their best life.

We can now say goodbye to the recommendations to eat a specific number of serving sizes across each of the food groups. Gone is information about what makes up a serving size for different types of food. Let’s be honest, did you ever weigh, scale, and categorize your foods so that you ate the prescribed amount of food for each food group? Of course not, nobody has the time for that!

Dairy Products: So long milk, it was good while it lasted

Milk, for as long as we can remember, has always been a staple of the Canadian diet. Its nutritional benefits were linked to bone and dental health, diabetes prevention, and heart health.

As the times are changing we are entering a new era of healthy eating and health professionals are putting dairy under the microscope. Not just milk is under scrutiny, its the entire dairy category! That includes items such as cheese, cream, butter, yogurt, and ice cream, just to name a few.

Many people are disgruntled with the removal of dairy as an independent category. It has been placed into another category that we can agree may be less visual, but it’s still a part of the food guide. It has become a misconception that dairy is deemed “unhealthy”. Dairy products still offer a variety of different benefits but the traditional dosage or “3 pints per day” is just unnecessary. To follow suite, dairy consumption/sales have also been decreasing for the last 10 years according to the government of Canada.

Dairy Products: The alternatives are getting more attention

For those of you that love dairy you are in luck. A variety of alternatives are at your disposal that are extremely competitive with cows milk when it comes to nutrients, fats, and calcium. If you are intolerant and allergic to cows milk you can still consume some of the alternatives (almond milk). You may have already identified the significant changes happening in the United Kingdom. Non-dairy sales were three times bigger than dairy sales at Whole Foods Market in the UK this year (2019). This means that dairy is not completely disappearing but consumers are focusing their attention on many other alternative forms.

- Almond milk

- Soy milk

- Coconut milk

- Rice milk

- Oat milk

Depending on which alternative fits your lifestyle, you may be able to decrease costs by making it at home and, therefore, decrease damaging environmental impacts while maintaining sufficient nutrient intake.

Milk Nutrition: What are Caddle members saying about milk?

You spoke up about milk consumption and the changes to the Canadian food guide. The majority of our respondents were millennials (in their 30’s) and from Ontario. Here is what we gathered:

- Out of the 92% that consume dairy, 62% disagree with the new food guide

- Large percentage of the respondents had small children at home (increased milk consumption)

- 50% consume milk for the taste and 43% said that they consume milk for its nutritional value

- 73% of members said they didn’t consult anyone about their dairy consumption

Dairy Products: Decreased consumption comes at a price

Changes that have been made to the Canadian food guide have outraged dairy farmers and rightfully so. Milk has been removed as an independent category and grouped into proteins. With milk consumption decreasing in general, it’s worrisome for stakeholders in the dairy industry.

The Canadian government places significantly high tariffs on importing milk into Canada. This is preventative measure attempts to decrease the market saturation of American products and protect local dairy farmers.

“The Canadian dairy industry is a key driver of our national economy and represents one of the largest agri-food industries in the country,” said Wally Smith, President of Dairy Farmers of Canada.

Canada’s dairy industry brings in about 20 billion in GDP, 3 billion in tax contributions and over 200,000 full-time jobs. The question that we have to ask ourselves as consumers is, are we willing to ignore new research findings in order to support the dairy industry?

Did you say a Plant Based Diet?

Some of you are wondering, what is a plant based diet? Others might be thinking how can this diet be sustainable long term?

No, a plant based diet doesn’t mean that you have to go into your fridge or freezer right now and get rid of that steak or chicken.

It means that you should consciously prioritize fruits, vegetables, nuts, grains, legumes, beans, seeds, and oils. Aside from the array of health benefits that are associated with this diet it also comes with environmental sustainability.

When switching to a plant based diet it comes with a bit of homework. You need to understand what nutrients you receive from the foods you plan on giving up and ensure that you are receiving the equivalent in the foods you plan on consuming.

The best way to get started is just allocating one day of the week to strictly eat plant based foods. Following food guides or industry professionals online to get the best recipes and up to date information doesn’t hurt either. Check out the example!

