COVID 19 Insights: Growing Isolation Blues

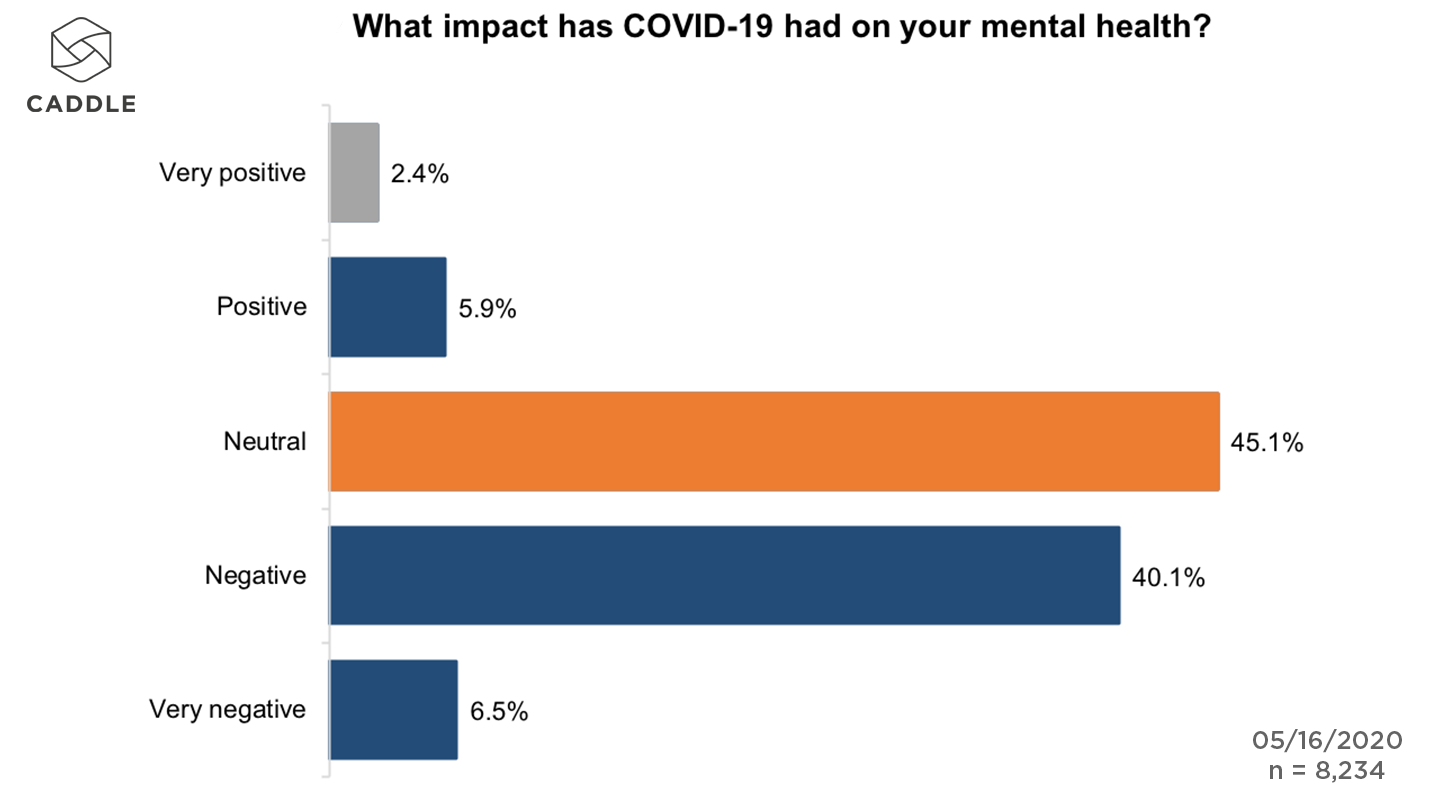

-46% Canadians say pandemic has negatively impacted their mental health

The images of a packed Toronto park this weekend showed how easily social distancing discipline can slip for some Canadians.

While the warm weather is a likely cause of people dropping their guard against COVID-19, the deeper question is why people would decide to take the risk in the first place.

The answer might lie in the growing emotional toll of social distancing. Data from our 10,000 daily survey respondents shows that half of young people feel COVID-19 has had a negative impact on their mental health.

What’s more, they are more concerned about the impact of social isolation than of actually contracting the virus.

We saw last week how Canadians are turning to retail therapy in the search for positive experiences during an emotionally difficult time.

In this context, is the flaunting of social distancing rules another manifestation of this trend?

Here’s what we found this week:

How is COVID impacting mental health?

Across all demographics, the pandemic is having a clear negative impact on mental health of Canadians. 46% of Canadians told us that COVID-19 had caused a negative impact on their mental health.

This figure goes even higher when looking at specific groups. Women are more likely to report negative impacts than men (48.6% vs 38.5%) while those under 40 were slightly more likely to identify adverse impacts on their mental health (48.4% vs 44.7%).

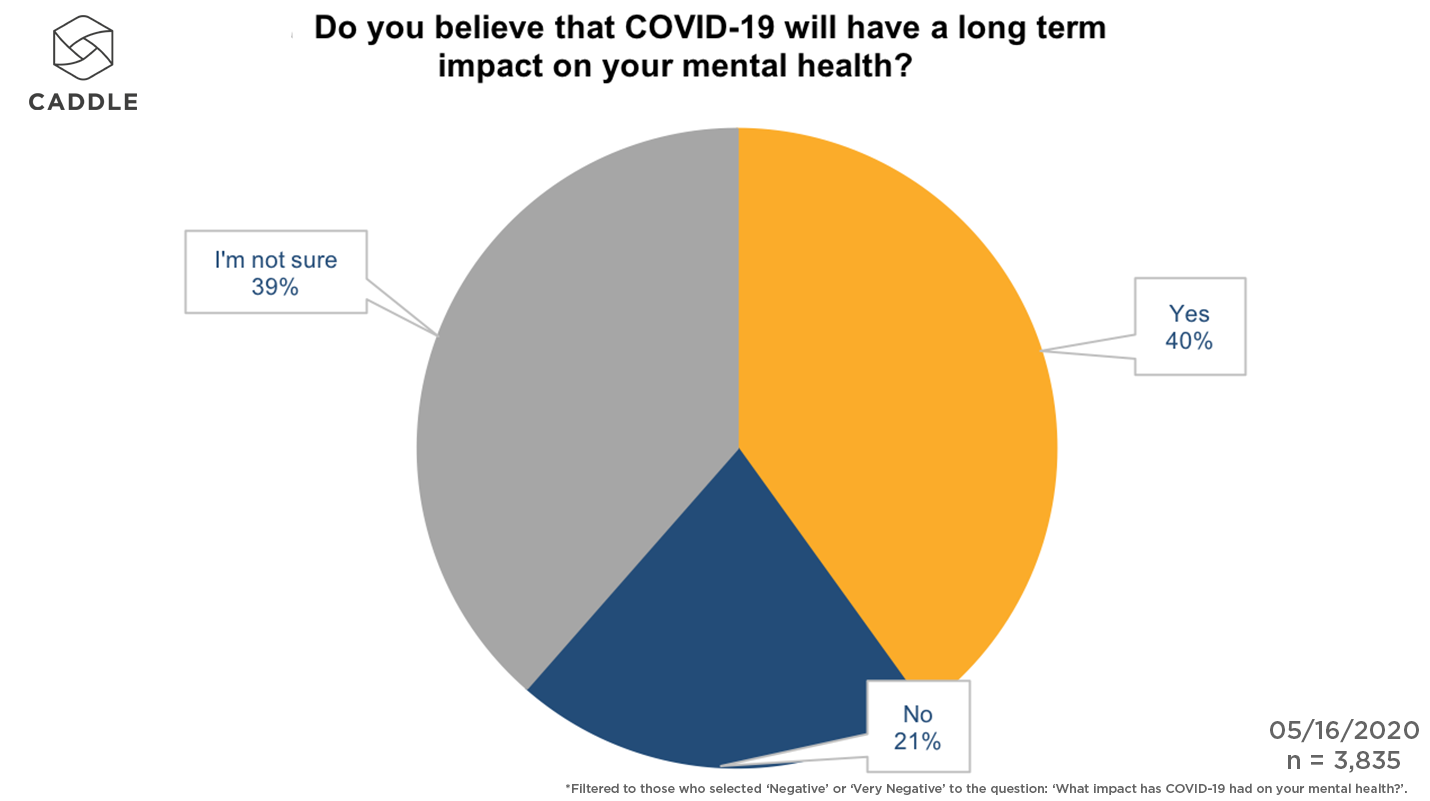

This may not necessarily be something that will resolve itself once governments lift restrictions. Just over 40% of those who said that the pandemic had a negative impact on their mental health also said they anticipated that COVID-19 will have a long-term impact on their mental health.

What is causing the trend?

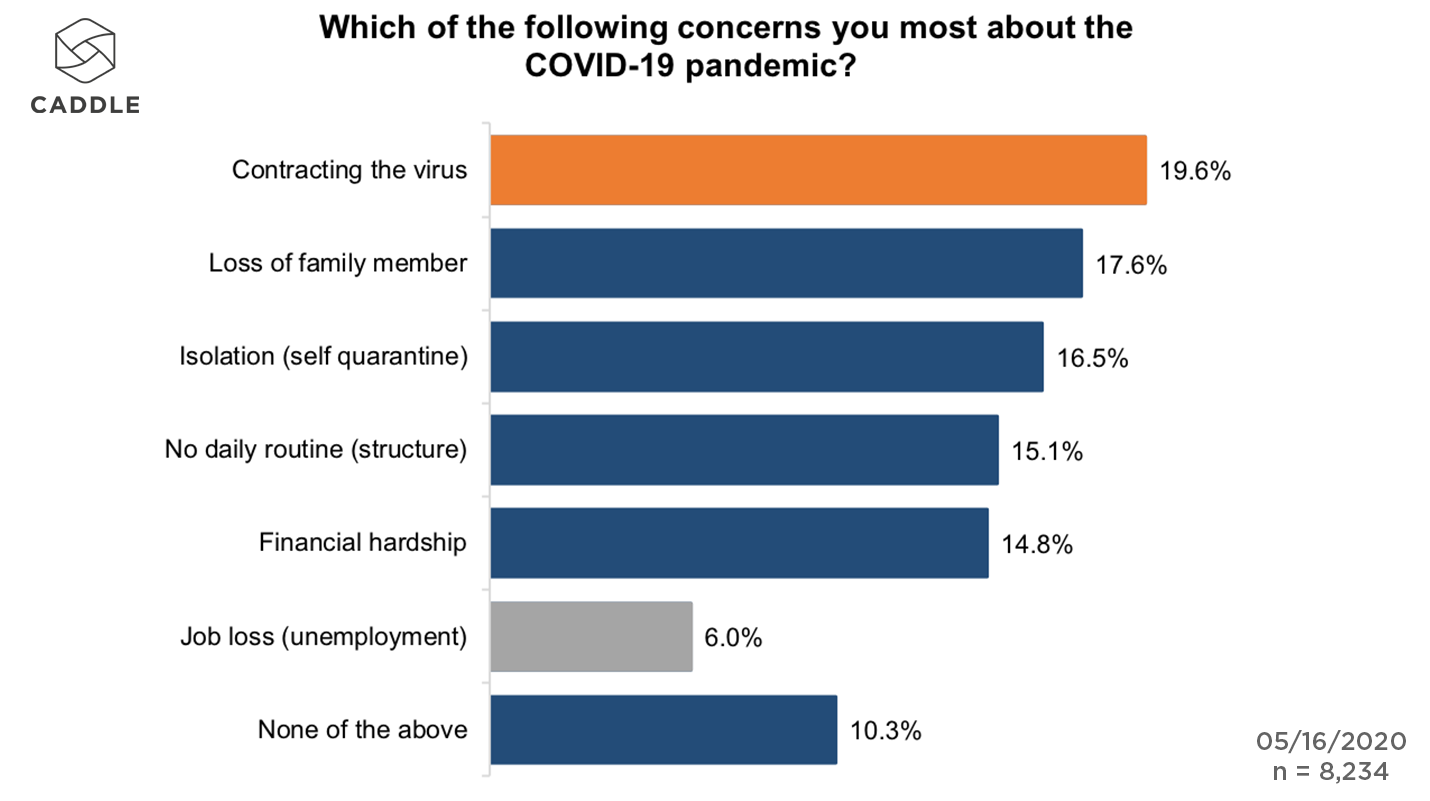

There is no single factor that defines of Canadians’ COVID concerns. However, our data shows that this clearly goes beyond the direct health implications of the pandemic.

Asked what concerned them most about COVID-19, 37% selected either the fear of contracting the virus themselves, or the loss of a family member.

Meanwhile 46% identified broader socio-economic reasons as their biggest concern about the pandemic. These are factors such as isolation, lack of daily routine, and financial hardship.

When looking at those who reported negative mental health impacts, this trend becomes more pronounced. 51% of this group selected these socio-economic impacts as their biggest concern rather than contracting the virus or losing a family member.

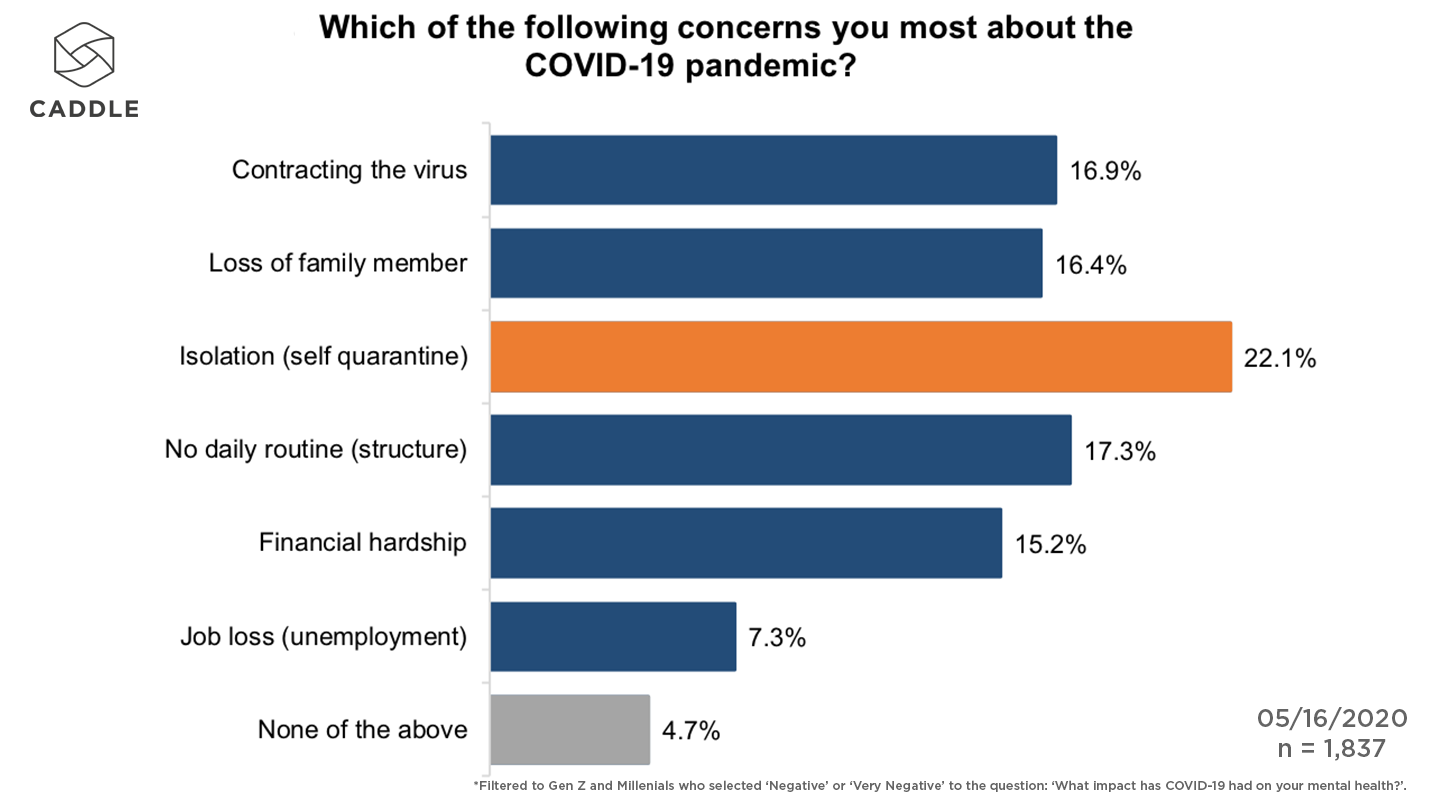

Now looking at Canadians under 40 who reported negative mental health impacts, 20% say social isolation is their biggest concern with COVID-19 compared to 16% concerns about actually getting the virus.

This lays bare the challenge governments face as we past the initial phase of the pandemic.

New daily cases have come down, and as a result we have seen anxiety over the virus come down.

While overall our data suggests broad support and adherence to guidelines, getting unanimous buy-in to distancing protocols may become more challenging, despite the threat of a second wave being very real.

Is social media a positive or negative?

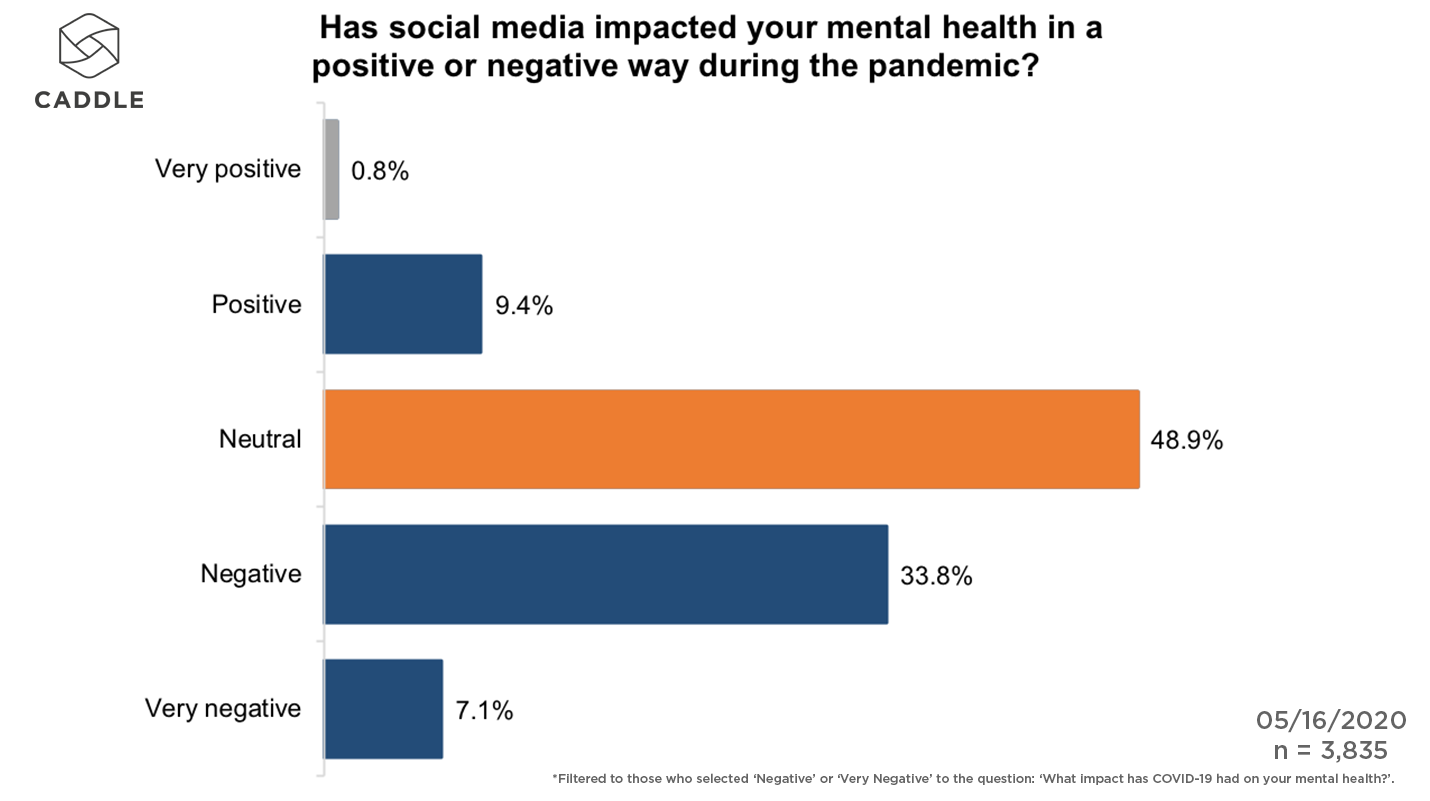

With Canadians cut off from seeing friends and family, social media offers an opportunity to keep people connected. However, what seems to be happening is the opposite. If social media is having any impact on the mental health of Canadians, it is a negative one.

Again looking at those who reported a negative mental health impact due to COVID-19, we see that 40% said that social media had impacted their mental health in a negative way during the pandemic.

One possible explanation for this is the overload of content relating to the pandemic that Canadians encounter on social media. After all, this has been a ubiquitous issue in conversations and media coverage for over two months.

After so long, it is possible that Canadians have reached saturation point with pandemic content. In a separate survey, we found that 34% of our panel actively avoided COVID content.

What does this mean for brands?