Plant Based Diet Example:

Breakfast: Breakfast wrap with whole grain tortilla, scrambled egg(s), black beans, peppers, onions, and your choice of sauce.

Lunch: Mediterranean salad with fresh lettuce, cucumbers, chick peas, lentils, goat cheese, avocado, and dressing.

Dinner: Grilled veggie kabobs with green and red peppers, grilled tofu, spinach salad, and zucchini.

Canada’s Food Guide: What you should takeaway from the changes

Canada’s updated food guide has retired the traditional rainbow and four food groups in order to appeal to a wider audience. It has demoted meat and dairy by placing them into categories with a wider range of proteins.

The new food guide accurately reflects the existing research about human anatomy and healthy living, while limiting the biased input from special interest parities.

Some of the main reasons people are cutting milk are connected to the environment, health, and ethics (religious beliefs). If you want to keep milk as apart of your daily routine consider the array of different alternatives that offer great taste, nutritional benefits, and no environmental impact.

This food guide does not spoon feed you like it has in the past. It requires you to take action by showing you what your plate should look like when you sit down to have a meal. It is apart of Canadian culture to cook, talk, laugh, and eat together.

It’s time to put down the processed food that have become so accessible and convenient. We should give the new food guide a chance and see if it can have a positive impact on society and our wellbeing.

About Caddle

Thanks for reading our blog post! If this is your first time on our webpage you may be wondering who we are and what we do?

Caddle is a data insights company that has a passion for understanding market trends which can be translated to the market industry leaders for the benefit of understanding the buying behaviors of their consumers.

Click this link to find out more and earn some cash back from our surveys!

[simple-author-box]

Fintech: 3 reasons why you didn’t like online banking

Fintech: Online Banking Adoption Rate

Online banking has seen tremendous growth and success in the Canadian market with an approximate 50% penetration rate. These numbers are constantly climbing and we could expect higher rates every year as the services become more user-friendly.

Online banking awareness is at an all-time high with 96% of people stating that they have at least heard about the services that are provided such as e-transfer, paying bills, depositing cheques and more.

Fintech can act as an extension for the existing physical spaces. For example, you could complete simple, mundane tasks online while using the available in-branch services to make more complex decisions

That being said, with the banking industry still shifting its focus from brick and mortar operations to digital servicing, it’s important to us at Caddle to determine what suggestions you would make to optimize this technology.

We got to hear from you!

Some of you still may be wondering, what is Fintech? It’s a combination of “Finance & Technology”. Fintech includes a variety of different services including:

- Insurance

- Transaction delivery

- Peer to peer lending

- Loans

- Digital wallets

- Online banking

So how does Caddle fit in? Caddle is a data insights company that has a passion for understanding market trends which can be translated to the market industry leaders for the benefit of understanding the buying behaviors of their consumers.

We took a look at what our members had to say about Fintech. With an average of about 8000 survey respondents approximately 80% of respondents were female, 50% were Millennials, and 40% were from Ontario. We hope that using this sample size we can garner a better understanding of Fintech and help provide the best insights.

Financial technology (Fintech) is used to describe new tech that seeks to improve and automate the delivery and use of financial services.

Based on the results we determined that our members are not supporters of this new technology for three major reasons.

1) Fintech: Digital Banking Awareness

We conducted a digital bank survey that was focused on determining our member’s awareness and preferences when it comes to conducting their finances online. For this particular survey, we are talking about banks that are solely online with no available storefronts.

We found that more than half of our members were familiar with digital banking. That being said, 54% did not use digital banks and the next best option was Tangerine. All those Toronto Raptors commercials are paying off!

What is interesting is that digital banks have a multitude of advantages that traditional banks don’t. For example, they can offer you higher interest rates and lower banking fees because they have cheaper operating costs than brick and mortar locations.

Fintech: Why not make the switch?

If people are willing to sacrifice earning more money there must be some underlying issues. Banks have invested plenty of money into targeting Millennials and onboarding them to digital platforms.

What is causing people to be so skeptical?

This could be a result of respondents feeling neutral when it comes to their personal info and data being safe with digital banks. Does that mean you heard about the Capital One security breach?

Members simply had no interest when it comes to switching to a digital bank. This could be a result of banks failing to address your concerns:

- Where do I deposit my cash?

- How do I talk to a real person?

- What type of insurance coverage do I get?

2) Fintech: The Banking App Experience

The findings from the banking app experience survey helped us identified that only 34% of members had a “good” experience when conducting transactions online. This includes them logging on a few times a week to check the status of their accounts.

Members were comfortable completing simple transactions such as:

- Transferring money (e-transfer)

- Paying bills

- Checking account balances

Fintech: Online Banking Stops Here

The previous results were anticipated but when asked if members conducted any other activities like communicating with advisors, applying for loans or mortgages, or opening accounts, the majority said they don’t complete any activities.

This is important because it is evident that members are not comfortable making certain decisions using online platforms whether or not it is an issue of privacy, lack of financial guidance, or inaccessibility.

3) Fintech: The New Digital Wallet

How many of you carry cash? Probably not often right? What if I told you now you don’t have to carry your wallet. The future is here, all you have to do is tap your phone to make a purchase! (ie: apple pay)

To be honest, it’s an interesting experience and there are valid points made from each side of the spectrum.

67% of you said that you don’t currently use a digital wallet.

Here are the following reasons why our members are skeptical about making the leap to digital wallets:

- Safety and security. Members disagreed with the following statement, ‘my personal information and money is safe with digital wallets’.

- Over half of the respondents were Millennial’s (1978-1996). A large portion of these members are not digital natives.

- There is a lack of awareness and perceived functionality.

- Digital wallets are a relatively new concept (less than 10 years). This technology is still in the early adoption stage.

- Out of the respondents that did use digital wallets they preferred Apple Pay.

Fintech: Digital Transactions Experience Steady Increase

According to a study completed by Payments Canada, they found that “in 2016, the number of contactless transactions increased significantly, to almost 2.1 billion transactions worth $67.1 billion.

This represents an 81% and a 78% increase over 2015, in both volume and value terms (respectively).”

At Caddle, we feel that the lack of presence and usage of digital wallets lies in the hands of the organizations. There is just simply a lack of education and promotion surrounding the benefits associated with this technology.

Hotspot shield also conducted a survey and found similar results.

“A strikingly small 12 percent had ever used any of the applications at all. Of those who had used the technology, PayPal was the runaway favorite, while second-place Google Wallet had been used by only 8 percent of the survey subjects”.

Consequently, our respondents displayed minimal interest in converting their handheld wallets to be linked to their mobile devices.

What’s that old saying? If it ain’t broke, don’t fix it?

The Saftey Guide

For those of you that are going to be cashing in those Caddle earnings and saving more money by shopping online, we have a safety guide just for you. Get your pen and paper ready. Whether or not you will be browsing Amazon or taking advantage of Cyber Monday/Black Friday, this guide will protect your money!

- Review your bank statements (every month)

- Don’t make purchases on PUBLIC wifi

- Secure your home wifi

- Use two-factor authentication (2 passwords for your banking)

- Change the password for your email/bank after the holidays

- Don’t share your PIN(s) with anyone

- Look for spelling errors or inconsistencies on websites

- Use 3rd party sources (PayPal) to secure your funds

In Canada alone, there were over 1.2 million in compromised funds last holiday shopping season with a total of 1179 victims.

Now that you have got some good tips and tricks we want to hear from you! Check out our daily surveys on the Caddle app and share some of your insights using this link. Whats are some of the holiday gifts that you will be purchasing? Are you going to be shopping online or in-store? We want to hear it first!

Thanks for reading! Follow us on social media and register online to have access to more blogs and surveys.

[simple-author-box]

How long does it take plastic to decompose – longer than you think

How long does it take plastic to decompose?