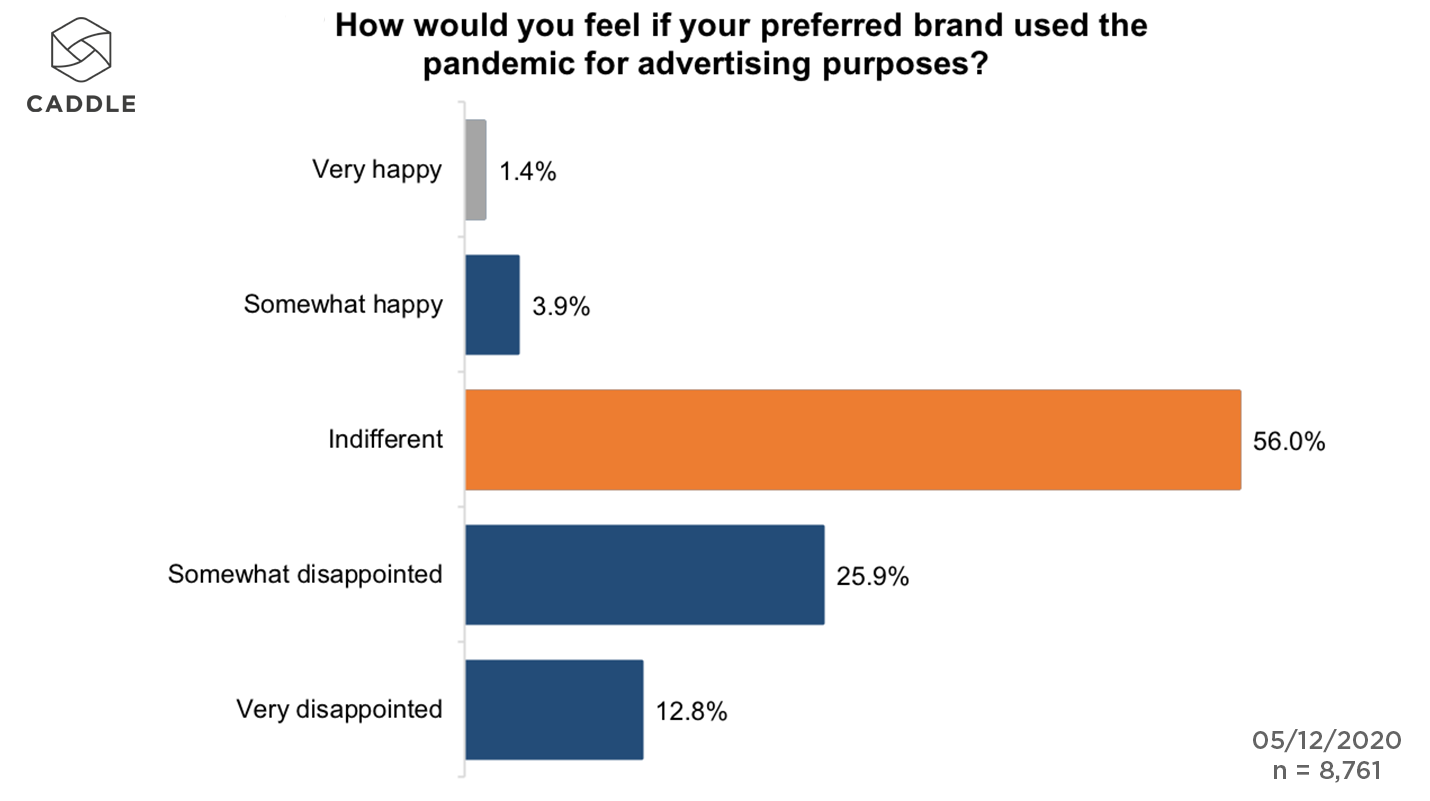

This data shows that brands need to tread very carefully when it comes to messaging during COVID-19.

Not only is COVID overload a potential factor, but Canadians are wary of brands using the pandemic as a platform for advertising.

38% said they would be disappointed if their preferred brand used the pandemic for advertising purposes. Meanwhile just 20% said a COVID advertising campaign would encourage them to support a brand.

Key Takeaways

Isolation is beginning to grate

The decline in anxiety over coronavirus suggests that, rightly or wrongly, we perceive it as less of a threat right now.

Even if it is only a small minority who break social distancing guidelines, the broader concern many Canadians feel about the impact of isolation shows that this will become a tricky balancing act for authorities trying to guard against a sudden spike in cases.

Canadians are craving positivity

This week’s data bolsters the insight we saw in last week’s report. Two months into social distancing, Canadians are ready for positive experiences and moments of joy. While that should not extend to breaches of guidelines, people are looking for ways to counteract depressing pandemic experiences.

Is this a new area for brands to do good?

COVID-based campaigns may not work, but there are other ways to resonate with consumers.

Earlier Caddle studies have shown that brands who play an active part in the fight against COVID will increase purchase intent among consumers. As concerns about the pandemic broaden to include more social factors, these represent a broader set of ways to brands to do good right now.

90% of Canadians will garden during COVID. Here's how they will shop

This will year will feel very different for Canadians buying gardening supplies.

There are two major emotions felt by consumers; anxiety and sadness. Each will have conflicting outcomes for how people will shop this year.

On one hand there is the sadness associated with social distancing, caused in part by a lack of outdoor time or things to do — particularly for parents. Here, gardening could serve as a morale booster.

On the other, there is the anxiety over the continued COVID-19 threat that would prevent gardeners going out shopping altogether.

Ordering online would be the obvious way to solve the dilemma, but how many gardeners are prepared to switch from shopping in-store?

Here’s what the Caddle data shows:

How many Canadians will be gardening this spring?

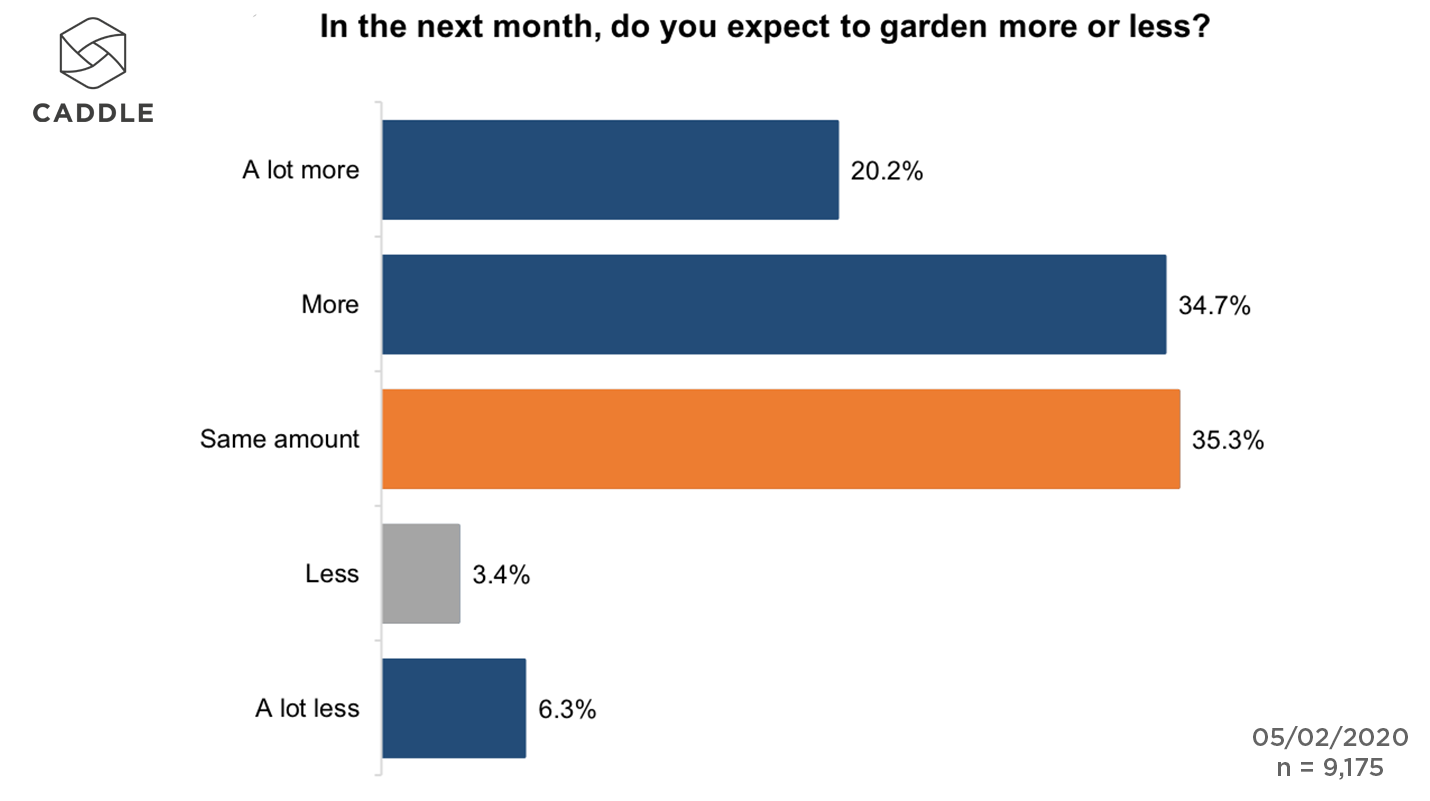

There is little to suggest that Canadians are being put off gardening by concerns about going out to purchase supplies. 54% of our panel expect to be gardening more in the coming month.

This includes people who say they are unlikely to garden in a typical week.

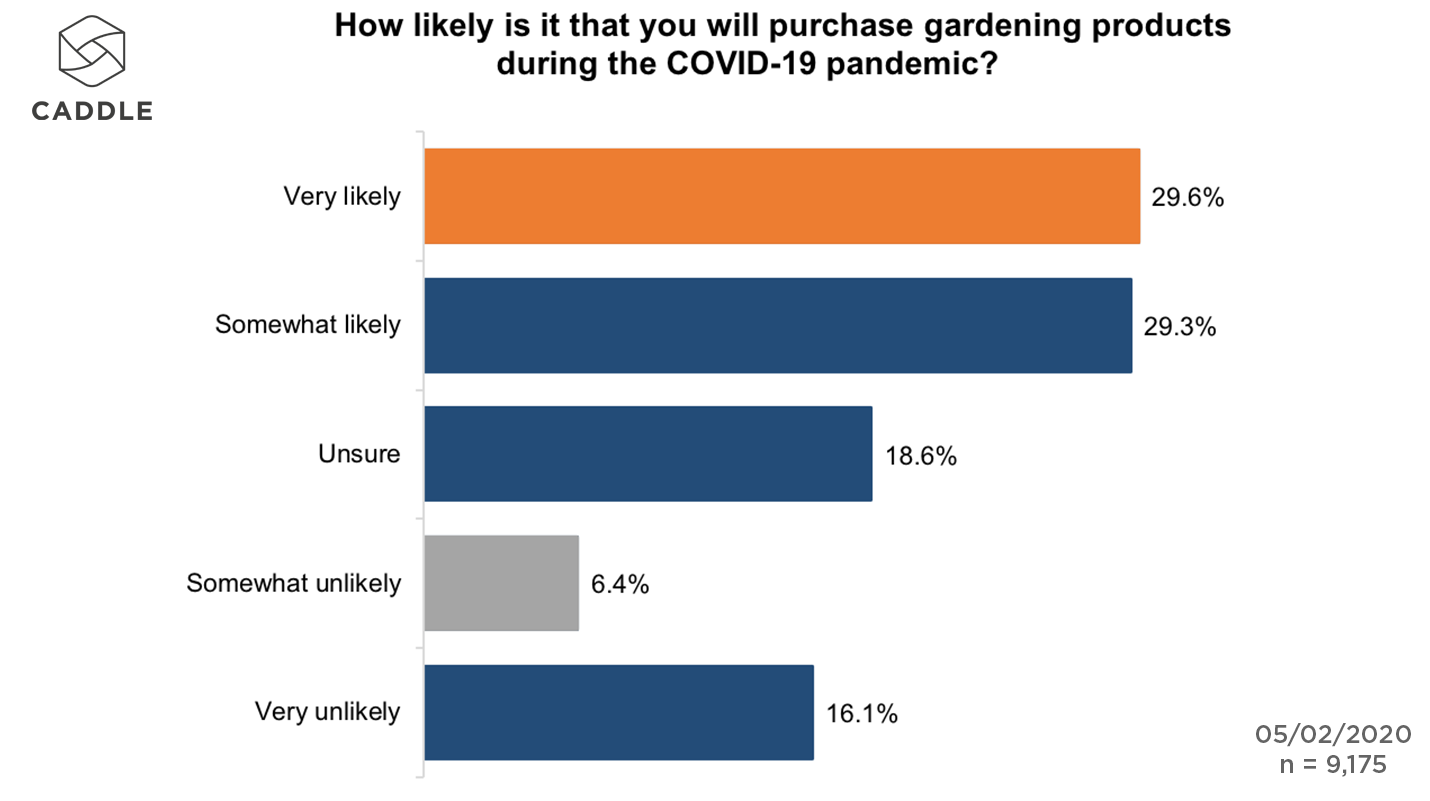

Despite the pandemic, 59% of our panel said it is likely they will purchase gardening products during the pandemic. Again this includes those who told us they normally don’t garden.

This means that the market is growing for all categories of gardening from plant material, to soil to plant and lawn food. Which retailers will win the battle for the increased demand?

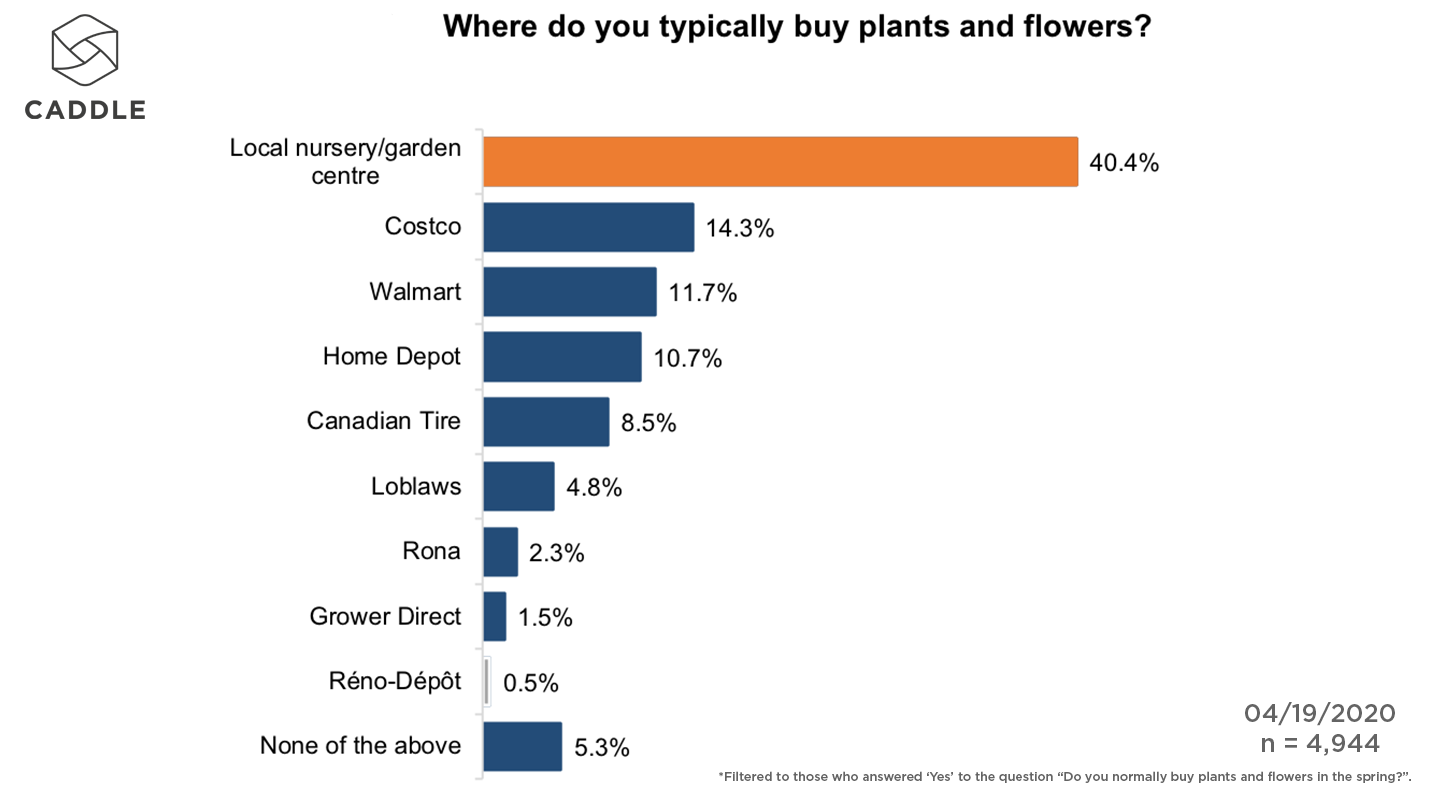

Local nurseries or garden centres are the preferred destination for 40% of those who tend to plant in the spring. This is followed by Costco (14.3%), Walmart (11.7%) and Home Depot (10.7%)

Will Canadian gardeners shop online?

Given the concerns many Canadians still feel about going to places where social distancing is more challenging, will we see more online shopping this year?

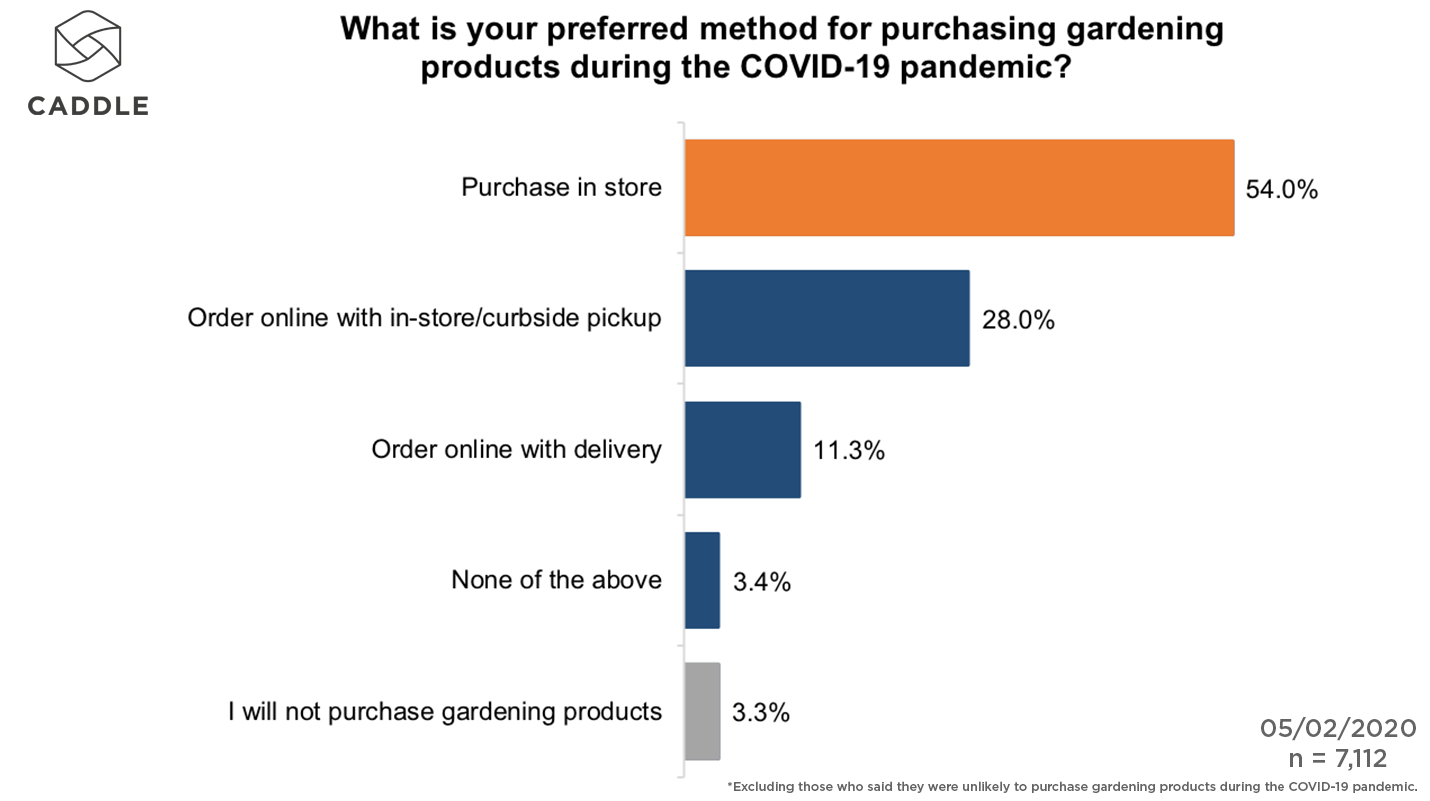

Traditionally, shoppers’ preference has been to purchase gardening supplies in-store. However in 2020, we can see that online purchasing is now preferred by almost 40% percent of regular gardeners.

This breaks down as 28.5% preferring buying online with curbside pickup, and a further 10.9% preferring online ordering with delivery.

However this still leaves the majority of gardeners who prefer to visit a store to make a purchase.

Excluding those that said they were unlikely to garden in a typical week, we see that the preference among gardeners is still for in-store experiences.

More than half of regular gardeners (54.4%) selected in store as their preferred method of shopping – almost double the percentage that preferred curbside pickup.

Which customers prefer online more?

The biggest factor in which way our panel prefers to shop for gardening supplies is by age group.

Looking specifically at those that indicated they were likely to shop during the pandemic, two thirds of Canadian Baby Boomers prefer in-store shopping, while the number for Millennial and Gen Z Canadians is just under 50%.

What products do gardeners want to shop for online?

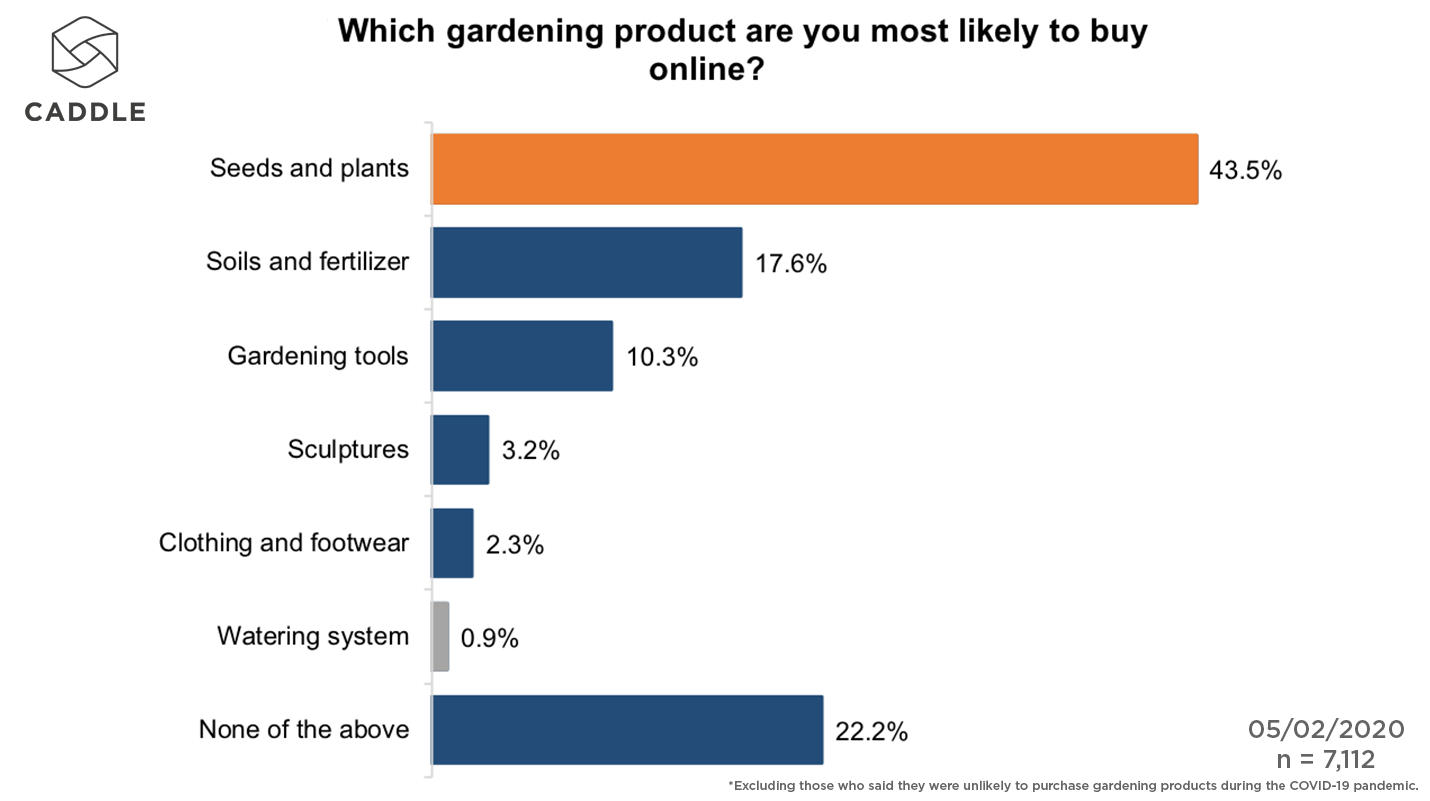

Whatever their preference for purchase method, there is consensus on what types of goods gardeners would look to buy online.

Seeds and plants is the top category our panel said they were likely to shop for online, followed by soil, then tools.

Even among those who said their preference was for in-store shopping 38% said the item they would shop for online would be plants and seeds.

What does this mean?

The split between online and offline means gardening retailers need to cater to both needs at the same time. The majority still favour in store shopping, but a significant minority prefer online.

Failure to offer online shopping, effective curbside pickup or delivery options risks seeing these customers go elsewhere.

On the in-store side, we know from previous research relating to the grocery segment that customers put a high premium on effective social distancing policies.

Almost half of our panel told us they would switch stores if their preferred location was not enforcing social distancing properly.

COVID-19 Insights: We’re Ready For Retail Therapy

-30% Planning Spending Spree In Next Month

COVID-19 restrictions are beginning to be lifted across Canada, but sadness increasingly defines how Canadians feel about their situation.

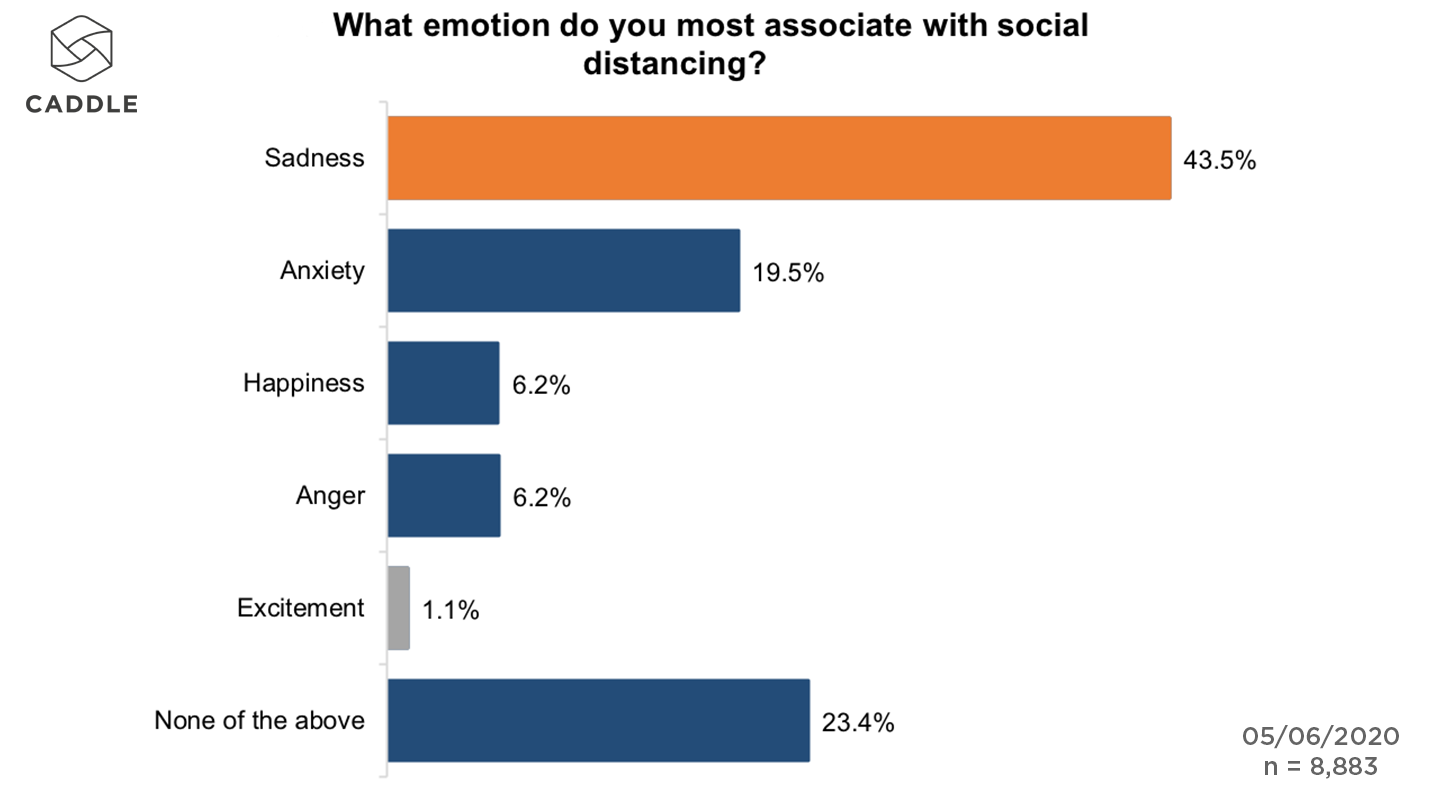

Caddle has been tracking the emotions felt by our 10,000 member daily survey panel in response to COVID since February. The most recent data shows a 43% increase in the proportion of Canadians reporting sadness associated with social distancing.

But one of the ways consumers are dealing with the COVID blues is by looking to retail therapy as a means to raise their spirits. Nearly one in three Canadians are planning a spending spree in the next month.

Here’s what we learned this week.

(If you’re not already on the mailing list, sign up for our free weekly summary here.)

Social distancing is getting us down

Since the early days of the crisis we have been tracking what emotion our panel most associate with both social distancing and coronavirus more generally.

When we asked on March 18, 57.9% of Canadians chose anxiety as the emotion they most associate with coronavirus. By May 15, this had fallen to 46.4% — much closer to the 41% we recorded on February 29th.

When it comes to social distancing, the picture is one of rising sadness. On March 25, 30.4% of our panel identified sadness as the emotion they most associated with social distancing. This rose to 43.5% when we asked on May 15 — an increase of over 40%.

This suggests that over two months of severely reduced social interaction is starting to get Canadians down.

Could a shopping spree help?

It is against this backdrop that we asked our panel about their spending plans in the month ahead.

We found that increasingly there will be a role for shopping as a way to lift Canadians’ spirits through such a tough time.

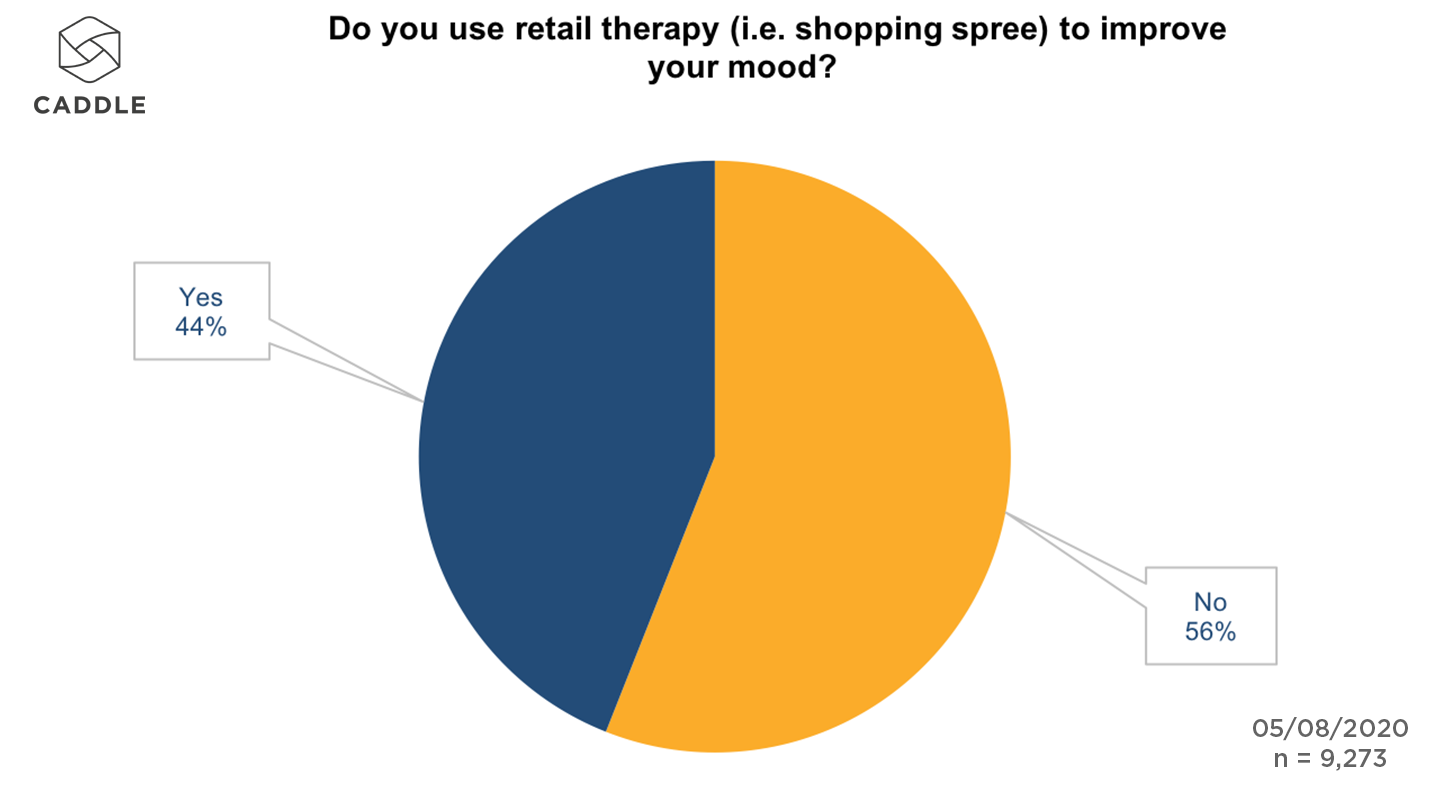

Caddle data shows that 44% of Canadians look to retail therapy as a means to improve their mood, while 40% of our panel say that a spending spree can make them feel happy or excited.

Now that retail stores are beginning to open up again, our data suggests that this retail therapy will become a significant factor in the next month.

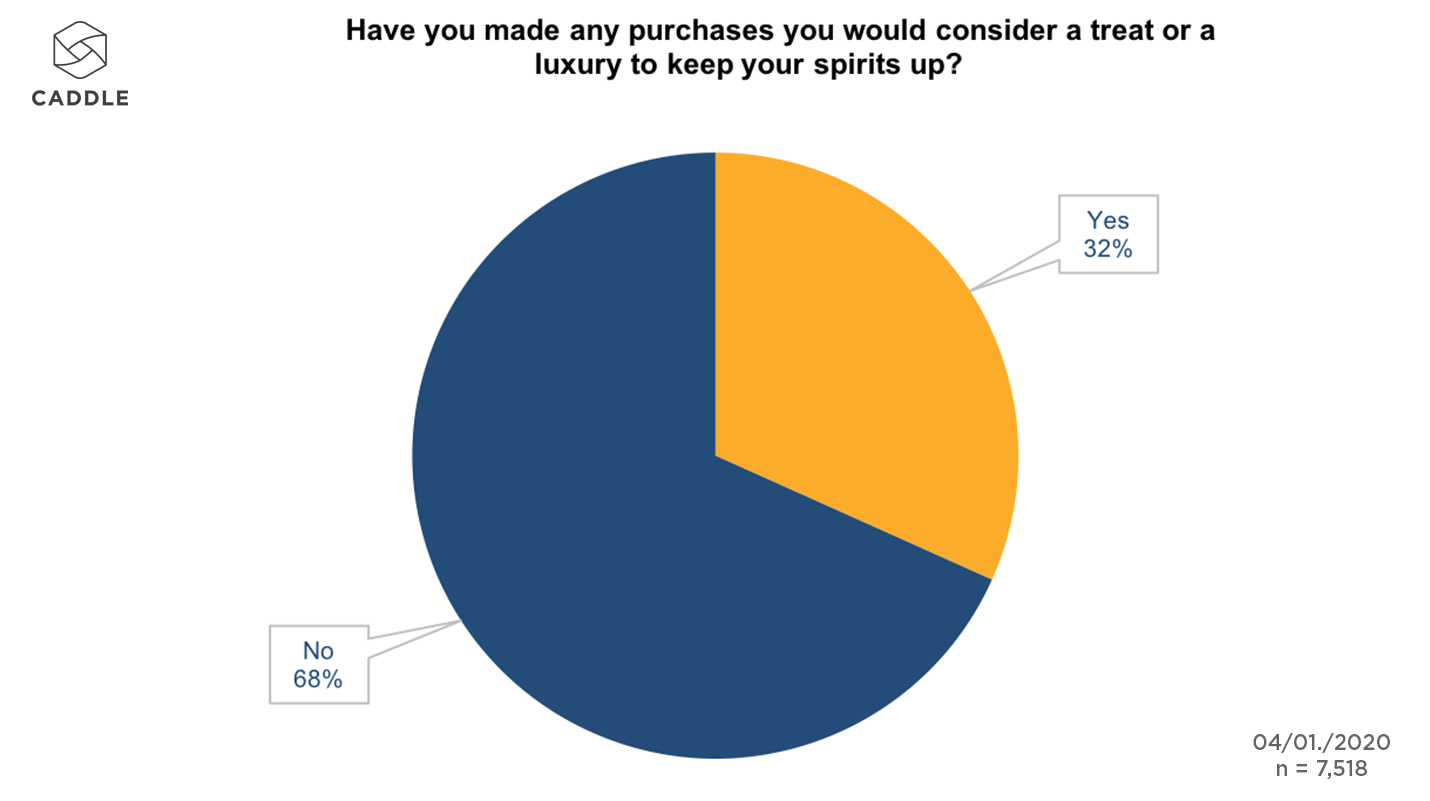

Even in the earlier stages of the pandemic, we had identified this mechanism. At the start of April we learned that a third of Canadians had made purchases they considered a treat or luxury to keep their spirits up during social distancing.

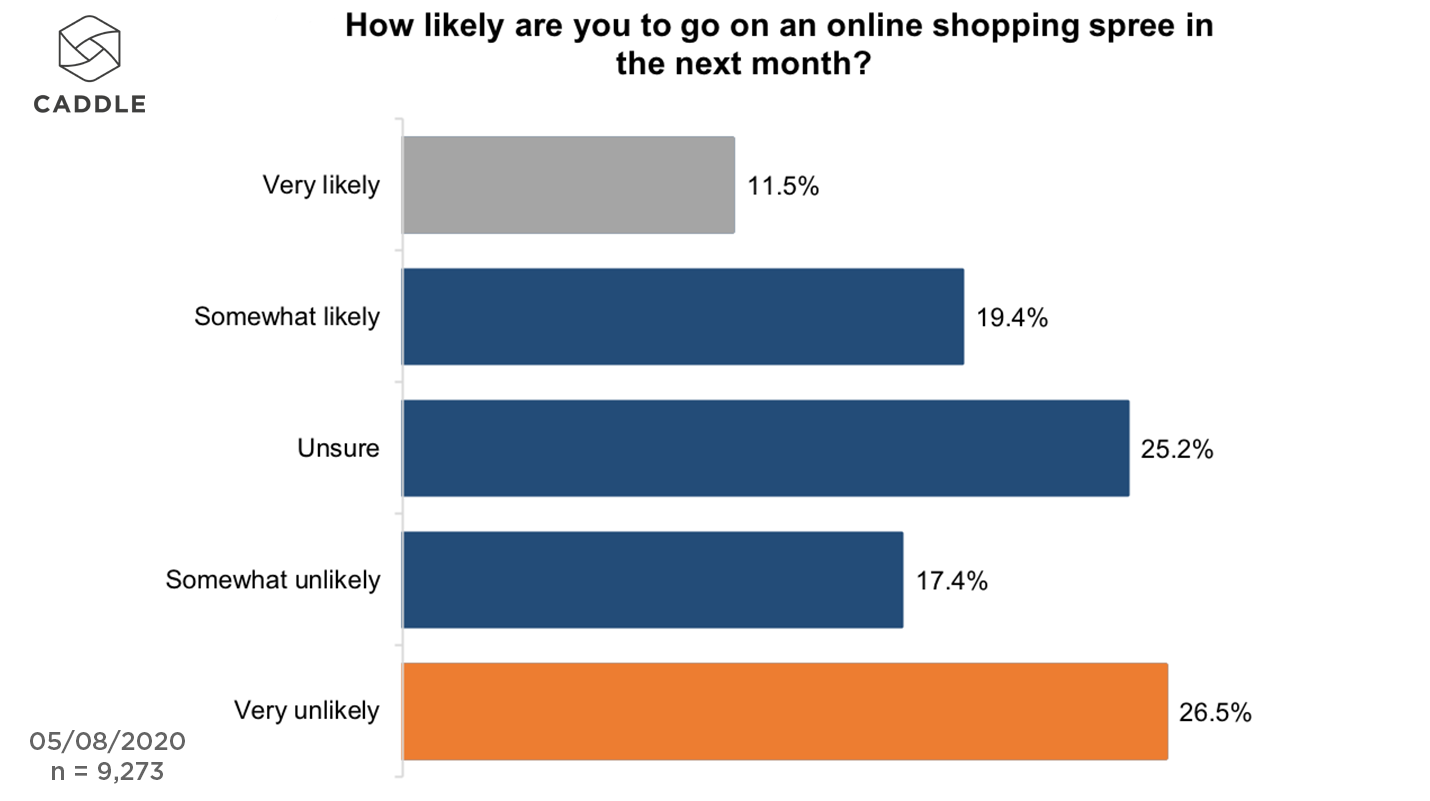

Now, across all respondents on our panel, 31% say they planning an online shopping spree in the next month.

When we look specifically at panel members who told us they use shopping to improve their mood, this rises to 52.7% of people planning a shopping spree in the next month.

Those who are more likely to believe in the morale boosting power of shopping are much more likely to be planning discretionary purchases in the next month.

It is also important to note that we asked specifically about online purchases and asked the question before the announcement that Ontario retail locations would be permitted to reopen on May 19.

What could these shopping sprees look like?

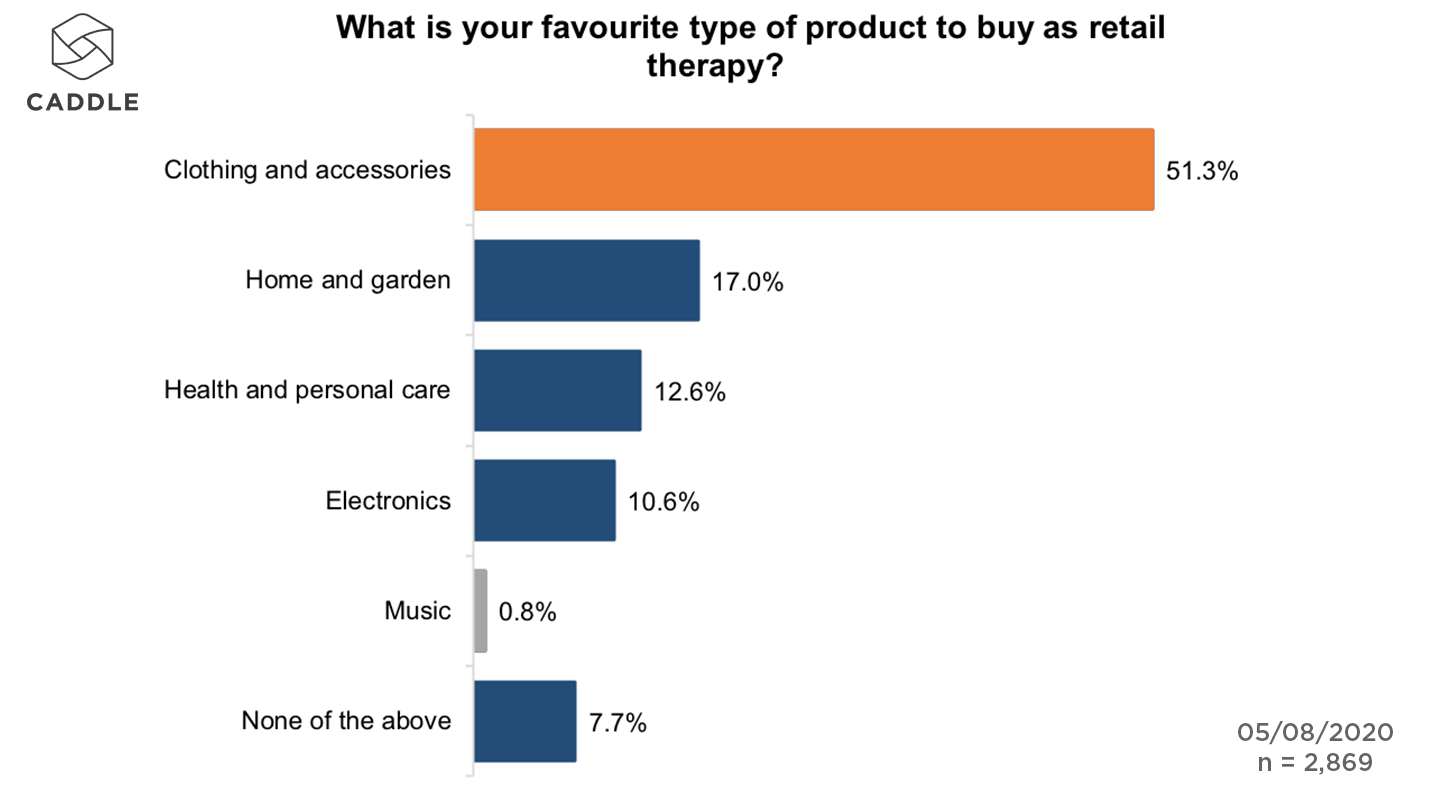

Clothing is likely to be the biggest category to benefit from this trend. Looking specifically at those who told us they were ‘likely’ or ‘very likely’ to go on a shopping spree in the next month, 51% selected this category where they make retail therapy purchases.