To be completely frank, that’s a difficult question. Modern plastic has really only been in production for about 50 years. But a lot of those plastics are still floating around the world today. The lifetime of single-use plastics varies from product to product, but this article aims to give a ballpark range for single-use products like plastic water bottles, plastic bags, and plastic straws.

What is plastic?

The first synthetic plastics were developed in early 1907. What gives plastic its strength and flexibility is the length of the molecule chains from the polymers that make plastic. The longer each chain of molecules, the stronger, more lightweight and flexible the plastic will be. When petroleum and fossil fuels were shown to produce longer chain polymers this then began the shift from natural to synthetic plastics.

Why is plastic bad?

Nowadays the majority of plastics used every day are made of polyethylene terephthalate (PET), which is a petroleum-based synthetic plastic.

What’s the harm in that you ask? Well, you know the stuff you put in your car that makes your car go? That’s made out of petroleum too and we all know how bad that is for the environment. So think about how bad that effects our landfills, oceans, and the world as a whole. Probably not the best remedy.

With most plastic being primarily petroleum-based for its strength, it also means that the majority of plastics won’t through biodegradation like natural products. Meaning it’s pretty damn tough to get rid of the stuff because it lives on this planet for quite some time.

How long does it take a plastic bottle to decompose?

No question about it, plastic is pretty bad and is made of some questionable materials that harm the planet. So, how long does this plastic stuff stick around for? Well, according to some researchers, they estimate that due to the PET used in objects like plastic bags, plastic water bottles and plastic straws, it could take upwards of 450 years to decompose.

Yep, a rather frightening estimation. Let’s break that down so it really hits home for you. Breaking that down is equivalent to 5,400 months, or 21,600 weeks, or 1,971,000 days just for one single plastic bottle to decompose. Now think about how many plastic water bottles are on this planet. Probably not so thirsty anymore now, are you? Check out some alternatives here.

How long does it take a plastic bag to decompose?

So, what about plastic bags, how long do they take to decompose?

Answer: between 10 and 1,000 years.

This is a rather frustrating statistic. If it takes 1,000, that’s concerning. But if it takes only 10 years, that’s not so bad– is it?

Guess again. It all depends on how much ultraviolet radiation a plastic bag gets from the sun. If it’s baking in the sun, the bag could break down a lot sooner (i.e., 10 years) than a plastic bag that’s hidden from the sun (i.e., 1,000 years).

Even if it takes 10 years, this is still concerning. Polyethylene in plastic bags does not biodegrade. It simply becomes brittle, causing the bag to break down into tiny plastic pieces. In other words, there may not be a plastic bag floating in the wind or oceans. Instead, there are now tiny microplastics being scattered around the world.

To fix this, maybe it would be best to go back to paper bags for our shopping needs. The alternatives are endless. You can find more great, simple options here.

How long does it take a plastic straw to decompose?

What was once the most convenient tool is now going through a shift for being one of the most hated plastic products – plastic straws.

It will take approximately 200 years for a plastic straw to decompose. Much longer than the time they have been in modern existence.

So, what can we do? Well, continuing to throw our plastic straws into the garbage would be a step in the opposite direction since they’re not easily recyclable due to their size. For starters, I would suggest alternatives. There are always alternatives, like stainless steel, paper, or biodegradable straws. Better yet, don’t use a straw at all! or just go without a straw. Go cold turkey on the drinking apparatus!

What impact does recyclable plastics having on this situation?

Scattered around this plastic world, 12 million tonnes of plastic waste and materials end up in the oceans each year moving us closer and closer to the plastic world we are trying to escape from. We need to be better.

Right now, we as Canadians recycle only 11% of all plastics with the other 89% being tossed into our landfills, oceans and or being incinerated into harmful fumes. Recyclable plastics can drastically change this statistic by removing all these harsh plastics from the environment and utilizing them to make others. If done correctly, those plastic grocery bags can be made and remade into the same bags or other plastic products instead of spending the next hundred years in a landfill or fixed to some innocent sea creature.