Home and garden was second with 17.0% planning spending in this area.

While clothing is a significant category across all demographics, there are variations elsewhere. Males are just as likely to treat themselves an electronics purchase as a clothing purchase (about 1 in 3), while older Canadians over-index on retail therapy with home and garden purchases (23%).

How much will we spend?

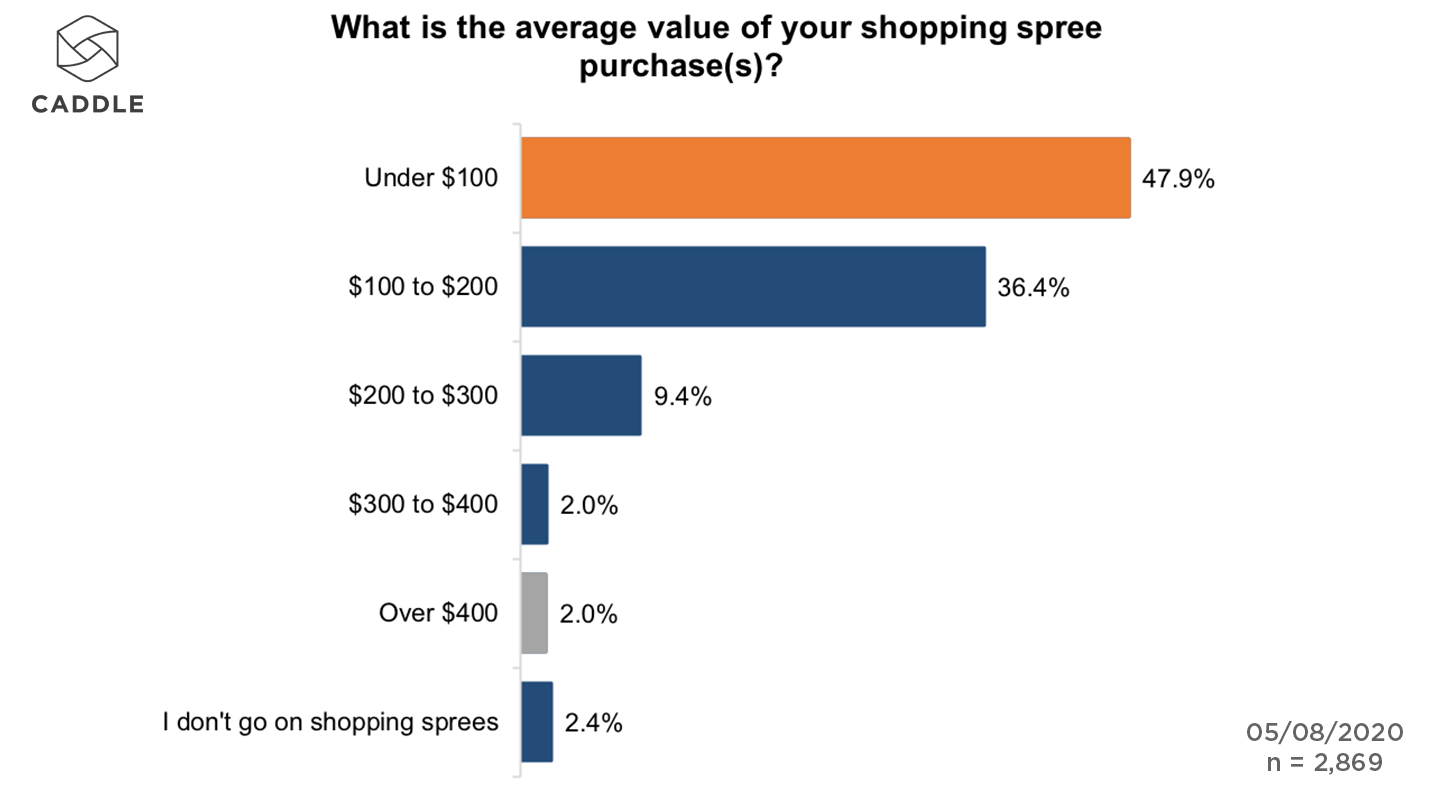

The vast majority of these planned spending sprees will be under $200. 49.9% of those planning a spending spree told us they planned to spend less than $100, with a further 36.4% looking to keep their purchases under $200.

Key Takeaways

We’re moving beyond ‘essentials only’ shopping

Earlier in the pandemic we recorded that cutting back on non-essential items was the key tactic Canadians were using to save money. That a significant minority are now starting to think about discretionary spending sprees suggests we might be moving into a new phase, where consumers feel more confident about making non-essential purchases.

The next month is crucial for online vs in-store

This data showed a third of Canadians planning an online shopping spree. However as stores begin to reopen, will these purchases migrate in store instead? Where this spending ends up taking place will be a significant indicator of the role eCommerce will play in the medium term in Canada

We’re ready for positive vibes

Despite the rising reports of COVID-related sadness, this data suggests that many Canadians are looking for those moments of joy and positivity. This is no doubt boosted by some restrictions starting to be eased. We’re looking for things that will lift our mood and there is an opportunity for brands to be part of that positivity.

COVID-19 Insights: Fast Food’s Trust Issue

59% concerned about contaminated packaging

The ability to reopen safely can’t come soon enough for Canadian restaurants of all sizes. But when they open, will consumers go?

We know from Caddle data that the consumer return to restaurants will be gradual, given concerns around social distancing. But as quick service restaurants explore how to make reopening work safely, we have found there is another dimension to the issue.

The results from our 10,000 daily survey panel members show that concerns about fast food extend beyond standing close to others in a busy restaurant.

How has COVID impacted fast food consumption?

Despite the slowdown in restaurant purchases, previous Caddle data has suggested some positive signs for fast food.

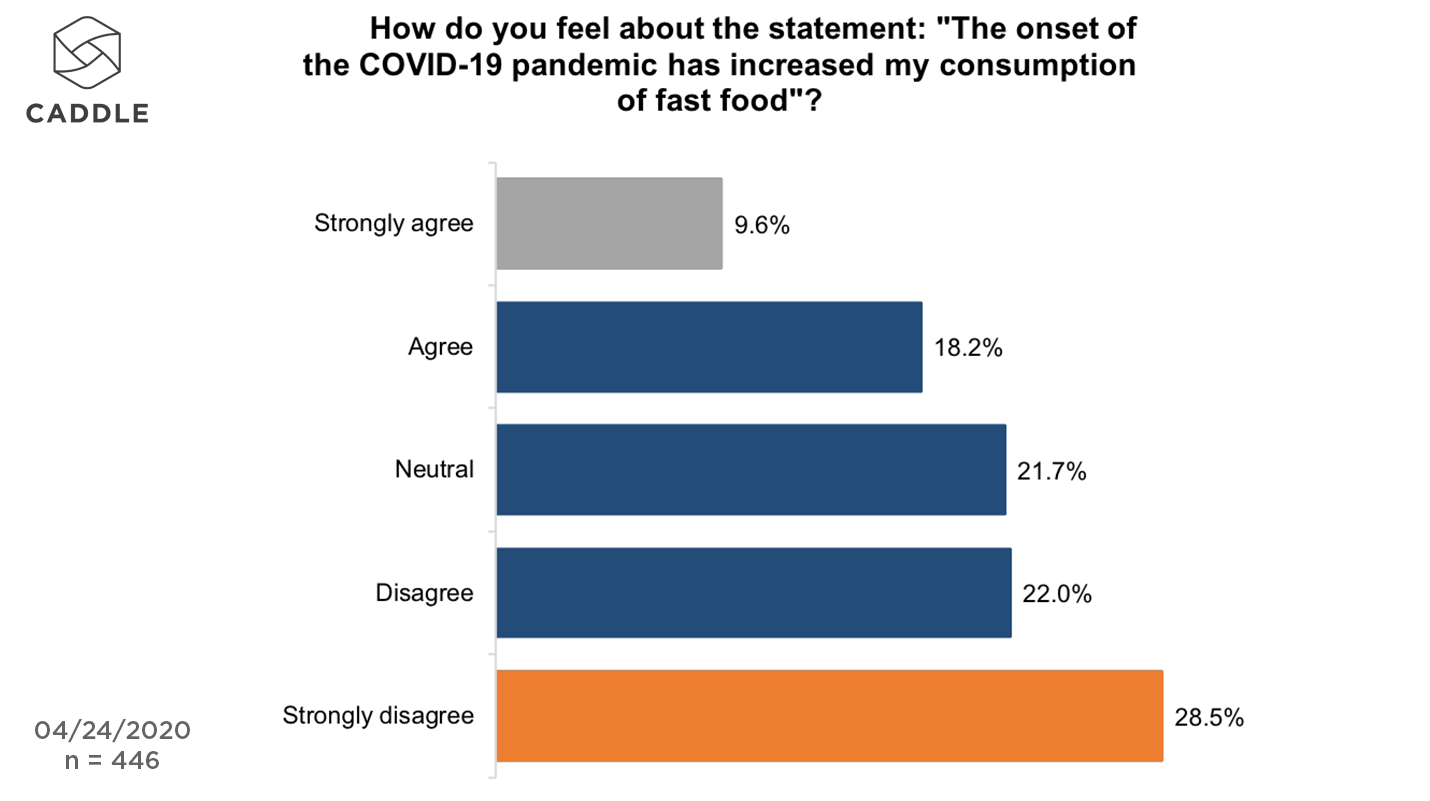

Canadians still look for quick and easy options for their meals and have reported a shift towards eating more comfort food. Yet with restaurants closed save for drive-through or delivery, this has not translated into higher consumption.

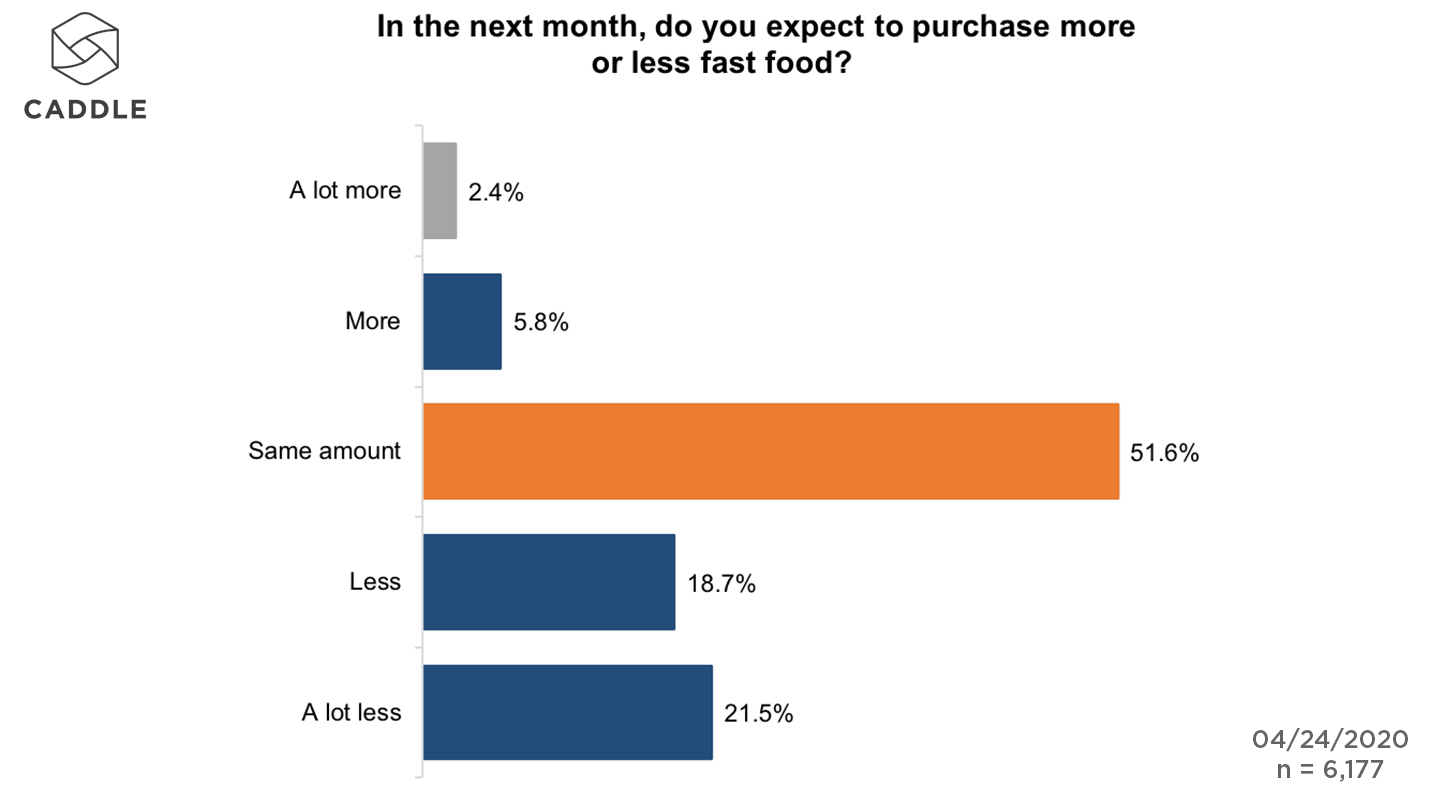

Just 15.5% reported they had been eating more fast food since measures to limit the spread of COVID-19 were introduced. On top of this, 40% said they expect to order less fast food in the month ahead.

Why are we ordering less?

The reduction in foot traffic from the closure of locations, coupled with a tightening of many consumers’ budgets would logically have an impact on consumption. However our data suggests another dimension to add to the mix; the safety of the product itself.

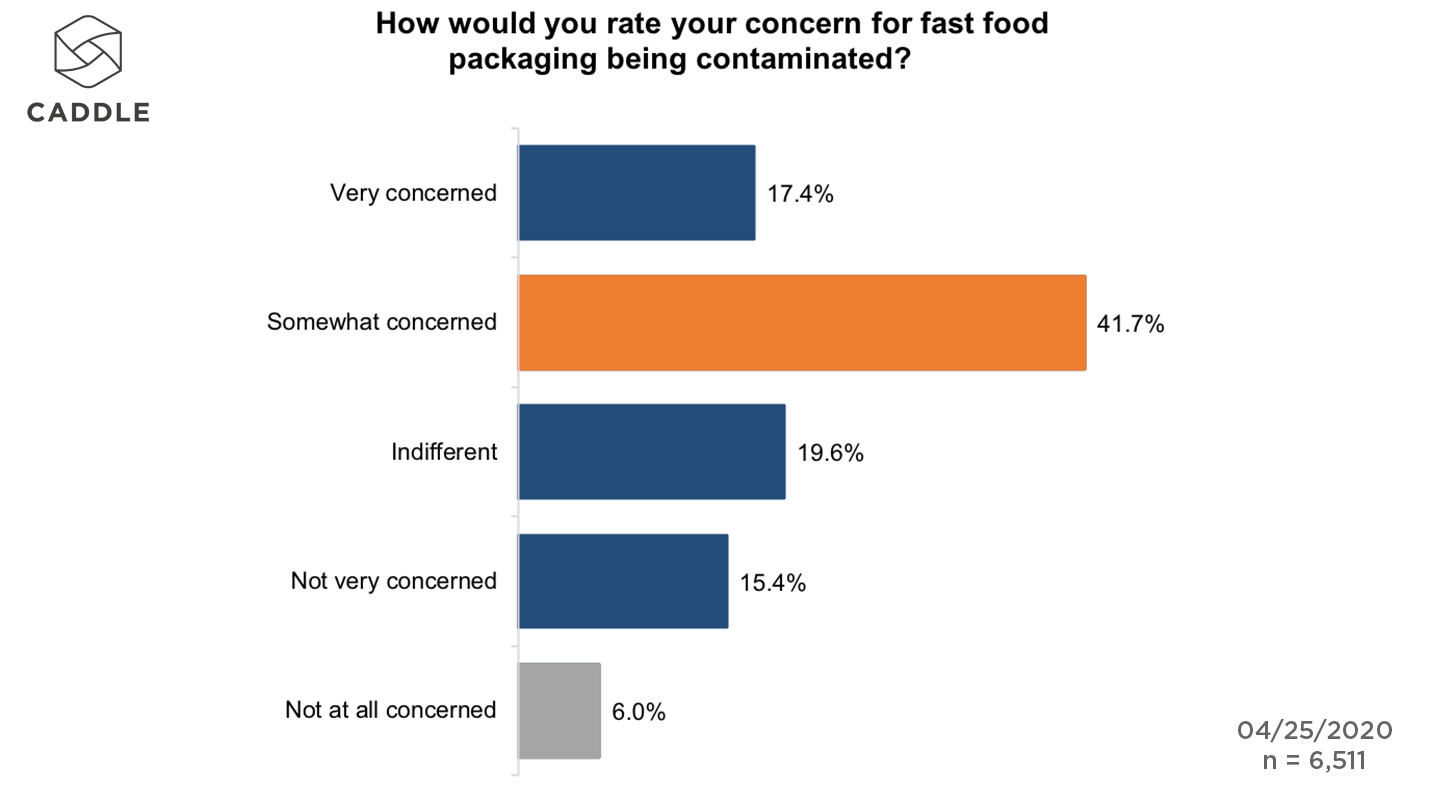

59% of the Caddle panel told us they were concerned about fast food packaging being contaminated. Meanwhile 65% disagreed with the statement that ordering fast food was the safest way to eat during the pandemic.

Customers are unconvinced that employees at fast food restaurants are observing social distancing measures. Over a quarter of respondents (27.3%) say they don’t think restaurant staff are observing social distancing protocols, compared to 18.7% who believe they are.

The one silver lining is that there was a net positive score on the issue of sterilization. 35% of our panel said they believed restaurants were implementing effective sterilization procedures, compared to 19% who thought they weren’t.

Do we trust food delivery?

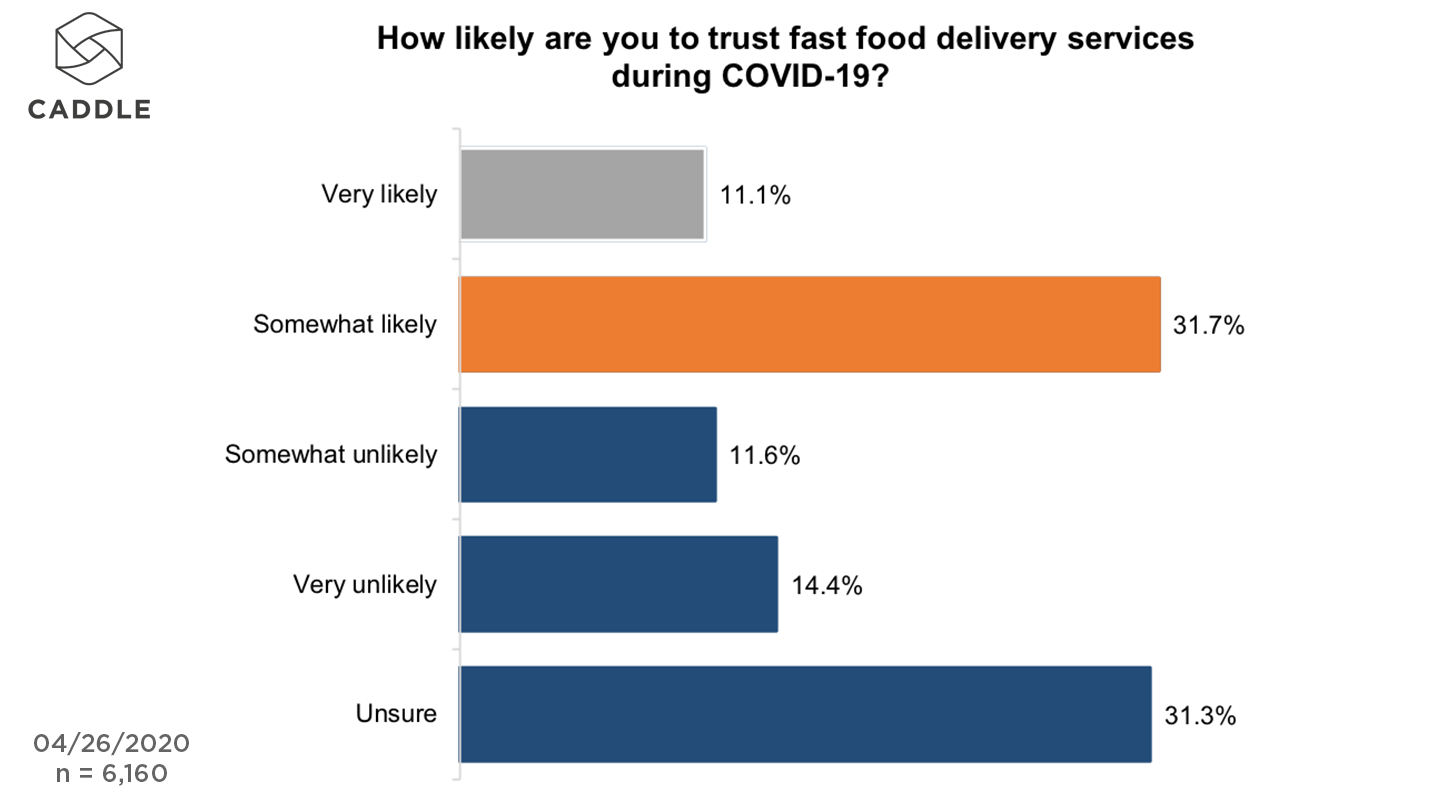

These concerns about safety do not appear to extend to the delivery of fast food. Just over 42% of the panel said they were likely or very likely to trust food delivery services during the pandemic. This compares with 26% saying they were unlikely to do so.

This hints at a significant issue for restaurants to address: consumers’ concerns with safety appear to be more directed at the in-restaurant procedures rather than the delivery process.

This means it is not a concern that will go away when restaurants are able to reopen. Brands will have to work hard to convince customers not just of the safety of coming into the store, but that behind the scenes proper measures are in place for food preparation as well.

Who is eating more fast food?

There’s no getting around the fact that most people are ordering less fast food, and envisage that being the case in the near future. But what of the people who told us they are ordering more?

This group makes up just under one in six of our panel. In a challenging situation, it is vital that brands find these people and communicate with them effectively.

So who should they be targeting?

Two key groups we have identified are younger males, and parents with more than two children. Both have higher proportions of respondents who said their fast food consumption had increased. However, these are still not groups where the majority report higher consumption overall.

In the case of younger males, 28% of those who eat fast food said they were consuming more as a result of the pandemic, compared to 15.5% in the panel overall. Likewise 17% say they expect to purchase more fast food in the next month — more than twice the 8.2% for the panel as a whole.

For parents with more than two children under the age of 18, 14.8% said they anticipated buying more fast food in the next month while 23.4% reported opting for fast food more since the start of the pandemic. In both cases the number filters out parents who indicated they did not eat fast food.

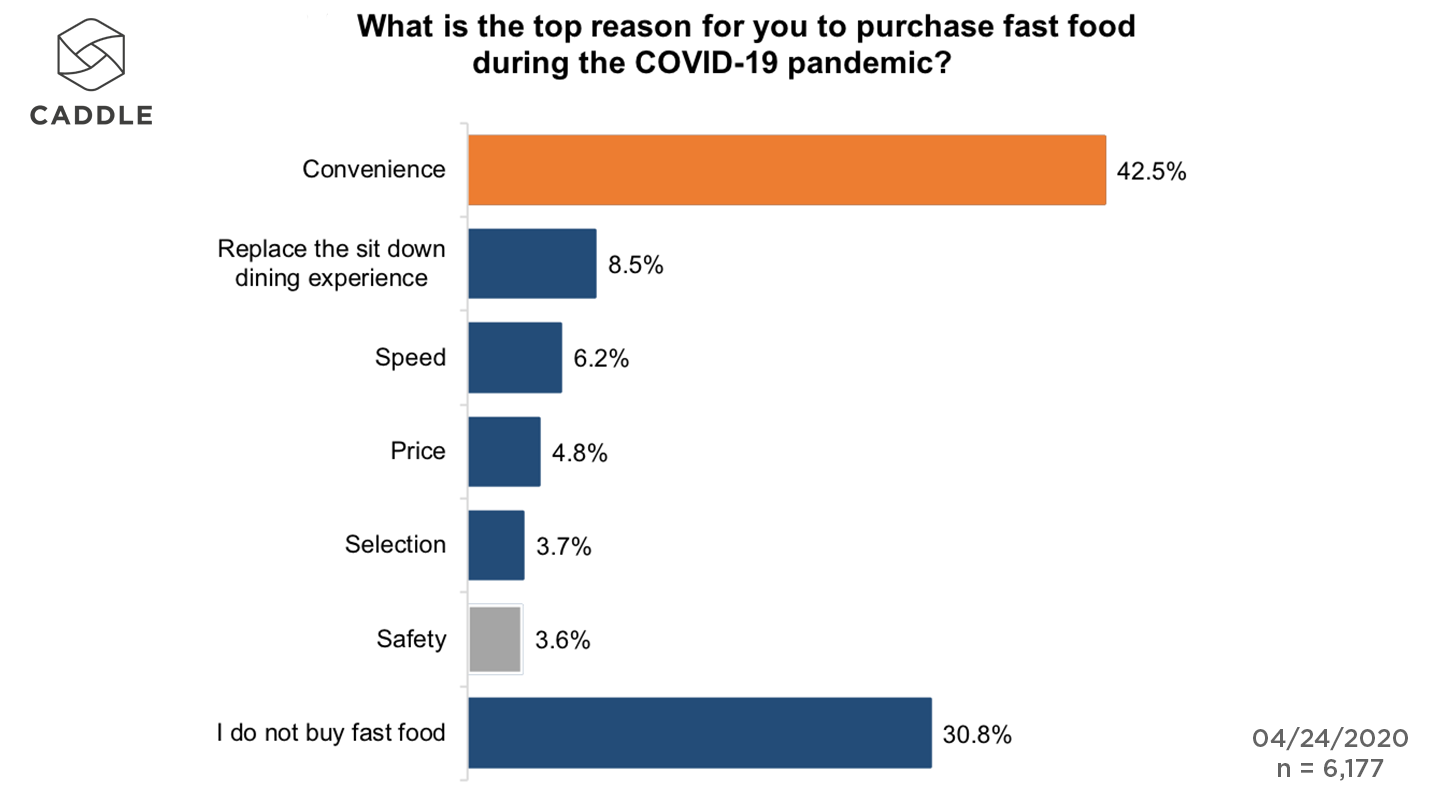

What’s driving purchase?

For these groups and the panel more generally, convenience remains the key to QSR purchases. Over 50% of those who usually consume fast food cite convenience as they top reason for purchase during the pandemic.

Key Takeaways

1. Communicate Safety In Every Area

The importance consumers put on COVID-19 safety should never be underestimated. This data shows clear concerns when it comes to fast food. These extend well beyond the enforcement of social distancing within restaurants once they re-open. Brands need to communicate what is happening in areas such as food preparation to reassure customers.

2. Offer convenience, but not at any cost

Customers clearly value the convenience QSRs offer. The more a restaurant opens up the more convenient it can become. However, there is a limit to how far brands can go. Our analysis in other segments suggests responsible social distancing policies could themselves become a driver of purchase decisions.

3. Dig into growth segments

Not everyone is cutting back on fast food. As this data shows, the situation created by the pandemic is leading to increased consumption for some groups. Even as restriction ease, brands need to focus on understanding and reaching these segments.

Canadians Wary of Contact Tracing

40% unlikely to to trust organizations with data

Provincial and federal governments will need to do more to convince Canadians to share personal data and participate in digital contact tracing.

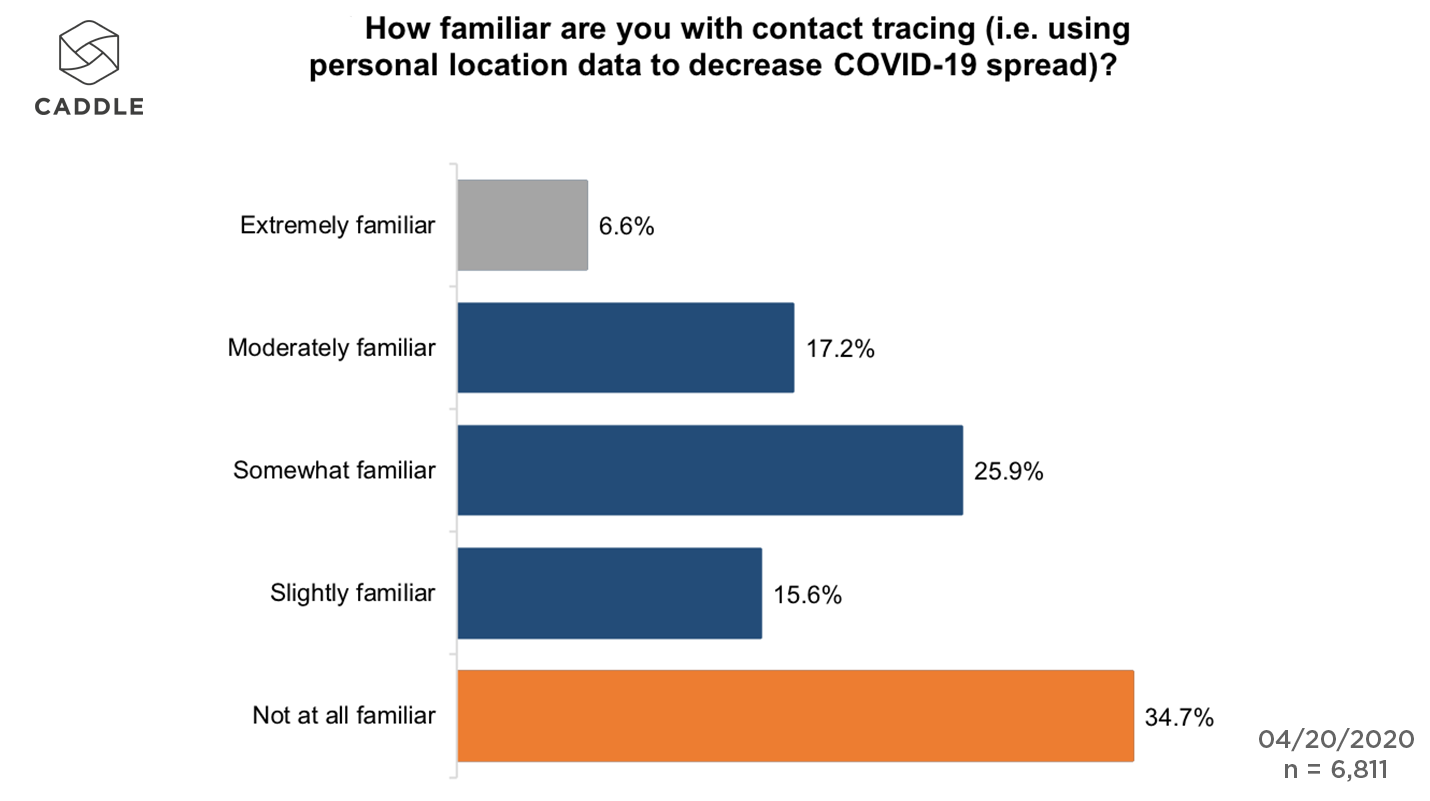

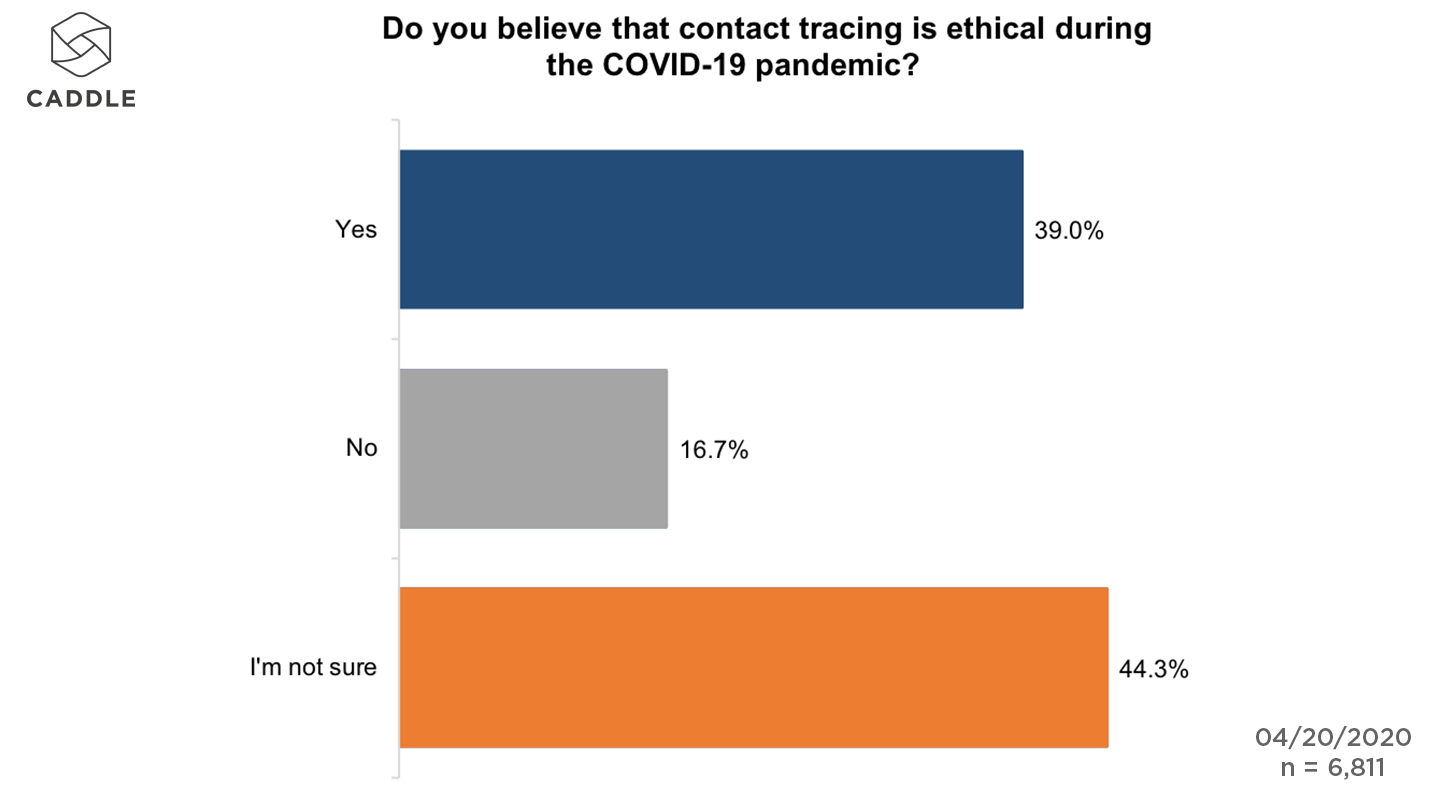

Data from Caddle’s latest survey of our 10,000 member daily panel shows that 35% of Canadians are completely unfamiliar with contact tracing, while less then half feel it is ethical — even during a pandemic.

This will become increasingly significant in the weeks ahead as governments explore the possibility of digital contract tracing services.

Two weeks ago, Alberta became the first province to introduce a voluntary contact tracing app. The service uses bluetooth technology to trace people who may have been exposed to COVID-19.

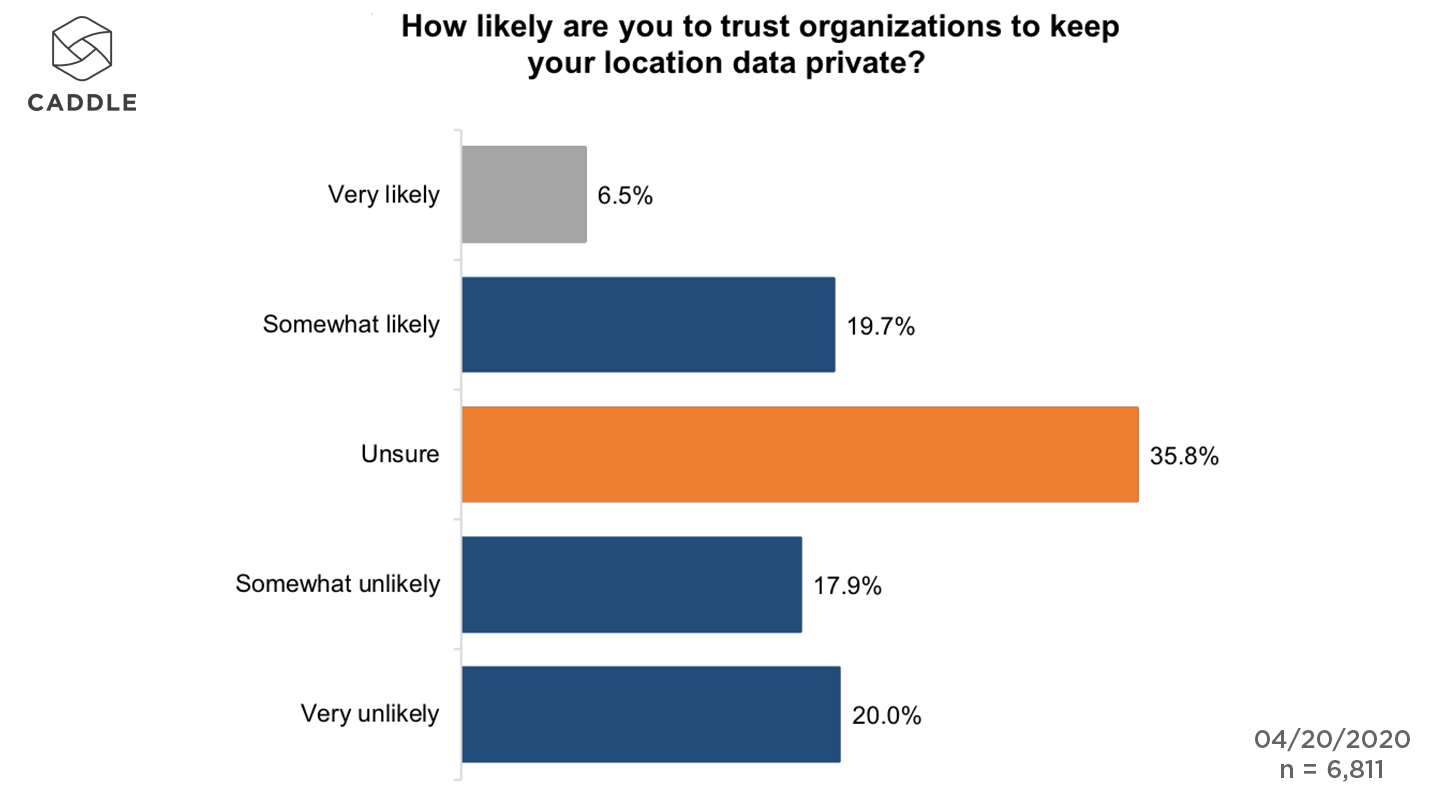

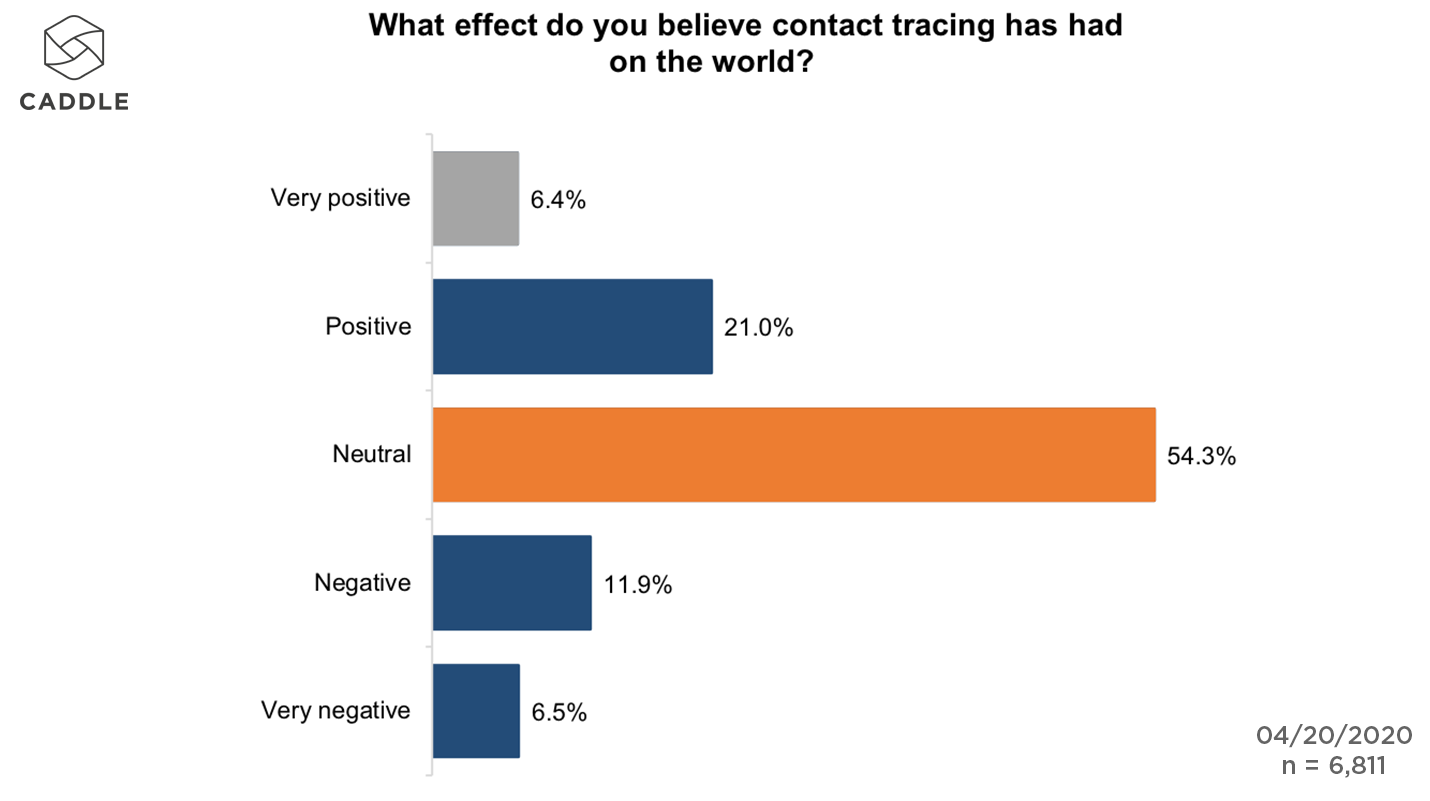

However less than 40% of people trust organizations to protect their data and, perhaps surprisingly, almost one in five feel contact tracing has had a negative effect on the world.

The good news is that the more Canadians know about contact tracing, the better they feel about it.

How familiar are we with contact tracing?

Overall, about 65% of Canadians declared some degree of familiarity with contact tracing.

With its use of mobile technology, you would be forgiven for thinking younger Canadians would be most familiar with the concept.

In fact, Gen Z Canadians are the group least familiar with contact tracing with 39% saying they were aware of it. Meanwhile residents of Quebec, the province with the highest number of cases in Canada, has highest proportion of people unfamiliar with it.

Any knowledge gap matters, because people’s attitudes are shaped by how much they know.

Is contact tracing ethical?

Overall, panel members were undecided on the ethics of contact tracing (44%), although a higher proportion see it as ethical (39%) than unethical (16%).

However, simply filtering out respondents without any familiarity with contact tracing shifts the numbers. More than half of those with any familiarity view contact tracing as ethical, compared to 30% undecided and 18% who see it as unethical.

Is our data safe?

The same picture emerges when it comes to whether Canadians trust that their data is safe.

Those with even a little familiarity with contact tracing are more likely to trust organizations with their data, than distrust.

More than half of those with no familiarity with contact tracing said they were unlikely to trust an organization with their data. When looking at panel members with at least a slight understanding of what contact tracing is, this figure falls to 30%.

Is contact tracing a good thing?

Even if many are still relatively unfamiliar with contact tracing, what is their gut feeling about it? Do people generally perceive it as something that is beneficial?

Given the roll out of apps in countries such as Australia, Singapore, South Korea and the UK as a means to limit the spread of COVID and enable lifting of restrictions, this might seem like a no-brainer. However the results are a little surprising.

While the overall sentiment leans towards positive, nearly 20% of panel members believe contact tracing has had a negative impact on the world.

Even excluding the answers of those who told us they were not at all familiar with the concept, 14.4% of respondents saw it as a negative, suggesting a deeper issue such as privacy concerns affecting the opinion of a small but significant proportion of people.

What does this mean?

Authorities looking to run digital contact tracing initiatives will need to couple this with a wider education initiative.

There is a clear relationship in the data between familiarity with contact tracing and positive sentiment towards it. Given that Gen Z Canadians are the most unfamiliar with it, this is more nuanced than a cliche about older generations being more resistant to technology.

The education piece needs to be about why it is necessary, how it can help, and the role that it has played elsewhere in the world.

Concerns about privacy and ethics will be hard to placate for all people. But with the right educational campaign, governments could encourage enough take up to make contact tracing services a viable option to limit the spread of COVID-19.

COVID-19 Insights: Attitudes shift on homeschooling

- Parents outlook 30% more positive than before closures

With schools closed across Canada, learning has looked very different in the wake of the COVID-19 pandemic.

It isn’t just the disrupted academic year, but the challenge parents nationwide face to help their kids to keep studying.

Roughly two months into school closures, how do Canadian parents feel?

In this week’s COVID report we look at what the parents on Caddle’s 10,000 member daily survey panel told us about their experiences with home learning.

Despite the disruptions, including financial hardship and the need for sudden new purchases, parents were positive overall about the situation.

How are schools doing?

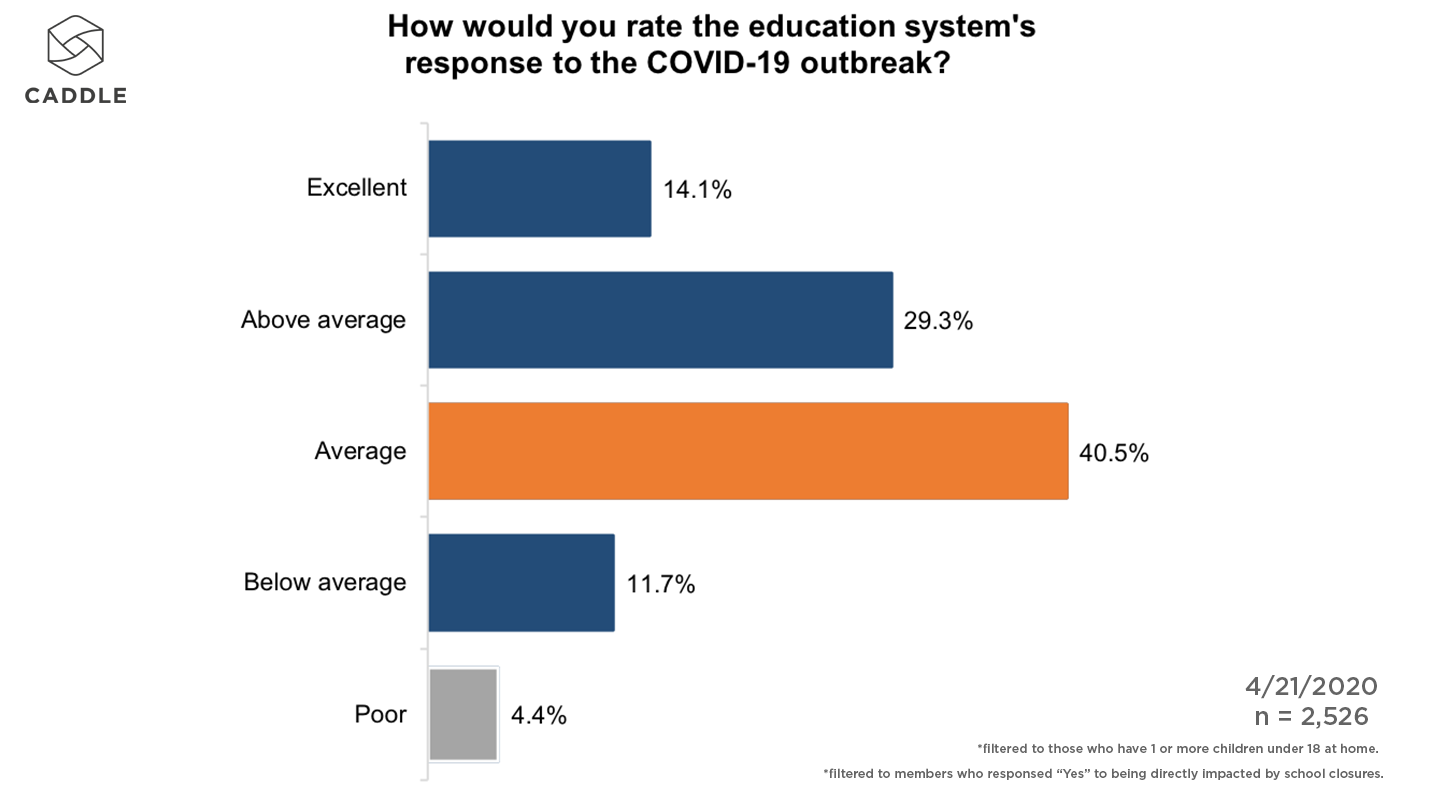

Overall, parents are positive about how schools have handled the COVID-19 crisis.

Looking specifically at parents who said they had been directly impacted by school closures, we found 43% were positive about how schools had handled the situation. This compares with 16% with a negative outlook.

Albertans were the most positive about their schools’ response, with half of parents holding a positive view, compared to 39.6% in Ontario.

However, concerns remain across the country about the impact of the closures on education. 80% of parents said they believed the COVID-19 crisis had impacted the quality of education.

The Financial Impact

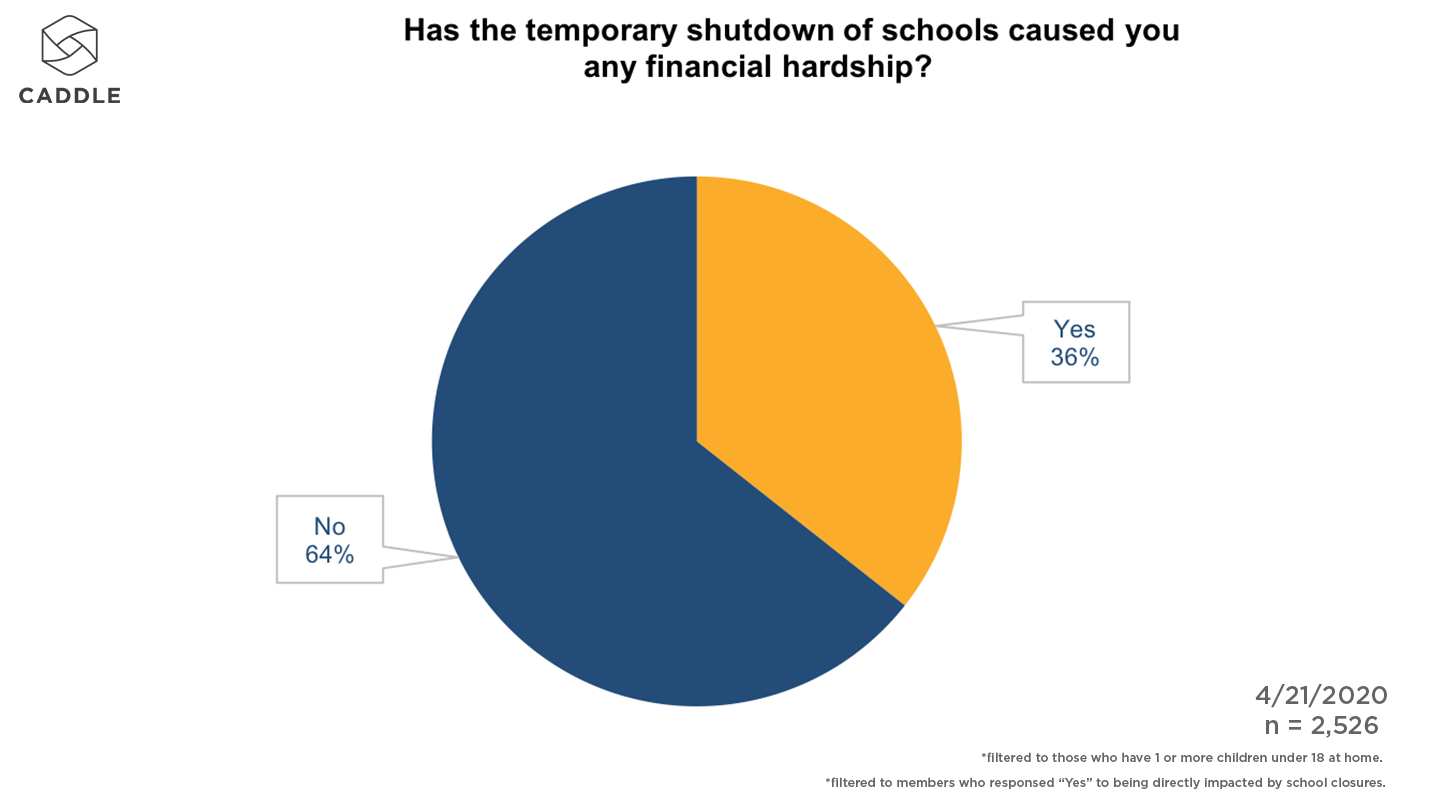

School closures are putting a financial burden on parents, too. Of those directly impacted by the shutdown, 36% said they had experienced financial hardship as a result.

Part of this would undoubtedly be explained by the broader economic situation, in addition to increased challenges between home and work life for parents. But there is another possible factor: additional purchases parents have had to make to facilitate home study.

Purchasing school supplies

Since Canadian schools closed, just over a third of parents on the panel have had to purchase or borrow school supplies. About half of parents anticipate not needing to purchase any school supplies, but what will the other half need to buy?

Accessories such as pens, books, and paper topped the list with just under a quarter of parents anticipating they would need to buy them.

But there are some notable bigger purchases on the list, too. Almost a fifth of parents anticipated needing to buy either a laptop (12.9%) or a printer (6.7%).

Perhaps as a result of the economic situation, or the nature of the purchases, brand name is not a big factor in these purchases. Instead parents are making school supplies purchases on the basis of price and availability.

How are parents feeling about homeschooling?

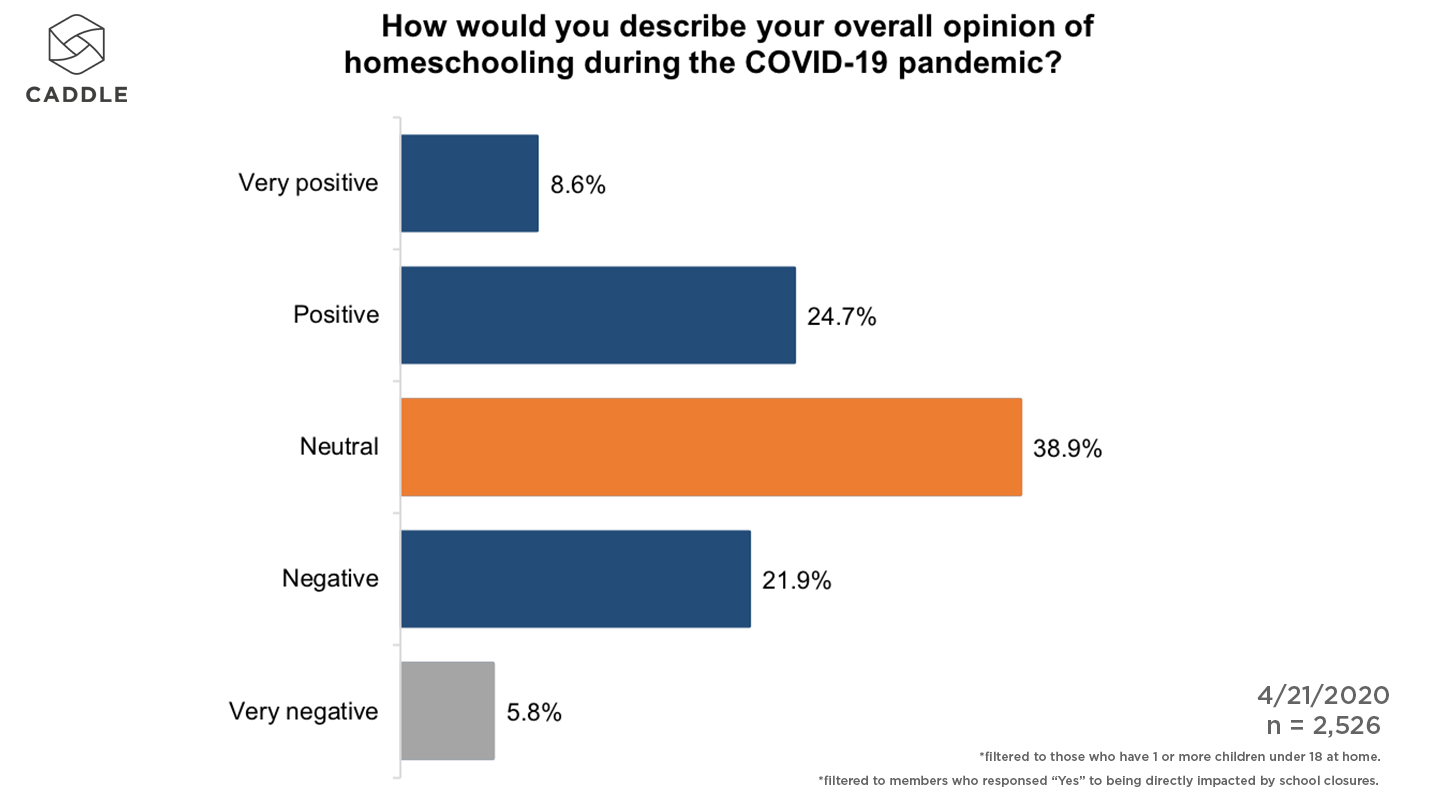

Despite the disruption and financial costs, parents have, if anything, become more positive about homeschooling.

We asked parents to rate how they felt about homeschooling before the closures compared to now.

What we see is a shift towards more positive views among those directly affected. Just over a quarter (25.7%) said they felt positively about homeschool prior to school closures. After two months of closures, this has risen to 33.3% — a 30% rise in positive sentiment.

This means there is now a slight net positive feeling towards homeschooling from parents affected by closures (33.3% positive vs 27.7% negative).

However this is not because the experience has changed minds from negative to positive. Most of the shift has come from those who told us they were undecided prior to closures.

The financial burden of school closures does not appear to be shaping these views. The net positive score for those who reported financial hardship due to the shutdown is higher for this group than those who did not report any financial hardship.

Does this mean the future of the classroom is digital?

Following school closures, parents appear to be becoming more open to the concept of digital classrooms.

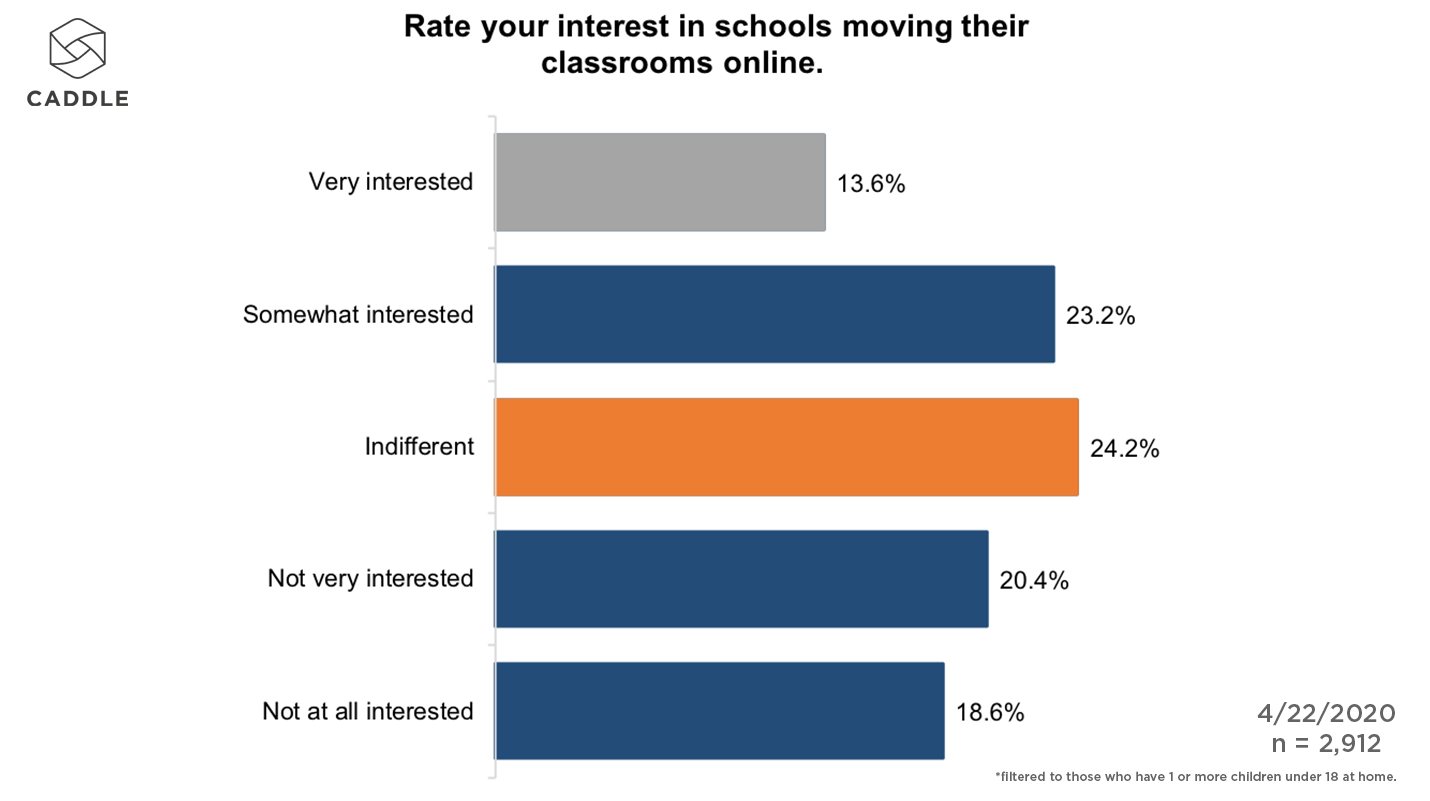

Overall, there is a roughly even split between positive and negative views. 36.8% of parents said they were interested in moving classrooms online, compared to 39% who were not interested.

Key Takeaways

Parents and Schools Rising to The Challenge

Despite understandable concerns about the impact on education, the picture emerging here is that parents and schools are coping well in difficult times.

Not only are attitudes to the performance of the school system positive, but the trend in attitudes towards homeschooling suggests parents are also rising to the challenge.

Price drives school supply purchases

As parents move to stock up home schools for their children, the two things they want are low price and easy availability.

This is undoubtedly a reflection of the biggest purchase category — stationery — but it suggests parents shopping in this category gravitate towards the products with the lowest cost, so long as they do the job.

The start of a big change?

This data does not suggest that there will be an overnight shift to online classrooms. But at the same time, experiences during the pandemic are leading some parents to start thinking how online learning could work in the future.

Half of Cannabis users make shift to online ordering

25% cannabis users increasing consumption in pandemic

The restrictions put in place to limit the spread of COVID-19 have posed a unique challenge for the Canadian cannabis industry.

In provinces like Ontario, government stores are the only legal cannabis delivery service. Once retail stores ceased to be ‘essential services’, stores could not pivot to delivery in quite the same way as restaurants or breweries.

Instead, many are operating versions of click and collect services. So how is the disruption impacting consumption and purchase habits?

Here’s what we learned from Caddle’s 10,000 daily survey respondents.

Is Cannabis consumption increasing?

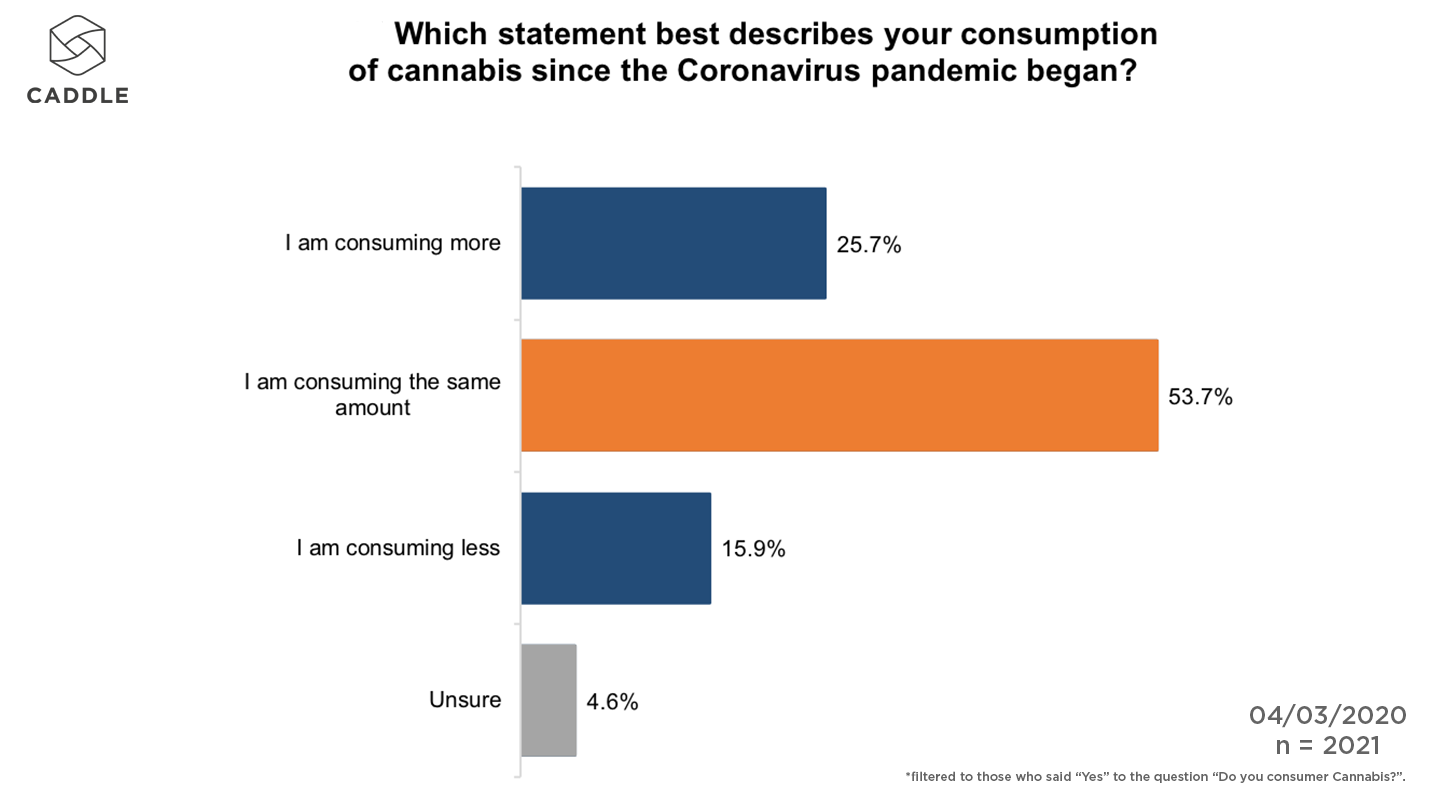

Since the pandemic began, cannabis users on the Caddle panel report a slight increase in use.

Just over 25% told us their consumption had increased, compared to 15.9% who reported a decline in usage. Slightly more than half of the panel reported no change in consumption.

What we have is a picture where almost 80% of users have either maintained or increased their consumption since the pandemic emerged.

Does this mean a shift to online?

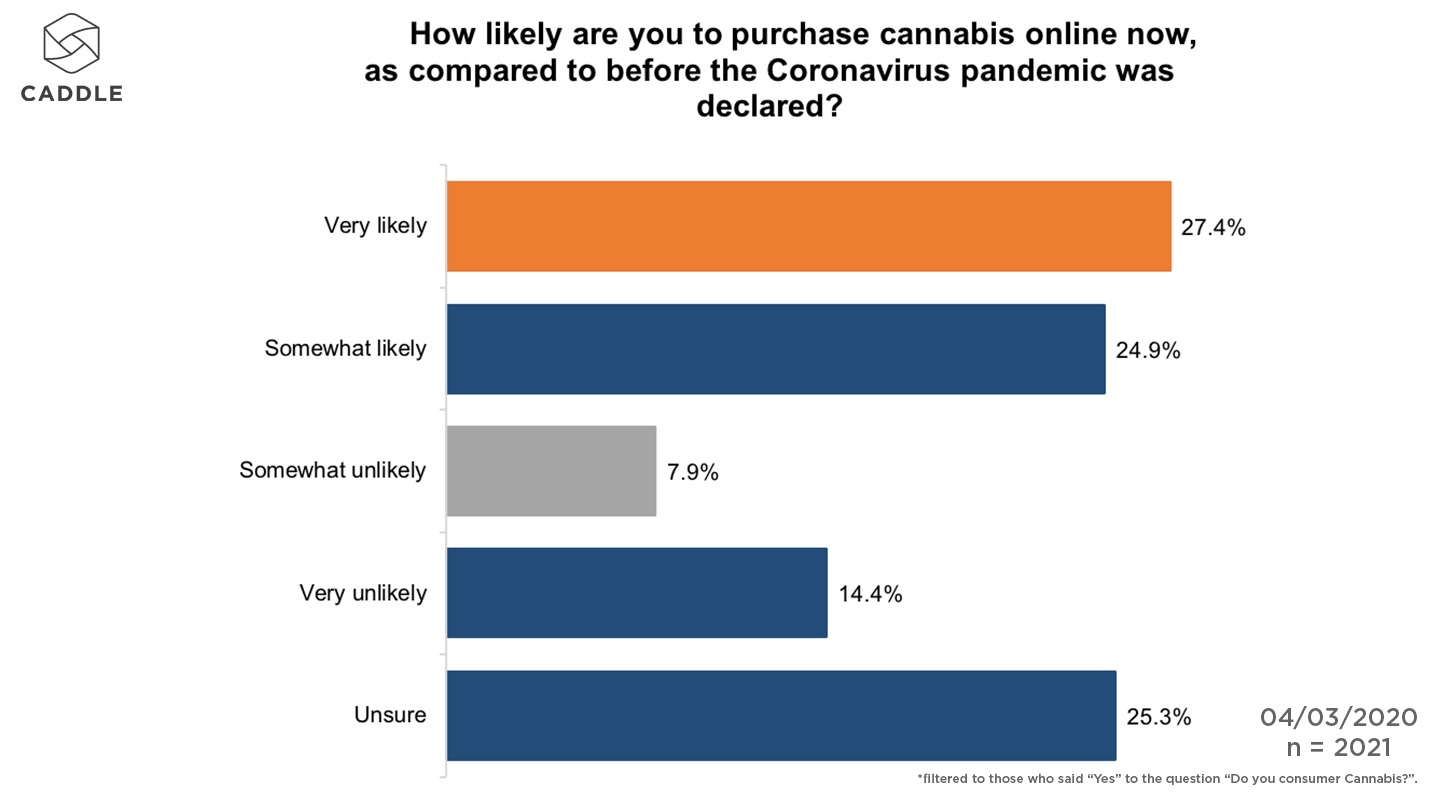

Over half of the panel (52.3%) said they were now more likely to buy online compared to before the pandemic was declared.

This trend holds across almost all groups. Gen Z, Millennial, and Gen X cannabis users said they were likely to try online, while the equivalent figure for Baby Boomers was 41%.

Ontarians were the most open to buying online with 55% reporting they were likely to buy online – compared to 45% in British Columbia.

The data does not distinguish between ordering online for delivery or to collect in person. However the big picture maintains the COVID-19 pandemic has potentially reduced the size market, with only about half of users considering making the switch to online purchase.

Which users are most likely to buy online?

Segmenting the users by their responses around online purchase we can group them into three distinct groups, distinguished by their consumption habits and demographic profile.

Segmenting the users by their responses around online purchase we can group them into three distinct groups, distinguished by their consumption habits and demographic profile.

Group 1 – Increasing cannabis usage, very likely to order online: Over-indexes on millennials Joints and edibles most popular means of consumption but over-indexes on bongs

Group 2 – Maintaining or Increase usage, somewhat likely to order online: Edibles and joints most popular , but under-indexes on smoking joints, over-indexes on bongs and vaping. No age skew relative to Cannabis users on Caddle panel.

Group 3- Maintaining / decreasing usage, unlikely to order online. Over-indexes on Generation X/Baby Boomer. Over-indexes on joints as preferred means of consumption.

Breaking the data down this way it’s clear that brand should be prioritizing Group 1 users in the current climate, since these users are increasing consumption and are most open to buying online.

Will Canadians switch to homegrown Cannabis?

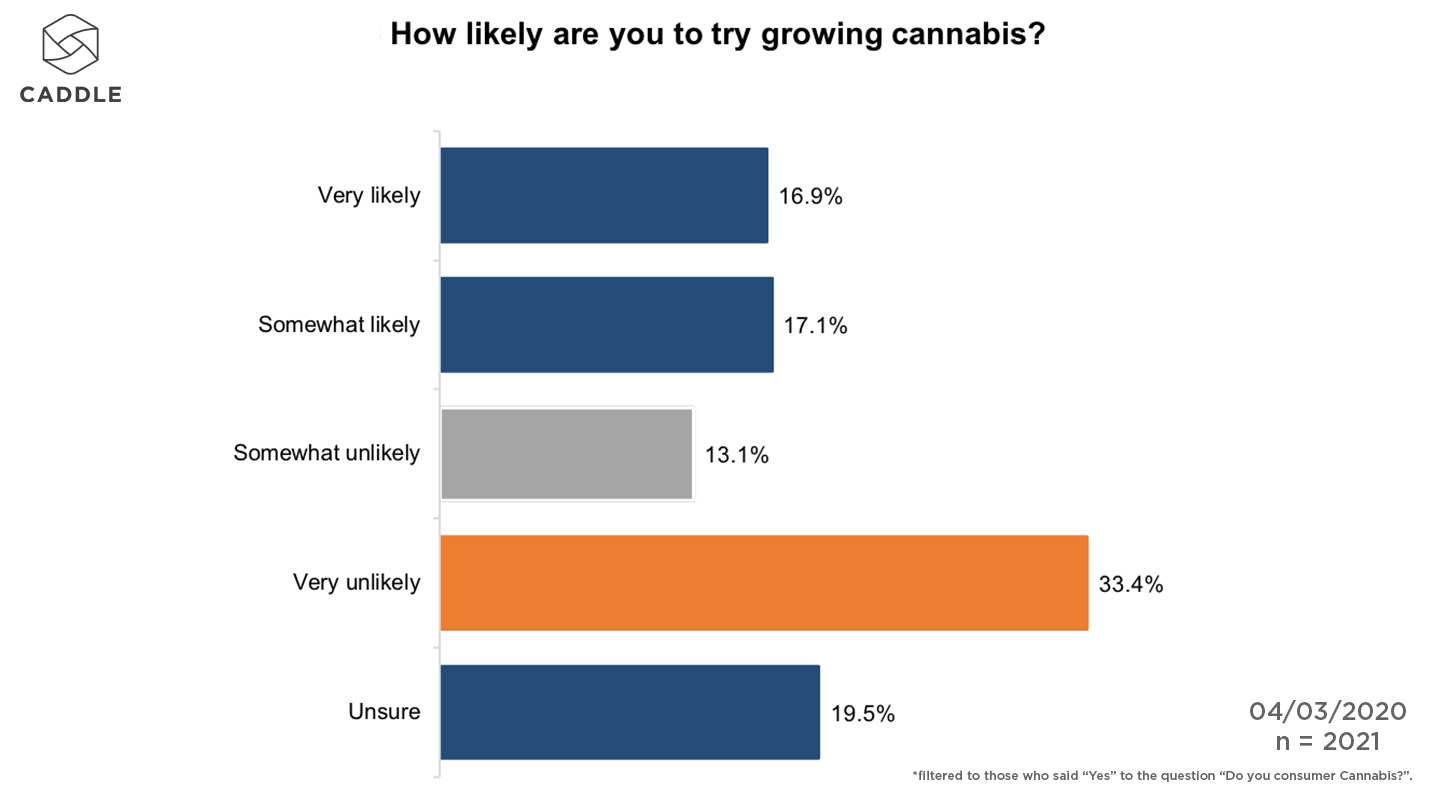

With visiting retail stores less of an option, the other alternative to order online is growing at home. However this does not appear to be widespread across cannabis users on the Caddle panel.

While 34% said they were likely to try growing their own Cannabis, 46% said they were unlikely.

Ordering online and growing at home do not appear to be mutually exclusive. Those who indicated they were likely to increase online ordering were also the segment most likely to try growing themselves. Of the users in ‘Group 1’, 44% said they were likely to grow their own cannabis.

Key Takeaways

COVID Disruption has shrunk the market

Seeing half of cannabis users say they are likely to purchase more online due to the impact of coronavirus is striking.

But given the lack of official alternatives right now, this suggests that a significant proportion of users are either ceasing purchase, or purchasing outside of the licensed store system.

Focus must be on top users

Now more than ever Cannabis brands need to focus on the segment that is reporting higher usage. Brands need to work to understand the needs of this segment and target their campaigns and offerings accordingly.

Changes more likely to be temporary

Online ordering for Cannabis is less accessible than in other spaces such as groceries. We know that half of those ordering groceries online due to the pandemic will switch back after the pandemic. Given the extra restrictions around online ordering in the cannabis industry, the figure will likely be higher in this space.

COVID-19 Insights: How Canadians are cutting spending

-40% looking to reduce luxury purchases

That the economic shock caused by the COVID-19 pandemic would have major implications for consumer spending is clear. Caddle data shows as few as 15% of Canadians feel they won’t need to reduce spending.

What is less obvious, however, is how spending will change. What tactics will Canadians use to save money? Are we postponing purchases until after the pandemic, and if so, when do we expect to make them?

We put these issues to Caddle’s unique 10,000 member daily survey panel to understand how the crisis is changing Canadian spending habits. So, what did we learn?

How many people are cutting spending?

According to Caddle data almost nine in ten Canadians have cut back spending during the pandemic. Just over 85% told us the economic conditions had caused them to cut back expenditure.

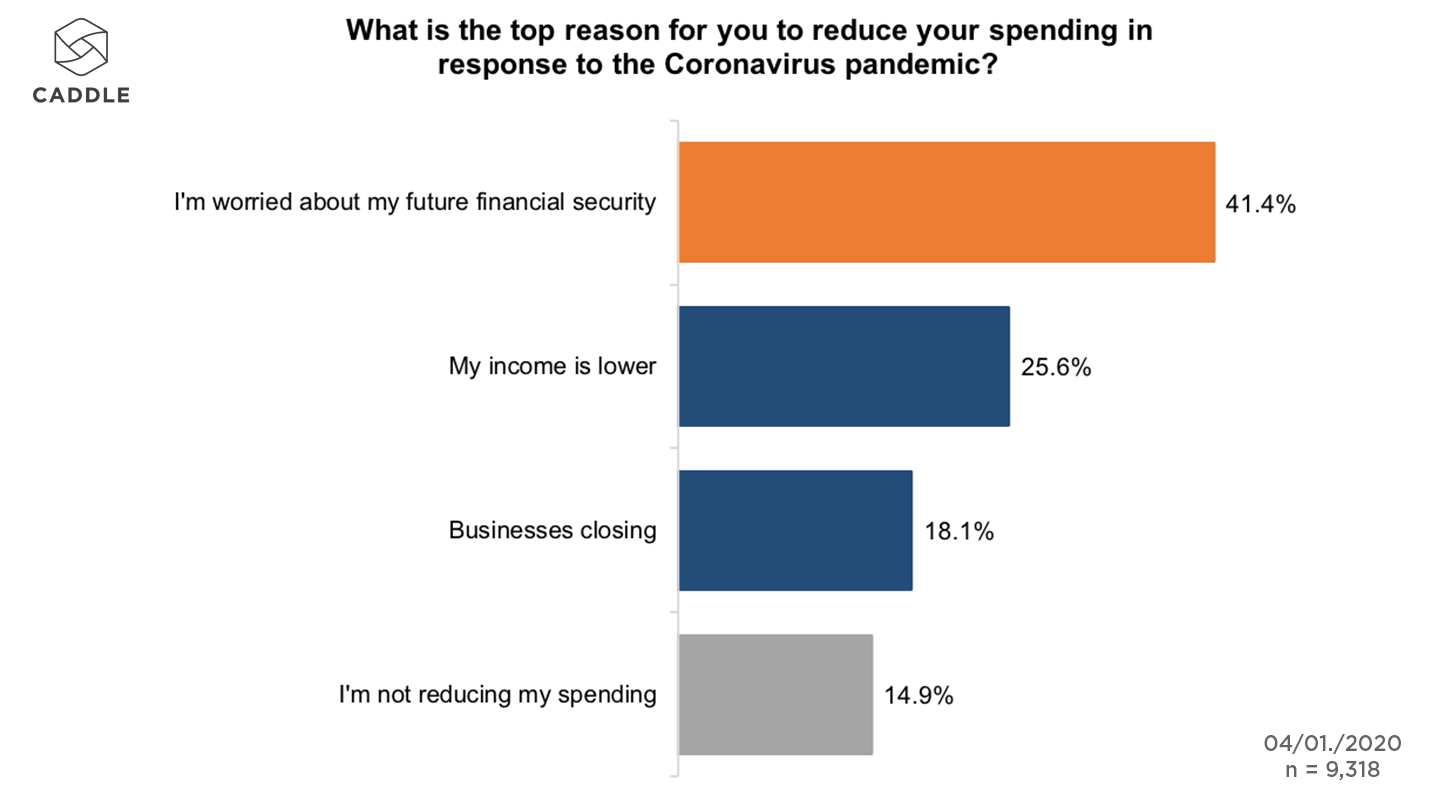

Unsurprisingly, a large proportion of those who are cutting back spending cited a direct economic reason. A quarter reported that their income was lower, while 18% said they were reducing spending as a result of a business closing.

However, almost as many people again are holding back expenditure due to overall uncertainty. Just over 40% of our panel cited concerns about their future financial position as a reason to put off spending today.

How are we cutting spending?

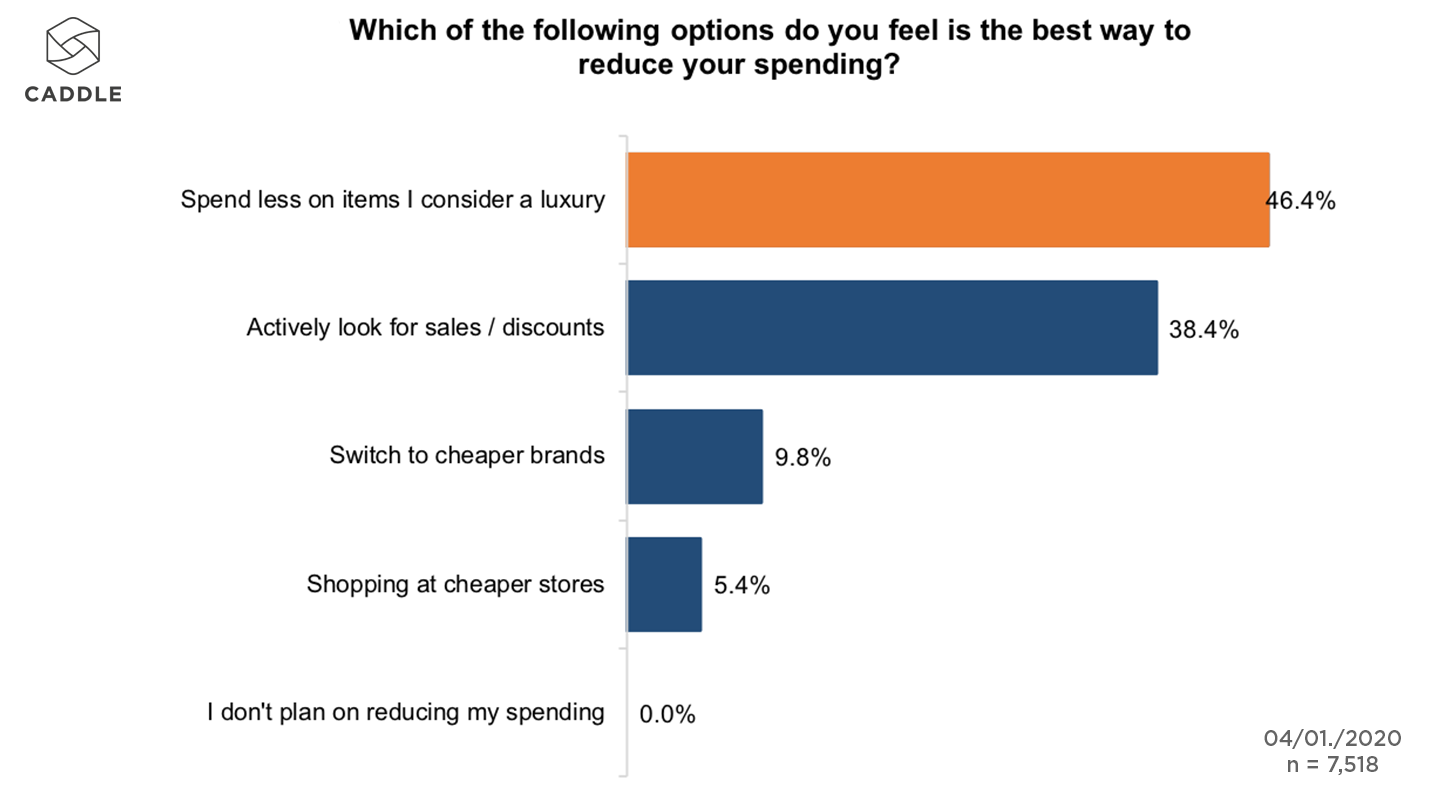

What will be the most popular money-saving tactic among Canadians? Across all age groups, cutting back on luxury purchases is seen as the best way to save money, followed by more actively looking for sales and discounts.

Meanwhile, a much smaller proportion of the panel told us they see switching to cheaper brands or stores as the best way to save money.

This data is significant for several reasons. Most noticeably, it informs the strategies Canadians see as most likely to use to save them money. It points to a big hit in discretionary spending by a large proportion of Canadians. With tighter budgets, luxury items are the first things to go.

Also significant is how few Canadians consider switching brands as the best option to save money.

In last week’s report we highlighted how one in five Canadians were prepared to switch grocery stores if their preferred brand failed to adequately enforce social distancing. However only 5% of our panel would consider switching stores as a top way to save money.

Likewise only 9.8% of our panel said they would switch to less expensive brands to save money. Yet in a study a few weeks earlier this month, 76% said a brand playing an active part in the COVID-19 response would affect their purchase decision.

This paints a complex picture of the impact of COVID on brand loyalty. Firstly consumers are more likely to reduce or cut out purchases entirely rather than switching to lower cost brands.

But beyond this, customers can be won or lost on action taken in response to COVID-19, rather than household economics.

How are different generations responding?

Breaking the preferred money-saving tactics down by generation reveals how different age groups respond to financial challenges.

The bonds of brand loyalty seem to be weakest for Canadians in Generation Z. Almost a quarter of those born after 1995 preferred switching to cheaper brands or cheaper stores as the way to save money. This compares with approximately 15% for the panel as a whole.

Meanwhile at the other end of the age spectrum, Baby Boomers were the only generation who did not choose cutting back on luxury purchases as the top way to save money. Instead, 46% said they would more actively look for discounts, compared to 38% for the panel as a whole.

‘Treat’ spending isn’t dead

The general preference for cutting back on luxury purchases does not mean we will completely cut back on things we consider treats. In fact, these types of purchases have a role in keeping our spirits up.

Excluding those who told us they were not cutting spending at all, a third of the panel said they had purchased a treat or a luxury item to keep their spirits up.

Interestingly, those who cited cutting back on luxury items as their preferred way to save money, were more likely to report making a luxury purchase to raise their spirits.

This suggests another complex relationship between consumers and the brands they buy.

For example, people who make the most luxury purchases may also be the people who have the most scope to save by cutting down on these items.

If such purchases also represent normality or better times for this group, it would make sense that they would also serve the purpose of a treat, reward or morale-boosting purchase during a challenging period.

Are we putting off purchases?

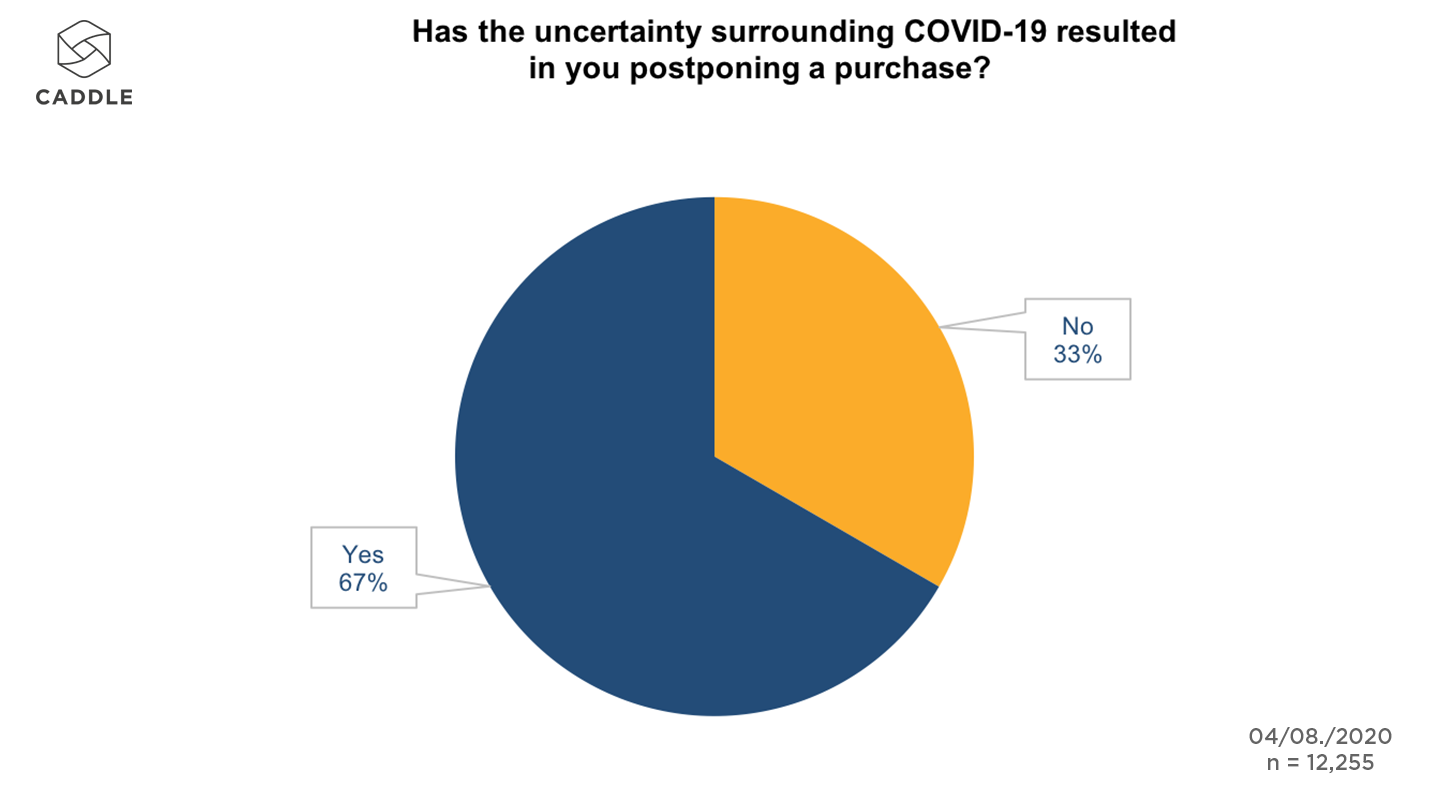

With a significant proportion of the panel cutting spending due to future concerns rather than direct economic impact, does this translate into purchases that could be made today being postponed?

Approximately two thirds of Canadians say they are putting off purchases due to the uncertainty around the pandemic.

There was little consensus around when the panel expects to be able to make these purchases. About 60% of those postponing a purchase expect to make in the next three months, but almost a quarter said they would postpone by over four months.

Key Takeaways

We’re cutting luxuries but will still treat ourselves

The first tactic many Canadians will adopt to save money is reduce luxury items. While undoubtedly a challenge for brands in this space, there is opportunity in tapping into the ideas of occasional morale-boosting treats.

Brand loyalty > Cutting Spending

The disruption caused by the COVID-19 isn’t necessarily interfering with traditional brand preferences. Only a small proportion of Canadians will abandon their usual purchase choices as their primary tactic for saving money.

Return to spending will be cautious

As we saw in our data on restaurant habits, a return to ‘normality’ for spending may be tentative once restrictions begin to be lifted. Relatively few consumers will go back to their old spending habits overnight.

COVID-19 Insights: How consumers pick their grocery store

Almost 50% would switch stores over inadequate social distancing

The importance of winning over grocery shoppers has arguably never been higher.

Consumers are making fewer trips to a smaller list of stores and a fifth of them are prepared to switch from their regular store.

So what determines which grocery store Canadian customers choose to visit, and what factors are breaking the bonds of brand loyalty?

Caddle turned to our daily panel of 10,000 Canadian consumers to find out.

Social distancing really matters

To Canadians visiting physical locations, part of the in-store experience has become more crucial than ever to where they choose to buy groceries.

Right now that means rigorous enforcement of social distancing policies. So much so, in fact, that a significant proportion of Canadians would abandon their preferred grocery store if they were not comfortable with the social distancing measures taken.

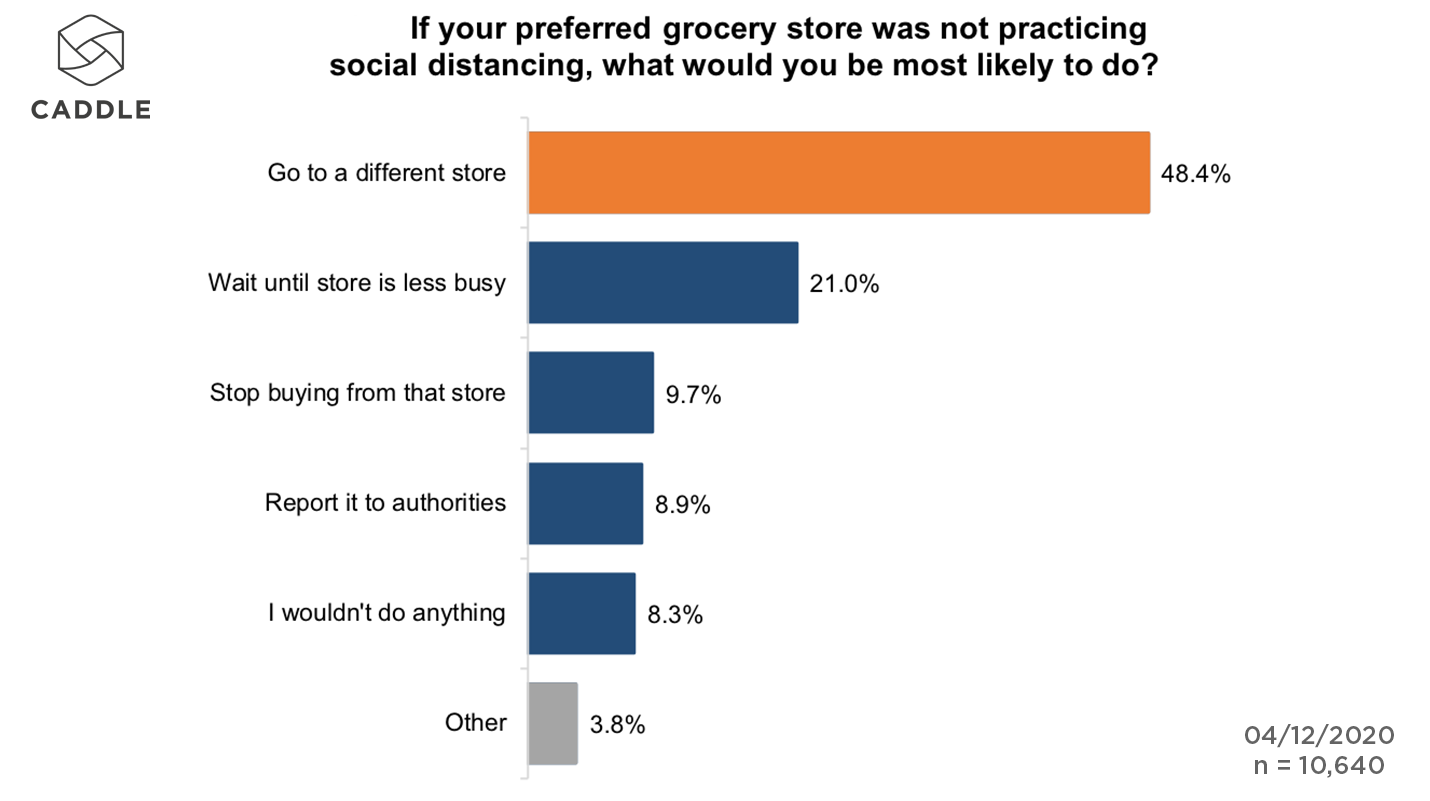

Almost half (48.4%) of the panel said they would switch stores if their store was not enforcing social distancing policies.

Product availability remains key

While grocery chains have been able to replenish shelves after the initial burst of panic buying, product availability remains the driver of grocery store choice.

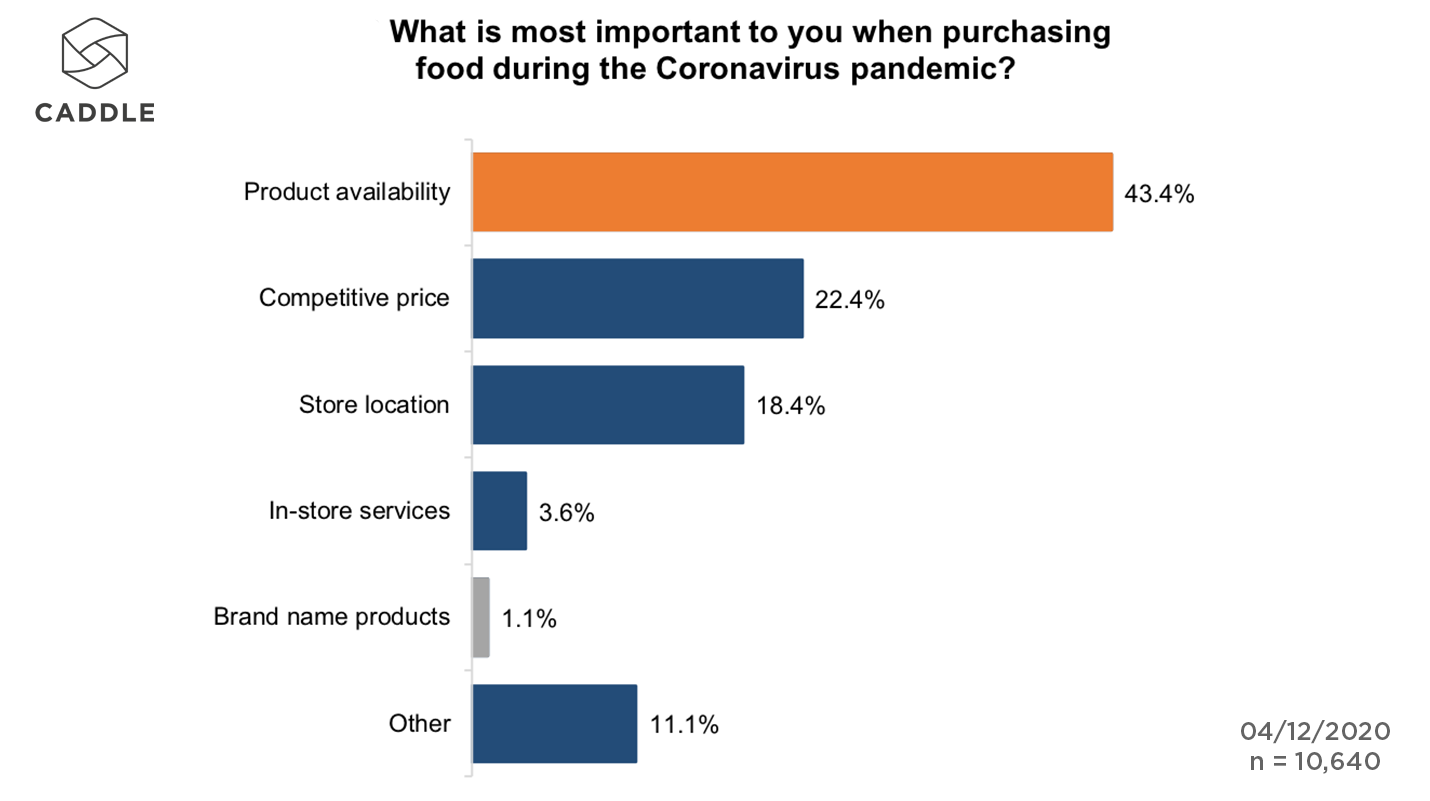

When we asked the Caddle panel on March 30th what determined which store they would visit, 33.4% cited product availability.

However this was around the time of frequent media coverage about empty shelves and panic buying. Have priorities changed in recent weeks? In a word, no.

Product availability remains the big decision maker. We asked the panel on April 12 and 43.4% said product availability was most important, although to a slightly differently worded question.

Nevertheless the picture is the same, availability matters more than competitive prices, or store location.

Is click and collect an alternative?

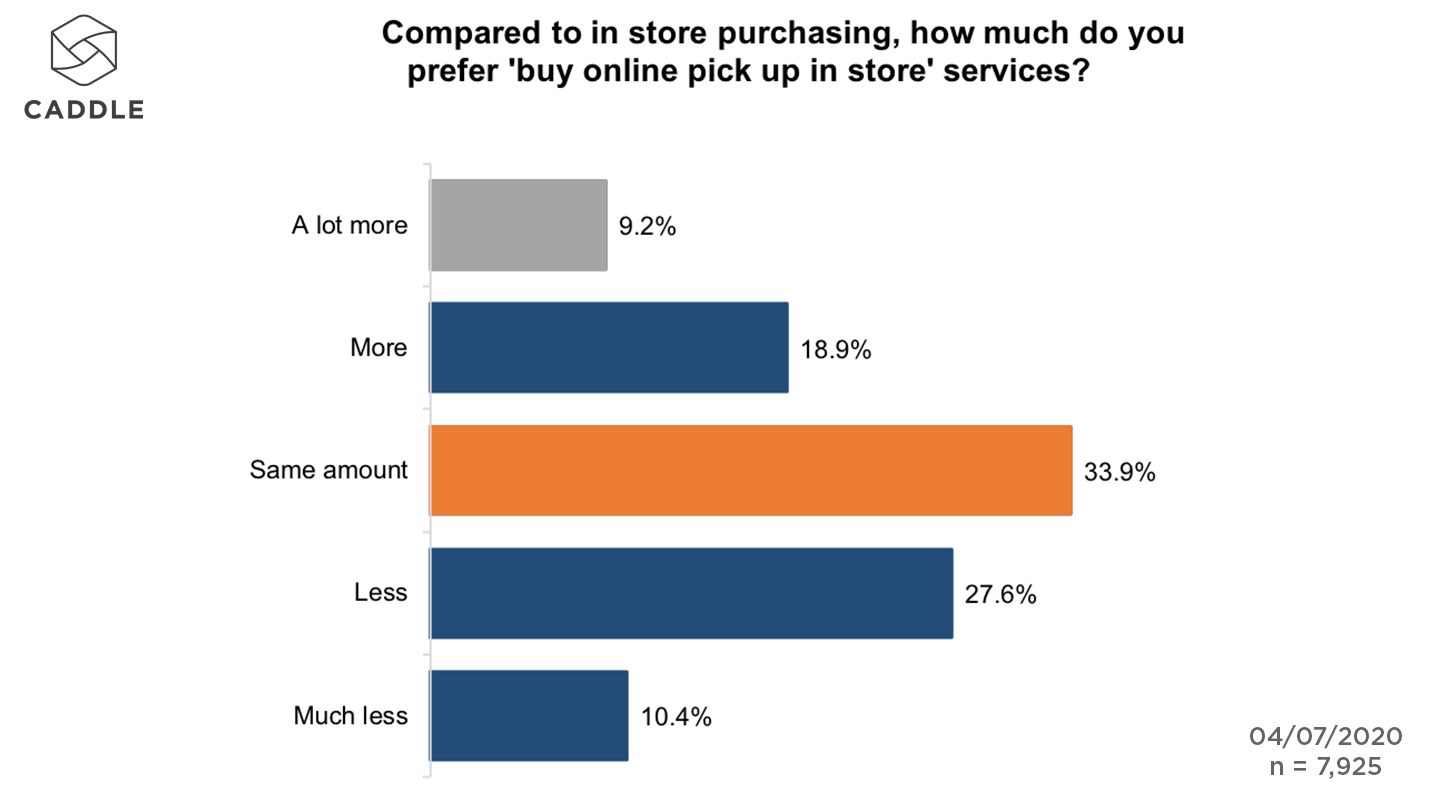

Compared to shopping in store, click and collect services are less popular – even during the current pandemic.

When looking specifically at panel members who had used click and collect services, 38% said they preferred in-store purchasing, compared to 28% who said they preferred ordering online and collecting.

Gen Z are the most open to click and collect. With 31% preferring it to instore, and 33% opting for the traditional in-store experience.

Baby Boomers are the least receptive with nearly 60% saying it is less preferable to buying in store.

This matters now in particular given the efforts chains are making to ensure access to grocery stores for older Canadians such as opening early or designating specific hours for seniors.

Based on this data at least, ordering ahead online will not play a part in creating more opportunity for older Canadians to buy groceries.

What is putting people off click and collect?

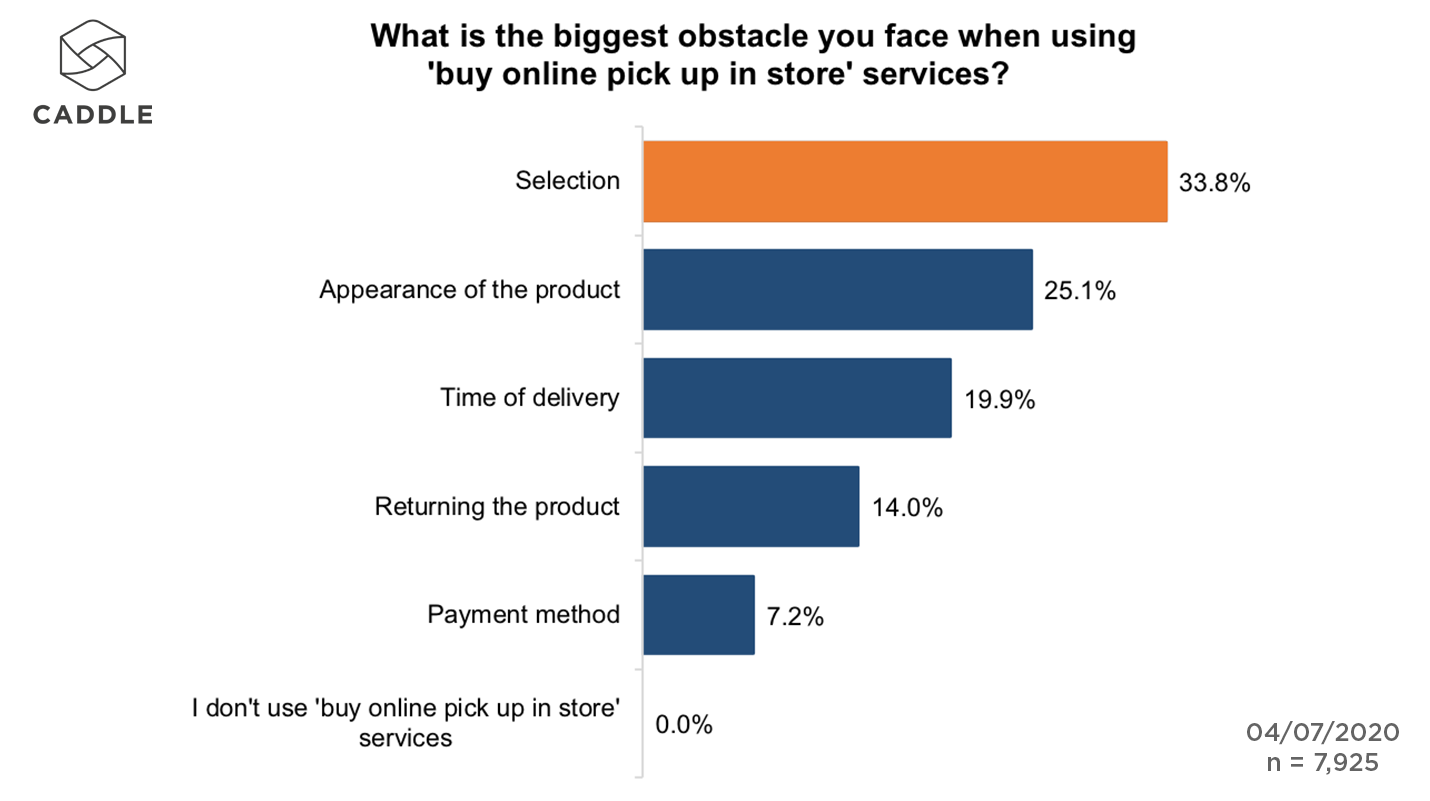

We asked the panel what they felt were the biggest obstacles with click and collect. The responses suggest consumers miss the choice, as well as the ability to easily browse the wide array of goods.

Panel members told us that selection and appearance of the product were the two biggest obstacles, followed by the time to prepare the order.

Alongside these obstacles are concerns about cost and complexity. Asked which word they associated most with the click and collect programs, 15.5% chose ‘complex’.

A further 14% selected ‘expensive’, which is surprising given the relatively modest fees charged for collection. If not related to service fees, this suggests wider concern about either higher prices online generally, or the ability to browse for savings on an online platform.

Is this a messaging issue?

Alongside the perceptions of cost or complexity, part of the reason there hasn’t been a wider take up of click and collect type services is a lack of awareness.

We asked the panel where they had heard about such services. Looking only at the respondents that told use they had never used click and collect 25% said they had never seen any messaging about click and collect services.

Key takeaways

Social distancing is crucial to in-store experience

Now really is the time for grocery stores to show how seriously they take social distancing. The data here suggests that customers will reward the stores that make this the focus of in-store experience — so long as they keep their shelves stocked.

Click & Collect isn’t first choice experience

Consumers still prefer the in-store experience. If stores want to encourage more customers to use click and collect services — whether during the pandemic or after — customers needs to be convinced with a better experience.

This means finding ways to improve the online browsing experience through better selection or product visibility, and minimizing any unnecessary complexity.

Grocery pickup services need sharper comms

Given that a quarter of those who hadn’t used click and collect weren’t aware of it, any push to increase usage of click and collect needs a stronger push on messaging. This could also go some way to countering the perception of the service as ‘complex’ or ‘expensive’.